Executive Summary

January delivered strong global equity returns, but with clear dispersion. Asia and Emerging Markets (EM) led decisively, while the US lagged amid elevated policy and geopolitical noise. A weaker USD, strong EM Foreign Exchange (FX), and outsized commodity gains, particularly in precious metals, dominated cross-asset performance, while US technology underperformed following mixed earnings and renewed rate sensitivity after the surprise appointment of Kevin Warsh as incoming Fed Chair.

De-dollarisation: Recent USD weakness is best explained by cyclical macro forces, i.e. slowing US growth, easing inflation, and narrowing rate differentials, as opposed to an imminent structural shift in the global monetary system. While longer-term reserve diversification trends warrant monitoring, the dollar’s central role across trade, finance, and market infrastructure remains intact, making diversification a rational portfolio response rather than aggressive positioning against the USD.

February opens with higher volatility and sharper factor dispersion, as markets recalibrate to a more hawkish-perceived Fed leadership, heavy AI-driven capex, and a rapid repricing of software and high-growth sectors. Near-term turbulence is likely to persist, but falling rate expectations later in the year, fiscal support ahead of mid-terms, and continued strength in value, small caps, and non-US markets provide a stabilising backdrop for diversified portfolios.

January Market Summary

January was a strong but uneven month for markets, characterised by clear leadership outside the US and unusually high policy and geopolitical noise. Equity performance was broad-based globally, but the dispersion was notable, with Asia and emerging markets materially outperforming and US equities lagging.

Currency and commodity markets were in the spotlight over the month. The US dollar weakened meaningfully across the board, risk currencies and EM FX strengthened, and commodities delivered outsized gains, particularly in precious metals. While the prospect of a “de-dollarisation” move in progress was often touted as an explanation for these moves, they more likely reflected a macro impulse centred on shifting growth expectations, rate differentials, and elevated uncertainty around US policy direction.

The announcement of Kevin Warsh as the new Fed Chair was a clear surprise for the market. A former Fed official widely perceived in both speech and action to lean hawkish, this appointment sets the stage for a reversal in January’s dollar trends. Further, staring down the prospect of a more hawkish Fed managing a smaller balance sheet, US technology was a clear laggard. Software earnings were disappointing to mixed, guidance was cautious, and valuation sensitivity to rates reasserted itself, leading to a sharp drawdown in software names despite selective strength in mega-cap names.

Outside the US, the picture was cleaner. Asia led decisively, supported by a weaker dollar, improving EM financial conditions, and renewed capex optimism in parts of the technology supply chain. Korea, Taiwan, Hong Kong, and Singapore all posted strong gains, with both earnings upgrades and multiple expansion contributing.

EM FX strength reinforced equity returns in USD terms, while commodities added a further tailwind. Gold and silver recorded extraordinary monthly gains, reflecting not only cyclical dollar weakness and falling real rates, but also heightened geopolitical risk premiums. Oil prices rose despite a volatile path, and industrial metals benefited from improving global manufacturing sentiment and inventory dynamics.

Geopolitical noise was exceptional in January, but to the relief of all, did not escalate into events of real consequence. The US military operation in Venezuela in early January was dramatic in optics but economically marginal, given Venezuela’s negligible share of global GDP and limited current oil production capacity. The Greenland affair was loud and unsettling, once again bringing the prospect of incremental tariffs back into the fold. Ultimately, cooler heads prevailed, with the US agreeing to talks and withdrawing trade-related threats made against its European allies.

