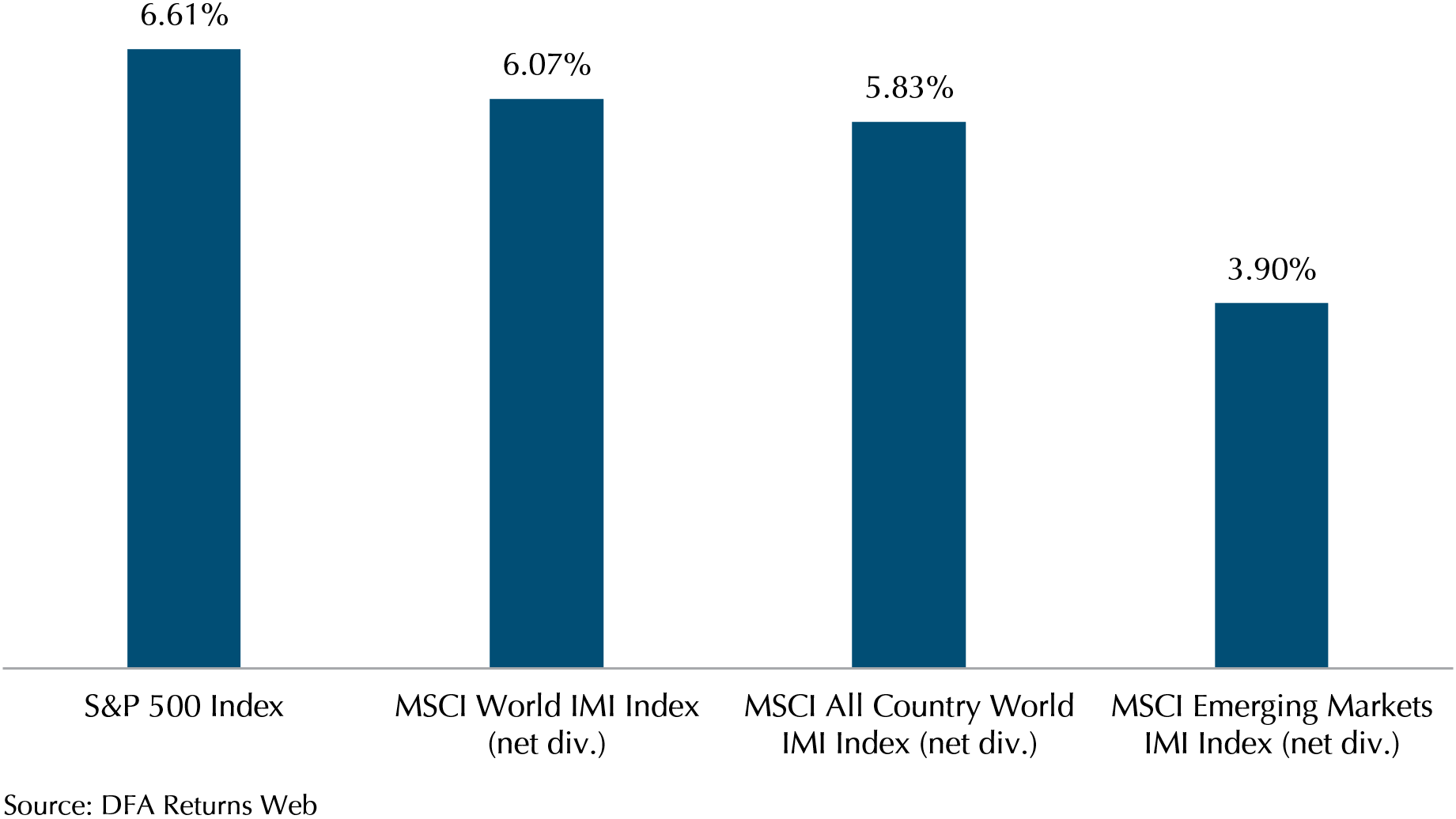

June proved to be a favourable month for the stock market as equities demonstrated resilience and rallied, defying the Fed’s signal to raise interest rates by another 50 basis points during their June monetary policy meeting. Major market indices, including the S&P 500, MSCI World IMI Index, MSCI All Country World IMI Index, and MSCI Emerging Markets IMI Index, recorded gains ranging from 3.90% to 6.61%. Meanwhile, in the bond market, longer-term yields remain constant despite market pricing in a higher probability of a rate hike in the second half of the year. Consequently, the Bloomberg Global Aggregate Index (hedged to USD) also remain unchanged.

