Executive Summary

The third quarter of 2025 marked a robust rebound for global markets, as easing trade tensions, strong earnings, and AI enthusiasm pushed equities to all-time highs. US, Chinese, and Japanese markets all delivered double-digit gains, while Singapore’s Straits Times Index also reached new records. Fixed income remained stable, supported by expectations of rate cuts. Although the AI trade continues to drive returns, current valuations appear fundamentally supported rather than speculative. As investors look to the final quarter, maintaining diversification and long-term focus remains key amid evolving policy and market dynamics.

September’s Performance

The third quarter of 2025 delivered exceptional returns across global financial markets, recovering decisively from the heightened volatility experienced earlier in the year. Global equities registered strong and broad-based performance, as markets shrugged off the volatility in the preceding quarter. This remarkable turnaround was fuelled by a confluence of positive developments, including easing trade tensions, robust corporate earnings, and continued investor optimism over the AI trade. September, in particular, saw many markets hit all-time highs or continue a strong recovery.

Equity Market Performance

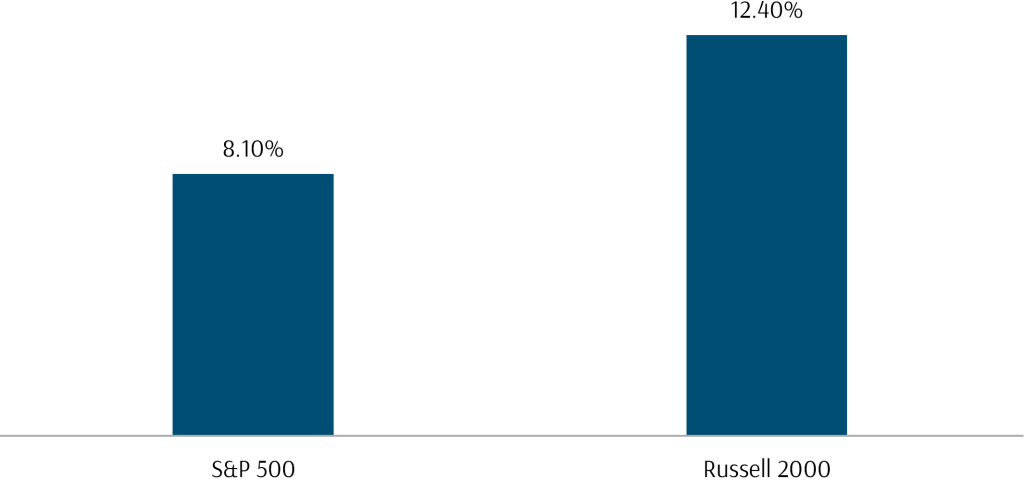

Exhibit 1: US stock market performance 3Q 2025 (USD)

US equity markets demonstrated remarkable resilience and strength throughout the third quarter, with major indices climbing to record highs in September. The S&P 500 delivered impressive gains of 8.1%, while small-cap stocks (Russell 2000 Index) generated returns of 12.4%. September proved particularly strong for US markets, with the S&P 500 posting its second-best September performance in 27 years at +3.6%, marking the fifth consecutive monthly gain for the index.

The recovery was particularly noteworthy given the severe drawdowns experienced earlier in the year. In April, the S&P 500 declined nearly 20%, the Nasdaq 100 fell 25%, and the Russell 2000 dropped 30% from their peaks. However, markets have recovered strongly, as the impact of tariffs on the economy and on inflation were not as bad as expected, as seen in the data so far.

Global Market Outperformance

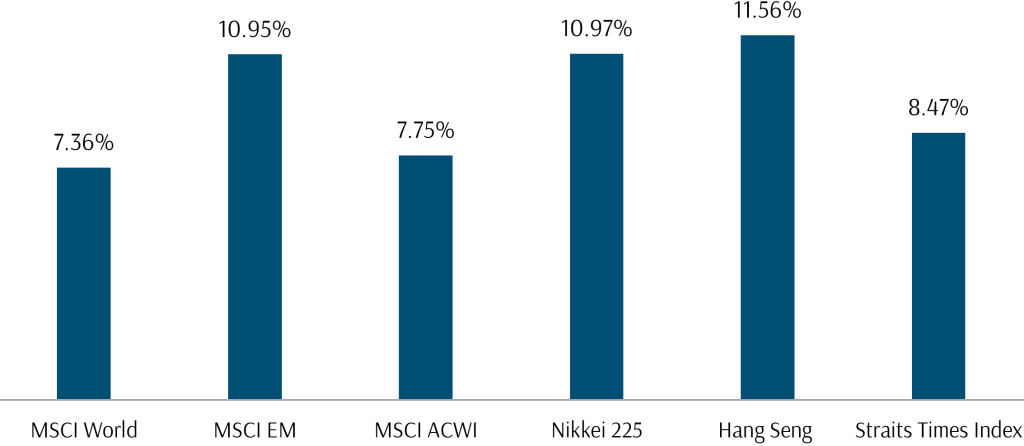

Exhibit 2: Global Market Index performance 3Q 2025 (USD and local currency)

