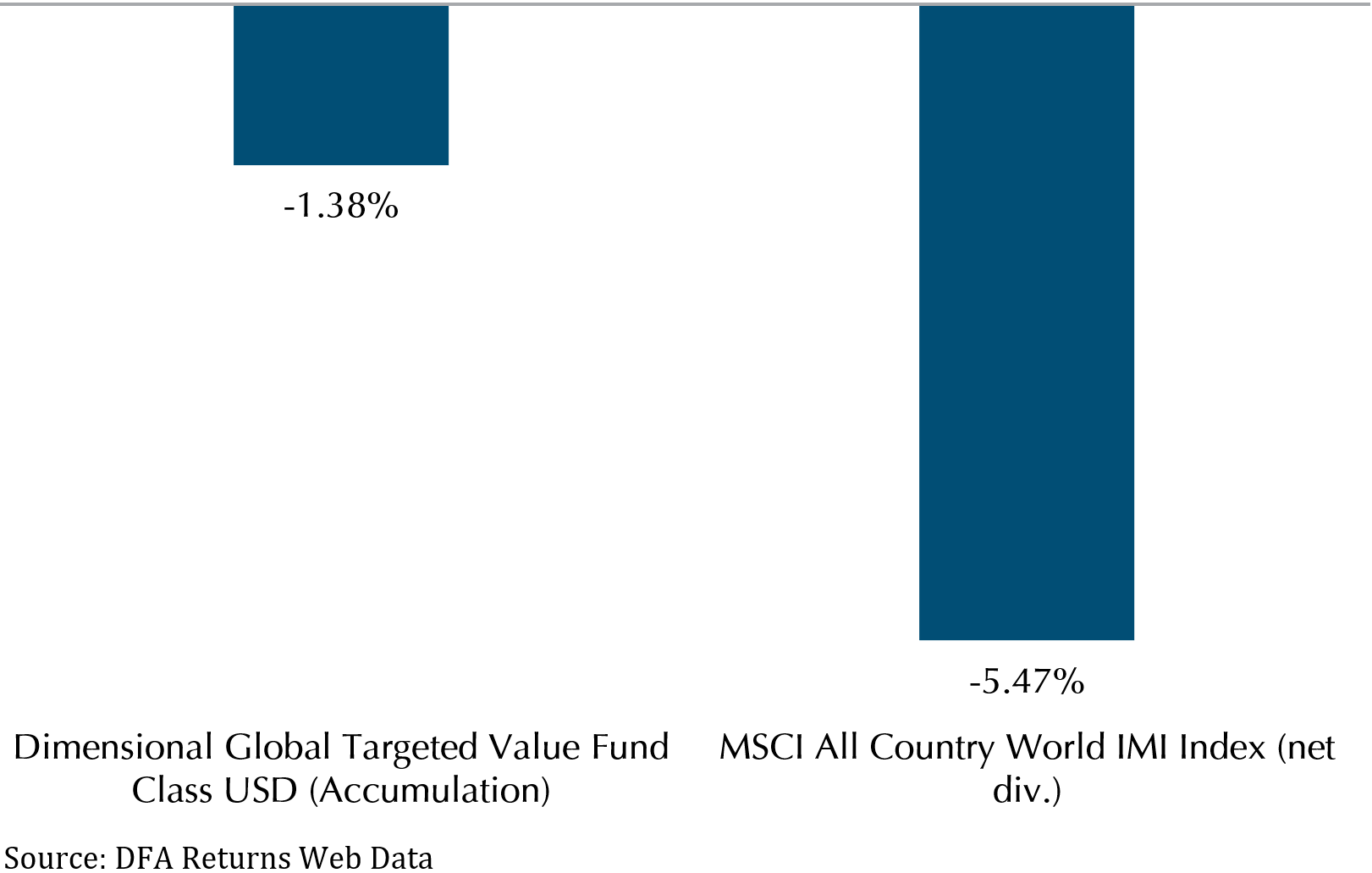

For the first quarter of 2022, investors have been plagued with news of high inflation, war, and rate hikes. Global market reacted to the news and had the worst performance since the global pandemic started. The MSCI All Country World IMI Index, for instance, posted a quarterly loss of 5.5% (Exhibit 1). In comparison, DFA Global Target Value Fund shows how the value premium held up over the quarter, falling only 1.4% for the first quarter.

