Executive Summary

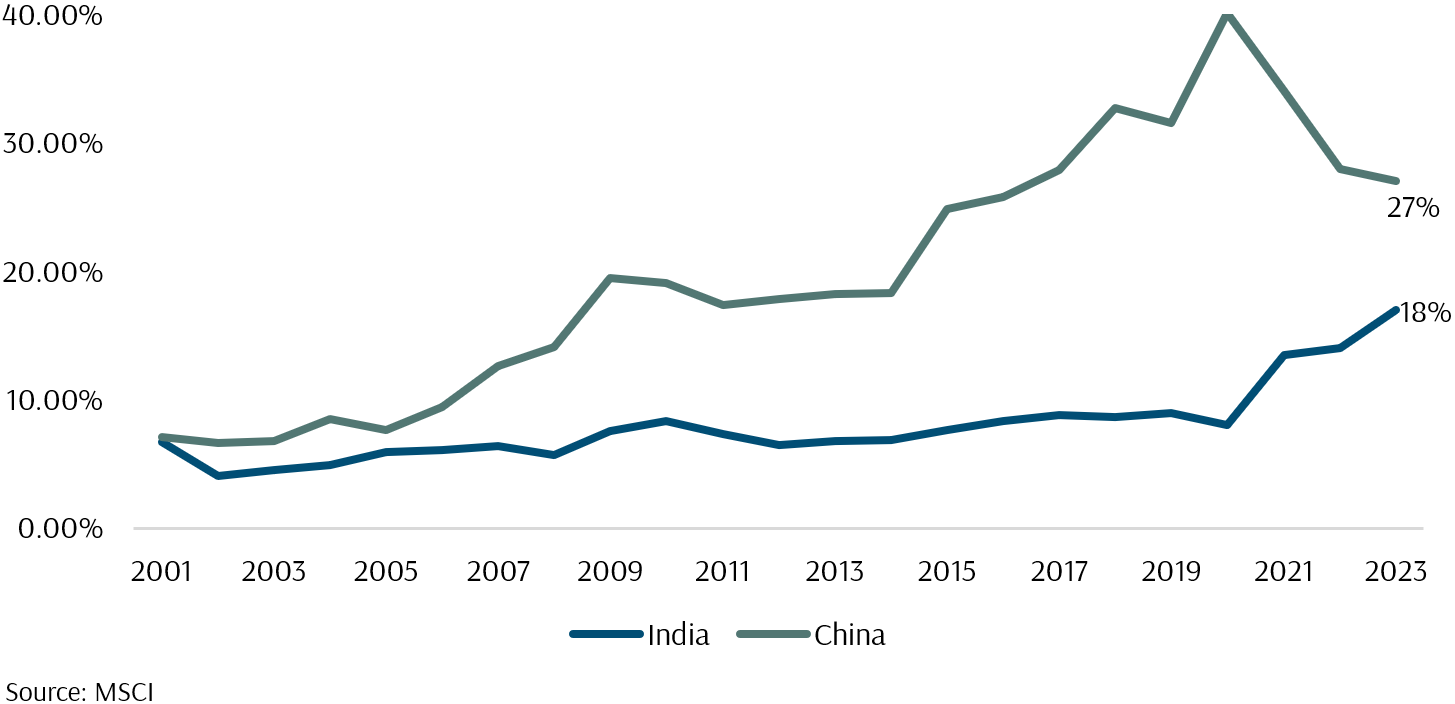

In May 2024, global stock and bond markets rebounded significantly, driven by strong corporate earnings, slowing inflation, and increased economic activity in the US and EU. The MSCI All Country World IMI Index rose by 4.1%, while the Global Aggregate Bond Index increased by 0.9% due to lower US yields. U.S. equities surged by 5.0%, buoyed by robust first-quarter earnings and moderate inflation. European markets also performed well, with 60.7% of the STOXX Europe 600 companies exceeding earnings expectations, leading to a 2.6% rise in the index. India’s equity market gained prominence, increasing its weight in the MSCI Emerging Markets Index from 8% in 2020 to 18% by April 2024, highlighting its growing global significance and investment appeal. This month, we will be covering the Indian equity landscape in more detail.

May Performance

In May, stocks and bonds resumed their rally, recovering the losses incurred in April. This rebound was fuelled by strong corporate earnings, signs of slowing inflation, and increased economic activity in the US and EU.

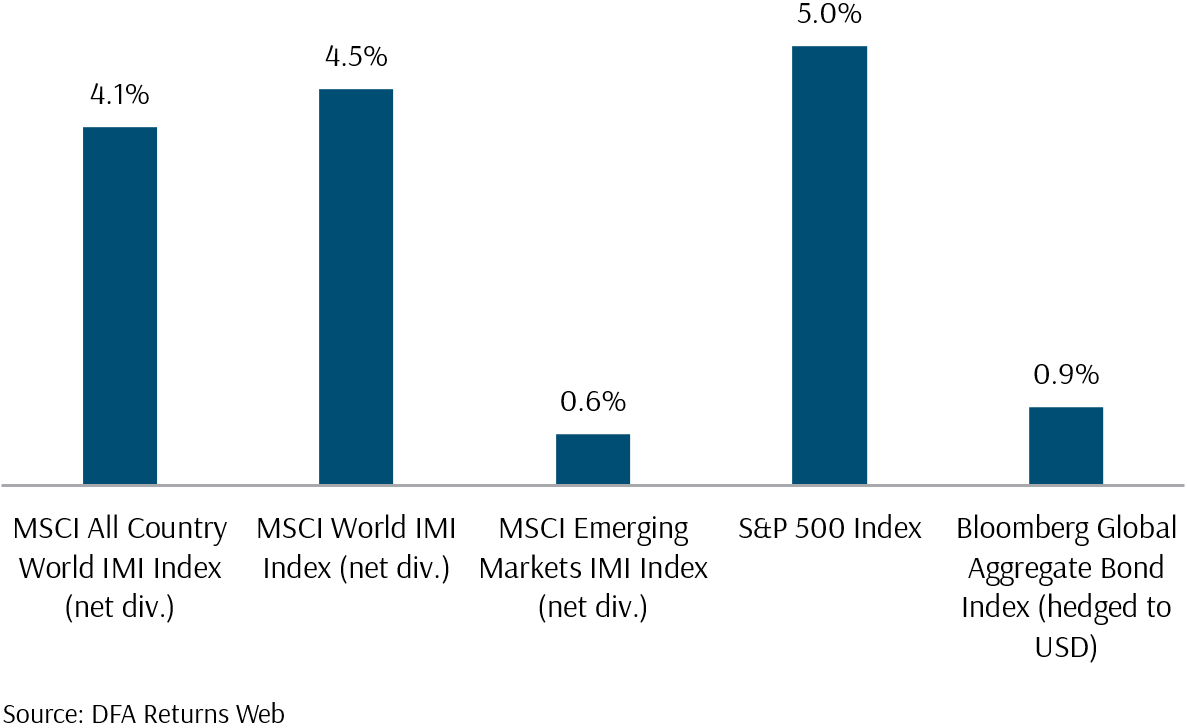

As illustrated in Exhibit 1, the MSCI All Country World IMI Index, covering approximately 99% of the global equity investment opportunity set, rose by 4.1%. The MSCI World IMI Index, which includes large, mid, and small-cap indices in developed markets, increased by 4.5%.

After outperforming developed markets in April, the MSCI Emerging Markets IMI Index was outpaced by developed markets in May, achieving a modest gain of 0.6%.

The Global Aggregate Bond Index increased by 0.9% after US yields declined in response to a lower-than-expected Consumer Price Index (CPI) report.

In the following section, we will delve into the reasons behind the strong performance of developed markets, followed by an analysis of the performance of Dimensional funds.

Exhibit 1 – Market Index Performance: May 2024 (USD)

Optimistic US and EU Results Boost Stocks

US equities made a strong comeback, delivering an impressive 5.0% return in May. This rally was fuelled by better-than-expected first-quarter earnings reports. According to FactSet, a business data & analysis company, a remarkable 79% of the S&P 500 companies reported positive earnings surprises, while 61% exceeded revenue expectations for Q1 2024. These robust earnings injected a sense of optimism into the market.

Adding to the positive sentiment, the US CPI rose by just 0.3% in April, a slight decrease from March’s 0.4%. This slowdown in inflation led to increased market speculation about a possible rate cut. Consequently, we saw the 10-year Treasury yield drop from 4.68% to 4.50% in May, which contributed to a 1% return for the Global Aggregate Bond Index.

Further boosting the market, the US Purchasing Managers’ Index (PMI) data revealed strong economic activity. The manufacturing component climbed to 50.9, and services rose to 54.8 in April, signalling expansion in these sectors. PMI is a critical economic indicator derived from monthly surveys of private-sector companies, and rising numbers indicate a healthy, growing economy.

Across the Atlantic, Europe also enjoyed a wave of positive developments. Corporate profits exceeded expectations, with 60.7% of the STOXX Europe 600 companies reporting first-quarter earnings that beat estimates, according to LSEG data. This performance is notably higher than the typical quarterly beat rate of 54%. As a result, the STOXX Europe 600 Index, which tracks the 600 largest companies in Europe, climbed by 2.6% in May.

