The start of 2022 has not been kind to the stock market as it continues to show negative returns in February. Temperamental market swings caused by rising inflation and upcoming rate hikes were further aggravated by news of Russia invading Ukraine.

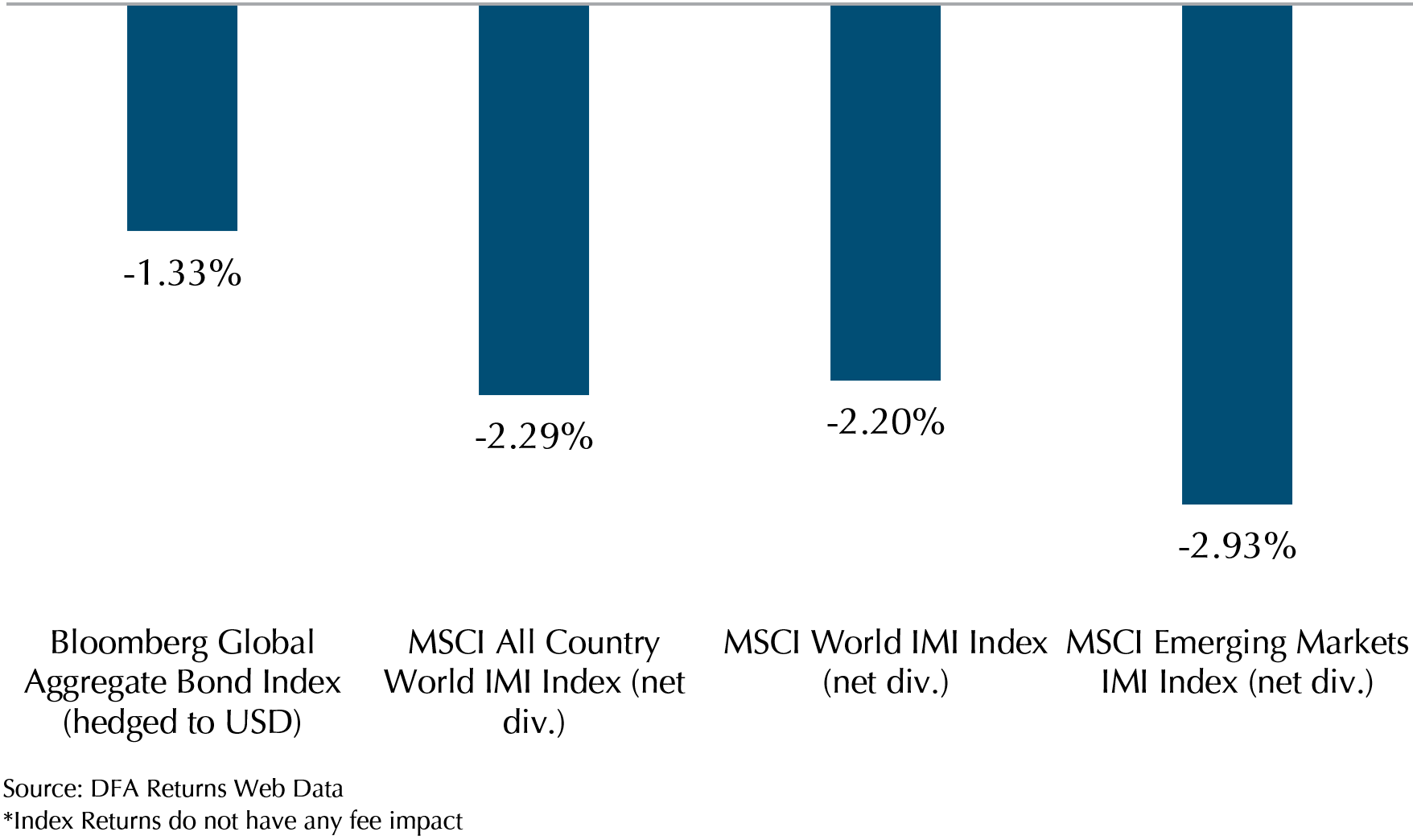

Exhibit 1: Reference Index Returns February 2022* (USD)

As we can see from the data above, both developed and emerging market are showing negative returns due to market sell off after news of Russia’s invasion breakout on 24th February.

