October and the start of November have been great months to be invested, as markets have made up ground on the losses for the year. Undoubtedly, the recovery is not complete, and the outlook still remains very uncertain, but the rebound over the past 2 months brings some welcome relief to what has been a challenging year for markets.

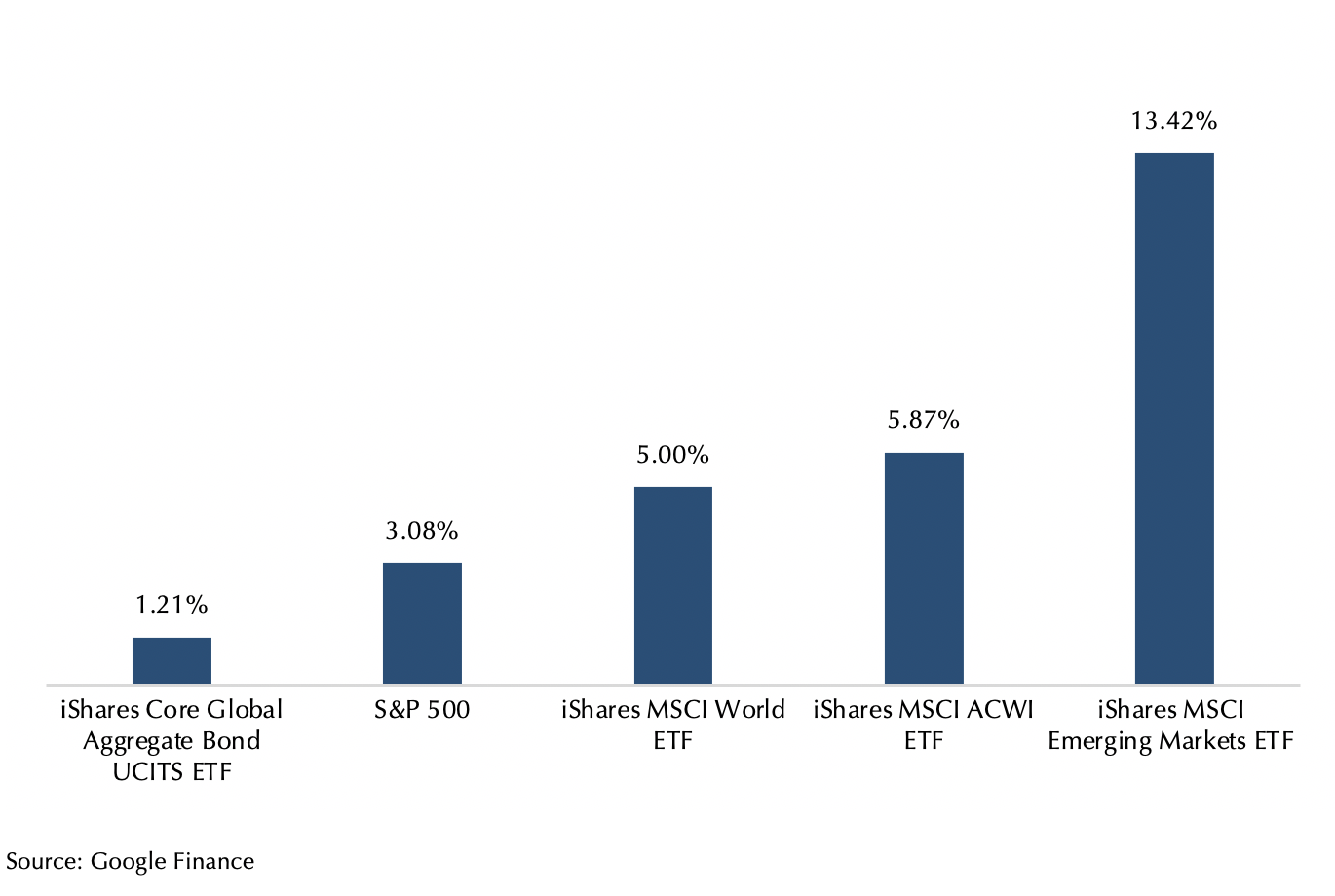

Exhibit 1: Index performance month to date 15 Nov 2022

Looking at the performance of the market indexes (using index ETFs as a proxy), we can see that overall stocks continued the recovery in November, but this time EM stocks had a big outperformance vs their underperformance in October. Global stocks as represented by the MSCI World were up 5%, outperforming the US-centric S&P 500 and bonds also rallied 1.21% for the month.

