After 2 months of consecutive losses, the stock market rebounded amidst a possibility of a slowdown of rate hike by the Fed as well as positive sentiments toward US earnings results. 71% of S&P 500 companies have reported a positive earnings per share (EPS) surprise and 68% of S&P 500 companies have reported a positive revenue surprise, according to FactSet.

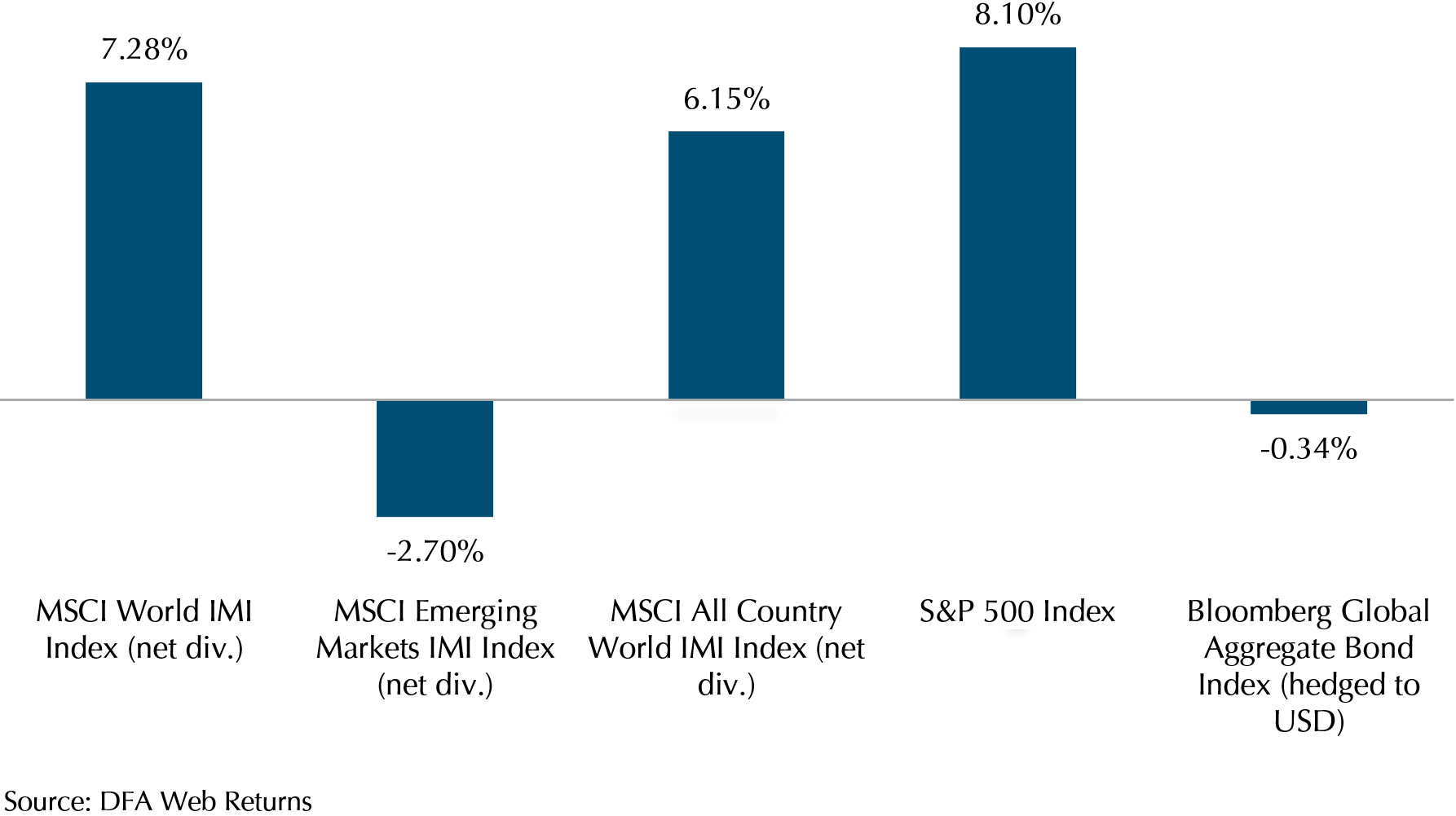

MSCI World IMI, MSCI All Country World IMI and S&P 500 climbed 7.28%, 6.15% and 8.10% respectively. However, emerging markets fell behind their developed market peers with MSCI Emerging Markets IMI falling 2.70%. Woes of China continuing its Covid lockdown dragged the EM index down after President Xi offered little signal on ending its status quo on a “dynamic zero-Covid policy” during China’s 20th Party Congress. Furthermore, US sanctions on exports of high-tech chips to China crashed China tech stocks with tech giants like Alibaba and Tencent falling 21% and 22% respectively.