Moreover, the Eurozone saw its business activity grow at the fastest pace in almost a year. The PMI for the Eurozone rose to 51.7 in April from 50.3 in March, surpassing the preliminary estimate of 51.4. This improvement was reinforced by first-quarter GDP growth, which was confirmed at 0.3% quarter-over-quarter, beating expectations.

In summary, May was a month of recovery and growth, with strong corporate earnings, easing inflation, and robust economic indicators driving both US and European markets. In the following section, we will examine Dimensional’s performance.

Dimensional Equity Funds Outshine Market Indexes in May With Small-Cap Surge

The Dimensional equity funds, which are tilted towards small caps, had their best month of the year so far in May, outperforming market indexes as a decline in yields significantly benefited small caps.

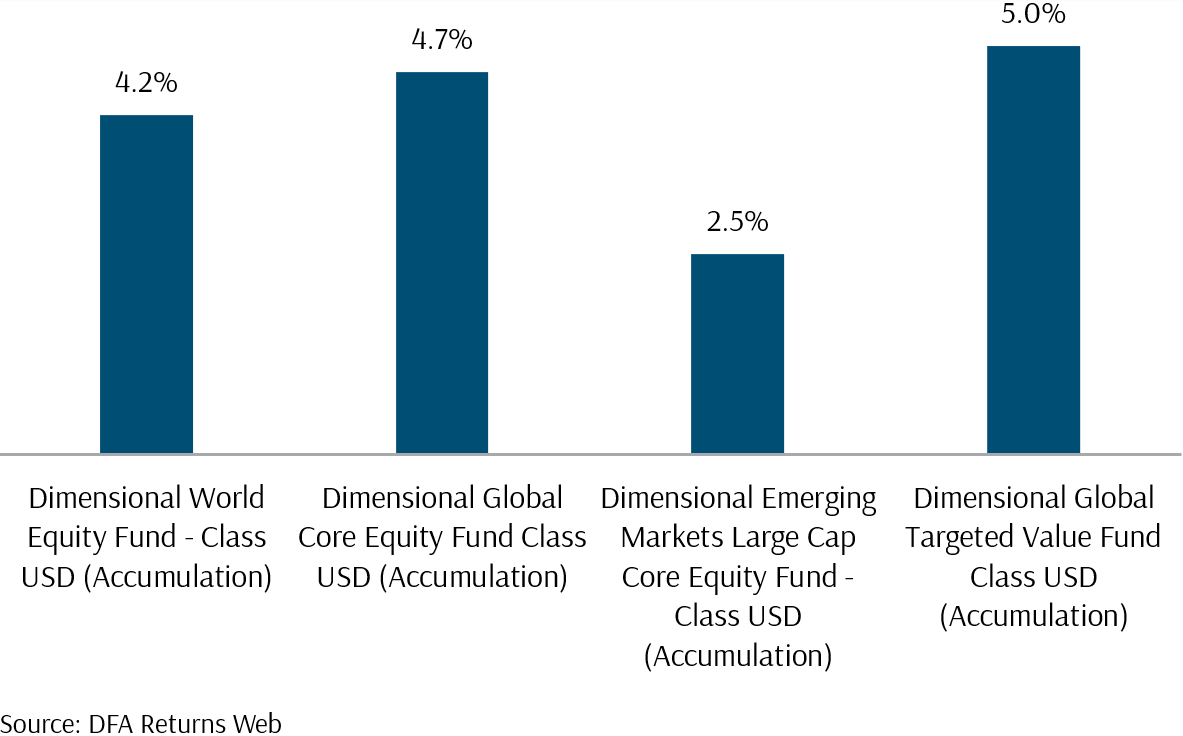

Exhibit 2 shows that the World Equity fund, which tracks both developed and emerging markets companies, rose 4.2%, outperforming the MSCI All Country World IMI Index by 0.1%. The Global Core Equity fund, which tracks developed markets, increased by 4.7%, beating the MSCI World IMI Index by 0.2%.

The Global Targeted Value fund, a small-cap fund with a focus on deep value, rose by 5%.

The Emerging Markets Large Cap Core fund was the standout performer, rising 2.5% and outperforming the MSCI Emerging Markets IMI Index by 1.9%.

In the following section, we look at why small-cap companies benefitted more from a fall in yield.

Exhibit 2 – Dimensional Equity Funds Performance: May 2024 (USD)

Falling Yields Boost Earnings for Small Caps With Higher Debt

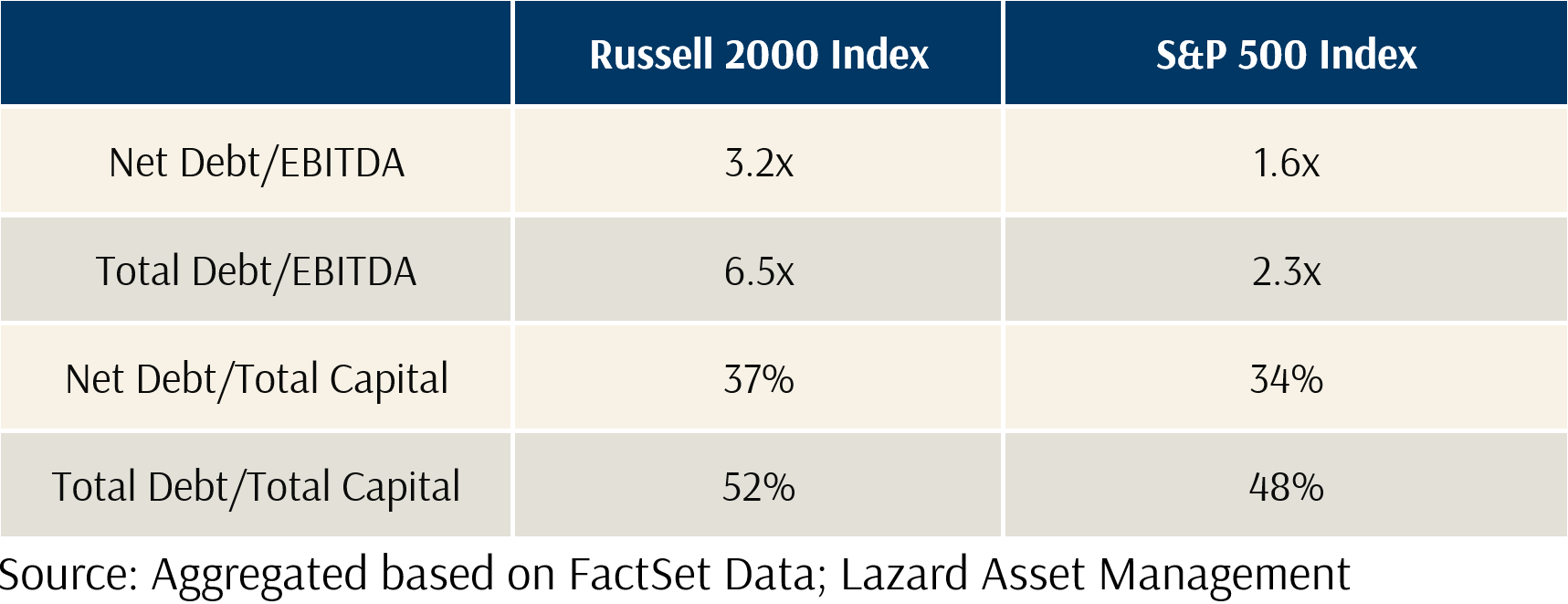

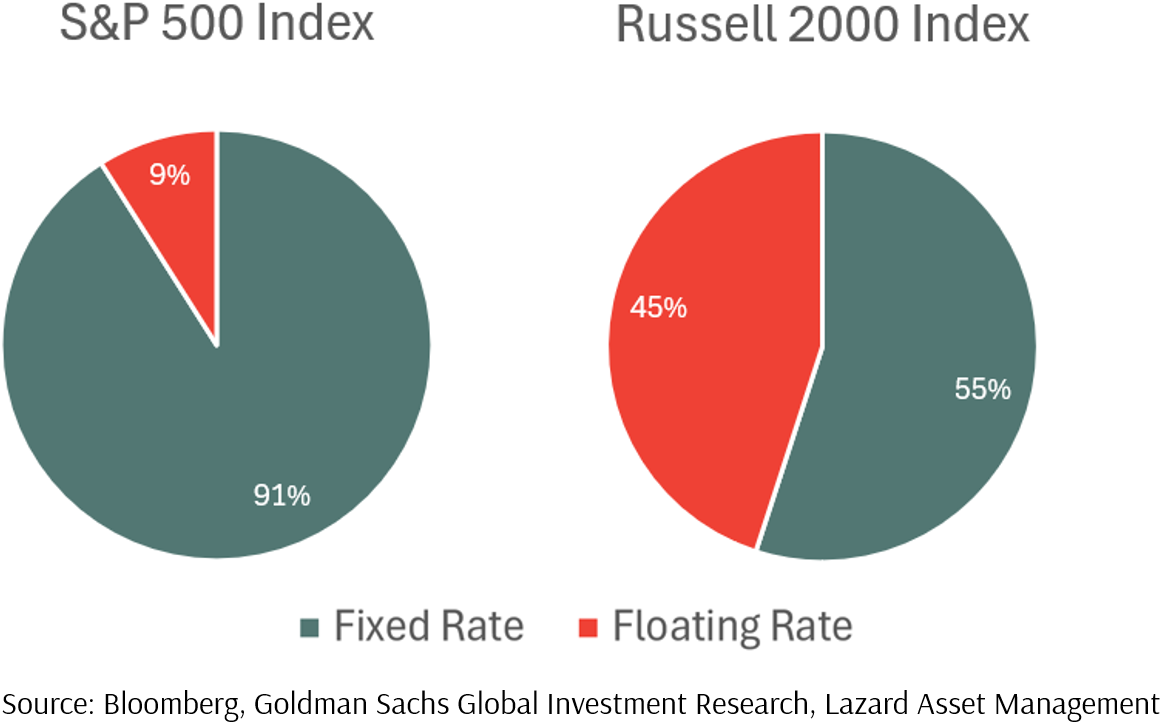

Exhibits 3 and 4 compare the amount and type of debt between the Russell 2000 Index, which tracks the smallest 2000 US companies, and the S&P 500, which tracks the 500 largest US companies.

