Executive Summary

- December was a mixed but calmer month compared to October and November. Markets initially rose on expectations of an interest-rate cut, pulled back after the Federal Reserve meeting, then partially recovered late in the month. By year-end, most global equity markets finished 2025 in strongly positive territory.

- Equity markets delivered modest gains overall, with stronger performance in North Asia and emerging markets offsetting weaker US technology stocks. Our equity funds rose across the board, with value- and small-cap-focused strategies performing particularly well. Fixed income funds were weaker during the month due to rising long-term interest rates and currency movements, although short-term bond funds held up better.

- Analysts expect 2026 to be another year of positive returns for financial markets but see lower and more uneven returns than in 2025. While company earnings are expected to remain relatively stable, market prices will continue to move based on sentiment, valuations and unexpected events. For investors, forecasts are unreliable as timing tools, and that staying invested in a well-diversified portfolio remains the most effective way to manage uncertainty and grow wealth over time.

December Market Summary

Following spikes in volatility over October and November, the first driven by fears of a hawkish Federal Reserve, and the second driven by hysteria over a potential top in the AI “bubble”, December proved to be a more sedate month, albeit also experiencing some volatility mid-month and eventually ending in mixed returns for markets. Ultimately, the bright spots outshone the murkier areas, allowing global equity market benchmarks to close the month, and the calendar year, out on a positive note.

Markets kicked off December with the optimism over a rate cut that carried November into strong gains carrying over. A general lack of negative catalyst enabled markets, particularly small capitalisation stocks, to lift to new highs heading into the Federal Reserve meeting. The Fed duly cut interest rates as expected – unfortunately that also marked the high for the month, as market quickly succumbed to profit-taking post-event. This, along with a missed-expectations report from Broadcom, an AI chip stalwart, sent markets swiftly lower, with technology stocks underperforming and the Nasdaq falling 4.5% from month highs.

While the technology sector was, once again, a catalyst for losses, fortunes turned partially as the holiday week approached. Micron, a manufacturer of RAM memory, released an earnings report far surpassing the most optimistic Wall Street analyst’s forecast, evoking reminiscence of Nvidia’s own breakthrough report two years ago.

This catalyst spurred a rebound in the sector, but its impacts were particularly felt in North Asian technology-focused markets like Korea and Taiwan, enabling those markets to break out to new highs as investors once again focused on the picks and shovels of the AI boom. A softer-than-expected inflation report also helped pull stocks well into positive territory, although bond yields stayed mostly sideways for the month. Following the Christmas break, markets were generally weak, with the exception of emerging markets, which powered through to close the year with an exemplary return.