Bond market saw little change in performance with Bloomberg Global Aggregate down by -0.34%.

Exhibit 1: Stocks and Bond Index Performance October 2022

Size and Value Premiums Stand Out in October

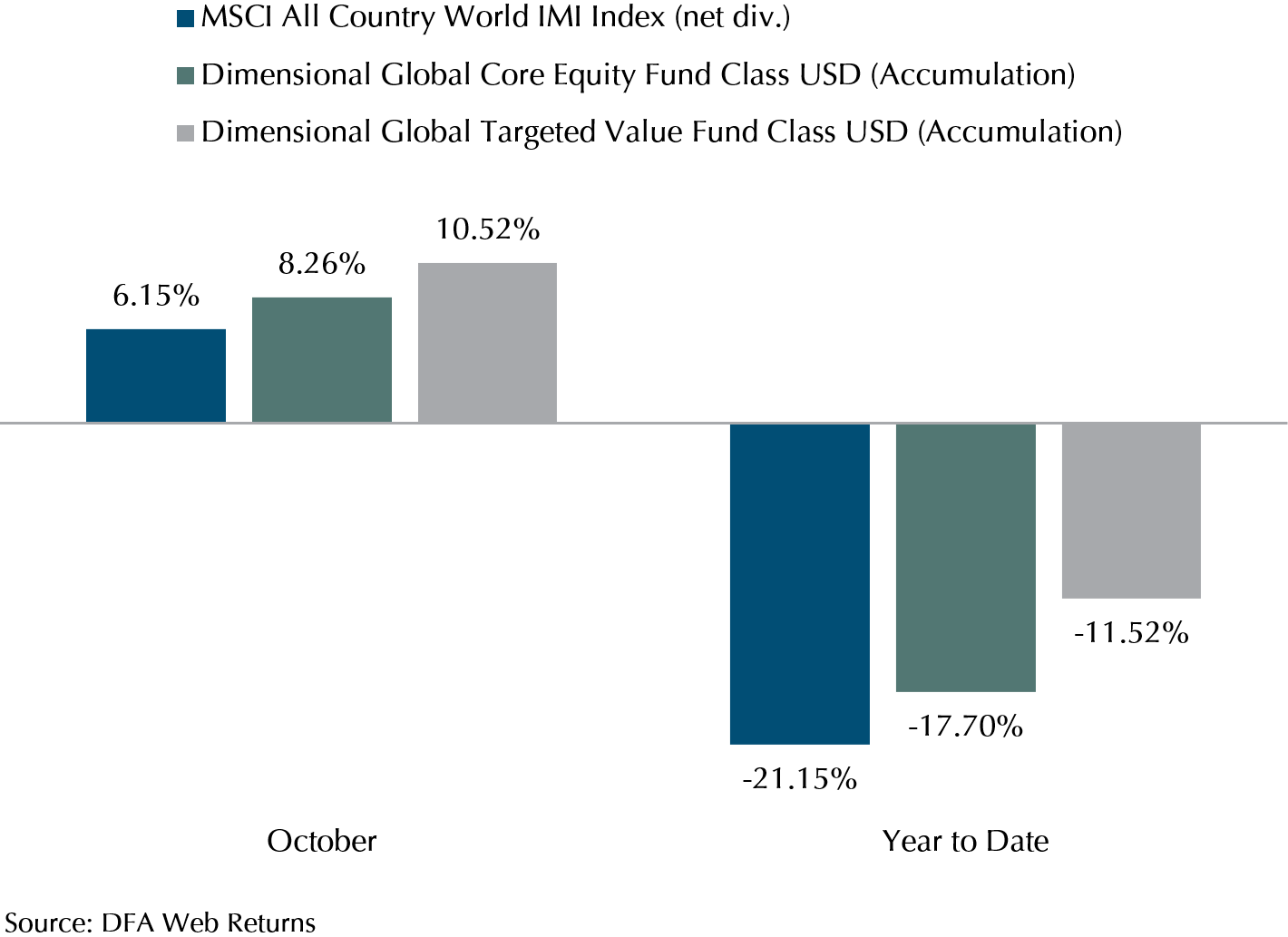

In comparison to the equity indexes, DFA equity funds did even better. Tilted towards smaller caps and value stocks, DFA equity Funds outperformed Providend-referenced MSCI All Country World as size and value premiums arose in October (Exhibit 2). Global Core Equity and Targeted Value outperformed MSCI All Country World by 2.11% & 4.37% respectively.

Global Core Equity and Targeted Value continued to shine as value premium builds up. Year to date, both the DFA equity funds have outperformed MSCI All Country World by 3.45% and 9.63% respectively.

Typical value companies in the banking and energy sectors beat estimates during the October earnings report. JP Morgan and Exxon Mobile, for example, beat earnings estimates and surged 20% and 27% respectively.

While October’s results provide a reprieve to the market, market volatility may be unlikely to come down anytime soon as elevated inflation continues to force central banks to raise interest rates to curb price levels.

Exhibit 2: DFA vs MSCI ACWI Performance (October & Year to Date)