Exhibit 3 – S&P 500 vs Russell 2000 Debt Ratios (As of Sept 2023, LTM)

Exhibit 4 – S&P 500 vs Russell 2000 Fixed/Floating Debt (As of Sept 2023)

Exhibit 3 reveals that the Russell 2000 Index has an average Total Debt to EBITDA ratio of 6.5x, more than double the S&P 500’s ratio of 2.3x. This indicates that a fall in interest rates, and thus borrowing costs, would benefit small-cap companies more than large-cap companies due to their higher leverage.

Additionally, as illustrated in Exhibit 4, with 45% of debt for the Russell 2000 companies being floating compared to 9% for the S&P 500 companies, a lower yield has a more immediate and pronounced impact on the Russell 2000.

As a result, small-cap companies, with higher interest expenses due to greater debt, benefited more on their bottom line and saw their stock prices climb higher compared to large-cap companies in May.

India’s Equity Landscape

As part of a series covering the equity landscape of major economies, this month we will be looking at India’s equity landscape.

The Importance of India’s Equity Landscape

In my April Market Review, I highlighted the growing significance of Emerging Markets due to their increasing weight in the MSCI All Country World Index (ACWI), driven primarily by China’s expanding influence. However, China’s dominance has been challenged, as shown in Exhibit 5. From 2020 to April 2024, India’s weight in the MSCI EM Index rose from 8% to 18%, while China’s share decreased from 40% to 27%.

Understanding India’s equity landscape is crucial, as it represents a growing share of the global emerging market, offering diverse opportunities for robust returns. Including India in your portfolio can enhance diversification and capitalise on its dynamic growth prospects.

Exhibit 5 – Weight of India vs China in MSCI EM (%)

In the following sections, we will examine evidence and analyse whether India has the potential to further expand its share of equity in the global market.

The sections include:

- Foreign Direct Investments (FDI) – India’s rising FDIs are pivotal for increasing its global equity market share, driving company expansion and technological advancements. Fuelled by the ‘China Plus One’ strategy, global corporations are diversifying supply chains, elevating India as a prime alternative.

- Demographic Dividend – India, with a median age of 28, stands to benefit from a demographic dividend similar to that which propelled China and South Korea’s economic growth, provided it can create productive jobs for its large working-age population.

- Financialisation of India’s Household Savings – The financialisation of savings in India is reshaping its investment landscape, particularly boosting equity markets. This transformation, driven by increasing participation in mutual funds and equities, is poised to elevate stock prices and broaden investor engagement.

- Artificial Intelligence (AI) – In 2023, the AI surge left India vulnerable due to its reliance on IT services, which dominate the service sector and contribute over half of the GDP. Basic IT customer service and entry-level staff will likely be the first affected. IT companies must reinvent themselves to thrive. Hence, the AI wave is not only an opportunity for development but also a battlefield for the self-preservation of India’s IT companies.

- India’s Election – The recent election was surprising because the incumbent Bharatiya Janata Party (BJP) did not secure the majority of 272 seats. This led to market volatility, as concerns arose that BJP’s business-friendly reforms might face obstacles, potentially affecting company valuations and hindering economic growth.

Now, let’s delve into potential factors affecting India’s equity market.

1. India’s Rising FDIs: The ‘China Plus One’ Strategy

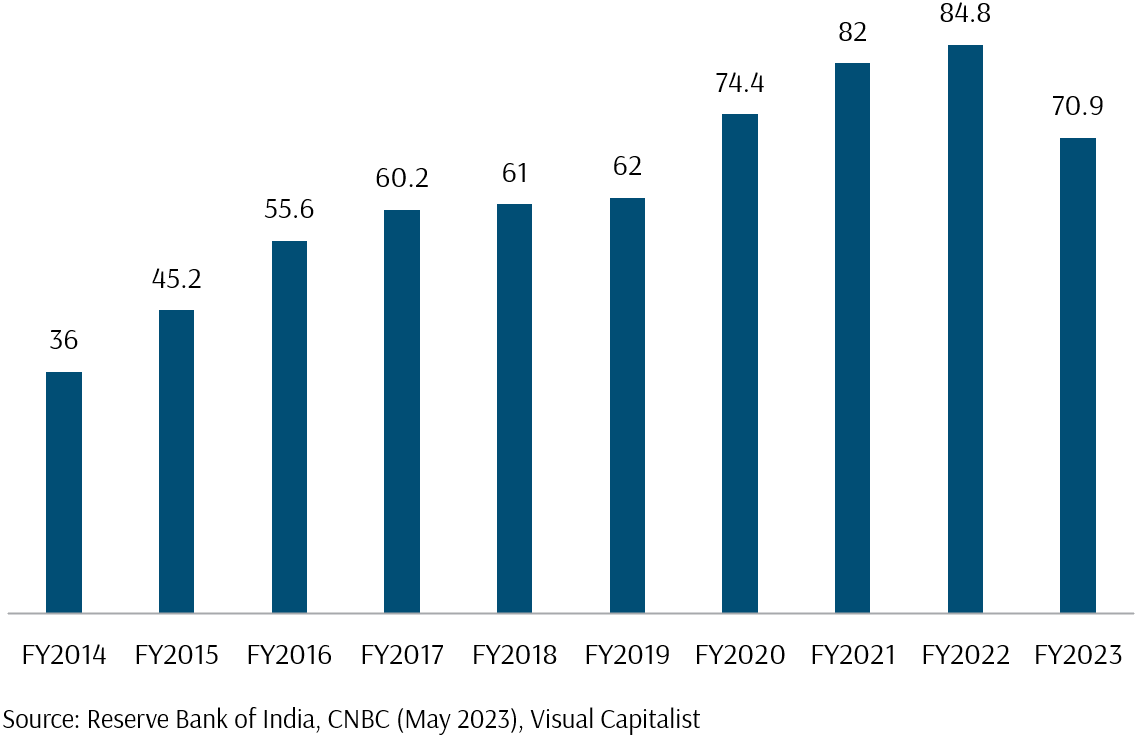

Exhibit 6 illustrates India’s Foreign Direct Investments (FDIs) from FY2014 to FY2023, measured in USD billion. Over this period, India’s FDIs exhibited a steady increase, reaching a peak of $84.8 billion in FY2022. Major global companies played a significant role in this growth, with notable investments such as Amazon’s $2 billion in 2014, an additional $3 billion in 2016, Walmart’s $16 billion investment in Flipkart in 2018, and significant investments from Google, Meta, and Foxconn in subsequent years.

However, in FY2023, India’s FDI decreased to $70.9 billion from the previous peak. This decline reflects broader global trends, where FDI in developing economies contracted, influenced partly by increased interest rates. According to UNCTAD’s Global Investment Trends Monitor, FDI inflows to developing countries decreased by 9% in 2023.

Exhibit 6 – India’s FDIs from FY[1]2014 – FY2023 (USD Billion)

Despite this recent decrease, India continues to attract substantial foreign capital, highlighting its enduring appeal amid global economic shifts. This trend underscores the ‘China Plus One’ strategy, where companies diversify their supply chains by expanding operations or sourcing products from countries beyond China while maintaining their Chinese operations. Geopolitical tensions, particularly between the US and China, have accelerated this strategic shift towards India, driven by its large labour force and supportive government policies. These factors position India favourably as a destination for foreign investment, mitigating risks associated with reliance on a single country and capitalising on its expanding market potential and investment incentives.

