Executive Summary

August 2025 was a strong month for equities, with global markets advancing in both USD and SGD terms. Solid corporate earnings, supportive policy signals, and improving economic data contributed to broad gains, particularly in Japan and Europe. Dimensional funds participated in these returns, with the Global Targeted Value Fund benefiting from value and small-cap strength. Meanwhile, Providend’s Income 60/40 portfolio delivered a steady 7.8% YTD, supported by Singapore allocations and the recovery of S-REITs. While markets are at all-time highs, clients are encouraged to remain focused on their ikigai goals and de-risk where appropriate to ensure sufficient cash for future needs.

August’s Performance

It seems like the stock markets are keen to mirror the lyrics of the smash hit Golden from the KPop Demon Hunters movie. August was an extremely good month for stocks overall, with global markets moving much higher, both in USD and SGD terms.

In this market review, we will take a look at the market performance and discuss some of the reasons for it, before looking at how the Dimensional funds performed in August.

Global Market Performance in August 2025

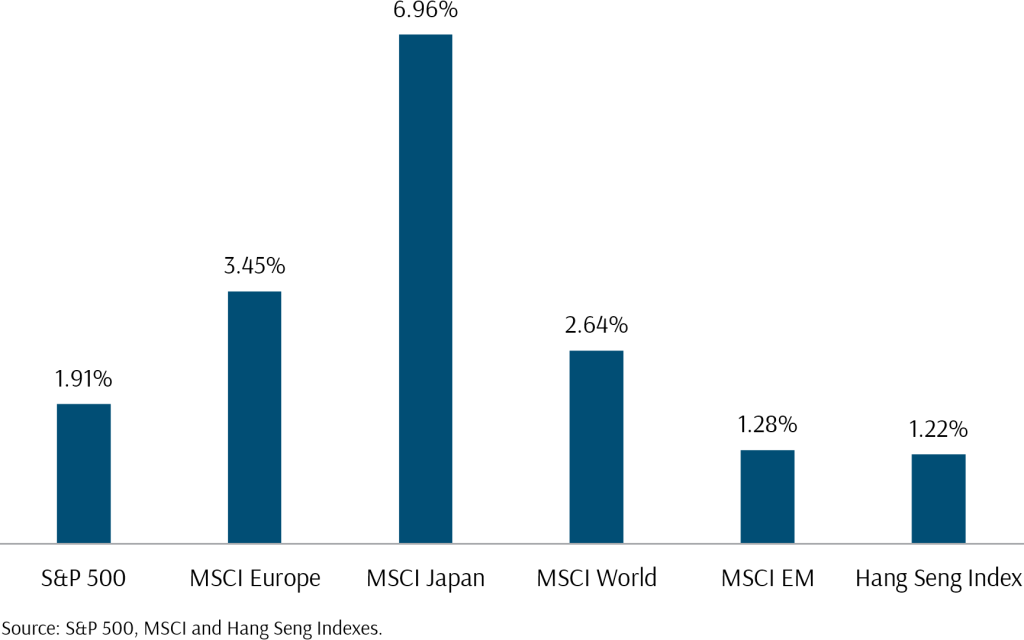

Exhibit 1: Global Market Performance August 2025 (In USD)

The S&P 500 (+1.91%) continued its upward trajectory in August, closing just shy of a new all-time high. Several factors contributed to this performance:

- Strong Corporate Earnings: Q2 2025 earnings season exceeded expectations, with approximately 82% of companies beating Earnings Per Share (EPS) estimates. Aggregate earnings grew around 12% year-over-year, well above the long-term average of 6%. The “Magnificent Seven” tech giants were standout performers, delivering 27% earnings growth, which significantly boosted the index.

- Monetary Policy Expectations: The Federal Reserve (Fed) signalled a potential rate cut at its September meeting, citing a slowing labour market and moderating inflation. This dovish stance buoyed investor sentiment and supported equity valuations.

- Economic Backdrop: Revised GDP data showed stronger-than-expected growth in Q2 2025, while inflation indicators such as the Personal Consumption Expenditures (PCE) Price Index remained stable. These factors reinforced the view that the US economy could achieve a soft landing.

However, valuations remain elevated, with the S&P 500 trading at 22.4 times forward earnings, raising questions about sustainability. Nonetheless, optimism around AI-driven productivity gains and resilient corporate fundamentals continues to underpin bullish sentiment.

