At 3pm yesterday, 18th Feb 2020, Mr Heng Swee Keat, Deputy Prime Minister and Minister for Finance, delivered Singapore’s FY2020 Budget Statement in Parliament.

Through the budget, Singaporeans can have a better idea of what the government sees, where are their key priorities and how they will allocate the government’s income.

In this article, I will provide a summary of the areas of the budget that may affect your family directly. Thereafter, I will explain what we can learn from this Singapore Budget and provide some tips on the appropriate personal finance posture your family can undertake.

Areas Of Singapore Budget 2020 That May Directly Impact Your Family

In this year’s budget, the government has made significant moves to help Singaporeans manage their expenditures in life, through various rebates, tax reliefs, cash incentives, credits, and vouchers.

Below are some of the moves made this year. I have grouped them according to traditional areas in which we are most familiar with.

The impact to your family will depend on your age, your family make-up, the type of home you live in as well as your income level.

Cash Incentives

All Singaporeans that are aged 21 years and above in 2020 will received a one-off cash amount.

The amount you will receive will depend on your assessable income for the year of assessment of 2019 (This is not your final taxable income but the income before tax reliefs & deductions)

- $0 to $28,000: $300

- $28,001 to $100,000: $200

- Greater than $100,000 or owns more than 1 property: $100

In addition, parents with one or more Singaporean children aged 20 years and below in 2020 can get an additional $100. This is regardless of assessable income.

For clarity, both spouses will qualify for the additional $100 ($200 in total) if they have a child below 20 years old.

Finally, all Singaporeans age 50 years and above in 2020 will receive a $100 top-up to their PAssion Cards in 2020. Merdeka and Pioneer Generation seniors are also included in this.

This top-up is to encourage those 50 years and above to stay active and healthy. They can use the PAssion Cards to pay for the following:

- Activities and facilities at community clubs

- Entry to public swimming pools

- Public transport

- Essentials and other items

CPF & CPF Life

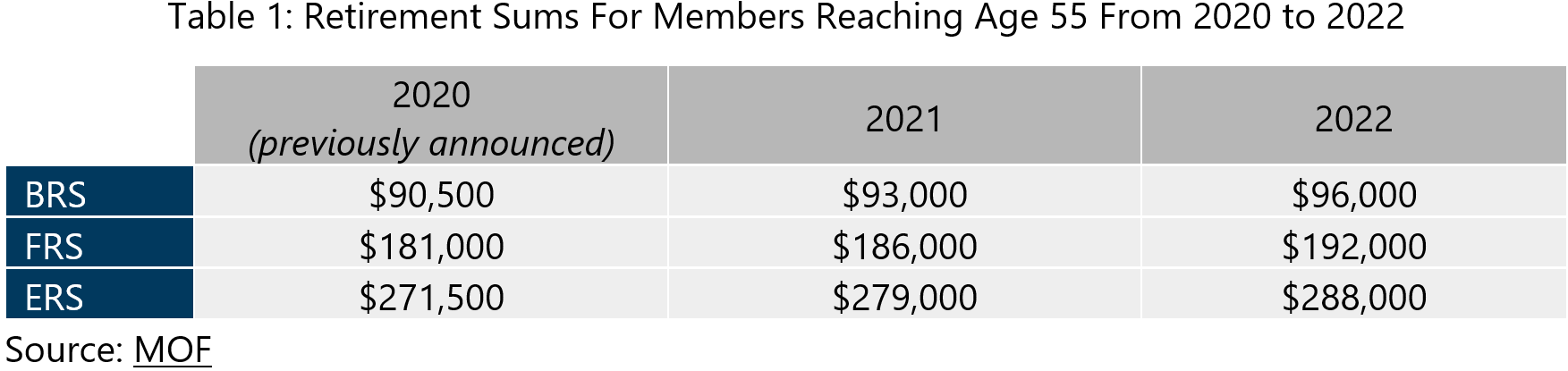

The Government has published the CPF Basic Retirement Sum (BRS), Full Retirement Sum (FRS) and Enhanced Retirement Sum (ERS) for the year of 2021 and 2022. They will be increased at a rate of 3% per annum.

