Given the headlines in early and mid-March, one might be forgiven for thinking that it would be a terrible month for markets as banks seemed to be collapsing and some Credit Suisse bondholders were wiped out after the bank takeover. However, it is always hard to predict short term market moves, and despite all the bad news, stock indexes rallied to finish the month higher, while bonds delivered on their promise to cushion portfolios by rising strongly in March as yields fell.

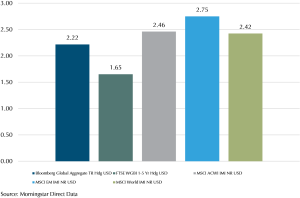

Exhibit 1: Market (Index) Performance March 2023 (In USD)

Looking at Exhibit 1 above, we can see that stocks rallied strongly to close out March. Developed world stocks were driven by a rebound in growth and larger tech stocks as investors rotated away from banks and energy stocks into the tech titans with large cash stockpiles. Emerging markets, particularly Asia, were much less affected by the banking crisis in the US and Europe, also saw strong buying which pushed the MSCI EM IMI up 2.75%.

Bond yields fell as the crisis around banks lowered expectations of future rate hikes, and increased the odds that the recession that has been predicted since early 2022 would finally happen sooner rather than later. As an example, the yield on the 2-year US Treasury fell almost 100 bps (1%) which is a very big move in the fixed income world (which roughly translates into 2% capital gain on 2-year bonds). Thus we can see bonds (as represented by the Bloomberg Global Aggregate and the FTSE WGBI) rallied strongly in March.