1a. Total Factor Productivity (TFP)

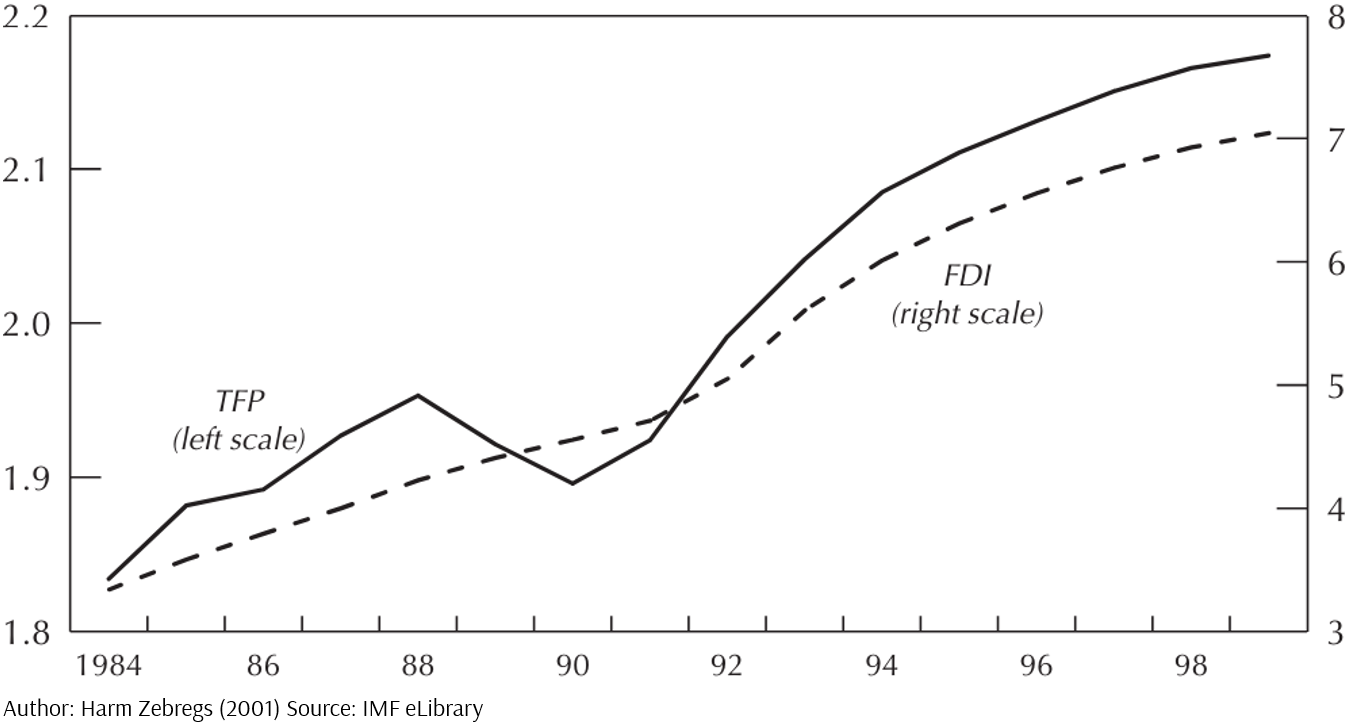

TFP measures overall economic or firm productivity, including technological advances, innovation, and efficiency gains beyond input accumulation. FDI enhances TFP by introducing new technologies, managerial expertise, and efficiency improvements. Research by Zebregs (2001) on FDI and TFP in China (1984-1999) shows a positive, bi-directional relationship (Exhibit 7), with FDI contributing to productivity growth through advanced technologies and managerial practices, leading to a significant annual TFP increase of 2.5 percentage points.

Exhibit 7 – TFP and the Stock of FDI[2] (in Logarithms)

Increased TFP benefits companies by enhancing efficiency, reducing costs, and increasing profitability. Studies, like Soumaré and Tchana (2015), illustrate bi-directional causality between FDI and stock market development in emerging markets (1994-2006). FDI stimulates local stock markets by attracting foreign investment and encouraging multinational affiliates to list, while developed stock markets attract foreign investors, signalling a robust investment environment in emerging economies.

1b. Manufacturing Sector – Plucking the Low-Hanging Fruit

FDIs from tech giants like Apple, Google, and Nvidia predominantly benefit India’s service sector, focusing on software development, digital services, and semiconductor design (Nvidia), thereby creating skilled jobs in IT-related fields. Despite starting from a lower base, the manufacturing sector holds significant potential for productivity growth.

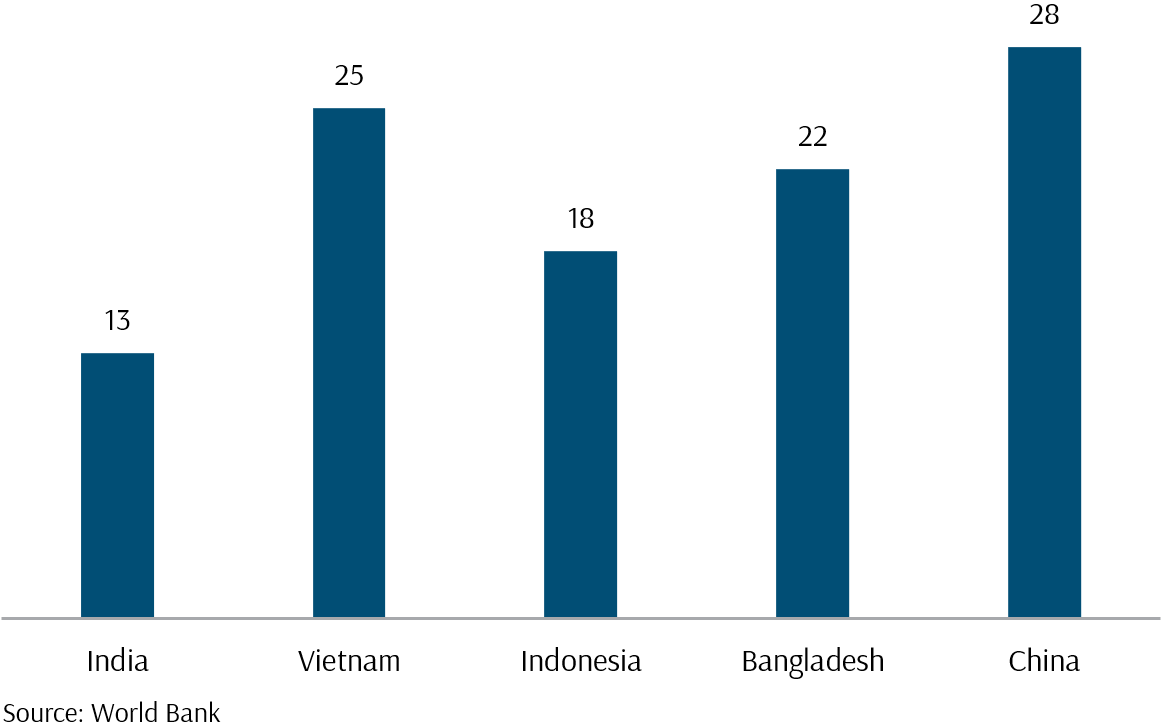

Encouraging manufacturing FDIs over services can drive economic growth and enhance productivity. As shown in Exhibit 8, in 2022, manufacturing contributed 13% to GDP, which is lower than Vietnam (25%), Indonesia (18%), Bangladesh (22%), and China (28%). Meanwhile, services constitute 55% of India’s GDP, with manufacturing at 14%, which limits employment expansion.

Exhibit 8 – Manufacturing Value Added in 2022 (% of GDP)

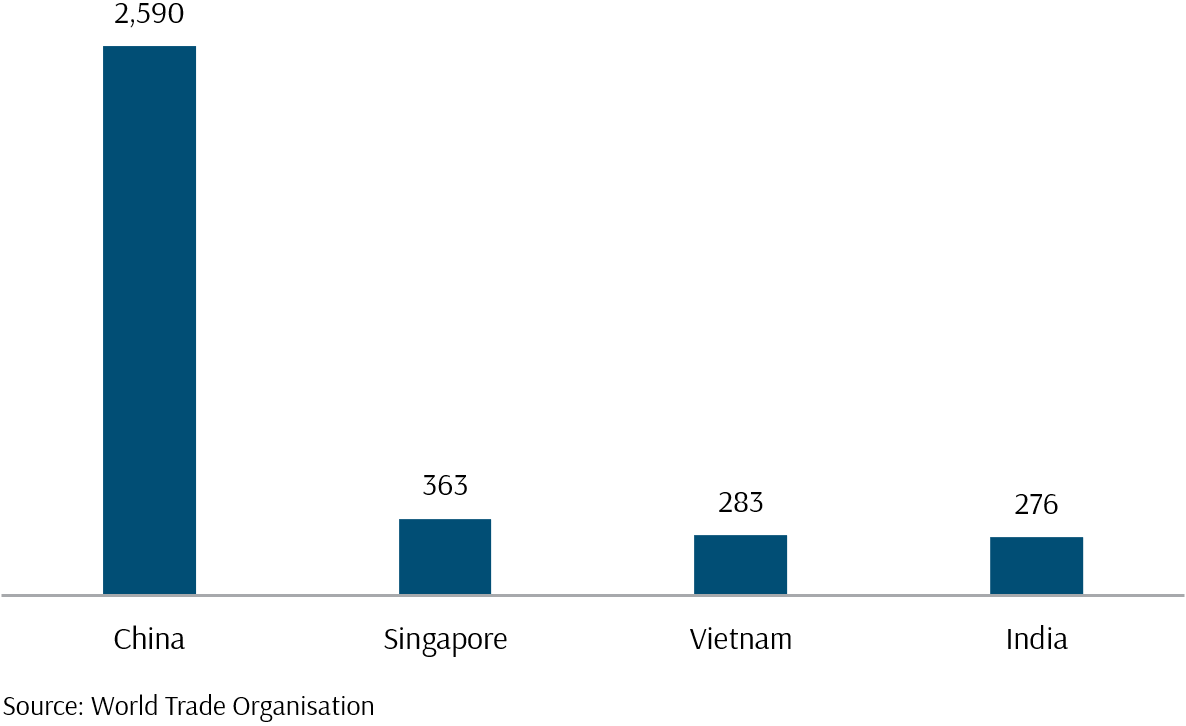

Service exports in IT and finance are competitive but employ fewer workers compared to manufacturing, which employs 63 million people. Despite strong service exports, India’s merchandise exports lag behind Vietnam’s $283 billion in 2020, underscoring the need to bolster manufacturing through increased FDI (Exhibit 9). This strategic shift can diversify the economy, strengthen resilience, and reduce reliance on services, fostering technological advancement, innovation, and infrastructure development to boost productivity and global competitiveness.