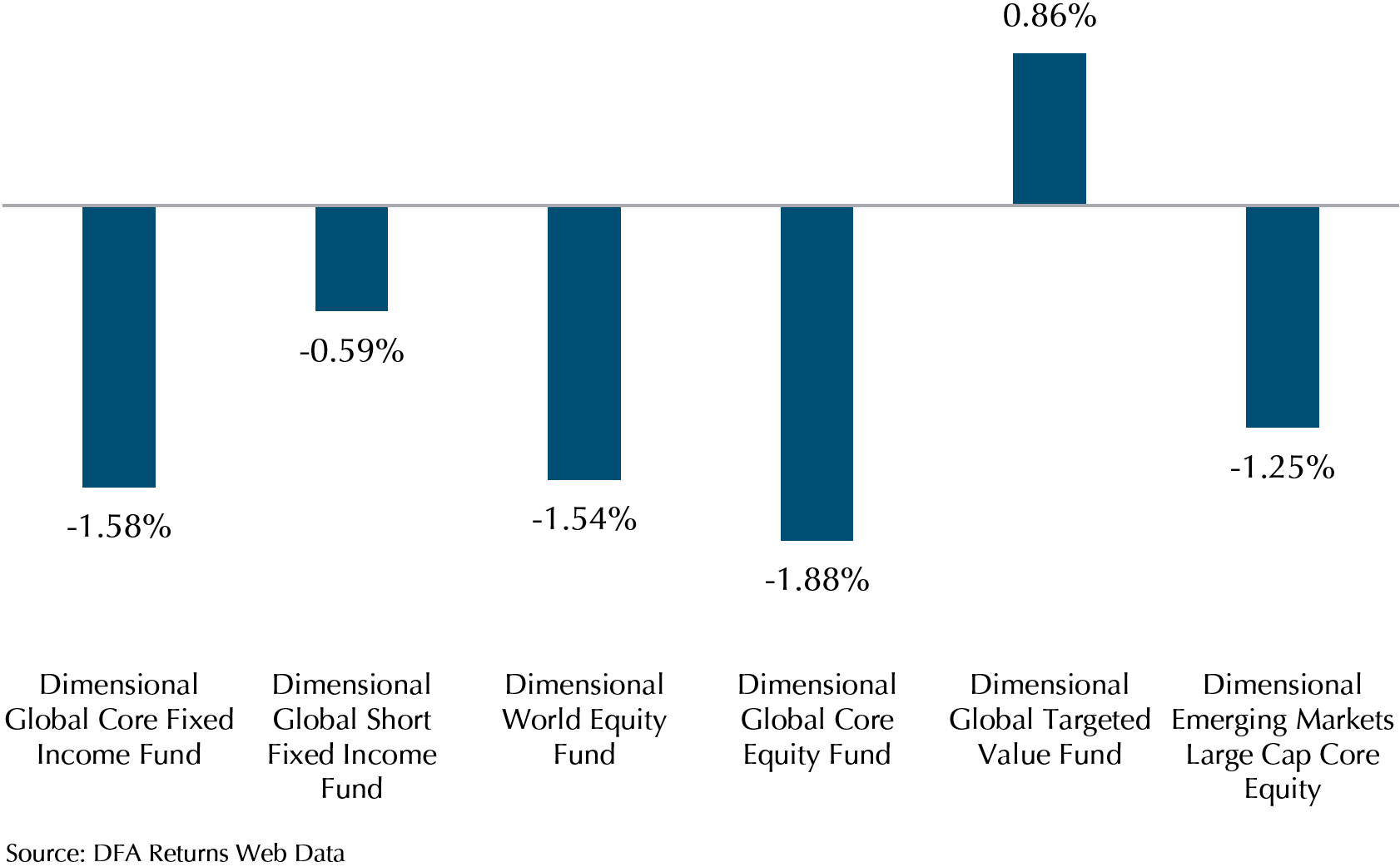

Exhibit 2: DFA Fund Returns February 2022 (USD)

