Markets spent the last 2 months second-guessing the Fed with hopes of rate cuts in 2023 as recessionary fears loomed. Unfortunately, the old adage of don’t fight the Fed came back to give investors a reality check, as an extremely hawkish Jerome Powell expressed very clearly his intention to keep rates elevated in an effort to fight some of the highest inflation we have seen in 40 years. This led the markets to recalibrate expectations and sell-off in the last week of August.

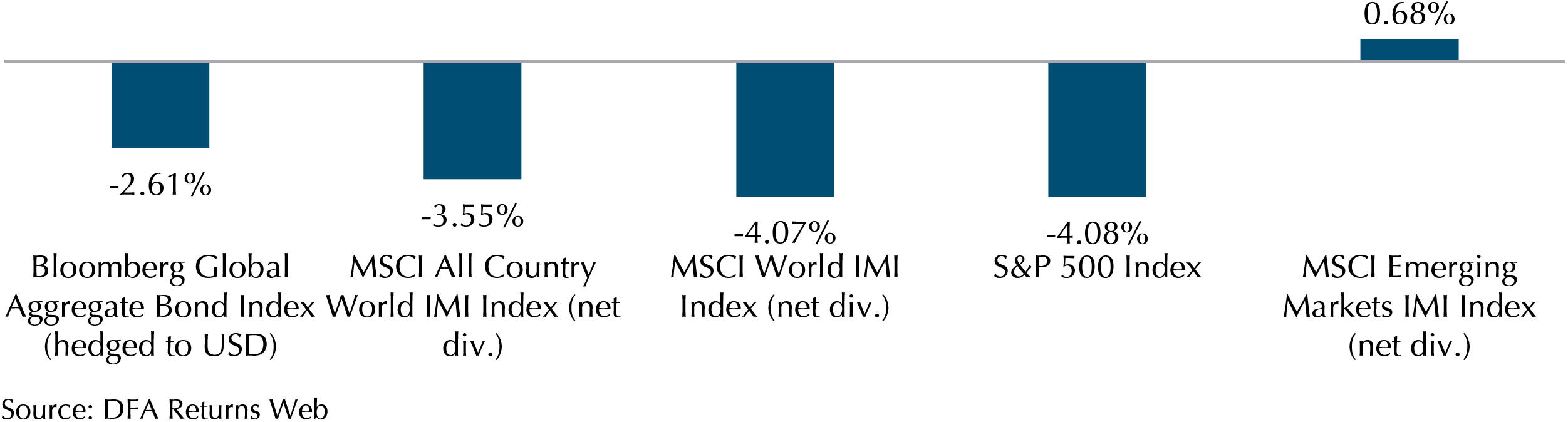

Exhibit 1 – Stocks and Bonds Index Performance August 2022

Markets fell in August after the relief rally in July saw the S&P 500 rise about 15% from its lows. Stocks fell, with the S&P 500 falling 4.08% in the month as the markets fell sharply in the last week of August. Bonds too continued to fall with the Bloomberg Global Aggregate falling 2.61%. This was not unexpected as the 10 Year Treasury yield climbed from 2.57% to 3.19%. Emerging markets were a bright spot, with EM stocks up for the month, helping the MSCI AC World fall less than the developed markets as seen by its outperformance vs MSCI World.