Exhibit 1 – MSCI ACWI vs DFA Global Targeted Value Fund

Developed Market outperforms Emerging Market

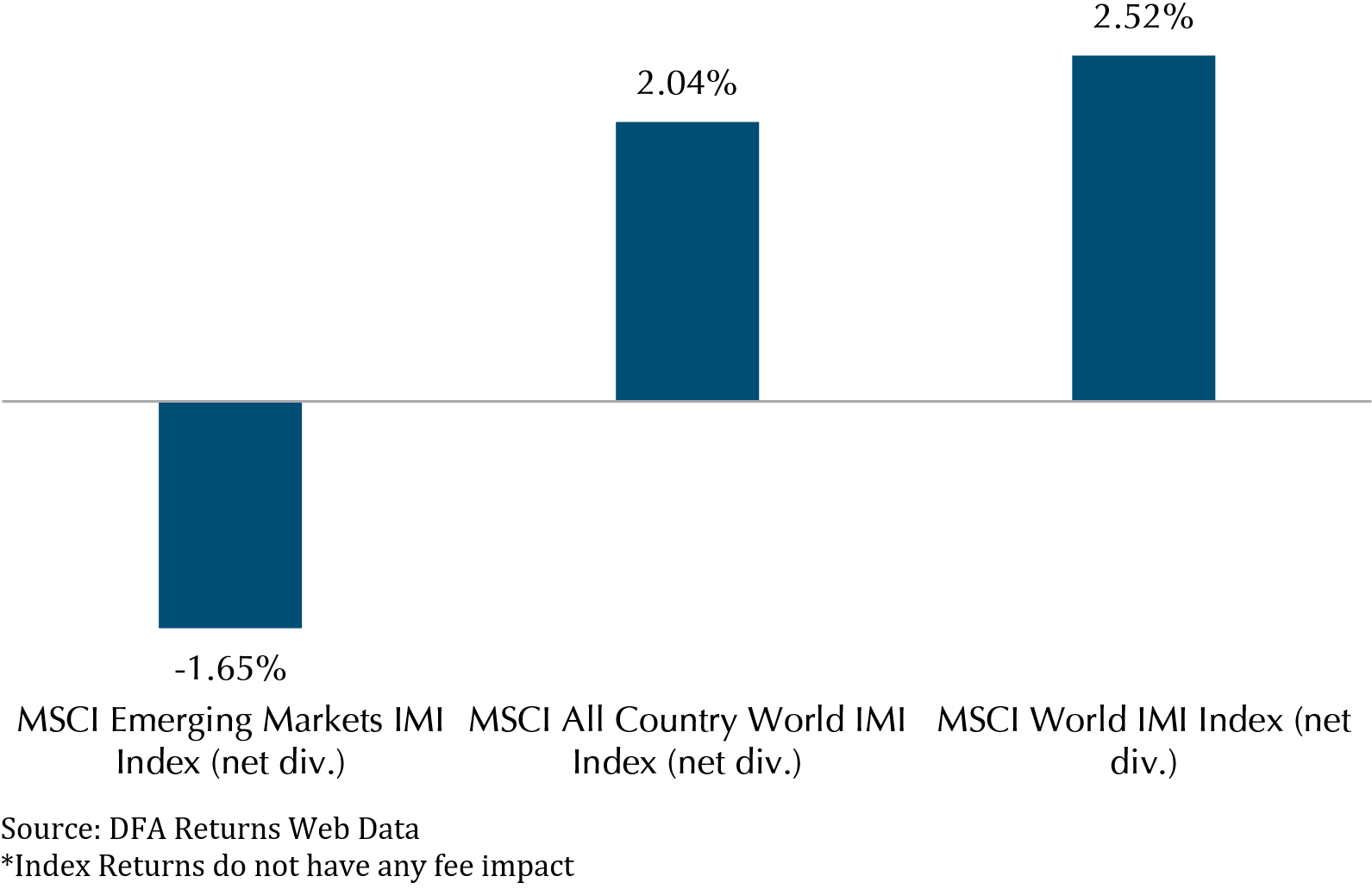

Exhibit 2 – Equity Reference Index Returns March 2022* (USD)