The key driver for this rebound in markets is that inflation continues to moderate, as recent readings show that the pace of price increases has slowed. The Fed has also responded by saying that it will look to slow the pace of rate hikes, although the final rate target is likely to be higher than previously expected. Lastly, a relaxation of Covid-19 rules in China, along with further state support for the real estate sector drove the rebound in EM stocks.

Capturing the returns for our clients

While it is great that the indexes and the markets recovered, we know that not all investors capture the returns from the market because they either use active funds that might have missed the market recovery due to tactical positioning, or they did not remain invested and did not experience the recovery.

Thus, we are thankful that 1) Our funds captured the market return (and in the case of Dimensional did better) and 2) our clients worked with our Client Advisers to stay invested.

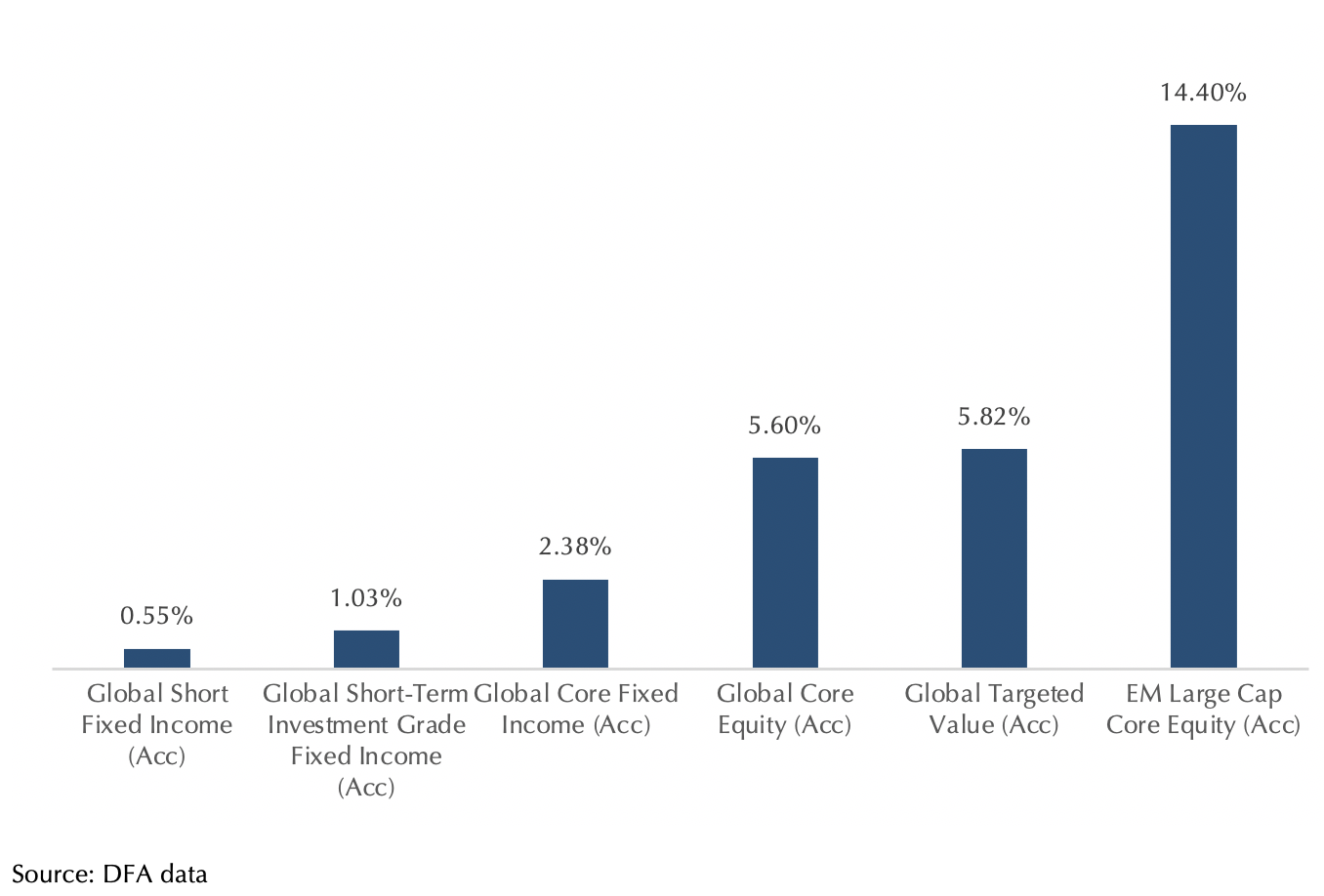

Exhibit 2: DFA funds return month to date 15 Nov 2022

Our funds captured the returns

Looking at the data above, we can see that the DFA funds performed exceptionally during this period. The equity funds all outperformed due to the value and small factors being present during this period. Comparing Global Core Equity to the MSCI World, we see that it outperformed by 0.60%. The Global Targeted Value continues to outperform larger stock indexes with a return of 5.82% month to date. The Emerging Markets fund returned 14.4% compared to the MSCI EM index return of 13.42%.

The Fixed Income has also shown a strong recovery as yields have fallen. The Global Core Fixed Income returned 2.38%, a 1.17% outperformance over the Bloomberg Global Aggregate Index. This highlights that the DFA funds are doing exactly what we would expect them to do, to capture the returns from a market recovery, and if value and small factors are present, to outperform the broader market.

For clients invested in index funds via Blackrock UTs or iShares ETFs, then you can rest assured that you got the market return (less costs) as the funds track the various indexes that we have mentioned so far in the article.

Staying invested helps you capture the market returns