Outside of the US, markets delivered exceptional performance during the third quarter, significantly outpacing their US counterparts. The Chinese market led the emerging market charge, buoyed by the extension of the US-China trade truce and continued Artificial Intelligence (AI) optimism. The Hang Seng Index delivered a performance of 11.56% over the quarter, and the MSCI Emerging Markets Index, with its 30% weight to Chinese stocks, returned 10.95% over the quarter. Japan also delivered strong returns, with the Nikkei 225 Index making new historical highs and returning 10.97% over the quarter. Overall, the developed market MSCI World Index (which includes US stocks) returned 7.36% over the quarter.

This data reflects the continued shift in global market dynamics, as investors rotated toward previously undervalued opportunities. The strength was not necessarily driven by fundamental improvements in the global economies, as many countries continue to face significant demographic challenges. Instead, the performance appears to reflect relative valuation attractiveness and reduced trade tension fears. In 2024, investors were focused mainly on the S&P 500 and the Magnificent 7, and flows to other markets were weak. However, with the increased concentration in the US markets on the AI trade, along with the continued uncertainty over trade tensions, investors have rotated to other markets in 2025, leading to strong performance for globally diversified portfolios.

Of keen interest to Singaporeans would be our local Straits Times Index (STI) performance, which was up 8.47% in the third quarter. The local index has seen a strong revival of interest in 2025, making new all-time highs in September on the continued strength of the local bank stocks and a resurgence in the S-Reits as interest rates have started to come down. The 3M SORA has fallen from about 2% at the start of July to 1.45% at the end of September. This steep reduction in borrowing costs and yields has boosted the S-Reits in two ways.

-

The lower borrowing costs make refinancing the debt in S-Reits more attractive for managers, and locking in a lower cost will allow investors to receive more of the cash flow from rents, as less is used for interest servicing.

-

Lower yields in T-bills and SGD corporate and treasury bonds are pushing investors to seek higher-yielding investments for their capital, and with Reits trading near five-year lows, there has been renewed interest in the S-Reit sector.

Fixed Income

Fixed income markets experienced volatility throughout the quarter as global political uncertainty and concerns around fiscal sustainability came into focus. Despite these challenges, the Bloomberg Global Aggregate Bond Index managed to end the quarter with a positive return of 0.6% (in USD), supported by US Treasury rallies and tightening credit spreads. This performance occurred against a backdrop of Federal Reserve rate-cut expectations, with markets pricing in 100 basis points of rate cuts over the next 12 months. Despite the continued uncertainty around the French government budget, and the US government shutdown, fixed income markets continued to show resilience and delivered positive returns in 3Q 2025.

How Did Our Portfolio Funds Do in 3Q?

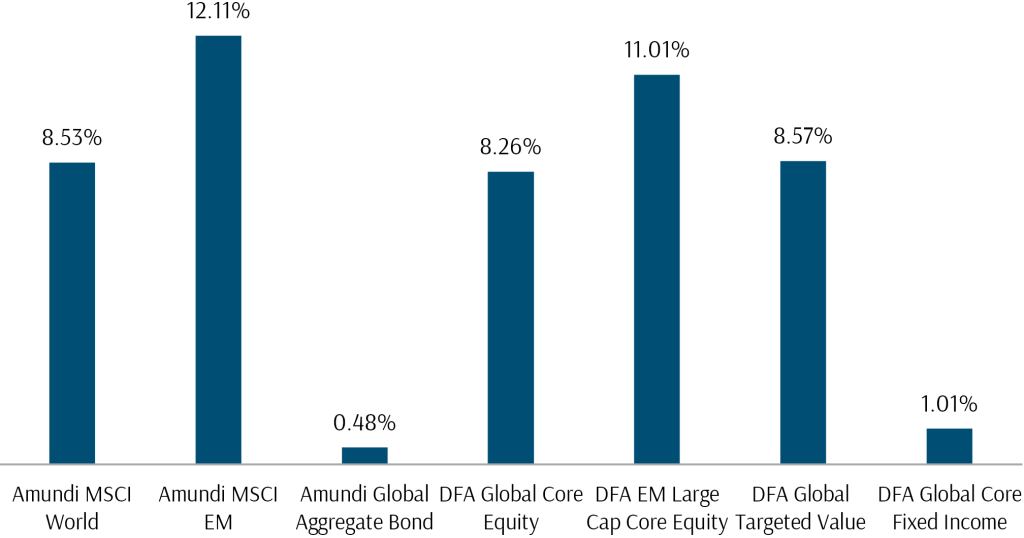

Exhibit 3: Fund Performance 3Q 2025 (SGD)

The funds in our portfolios did as expected, and with the USD/SGD stabilising, we also saw improved performance in SGD terms, as seen from the chart above.