Equity Market Performance

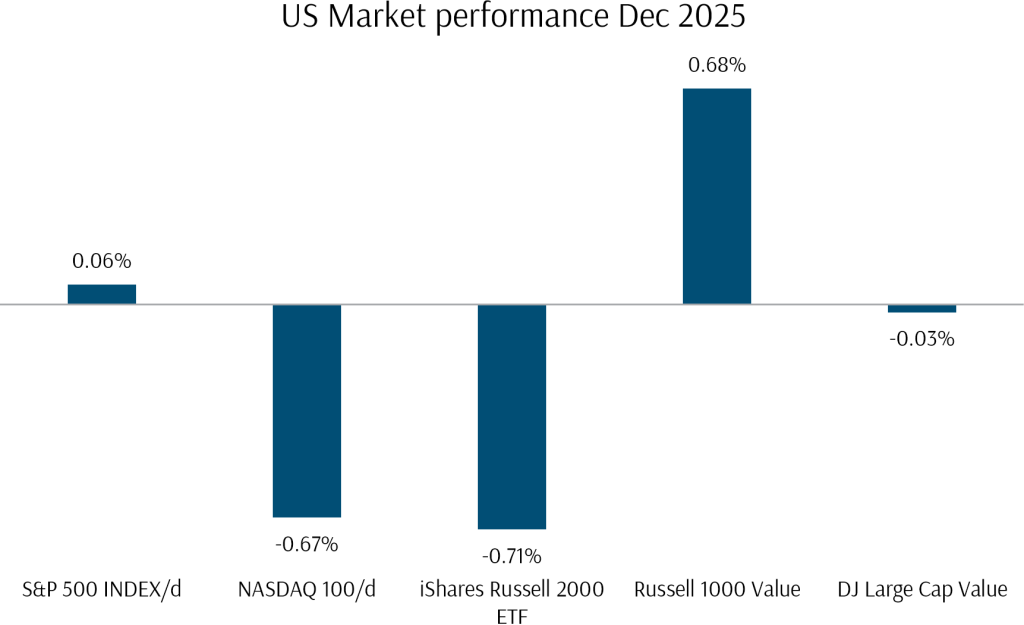

US equity markets were mixed in the month, with the S&P 500 up a modest 0.06% and the Nasdaq 100 down for the second month in row, losing -0.67%. Technology sector weakness was persistent, resulting from negative sentiment after Broadcom’s weaker-than-expected earnings report. Micron’s home run report stemmed losses and allowed tech shares to regain some ground.

Elsewhere, the Russell 2000 small cap stock index and other small cap indices started the month as top outperformers, as rate cut optimism persisted. In a now familiar pattern, this outperformance faded post-event, as investors took profit in small cap growth segments in the US and looked for other opportunities elsewhere, causing the Russell 2000 index closing down 0.70%. However, international small cap and value segments maintained their outperformance trend, managing to close the month with flat to slightly positive returns.

On the macro-economic front, the Federal Reserve decision to cut rates was widely expected by markets, with no substantive changes to the expected path of interest rates heading into next year. The November inflation report provided much relief for markets after what had been a poor weak, with the number coming at 2.7% yoy versus an expected 3.1%, sending bond yields lower.

Exhibit 1: US Stock Market Performance December 2025 (USD)