Exhibit 9 – Merchandise Exports by Country in 2020 (In USD Billions)

Looking ahead, India’s manufacturing sector holds immense untapped growth potential. Strategic investments and reforms can integrate Indian companies into global supply chains, substantially boosting the manufacturing sector’s revenues in the coming years.

1c. Will the Upward Trend of FDI Continue?

According to a report by The Wall Street Journal, Apple and its suppliers like Foxconn are targeting to manufacture over 50 million iPhones annually in India within the next two to three years. Plans also include producing 10s of millions more units in subsequent years.

These initiatives would position India to contribute a quarter of global iPhone production and potentially increase its share further by the end of the decade.

Major technology companies such as Google and Amazon are also looking to expand their investments in India. For instance, Amazon plans to increase its investment in India to $26 billion by 2030.

Officials in India also note that India aims to attract a minimum of $100 billion annually in FDI over the next five years. This target contrasts with an average of over $70 billion annually in FDI from the past five years ending March 2023 and marks a reversal from the previous year’s decline. They anticipate that the current fiscal year will approach the $100 billion target.

Hence, the upward trend in FDI is likely to continue, driven by ambitious plans from major tech companies and India’s proactive investment targets aiming for significant annual inflows.

1d. Attracting FDIs Through Reform and Infrastructure Development

The Indian government is actively reforming and investing in infrastructure to attract FDIs through measures [3] such as tax cuts, simplified regulations, and promoting industrial land availability. Efforts include enhancing liquidity for financial institutions and implementing GST simplification

For manufacturing, India has raised FDI limits in defence and insurance, promoted electronics manufacturing, and established Special Economic Zones (SEZs) with tax exemptions.

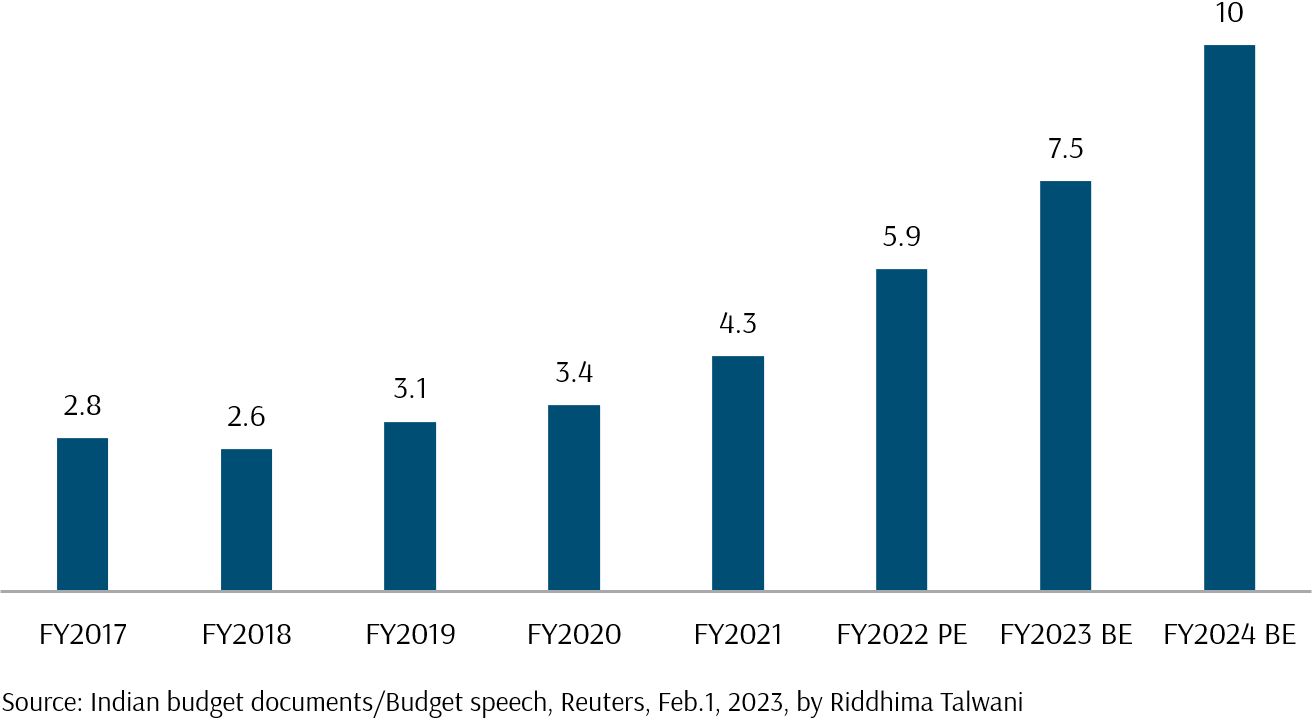

Capital expenditure in India has steadily risen from 2.8 trillion rupees (about 34 billion USD) in FY2017 to 10 trillion rupees (about 122 billion USD) in FY2024, as shown in Exhibit 10. This investment improves connectivity, reduces logistical costs, and enhances operational efficiency, bolstering India’s appeal to foreign investors. However, infrastructure investments must yield returns above 6.5% to 7% due to high government interest rates and potential institutional losses highlighted in the 2023 budget, where interest expenses represent a significant expenditure. Rapid economic growth is crucial to manage rising borrowing costs and ensure financial stability for local companies.

Exhibit 10 – India’s Capital Expenditure From FY[4] 2017 – FY 2024 (In Trillion Rupees)

1e. FDI Summary

In summary, India’s FDI landscape has witnessed substantial growth, reaching a peak of $84.8 billion in FY2022 before stabilising at $70.9 billion in FY2023. Despite a slight decline, these figures underscore India’s enduring appeal as a preferred investment destination, bolstered by strategic initiatives like the ‘China Plus One’ strategy. This approach has not only diversified global supply chains but also contributed to India’s emergence as a pivotal player in the global market.

The influx of investments from tech giants and manufacturing leaders reflects confidence in India’s economic resilience and potential. Looking ahead, continued reforms and targeted investments in infrastructure and manufacturing are poised to further elevate India’s global market equity share, fostering sustainable economic growth and enhancing its competitive position on the world stage.

2. Demographic Dividend in India

The demographic dividend refers to the economic advantage gained when a larger proportion of the population is of working age relative to dependents. This leads to heightened productivity, greater savings, and potential economic growth, thereby reducing dependency on social services and government spending while boosting earnings for local companies.

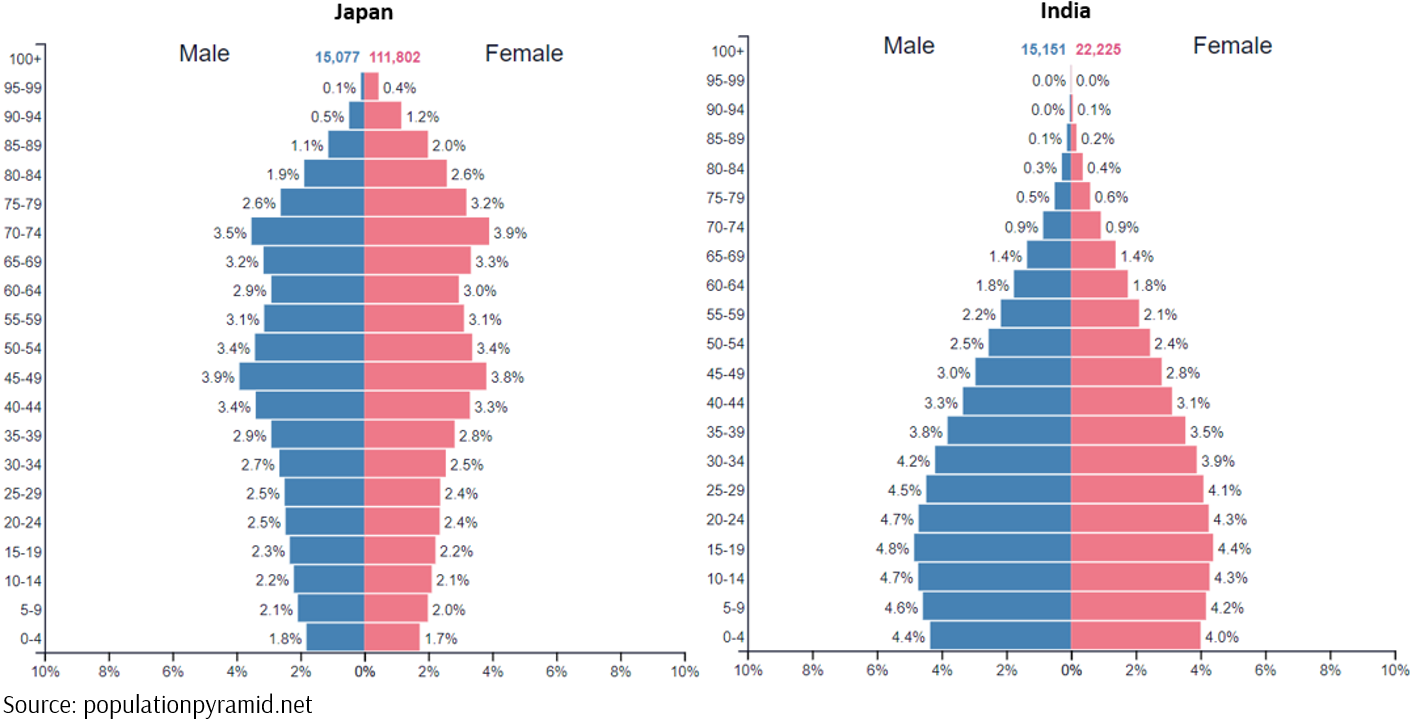

India holds a significant demographic advantage over countries like China and the US due to its younger workforce. As of 2020, India’s average age is around 28 years, compared to 38.4 years in both China and the US, and 48 years in Japan. This youthfulness offers India a demographic dividend, with a larger working-age population relative to dependents, potentially boosting economic growth. Exhibit 11 illustrates the population age composition of Japan and India.