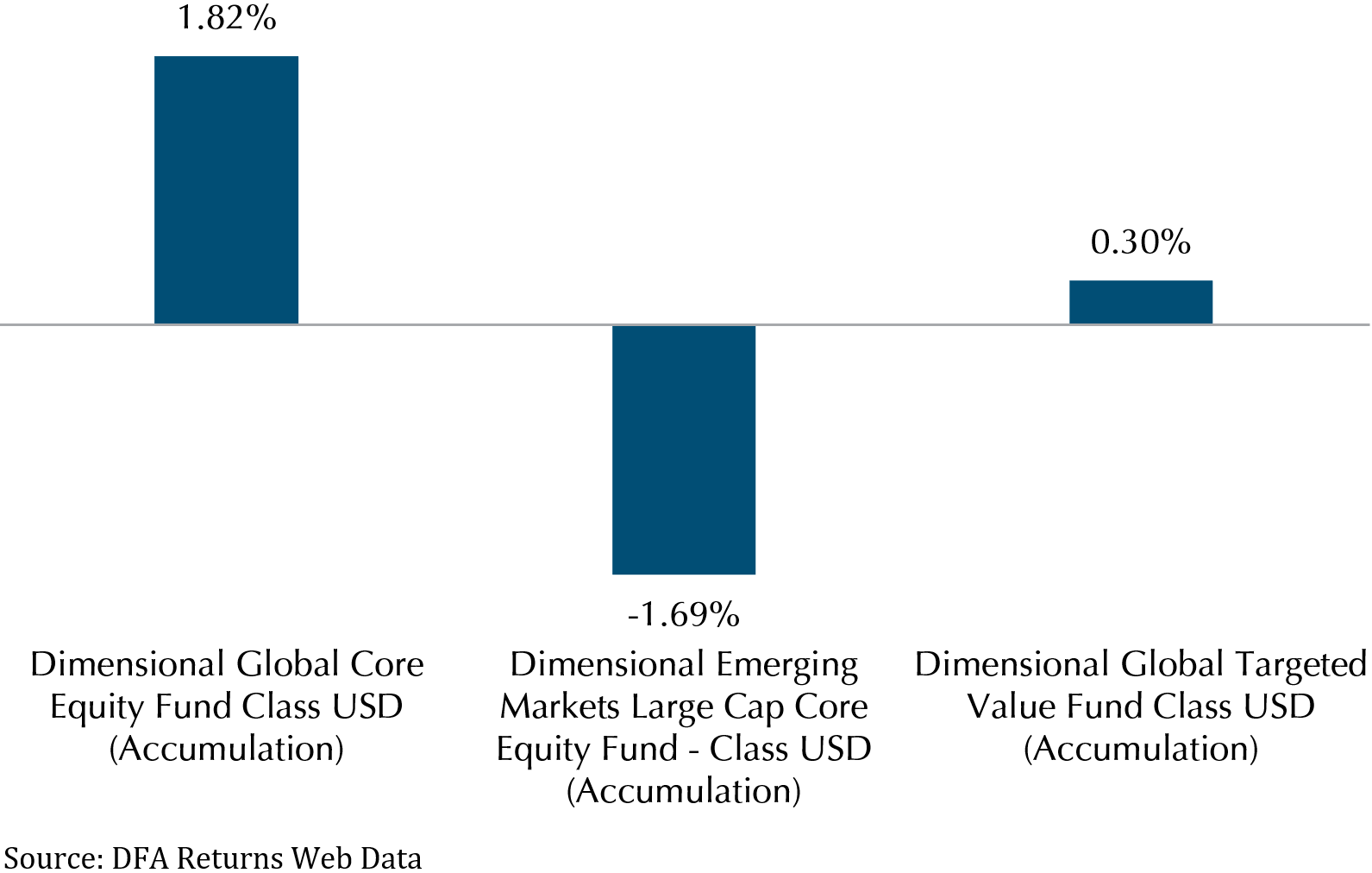

Exhibit 3 – DFA Equity Fund Returns March 2022 (USD)