Prepare for More Volatility

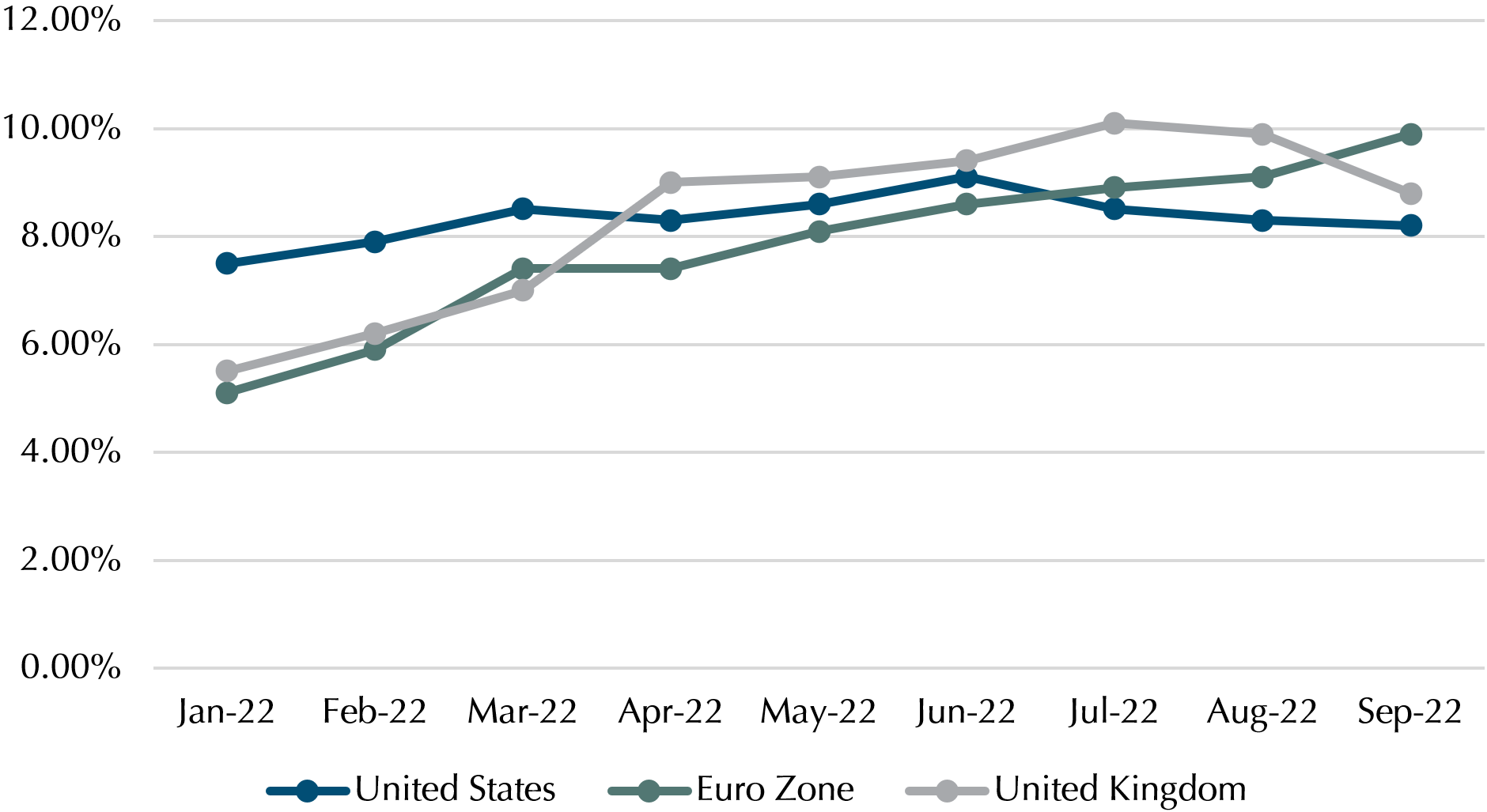

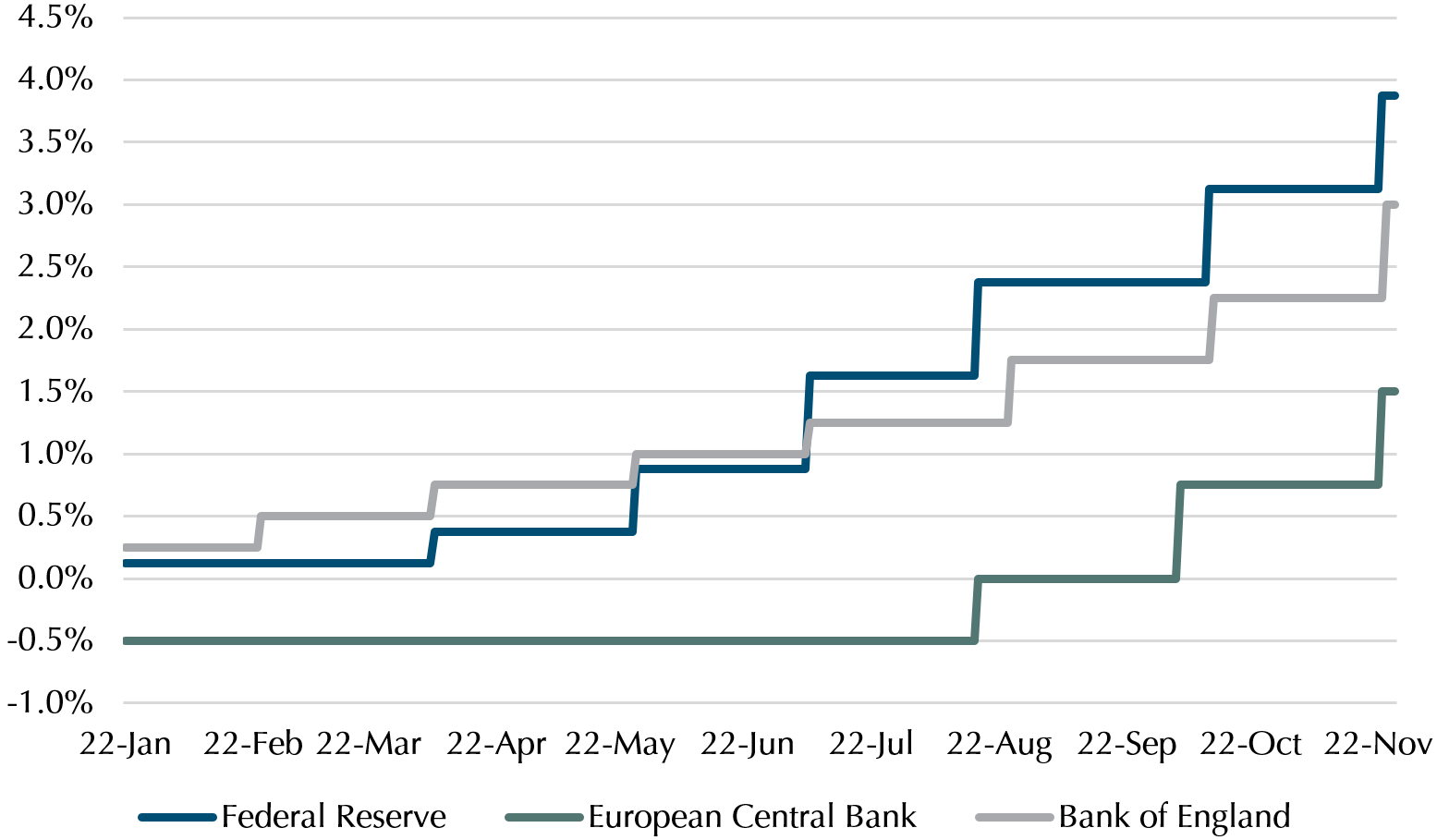

Exhibits 3 & 4 show the inflation rate and interest rate for the US, Europe, and the UK, respectively. Year to date, inflation rates remain well above central banks’ target inflation rate of 2-3% and in response, central banks have raised interest rates during this period. Notably, all 3 central banks hiked 75bps in tandem in November.

Central banks across the major economies will continue to raise interest rates in response to