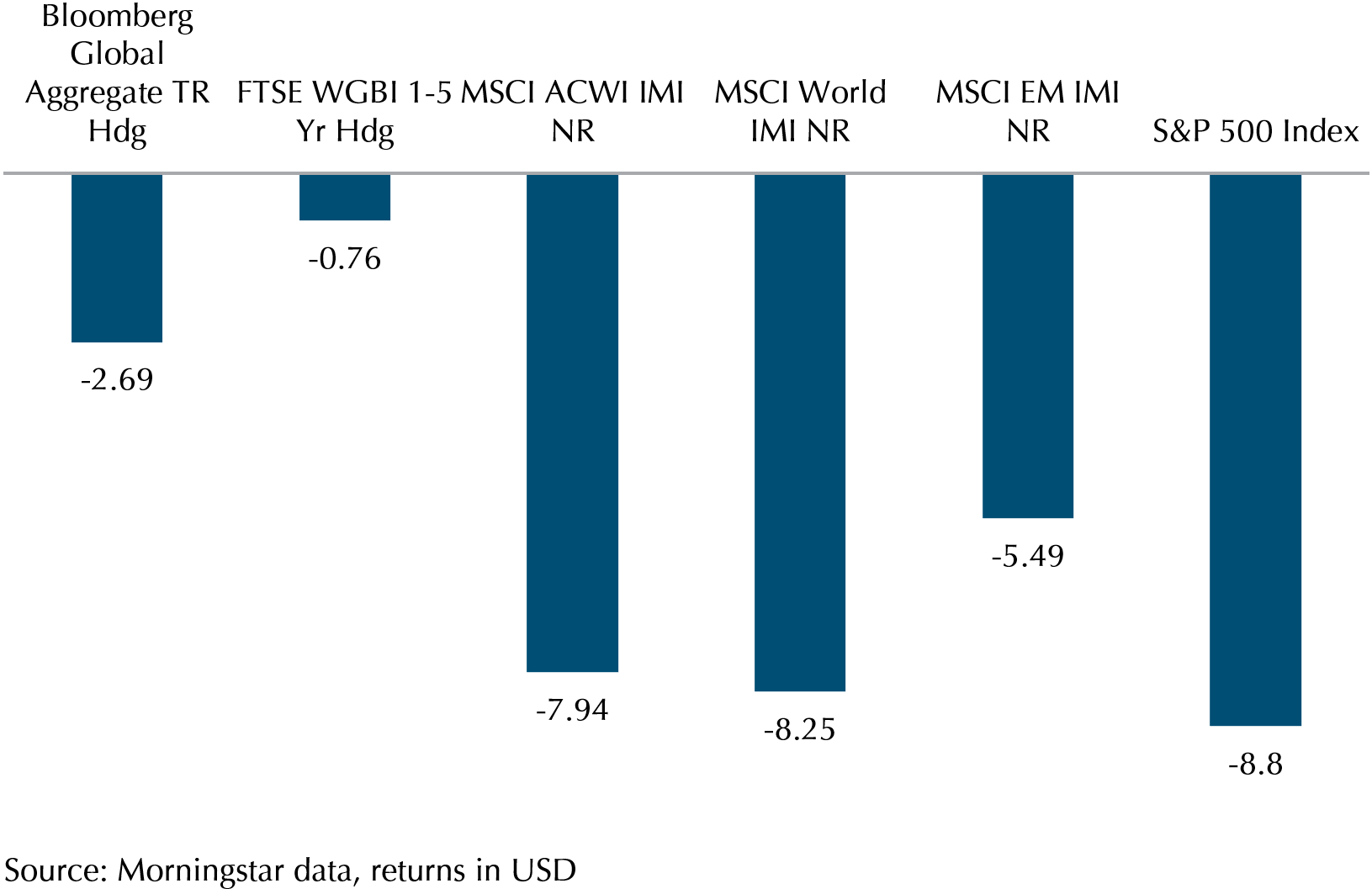

April was an extremely difficult month for stocks and bonds. The S&P 500 fell 8.8% in April, its worst month since March 2020, while our reference index, the MSCI AC World IMI did better, with a -7.94% return for the month, supported by Emerging Market stocks that did relatively better. The MSCI Emerging Markets IMI had a -5.49% return over April, outperforming the US market.