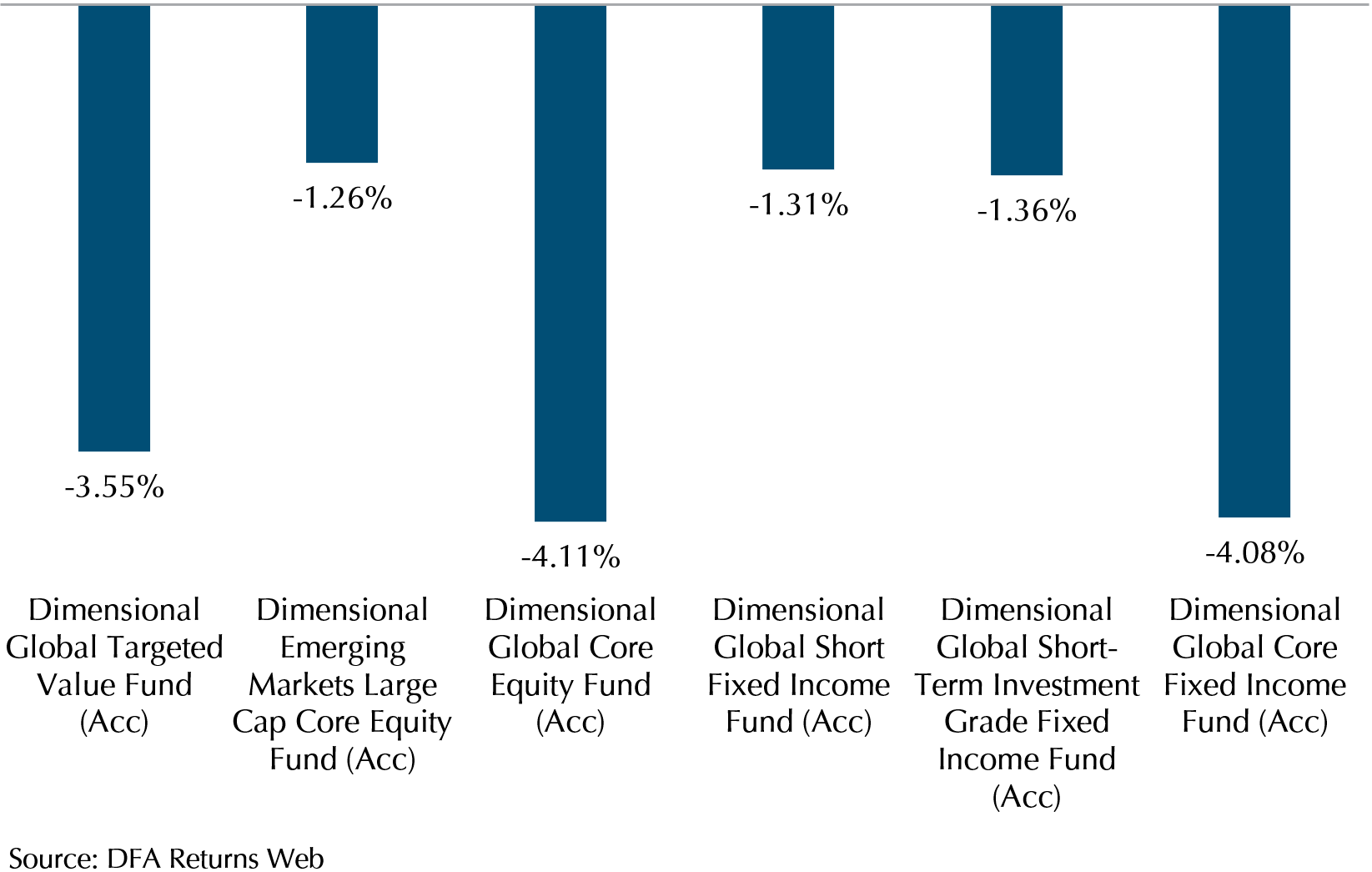

Exhibit 2 – DFA Equity and Bond Funds Performance August 2022 (USD)

Dimensional funds fell in line with the market, but value continues to stand out with the Global Targeted Value fund falling less than broader developed markets. Short-term bonds are in our portfolios to reduce volatility in times of market stress, and in this case they continue to deliver, falling less than stocks and intermediate bonds. The emerging markets fund underperformed the MSCI EM IMI as smaller companies did better over the month and the Dimensional EM fund does not have exposure to small caps. Even so, the DFA EM fund fell far less than developed world stocks for the month.

Which Emerging Market countries are performing?

