It was 6am in the morning, when the director yelled, “…and CUT, it’s a wrap!” I breathed a sigh of relief. It had been a gruelling 24-hour shoot for a commercial. No amount of caffeine could mask the fatigue I felt. At that point, I was confused. I had started work and ended at the same time.

Miraculously, I drove home safely, cleaned up, and got to bed. My body wanted to shut down, but my mind wouldn’t stop spinning. Is this what I want to be doing for the rest of my career? How much money can I actually earn? How many more dinners with my family will I miss because I’m “working”?

And yet… it paid well. Very well. I had seen the remuneration sheet. These were the thoughts running through the head of a 19-year-old intern who dreamed of being a film director.

The Lipton production team needed an extra at last minute (I am on the extreme left).

I loved the craft, but not the hours. Eventually, after college, I pivoted into finance and investments. Why? Because at that time, the goal was simple: understand how money makes more money whilst also making money in exchange for my time. My first job was with a financial education company. Outside of working hours, I spent time learning its materials and absorbing as much as I could on investments. Subsequently, I built spreadsheets to track everything—my spending, savings, investments.

Stocks. Options. CFDs. Crypto. Futures. I tried them all. I was always watching, always waiting for the breakout. Every alert felt urgent. Every market dip, personal. I convinced myself that constantly checking was a form of control.

But the truth? I was anxious and tired. All that news, comments and opinions were slowly injecting fear and anxiety into me. It was a false sense of security.

My trading desk during my stint as a professional commodities trader.

A Recalibration of Success

On paper, my career was doing well. I was moving up the corporate ladder. But deep inside, I felt I was still not doing too well at investing. After countless tweaks and restless searching, I finally stopped to reflect. Maybe I needed a mindset recalibration. Maybe it was how I defined success.

That led me to Lifebook, a programme by Jon and Missy Butcher. It introduced 12 categories of life, helping me define my beliefs, vision, and strategies for each. What began as a quest to improve my investing turned into a full re-evaluation of life.

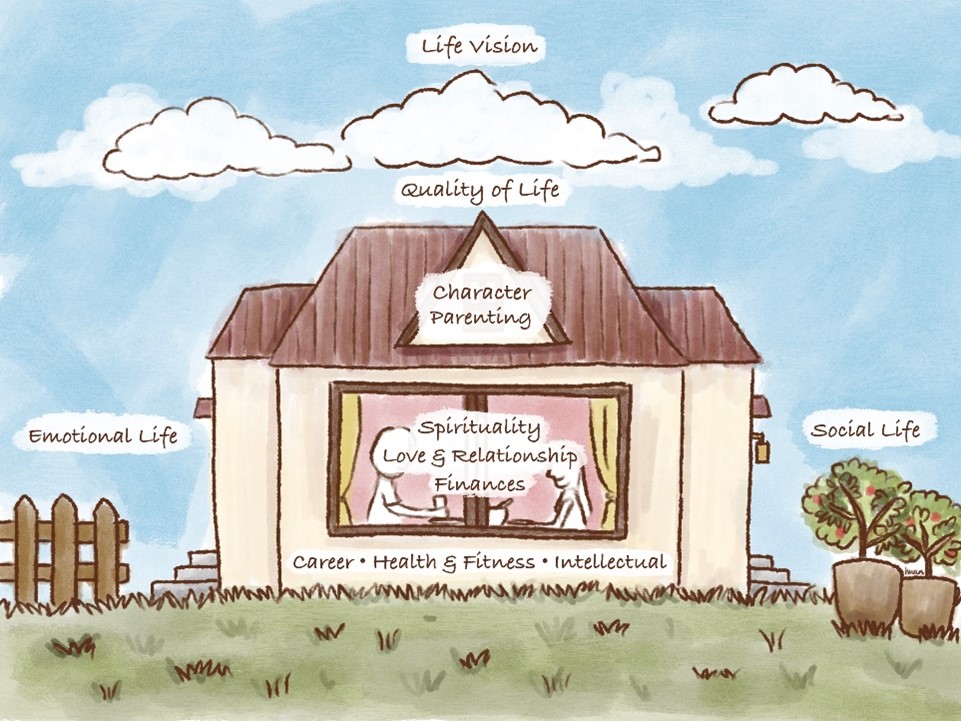

The 12 categories are Health & Fitness, Intellectual Life, Emotional Life, Character, Spirituality, Love & Relationships, Social Life, Career, Financial Life, Parenting, Quality of Life, and Life Vision. It was really one of the greatest discoveries of my life.