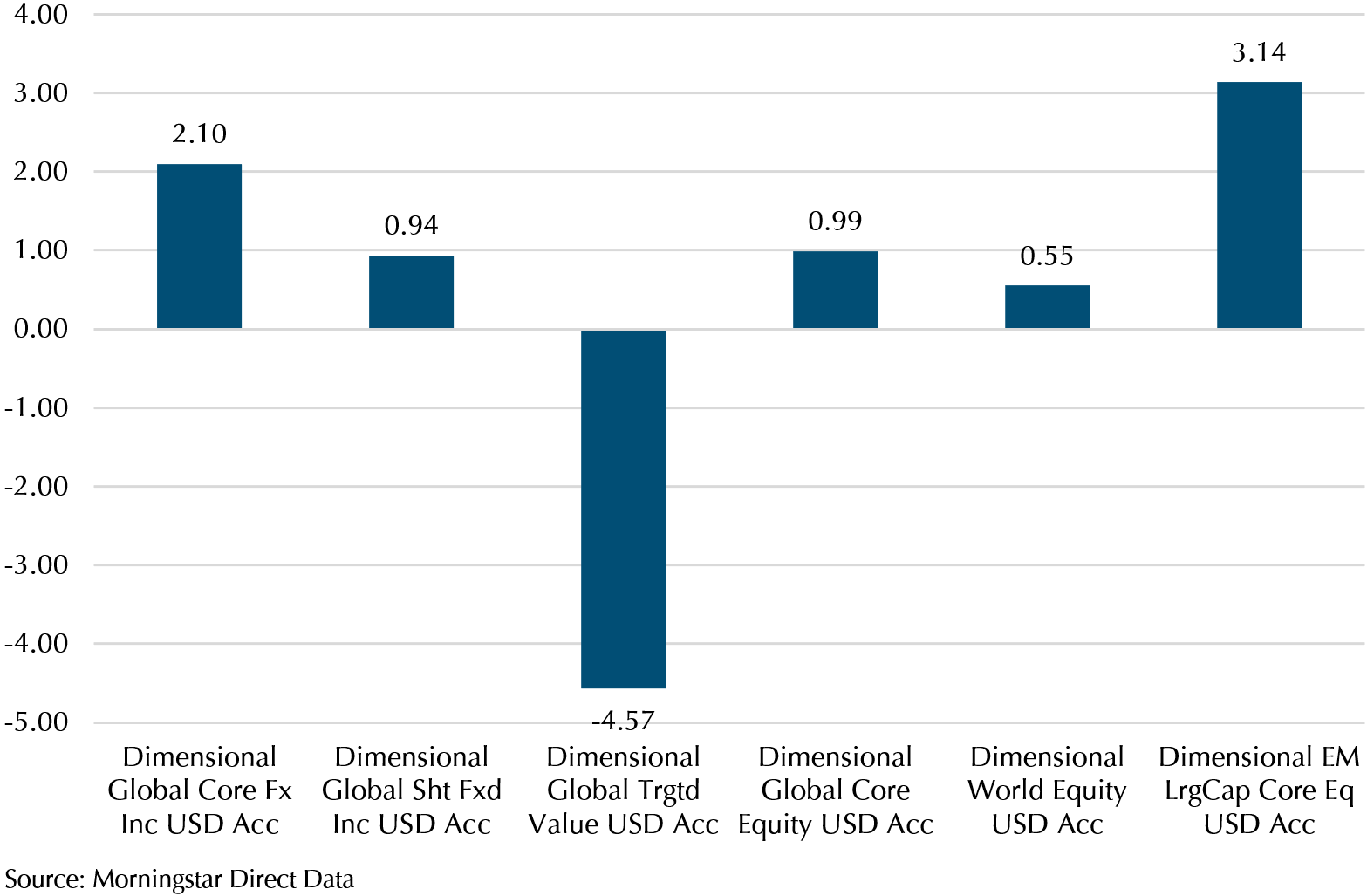

Exhibit 2: Dimensional Fund Performance March 2023 (In USD)

We then switch to looking at the Dimensional funds that are in our portfolios, and readers would notice that on the equity side, some of the funds have underperformed the indexes, particularly the developed world equity funds such as the Global Core Equity and the Global Targeted Value fund. Unfortunately, bank and energy stocks fall into the more value/profitable spectrum as they did very well last year (in terms of profitability) and therefore the Dimensional funds do have a higher allocation to them vs the indexes. The funds are also underweighting the large growth tech titans vs the index, therefore underperformed the indexes in March. In particular, the Global Targeted Value fund did much worse as smaller banks were under pressure in March. However, do recall that last year, these funds outperformed the indexes as value and small stocks did well, and so we cannot have index outperformance without certain periods of underperformance. Overall, these funds have outperformed since August 2020 when value stocks started to gain ground as rate expectations rose.

What Happened to The Banks?

Much has been said about the collapse of Silicon Valley Bank (SVB) in the news, but there are some points that are less highlighted. In 2018, the US rolled back some regulations around smaller banks (with assets below US$250b) allowing them to have lower cash levels as compared to the systematically important large banks. After the Great Financial Crisis of 2008, banks were forced to hold at least 10% of assets in cash. However, after the regulations were loosened and when interest rates rose, small banks reduced cash levels to an average of just 7% in 2023 (according to Federal Deposit Insurance Corporation data). Smaller banks, trying to generate profits, were using the cash to invest in long-term bonds to get higher yields. They would become vulnerable if depositors all wanted to withdraw their money, as in the case of SVB. This put the smaller banks under a lot of pressure in March 2023 and the subsequent fall in their stock prices reflected this.

Things also came to a head in Europe as fears around Credit Suisse, already suffering from years of mismanagement, led it to be eventually taken over by UBS for USD$3 billion.

It Is Not Systemic.

What happened to the affected US and Swiss banks this time was idiosyncratic, not systemic. In other words, it was caused by a lack of proper risk management within the banks that led to the collapse of these banks.

Silver Gate, SVB, and Signature Bank all had concentrated high-risk clients which are prone to withdrawing deposits during a tightening environment. Furthermore, SVB and Signature bank holds only 7% and 5% in cash over their total assets in comparison to the industry average of 13%. This means that when an event triggers withdrawals, the outflows will be large and these banks wouldn’t be able to meet the demand, which is exactly what happened.

On the other hand, Credit Suisse’s downfall has been years in the making. From being charged with bribery and fraud in Mozambique’s tuna bond scandal, losing 10 billion dollars of clients’ money on Greensill funds which were marketed as safe, to having too huge an exposure to Archegos Capital Management causing the company to lose 5 billion dollars, Credit Suisse has been experiencing many scandals in the past few years. The Swiss investment bank deposit decreased by 40% or about 123 billion in 2022. The fall of the US banks only acted as a catalyst for Credit Suisse’s downfall as investor sentiment caused by the credit crisis drove the Swiss bank’s share price down and led to its collapse.

Aside from these isolated cases, the health of US and Europe banks’ balance sheets is in good condition. A CET (Common Equity Tier 1) ratio indicates the amount of losses a bank can absorb without risk of failure. As of the end of 2021, US banks’ CET ratio is 9.7% in contrast to the minimum required CET ratio of 4.5%. Similarly, Europe banks, on average, have a liquidity coverage ratio of 160% while the minimum regulatory requirement is 100%. The liquidity coverage ratio is the proportion of highly liquid assets held by financial institutions to ensure they maintain an ongoing ability to meet their short-term obligations.

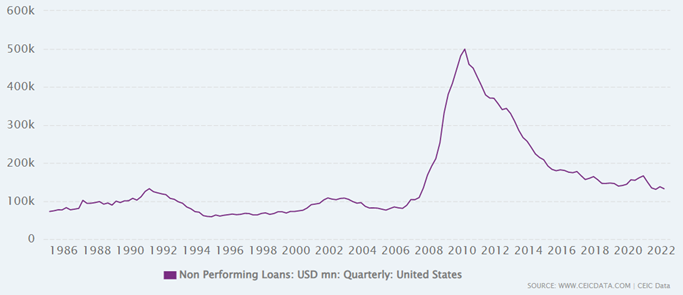

In contrast to 2023, the 2008 subprime mortgage crisis was caused by lax lending and overleveraging leading to a drastic fall in housing prices and high default rates, resulting in liquidity issues in US banks. US non-performing loans (NPL) were at a historic high during 2008-2010 while the NPL in 2022 was comparatively much lower (Exhibit 3).

