January turned out to be one of the more volatile periods in the stock and bond markets in recent history. We saw 1000 point intraday swings in the Dow, 10-year treasury yields shooting sharply higher, and plenty of panicky headlines in the financial press.

What happened in January?

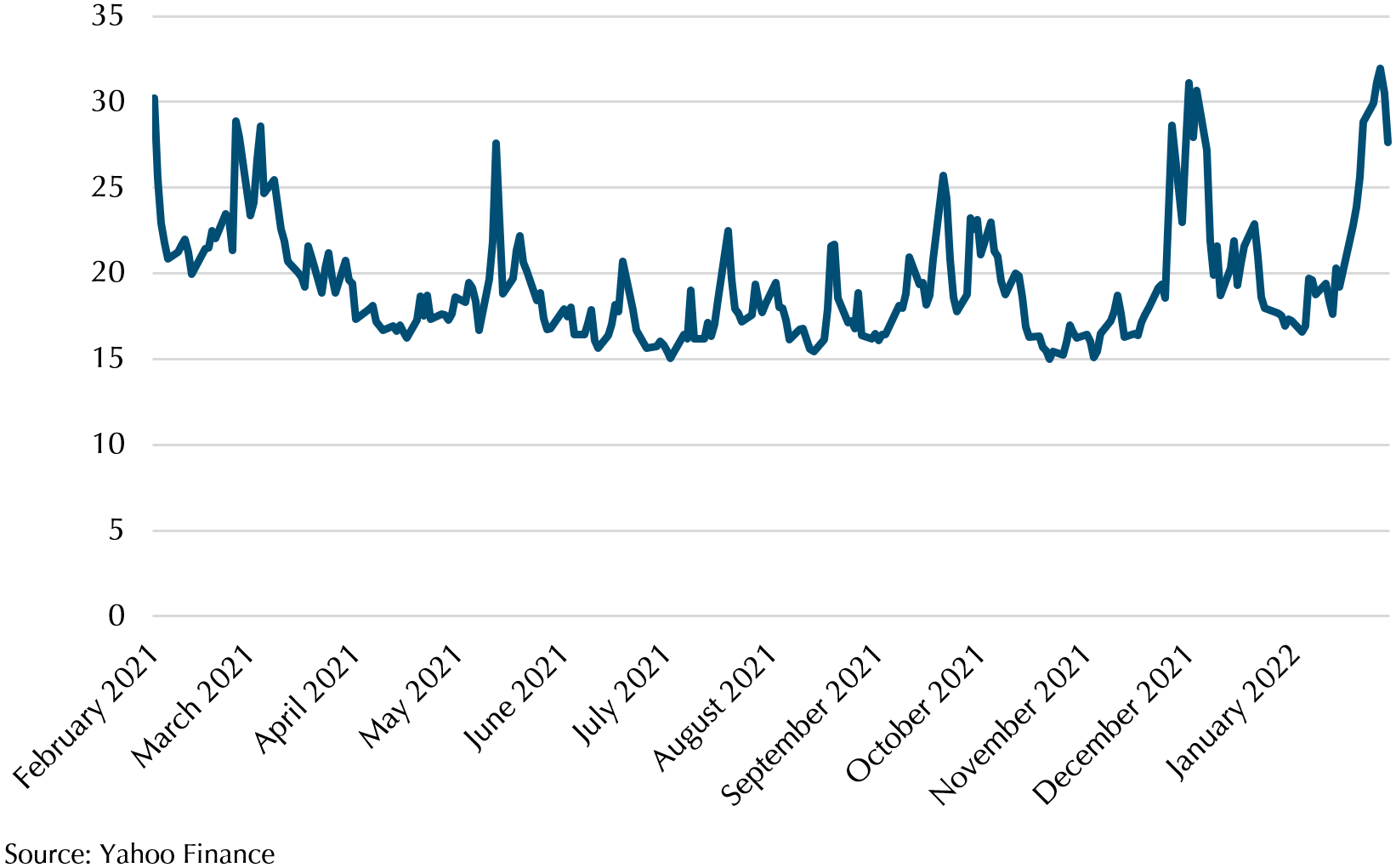

Volatility surged in January, with VIX reaching the highest level in a year. As a result, the Nasdaq and S&P got battered as the former index went into correction territory while the latter briefly entered correction territory before rebounding slightly (A correction is a 10% fall from a recent index high). The first week of 2022 started with the Nasdaq, of which tech stocks comprise more than 50%, falling by 4.5%. This was due to the Federal Reserve releasing their December policy meeting minutes on 5th January which showed a hawkish pivot towards 3 rate hikes this year. This pushed the 10-year US treasury yield from 1.668% to 1.705%, reaching its highest level since January 2020 (The 10-year yield eventually closed the month at 1.78%). This contributed to the drop in Nasdaq as the higher expected future cashflows from tech stocks were discounted at a higher rate.

Exhibit 1: VIX Index Feb 2021 to Jan 2022

The reason for the hawkish pivot by the Fed is due to inflation data stubbornly staying above the US central bank’s target of 2% due to supply and demand imbalances. Nasdaq got further pummelled when December consumer price index, released on 12th January, showed a 7% increase year on year, causing the index to fall 2.51% on the following day. Volatility increased again after the Federal Reserve’s open market committee released a statement on 26th January after a 2-day meeting signalling the possibility of more than 3 rate hikes in 2022 along with a more aggressive tapering of net bond purchases.