India’s population pyramid shows a youthful demographic, with a significant proportion in the 0-34 age group. This demographic advantage provides India with a vast and energetic workforce capable of driving economic growth, fostering innovation, and market expansion. In contrast, Japan’s age pyramid shows an ageing population, supporting robust technological advancement and a mature, skilled workforce.

Exhibit 11 – Japan and India Population Pyramid in 2022

A United Nations study[5] suggests that realising a demographic dividend would boost economic growth through heightened productivity, greater savings and investment, and increased consumer demand. This can create a positive feedback loop, further stimulating domestic production, job creation, and innovation. Hence, India’s youthful population provides a significant economic advantage, fostering growth and innovation for companies operating in the country.

2a. Untapped Potential in Educated Indians

Despite rising education levels in India, significant underemployment persists, highlighting untapped potential in the labour market. An International Labour Organization report reveals a stark contrast in unemployment rates: 29.1% among graduates versus 3.4% among the illiterate. Youth with secondary education or higher face an 18.4% unemployment rate.

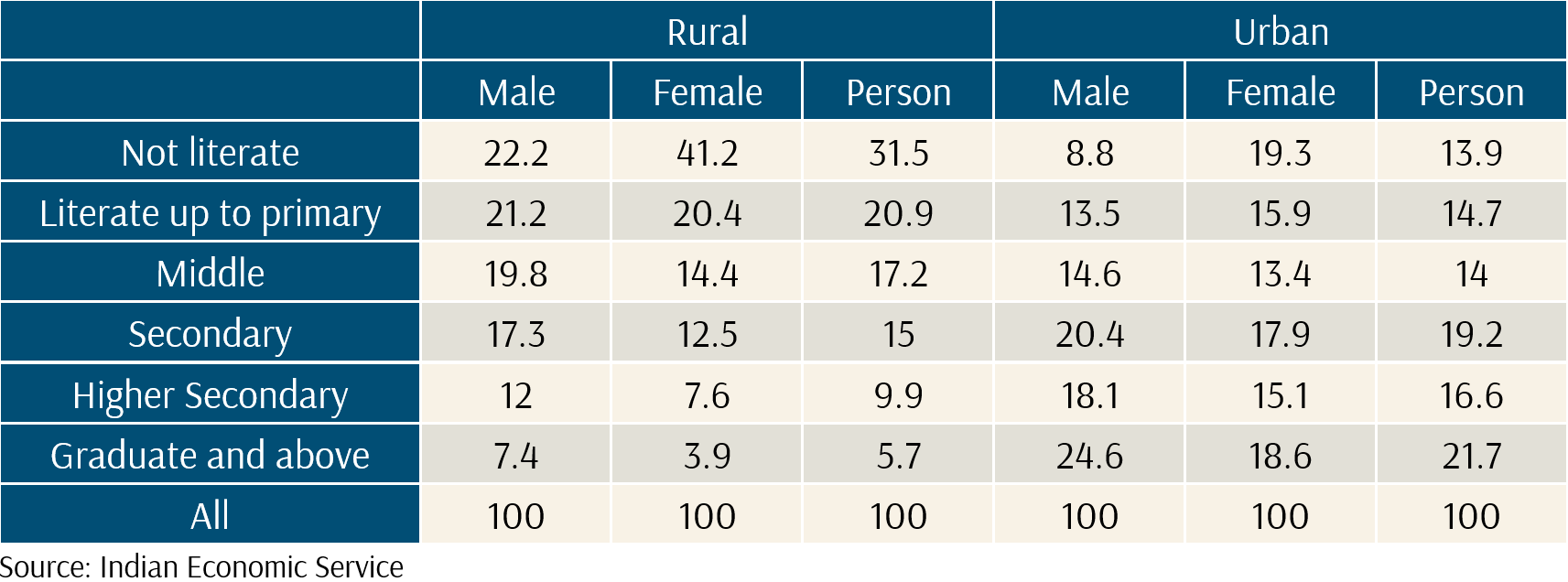

Exhibit 12 illustrates disparities between rural and urban educational attainment. In rural areas, 31.5% are illiterate, compared to 13.9% in urban areas. Only 5.7% of rural residents are graduates, versus 21.7% in urban areas. These disparities indicate a clear opportunity for companies to leverage educated talent, particularly in urban areas. Bridging the rural-urban education gap through targeted interventions could expand the educated workforce, enhancing productivity and innovation.

There is also significant untapped potential among India’s female workforce. Women’s labour force participation is 33%, below the global average of over 50% (World Bank). This disparity is pronounced in rural areas, where 41.2% of women are illiterate, compared to 22.2% of men. In urban areas, 18.6% of women hold graduate degrees or higher.

Companies can improve performance by promoting female participation through targeted recruitment, flexible work arrangements, and support for higher education and professional development.

Exhibit 12 – % Highest Level of Education Complete in India (15 Years and Above)

2b: Long-Term Economic Planning and Vision: A Dividend With an Expiration Date

India stands at a critical juncture, with a significant demographic advantage but facing challenges in maximising its potential. With a large working-age population, India must urgently create productive jobs to capitalise on this demographic dividend, especially as China shifts focus from manufacturing. However, unlike the East Asian Tigers, India’s leap from agriculture to services has not generated enough well-paid jobs, particularly for those with lower educational levels. While high-tech exports benefit skilled workers, many remain unemployed or underemployed.

Recent setbacks under Prime Minister Modi’s government, including withdrawal from the Regional Comprehensive Economic Partnership, indicate a retreat from deeper regional integration. The ‘Make in India’ initiative, now focusing on import substitution under ‘Make for India,’ risks repeating past mistakes seen in South Korea and China, delaying growth until they embraced export-oriented manufacturing.

Radhicka Kapoor from the Indian Council for Research on International Economic Relations calls for renewed reforms, emphasising attracting formal sector firms to labour-intensive manufacturing, improving labour productivity, and enhancing female workforce participation. These reforms are crucial for unlocking India’s demographic potential and achieving Modi’s goal of developing India by 2047.

India’s demographic dividend is time limited. Without structural reforms, India risks missing out on its labour-intensive manufacturing advantage, leaving it unprepared for future fiscal and social challenges associated with an ageing population. To realise its economic potential and ensure sustainable growth, India must take decisive policy actions to overcome its current challenges and prepare for a prosperous, inclusive future.

2c. Demographic Dividend Summary

India’s young population represents a substantial economic opportunity, marked by heightened productivity, increased consumer spending, and a competitive labour cost advantage. Nonetheless, persisting challenges include underemployment among educated individuals and low participation of women in the workforce. To fully capitalise on this demographic advantage, reforms are essential, emphasising labour-intensive manufacturing, enhancing productivity, integrating more women into the workforce, and addressing rural-urban disparities, especially the lack of formal job opportunities in rural areas. Failing to implement these reforms could limit India’s potential to maximise its demographic dividend, potentially impacting long-term economic growth and the performance of its equity markets.

3. Modernising Household Savings: India’s Financial Transition

The Indian financial landscape is experiencing a transformative shift towards the financialisation of savings. This significant change is poised to broaden investor participation and potentially boost stock prices through increased demand for shares. Let’s delve into the details of this transformation, supported by recent data and insights.