Equity Market Performance

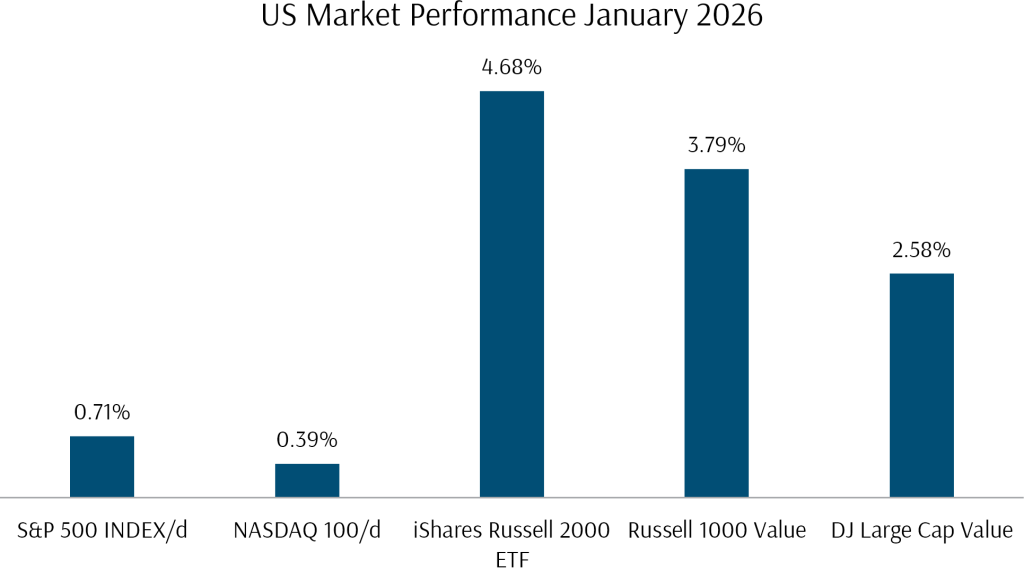

US equity markets were positive in January but underperformed global equity markets. The S&P 500 rose 0.71%, and while the Nasdaq 100 managed to eke out a 0.39% gain after two consecutive months of losses. Technology sector weakness was still somewhat persistent, reflecting the mixed earnings reports from large cap tech stocks, as well as the ongoing sell-off seen in the software sector on the back of accelerating developments in AI.

Elsewhere, the Russell 2000 small cap stock index and other small cap indices maintained their trend of outperformance, showing gains well in excess of benchmark indices, benefiting from the ongoing rotation away from large cap growth stocks. Value-tilted indices continued to outperform as well, benefiting from the same rotational flows.

US macro-economic data was firm, exiting a late-2025 government shutdown to enter the new year on a surprisingly firm footing, fuelled by resilient consumer spending and a heavy-duty surge in AI infrastructure investment. Unemployment fell slightly to 4.4%, although inflation remained somewhat sticky at 2.7%. Meanwhile, the Federal Reserve opted for a January pause, holding rates steady at 3.50% to 3.75%. The appointment of Kevin Warsh to succeed Chair Powell this spring created an initial stir, resulting in a rise in market volatility towards the end of the month.

Exhibit 1: US Stock Market Performance, January 2026 (USD)

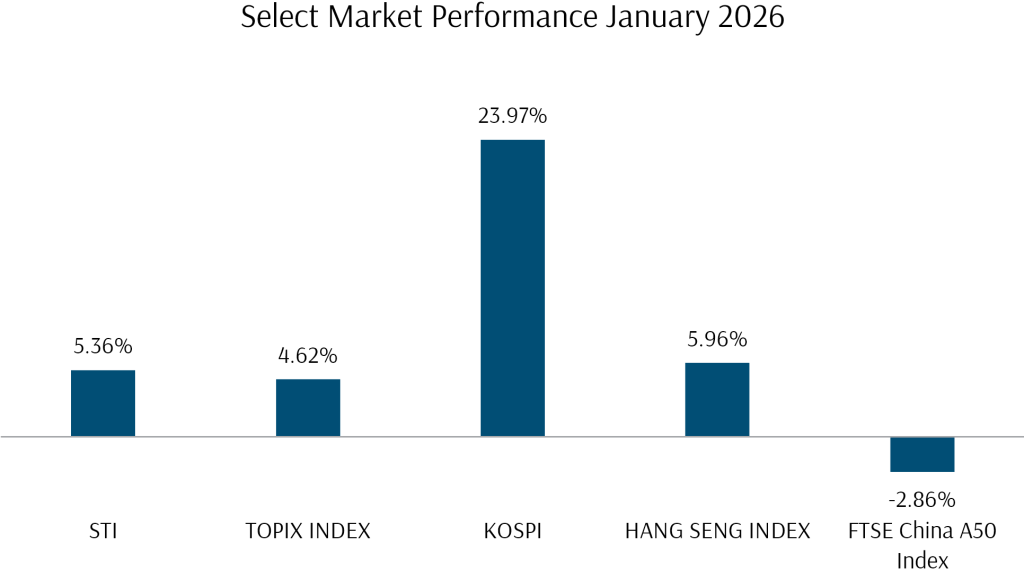

Asian markets mostly saw strong positive returns, as the ongoing AI capex boom fuelled large price rises in technology equipment components, especially in the memory segment, which saw DRAM contract prices rise an astounding 92% quarter-on-quarter.