Looking across at the bond markets, we saw the Bloomberg Global Aggregate Index fall 2.7%, continuing the worst run for bonds in decades. The index has returned around -7.8% year to date, and as yields continue to rise, the outlook for bonds in the near term is likely to remain negative.

Exhibit 1 – Stocks and Bonds Index April 2022 Performance

Bonds are still defensive for our portfolios

Looking at the data in Exhibit 1 above, we can see that bonds fell less than stocks, and that stocks are extremely volatile. The S&P 500 has fallen more in 1 month, than what it took the largest bond index, the Bloomberg Global Aggregate, to fall in 4 months (-8.8% vs -7.8%). It might be a rough time for bonds, but if the volatility continues for stocks, then bonds will always help to preserve portfolio value. Our conservative portfolios are even more defensive, typically only holding short term bonds. Represented by the FTSE WGBI 1-5year, short term bonds fell only 0.76%, and have fallen 3.2% for the year till April. Thus we can see that even with the poor performance of bonds, they continue to be a defensive allocation within our portfolios to mitigate the equity volatility.

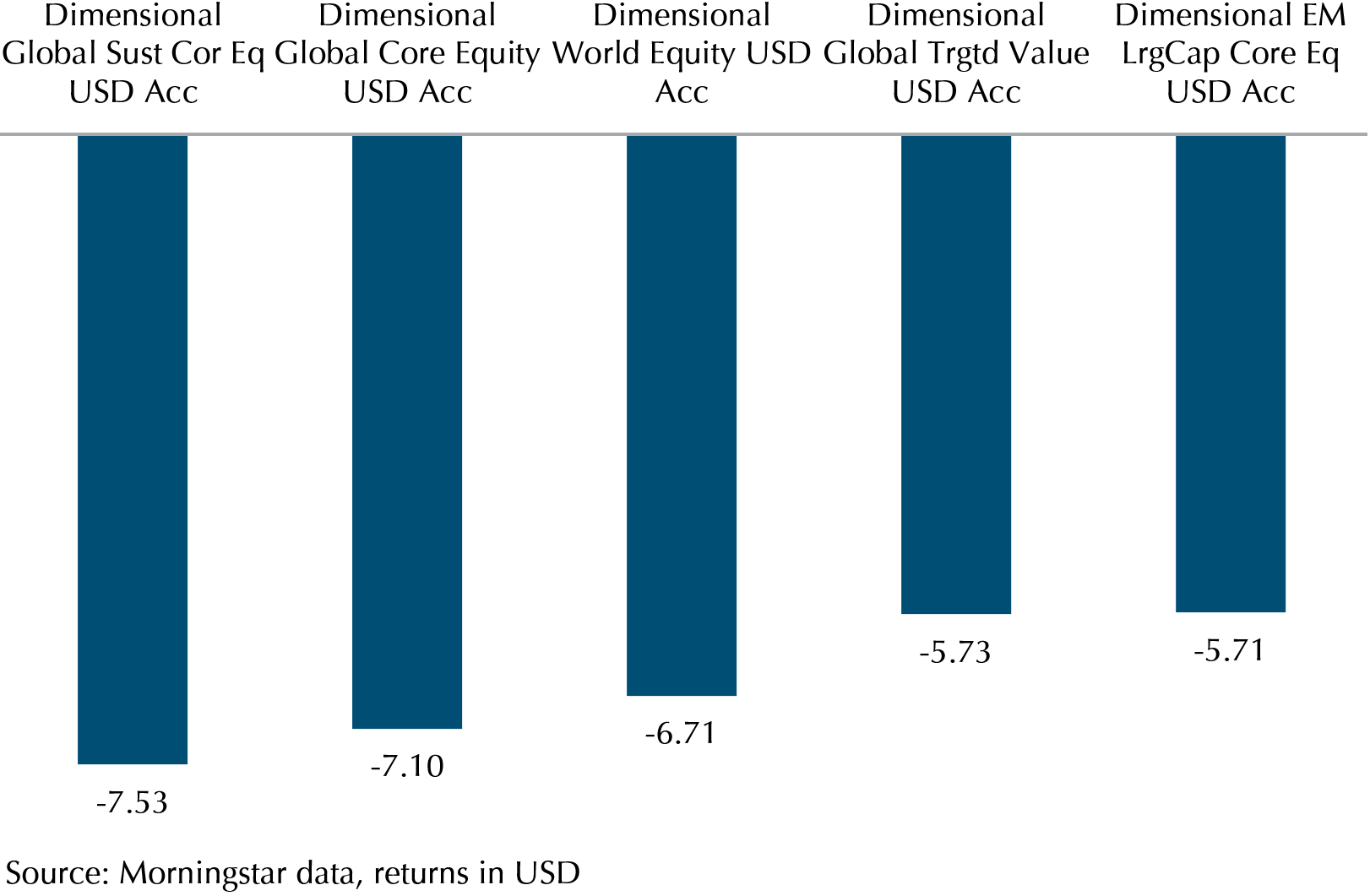

Value remains a bright spot in the gloom

While it might seem rather gloomy on the equity front, we continue to see outperformance of the value factor, and thus our allocations to funds managed by Dimensional continue to do better than the market. From the Sustainability Core to the Targeted Value fund, all the funds outperformed the MSCI World IMI (-8.25% in Apr). Naturally, the Targeted Value fund has performed the best given that value stocks have continued to outperform in this rising interest rate environment. (See Exhibit 2)