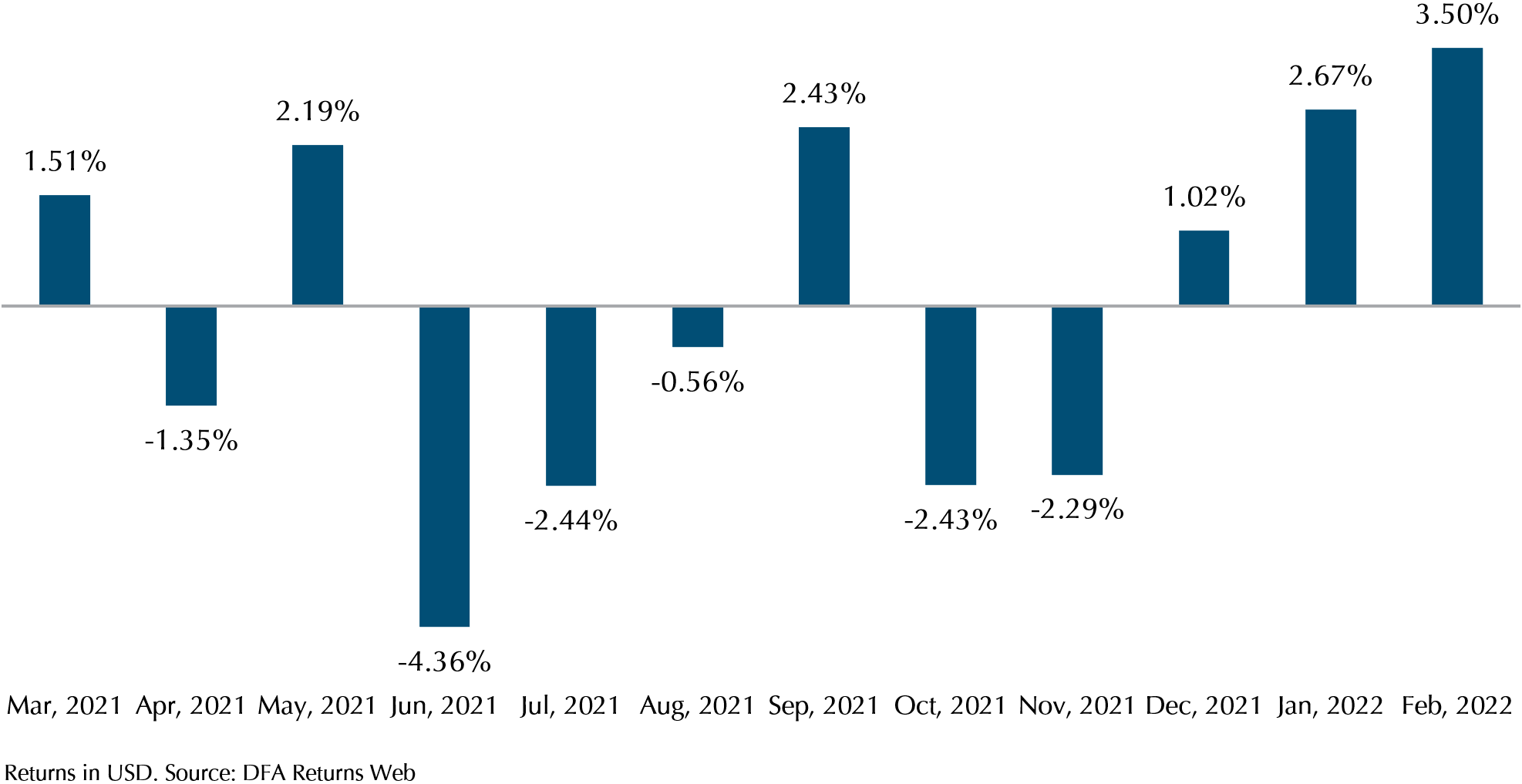

Most of Dimensional’s funds outperformed their benchmarks (Exhibit 2). Value stocks’ presence helped cushion Dimensional equity funds’ drop as the value premium has continued to show up strongly in 2022. Of note, small company stocks and value stocks had a stellar performance as the Global Targeted Value not only came out unscathed in February after news of the Russia-Ukraine crisis broke out but also gave positive return and outperformed its benchmark the most in a year. With reference to Exhibit 3 below, we can see that Global Targeted Value has been outperforming its benchmark since December 2021 and in February 2022 the outperformance is the highest in a year at 3.5%.