high inflation, so we expect to see interest rates being highly sensitive to inflation data so long as prices remain at elevated levels. Hence, market volatility is likely to persist until inflation stabilises.

Exhibit 3: Year to Date Inflation Rates

Exhibit 4: Year to Date Central Banks Interest Rates

Market Sees Inflation Rate Dampening as the Fed Gains Credibility in Taming Inflation

If inflation continues to remain elevated or even increase, wouldn’t the central banks keep raising interest rates resulting in the market crashing even further? Even though we are unable to predict the future and answer this question directly, we can get some sense of what the market thinks of inflation going forward.

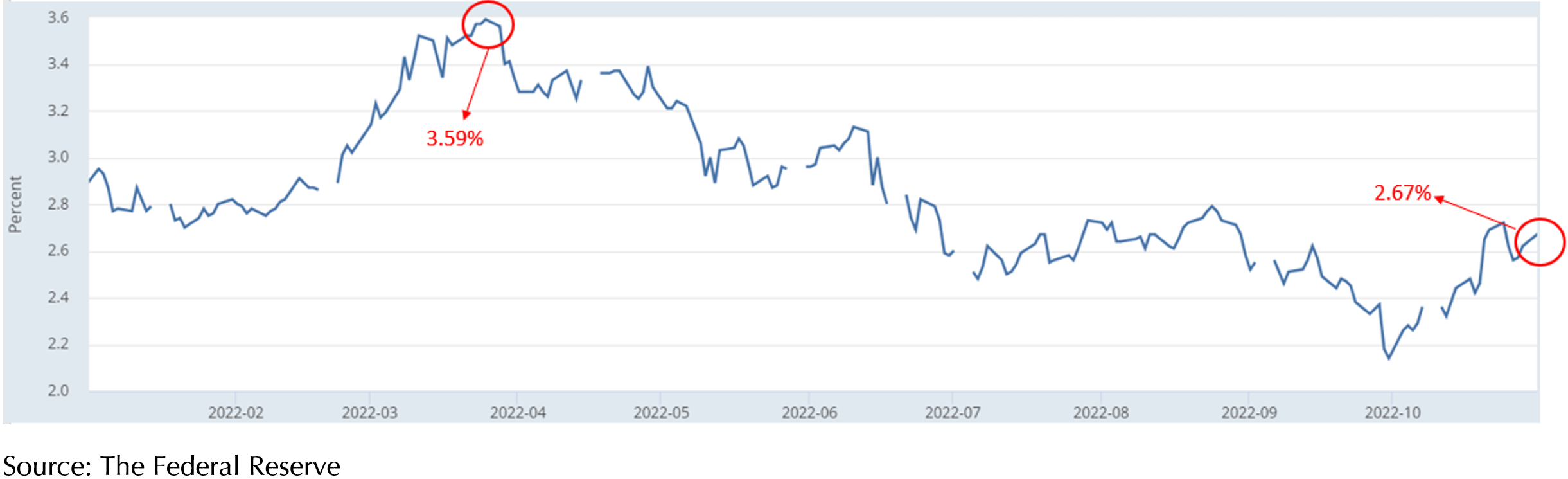

Exhibit 5 shows the market expectation of average inflation over the next 5 years in the US. This has fallen from 3.59% in late March to 2.67%. In other words, the market is expecting the inflation rate to come down. Furthermore, the Federal Reserve will likely stop hiking rates and even cut rates once inflation is under control.