The Amundi MSCI World Index fund, which tracks the developed world index, returned 8.53% over the quarter, supported by the strong US stock market performance in September and the continued rally in global stocks. The DFA Global Core Equity fund performed similarly, but the strength of growth stocks versus value stocks led to a small performance difference between the two funds. However, small caps did better globally, with the DFA Global Targeted Value fund, a small-cap value fund, outperforming the Amundi MSCI World Index fund.

Emerging market funds did extremely well, with the Amundi MSCI EM fund delivering a 12.11% return over the quarter, while the DFA EM Large Cap Core Equity fund returned 11.01%. As the EM performance was driven strongly by optimism over China’s AI development, the stocks that performed were the large-cap growth stocks, so the DFA fund, which focuses on mid-cap value stocks, did not do as well. However, it was still able to capture most of the return from emerging markets.

For the fixed income funds, the DFA Global Core Fixed Income took advantage of tighter credit spreads and a larger allocation to US Treasuries to outperform the Amundi Global Aggregate Bond Index fund, but bond funds performed their roles as a less volatile allocation in the portfolio while still capturing the yield available at current market prices.

Is AI a Bubble Yet?

The continued rise of AI-focused stocks has some wondering if we are in a similar position to the tech bubble before it burst in 2000. However, there are some key differences that show that the rally has fundamental support.

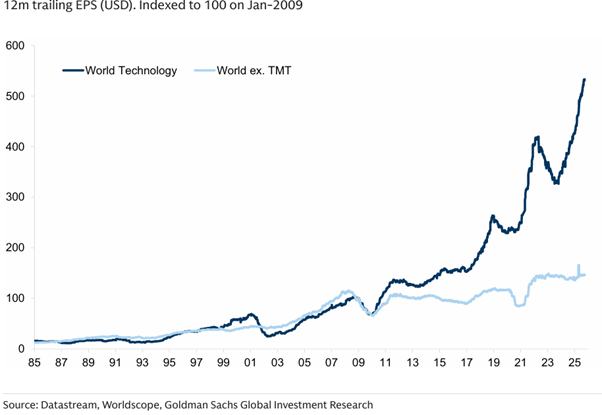

1. Earnings-Driven Performance: The technology sector’s appreciation has been fundamentally driven by sustained profit growth rather than irrational speculation about future potential. Goldman Sachs data shows that tech earnings have significantly outstripped those of the global market, with the gap particularly widening since the financial crisis. This earnings momentum has been a large driver of recent prices, making the rally fundamentally justified rather than speculative.

Exhibit 4: Tech earnings vs non-Tech earnings

2. Strong Corporate Fundamentals: Unlike previous bubbles, today’s leading companies maintain unusually strong balance sheets. The “Magnificent 7” companies demonstrate superior financial health compared to tech bubble leaders from 2000, with higher cash reserves, lower debt levels, and stronger profitability metrics. Their aggregate return on equity of 46% far exceeds the 28% achieved by tech bubble leaders in 2000.

3. Valuation Context: While current valuations appear stretched, they remain significantly below historical bubble peaks. The median forward P/E ratio of dominant companies today is roughly half that of the biggest companies during the late 1990s dot-com bubble. Additionally, higher valuations are justified by historically high ROEs, which legitimately support premium pricing.

For now, at least, it would appear that we are not necessarily in a bubble, and that tech companies do have the fundamentals to support their valuations. However, expectations and the business environment can always change, so investors should always look to stay diversified, and focus on their long-term ikigai goals to define their investment horizons and objectives.

Looking Forward: Will the 4th Quarter Be More Volatile?

The third quarter of 2025 showed that despite the various challenges to the business environment, investors remained optimistic about the potential of AI, and that companies are resilient and able to adapt to the new economic conditions. The combination of easing trade tensions, strong corporate earnings, economic resilience, and expanding market breadth created a favourable environment for risk assets across multiple categories.

However, several important considerations remain for investors going forward. Markets have priced in a lot of good news and optimistic expectations. Any change to these future expectations on the downside might lead to some potential market volatility.

Additionally, while Federal Reserve rate-cut expectations provided support for markets, there remain genuine risks that these expectations might prove overly optimistic, given the potential inflationary impacts of trade policies and fiscal spending. The interplay between monetary policy, trade policy, and economic fundamentals will likely remain critical factors influencing market performance in subsequent quarters.

While the portfolios are well diversified, this does not mean they are immune to volatility. We therefore encourage clients to ensure they have implemented a comprehensive wealth plan with their Client Adviser, one that covers near-term spending needs while allocating an appropriate amount of capital at a suitable level of risk for longer-term goals. This approach will give you the peace of mind to ride through market volatility, stay invested for the long term, and allow your wealth to compound and fulfil your ikigai goals.

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.