The rates are as follows:

Clients who turn 55 years old in 2021 or 2022 should take note of these new requirements.

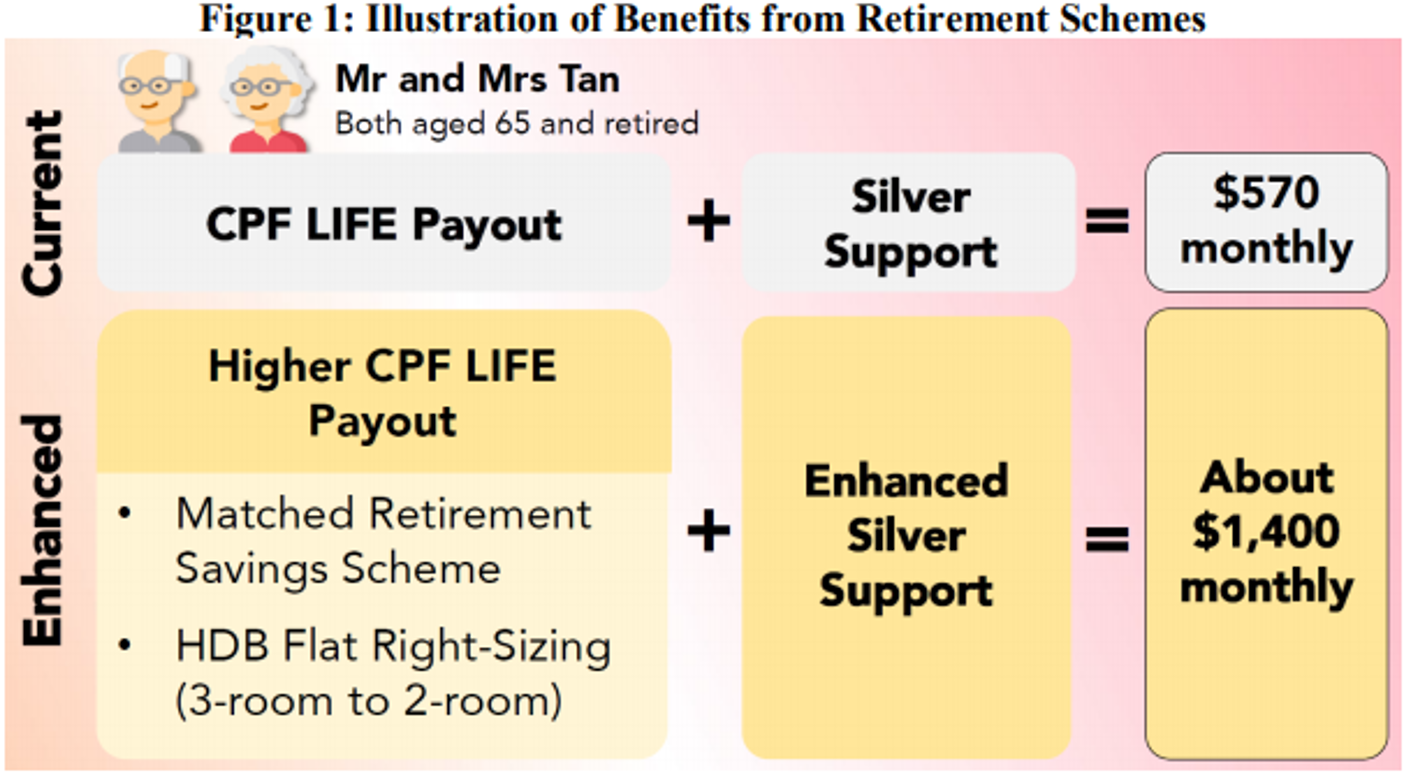

Next, to help older middle-to-lower income Singaporeans meet their retirement needs, the government will match every dollar of cash top-up made to CPF Retirement Account (RA) under a new Matched Retirement Savings Scheme.

Singaporeans who are between the age of 55 to 70 years old and are unable to set aside more than the CPF BRS will be eligible for this scheme.