Exhibit 2 – DFA Equity Funds Performance April 2022

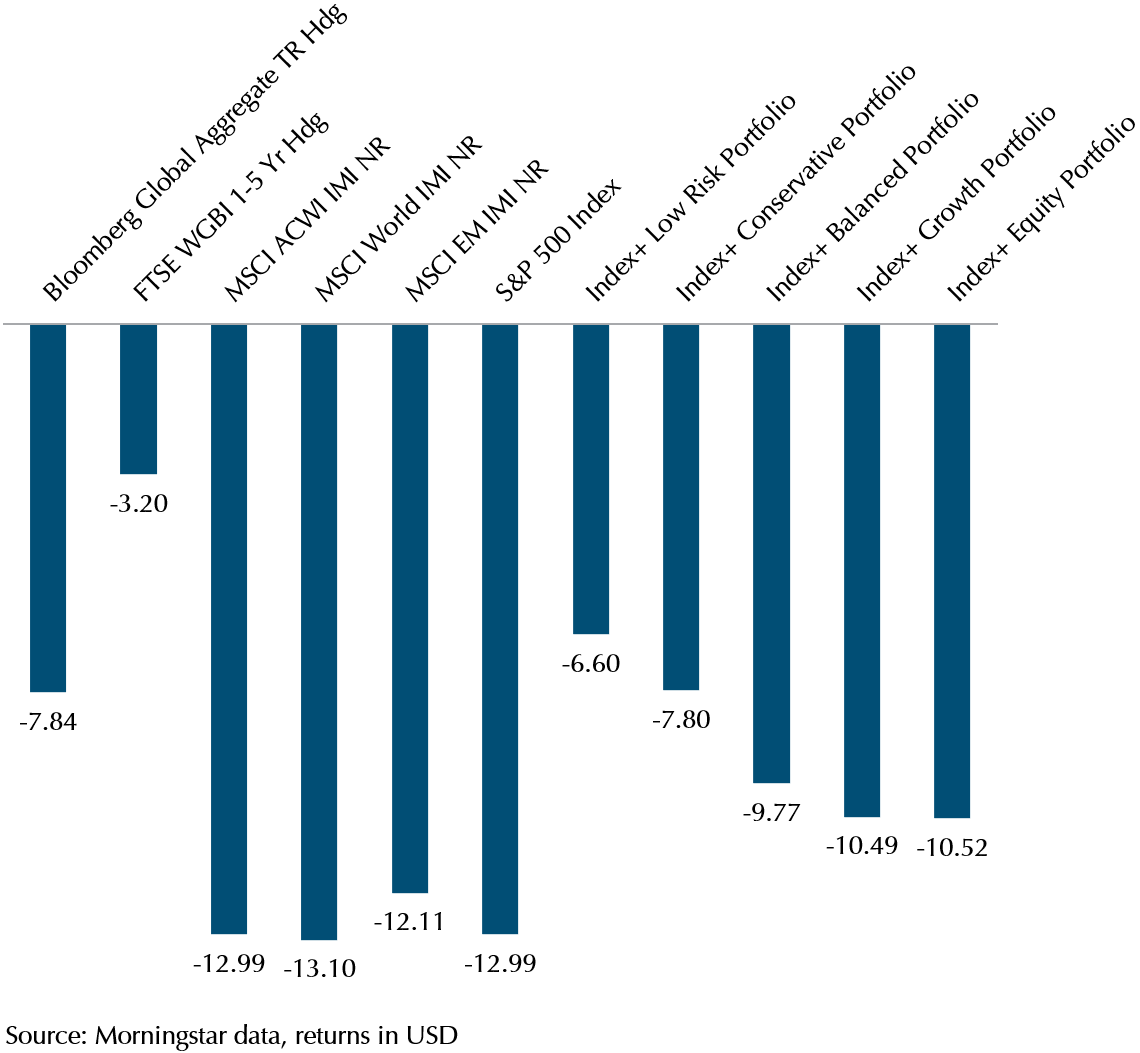

Overall, what this means is that relative to the broader market, our portfolios have done better than the broad indexes. (Exhibit 3)

Exhibit 3 – Providend IndexPlus Portfolios vs Market Indexes Year to Date 2 May 2022

Looking at the data in Exhibit 3, we can see that our 100% equity portfolio is doing much better compared to the various stock indexes, and our conservative and low risk portfolios are doing slightly better than the Bloomberg Global Aggregate Index which typically represents global fixed income returns. We recognise that the returns are still negative, but at least in these difficult times, our portfolios have at least mitigated the impact from falling markets. (Note: These are model returns. Depending on when you invested, your actual returns might be different.)

What is driving the market lower?

The market has been facing the same challenge for the past few months. Across the world, central banks are acting to tame inflation, which has been caused by the easy monetary policy during the pandemic stoking demand, and the supply chain challenges due to the Russia-Ukraine conflict and Covid outbreak in China reducing supply.

This has pushed central banks across the board (except in China) to tighten monetary policy by either raising rates or switching the quantitative easing programs that started in 2020 into a form of quantitative tightening.

In fact, central banks are not just looking at taking one course of action to tighten policy but are looking at 2 actions at the same time, hence the sudden headlines about “double barrelled” moves by central banks to tighten policy. We saw this both at home from MAS, and also more recently, by the US Federal Reserve, highlighting the urgency that central banks are feeling in the fight against inflation.

The end result is higher bond yields (10 year treasury is >3% yield) which equals lower bond prices, and lower equity prices as the discount rate increases.

