In recent years, I have been hearing more and more investors say that all they need to do is buy an ETF or Index Fund that tracks the S&P 500 index and they would get the investment returns they need. In this article, I hope to dispel this myth.

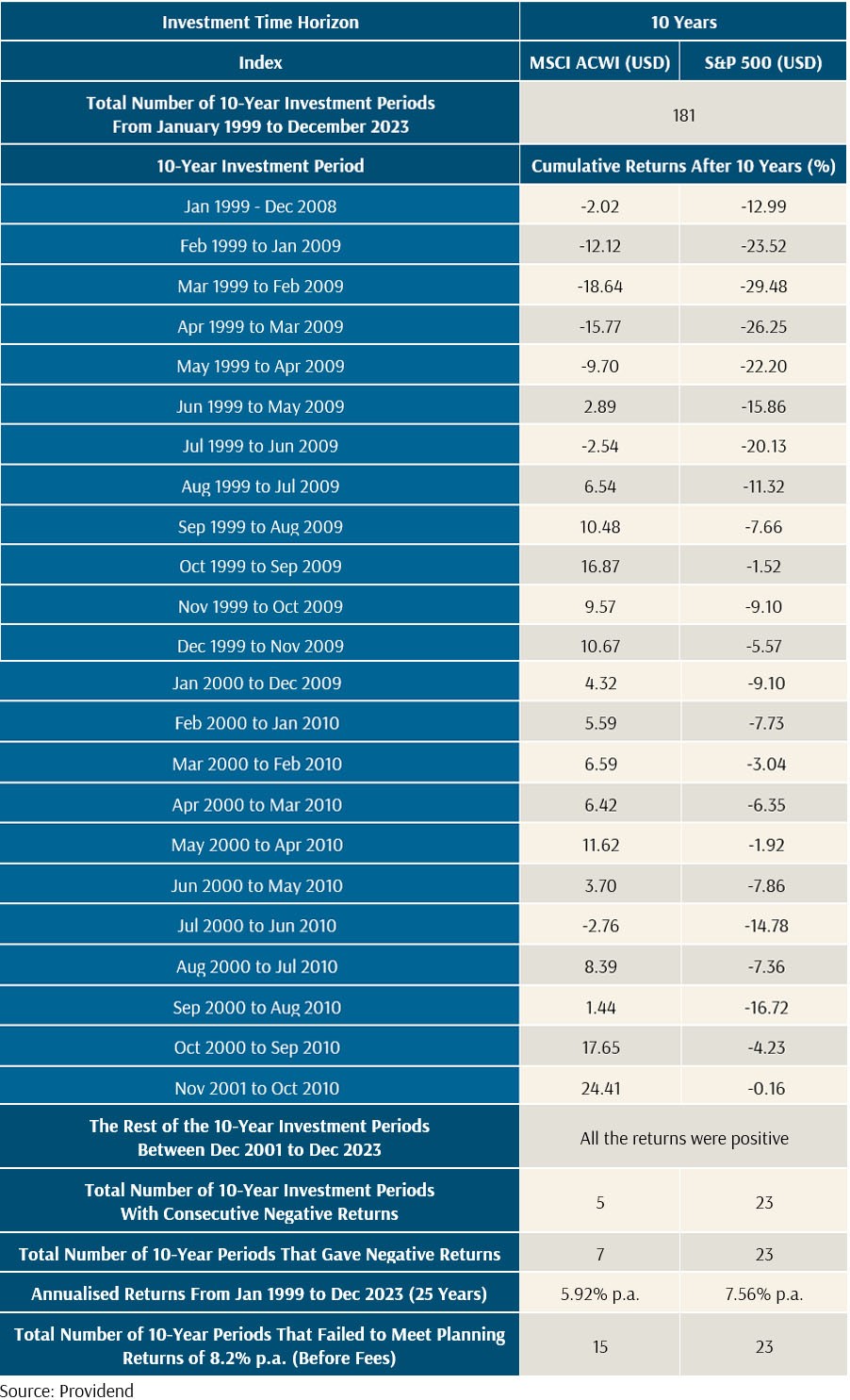

Using the S&P 500, as well as the more diversified MSCI All Country World Index (ACWI, which includes other developed markets outside of the US as well as emerging markets), I looked at the cumulative returns for each of the 10-year investment periods based on monthly intervals between Jan 1999 to Dec 2023 (a 25-year period). You can see from the table that there are 181 such periods. This means that if an investor has a 10-year investment horizon, between Jan 1999 to Dec 2023, on a monthly basis, there were 181 possible 10-year periods where investors could have been invested. The first 10-year investment period was from Jan 1999 to Dec 2008, the second period was from Feb 1999 to Jan 2009, the third period was from Mar 1999 to Feb 2009, and so on, with the last and 181st 10-year investment period being from Jan 2014 to Dec 2023. A few observations can be made:

- For the MSCI ACWI, you will notice that there were 7 negative 10-year investment periods in the 25 years, but for the first 5 months of 1999, regardless of the month an investor started investing in, after 10 years, his returns were always negative. For the S&P 500, it was worse. There were 23 negative 10-year investment periods and they all happened in the first 23 months of the 25 years. This means that between Jan 1999 to Nov 2001, regardless of the month an investor started investing in, after 10 years, his returns were always negative.

- For the MSCI ACWI, the annualised return for the 25 years was 5.92% p.a., whereas S&P 500 did better at 7.56% p.a.

- When planning for our clients’ financial goals, we used a gross planning return of 8.2% p.a. for a 100% globally diversified portfolio of equities. We estimate this using the Ibbotson-Chen model. This is the return an investor needs to reach his goals if he is able and willing to take the risk of investing in equities. While both indices yield positive returns over the long term, there were 15 and 23 periods where the MSCI ACWI and S&P 500 respectively failed to meet the needed returns.

A Comparison of Returns Between the MSCI ACWI (USD) and S&P 500 (USD):

From the observations, we can draw several applications:

- While it is true that staying invested in an S&P 500 tracker fund over the long term will yield positive returns, you might invest in a period where you might not get the returns you need or even lose capital.