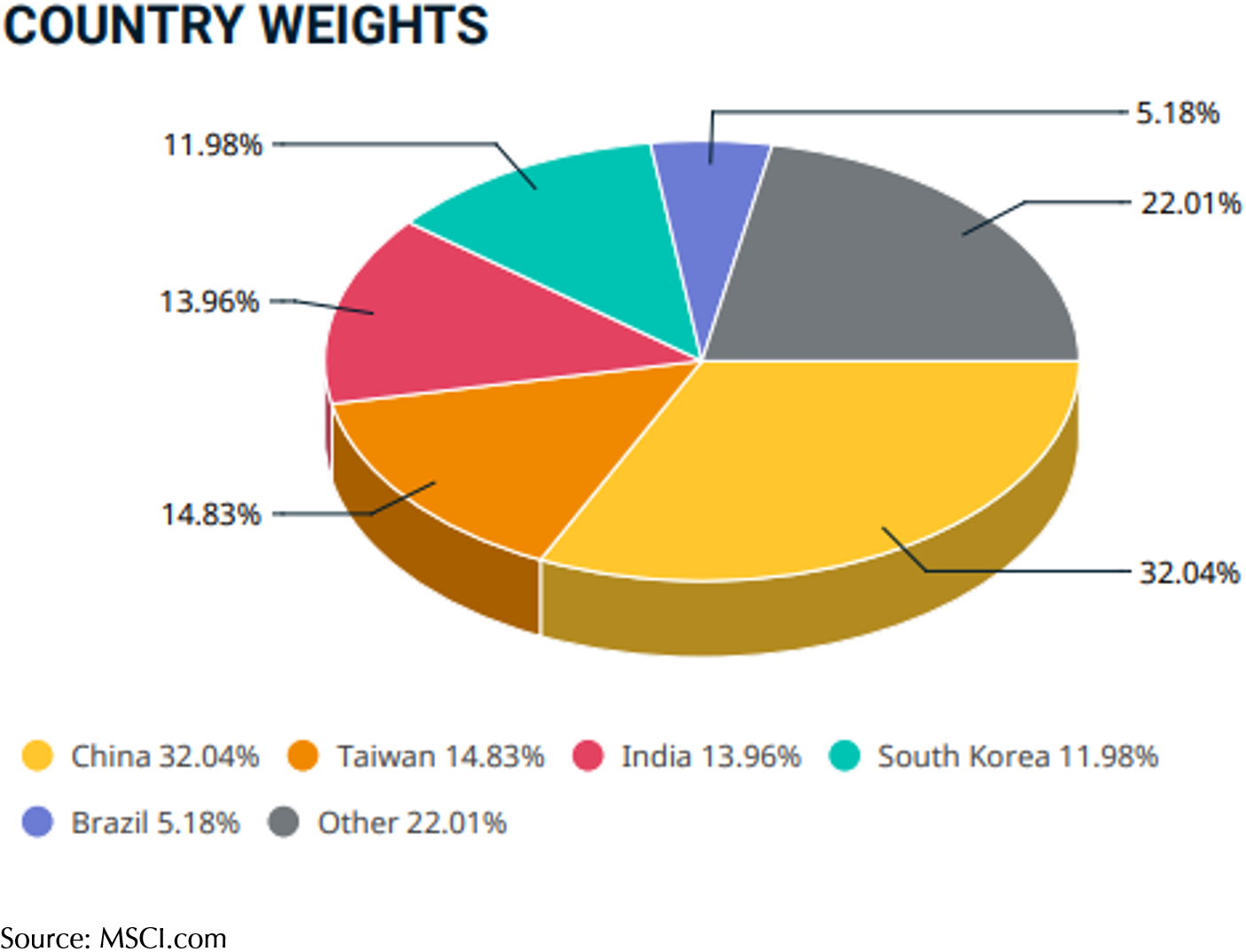

Exhibit 3 – MSCI Emerging Market Index (USD) Country Weights

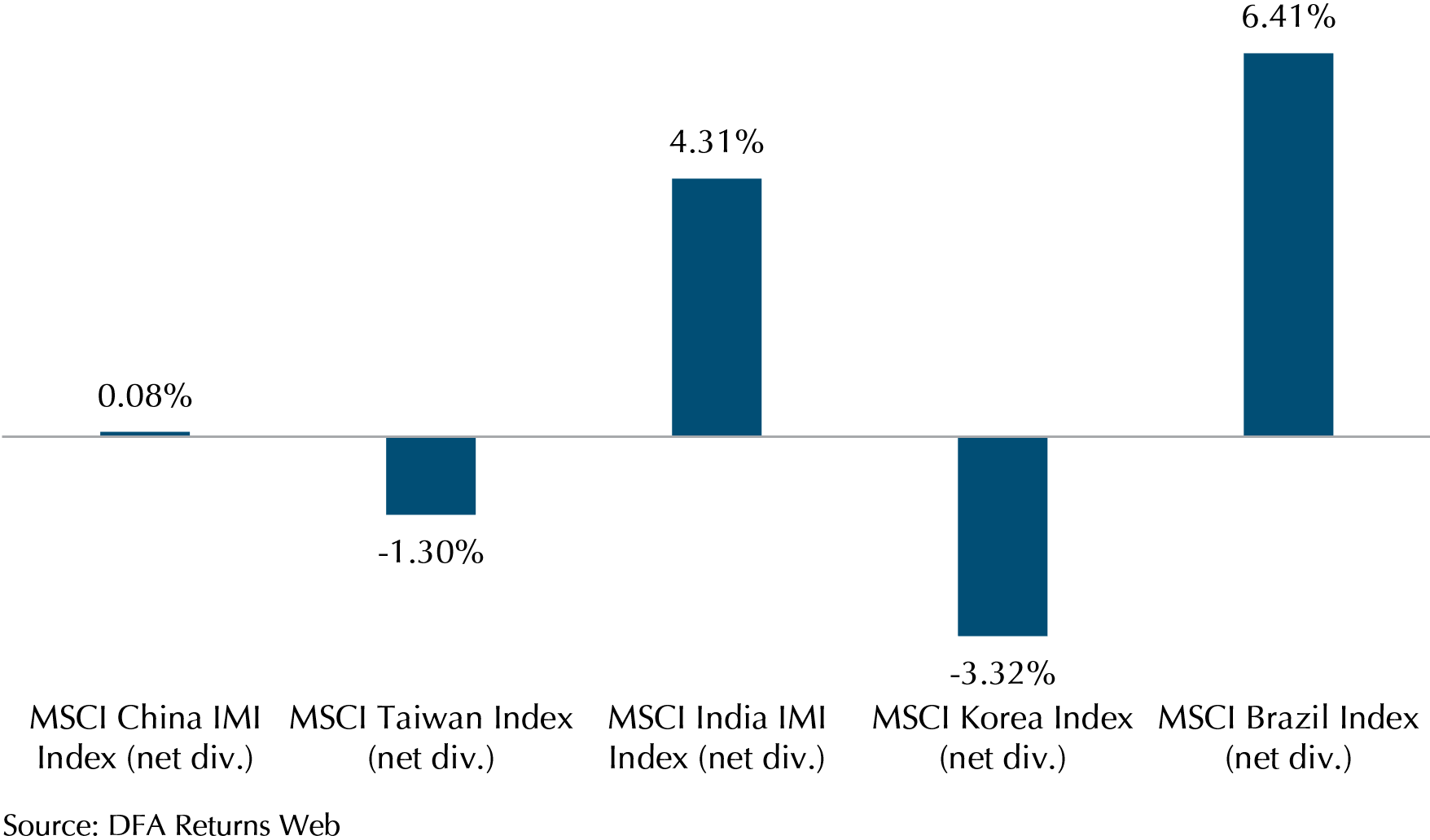

Exhibit 4 – MSCI Emerging Market Indexes

Shown in Exhibit 3, the top 5 compositions in MSCI Emerging Markets are China, Taiwan, India, South Korea, and Brazil. MSCI Emerging Markets’ positive performance in August (Exhibit 4) was mainly attributed to a positive performance in India and Brazil at 4.31% and 6.41% respectively.