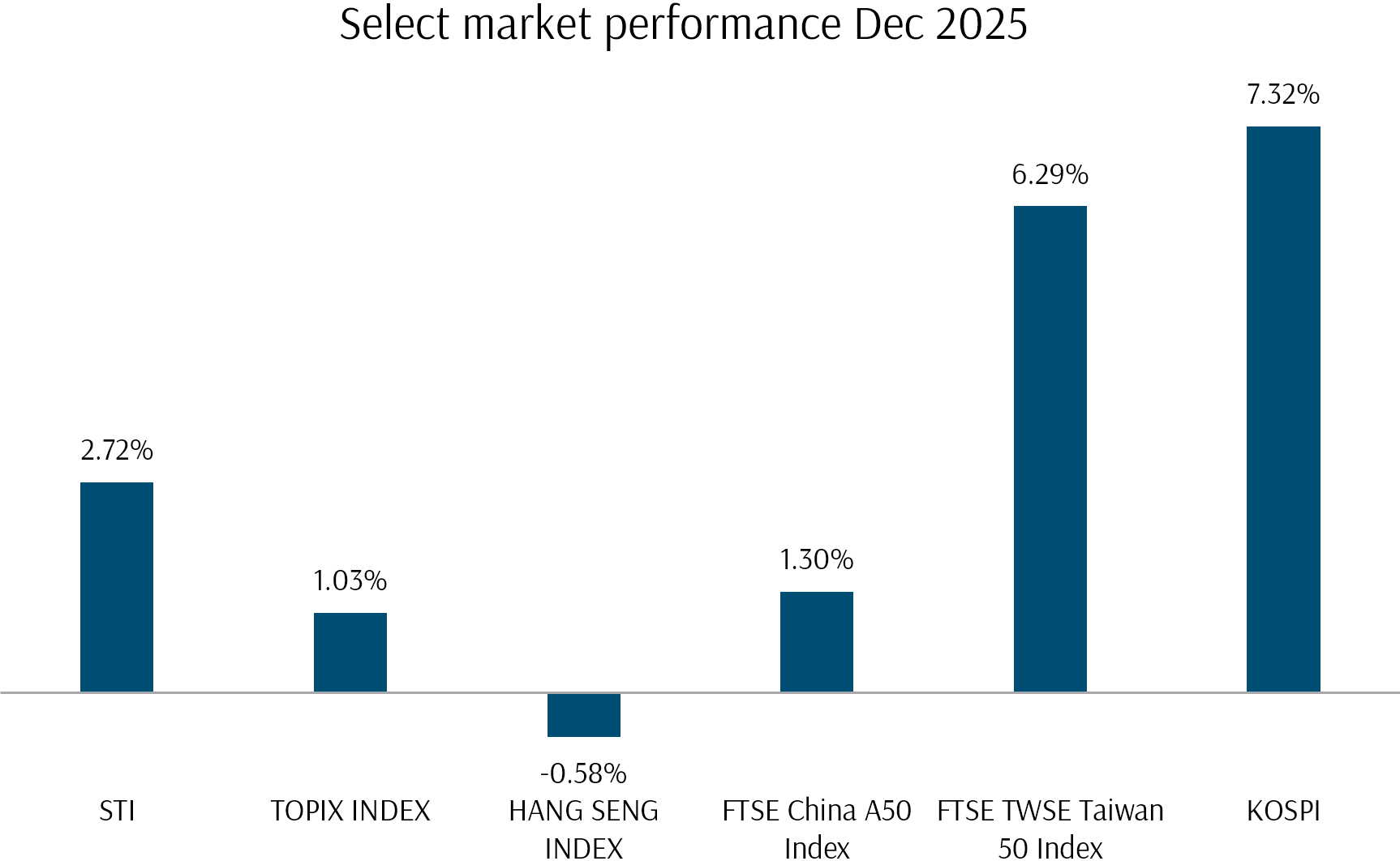

Elsewhere in the world, Asian markets mostly saw strong positive returns after Micron’s earnings report and last month’s outsized losses. Tech-focused markets gained the most, with the Kospi index up 7.3%, followed closely by a 6.3% advance in Taiwan. Greater China and Hong Kong markets were mixed. Japanese markets managed to finish the month with 1% return.

Locally, the STI index continued to be a standout, with the STI index up 2.72 % percent, driven by multiple sectors including banks, utilities, conglomerates and property developers.

Exhibit 2: Select Market Performance October 2025 (Local Currency)