Rate hikes, which tend to cause bond yields to increase and returns to decrease, by the Federal Reserve continue to be the main factor for negative returns in bonds, with the market pricing even more hikes in February as inflation rose faster than expected to 7.5 percent for the month of January over the previous year, exceeding the 40-year high set in December. However, short term bonds are less sensitive to movements in the interest rate, and hence exhibit lower volatility in our current environment. As such, we allocate short term bond funds to portfolios with a lower volatility mandate, like the low risk and conservative portfolios, because of its relative price inelasticity to change in yield.

Exhibit 3 – Global Targeted Value Performance Over Average Benchmark Performance

Ukraine-Russia Crisis

Russia’s invasion of Ukraine has gripped news headlines and has contributed to more uncertainty in the markets. Undoubtedly, there is an increased level of uncertainty due to the crisis, and this has been reflected in market prices, particularly in the major US indexes like the S&P 500 and the Dow.

However, we would like to highlight the following few points to show that the diversification across our portfolio continues to provide different sources of return that reduce the volatility in times of uncertainty:

1. Value Stocks and Emerging Markets Continue to Provide Positive Returns

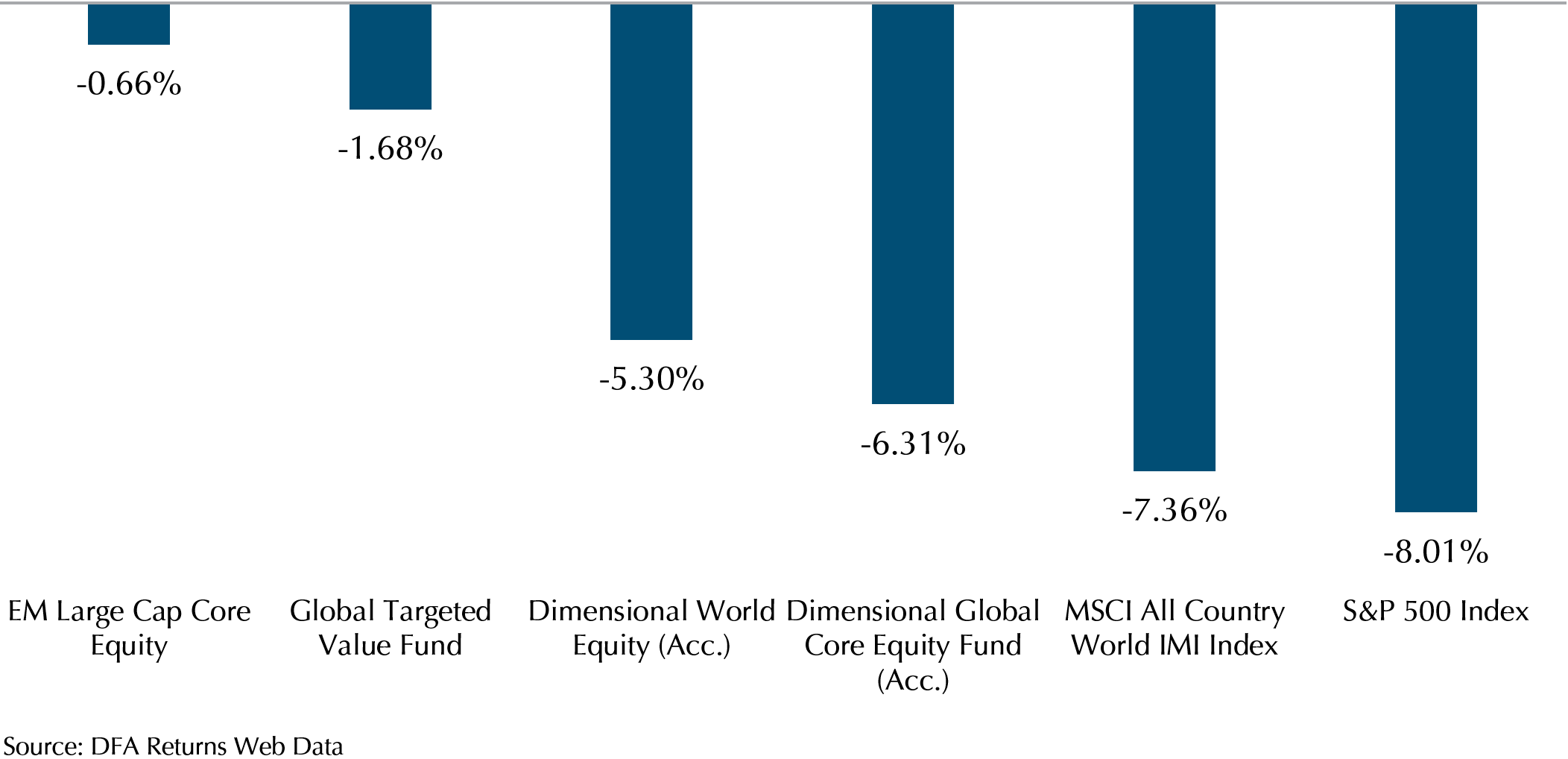

Exhibit 4 – Year to Date Returns: DFA Funds vs S&P 500 (End Feb 2022)

From the news headlines, you might get the impression that equities are reaching or have reached a market correction of 10% drop in returns, but that is not the case. On Exhibit 4, you can see that many DFA funds that our portfolio holds fell much less than 7% year to date. That is a huge relative outperformance compared to the negative 7.36% year to date return on the MSCI All Country IMI Index and the negative 8.01% return on the S&P 500 Index.