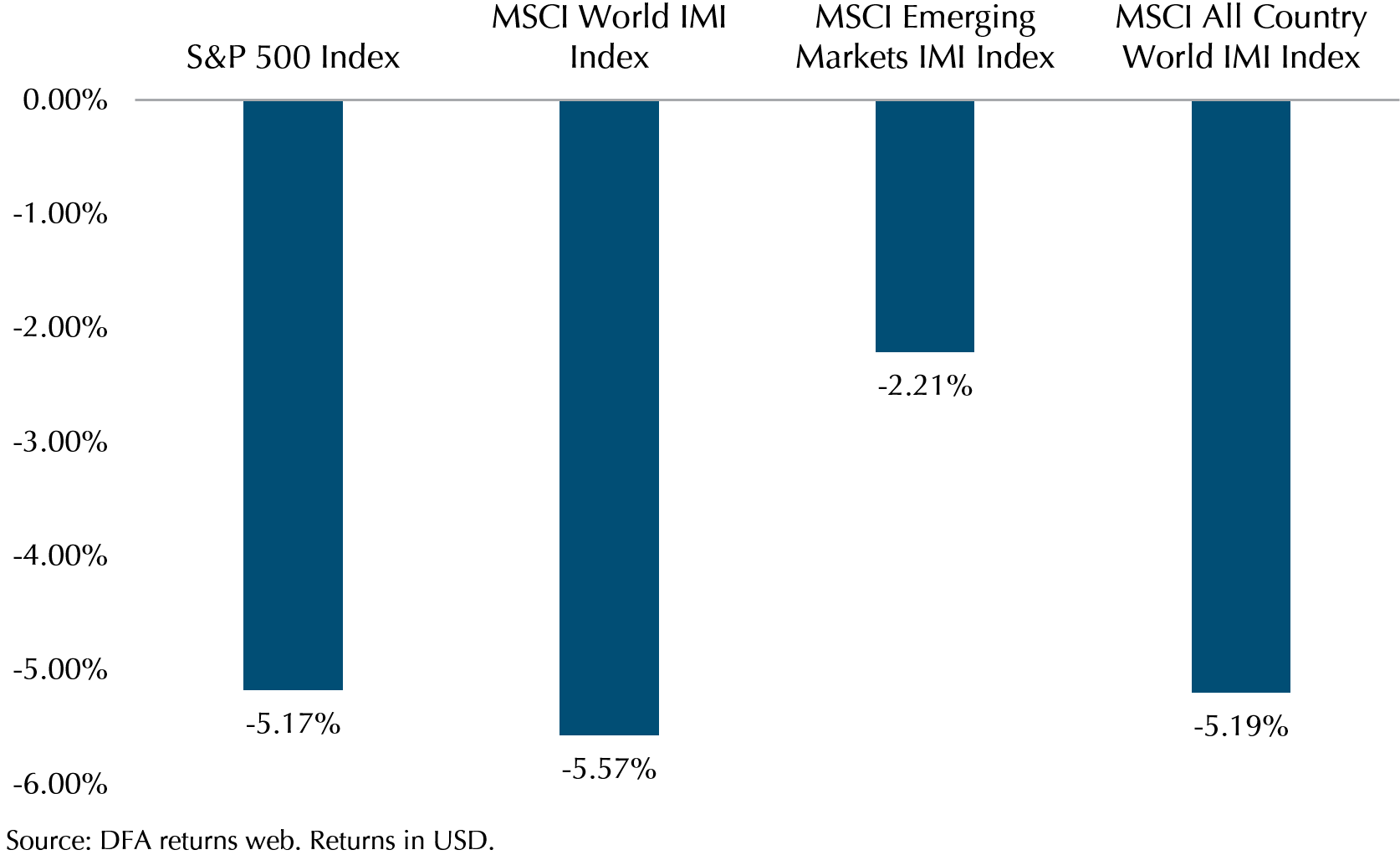

Exhibit 2: Major Index performance Jan 2022

While a large part of the volatility was in the Nasdaq, the major indices were not unscathed and the S&P 500, MSCI World, Emerging Markets and All Country World Indexes were all down significantly in January.

Inflation is running hot, and the hot topic

As economies recover from the on-going pandemic, demand has outstripped supply as consumers increased their demand for goods while supply chain remains disrupted by the global pandemic. Chips shortage and rising oil prices are an example of the contributors to rising inflation everywhere.

As inflation heats up, central banks look for an exit strategy to the era of easy money. While the US Federal Reserve is signalling an increase in rates, MAS has tightened its monetary policy in its first out-of-cycle move in seven years as overall inflation in Singapore rose 4% in December on a year-on-year basis, hitting a nine-year high. Tighter monetary policy combats inflation by raising the cost of borrowing resulting in less money supply circulating in the economy. For example, a tighter monetary policy is likely to increase interest rates in Singapore, which might reduce the amount of loans made for real estate transactions and lower transaction prices, reducing the cost of housing (one of the top 3 components of Singapore’s CPI).

On a contrasting note, China’s central bank, PBOC, took an expansionary stance by cutting reserve rate ratio and reducing policy interest rates in January to support its slowing economy and improve the financial health of property developers. On the same day that PBOC lower its mortgage lending benchmark rate on January 20th, Evergrande’s stock price rose by 4.6%. Due to the changes in regulations and tighter monetary policy, the Chinese real estate market has been slowing down, resulting in liquidity challenges for real estate developers. A lower benchmark rate could reduce mortgage rates and encourage property buying which in turn would increase cashflow and the ability of property developers to finance their debt obligations.

Inflation and monetary tightening might seem like negative news because of its almost immediate effect on market prices, it is crucial to have a perspective of the long term. While an increase in the interest rate would mean that investors with a leveraged position may decide to deleverage because of higher cost of capital which in turn “corrects” the market, it also means that the central bank believes that the economy’s fundamentals are now doing well and no longer requires monetary support. Similarly, high inflation both reflects a decrease in purchasing power and an increase in consumer appetite.

Holding a diversified portfolio allows you to benefit from inflation. For example, rising oil prices have boosted returns for oil & gas companies. ExxonMobil stock price rose 24% in Jan, reported blockbuster results in early Feb and rose another 6%.