Exhibit 1: Market (Index) Performance June 2023 (In USD)

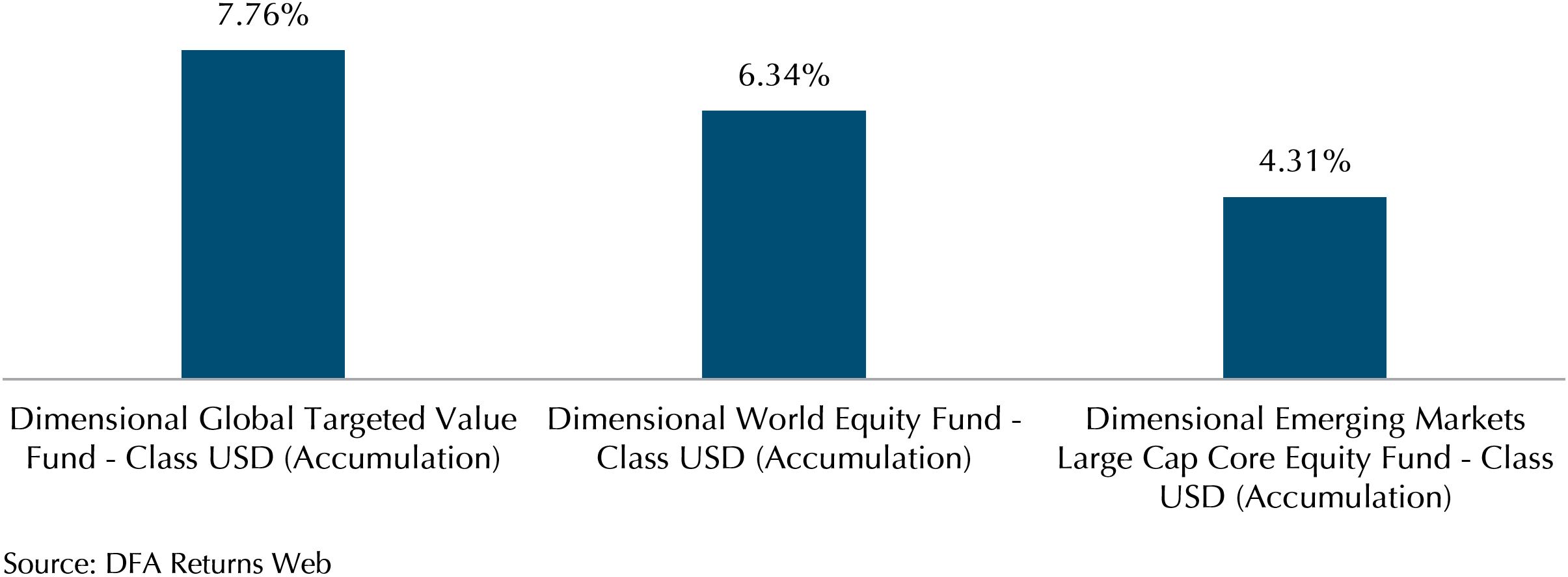

Dimensional funds outperform market indexes in June

In June, Dimensional funds showcased the emergence of value and size premiums, coinciding with the alleviation of concerns surrounding a systemic bank crisis and a significant reversal in the previous months’ selloff of US regional banks. As a result, all Dimensional equity funds outperformed the market indexes.

The Dimensional Emerging Market Fund outpaced the MSCI Emerging Market IMI index by 0.41%, the Dimensional Global Targeted Value surpassed the MSCI World IMI index, which encompasses large and mid-cap companies in developed markets, by 1.69%, and the Dimensional World Equity Fund outperformed the MSCI All Country World IMI index, which encompasses large and mid-cap stocks across developed and emerging markets, by 0.51%. June marked a positive conclusion to the first half of the year in the stock market.