3a. Rise of Mutual Funds in Gross Savings

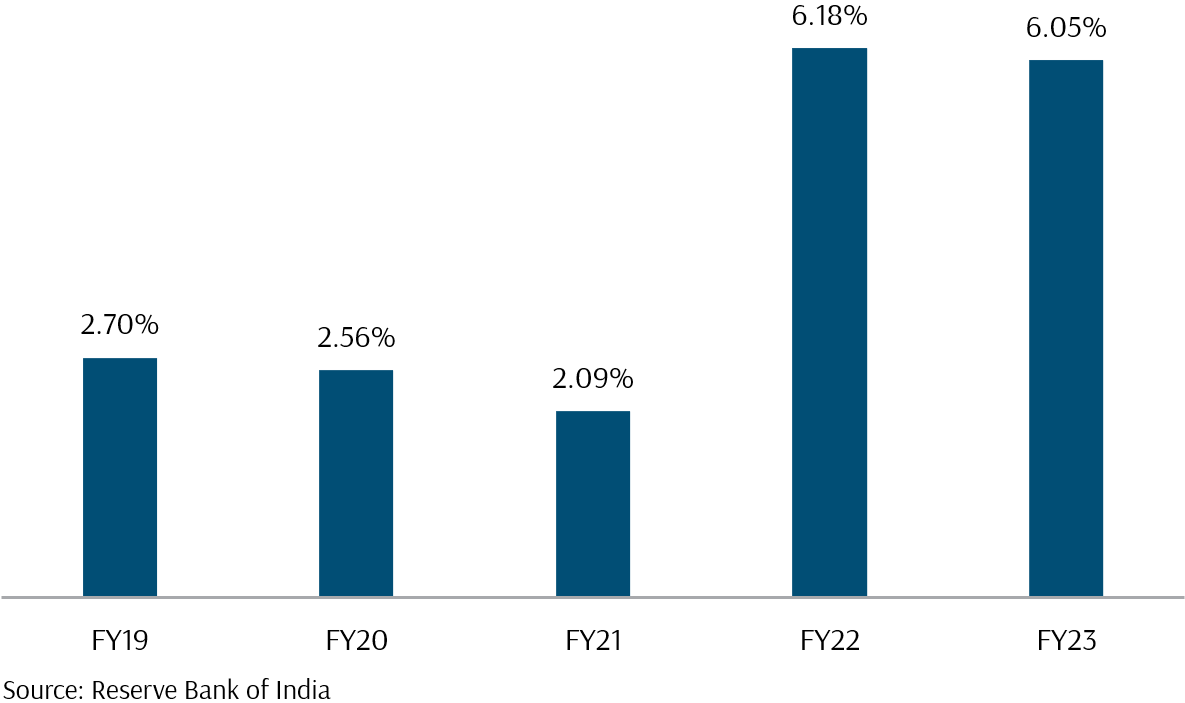

Over the past five fiscal years, the percentage of mutual funds in India’s gross savings has shown a compelling upward trajectory. As illustrated in Exhibit 13, in FY19, mutual funds constituted 2.70% of gross savings. This figure decreased slightly to 2.56% in FY20 and further to 2.09% in FY21. However, from FY21 onwards, there has been a dramatic rise, with mutual funds accounting for 6.18% of gross savings in FY22 and maintaining a high level of 6.05% in FY23. This sharp increase indicates a growing preference among Indian savers for mutual funds as a primary investment vehicle.

Exhibit 13 – India’s Mutual Funds to Gross Savings (%)

3b. Drivers of Investor Behaviour Shift

Several factors are driving this shift in investor behaviour. Increased financial literacy among the general populace has led to a better understanding of mutual funds and equity investments. As more individuals become aware of the benefits of these investment options, there is a noticeable shift in their savings patterns. Technological advancements have also played a crucial role. The rise of digital platforms has revolutionised the investment landscape, making it more accessible and convenient for a broader audience. These platforms have lowered entry barriers, allowing even small investors to participate in the market with ease.

3c. Regulatory Support and Market Confidence

Regulatory support has been another significant factor. Pro-investor policies and regulatory measures have instilled confidence in the market. Initiatives such as the implementation of investor protection frameworks[6] and the introduction of transparent processes[7] have enhanced trust among investors. Moreover, the positive performance of the Indian equity market has attracted new investors seeking to capitalise on returns. The robust performance of Indian equities has made them an attractive option for savers seeking higher returns compared to traditional savings instruments.

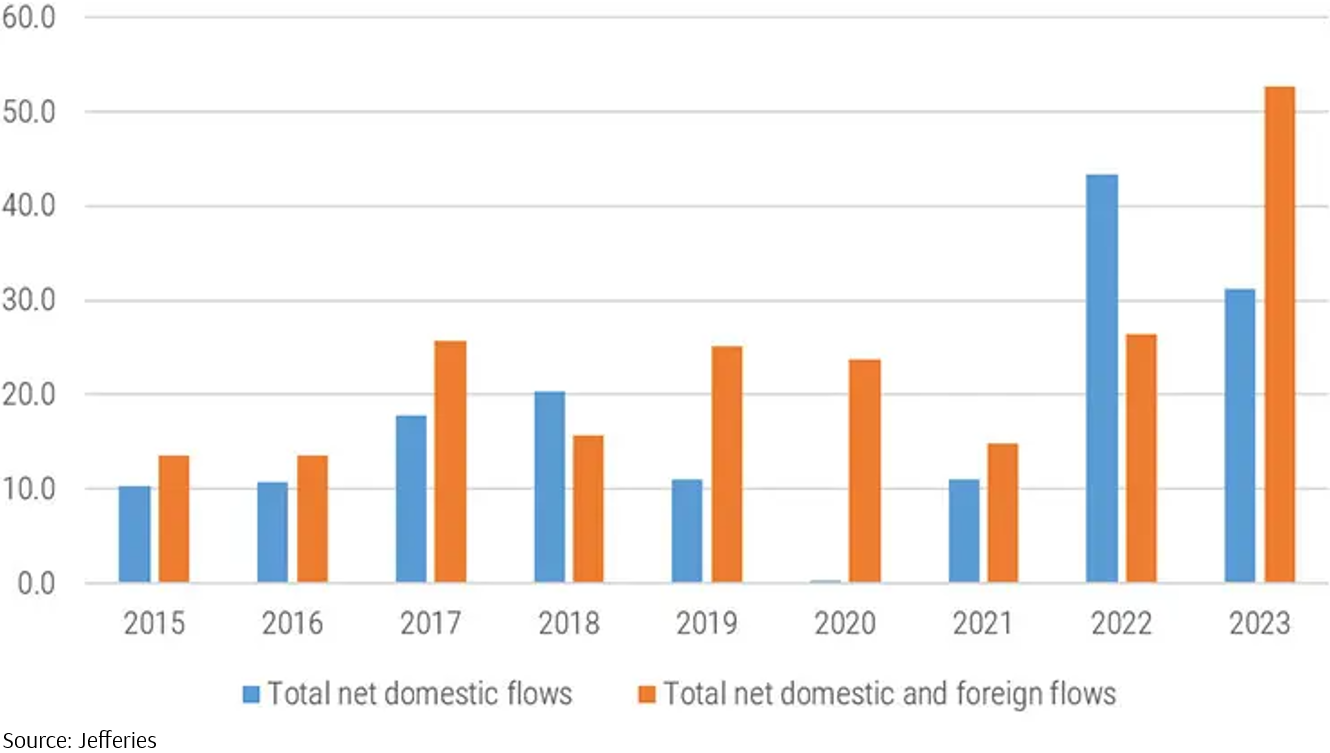

Insights from Robeco [8] highlight that domestic flows are playing a crucial role in underpinning India’s equity valuations. Despite global uncertainties, domestic inflows into Indian equities have remained robust (Exhibit 14), providing a stable foundation for market growth. This consistent influx of domestic capital mitigates the impact of volatile foreign investments and supports high equity valuations. The rise in retail investor participation is diversifying the investor base, reducing dependence on foreign institutional investors (FIIs) and adding resilience to the market.

Exhibit 14 – Net Domestic and Foreign Inflows Into India’s Equity Market

3d. Role of Domestic Flows in Equity Valuations

The financialisation of savings in India is expected to positively impact stock prices through several mechanisms. As more savings flow into mutual funds and directly into the equity market, the demand for shares increases, driving up stock prices and benefiting investors. The rising percentage of mutual funds in gross savings underscores this growing demand. Additionally, a diversified and broadened investor base contributes to market stability. With more domestic investors participating in the market, the impact of external shocks is mitigated, reducing volatility and fostering a conducive environment for long-term investment.

3e. Enhanced Market Liquidity and Economic Implications

Enhanced market liquidity is another positive outcome. Greater investor participation enhances market liquidity, making it easier to buy and sell shares without significantly impacting prices. This increased liquidity is particularly beneficial for investors who require the ability to execute large transactions efficiently. The financialisation of savings is not just a boon for the stock market; it has broader economic implications as well. When savings are channelled into productive investments through mutual funds and equity markets, it leads to more efficient allocation of capital, spurring economic growth, creating jobs, and contributing to overall economic stability.

Moreover, the enhanced market stability and liquidity resulting from broader investor participation make the Indian equity market a more attractive proposition.

3f. Summary for Financialisation of India’s Household Savings

In conclusion, the ongoing financialisation of savings in India represents a significant opportunity for investors. By channelling a larger portion of savings into mutual funds and equities, Indian investors are not only seeking higher returns but also contributing to the overall growth and stability of the market. This trend is likely to continue, bolstering stock prices and creating a favourable investment landscape.

4. AI Wave: Riding It to Success or Getting Crushed by the Challenge

AI’s rise presents both a significant opportunity and threat to Indian IT giants like Infosys and Tata Consultancy Services (TCS). These companies excel in tasks involving the manipulation of numbers and symbols, such as coding. However, AI’s capabilities in these areas make these companies vulnerable.

The IT and business services sector is crucial to India’s economy, employing 5 million people, contributing 7% to GDP, and accounting for nearly a quarter of exports. While simpler services like call centres make up a fifth of foreign revenues, IT services, including data migration to the cloud, generate three-fifths. According to Capital Economics, if AI were to eliminate this industry without resource reallocation, India could see a reduction of nearly one percentage point in annual GDP growth over the next decade. A more likely scenario of gradual decline could slow growth by 0.3-0.4 percentage points.