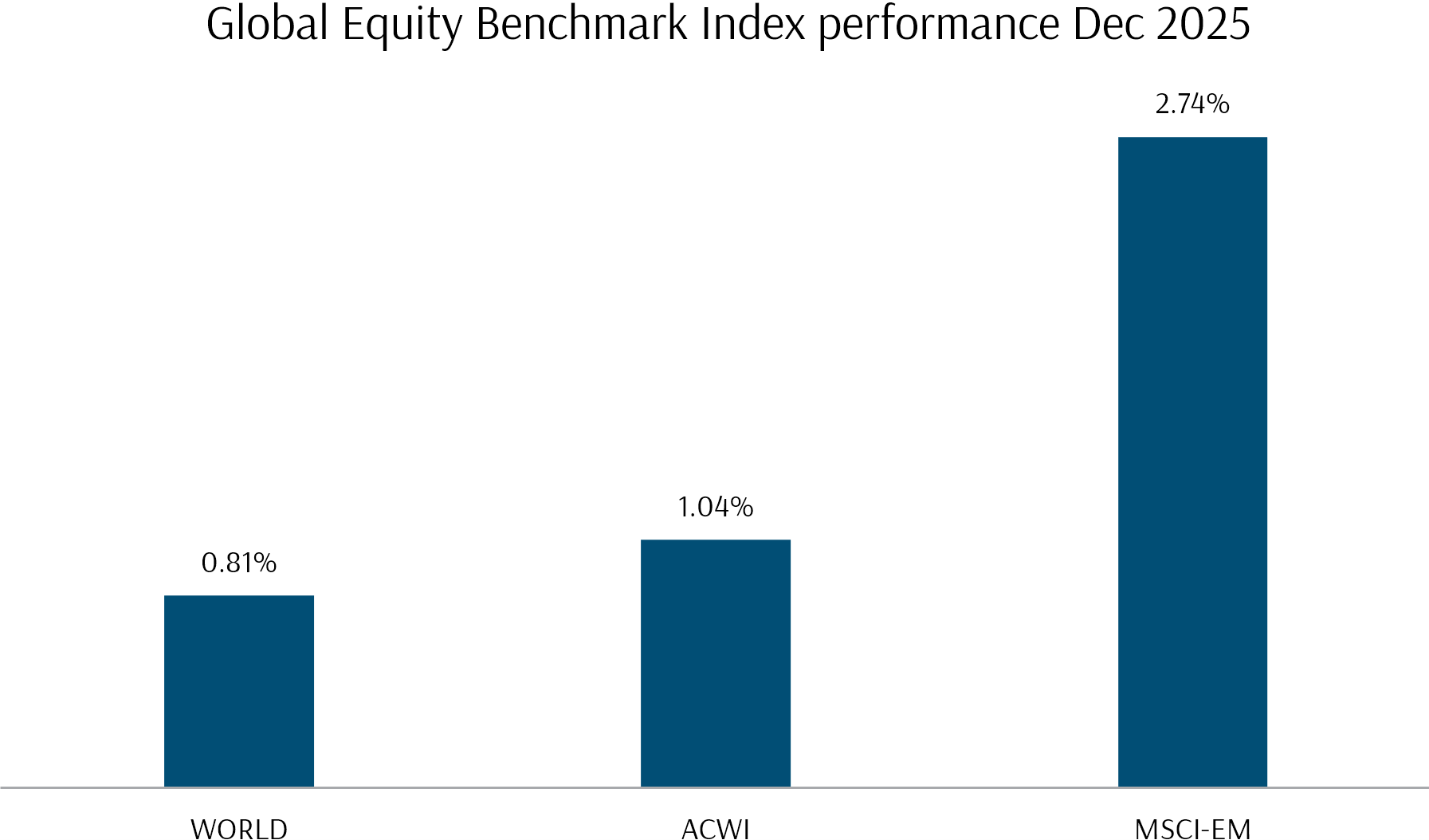

Globally, US market performance detracted from overall returns, but outsized gains in Developed Asia and EM meant that broad global indices still managed to close December with a respectable gain.

Exhibit 3: Global Equity Benchmark Index Performance December 2025 (USD)

Fixed Income and Other Markets

Fixed income markets were weaker in December, as yield curves steepened across the globe. Longer duration bonds lost ground as bond yields rose, while short duration bond funds managed to turn in a slightly positive performance following weaker-than-expected November inflation numbers in the US. US 10-year yields rose 14.6 basis points following 4 straight months of declines. Meanwhile, 10-year yields in Singapore rose 10.7 basis points, notching up the 4th straight month of higher yields.

Overall, the Bloomberg Global Aggregate Bond USD Index was down- 0.21% for the month.

In other markets, the US Dollar Index fell 1.2% over the month, and crude oil prices fell 3.86% to extend its losing streak to 5 months. It was an excellent month for commodities, with Gold up 2.53%, while Silver was the outstanding performer for December, rising an astounding 27%. Silver prices rose 138% in 2025, the largest annual gain since 1979. Investor inflows on interest rate and currency expectations and diversification – largely like factors which drove Gold to new highs in the year. The move was amplified by a liquidity squeeze in on the London exchange, who was in turn driven by speculation on US Tariff policies on the metal, resulting in physical silver stocks being withdrawn from London and reshored into the US. To make matters worse, China, a leading silver exporter, introduced export controls, further exacerbating supply constraints. Copper was a distant second with a 7.8% gain, driven by persistent industrial demand amidst the ongoing AI buildout boom.