Developed market equities see a positive month for the first time this year. In particular, US market equities rebounded from a loss on 14th March. The rebound was followed by a positive momentum which drove US market indexes to positive territory in March. S&P 500, for example, rose 11% from 14th March to 29th March before paring gains on the last two days of the month. It finished the month of March up 3.58%. MSCI All Country World IMI Index and MSCI World IMI Index rose more than 2% driven mainly by a big tech rebound. Large cap tech companies like Apple, Alphabet, Amazon, Microsoft, and Meta climbed carrying the entire index higher (Exhibit 2).

From Exhibit 3, we can see that Dimensional Global Core Equity Fund, which has 5 of the largest US tech companies in its top holdings, has risen by 1.82% while Global Targeted Value Fund risen only 0.3% as it does not hold any big tech companies. Dimensional Emerging Market Large Cap Core Equity, on the other hand, fell by 1.69% in line with the MSCI Emerging Markets Index as concerns of a slower growth in China, Omicron lockdowns hitting the economy and delisting of Chinese listed stocks in US market are added to the existing list of challenges facing EM stocks.

Federal Reserve raised 25 bps on March 16th. Signals 5-6 more rate hikes in 2022.

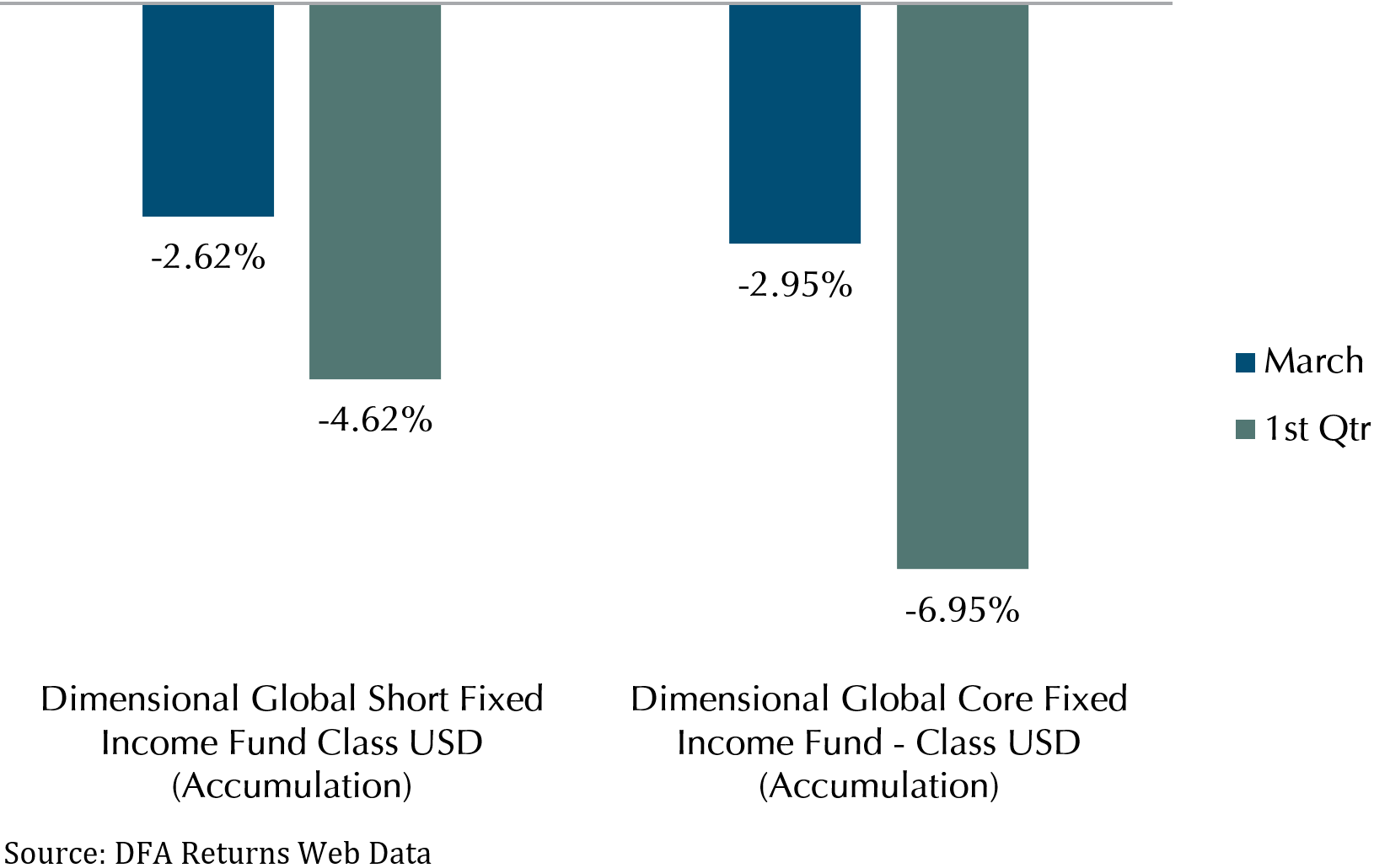

In light of a strong US labour market and persistently high inflation, the Federal Reserve has raised rates by 0.25%. With a median projection for the appropriate level of the federal funds rate at 1.9% at the end of this year, a full percentage point higher than projected in December, the Federal Reserve is signalling 6 more rate hikes. In an interview with Bloomberg on 23rd March, Mary Daly, president of the Federal Reserve Bank of San Francisco, has said that she is open to a 0.5% rate hike on the next meeting, and start reductions in the Fed’s balance sheet, if the data says that is needed. Released on 31st March, February’s personal consumption expenditure price index increased 5.4% from a year ago, the largest increase in nearly 40 years. This increase may give Fed a basis to front load rate hikes causing yields to rise more and bond price to fall. As inflation continues to show no sign of subsiding, fixed income returns continue to show negative returns. Dimensional Global Short Fixed Income and Global Core Fixed Income have fallen 2.62% and 2.95% which totals to a loss of 4.62% and 6.95% respectively for the first quarter. For the month of March, equity is a cushion for the fall in fixed income. The unpredictability of market movements reinforces the benefits of diversification in different asset classes.

Exhibit 4 – DFA Fixed Income Returns March and 1st Quarter 2022 (USD)