Double Barrelled Tightening by the Fed

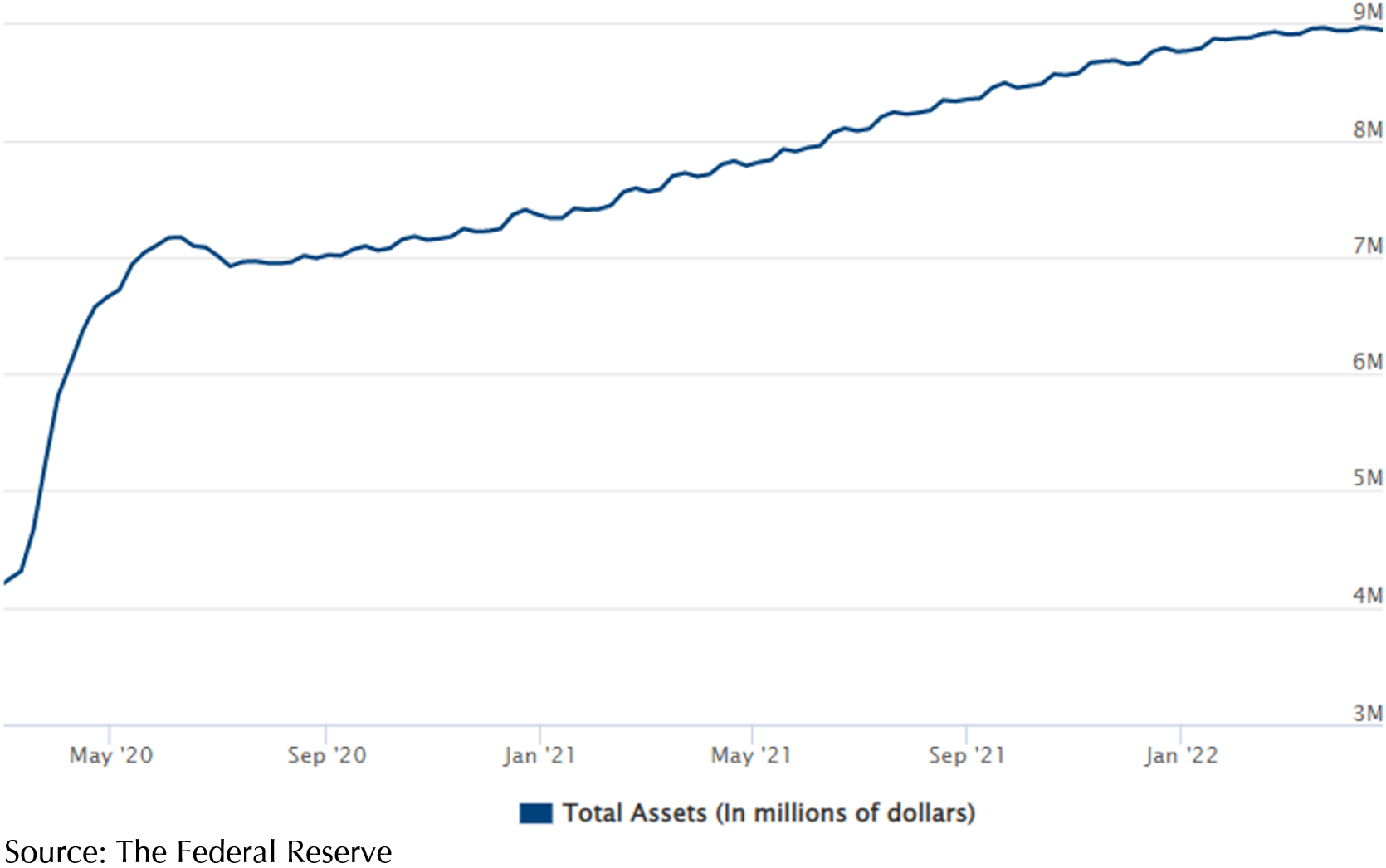

The Fed is taking two steps to combat inflation. First, they are raising the Fed funds rate by 0.5% to 0.75%, and are likely to continue to raise it at subsequent meetings with an end goal of 2.5%-2.75% by the end of 2022. Next, they are ending asset purchases which have ballooned the balance sheet from $4 trillion to $9 trillion since the start of the pandemic (see Exhibit 4), and instead are shrinking the balance sheet by about $120 billion a month eventually. The estimated reduction in balance sheet is $600 billion this year. Fed Chairman Jerome Powell equated the effect of shrinking the balance sheet this year to an additional quarter-percentage-point increase in the central bank’s benchmark short-term rate.

Exhibit 4 – Federal Reserve Balance Sheet From March 2020 to Present

Double Barrelled Tightening by MAS

MAS announced two monetary tightening measures on 14 April:

- MAS will re-centre the mid-point of the exchange rate policy band at the prevailing level of the S$NEER. This effectively moves the mid-point of S$NEER upwards.

- MAS will increase slightly the rate of appreciation of the policy band which steepens the slope of S$NEER.

Recentring of mid-point is the most aggressive way of exchange rate tightening because it shifts the entire policy band parallel upwards. Typically, a recentring of the mid-point will have a quicker and greater impact on currency. In this case, SGD will appreciate strongly against other currencies immediately. On 14 April, the day where MAS released the statement on tightening, SGD appreciated 0.68% against the USD.