How Did Our Portfolio Funds Do In December?

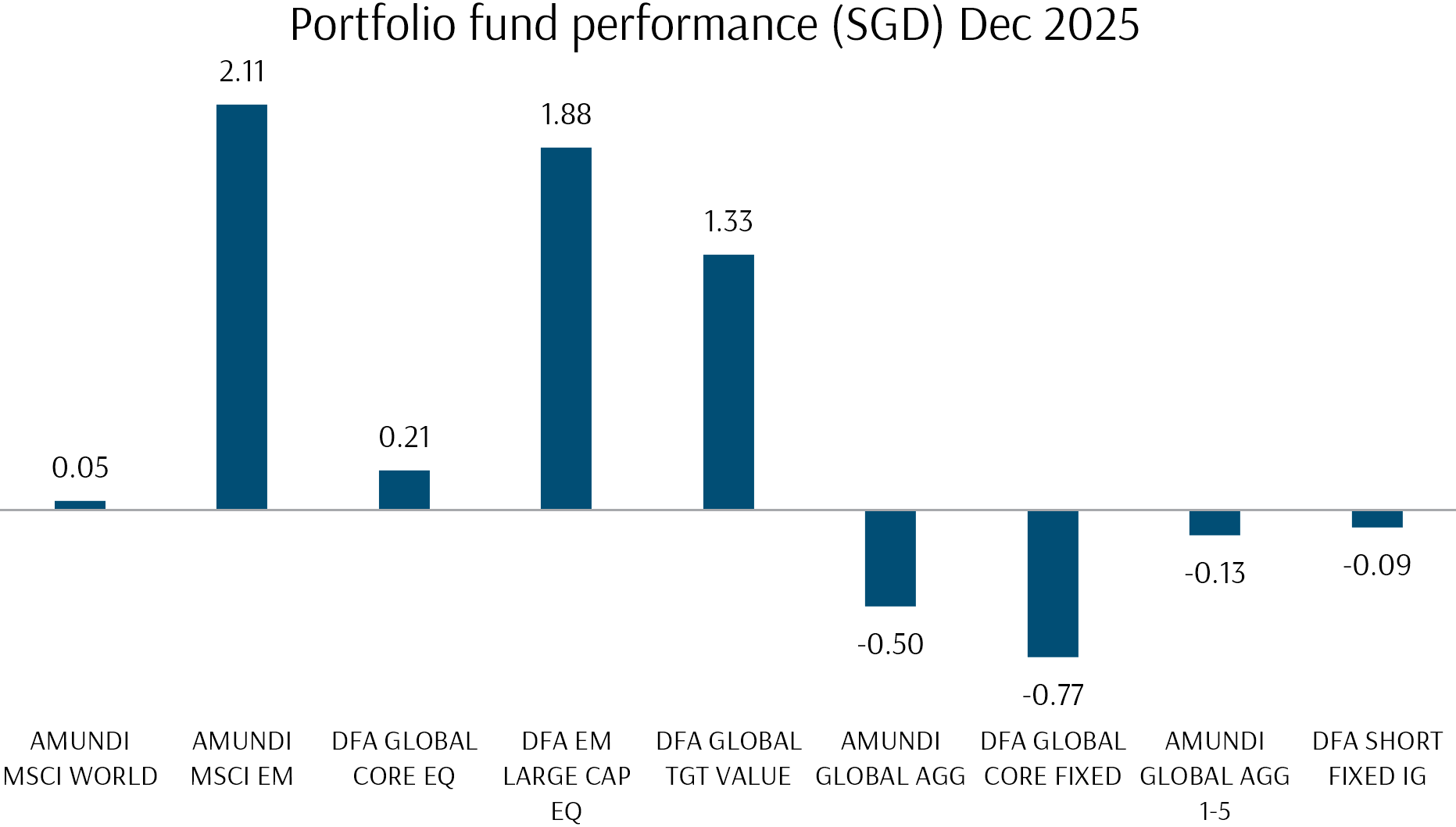

Exhibit 4: Fund Performance December 2025 (SGD)

Portfolio fund performances were split by asset class. Equity funds rose across the board, while fixed income funds were impacted by macro rate and currency moves.