The banks today have stronger balance sheets compared to 2008. Hence, it is unlikely that the failure of these banks will lead to a systemic issue. However, much uncertainty remains as we are still facing a tightening environment. If the uncertainty dissipates, the market attention will then go back to the Fed which will continue to focus on inflation and interest rate hikes.

Exhibit 3 – US Non-Performing Loans

Market and The US Central Bank Dissonance

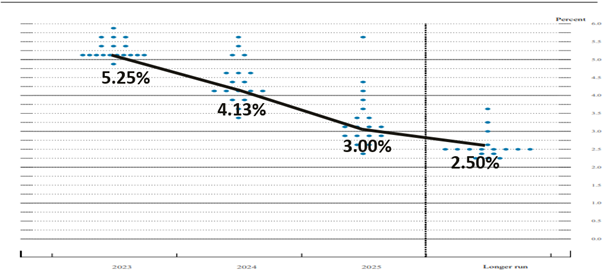

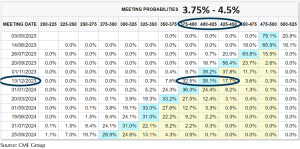

In the recent monetary policy meeting by the Feds (FOMC), the US central bank raised rates by 25 bps despite the banking scare. This shows that the Fed is still prioritising price stability above everything else. Based on the Fed dot plot (Exhibit 4), the Fed forecast they will be hiking rates to 5.25% at the end of 2023. In contrast, according to the CME Group estimates, the market is seeing that the interest rates will have a higher probability of being between 3.75% – 4.50%. So why is there a disagreement between the market and the US central bank? Since the banking crisis started on 8 March, the 2-year yield has fallen by 100 bps. The market is pricing in a high probability of a recession that may force the Fed to reverse its current rate trajectory.

While we cannot know which side is correct, what is likely is increased volatility as the information becomes clearer around the likelihood of recession, the stickiness of inflation and the monetary policy that will be used should a recession occur.

Exhibit 4 – The Fed Dot Plot

Exhibit 5 – Market Table Probability of Interest Rates

Constant Risk Management and Diversification Protects Your Portfolio

The recent scare around US and European banks is a good example to highlight the way your portfolio is protected via diversification and risk management.

Providend constructs portfolios with high quality bonds that will typically rise during periods of equity market volatility. We do not look for the highest yield, as that would mean taking on risk that is not required in our portfolios. In our implementation, we make sure that the funds and managers we use follow their mandates to avoid risky bonds. In March, this has paid off as the bonds in our portfolios rose almost as much as equity, giving our portfolios a much-needed boost during the volatile period.

The managers we select also manage the risk in the portfolios carefully. Dimensional uses prices to assess the risk of bonds, and in the case of additional tier 1 (AT1) bonds, the yields on the bonds are much higher than similar rated bonds, implying a higher level of risk. Therefore, these bonds are not included in the portfolios as they are too risky for the portfolio. Similarly on the equity side, there are limits on exposure to sectors (max 10% typically) so exposure to banks and financials are capped. For specific companies, they will monitor the news and limit exposure accordingly. Using Credit Suisse as an example, since the bad news around the company hit in 2021, Dimensional has held an unweight position in its funds vs the index.

At Providend, we too ensure that our advice to clients reflects the risk involved. As recently as February, we advised a client against taking a position that would involve taking on Credit Suisse credit risk, as the news flow around the company since 2021 has not been good so the position would have been riskier than it seemed.

Lastly, diversification is also key to avoiding big portfolio drawdowns. Due to the highly diversified nature of the funds we use, the total allocation of the failed banks was less than 0.1% in the Dimensional Global Core Equity Fund and less than 0.2% in the Global Targeted Value Fund so the direct impact of the failed banks on the portfolios is low.

Looking Forward to The 2nd Quarter

It has been a difficult quarter so far in 2023, with lots of rain in Singapore, and lots of uncertainty in the market. However, our portfolios are delivering positive returns in 2023, and markets seem to have recovered some poise after swooning in March. The quick action by Central Banks to protect depositors, and the takeover of SVB assets by First Citizen Bank brought some calm to investors that feared further contagion.

There will always be uncertainty in investing, but it is this very uncertainty that gives us the higher return that allows us to achieve our wealth and life goals. If you have any questions or concerns, do reach out to your adviser who is there to help you navigate this uncertainty. Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.