Between 2021 and 2025, if you top up your CPF RA via the Retirement Sum Top-Up Scheme (RSTU), the government will match it dollar-for-dollar up to $600 a year.

You can help your parents or your non-working spouse top-up their CPF RA to take advantage of this match. This top-up via the Matched Retirement Savings Scheme can boost their future CPF Life payout by an estimated $42 a month ($504 a year)

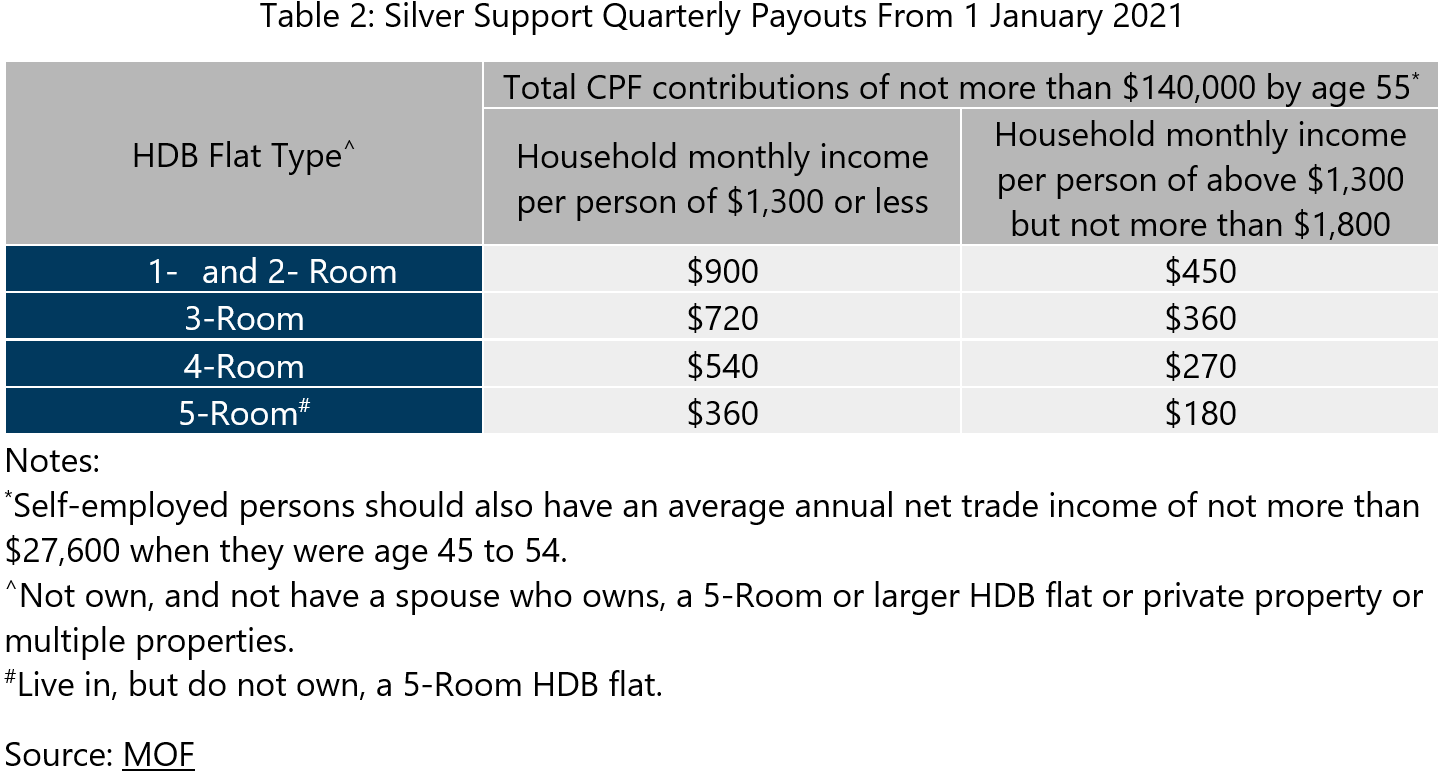

Finally, the government has also lowered the criterion to qualify for the Silver Support Scheme, which aims to help those with low income during their working years to have more during their retirement.