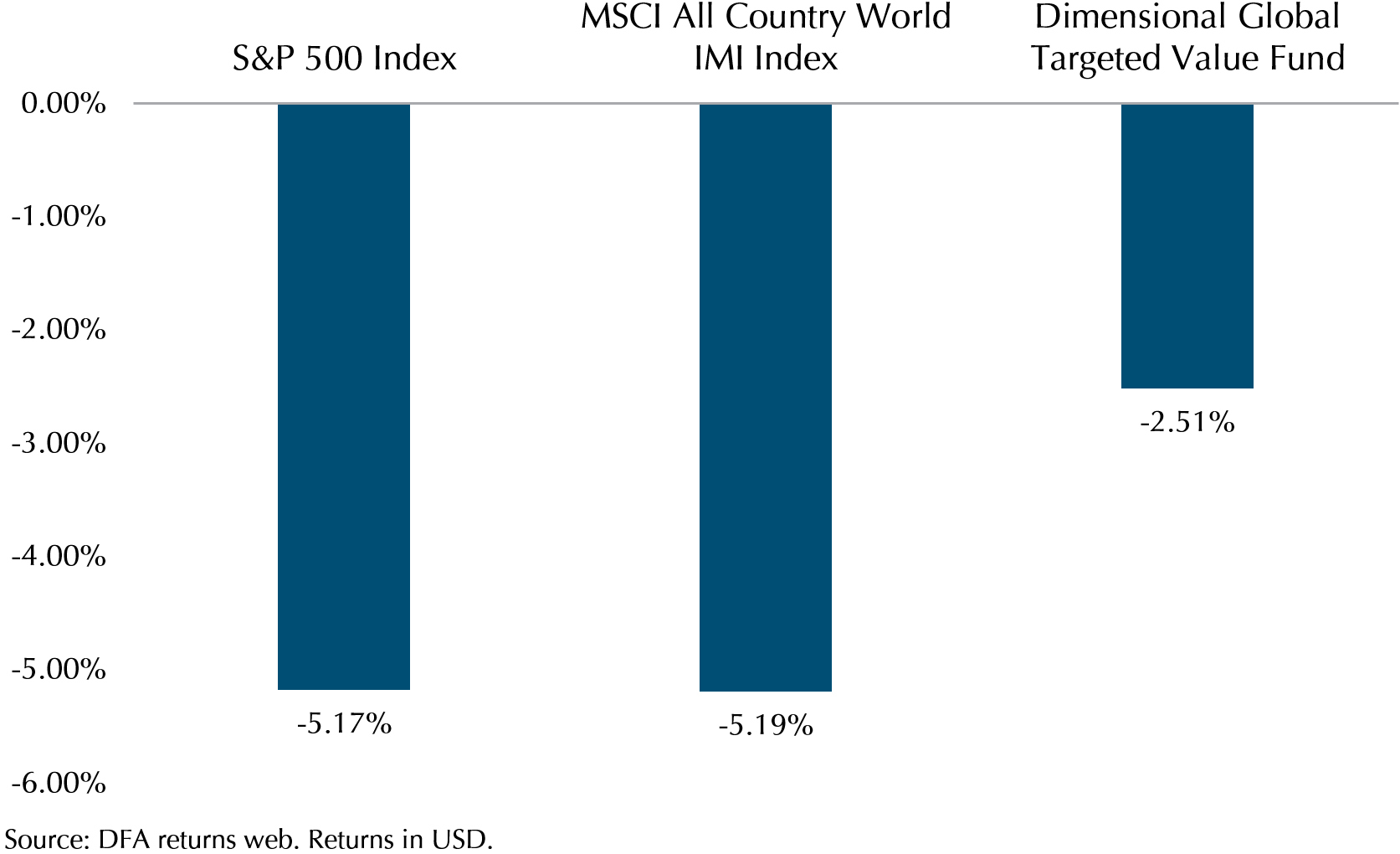

Value shows its value

A bright spot in this difficult month was how well value stocks held up during the sell off. Value stocks have a higher proportion of their cashflows in the present, therefore are affected less by a higher discount rate.

Exhibit 3: Value stocks outperformed in Jan

Looking at Exhibit 3, we can see that the Dimensional Targeted Value Fund, which is focused solely on investing in smaller value stocks, outperformed the S&P 500 and the much broader MSCI ACWI by 2.5%, which is a reflection of how much better value stocks did over the month of January.

