We thought that it would be a good time to take the chance to share with you some of the common questions we have been receiving in the past months and use this opportunity to share our responses with everyone.

Question 1 – How are my portfolios doing relative to the market?

If you are invested in our passive index-tracking Index portfolios, the good news is that your portfolios and funds are tracking the market index, and you are getting the market performance.

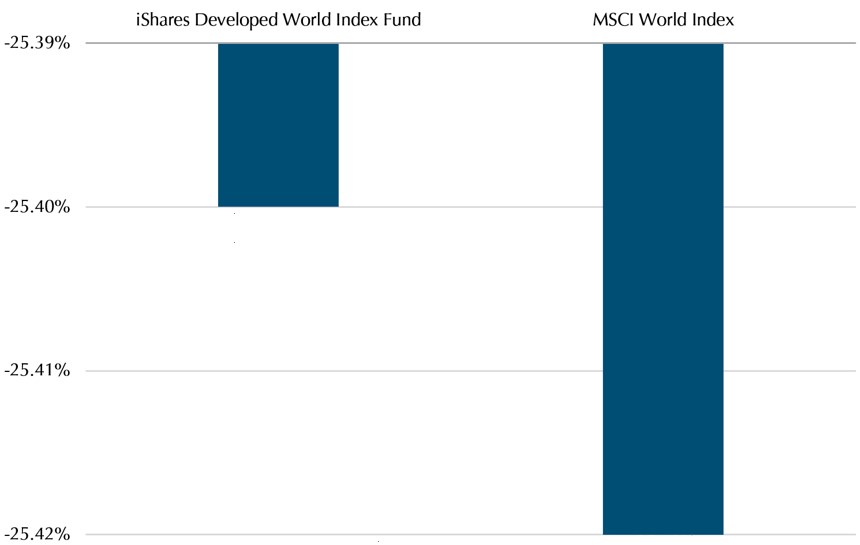

For example, the BlackRock iShares Developed World Index Fund has returned -25.4% compared to the MSCI World Index which is down 25.42%

Exhibit 1: iShares Developed World Index Fund vs MSCI World Index YTD returns to 30 Sep 2022 in USD

Source: BlackRock

The MSCI World Index is the most widely used index to refer to the developed world stock market, which includes approximately 70% weight to the US, and large allocations to UK, Europe and Japan.

If you are holding an Index portfolio, you are getting the market performance and there is no underperformance or overperformance for that matter.