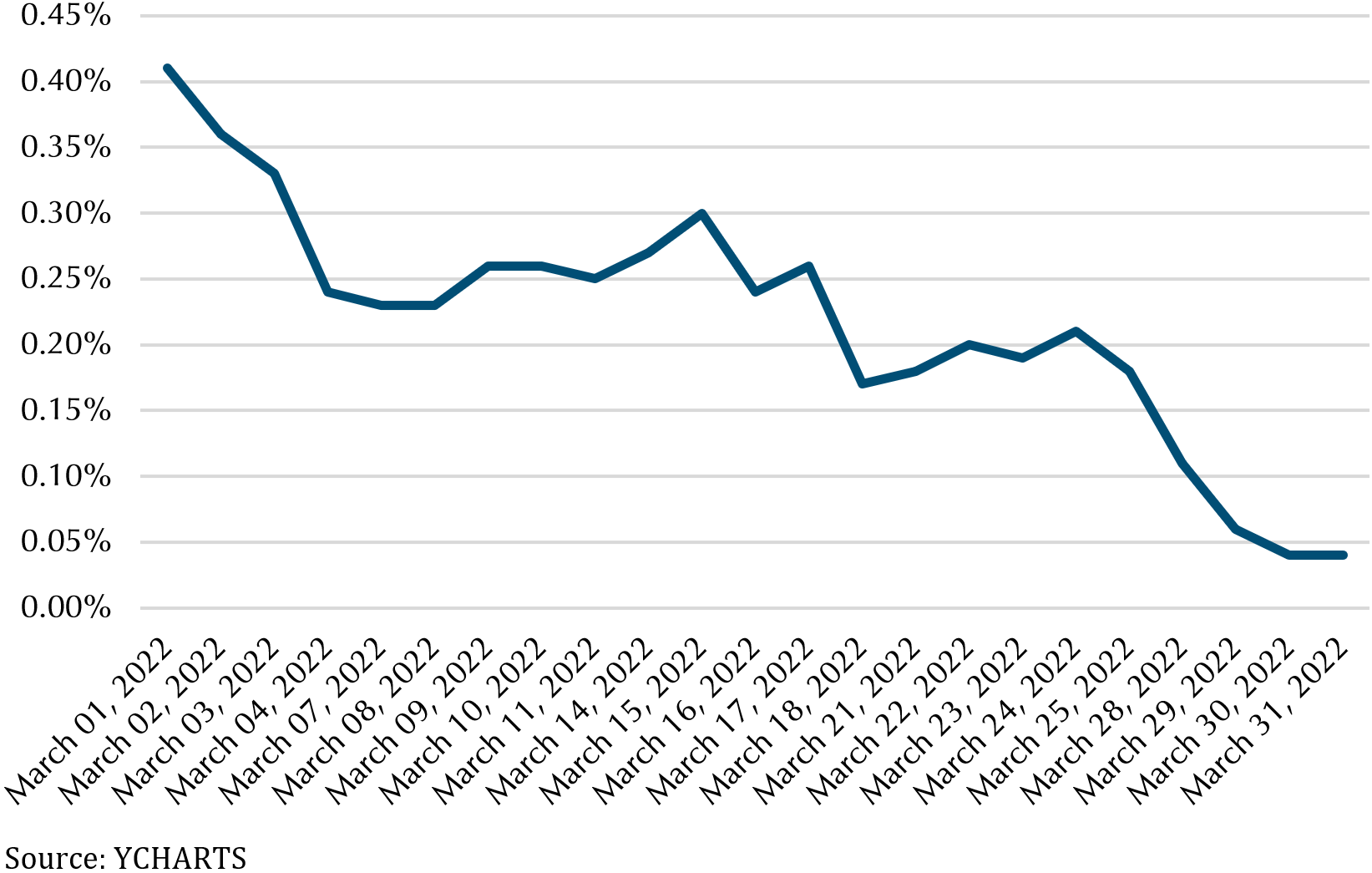

5-year and 30-year Treasury yield inverts for the first time (28th March) since 2006.

For the first time in 15 years, both 5-year and 30-year treasury yield has inverted, the 5-year treasury climbed nine basis points to 2.63%, rising above those on 30-year bonds as investors sell shorter term dated bonds faster than longer dated bonds. The inversion of yield curve signals market pricing in a possibility of Federal Reserve raising rates enough to slow down economic growth. The spread between 2- and 10-year treasuries, one of the most closely watched parts of the yield curve, is also reaching negative territory (Exhibit 5). Historically, a persistent inverted yield curve has predicted a recession like the 2008 financial crisis and the 2020 recession.

Exhibit 5 – 2 minus 10 Year Treasury Spread

On the bright side

Amidst all the bad news, the market is now realising that its worst fears had not materialised. While the war in Ukraine is still ongoing, peace talks between Russia and Ukraine show progress during a meeting between the two country’s representatives on the last week of March where Russia promises to scale down on military operations. Investors are further reassured when Ukraine announced that they have taken back the Kyiv region. Market sentiments are much better than a month ago, where investors feared that the invasion may lead to an all-out war between Russia and NATO.

Meanwhile, positive news is coming out of China. Chinese government have signalled easing of crackdown on Chinese businesses that are listed overseas. The news is especially a huge relief for US-listed Chinese companies like Alibaba. China also reported January and February economic data that soundly beat expectation on retail sales, fixed asset investment and industrial production. However, the recent outbreak in Shanghai is likely to be a headwind for China in the coming months, as economic activity in the financial hub of China may slow as a result of a lockdown.