- Payouts will be raised by 20%

- Instead of the current criterion of $70,000, Singaporeans with no more than $140,000 of total CPF contributions (CPF OA + CPF SA at age 55, including amounts, are withdrawn for housing, education and investments) by age 55 will also be eligible for this scheme. Self-employed Singaporeans should not have more than $27,600 (previously $22,800) in trade income between the age of 45 to 54.

- Insertion of a new criterion for those with household monthly income between $1300 and $1800 a month

The significance of this expansion in criteria is that it allows older people to qualify.

Together with moving from a 3 RM HDB to a 2 RM Flexi HDB so that you will have more in CPF Life, the improved Silver Support Scheme could potentially increase your income in retirement immensely.

Personal Tax Rebate Or Relief

For this year, there are no notable personal tax rebates or relief.

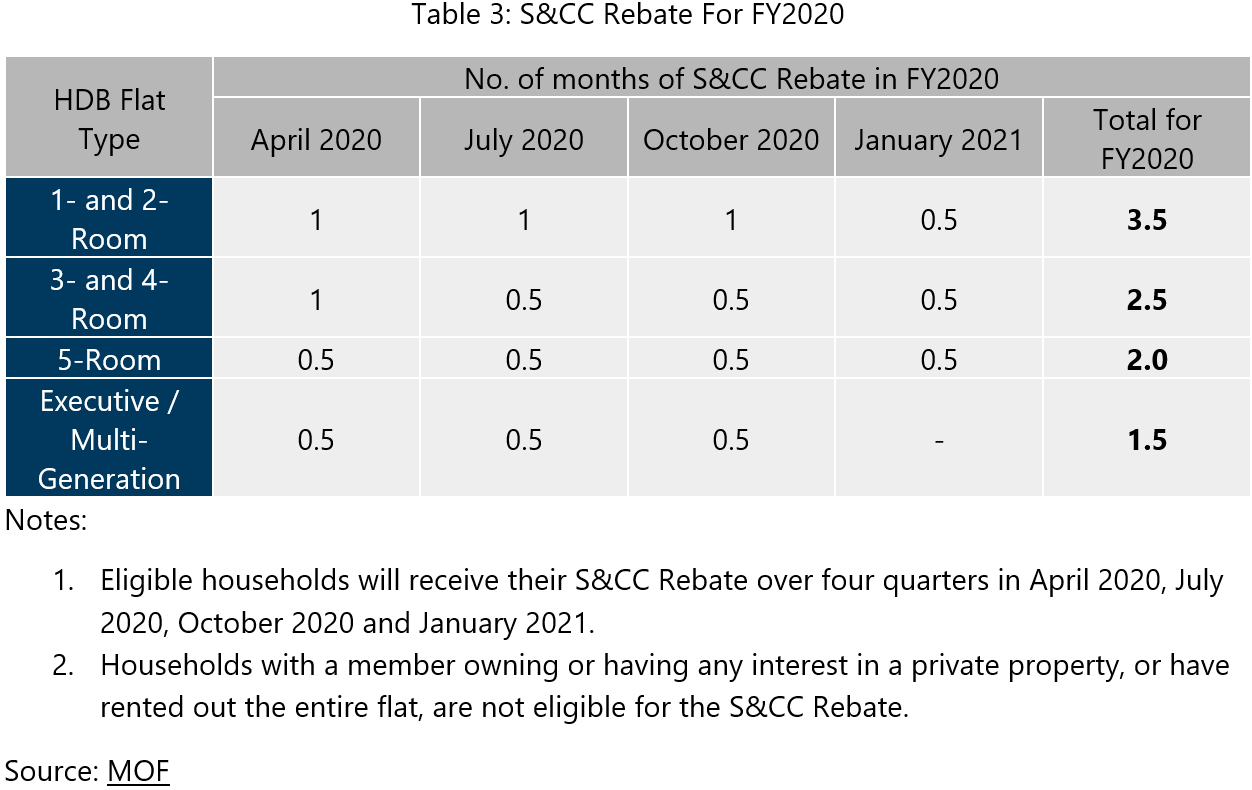

Service And Conservancy Charges (S&CC) Rebates

Singaporean households living in HDB flats will receive rebates to offset your Service and Conservancy (S&CC) charges over FY2020:

Vouchers

The government will be giving out grocery vouchers for those who are in the lower-income spectrum.