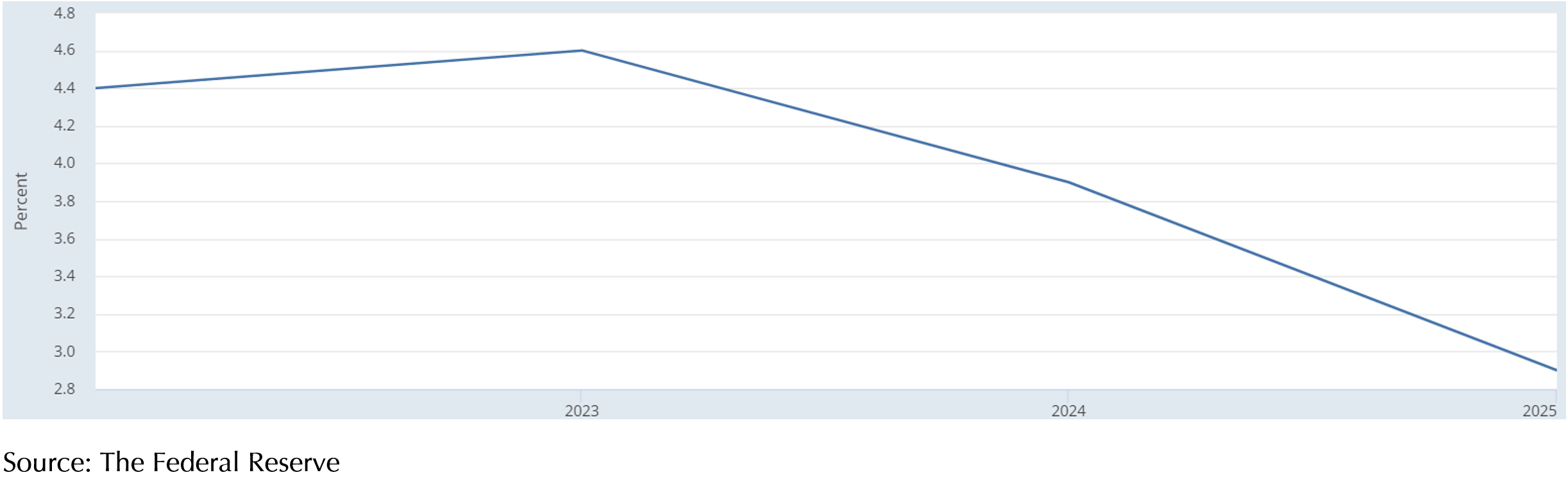

The terminal rate, or the level at which the Federal Reserve is expected to stop raising interest rates, is projected to be 4.6%. The Federal Reserve is expecting to hit this terminal rate in 2023 before reducing rates in 2024 and 2025.

Even though the projections may change depending on the persistence of the inflation rate as data continues to pour in, the market is showing confidence in the Federal Reserve’s conviction to curb inflation as shown in Exhibit 5.

Hence, the prospect of a perpetual rising interest rate and inflation crashing the market is likely due to recency bias and the market is saying otherwise. Furthermore, history has shown that the market will deliver positive returns, on average, following sharp declines.