Exhibit 2: Dimensional Equity Funds Performance June 2023 (In USD)

Sobering headlines but stellar market performance

As we reflect upon the past six months and enter the second half of the year, it’s important to consider the events that unfolded in the market. Initially, the year began with robust gains, but the persistence of inflation, fuelled by a resilient labour market in the US and Europe, led to concerns about potential interest rate hikes by central banks. Consequently, both stocks and bonds experienced losses as yields climbed higher.

Amidst the backdrop of a rising interest rate environment, we witnessed the occurrence of a few notable US regional bank failures in March and April. The failure of Silicon Valley Bank and First Republic Bank due to panic withdrawals by business and retail depositors was followed by the collapse of Credit Suisse, Switzerland’s second-largest bank, stemming from years of scandals. This prompted a sell-off in US regional bank stocks, which also impacted the broader market to a lesser extent.

However, the concerns of a systemic crisis were mitigated as regulators and central banks made concerted efforts to reassure depositors of the safety of their funds. Furthermore, JP Morgan and UBS took over First Republic Bank and Credit Suisse respectively, with both institutions being the largest banks in their respective economies. Despite these challenges, the equity market displayed significant growth. US mega-tech companies demonstrated resilience in their top-line revenues and bottom-line earnings, even in a tightening environment. Additionally, optimism surrounding artificial intelligence contributed to a rally in these major tech firms. Consequently, the strong performance of these mega-tech companies drove major developed market indices up, as large-cap tech stocks are a large weight in them.