Singaporeans who are 21 years and above, living in 1 RM and 2 RM HDB flats and do not own more than one property, will receive $100 worth of grocery vouchers each year in 2020 and 2021. These vouchers can be used in participating supermarkets such as NTUC FairPrice, Giant and Sheng Siong.

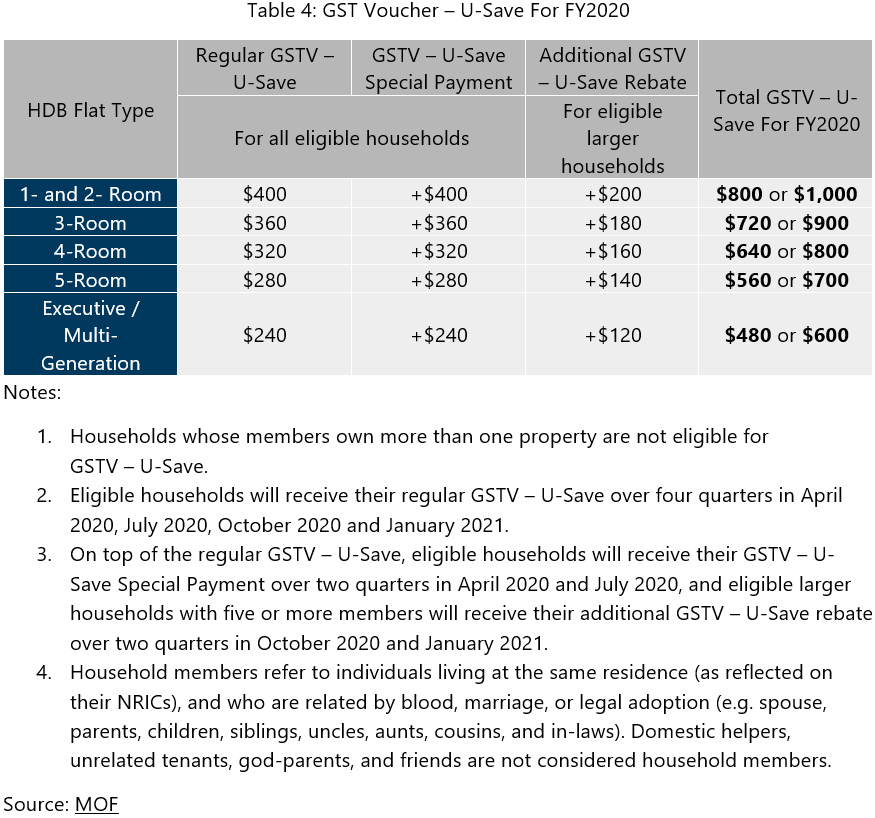

In addition, eligible HDB households will receive double of their regular GST Voucher (GSTV) though a one-off GSTV – U-Save Special Payment. Households with 5 or more members will receive more.

SkillsFuture & Training Grants

SkillsFuture is our government’s initiative to encourage us to be continuously learning so that we can fulfil our maximum potential.

This year, there are 2 one-off credits that are given.

The first is a one-off SkillsFuture Credit (SFC) top-up of $500. To qualify, the person must be a Singaporean citizen, and more than 25 years old as of 31st Dec 2020.

You can start using the credits from 1st Oct 2020. Unlike the previous credits, this credit is valid for 5 years after which, if it is not used, the credit will lapse.

The second is another one-off SFC top-up of $500. This is to support Singaporean citizens who are 40 to 60 years old (as at 31st Dec 2020) in their career transition. This is over and above the first one-off SkillsFuture credit mentioned above.

Like the first SFC, there is a 5-year validity period for this credit.

Effectively, a Singaporean aged between 40 to 60 years old can in total be credited with $1000 worth of SFC.