Accordingly, tech-focused markets gained the most, with the Kospi index up 24% for the in the month. Developed markets in Singapore, Japan and Hong Kong all turned in strong performances. Chinese markets underperformed, losing ground in the month as investors turned away from traditional economic bellwethers in banks, manufacturing and property sectors, as economic data releases in the month showed manufacturing was still in contraction, while Q4 GDP estimates came in at 4.5%, the weakest levels in three years.

Exhibit 2: Select Market Performance, January 2026 (Local Currency)

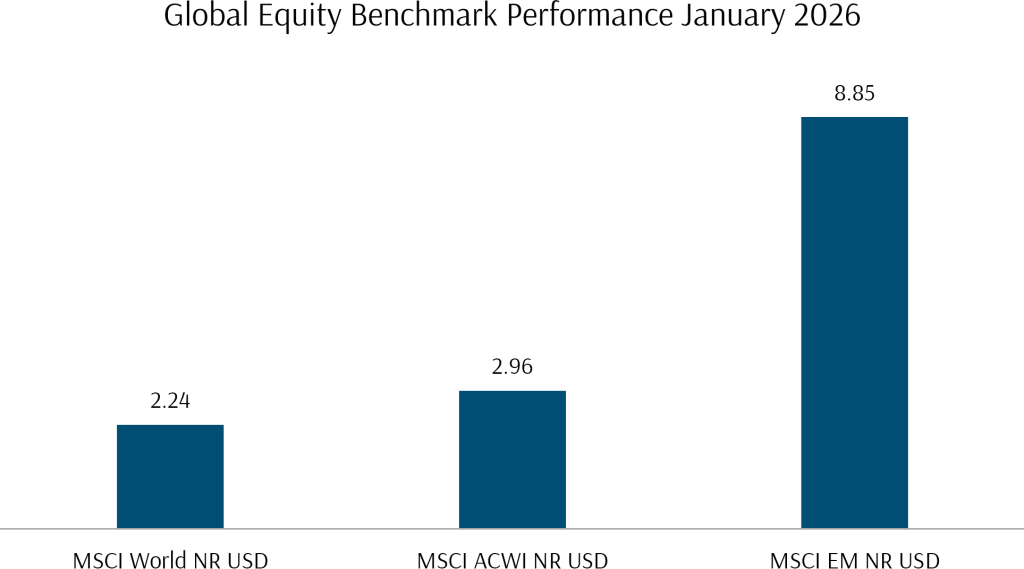

Globally, US market performance, while positive, significantly lagged returns in EM. Nevertheless, January was an excellent month for global equity markets, with the broad MSCI All Country index returning 2.96%.

Exhibit 3: Global Equity Benchmark Index Performance, January 2026 (USD)

Cross Asset Performance

Fixed income markets were mixed in January, with core yields finishing higher as the 10-year US Treasury climbed to 4.26%, driven by the Federal Reserve’s somewhat “hawkish pause” and the month-end nomination of Kevin Warsh as the next Fed Chair. This was mitigated by a strong performance in credit and EM bonds, with investment-grade spreads hitting multi-decade tights, and EM sovereign and Asia high-yield debt capitalising on a weaker USD and localised rallies in Latin America.

Overall, the Bloomberg Global Aggregate Bond USD Index returned + 0.24% for the month, but USD weakness meant a flat SGD performance of +0.05%.

