Hong Kong is a place I would gladly visit anytime. Apart from the great food and the excellent craft beer, the thing I get most excited about is its well-established network of trekking trails. The landscape is unique, and the trails are well connected, easily accessible and most exits take you conveniently to civilisation in minutes. They also offer a great workout as parts can get very steep! The best part is, after hours surrounded by nature, I could enjoy my plate of delicious fatty roast goose meat at Yat Lok (Stanley St.) and an authentic HK milk tea with no guilt!

However, I went to this beloved destination 2 weeks ago with mixed feelings. On one hand, I was very excited to go as I was there to attend the Dimensional Global Investment Forum. This forum by Dimensional Fund Advisers would give me the opportunity to meet and learn from giants in the field of investment management and economics. On the other, I went with a little sadness. At the time, Hong Kong was going through a period of protests and demonstrations. Hong Kong has never been so divided and I was concerned for my friends and the people of Hong Kong.

The forum was an amazing experience. I had the opportunity of a lifetime to meet 2 Nobel laureates – Professor Robert Merton and Professor Myron Scholes, renowned economist Professor Edward Lazear and many more investment professionals both hosts and participants.

(Left: Professor Myron Scholes, Right: Dimensional Founder and Executive Chairman, David Booth)

(Left: Professor Myron Scholes, Right: Dimensional Founder and Executive Chairman, David Booth)

One of the highlights of the day was the session where Dimensional Founder and Executive Chairman, David Booth, moderated a conversation with Professor Myron Scholes. They shared their journey of how they took the leading economics and financial sciences research from the 60s, 70s, 80s and applied them to live investments strategies, bringing low-cost index funds and evidenced-based investing to common investors, transforming the investment landscape, levelled the playing field and created a tremendous amount of wealth for institutions as well as individuals.

Reflecting during the event, I was immensely thankful to these gurus. They are independent, selfless, and rigorously driven by their passion, relentlessly pursuing truth in their scientific research yet pragmatic enough to work with investment firms such as DFA to bring sensible and cost-effective solutions to the man on the street.

As an adviser, my mission is to help my clients achieve their life goals. My duty in managing their investment portfolios is to ensure that when the time comes, they have enough to live their desired lifestyles and provide for their loved ones. Certainty and high confidence in the outcome are what I need from my investment portfolios to give my clients the peace of mind that they seek. Not investment strategies that sound good but don’t deliver. In other words, I focus on probability, not possibility when it comes to guiding my clients.

Just like building a foundation for a building, to build wealth with certainty, we must get the “big rocks” in before the “smaller rocks”. The “biggest rocks” to build wealth comes before you even invest a dollar. These are good money habits, a strong financial foundation and setting long term goals. Then come the “big rocks” in investing. These are the factors that have the most impact on achieving a positive outcome with high confidence. In investing, what works is to focus on the drivers of long-term returns, and these are the equity premium, size, relative price (value) and profitability. After that, we want to focus on diversification as returns are random and cost-effectiveness in implementation to prevent erosion of returns. That is why at Providend, our investment solutions are implemented with Dimensional and Vanguard funds.

These concepts I have described are foundational. It is simple, logical and rational but interestingly, it is perplexingly difficult to carry out. As I reflected on what I learnt from the conference and my own investment journey, I concluded that there are 2 two reasons that make things difficult:

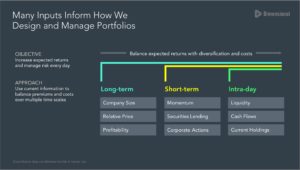

- There is always a temptation to time the markets. Events and crises may occur in a similar pattern, but the world is ever-changing. This drives home the point that even with knowledge, experience and time, no one can consistently time the markets. The pattern of an average of 40 years between a major crisis, and an average of 10 years between bear markets may repeat itself, but the cause and timing will never be the same. Even though it the data shows that trying to outguess the market is a loser’s game (according to the SPIVA 2018 scorecard, less than 20% of active funds beat their benchmark over the past 15 years), many investors are still lured by the temptation base investment decisions on it. So is our future as investors bleak? Thankfully, the good news is we don’t have to play the losers game of predicting the markets. We don’t have to leave our investments to chance. This is where I appreciate the rigorous research of all the finance and economic scientists who brought us the truth that simplicity is the best investment policy. Buy the markets, keep costs low and stay invested. Even better yet, Dimensional has implemented the ideas from rigorous academic research into actual investments that my clients can participate in. They work behind the scenes relentlessly to identify new drivers of return for long-term, short-term and even intra-day portfolio design and management as shown below.

This research is also important to debunk and demystify any ideas or arguments that don’t stand the test of time. This can prevent investors from being distracted by noise and going in the wrong direction. My takeaway from the conference is that I can trust the markets and trust my investments because the facts presented are verifiable. These are the “smaller rocks, pebbles and sand” in wealth building. - Every investor is human. The simple action to sit back, relax and do nothing about our investments is counter-intuitive to us. It’s just too difficult for most people. The media doesn’t help too. They sensationalise the news, they made you feel stupid for not doing something about your investments. The product salesmen don’t help either. They know what entices you, and play to your emotions. “You need to get in now, or you will miss it”, “You need to switch, the trends are shifting”. Does it sound all too familiar? Sounds good and logical? Active, tactical, dynamic, rotate etc all these words sound good and pleasing to our ears, but what good does it really do for our investments? How then do we navigate ourselves and the world? As an investor, stay humble, know yourself, your priorities in life, and make your life decisions before making financial decisions. Have a clear investment goal that aligns with your life goals, know your risk tolerance and be prepared, don’t predict. Are you fearful of a major crisis? Then the good news is that it will only come once a lifetime and it may already be over. Are you still waiting for that once in a lifetime opportunity to invest? Then you must ask yourself is it worth it to wait? Not being invested is like buying a put option and there is the cost of buying a put option. Are you buying one without you knowing it?

After the forum, I now have a deeper understanding of why investing is best kept simple. I understand why keeping it simple is hard work in investing. As I reflect over the past 3 years, I realised that although we trust passive investing and our approach is to buy and hold, we are by no means passive.

What do I mean?

We have been very busy helping our clients to do nothing. Telling our clients we are doing nothing is way harder than telling our clients we will do something. We need facts and evidence to verify why it is good to do nothing. On the other hand, ideas and opinions are often sufficient to tell clients we are doing something. And this battle is an ongoing one because we are after all human.

It is very scary to remain still when the whole world is roaring! We must prepare our clients to respond in the right way when the storm comes. Keeping still in a storm requires faith, and faith come from trust. That means more regular communication of risk coaching pieces, more contact with clients to assure them that they are in good hands, and much deeper trust must be nurtured to do what’s counter-intuitive. So, after the big rocks, smaller rocks, pebbles and sand, we cement our client wealth plan with trust!

I’m thankful for all the fond memories I have each time I go to Hong Kong. For now, my thoughts and prayers go out to Hong Kong as there has yet been a clear resolution between the protestors and the government.

This is an original article written by Vincent Tey, Head of Advisory Team at Providend, Singapore’s Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. What Happened After The Global Financial Crisis

2. Know What You Can Control As An Investor

3. What Is The Key Driver Of Long Term Stock Market Returns

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.