Some clients may have come across advertisements of companies that are about to do an initial public offering in the newspapers or certain bulletin boards.

The initial public offering is known as IPO for short. It is an exercise where a private company is listed on a public stock exchange. When a company is listed on a public stock exchange, the company’s shares can be actively traded.

Owners of the previously private firm cede partial control of their private company and made it available to the public. When the company is on the public stock exchange, the company’s value can be realized.

Why are there More REIT Listings in Singapore and Why Do Owners IPO their Companies?

In recent times, we see fewer public companies listed but more and more we see interest from owners of properties to list their properties as a real estate investment trust (REIT) in Singapore.

The reason is two-fold:

- Singapore has matured as a REIT marketplace. This is in terms of the complementary services, personnel needed for REITs to be developed. Investors in Singapore have also become sophisticated in their understanding of REIT as both an income and capital appreciation asset.

- There are enough private owners who have a property portfolio that they need to lighten up

Companies IPO for a few reasons:

- To raise capital that they could not raise otherwise in a private capacity

- For branding to aid the growth of their business, or to gain more favourable borrowing rates

- To reduce or eventually dilute their shareholding

If a company is listed for reasons #1 and #2, they are more likely to be in this for the long haul. However, if the reasons are #3, then you have to be careful.

One prevalent reason a group of private owners list a subsidiary or a portfolio of assets is that this is how far they can take the business themselves or that the business climate has started to become challenging.

Listing a company via IPO is selling at attractive valuations.

If you are not careful, you will end up being an investor who subscribes to shares of a business whose business fundamentals have weakened, or that the portfolio of assets is not cheap relative to the income they bring in.

Thus, people make fun of IPOs by saying it actually stands for Its Probably Overpriced.

The challenging nature of IPO is that you might not be able to deduce if the reason for listing is to reduce or pare their stake in a declining business, or that it is a strategic reason to pare down their stake, but the portfolio is still important to the owners.

You need some investment sophistication to be able to evaluate the owners’ reasons for listing.

The High-Level Metrics I Use to Assess the Quality of a REIT

When it comes specifically to REITs, you may be looking at REITs to provide the residual cash flow to pay for your annual expense needs.

We have to be careful about the REITs we allocate our net wealth to. It might be risky to allocate a large portion of your net wealth to a REIT that is just listed via an IPO or about to list.

Typically, what separates a better quality REIT from one that has less quality are:

- The quality of the manager. The manager manages the portfolio, decides which assets to acquire or dispose of. They also control the leasing of the properties. They have to manage the debt maturity and the lease tenure of the properties. They have to be able to anticipate the unique property cycles which greatly affect the performance of their properties.

- The outlook for the operating environment of the properties. Each REIT portfolio usually is made up of a category of properties and can be diversified across various cities or concentrated in certain cities. Where demand for space is greater than supply, the environment is more conducive for rent growth. Employment in the city plays an important role. Business growth and manufacturing production plays an important role as well

- Valuation. If you buy properties that are cheap, you have a margin of safety. If you buy properties that are wildly above the market’s fair value, you might face headwind when the property cycle turns

For a REIT that is about or just IPO, #1 is a big unknown. If you do not do enough work, you may not detect that #2 is weakening for where the properties are operating in.

Potentially, the anticipated income that you are looking to get may be cut.

Case Study: ARA Hospitality Trust and Eagle Hospitality Trust’s IPO

In 2019, we have 2 REIT IPO.

They are ARA Hospitality Trust (ARA-HT) and Eagle Hospitality Trust (EHT). Both REITs consist of a portfolio of United States hotels.

ARA-HT IPO at a price of US$0.88 per unit and indicated a dividend yield of 8.2% a year. EHT IPO at a price of US$0.72 per unit and indicated a dividend yield of 8.2% a year.

The difference between them is that ARA-HT and EHT is the nature of the hotels. ARA-HT consists of a portfolio of select-service hotels while EHT is full-service hotels.

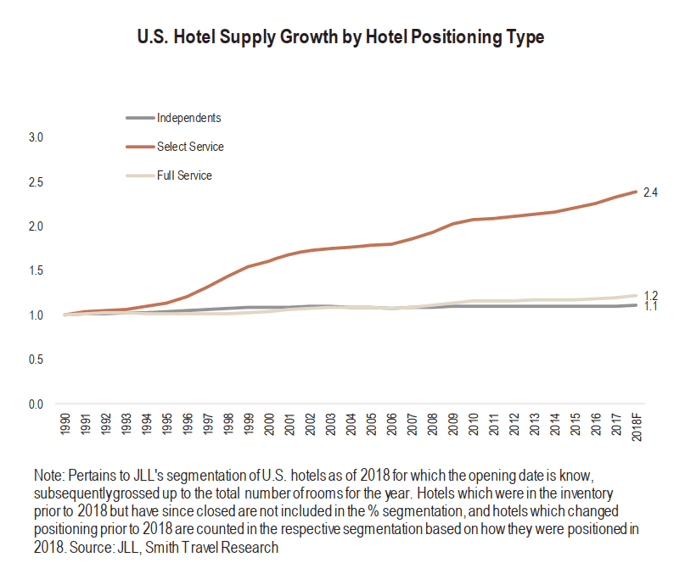

The demand and supply dynamics for select service and full service in the United States is different.

Prior to the IPO, I have done some preliminary research on the supply growth of different hotel segments in the United States.

If there are much supply coming online, unless there is a lot of demand, usually it affects the revenue of hotels (which affects the rental revenue of the hospitality REITs)

I wonder if the supply growth would result in an oversupply situation that will affect ARA-HT.

