Volatility in the market continues to be high in May as the debt ceiling impasse between US political parties generated headlines over the month while sticky inflation data from US and Europe shows that changes in price levels will continue to dictate market sentiments.

Over the month, the debt ceiling issue in the US continues to oscillate between glimpses of hope and subsequent disappointments, creating a sense of uncertainty and volatility in the market. However, the issue was eventually resolved at the end of the month. The resolution led to a strengthening of the US dollar. This means that the Index Plus SGD and Index Plus Saxo SGD portfolios will do well against their USD counterparts as the value of the portfolios held in the SGD portfolios when converted back into SGD, will increase.

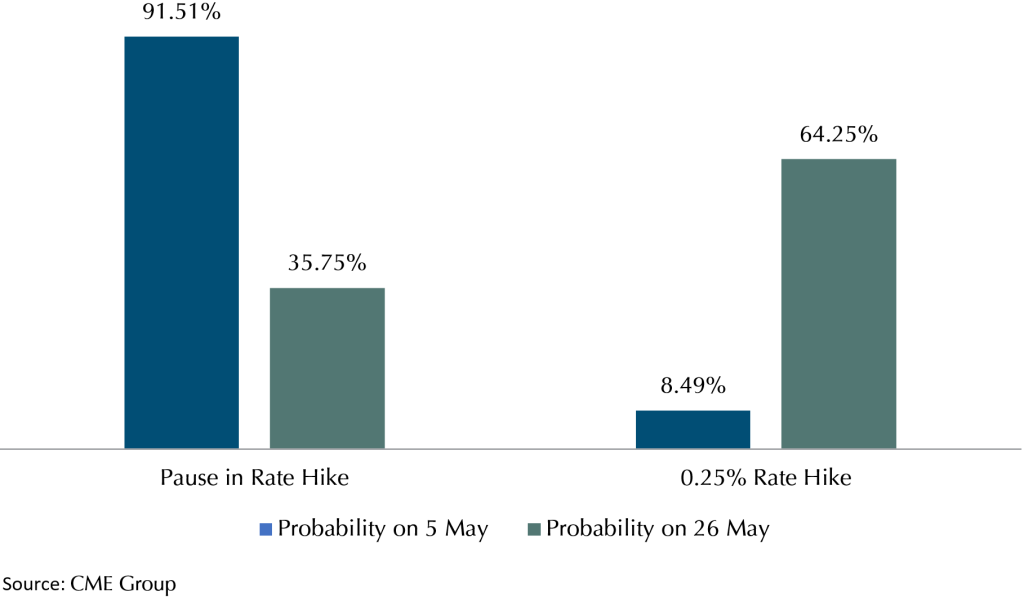

Aside from the debt ceiling issue, the market remains fixated on the ever-present concern of inflation as May’s core inflation data remains persistent in the US and Europe, fuelling concerns that central banks could keep rates higher for a longer period. The US core personal consumption expenditure (PCE) data released in the last week of May rattled the market as the data indicates that inflation remains sticky. The probability of a rate hike at the June US monetary policy meeting spiked from 36% on 5 May to 64% on 26 May as illustrated in Exhibit 1. The core PCE is the major central bank’s preferred gauge for inflation within their economy which excludes volatile components, such as food and energy, from the price index.