Why is the Emerging Market performing better?

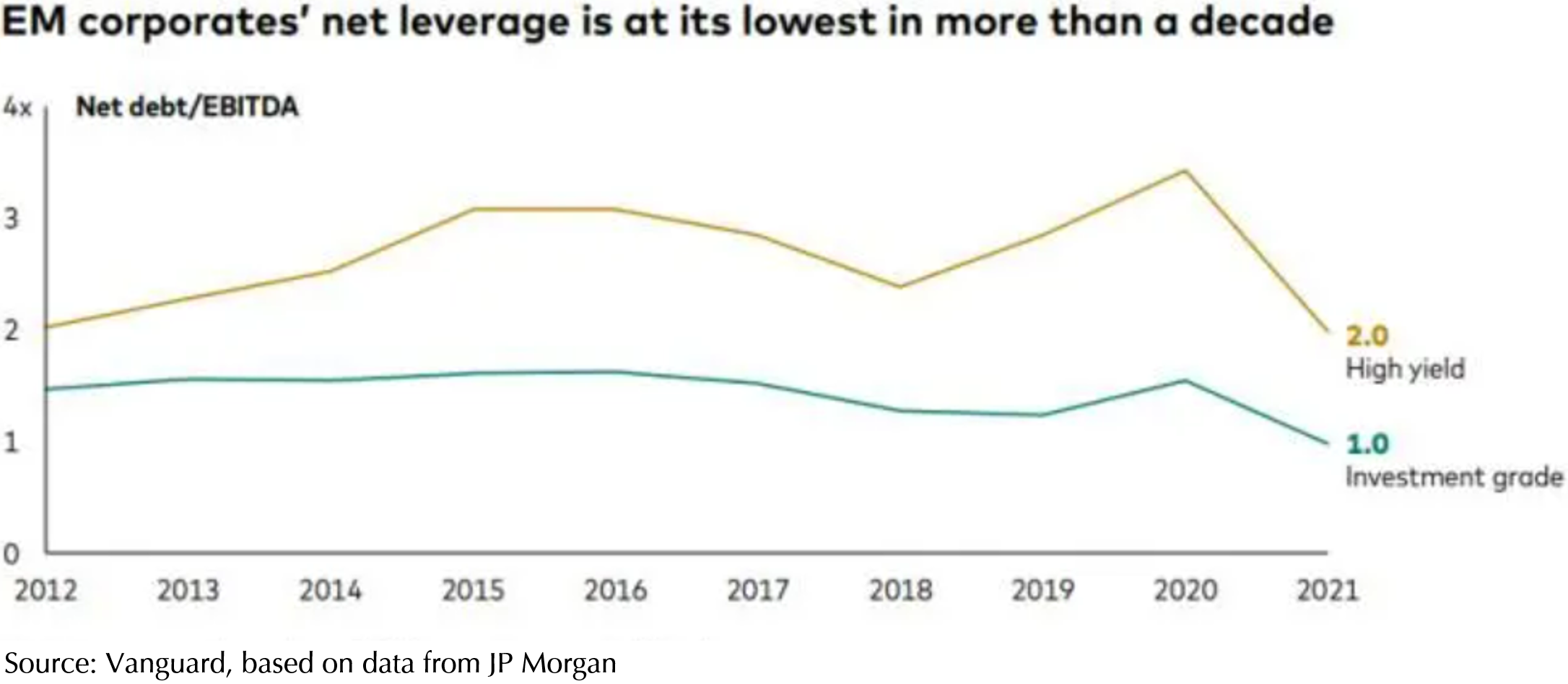

Exhibit 5 – Emerging Market Corporate Leverage

Driven by strong demand for commodities, Emerging Market companies that are commodity-related are benefitting from rising commodity prices which is helping with their bottom line amid rising cost. Furthermore, Emerging Market net leverage (Net Debt/EBITDA) is at its lowest in more than a decade (as shown in Exhibit 5), making them more poised to face a rising interest rate environment than their developed market peers. A rising interest rate environment means that companies with higher debt will face tougher conditions raising funds to sustain or grow their businesses and the market is now pricing in a more hawkish rate hike after the Fed’s Jackson Hole speech.