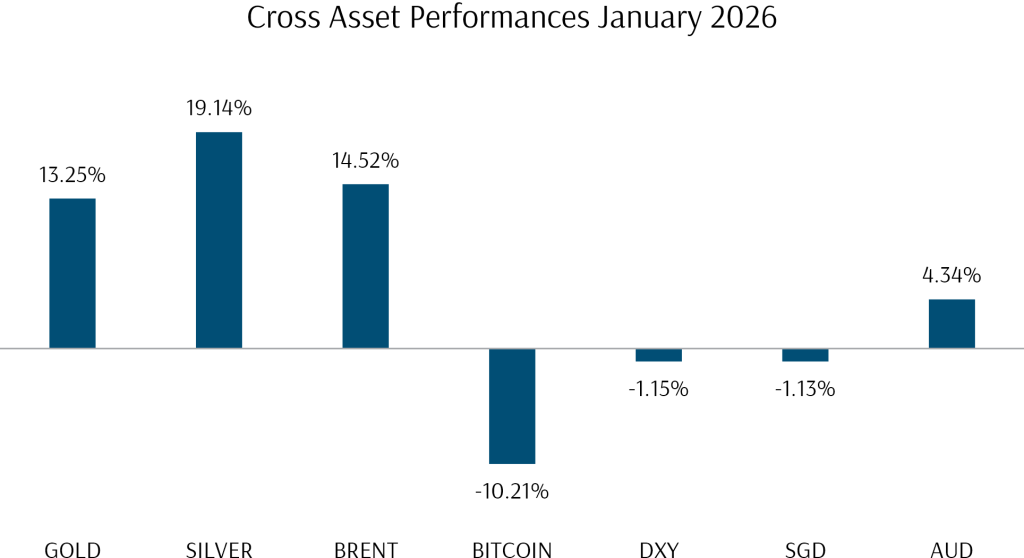

In other macro markets, activity was volatile and frenetic. The US Dollar Index extended its losses, falling 1.15% over the month following a similar fall in the previous month. The US dollar lost similar ground against the SGD, and bearish sentiment prevailed through the month, following the twin episodes of Venezuela and Greenland. The announcement of Kevin Warsh as the next Fed Chair appeared to create a temporary floor beneath the dollar, restoring some semblance of regularity to currency markets.

In commodity markets, it was another tumultuous month. While the Venezuela affair failed to move energy prices significantly, rumblings of Iranian tension in the month was a far more effective catalyst, ultimately moving crude oil prices 14.5% higher in January, stemming a 5-month losing streak. Colder-than-expected winter weather in the northern hemisphere also provided a strong bid for oil prices.

In precious metals, constant de-dollarisation talk was a strong catalyst for gains, with gold ending January 13.25% higher, while silver also rose 19.14%. Gains in the sector were even sharper earlier in the month, but in this instance, the potential appointment of Kevin Warsh as Fed chair had the opposite effect of putting a cap on precious metal prices. In stark contrast to commodities, Bitcoin fell 10% for the month, effectively putting the “alternative to gold” moniker to rest.

How Did Our Portfolio Funds Do in January?