Exhibit 1: Probability of Fed Rate Hike on 14 June

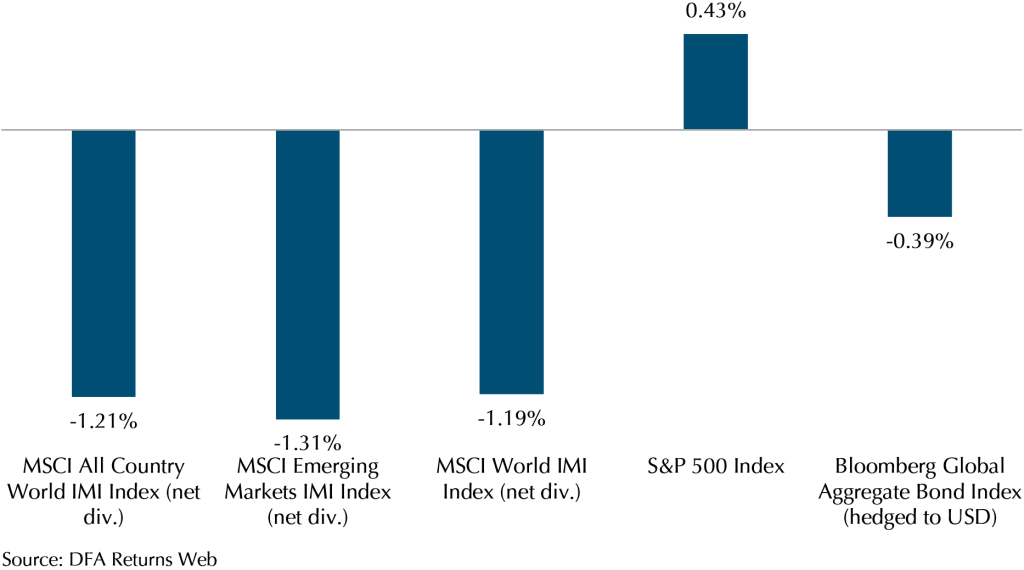

Against the backdrop of stubborn price levels, yields on bonds rose as the market priced a tighter economic environment, causing the Bloomberg Global Aggregate Bond Index (hedged to USD) to fall by 0.39% while the equities indexes, the MSCI All Country World IMI (ACWI), the MSCI Emerging Markets IMI and the MSCI World IMI fell 1.21%, 1.31%, and 1.19% respectively as shown in Exhibit 2. The ACWI Index represents a comprehensive view of the global equity market and includes both developed and emerging market countries, the Emerging Market Index focuses specifically on emerging market economies while the World Index represents developed market economies.

Exhibit 2: Indexes Performance May 2023 (in USD)