Jackson Hole speech shows the Fed resolution to curb inflation

The Fed’s tone during Jackson Hole speech was more hawkish than usual. Jerome Powell emphasises that bringing back price stability (2% inflation) is the number one priority.

In his speech, the Fed’s Chair, Jerome Powell, said that “In current circumstances, with inflation running far above 2 percent and the labour market extremely tight, estimates of longer-run neutral are not a place to stop or pause.” Furthermore, he also said “another unusually large increase could be appropriate at our next meeting.” On the same day after Jerome Powell’s speech, the probability of a 75bps Fed fund rate hike in September rose from 45% to 60%.

Market fell sharply on Friday after Jerome Powell’s speech with Dow Jones and S&P 500 down by 3.03% and 3.37% on the same day respectively.

While labour conditions are also part of the equation when deciding the interest rate path, it is safe to say that inflation will dominate the Fed’s decision on setting rates until inflation cools down. It would take consecutive months of inflation data rather than just one data point (in July) to show evidence of inflation cooling down.

Currently, we are facing a situation where demand for goods is outstripping supply. Unless supply chain eases, Central Banks across the world are likely to continue to raise interest rates to curb demand. Unfortunately, supply constraints are showing no signs of abating as China, the factory of the world, remains determined to maintain its strict zero Covid policy which is stalling its economic recovery.