Staying in your seat during the roller coaster ride

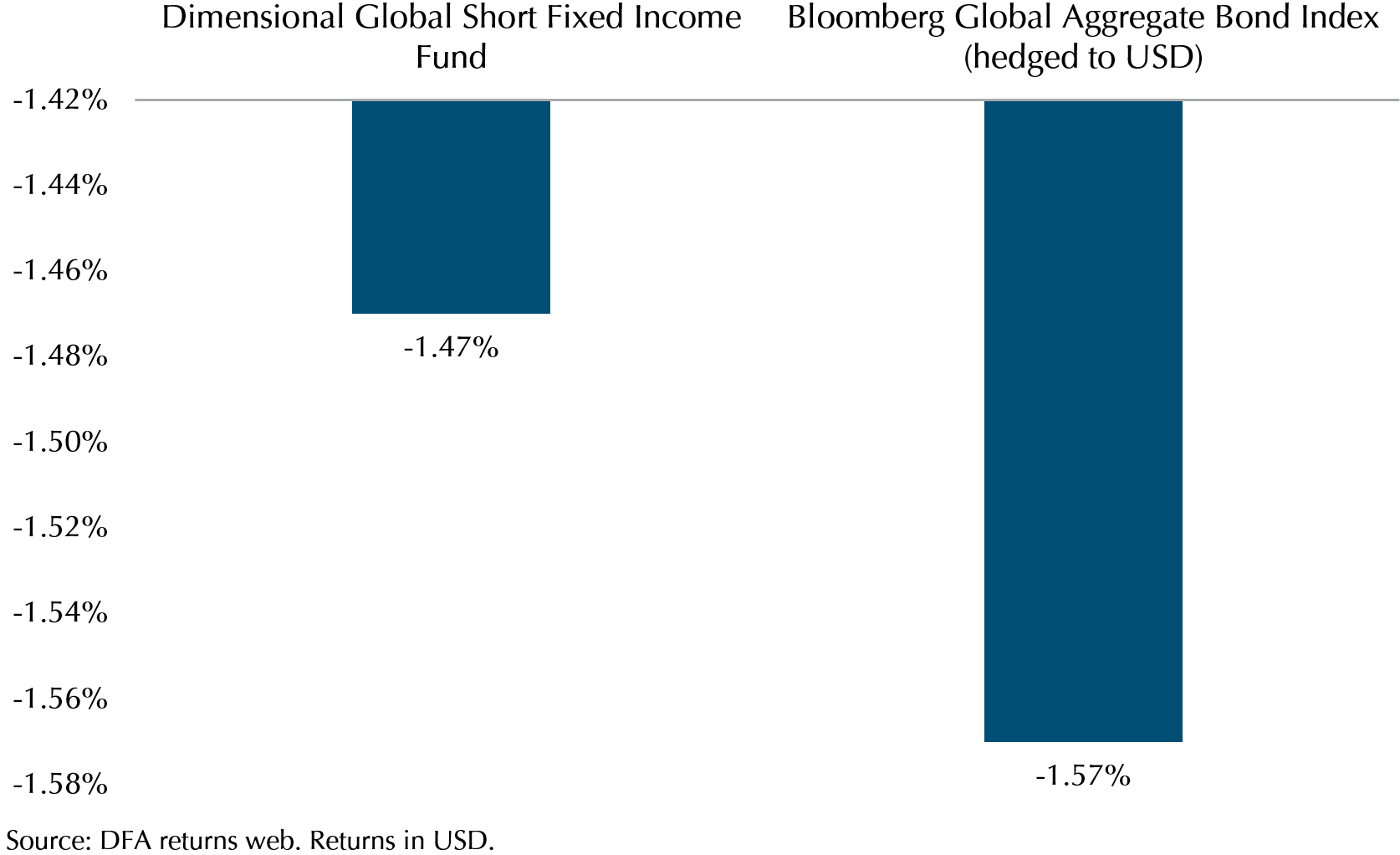

Our CEO Chris likes to compare investing to a roller coaster ride, with its ups and downs but the key is to complete the ride safely, and you can only do that by staying in your seat. Similarly for investing, you can only reach your wealth goals if you stay invested and not react to the markets short term. Our portfolios are designed to help you do that in 2 ways. 1) As we have explained earlier, value stocks are holding up better during this period of volatility and 2) our fixed income allocations are contributing to reducing the volatility of the portfolios. While rising bond yields have hit bond prices, the fall is still much lower than in equity, thus our fixed income allocation continues to serve their purpose to reduce volatility. (See exhibit 4 below)

Exhibit 4: Fixed Income performance Jan 2022

Happy Lunar New Year!

As we usher in the year of the Tiger (which has been quite fierce so far from what we see in the stock market), we would like to wish all our clients a very Happy, Prosperous and Healthy Year of the Tiger. Thank you for your continued trust and support. Huat ah!

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.