Even though inflation is at a 40 year high since 1980s, it does not mean that inflation will be persistently high like in the 70s and 80s. Factors that caused the persistently high inflation during the 70s like the abandonment of the Bretton Wood system and oil price shock caused by Arab’s oil oligopoly are not similar to today’s situation. Current high inflation is driven by supply bottleneck caused by pandemic lockdown and a jump in consumer’s demand during the pandemic which took the suppliers by surprise as they decreased production. These factors are likely to be transitory rather than permanent as easing of lockdown restrictions and suppliers resuming production to meet demand will eventually cool down inflation. Furthermore, borrowing rates are still at a historical accommodative level even if Federal Reserve hike rates to 2.5%-3% at the end of 2023.

Last but not least, while an inverted yield curve might foreshadow a recession, the lag time can be very long. For example, prior to the 2020 recession in February and March, the 2-year and 10-year spread were briefly inverted on 28th August 2019. In between the time when the yield curve inverted and the recession, the S&P 500 climbed 15.5% before falling. It is also important to note that an inverted yield curve does not always mean a recession. There are other economic indicators that investors look out for. Consumer spending, for example, is often a leading economic indicator of the economy. On 15th March, a forecast released by National Retail Federation (NRF) projected that consumer spending on non-store and online sales are expected to grow between 11% and 13% to a range of 1.17 trillion and 1.19 trillion.

Conclusion – Trust in the invisible hand

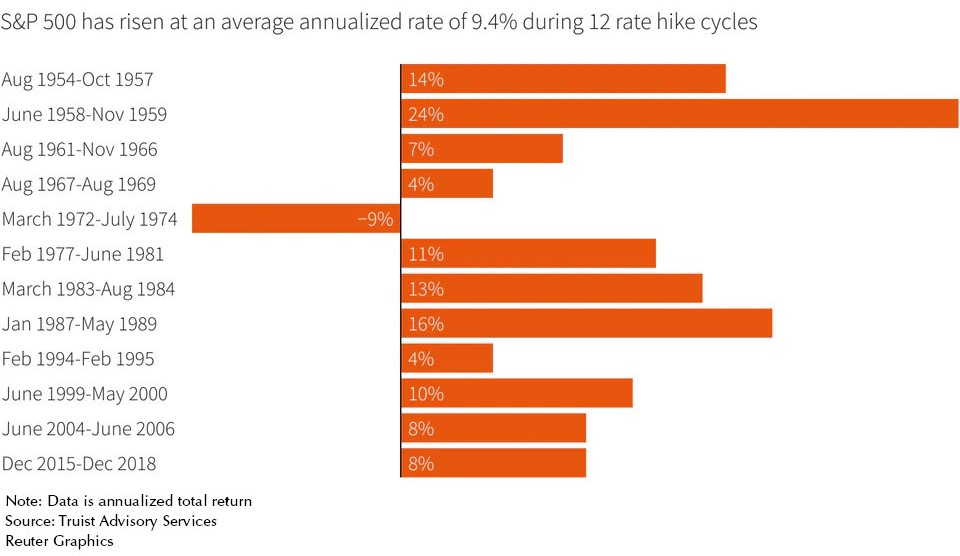

In response to rising prices, the Federal Reserve will continue to hike rates to control inflation. However, this does not mean that market will fall. In fact, US stock market has shown to be able to weather rate hike cycles. As shown in Exhibit 6, the S&P 500 have shown positive returns at 11 of the 12 rate hike cycles at an average annualized rate of 9.4%. Finally, a high inflation rate may seem scary as it can erode purchasing power of money, but it will not last forever as the invisible hand will drive prices back to its equilibrium. The invisible hand is an economic concept introduced by Adam Smith that describes the unintended greater social benefits and public good brought about by individuals acting in their own self-interests. In the context of a supply bottleneck and rising prices, like where we are now, supply will increase as producers or new entrants will take advantage of prices to increase production which in turn drives prices lower. Stay positive and invested.

Exhibit 6 – US Stock Market During Rate Hike Cycles

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.