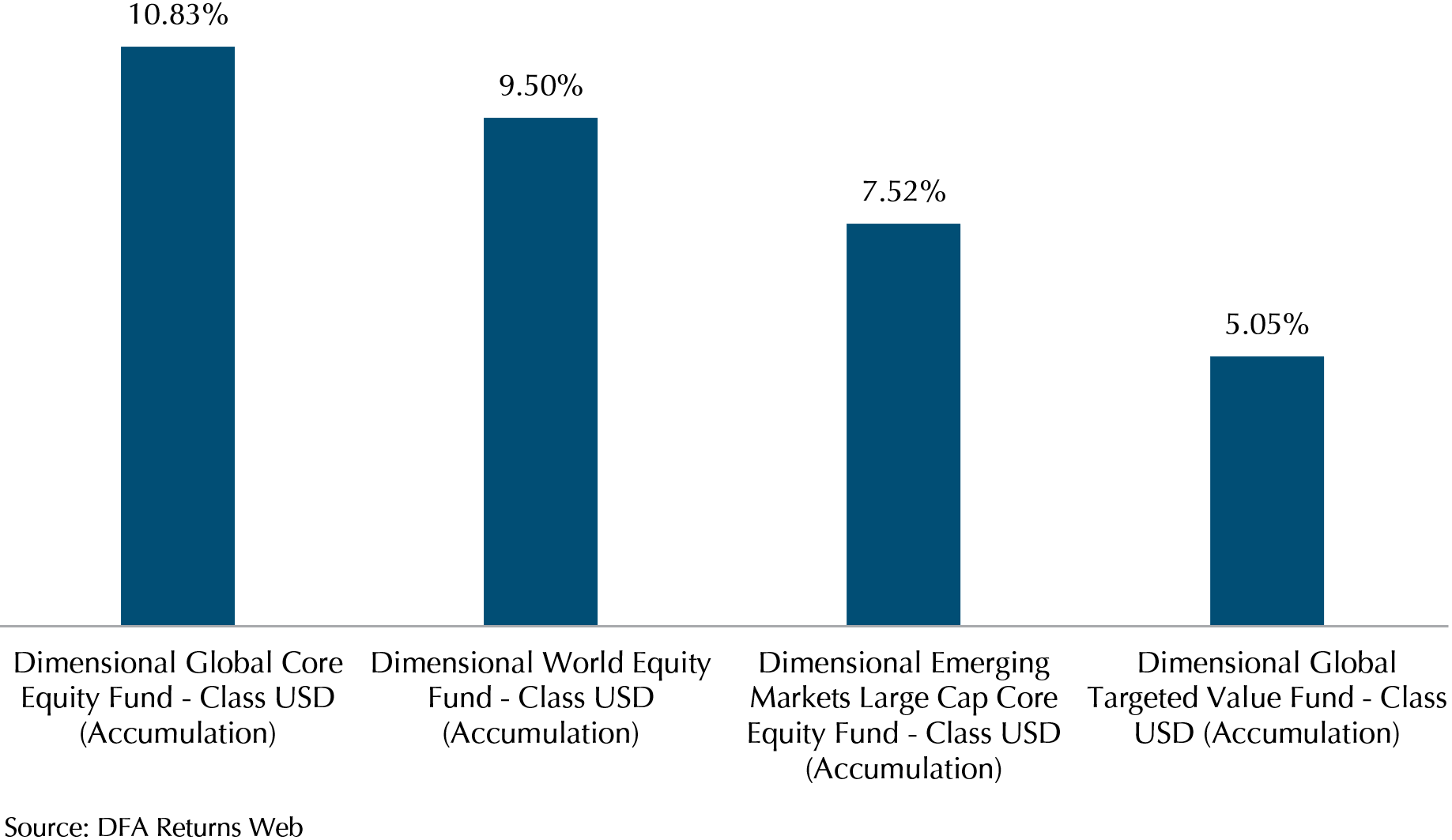

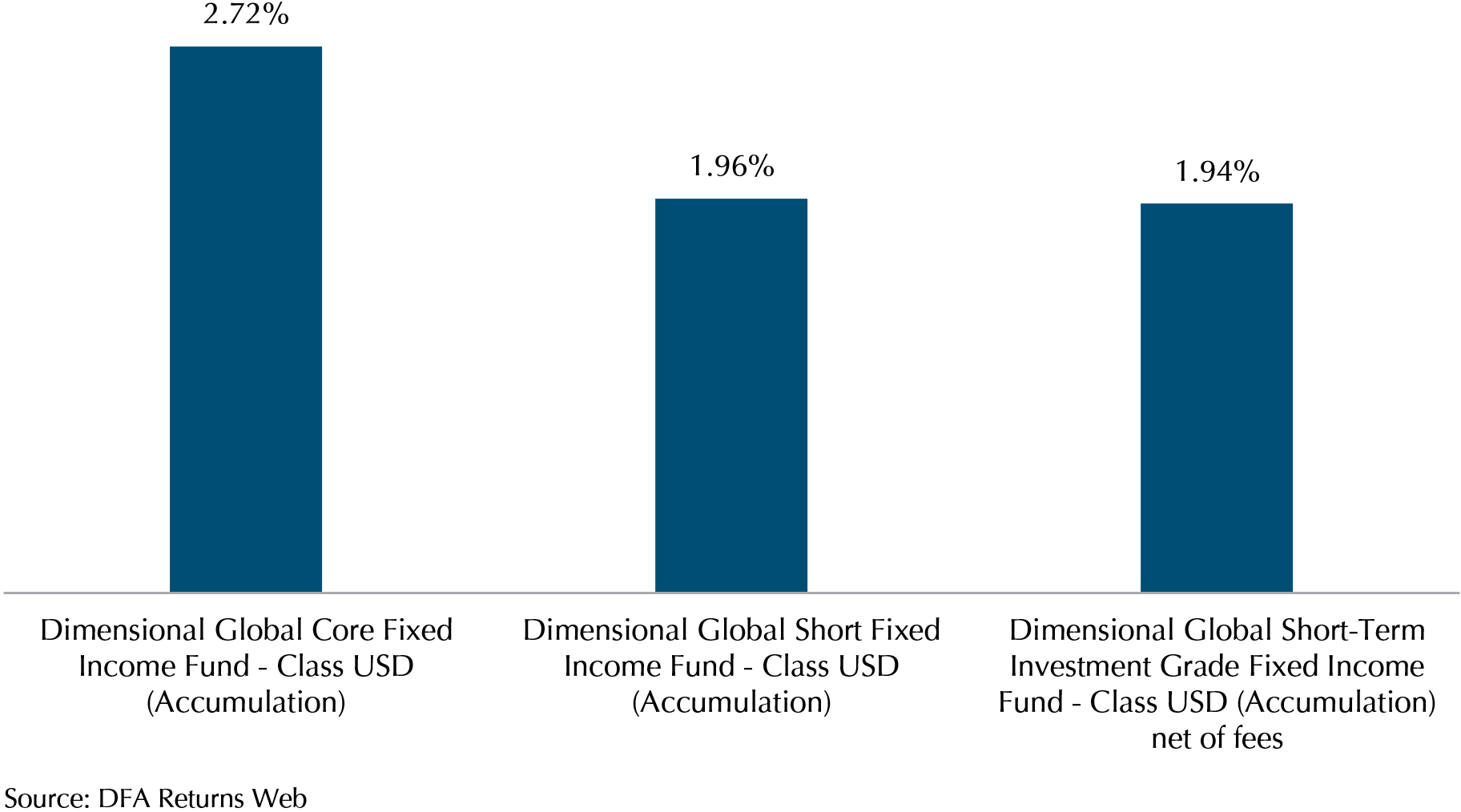

Dimensional funds and Index Plus Portfolio (USD) performance

As of 30 June, the year-to-date performance of Dimensional equity funds (Exhibit 3) ranged from 5% to 11%, while Dimensional bond funds (Exhibit 4) showed a performance range of 1.9% to 2.8%.

Notably, the Dimensional Global Core Equity and World Equity funds achieved impressive returns of 10.83% and 9.5% respectively. Although the Global Targeted Value Fund did not perform as well, its strong outperformance against market indexes in 2022 helped mitigate the downside impact on our investors’ portfolios.

Exhibit 3: Dimensional Equity Funds YTD Performance as of June 2023 (In USD)

Exhibit 4: Dimensional Bond Funds YTD Performance as of June 2023 (In USD)