Over the course of the year, we have received many questions about the possibility of tactical adjustments to the portfolio as the markets fell. We remained confident that our asset allocation is sound, and confident that the managers we work with will be able to weather the storm and capture the returns when the markets recover. Therefore, our strongest advice to our clients is to stay invested and focused on the long term.

We have been working with the Client Advisers to increase the level of communication with clients, via a more frequent market review, an audio version of the market review, and communication via WhatsApp and phone calls when the markets get too volatile (such as earlier in the year).

This is done with the goal of keeping our clients invested in mind, as we want to be able to help our clients capture the returns when the markets recover, and we are thankful for your trust in us that many of you have stayed invested, and therefore have experienced the recovery in October and November.

Uncertainty remains – focus on your long-term wealth plan

While it has been a good couple of months, it is not likely that we are entirely out of the woods yet. Inflation remains high, albeit moderating but a sudden geopolitical shock might bring inflation to the forefront again.

The data on inflation remains patchy as the full extent of the recent rate hikes is yet to be felt (or not felt) by the economy and there remains uncertainty around how much further central banks will have to hike rates to control inflation.

Earnings also remain a challenge as companies start to factor in the effects of the end of the era of low rates and higher inflation on consumer behaviour. We have seen mass layoffs in the tech sector as companies look to shore up profitability, and continued impact of inflation on consumer decisions affecting retailers.

We hope that the performance of the portfolios in these past months, along with the continued efforts by our Client Advisers to maintain a high level of communication would give you the confidence that your portfolios will recover along with the markets and allow you to stay invested while focusing on your long-term wealth plan.

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.