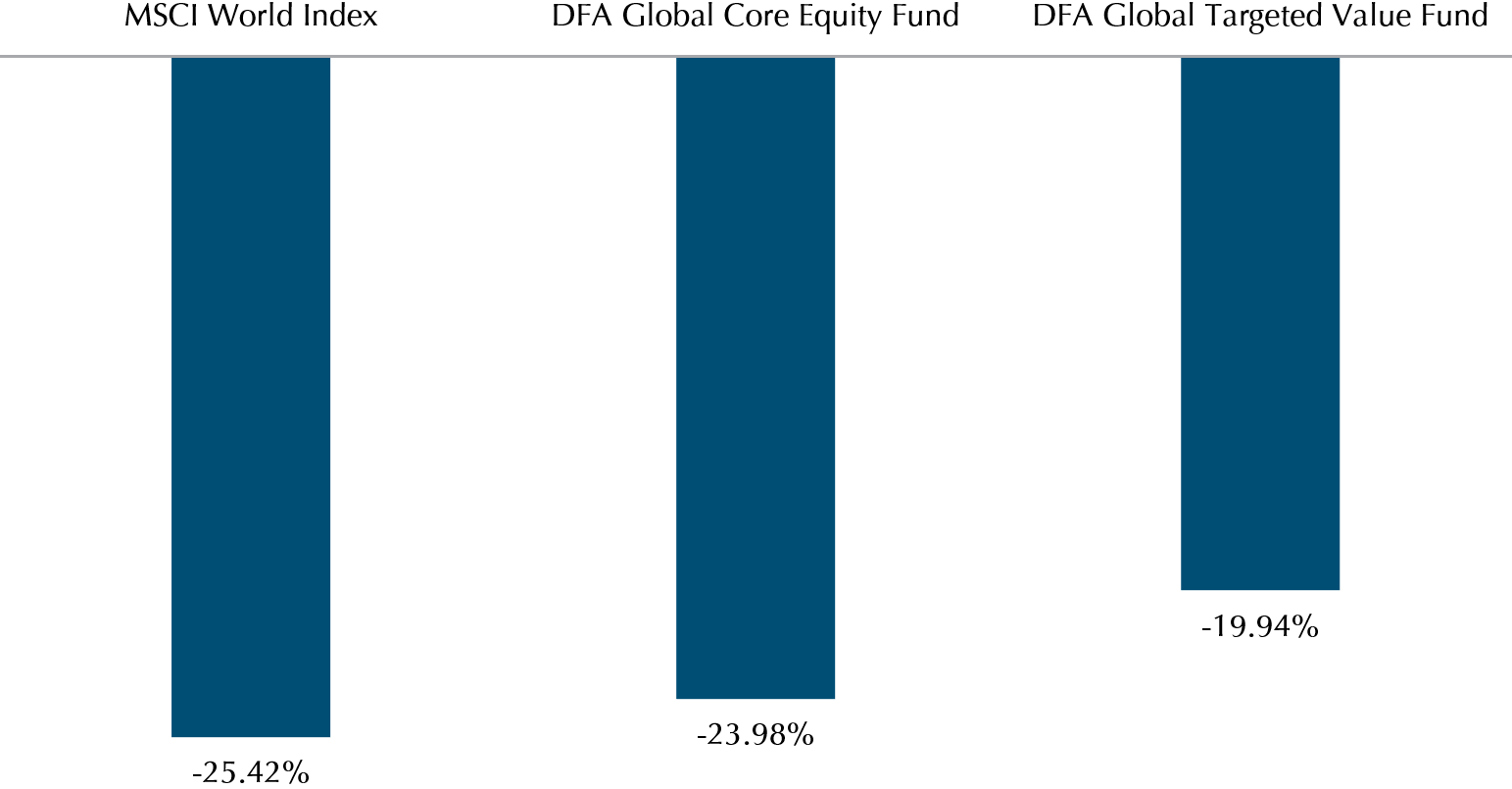

On the other hand, there is even better news for clients in our IndexPlus portfolios. These portfolios have tilts to value stocks and smaller stocks implemented via funds from Dimensional Fund Advisors (DFA) and they are outperforming the market this year. Please note that outperformance is relative, and in 2022 that means that they have fallen less than the market. Unfortunately, we cannot totally avoid volatility, but it can be mitigated at the asset allocation level.

Exhibit 2: DFA funds vs MSCI World Index YTD returns to 30 Sep 2022 in USD

Source: DFA

Source: DFA

If you look at performance of the DFA funds vs the market index (MSCI World), you can see that the performance of the DFA funds is better (i.e., they have fallen less) than the market. This is because of their tilts to value and small-cap stocks. In particular, the Targeted Value Fund, which focuses on smaller value companies, has outperformed by about 5%.

Therefore, relative to the market, the IndexPlus portfolios are doing better, and if your portfolio has the Targeted Value Fund, it will be in a better position relative to the market.

Question 2 – I hear that Fixed Income is not doing well, should I sell my Fixed Income funds?

It is true that Fixed Income is not doing well in 2022, as rate hikes by Central Banks have pushed up bond yields, and yields move inversely to price therefore the price of bonds has fallen, and fixed income funds have had a bad year of performance.

However, yields on bonds are higher, and what this means is that you know what the return is likely to be on your fixed income funds in the future. Short-term bond funds are typically reporting a yield to maturity of around 4-5% now. What this means is that any investor in the fund today would be getting a return of 4-5% each year in the future. (Assuming that yields remain stable). Therefore, the future returns of the funds are much higher, and will eventually recover the current mark-to-market losses over time.

If rates go lower, this will accelerate the process as bond prices rise when yields fall.

This is not the easiest concept to explain in writing, so should you have any questions or concerns over fixed income, please contact your adviser as they will be more than happy to discuss the higher expected returns of fixed income with you.

Question 3 – What are the portfolios doing to manage the volatility in the market?

It might seem that there is little activity going on in your portfolios despite all the frenetic market news. This is because the managers of the funds are doing all the activity in the background. The Dimensional funds are rebalanced daily to capture the higher expected returns of value and small-cap stocks.

This means that every day, the portfolio managers of the DFA funds will look at the stocks in their fund’s investible universe and buy stocks that have become value stocks (using their metric which is Price to Book) and sell those that are no longer value stocks (typically because their prices have gone up). They will also look to trim positions in larger companies and use the proceeds to buy positions in smaller companies. Do note that this is just a simple illustration and the actual process is a lot more involved with data analysis and qualitative decision-making.