China’s path to economic recovery hampered

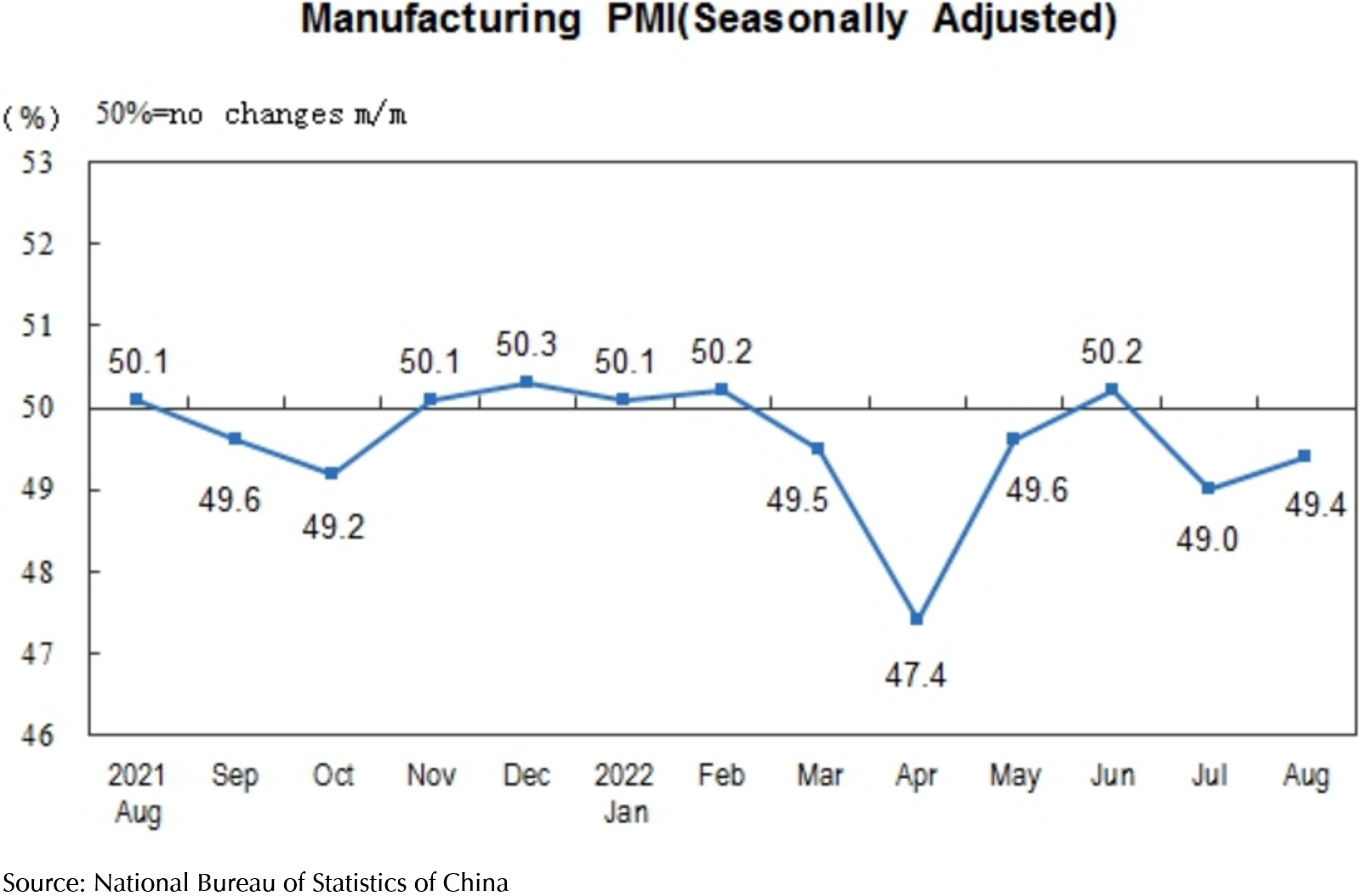

Exhibit 6 – China Purchasing Managers Index

China’s Purchasing Manager Index (PMI), a barometer for the country’s manufacturing sector, continues to shrink in August at 49.4 (an index of less than 50 is contraction). The PMI has so far shown contraction for 5 of the 8 months year to date (as shown in Exhibit 6). Sporadic Covid-19 lockdowns across the country which are weighing heavily on consumers’ confidence is likely one of the causes of the contraction. Meanwhile, China real estate developers’ liquidity risk remains a major concern as many Chinese homebuyers refuse to pay mortgages for unfinished residential projects. If the developers’ liquidity issue exacerbates, for example, multiple developers defaulting on their debt, it will impede China’s economic recovery.

In addition to a slowdown in factory activity within China, the Russia-Ukraine conflict is also aggravating the ubiquitous inflation. At home, we are facing the highest inflation in almost 14 years as energy and food prices soar as natural gas and fertilizers face shortages.

Inflation highest in Singapore in more than a decade

Singapore’s core inflation rose by 4.8% in July driven mainly by rising energy and food prices. The price of natural gas, which accounts for generating 95% of Singapore’s electricity, has skyrocketed since the invasion of Ukraine.

Food prices were also impacted by the Russia-Ukraine conflict as the supply chain in both countries were disrupted, causing fertilizer, an essential nutrient to help crops grow, to be in shortage as Russia and Ukraine together accounts for 28% of global fertilizers for crops.

Apart from the Russia-Ukraine conflict, there are also tensions between the US and China as the trade war continues to impose restrictions on trade and manufacturing. This means that companies with global operations might be affected, however, there will be companies with more local supply chains that benefit. Diversification is the key to ensuring that our portfolios are able to capture the market returns.

Diversification is important during uncertain times

Being diversified will ensure that you hold the best-performing stocks during any period. Our diversified portfolios ensure that we will participate in the best returns from the market even during periods when the overall market is down, reducing the volatility in our portfolios. For example, energy and oil stocks have done well in 2022, helping our overall portfolio falls less than the major indexes.

While we brace for some challenging times ahead both in the markets abroad and also at home in Singapore, we at Providend ensure that we have a plan to keep clients’ investment portfolios and financial plans on track. Our advisers are always available to discuss your situation with you and to listen to your concerns.

Thank you for your continued trust and support and do stay positive in these uncertain times.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.