The past week saw the NASDAQ index rally 20% from its recent low in mid-June, leading to new headlines discussing the emergence of a new bull market for the NASDAQ stocks.

New bull market?

First, let us refresh what a bear market and a bull market are. A bear market is a term used by the financial press to describe a 20% fall for stocks from a recent peak, and a bull market is what analysts describe as a 20% rise from a recent low.

The Nasdaq has bounced more than 20% from its recent low in June, leading some to call it a new bull market. Having said that, we note that despite the rally, the Nasdaq is still down 18% for the year, so there is still some way to go to make up for the losses this year.

Similarly for the S&P 500, it has bounced 17% from the lows, but it is still 10% down for the year.

Why is the market rallying?

When we look at the catalysts for the market rally, it comes down to interest rate expectations. Tracking the market expectations of interest rate hikes using the Fed Funds futures, the current data shows the market assigning a 31% probability for a 0.75% hike, and a 69% probability for a 0.5% hike. This is down from a 52% probability for a 0.75% hike last week. What changed the market expectations? It was due to the new information that came out in the past couple of weeks that shows inflation may be moderating and the economy is still holding up.

Economic growth is still holding up

The labour market remains strong as the unemployment rate fell to 3.5% in July from 3.6% in the previous period. Aside from February 2020 which also had an unemployment rate of 3.5%, this is the lowest in 52 years as shown in the table below. Furthermore, non-farm payrolls increased to 528,000 which far exceed the expected number of 258,000.

Inflation data shows inflation is moderating for now

Headline inflation in July was flat month-on-month and increased 8.5% on an annual basis which is lower than June’s report of 9.1%. The headline inflation also fell below the consensus estimate of 8.7% on an annual basis and 0.2% on a monthly basis. A fall in energy prices which broadly fell 4.6% in July contributed largely to the slowdown. Core Consumer Price Index (CPI), which excludes food and energy prices, rose 5.9% annually and 0.3% monthly, compared to respective estimates of 6.1% and 0.5%.

Producer Price Index (PPI), which reflects the wholesale prices reported by domestic producers, reports that wholesale prices fell by 0.5% month-on-month. The price contraction is the first time since April 2020. On an annual basis, wholesale inflation rose by 9.8% which is much lower than June’s increase of 11.3%. Energy, which dropped 9% at the wholesale level, contributed to majority of the decline. On a monthly basis, Core PPI rose by 0.2% which is lower than the expected 0.4%.

Markets continued recovery depends on the data

With inflation moderating and labour markets healthy, the market is expecting the Fed to slow the pace of rate hikes and this has resulted in a very strong stock market rally in the past few weeks. As new data comes out, markets will continue to price in the new information and prices will change to reflect the new expectations.

However, the opposite can also happen. If the new information is more negative, i.e., if future inflation prints are higher, then expectations of a higher rate hike by the Fed will increase and markets could come down again.

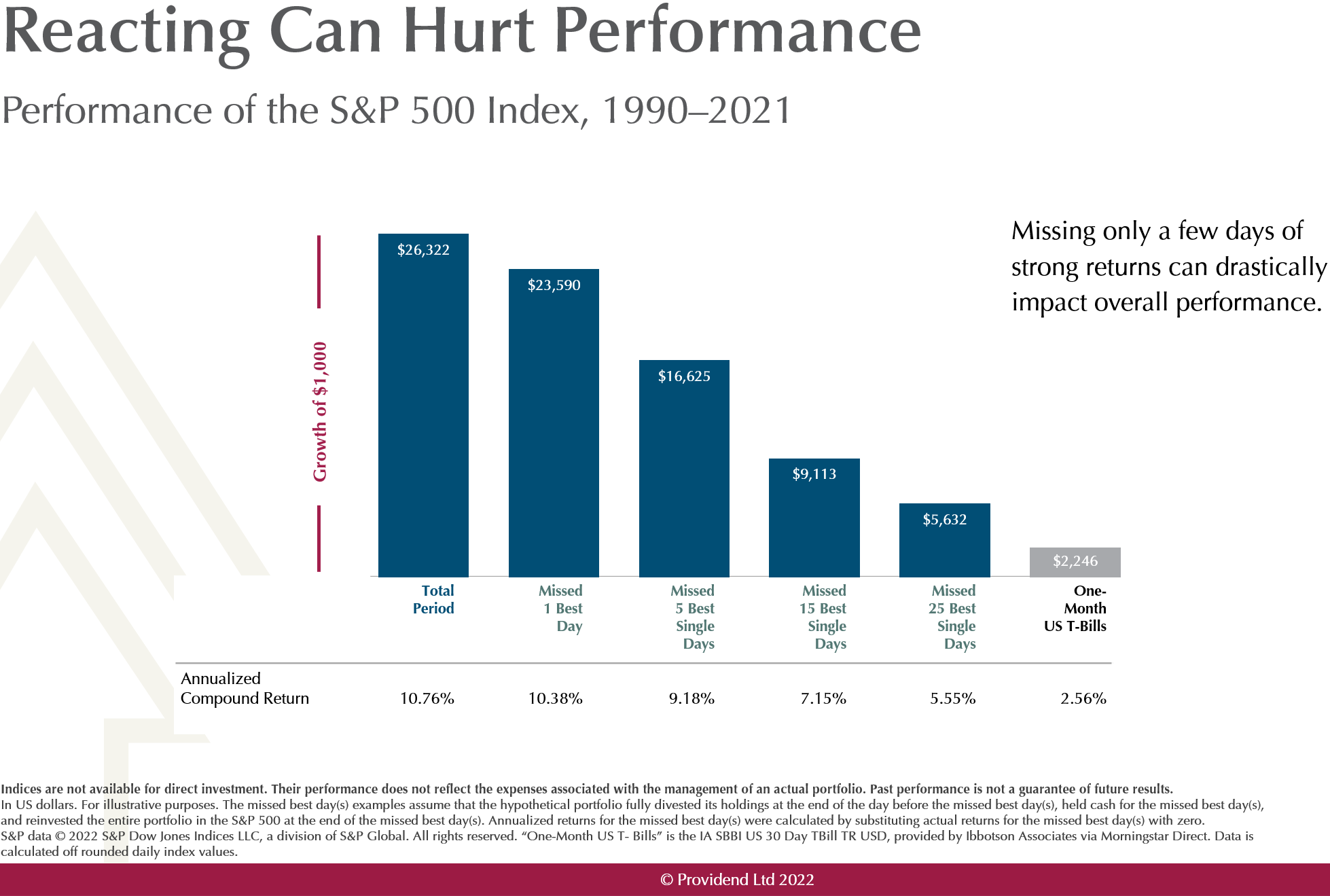

Therefore, we do not look to trying to predict market bottoms or tops, as that is a very low probability way of trying to achieve your wealth goals. For example, if we went into this rally underweight on equities, it would mean that our portfolios would not have recovered in line with the markets.

Staying invested and disciplined helps you reap the rewards

Instead, your portfolio captured the gains of this rally as we stayed invested, and we did not miss out on the good days, which we know are key to ensuring a successful outcome for your wealth plan (See exhibit 1 below).

Exhibit 1: Performance of S&P 500 measured: Staying invested vs missing some of the best days

Continue to engage with your adviser

As we increase our communication during this period of market uncertainty, do continue to engage with your adviser should your wealth goals or financial situation changes, so they can continue to guide you in making the best life decisions going forward. Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.