For EHT, preliminary research has highlighted several red flags about the IPO. Readers can Google: “Eagle Hospitality Trust and Queen Mary”

To make it easy for you I have provided some links here:

- The Story of One Sibei Old Ship (written by me)

- Crowd-sourced Investigation into EHT

Suffice to say, conscientious investors managed to dig up a few shenanigans in EHT.

In Feb 2020, both ARA-HT and EHT announced their maiden results.

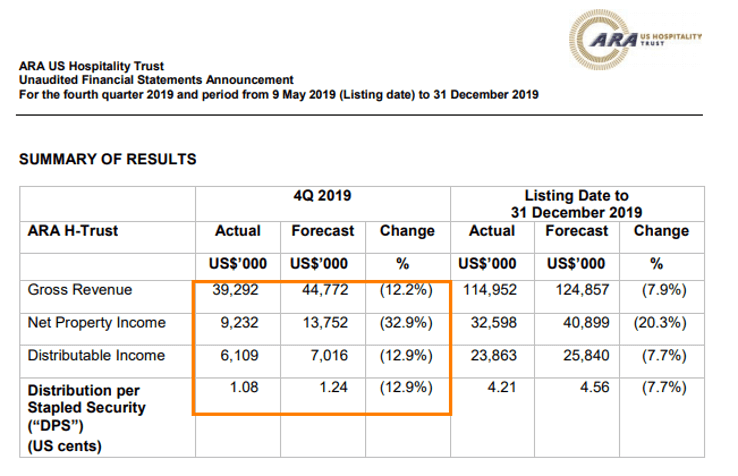

ARA HT’s Q4 results missed their initial forecast. Missing initial forecast by this much for a REIT tends to be a rather rare event. Revenue is 12.2% below forecast and the income to be distributed to investors is 12.9% below forecast.

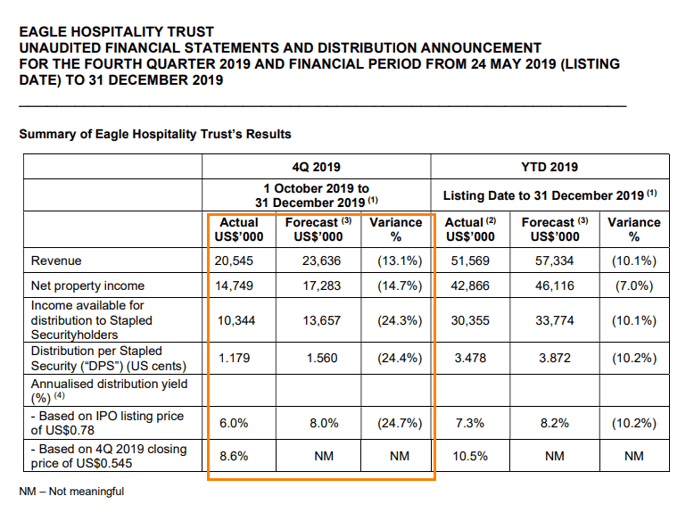

EHT’s Q4 results also missed their initial forecast. Their income to distribute to unitholders is 24.7% below forecast.

The magnitude of both REIT’s distribution miss was enormous in the grand scheme of things. It should be noted that this was in a period where the United States was not embroiled in any Covid-19 health issues.

With the recent issues, hotel revenue will get more severely affected.

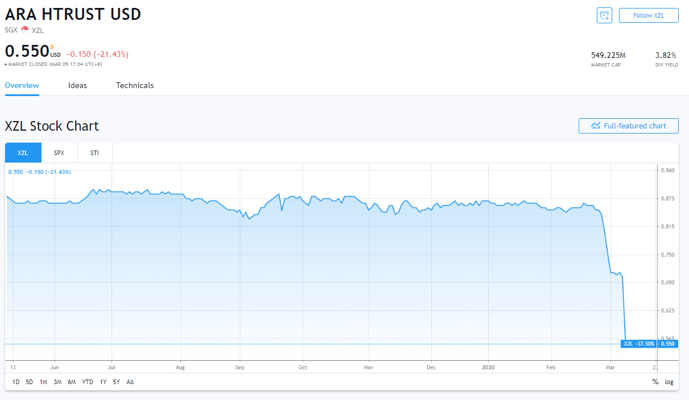

EHT’s share price has been an experience that many of its IPO investors would wish to forget:

A unitholder who subscribed at IPO would have suffered a 61% unrealized capital loss.

ARA-HT’s share price has been more resilient prior to the general stock market downturn brought about by Covid-19 and the oil crisis. As of today (10th Mar 20), IPO unitholders would have been down 37.5% in unrealized capital loss.

What Should be the Right Approach to Take?

If we are not sure about the management quality, the motivation of owners to IPO their assets, then the right approach is not to invest in IPO or take a measured amount.

As investors,

- Review a few quarters of the REIT’s financial results.

- Evaluate whether there are any red flags in the financials.

- Match the financial and the qualitative story management tells from IPO and over the next few quarter results. Evaluate whether the story is coherent and their explanation of things

This is a safer approach to take if you are investing.

You should not be afraid that you will be missing out on a good dividend yield if you miss an IPO. Taking this approach would have allowed you to avert potential large losses in EHT and ARA-HT.

The quality REITs would be able to grow their rent and dividend per unit over time, thus giving you greater income, even though you may have bought the REIT at a higher price.

Summary

We should note that in this period, there are some REIT IPO that have performed better. They showed higher than forecast revenue and income distribution growth.

Active investment in individual stocks / REITs requires a certain level of effort and conscientiousness in order to grow your wealth and provide an income. More so, the effort and conscientiousness are also to prevent our net wealth from being impaired.

An IPO’s narrative may sound very enticing but perhaps it would be better we hold our horses and observe & assess the manager’s quality and the operating environment.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm.

–

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.