Exhibit 5: 5-Year Breakeven Inflation Rate

Exhibit 6: FOMC Summary of Economic Projections for the Fed Funds Rate, Median

Why Staying Invested Is Important

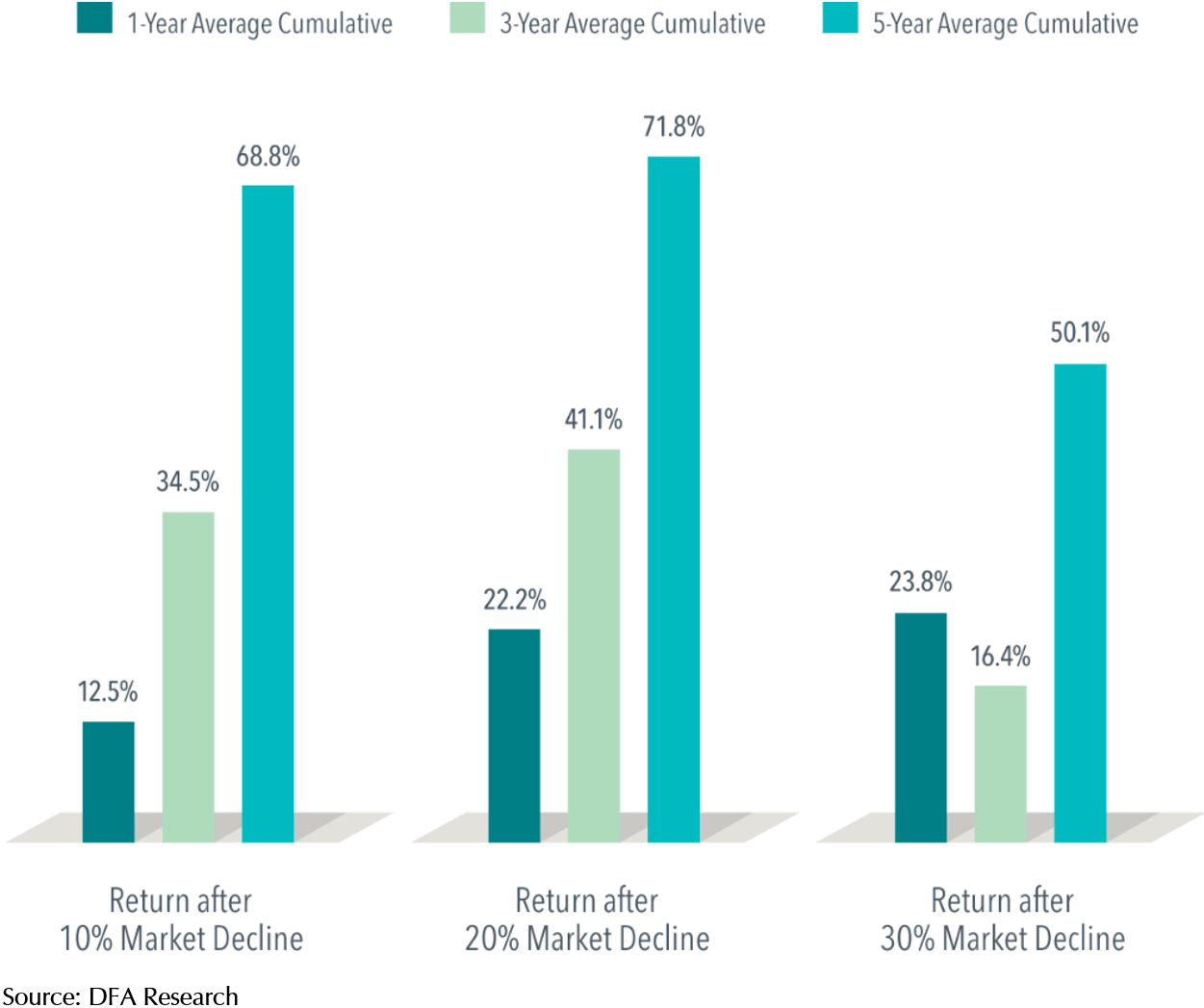

Exhibit 7 shows the average cumulative returns over the years after sharp declines between July 1926 – December 2021. On average, just one year after a 10% market decline, stocks rebounded 12.5%, and a year after 20% and 30% declines, the cumulative returns topped 20%. Over three years, stocks bounced back more than 30% after declines of 10% and 20%. While still positive, returns were not as impressive after a 30% decline. But five years after market declines of 10%, 20%, and 30%, all the average cumulative returns topped 50%. This data shows the importance of staying the course to capture the long-run returns in the equity markets.

Exhibit 7: Bouncing Back – Fama/French Total US Market Research Index Returns, July 1926 – December 2021

Conclusion

A volatile market can be unsettling. However, you are not alone on this journey. Our advisers are always available to discuss your situation with you and to listen to your concerns. Let’s keep our eyes on the goal and make sure our financial plans and investment portfolios remain robust.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.