European equities (MSCI Europe + 3.45%) outperformed their US counterparts. Several factors, including a combination of macroeconomic resilience and policy support, contributed to performance:

Improving Economic Data: Eurozone Purchasing Managers’ Index (PMI) rose to 51.1 in August, signalling expansion in manufacturing and services. Loan growth remained robust, suggesting healthy credit conditions.

Policy Tailwinds: The European Central Bank is expected to cut rates multiple times in 2025, providing a supportive monetary backdrop. Fiscal policy is also turning more accommodative, with potential infrastructure spending linked to post-war reconstruction in Ukraine.

Valuation Advantage: European equities remain attractively priced relative to US stocks, with forward Price-to-Earnings (P/E) ratios around 14x versus 22x for the US, attracting global investors seeking value.

Political uncertainty in France, with the possible collapse of the government, tempered gains somewhat, but overall sentiment remained positive.

Japan (MSCI Japan + 6.96%) was the standout performer among developed markets in August, as the following factors added to the performance:

- Trade and Policy Developments: A US-Japan trade deal reducing auto tariffs from 25% to 15% boosted investor confidence. Additionally, expectations of a Fed rate cut and a pause in US-China tariff escalation supported global risk appetite.

- Domestic Strength: Japanese Q2 2025 GDP returned to growth, and corporate earnings were broadly resilient. Inflation data confirmed a shift toward moderate inflation, reducing deflationary concerns. Structural reforms aimed at improving corporate governance and attracting foreign investment further bolstered sentiment.

- Sectoral Drivers: AI-related demand for data centres and semiconductor equipment added momentum to Japanese equities, particularly in technology and industrial sectors.

Hong Kong’s Hang Seng Index extended its recovery, albeit at a slower pace compared to earlier in the year. Investors were attracted initially by low valuations, as after years of underperformance, Hong Kong equities were deeply undervalued entering 2025, attracting bargain hunters. This was followed up by various growth catalysts such as China’s AI push. The launch of China’s DeepSeek AI platform and the blockbuster success of the animated film ‘Ne Zha 2’ boosted confidence in China’s tech and consumer sectors. Additionally, a major licensing deal between Pfizer and Chinese biotech firm 3SBio sparked a rally in healthcare stocks.

Lastly, liquidity has been strong as capital inflows from mainland China have continued, reflected in falling Hong Kong Interbank Offered Rate (HIBOR) rates and strong trading volumes on the Hong Kong Stock Exchange.

Thus, we can see that the aggregated MSCI World (+2.64%) reflected a strong August for developed market equities, led by Japan and Europe, with the US market contributing strongly as corporate earnings remained robust.

Emerging markets (EM) (MSCI Emerging Markets +1.28%) posted modest gains, lagging developed markets but still positive. A weaker US dollar and expectations of Fed rate cuts provided room for EM central banks to ease policy, reducing capital flight risks. Performance within the EM countries was mixed overall, leading to muted gains. China, the largest EM component, benefited from trade truce extensions with the US and government initiatives to boost semiconductor production. Latin American markets such as Brazil and Peru, outperformed on currency strength and improving inflation, while India and Korea lagged due to tariff hikes and tax concerns. However, Emerging Markets have continued to deliver strong performance in 2025 overall as investors look to diversify their exposure more broadly.

At Providend, our continued emphasis on diversification has helped to deliver returns for our portfolios. In August, the MSCI World outperformed the S&P 500 due to the strength of European and Japanese equities, and our portfolios captured the returns.