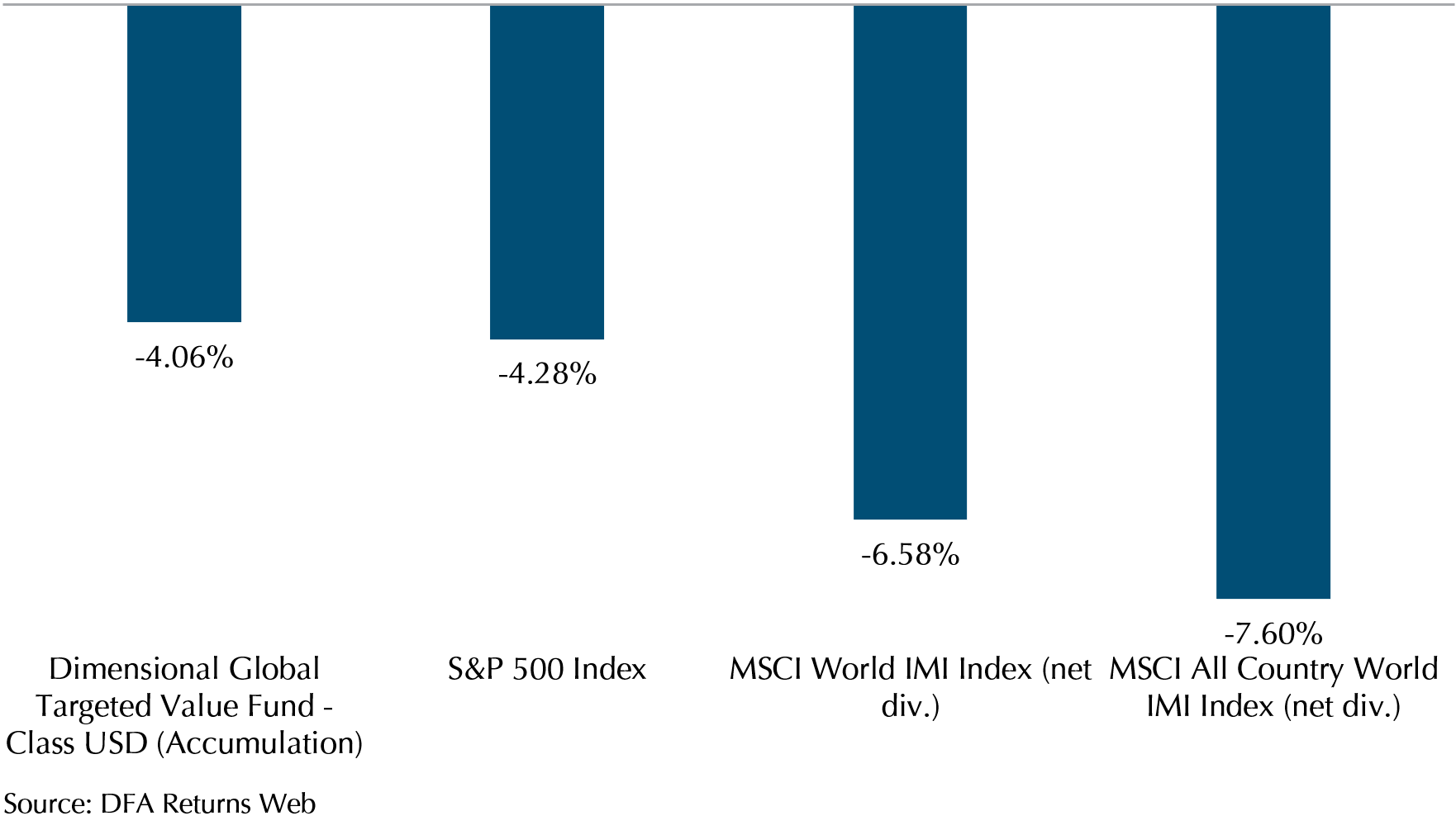

In fact, if we examine the market peak from 1 January 2022 to 30 June 2023, Global Targeted Value continues to outperform all major market indices, as depicted in Exhibit 5. Furthermore, when compared to the market indexes, the Global Targeted Value Fund demonstrates relatively lower fluctuations in stock performance, thanks to its comparatively smaller negative performance in 2022 and modest positive performance in the first half of 2023. By incorporating Dimensional value-tilted funds into the Index Plus portfolios, we have effectively reduced portfolio volatility, offering our clients a more positive investment experience as they progress toward their financial goals.

Exhibit 5: Global Targeted Value vs Market Indexes from Jan 2022 to Jun 2023 (In USD)