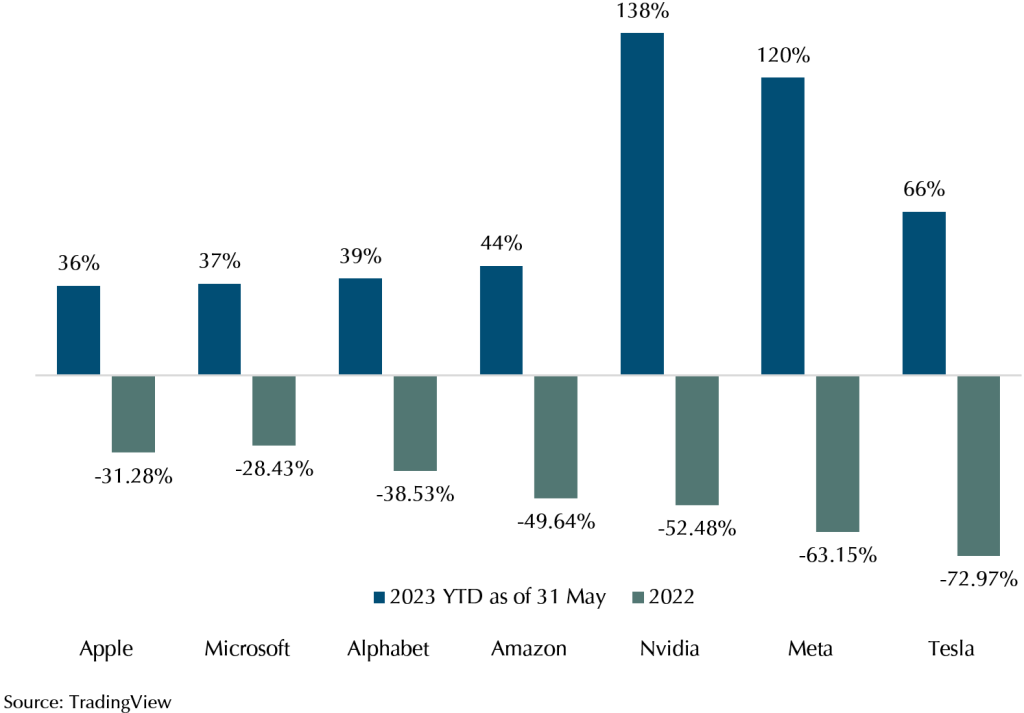

The S&P 500, however, climbed 0.43% showing resilience amidst a more challenging and restrictive economic landscape. The performance of the US Market Index, which tracks the top 500 US companies, continues to be driven by the mega-cap tech companies as strong earnings reports led to a rally in April, and carried into the month of May. The S&P 500 has climbed 9.65%, and more than 90% of the S&P 500 gains were attributed to these big techs as shown in Exhibit 3. Also illustrated in Exhibit 3 is the stark contrast between the S&P 500 remarkable performance year to date and its dismal performance last year. The stark contrast underscores the importance of diversification and the idiosyncratic risks of having an overconcentrated portfolio. An investor who was to invest only in Nvidia’s stock from the start of 2022 to today, will see their portfolio fall by 35% even though Nvidia appreciated by 138% year to date. However, an investor who invests in S&P 500 will see their portfolio fall by a much lesser value of 11% over the same period even though S&P 500 only appreciated by 9.65% year to date. At Providend, we help our clients invest in well-diversified equity funds to mitigate the volatility caused by concentrated portfolios. For example, the Dimensional Global Core Equity Fund holds more than 8000 stocks which helps diversify away idiosyncratic risks.

Exhibit 3: US Largest Tech Performance for 2023 YTD as of 31 May and 2022 (in USD)

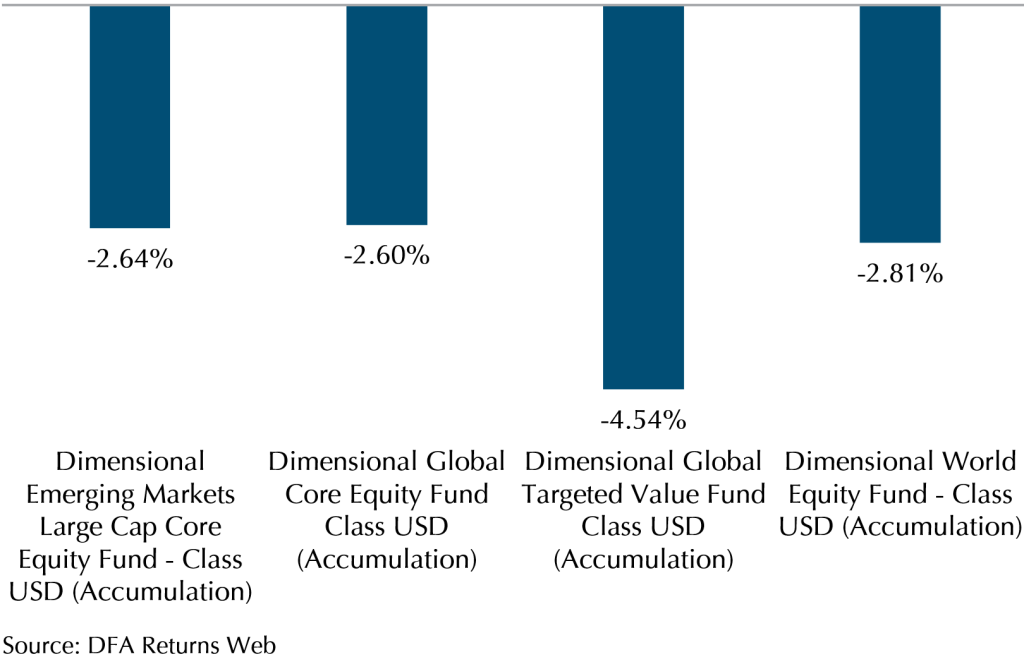

US Regional Bank Woes Continue to Drag Dimensional Equity Funds

Selloffs in US regional banks continue as concerns over the health of the banks spillover into May. The selloffs caused Dimensional equity funds, which have higher weights in the financial sector, to continue to underperform against the market indexes in May. As illustrated in Exhibit 4, all equity funds fell by more than 2.5% in May. Most notably, the Dimensional Global Targeted Value Fund, which has the highest weight in the financial sector amongst the Dimensional equity funds, fell by 4.54%.