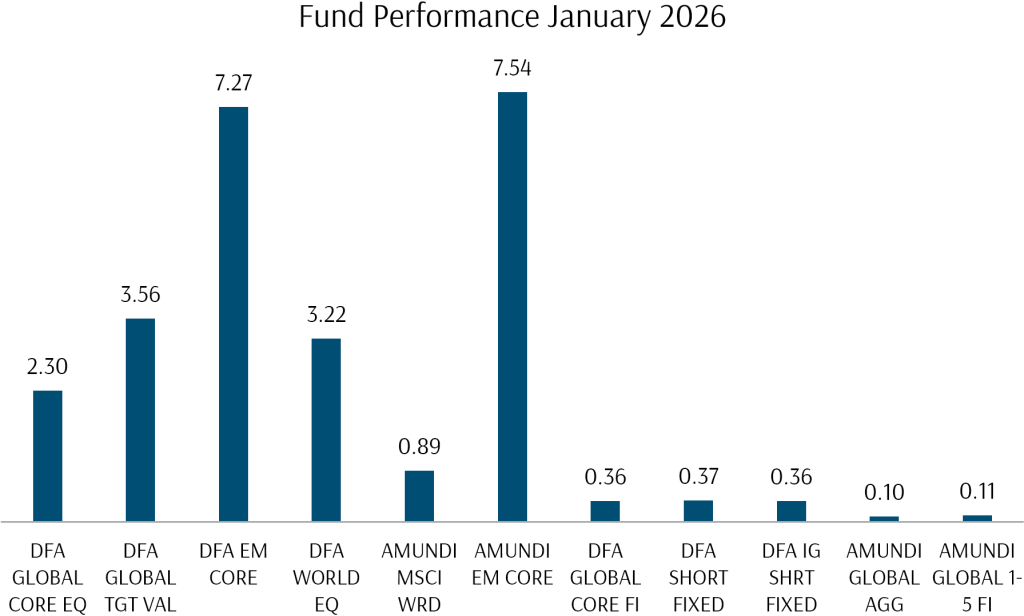

Exhibit 4: Fund Performance, January 2026 (SGD)

Portfolio fund performances were positive across the board, with outstanding performances in certain funds. Equity funds were positive without exception, while fixed income fund returns were somewhat muted due to macro and currency volatility.

Dimensional Fund Advisors (DFA) fund performances continued to impress, as Value and Small Cap factors carried their Q4 2025 momentum in 2026. DFA equity funds mostly outperformed benchmark indices, with the Global Targeted Value Fund turning in an outstanding 3.56% return in SGD terms. The Global Core Equity Fund more than doubled the performance of the MSCI World Index. The ongoing outperformance of Value and Small Cap factors was even more salient in January, as noise around AI and technology sector earnings and valuations remained elevated.

Emerging markets had the biggest returns, with the Amundi MSCI EM fund gaining 7.54% and the DFA EM Large Cap Core Equity Fund gaining 7.27%, respectively.

DFA Fixed income funds also performed well through January, with all funds gaining 0.35 – 0.37%, largely on the back of overweights in regions outside of the US.

De-Dollarisation: What the Headlines Really Mean

Cyclical Forces vs Structural Change

Recent movements in the US dollar and heightened geopolitical uncertainty have brought renewed attention to the concept of “de-dollarisation”. At its core, de-dollarisation refers to a gradual erosion of the US dollar’s role as the dominant global reserve, trade, and financing currency. This is not a short-term market event, but a slow, structural process that, if it unfolds meaningfully, would do so over decades rather than years.

It is important to distinguish this from normal periods of currency weakness, which are typically driven by cyclical factors such as growth, inflation, and interest-rate differentials.

The recent weakness in the US dollar can largely be explained by such cyclical forces. Slowing US growth, easing inflation, and falling interest-rate differentials have reduced the dollar’s near-term support, while stronger growth and higher inflation in parts of Europe, Japan, and Asia have supported other currencies.

Alongside these cyclical trends, longer-term structural developments are also at play. A more multi-polar global order, increased use of tariffs and sanctions, and shifting trade patterns, have encouraged some countries to gradually diversify their reserve holdings. These trends warrant monitoring, but they do not, on their own, signal an imminent displacement of the US dollar from the global financial system.

What Would True De-Dollarisation Look Like?

Ultimately, genuine de-dollarisation would require persistent deterioration across multiple dimensions: central bank reserve usage, trade invoicing, global payments, banking and clearing infrastructure, and the legal and institutional frameworks that underpin global finance.

While there has been a modest decline in the dollar’s share of official reserves, which has been driven in part by diversification into gold and by actions taken by sanctioned countries, broader measures of the dollar’s role in trade, finance, and infrastructure have remained broadly stable.

Why the US Dollar Still Dominates

At present, the US dollar remains the only currency with the scale, liquidity, openness, and institutional depth required to support global capital markets. Alternatives face meaningful structural constraints, making diversification more likely than outright replacement.

For investors, the key question is not whether de-dollarisation is possible in the very long term, but how portfolios should be positioned today. Attempting to front-run uncertain and low-probability tail outcomes through aggressive currency positioning, wholesale withdrawal from growth assets, or extensive use of hedging strategies carries significant costs.

History shows that such approaches often do more harm than good, permanently impairing long-term outcomes through lost compounding, high transaction costs, and poor timing. Major institutional investors around the world continue to operate within the global financial system, recognising that while extreme scenarios cannot be ruled out, planning must remain grounded in what is observable, manageable, and investable.