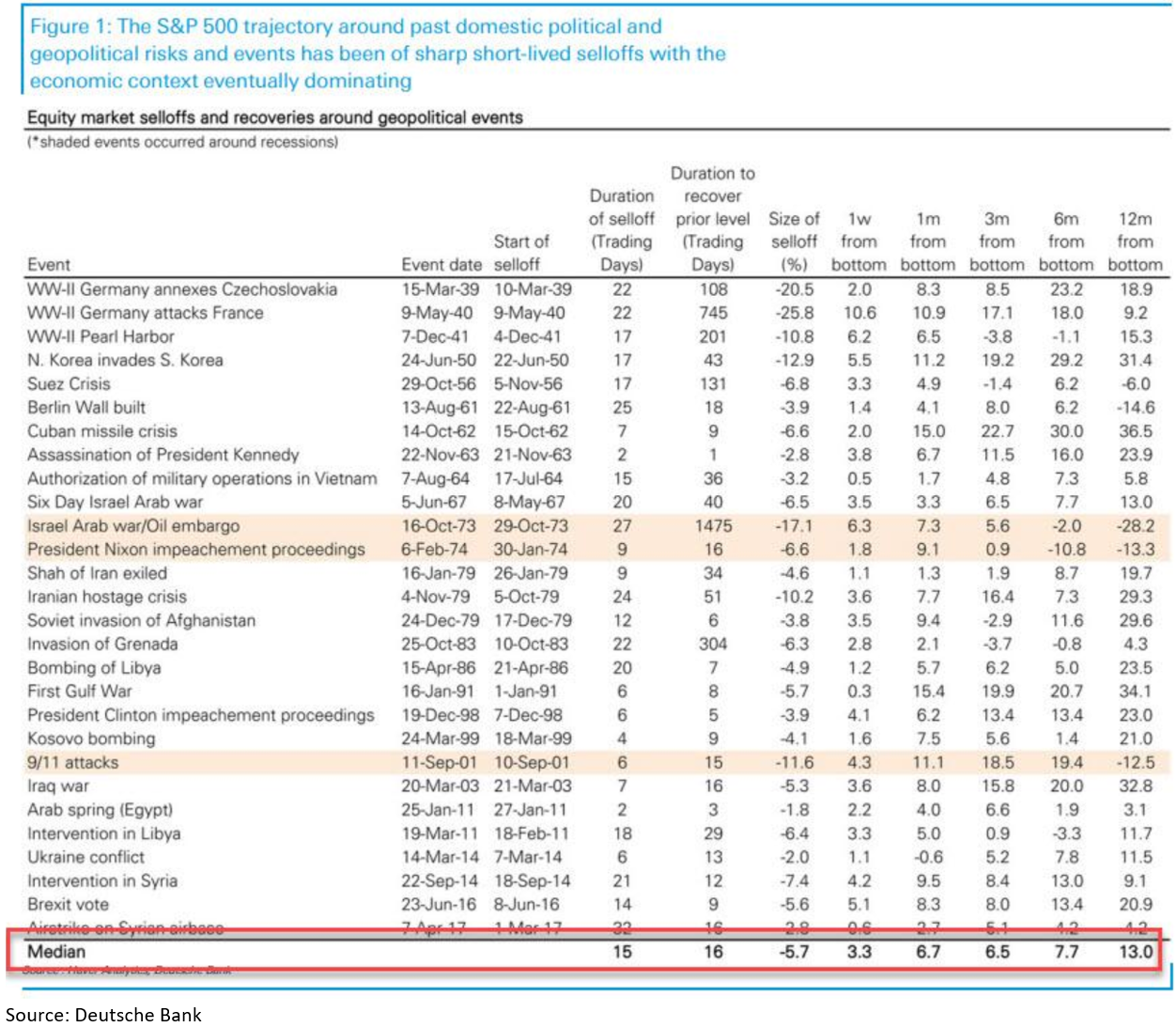

2. The Impact of Geopolitical Tensions Is Typically Short-Lived

According to an analysis done by Deutsche Bank equity strategists Binky Chadha and Parag Thatte, the impact of geopolitical events on markets is short-lived. The median selloff in the S&P 500 is 5.7%, and markets take around 16 trading days to recover (Exhibit 5). Of course, not every event is the same, but if the reaction of the S&P 500 to past geopolitical events is anything to go by, then there is some optimism that geopolitical events will not have too long an impact on our portfolios.

Exhibit 5

In terms of actual portfolio impact, the exposure to Russia in the portfolios ranges from 35 basis points (0.35%) to 7.5 basis points (0.075%), so the direct impact from the conflict is going to be very limited.

3. Inflation Woes Take Precedence

Despite worries on the crisis affecting the US economy, the rising inflation rate has not been relegated to an afterthought. Fed Chairman Jerome Powell said on Wednesday, 2nd March, that he still sees interest rate hikes ahead though he noted the “implications for the US economy are highly uncertain” from the Ukraine war.

Upward inflation pressure is likely to grow as supply chain bottlenecks worsen due to sanctions in Russia and conflict along the coast of the Black Sea disrupts crude oil logistics, critical raw materials, and key agriculture exports. As of the 3rd of March, the price of Brent crude has risen more than 40% year to date, which will likely be a big factor on upcoming inflation data. Expectations of an interest rate hike have risen since the crisis as the market prices in more tightening from an already hawkish Federal Reserve. The good news is that value stocks so far have held up much better in the face of rising rate expectations.