Exhibit 4: Dimensional Equity Funds Performance May 2023 (in USD)

Why is the selloff continuing? Due to increasing inflation, the US central bank has implemented significant interest rate hikes since early 2022. Consequently, the rise in interest rates has caused yields to increase, resulting in a substantial decline in the value of long-term assets held by various regional banks. This decline has caused concern among depositors, who fear that these banks may be facing liquidity problems. Ultimately, these worries have triggered bank runs in some cases. Since early March, Silicon Valley Bank and Signature Bank have failed due to bank runs, followed by the subsequent failure of First Republic Bank. Consequently, there has been a selloff of stocks and bonds belonging to US regional banks. This selloff has led to a significant increase in the yield demanded for US regional bank bonds, often by approximately 2 percentage points more compared to US Treasuries. The rising yield signifies that issuing bonds to raise funds will now be more costly.

Moreover, following the COVID-19 pandemic, commercial real estate (CRE), especially in the office space, has been showing weaknesses as more employees shift towards working remotely leading to high vacancy rates CREs. Stress in the CREs rose concern about US regional banks’ overexposure to CRE loans. According to an analyst’s report from JPMorgan Private Bank, small regional banks hold 4.4x more exposure to US CRE loans than their larger peers. Having more exposure to CRE loans means that regional banks will be more impacted if many CRE loans were to default.

The challenging environment has increased the uncertainty for these regional banks leading to their continued selloff in May.

In spite of the drag on Dimensional equity funds as a result of the US regional bank selloffs, the funds are still doing better against the market indexes. For example, from the start of 2022 till 31 May 2023, the Dimensional Global Targeted Value Fund fell by 11% while Providend’s reference index, the MSCI All Country World Index, fell by 12.7%. Despite the market weakness, there are encouraging indications that inflation might be reaching its peak. This suggests that the terminal rate, the highest point of interest rates in an economic cycle, is either approaching or has already been reached. As a result, the US regional banks could potentially find relief from the current tightening economic conditions.