Dimensional Fund Performance in August 2025

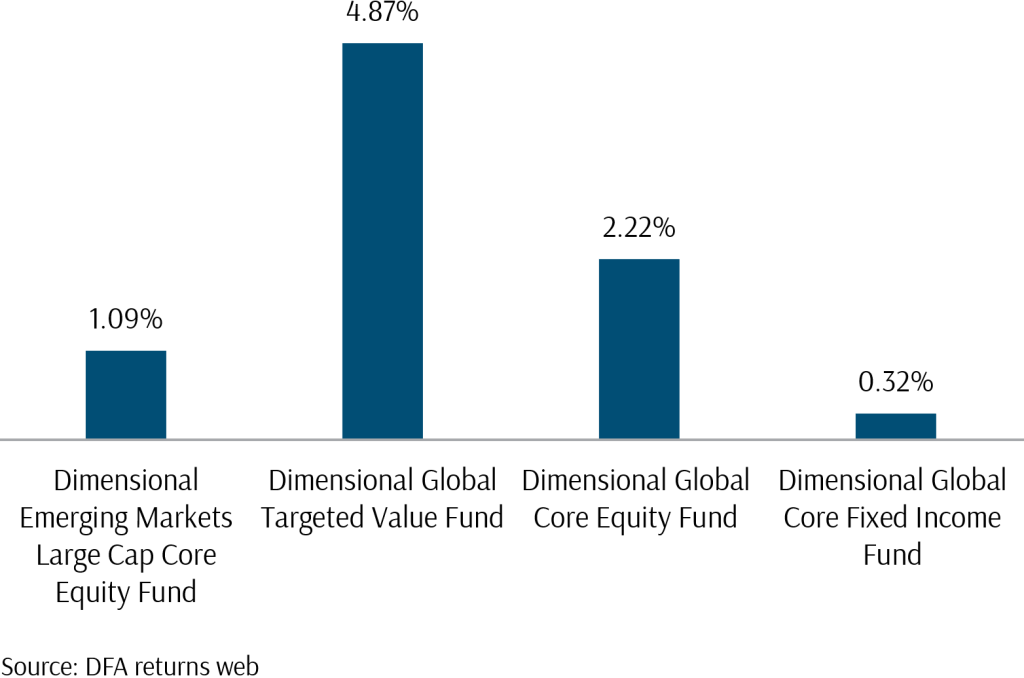

Exhibit 2: Dimensional Fund Performance August 2025 (In SGD)

Dimensional funds had a strong August, particularly the Global Targeted Value Fund, which invests in small companies that have lower relative valuations. The rebound in smaller companies in the US in August, along with the outperformance of value stocks versus growth stocks, allowed the Targeted Value Fund to become the best performer in August among the various Dimensional funds we allocate to.

The relative stability of the USD/SGD currency pair also meant that portfolio gains in SGD were strong in August, and our portfolios are delivering returns close to the planning targets YTD August 2025.

A Strong Year for Singapore Stocks

We would like to make a special mention to our Income 60/40 portfolio, implemented via the Fullerton WiseIncome fund. The return of the portfolio YTD August 2025 is 7.8%, the best performing portfolio in SGD terms, despite it having a 40% allocation to fixed income and only 60% in equities. This is because it has the lowest allocation to US stocks among the portfolios and the highest allocation to Singapore assets, via a sizable 30% allocation to S-REITs, which have started to recover on expectations that rates are on their way lower.

The demand for SGD yield is likely to continue to increase as the risk-free T-bill rates continue to fall, prompting investors to seek assets that offer higher returns. Our Income 60/40 portfolio can be an effective way to capture these higher returns; however, it is not without risk, unlike T-bills.

For example, the Income 60/40 portfolio has delivered a 7.8% YTD return (compared with the average T-bill yield of around 1.5%–2%). This performance is achieved by taking on additional risks: credit risk through corporate bond investments, equity risk with a 30% allocation to MSCI ACWI stocks, and sector/interest rate risk via S-REIT holdings. The higher return reflects the increased risk exposure.

This approach may not be suitable for everyone, as each investor has different goals and risk tolerance. It is advisable to discuss your options with your Client Adviser before making any adjustments to your allocation.

A Year of Surprises

We can never predict the way markets will go, just as few would have predicted an animated movie about K-pop would become the biggest hit of 2025, in a year with heavyweight movie contenders like ‘Superman’, ‘Fantastic Four’ and ‘Mission: Impossible’.

The year began with uncertainty around the durability of the AI expansion, US economic policy, and its global impact. Yet, as we approach the last quarter, stocks are reaching all-time highs worldwide, while inflation remains subdued, leaving room for potential rate cuts by year-end.

Investors who have remained in the markets have benefitted from compounding returns and are likely to see their portfolios reach new highs in 2025. While this is encouraging, at Providend we continue to emphasise the importance of focusing on your ikigai goals and their supporting wealth goals. Once targets are met, it may be worth considering how to de-risk portfolios to ensure sufficient cash for future needs. Your Client Adviser is always available to offer guidance and support as you plan for the long term.

As I write this market review, we celebrate Providend’s 24th birthday. Thank you for your continued trust and support throughout the years.

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.