Many of our clients are invested in investment-linked policies (ILP) and unit trusts, which are usually recommended to them by their previous advisers.

We would often tell them to check the following if they wish to find out if these are the right wealth building instruments for them:

- The performance of the ILP or unit trusts versus their respective benchmark (every one of these products has a benchmark that the instrument is measured against)

- The total cost – which includes the sales charges, an annual expense ratio of the fund, annual account maintenance fees, annual distribution fee by the company. The total cost should not be too high and needs to be rational.

Some would raise to us that the performance was not going anywhere. Some would lament that the unit trust is not losing money, but their wealth seems to be growing very slowly.

When we try to explain to them that cost is a factor, they will often tell us that it is OK for them to earn those fees because these managers are doing the hard work in allocating their monies.

Fact: It is not wrong to earn a fee BUT we should always think about how much fees to pay and the effectiveness of what we are paying for.

The issue for many people is that the fees which they are paying for their investments are too high and the effectiveness of their investments is concerning.

During our interactions with our clients, we observe that many do not know the various categories of fees that they end up paying for their past investments.

Some of these fees are hidden in the fine print. Even seasoned investors sometimes have trouble deducing if these costs have small or great repercussion to returns. When seasoned investors do not understand these investments, they choose not to touch them.

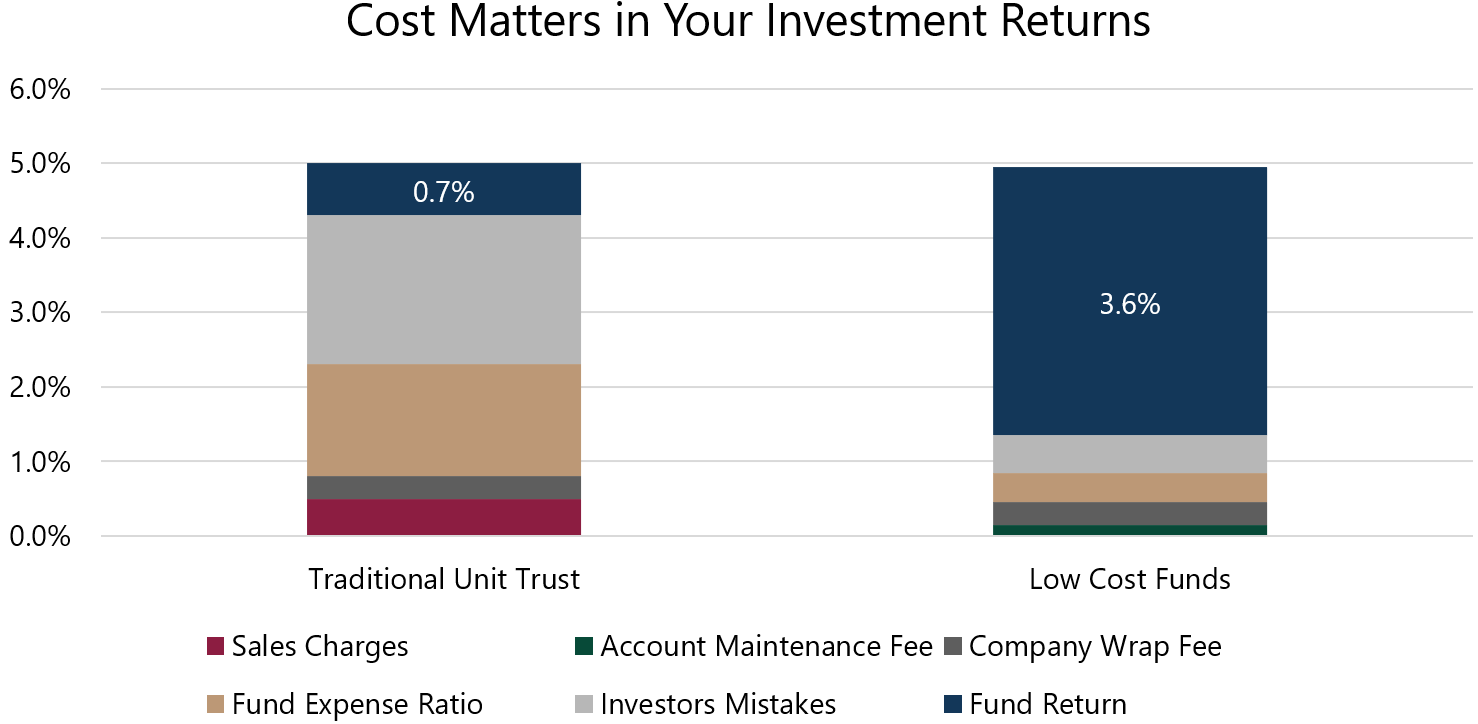

Figures are estimates based on typical traditional unit trust and DFA portfolio.

The diagram above illustrates the total costs and the relative returns of the underlying funds for a traditional unit trust. For comparison, I have included the total costs and fund return of Dimensional funds we recommend to our clients at Providend.

The total cost for unit trusts will vary based on where you buy from. The biggest cost is the fund expense ratio, which is typically 1.5% to 1.8%, if not more. The sales charge may seem low here, but for some unfortunate friends, they have bought their unit trusts and ILP from a high-cost vendor. The sales charges for ILP can be as high as 4% to 5% (which makes you wonder how can the ILP make money!)

Ultimately, cost matters because they eat into your returns. So here’s what you can do today:

Evaluate your ILP and funds using the 2 metrics that I have highlighted above. See whether you are paying too much. Evaluate when was the last time your advisers or your platform improved you as a wealth builder.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. Elements Of Wealth And How It Is Built | Investment Series

2. Stay Invested for The Long Term? Think Again!

3. How To Get Passive Income From Your Accumulating Funds

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.