Providend’s Approach To Achieving Your Ikigai Goals

In an upcoming client note, we will discuss Providend’s approach towards managing and mitigating de-dollarisation and other currency/macro risks in greater detail. For now, while de-dollarisation is a legitimate long-term consideration, it is neither imminent nor binary. Medium-term currency movements remain dominated by macroeconomic forces, and the global financial system continues to function around the US dollar.

Our approach remains focused on disciplined diversification, conservative planning, and practical resilience, allowing clients to stay invested, remain grounded through uncertainty, and continue progressing toward their long-term ikigai goals.

Looking Forward to February 2026

Markets have moved at a frenetic pace in January. With the first month of January in the books, the market landscape is being reshaped by a rapid sequence of structural shifts that have pushed volatility back into the spotlight. February has begun with a significant spike in market volatility.

Over the past four weeks, the S&P 500 is now down 2% and the Nasdaq shedding 4.2%, a divergence that highlights the specific pressure on high-growth tech. While global benchmarks like the MSCI All Country Index remained relatively steady with a modest 1.3% decline, and EM is still up 2.18%, the headline stability masks significant turbulence beneath the surface.

The initial catalyst for this recent action was the nomination of Kevin Warsh as the new Fed Chair, an event that effectively put a plug on the “de-dollarisation” theme but simultaneously introduced fresh anxiety regarding the Fed’s long-term balance sheet. While Warsh is a known hawk whose appointment triggered a slight uptick in long-term rates and a subsequent P/E de-rating for expensive stocks, his short-term mandate is likely to involve navigating rate cuts and supporting the administration’s growth agenda. This restoration of institutional faith in the Fed is a positive, but the market is still recalibrating to a future where long-term support might be less of a given.

The next catalyst has been more profound and has been a less-than-familiar moment for the market. For those acquainted with the “Terminator” movies, this is best described as a “Skynet moment” for the software sector. The release of advanced agentic capabilities from Anthropic’s Claude has sent a shockwave through enterprise software, streaming, and financial services, with many fearing that AI agents could disintermediate incumbents faster than they can adapt.

This sentiment, combined with cooling enterprise growth and previously stretched valuations, resulted in a staggering 24% four-week decline in the software index, a level of decline rarely seen by industry veterans. When confronted with a fundamentally new paradigm, there is a tendency for markets to react first and ask questions later. While some of this selling appears indiscriminate, the threat posed by AI agents is real, and we do not expect a quick return back to previous highs. However, it is important to remember that the largest technology weights in global indices, and consequently our portfolios, are often the owners of these very AI winners, positioning them as the ultimate beneficiaries of this transition in the long run.

Adding to the complexity is the sheer scale of capital expenditure currently being deployed. With Google announcing $170 billion and Amazon projecting $200 billion in 2026 spend, the market is struggling to digest the “pain-now, gains-later” math of the AI race. While these figures create short-term earnings drag through depreciation and have even caused some jitters in the credit markets, this massive buildout is effectively functioning as a massive private-sector fiscal stimulus. At roughly 2% of GDP, this spending is a significant tailwind for industrials, utilities, and EM tech factories.

Early February developments have already shown that while “expensive” stocks are being punished, value and small-cap factors are holding firm, which has allowed our Dimensional factor tilts to shine. As we look toward the second half of 2026, the combination of eventual rate cuts, pre-midterm fiscal stimulus, and accelerating European defence spending should provide a much stronger floor for equities.

With a comprehensive wealth plan already in place with your Client Adviser, covering near-term spending needs while allocating capital at a level of risk suitable for your longer-term goals, you can have the peace of mind to navigate market volatility and stay invested for the long term, allowing your wealth to compound and fulfil your ikigai.

As always, if you have any questions, please do not hesitate to reach out to your Client Adviser. Thank you for your continued support and we would like to wish all clients a very Happy and Prosperous Lunar New Year.

The writer of this market review, Glenn Tan, is Portfolio Manager at Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm. He is also a CFA Charterholder and a Certified Financial Risk Manager (FRM).

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.