Providend is also constantly monitoring the portfolio and the managers to ensure that the funds are performing as we would expect them to. For example, in a period where value stocks are doing well, such as now, we would expect that the DFA funds will be showing outperformance. If they are not, we will be discussing with the managers why it is not the case.

Your portfolios are being monitored daily, so you can have the peace of mind that your investment is in good hands despite the market volatility.

Long-term investment beats inflation

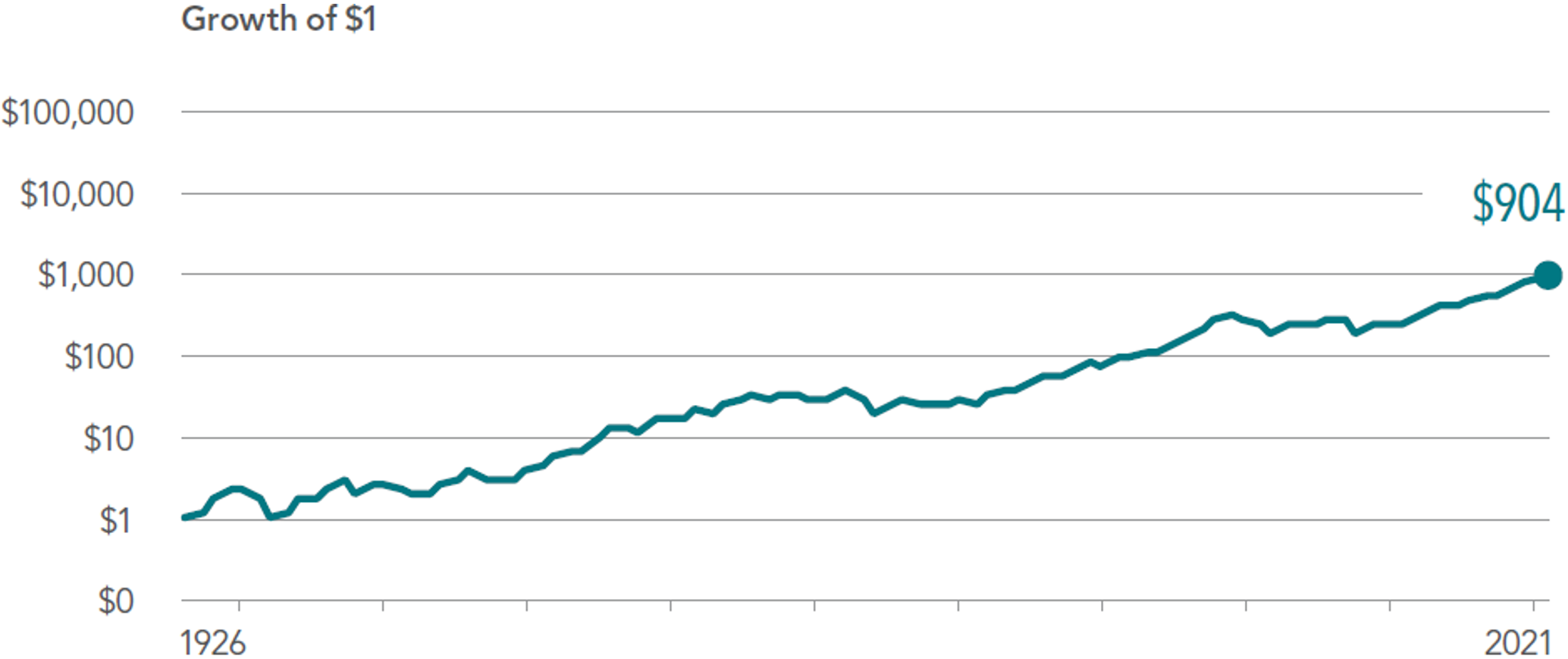

We would like to leave you with the encouragement that the data shows investing in stocks is one of the ways to generate returns that beat inflation.

Exhibit 3: S&P 500 real returns in USD

Source: DFA

Source: DFA

Exhibit 3 shows the real returns of $1 invested in the S&P 500 over time. Real returns are the returns of the S&P 500 minus inflation. Therefore, the returns you see in the chart above are returns above inflation.

We hope that this will encourage you to stay invested during these turbulent times and focus on the long-term goals of your wealth plan. Do contact your adviser should you have any questions. Thank you and we would like to wish all our Hindu clients a Happy Deepavali!

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.