Conclusion – Stay Invested for the Long Term for the Best Investment Experience

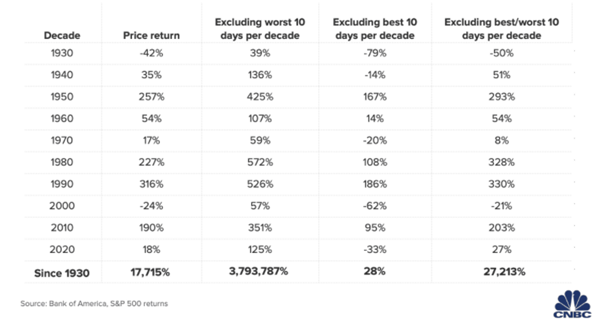

Exhibit 6 – S&P 500 Returns, Missing the Best and Worst Days

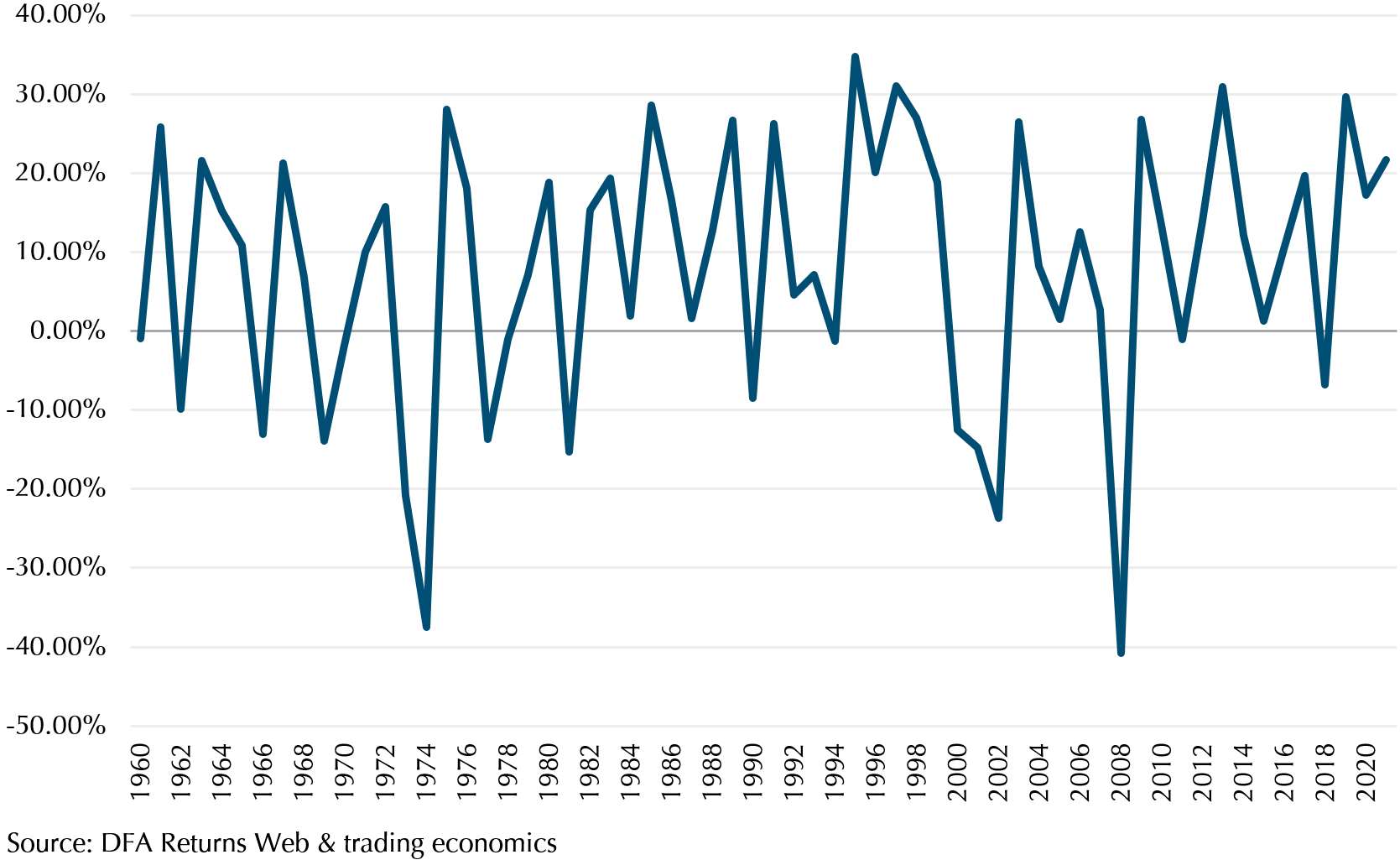

Exhibit 7 – Real Return of S&P 500 from 1960

While inflation has always existed, many investors have more concerns now due to the recent alarming rise in inflation rate. Despite the negative returns for the past two months, investors should avoid the impulse to sell or time the market. Looking at data in Exhibit 6, going back to 1930, it is found that if an investor sat out the S&P 500′s 10 best days per decade, total returns would be significantly lower than the return for investors who waited it out.

Investing in stock market for the long run not only helps to preserve your wealth’s purchasing power but also grows it. Exhibit 7 shows the real return of S&P 500 from 1960 which is calculated by deducting the actual return of S&P 500 from inflation for that year. Even though the movement of real returns are random and unpredictable, the annualised rate of real return for S&P 500 since 1960 is 6.64%. In other words, not only is your wealth not eroded but your purchasing power will grow by 57-fold if you stay invested in S&P 500 from 1960. Similarly, we believe the robustness of our globally diversified portfolio helps minimise the negative effect of inflation in the long run and increase the purchasing power of our investors’ wealth. Let us weather through global market storms together and reach your financial and life goals.

Thank you for your continued trust and support. Stay safe and healthy.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.