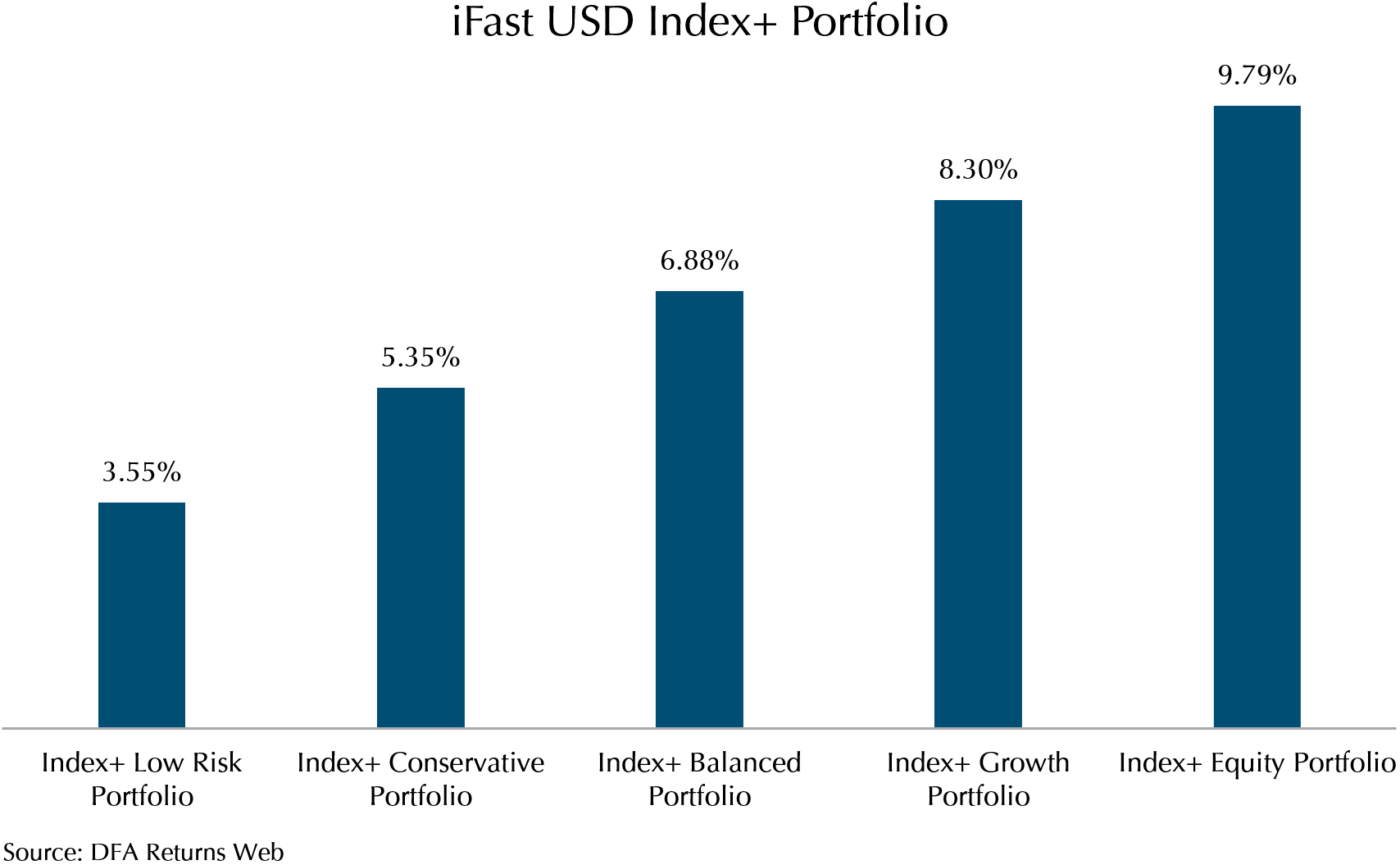

Upon reviewing the year-to-date performance of our Index Plus portfolios, as depicted in Exhibit 6, we observe strong positive performance across all portfolios. As expected, portfolios with higher equity allocations have yielded higher returns. The Index Plus Equity portfolio, with a 100% equity allocation, has achieved an impressive 9.8% return. Similarly, our Index Plus balanced portfolio, consisting of a 60% equity and 40% bond allocation, has shown a solid 6.9% increase. Even the Index Plus Low-Risk portfolio, with a conservative 20% equity and 80% bond allocation, has delivered a noteworthy 3.6% return.

Exhibit 6: Index Plus Portfolios YTD Performance as of 30 June 2023 (In USD)

Looking forward

The media has been reporting unsettling news that has contributed to market volatility. It is unclear whether the market naturally tends to feel nervous and actively seeks out worrisome themes, or if the unsettling news itself triggers the market’s unease. In simpler terms, it is uncertain which comes first – the chicken or the egg. However, this very uncertainty in the market is what offers investors an expected return.

Looking ahead, there may be challenges on the horizon, but indicators continue to suggest a resilient economy, and such strong gains often signal the end of a bear market. Historical data reveals that in 21 other instances since 1950, when the S&P 500 gains at least 10% or more in the first half of the year, it further rallies into the second half in 17 of those cases, with an average full-year increase of +25%.

It is important to note that we are not predicting continued market rallies for the next six months. On the contrary, we wish to emphasise that market movements are unpredictable. Just when it seems that the market has reached its peak, it may continue to rally. Nevertheless, empirical evidence has shown that the market tends to move upwards over time, and remaining invested can improve your chances of capturing market returns and achieving your financial goals.

Should you have any concerns, please do not hesitate to reach out to your client advisors. We are enthusiastic about the opportunity to work with you, guide you on your life journey, and take pride in helping you achieve your financial goals.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.