Similarly, a raise in slope causes SGD to appreciate faster albeit to a lesser extent. It is the most used tool to adjust S$NEER and is being reviewed regularly to ensure that it is in line with the economy’s fundamentals. For example, on 25 January this year, MAS also announced raising the rate of appreciation slightly to dampen the effect of inflation. For the first time in 12 years, MAS has used these two tools together to tighten policy, reflecting the strong concerns our central bank has on inflation.

Double trouble ahead?

Why is inflation so challenging this time around? This is because the factors affecting it come from different directions. The Ukraine-Russia war continues to rage in the Donbas region with no end in sight. This will continue to constrain supply chain as exports in Ukraine are disrupted while Russian exports are sanctioned. This has the effect of reducing supply of factors of production such as raw materials (agriculture, rare earths, etc.) and the means of production i.e., energy (oil and gas).

In a further blow to supply, the various lockdowns and restrictions across China as it fights the Omicron outbreak are hampering the production and delivery of goods. None other than Apple has guided a $4 billion to $8 billion dollar hit to revenue as it expects lower production of its products due to continued restrictions on its factories. Similarly, other multinationals face delays in shipping and manufacturing. The data bears this out as we saw China factory activity contract in April. The official manufacturing Purchasing Managers’ Index (PMI) fell to 47.4 in April from 49.5 in March, which is a second straight month of contraction.

On the demand side, there is concern that central banks are still not reacting fast enough in the developed world to tighten policy. The markets were pricing in a 0.75% hike by the Fed, amid concerns that if the Fed does not act soon, it might be forced to raise rates even more in the future, pushing the US economy into a recession. The ECB has not yet committed to raising rates, and the BoJ is continuing its policy of QE and yield curve control. Thus, the fear in the markets stems from the uncertainty that central banks will be able to tame inflation without tipping economies into a recession.

To invest or not to invest, that is the question

It might seem like it’s a bad time to be an investor given all the uncertainty. However, it is this very same uncertainty that delivers a higher return in the future. Prices have fallen, for both bonds and stocks. What this means is that future returns are higher. For bonds, this can be seen immediately in the higher yield. Investors are demanding more return on their bonds to deal with the uncertainty of inflation and possibly even higher interest rates in the future. For example, the SSB (Singapore Savings Bonds) issued in May 2021 had a yield of 1.56%. The SSB issued in May 2022 will have a yield of 2.53%. Thus, returns on SSB have improved by almost 1%. For stocks, if prices are falling because a higher discount rate is being used, that means that investors are pricing stocks at a higher rate of return (you can think of the discount rate as the Internal Rate of Return or IRR).

Thus, if you have already sat through the turbulence of the past 4 months, painful as it was, then it does not make sense to stop investing as you are going to see higher returns going forward once the uncertainties are resolved.

Your wealth plan is your hedge

As we were reminded recently by our colleagues in the Solutions team, our clients are not just depending on the portfolio composition to achieve their wealth goals. Your wealth plan is designed to protect your spending goals too.

Using RetireWell, you have a buffer from the immediate market turbulence in the form of cash. Inflation might be up, but so are rates and yields. There is the opportunity to mitigate some of the impact by putting some of the cash into high quality bonds (that are all yielding a lot more right now).

Similarly, the longer-term effects of inflation are mitigated by the rising glide path of a larger equity allocation in the future buckets. This will allow your investment returns to eventually catch up and beat inflation, as markets and economies adjust to the new business environment. We have previously provided many examples of companies raising prices and increasing revenues. Nestle (maker of Milo, Maggi Mee, Nescafe, Nespresso, etc.) is the latest example, having raised prices by 5.2% in 1Q 2022, driving revenue growth of 7.2%.

Lastly, there is the Reserve bucket for unforeseen emergencies. Thus, with a strong wealth plan in place, you are best positioned to benefit from the investment returns once we exit this difficult phase for the global economy.

We will help you stay in your seat through this bumpy ride

We acknowledge that it has been a difficult period for our clients. Even though our portfolios have not fallen as much as markets or even portfolios focused on growth stocks (NASDAQ down 20% year to date), the negative trajectory is not the most pleasant.

We encourage our clients to remain invested as longer term will lead to better returns, though we also understand it is not easy as it might be preferable to take immediate action.

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.