I took a few days off and went for a silent retreat at Maranatha Retreat House in Janda Baik, Malaysia. There, I pondered deeply about the type of life that I would like to have.

With much clarity, focus, and intentional planning, I held in my hand the 12 categories of my life. Each well-defined, with its own vision and strategy. As far as success in money and investments is concerned, I distilled it down to needing more time, education, and investing in smaller amounts. Unfortunately, it really only covered one part of the equation.

Fast forward a few years, and I found myself chasing new ‘highs’ again. Each milestone I reached only revealed another ahead, as if the goalpost kept shifting with every step forward.

I didn’t seem to be getting anywhere.

Discovering Sufficiency

While doing research for work, I stumbled upon an article from Providend on the value of advice. That’s where I first encountered the Philosophy of Sufficiency.

Our CEO, Chris, shared that, in sufficiency, you don’t maximise investment returns but seek the most reliable path to enough returns to meet your needs. You don’t hoard all your surplus for tomorrow, but you use part of it for the important things in life. He also shared about contentment, where you no longer crave or desire anything that you don’t already have, but instead make the conscious decision to enjoy, appreciate, and accept what you have.

To make this work, I would need to know what is really important to me in my life and accept that I can’t have everything. Hence, it set me on a path towards considering what my non-negotiable life goals are. Today, it is called Ikigai goals.

My first tote bag drawing experience at Providend’s quarterly retreat.

Over months of reading Providend’s work and listening to their conversations, the message sank in. I didn’t just need sufficiency in finances. I needed it in all 12 categories of my life.

I had been building myself up—growing, improving, constantly strategising. But I wasn’t appreciating what I already had. I hadn’t realised that true happiness comes from fully appreciating what I already have today.

Success in Life Is Defined Not Only With Dollars & Cents

The moment I realised that I was already wealthy, not in numbers but in the life I was living, my perspective changed significantly. Right now, I am not looking for more, but rather, enough. Peace of mind, a good night’s sleep, quality time with my loved ones, and taking things slow on holidays are far more important than impulse checking my portfolios. Gone are the days when I was a slave to my portfolio tracker.

Enjoying the sunny & chilly weather of Perth, Australia, with my wife.

I finally understood that money was just an enabler to one’s life goals. Providend, with its collective wisdom, understood this long ago and continues to help its clients define what truly matters.

A rendition of the 12 Categories of my Lifebook.

Today, my biggest life goal is simple: equilibrium. Balance across all 12 life categories. That, to me, is my Ikigai goal. I have also started a weekly habit of documenting the blessings that I have encountered throughout my week. Here are some of them:

-

“I am thankful for the wisdom of understanding that I’m part of a bigger project towards giving clients a good life that they deserve.”

-

“I am grateful for the senses that I have in my human body. These senses allow me to feel the unconditional love from my loved ones.”

-

“I am thankful to have enough financial sustenance to keep my body, mind and soul alive – to live a good balanced life.”

-

“I am grateful for being part of a company of people that practise sufficiency in their approach to investments and insurance. This minimises the tendency of mis-selling and overselling to clients.”

-

“I am grateful for this life and every material thing that I own – be it small or large, cheap or expensive, meaningful or otherwise.”

-

“I appreciate the space to learn, grow and develop to be a trusted adviser.”

-

“I thank you, my Creator, for blessing me with this life and for giving me a mind to be able to comprehend a deeper meaning behind all these experiences.”

Perhaps success in life is not only how much material wealth, achievements, recognition, or money one has amassed, but the bigger picture behind all these experiences.

Perhaps now, by practising sufficiency, one can have more ‘heartspace’ for a deeper reflection on life.

To quote the late Pope Francis, “The heart is the locus of sincerity, where deceit and disguise have no place. It usually indicates our true intentions, what we really think, believe and desire.”

Perhaps after deep contemplation of the heart, we can further crystallise our ikigai goals and channel our means (money) towards living our lives meaningfully.

I’m still a pilgrim on this journey called ‘Life’, and I’m very excited for what lies ahead!

This is an original article written by Ferris Narcis, Associate Adviser at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

If you are interested in joining our Providend Associate Adviser Programme, kindly visit this link to find out more: https://providend.com/careers

For more related resources, check out:

1. Beyond Stock Market Returns: How Providend Transformed My Investment Approach

2. To Everything There is a Season: Balancing Wealth, Health and Ikigai Through Life’s Changing Seasons

3. I’m in My 30s—Here’s the Advice I Wish I Knew in My 20s

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

Through deep conversations with our advisers, you will gain clarity on what matters most in life and what needs to be done to live a good life, both financially and non-financially. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.