Once again, DFA fund performances stood out. Equity funds mostly outperformed benchmark indices, with the Global Targeted Value Fund turning in an outstanding 1.33% return in SGD terms, well ahead of global small cap benchmarks. The Global Core Equity Fund also outperformed the MSCI World Index – however the fall in the US dollar over the month impacted resulting in a more marginal 0.2% December return. The ongoing outperformance of Value and Small Cap factors further highlight the persistence of market rotation and diversification, as noise around AI and technology sector’s earnings and valuations remained elevated.

The Amundi MSCI World Index Fund that tracks the developed world index was almost unchanged in SGD terms. Emerging market had the biggest returns, with the Amundi MSCI EM fund gaining 2.11% and the DFA EM Large Cap Core Equity Fund gaining 1.88% respectively.

For fixed income funds, performances were largely negative, driven by higher long term bond yields and a weaker USD. The DFA Global Short Term IG Fixed Income USD Fund was an exception, turning in a modest positive return boosted by gains in short term credit bonds.

Top of Mind Topic: Outlook 2026 Part 2

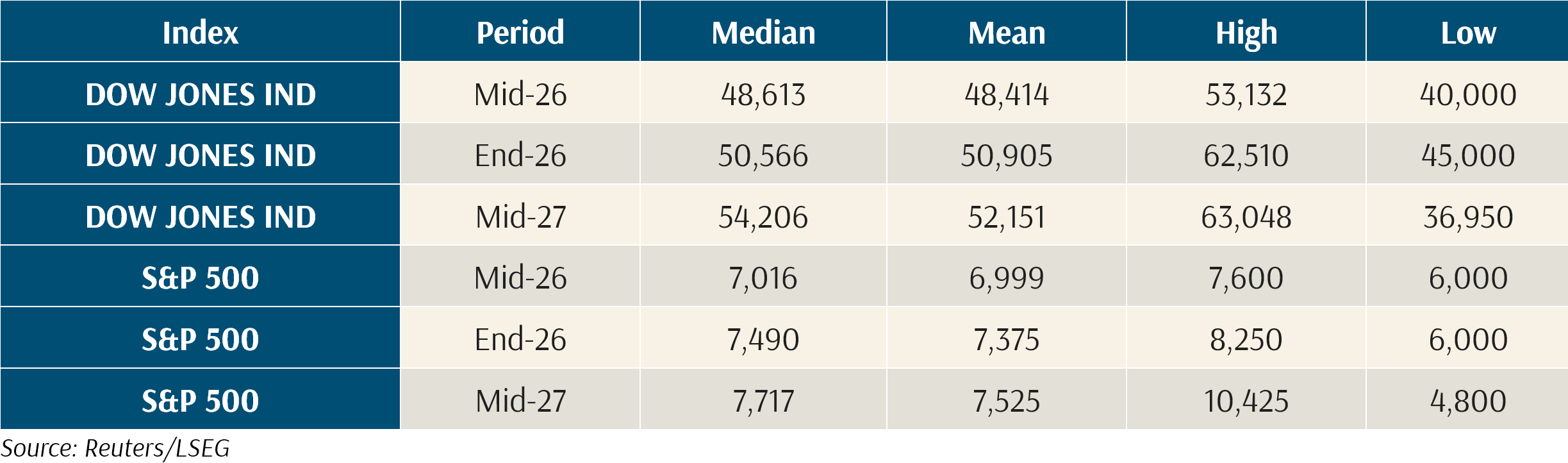

In this month’s discussion, we review a snapshot of market participant’s views on returns in global markets, using poll data from Reuters, starting with US equity indices.