A Chill in the Air: Signs of Cooling Inflationary Pressure

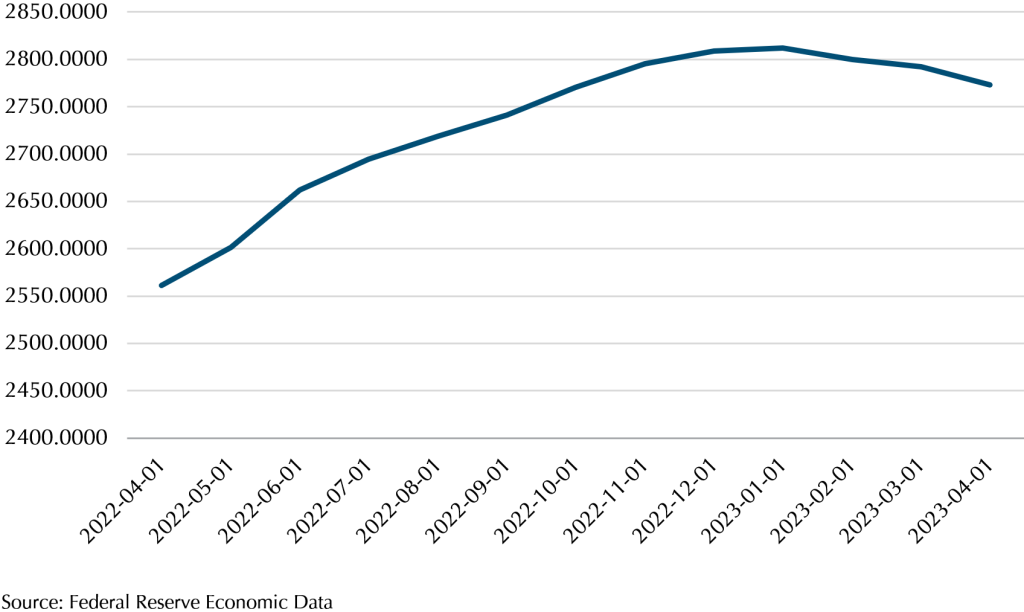

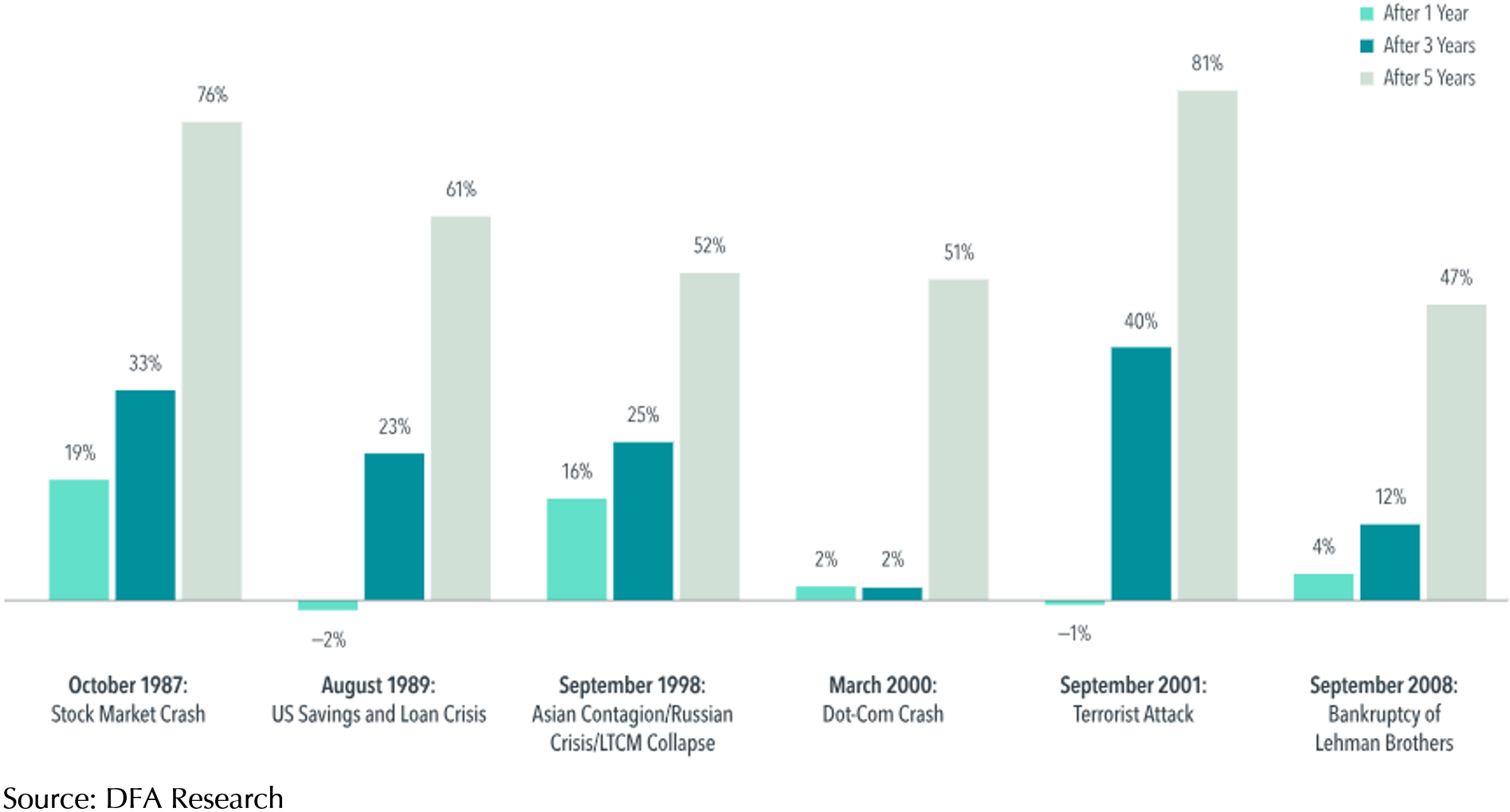

Data (Exhibit 5) extracted from the Federal Reserve Economic Data (FRED) shows that US banks are tightening lending standards for commercial and industrial loans to large and middle-market firms. Tightening lending standards mean that there is less lending which can cool down the economy and inflation. In fact, if we look at the commercial and industrial loans for the past year as illustrated in Exhibit 6, we can see that lending has plateaued in Q4 2022 and has started to come down as of 2023.