The IT sector constitutes 12% of the Nifty 50 Index in India, indicating that any negative impact on this industry could significantly affect the country’s equity market.

4a. Threats Posed by AI and Chatbots

AI and chatbots pose a significant threat to Indian IT companies by reducing the demand for human labour. Technologies like ChatGPT are increasingly capable of performing core tasks such as coding and data processing. Last year, these companies collectively laid off 75,000 employees, officially due to a broader tech sector slowdown, but indicative of AI’s growing impact on traditional job roles. This trend suggests a future where AI-driven automation diminishes the need for human involvement in routine tasks. In April, TCS’s Chief Executive, K. Krithivasan, predicted that within approximately a year, chatbots would be capable of handling many of the tasks typically performed by call centre employees.

Additionally, the efficiency and capability of AI in handling well-defined tasks present a competitive threat. Firms that adeptly leverage AI may outcompete those relying more heavily on human labour, pressuring Indian IT firms to integrate AI swiftly and effectively or risk losing market share. This underscores the necessity for Indian IT companies to innovate and adapt to maintain their competitive edge.

4b. Opportunities Through AI Adoption

Conversely, AI and chatbots offer substantial opportunities for Indian IT companies to enhance their service offerings and operational efficiencies. By embedding AI technologies, firms like Infosys and TCS can deliver more sophisticated and efficient solutions. AI can streamline processes, improve accuracy, and handle larger volumes of work more quickly than human employees, providing higher-quality service to clients.

AI also opens new market segments. By positioning themselves as leaders in AI integration and solutions, Indian IT companies can attract a broader range of clients looking to adopt AI in their operations. This strategic positioning can drive growth and expand their market base, ensuring they remain relevant in an evolving industry.

Cost reduction is another notable benefit. Utilising AI can significantly lower operational expenses by automating routine tasks, thereby increasing profitability. This financial advantage allows companies to reallocate resources towards more strategic and innovative areas, fostering long-term growth and maintaining a competitive edge.

4c. The Impact of Global Capability Centres

Adding another layer of complexity is the trend of foreign companies establishing Global Capability Centres (GCCs) in India. Firms like Rakuten are increasingly setting up their own GCCs, allowing them to internalise IT functions, align better with business objectives, and foster innovation within their own frameworks. This shift poses a direct challenge to Indian IT service providers as it reduces their traditional outsourcing business.

The establishment of GCCs reflects a strategic move by global companies to exert greater control over their operations and innovation processes. By harnessing local talent within their organisations, these firms can achieve faster innovation cycles and cost efficiencies, making the traditional outsourcing model less attractive.

4d. Leveraging AI to Reclaim Business

However, the strategic adoption of AI offers a pathway for Indian IT firms to mitigate the impact of GCCs and reclaim lost business. By integrating advanced AI solutions into their service offerings, companies like Infosys and TCS can provide compelling value propositions that GCCs might find challenging to replicate independently.

Enhanced service offerings through AI enable Indian IT companies to offer more sophisticated and tailored solutions. AI-driven analytics and insights can help clients optimise their operations beyond what in-house teams might be able to achieve, making outsourcing more attractive than setting up and maintaining a GCC.

Additionally, AI facilitates cost efficiency and innovation, allowing Indian IT firms to offer competitive pricing and develop new products and services. This positions these companies as cutting-edge solution providers rather than mere outsourcing destinations.

Scalability and flexibility are also significant advantages. AI allows for greater scalability and adaptability in operations, a strong selling point for global companies seeking robust IT solutions. Indian IT firms can leverage AI to quickly scale up services to meet evolving client needs, which might be harder to achieve through a GCC setup.

4e. Summary: Strategic Positioning for the Future

For Infosys, TCS, and other Indian IT giants, the strategy should be to aggressively integrate AI into their service offerings and focus on high-value, innovation-driven solutions. By doing so, they can position themselves not just as outsourcing partners, but as integral technology collaborators that bring substantial value to their clients. Partnering with AI startups, investing in AI research, and upskilling their workforce to handle AI-related projects will be crucial in maintaining their competitive edge.

In conclusion, while the rise of GCCs and the proliferation of AI present significant challenges to the traditional outsourcing model of Indian IT services, the strategic adoption of AI offers a promising pathway to mitigate these threats. By embracing AI, Indian IT companies can enhance their value proposition, making them indispensable partners in the digital transformation journeys of global enterprises.

5. Impact of Election on India’s Economy and Market

In early June, India, held elections with Prime Minister Modi seeking a historic third term. Throughout his tenure, Modi’s policies have notably supported business interests, particularly through increased spending on infrastructure and manufacturing, which have delivered economic growth and has seen India’s stock market reach record highs. Investors have been watching the results keenly as they hope for more policy continuity and stability.

However, following the announcement of election results on 4 June 2024, Modi’s BJP party secured only 240 seats, falling short of the 272 needed for a majority. This necessitates forming a coalition with other parties, potentially affecting the implementation of anticipated reforms and spending plans, causing a brief 6% dip in the market index.

Market expectations had been optimistic about BJP’s business-friendly reforms, which were anticipated to boost equity valuations. These reforms encompassed land and labour reforms in rural areas, alongside substantial investments in infrastructure and manufacturing. Consequently, companies heavily reliant on these initiatives displayed heightened volatility compared to the broader Nifty 50 Index. For instance, Larsen & Toubro Ltd, a major player in India’s engineering and construction sector, experienced more than 12% decline in its share value following the announcement of the election results, reflecting its sensitivity to fluctuations in India’s infrastructure and manufacturing investments.

However, as market uncertainty settled the following day, investor confidence rebounded, reflecting a belief in the resilience of local stock fundamentals and the potential continuity of these reforms. Hiren Dasani, co-head of Emerging Markets Equity at Goldman Sachs Asset Management, highlighted that despite varying government coalitions from 1991 to 2014, India has consistently maintained a trajectory towards business-friendly economic policies without significant policy reversals.

Therefore, despite recent political developments, there is strong confidence that India will persist with its business-friendly policies and reforms aimed at attracting foreign direct investment (FDI). The initial market volatility following the election has stabilised, underscoring faith in the enduring strength of India’s economic fundamentals.

India’s Equity Landscape – Well-Positioned for Future Success

India’s equity landscape is evolving rapidly, characterised by increasing FDIs, a demographic dividend, and the financialisation of household savings. With its share in the MSCI Emerging Markets Index rising from 8% to 18% between 2020 and 2024, India has become a crucial player in the global market. Factors such as robust FDIs driven by the ‘China Plus One’ strategy, a young and expanding workforce, and a shift in household savings towards equities underscore the country’s potential for continued growth. However, the threat posed by advancements in AI, especially to India’s dominant IT services sector, remains a challenge. Despite recent market volatility, India’s economic policies have consistently aimed at fostering a business-friendly environment, suggesting a resilient outlook for its equity market.

Don’t Sell in May – Stay Invested Instead

May proved to be a remarkable month for global markets, with stocks and bonds rebounding strongly due to favourable corporate earnings and signs of easing inflation in the US and Europe. The MSCI All Country World IMI Index rose by 4.1%, reflecting broad-based optimism. In this context, the Dimensional Equity Funds, particularly those with a small-cap tilt, outperformed, driven by declining yields and strong economic activity in developed markets. Meanwhile, India’s equity landscape shows significant potential for growth, bolstered by increasing FDIs, a young workforce, and rising household investments in equities. Despite recent volatility linked to political developments, India’s market fundamentals remain robust.

Investors should stay diversified to capture the opportunities presented by both the global recovery highlighted in May and the long-term growth potential in India. By maintaining a balanced portfolio that includes exposure to dynamic emerging markets like India alongside developed markets, investors can optimise their returns and mitigate risks. The positive developments in global markets, combined with the structural growth drivers in India, make a compelling case for a diversified investment strategy that leverages the strengths of both regions.

We trust you found this month’s market review insightful. Should you have any concerns, please do not hesitate to reach out to your Client Adviser. Thank you.

– Footnotes –

[1] FY stands for fiscal year from 1 April to 31 March. E.g. FY 2014 is April 2013 to March 2014.

[2] Values shown in the graph are the author’s estimates.

[3] For more details on India’s measures to attract FDI, visit:

a. The Press Information Bureau

b. The India Brand Equity Foundation

c. The Ministry of Electronics and Information Technology

[4] 2021-2022 PE: Previous estimate for the fiscal year ending March 2022.

2022-2023 BE: Budget estimate for the fiscal year ending March 2023.

[5] Frontier Technology Issues: Harnessing the economic dividends from demographic change

[6] Securities and Exchange Board of India (SEBI)

[7] SEBI has introduced and enforced a variety of investor protection measures under Section 11(2) of the SEBI Act. These include stringent regulations on market intermediaries, robust market surveillance systems, and mechanisms for investor grievance redressal, such as the centralized web-based platform SCORES (SEBI Complaints Redress System) 2.0. This platform streamlines the process for investors to lodge and track complaints, enhancing transparency and efficiency in resolving investor issues.

[8] Domestic flows underpin India’s equity valuations

To learn more about our purpose-driven approach towards investment management, please visit this link.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.