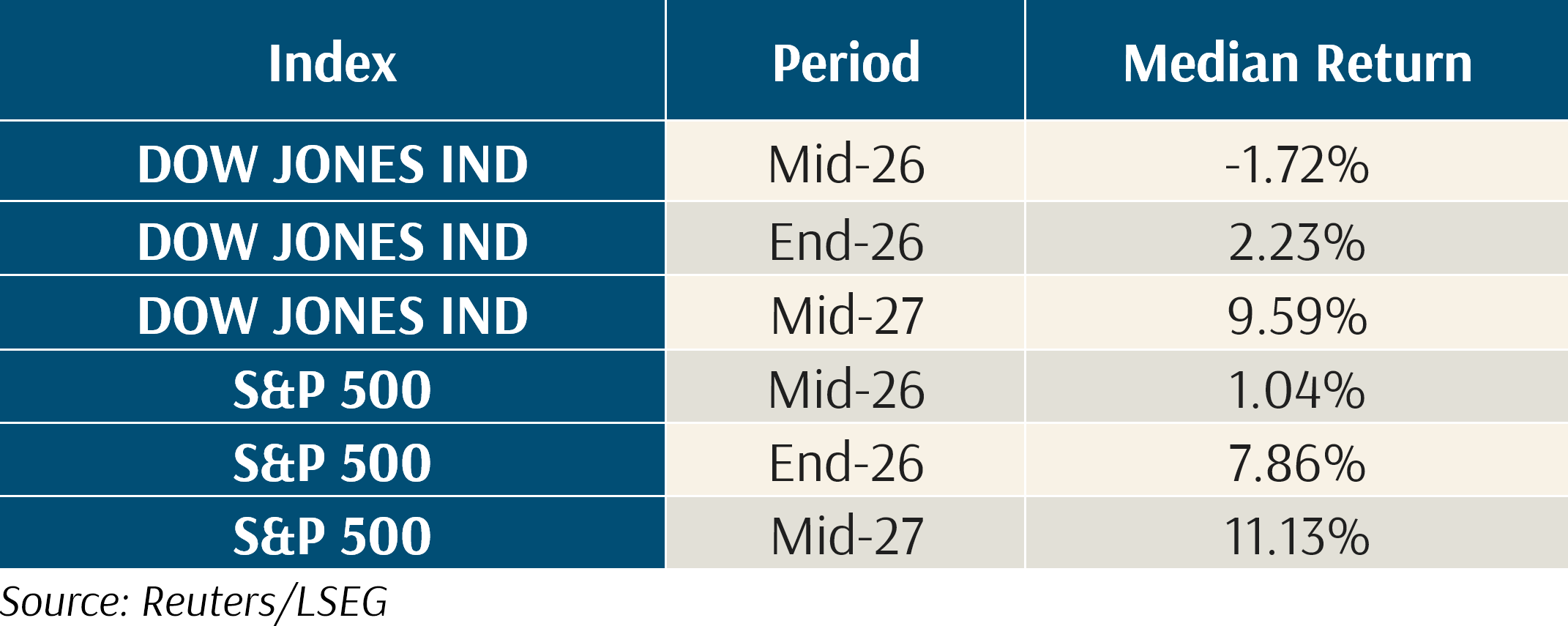

Using the data above, based on the median target level, expected US equity market returns are:

As we can see, Reuters contributors are more bullish on the S&P500 than the Dow Jones Industrial Index, which has a lower weighting in technology stocks. They expect modest returns in the first half of 2026, but see gains accelerating into the second half and following through into the first half of 2027. Overall, they expect gains to be below what we have seen in 2025.

Now, the question is, do these polls/forecasts actually provide any informational value, given that its common knowledge that markets are notoriously difficult to predict? Let’s evaluate how these contributors performed with their predictions at the start of 2025.