Exhibit 5: Proportion of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms (%)

Exhibit 6: US Banks’ Commercial and Industrial Loans (Billions of USD)

Moreover, the manufacturing PMI which is based on a monthly survey of purchasing managers in manufacturing companies, indicates that purchasing managers in US and Europe are expecting a contraction in the manufacturing sector. The manufacturing PMI is a leading indicator that measures the activity level of the manufacturing sector within a specific country or region. It provides insights into the health and expansion or contraction of the manufacturing industry. A reduction in business activity in the manufacturing industry will further help cool down the economy and inflation as well.

If cooling inflation gains traction and show momentum of reaching the central banks’ inflation target, the central banks will likely pause or even reverse interest rates which can provide relief to companies, especially for the US regional banks and the financial sector.

Stay Rational and Look Beyond the Headlines

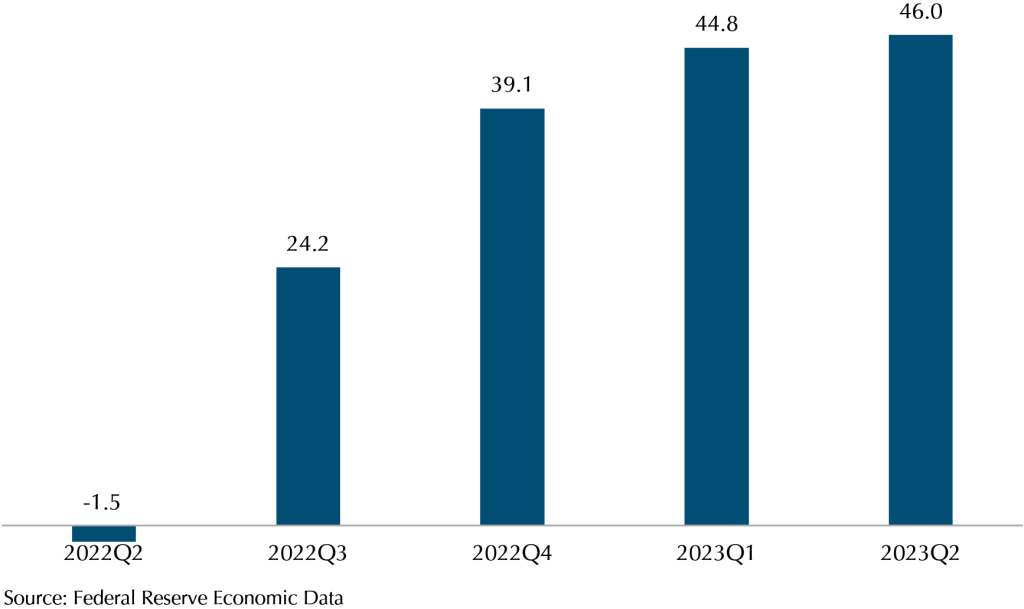

Exhibit 7: Performance of a Balanced Strategy – 60% Stocks, 40% Bonds (Cumulative Total Return)

While recent headlines may be unsettling and impacted your global diversified portfolios, historical data demonstrates that markets do recover over time, as illustrated in Exhibit 7.

Through the market’s ups and downs, your client adviser is your invaluable partner, assisting you in navigating challenges and offering counsel which can contribute to a better investment experience. By maintaining a long-term perspective, and embracing uncertainty as part of the investment journey, you can weather storms and position yourself to capture market returns that lie ahead. Stay disciplined, stay invested, and remain steadfast in pursuit of your wealth goals.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.