- If you invest in a single index like the S&P 500, there may be prolonged periods of negative returns or periods where you cannot get the returns you need, even if they are positive. So, even if you have a 20-year time horizon, after 10 years of losses, you may bail out and thus lose capital. However, during periods when the S&P 500 was in a prolonged downturn, the MSCI ACWI was giving positive returns. Therefore, it would be wiser for investors to be globally diversified. You may get a lower return than investing in a single index, but you are able to stay invested to get the returns you need.

- The US market has done well over the past 100 years, but there is no guarantee that things will remain the same in the future. You really do not want to risk all your money into a single-country index. The purpose of diversification is to minimise idiosyncratic risks. At the company level, this means holding shares in many companies because some may fail due to issues like poor management. Similarly, we diversify across sectors because we cannot predict which industry might become obsolete. Just because a particular industry has not become obsolete in the past doesn’t mean it won’t happen in the future. The same principle applies to countries. Even though the US has performed well over time, we invest in multiple countries to protect against the risk of significant adverse events in any single country. A country’s past success does not guarantee its future performance.

Take Argentina, for example. In the late 1800s, it became one of the world’s top ten economies, thriving for 30-40 years thanks to its grain and beef exports. However, the Great Depression and subsequent political mismanagement led to a severe economic decline. Therefore, while investing in the S&P 500 may seem wise, diversifying internationally can help cushion your portfolio against potential downturns in any one country, even if it means sacrificing a bit of return.

When investing for the purpose of enabling non-negotiable life events such as retirement, we need to use an approach that gives us the highest probability of success. Simply investing in a single index like the S&P 500 index is not the silver bullet.

The writer, Christopher Tan, is Chief Executive Officer of Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“. He is also a Certified Ikigai Tribe Coach.

The edited version of this article was published in The Business Times on 17 June 2024.

Through deep conversations with our advisers, you will gain clarity on what matters most in life and what needs to be done to live a good life, both financially and non-financially. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.