The median target for 2025-end S&P500 level was 6600. The actual level was 6994. Analysts predicted a 12.2% return versus an actual return of 16.4%. The actual return sat at the 88% percentile of predictions, meaning that only 12% of analysts expected the S&P500 to perform better-than-actual. Overall, most analysts were at least directionally correct, with only a lonesome pair predicting a decline in 2025. Based on 2025’s results, it appears that our panel didn’t have an entirely disastrous outing, but the median estimate was still 25% short of the actual market return.

Interestingly, the panel was much more consistent in predicting the 2025 earnings per share number for the S&P500. The median estimate was 271, only 2% or so off the likely actual figure of 2025 (once the fourth quarter is reported, this will be finalised). In this case, analyst actually over-estimated earnings at the start of the year, yet under-estimated market returns.

For 2026, it appears that analysts are generally more pessimistic than in 2025. 20% of the panel has predicted an unchanged or negative return, versus a 10% number in 2025. Almost all analysts expect the S&P500’s multiple to remain the same, or contract.

In practice, such predictions are realistically more useful as thought experiments and possible theoretical values, rather than dependable return expectations. Even the best analyst who accurately predicts earnings to the cent, would have his work cut out for him in trying to predict the earnings multiple the market wishes to impose at any given time. In the meantime, unexpected events that derail such predictions inevitably occur.

Investors who are overly focused on these numbers may even perturb their investment performance. The most common scenario arises when they may become overly anchored to target levels over time, especially when they have loudly proclaimed their views to everyone, and develop overly bullish or bearish views, despite evidence to the contrary. They begin convincing themselves that the market is “overpriced” or ”undervalued”, depending on their view. This inevitably leads to higher opportunity costs, or excessive risk-seeking, both of which behaviours likely to negatively impact returns. In our experience, the chances of this happening are much higher than the odds of any given analyst getting his or her short-term prediction correct.

Looking Forward to 2026

With December and 2025 in the books, it is time to take stock of what has been a somewhat tumultuous but ultimately rewarding year. In USD terms, the MSCI World index was up 21.09%, while MSCI EM notched up an even more impressive 33.57%. The equity funds in our portfolios have reported double digit gains across the board, with 3-year annualised returns reaching well into double digits. Our fixed income funds have served their purpose well, with USD class funds putting a substantive performance for the year. When considered within the perspective of the volatility experienced during the April 2025 trade war storm, these returns are incrementally more impressive.

January, and 2026, has started off on a good footing, with equity markets up strongly in the first week of trading, largely carrying on the themes which brought December to a close. North Asian markets continue to outperform other developed and emerging markets, with the AI boom turning Asia’s traditional tech exports into something reminiscent of a good old commodity boom. Geopolitical developments have come to the forefront once again, with the US unilateral action in Venezuela dominating the headlines in the first weekend of the month, which we have written about in: Venezuela in Focus: Political Developments and Market Implications

Research houses and commentators are sanguine on the market prospects for this year, but do expect gains to be more modest compared to the last few years. Geopolitical developments, market concentration and higher valuations continue to be top-of-mind with regards to risk. On the upside, growth is expected to be supported by a favourable interest rate environment, fiscal spending, a broader cyclical recovery, as well as AI-related spending across the globe.

As with all market predictions, unpredictable events will inevitably throw spanners in the works. Globally diversified portfolios, tilted towards evidence-based fundamental factors, remain the best option for investors to manage the highlighted risks, while staying invested and grounded through periods of volatility and exuberance.

With a comprehensive plan already in place with your Client Adviser — covering near-term spending needs while allocating capital at a level of risk suitable for your longer-term goals — you can have the peace of mind to navigate market volatility and stay invested for the long term, allowing your wealth to compound and fulfil your Ikigai. If you have any questions, please do not hesitate to reach out to your Client Adviser.

The writer of this market review, Glenn Tan, is Portfolio Manager at Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm. He is also a CFA Charterholder and a Certified Financial Risk Manager (FRM).

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.