GST Held At 7% Going Into 2021

In 2018, Mr Heng announced that the government would be raising the GST by 2 percentage points, to 9%, sometime from 2021 to 2025. This is to raise recurring revenues to meet our growing expenditure, especially on healthcare.

The government decided that the GST rate increase will not take effect in 2021 and it will remain at 7% in 2021. Mr Heng updated that the increase will still have to happen by 2025.

GST will still be absorbed for publicly subsidized healthcare and education.

Mr Heng also gave a little more detail on the transitional support that households can expect to cope with this change:

- Households will receive at least 5 years’ worth of offsets to deal with the additional GST expenses and up to 10 years’ worth for lower-income households

- Under the Assurance Package for GST, every adult Singaporean will receive a cash payout of $700 to $1,600 over 5 years. For example, a family of four with a combined household income of $6,000 living in a 4 RM HDB flat can receive about $7,000 in offsets over five years in total. This includes cash of about $4,000.

What We Can Learn From The Budget

Budgeting can be carried out at a country level, a company level or on a personal level.

For the past 16 years in my working career, I have been budgeting and I would attribute a significant part of my success to this financial habit I have built up. Budgeting has provided me with financial clarity. It has assured me that I have sensibly allocated adequately to assets that provide future cash flow for me and allows me to confidently spend the rest in areas that I value.

An effective personal budget should be one that starts with a clean slate. Before thinking about what is needed now and what we need in the future to ensure we live a good life. Followed by allocating our projected cashflow or available cashflow according to our current and future needs.

We call this kind of budgeting system a Zero-based Budget. Every year we bring it to zero, and we critically rethink based on our current and future needs.

The government is doing the same thing and if this is the case, we should pay attention to where they allocate the money.

In every Singapore Budget, we can see a few areas where the government almost always allocate the same proportionate amount of money. But for each budget, there will always be certain focus areas.

These focus areas were recommended based on the data and feedback on the ground.

Many a time, as a family, we might not be able to sense everything. Your wife and yourself may work in 2 specific industries and can only gain anecdotal evidence of how other industries are doing.

However, from the Budget, you would be able to know:

- The growth areas they are allocating capital to. As a businessman, there might be a blue ocean for you to explore to create a new segment by taking advantage of your experience, competency and future government funding.

- Signs that the economy is in prosperity or distress. As a family, there should be a certain part of your cash flow that can vary depending on how well you are doing as a family and the economic outlook. The country’s budget allocation will shed light on whether one should be conservative with their cash outflow or to spend more freely.

In this year’s Singapore budget, the main themes of resource allocation are:

- Stabilization and support. An export centric economy is hit by a reverse of globalization, due to a trade war between our two major trading partners. A COVID-19 virus has halted physical interaction and hampered business interaction in the places we export to as well as local consumption.

- This year’s budget is focused on incentivizing companies in Singapore to retain and re-train Singaporeans

- It also provides support for companies by allowing them to faster write down their plant & machinery, renovation & refurbishment for 1 year. It gives them greater access to working capital and allows greater flexibility in rental payments at government-managed properties

- Specific industries such as tourism, aviation, retail, food services and point-to-point transport services will get additional help

- Growing our economy. The government will improve support for deep-tech start-ups, help existing SMEs to go digital, provide assistance to 900 most promising enterprises to grow by giving them the support they need.

- Addressing Climate Change. To reduce our carbon footprint and emissions. There will be significant investments in incentivizing the growth of the electric vehicles in Singapore as well as coastal and flood defence.

There are two significant special packages totalling $5.6 billion to help firms & households. The size of these packages significantly exceeds most analyst’s original projections.

The message is clear:

- Help the businesses

- If they do not survive, there will be greater unemployment

- Greater unemployment will result in a whole host of residual social, family and financial problems for the households

The Appropriate Personal Finance Posture To Take

With that said, we would like to provide some tips on what we think you can take to navigate this environment better.

1. Review & Rationalize your budget. Ideally, we should have two sets of budgets.

- 2. A Baseline Budget. A Budget that is sensible during normal environments. Both spouses have good jobs, growing income. The budget is well aligned with what you wish to achieve today and in the future.

- 3. A Very Conservative Budget. A Very Conservative Budget is one where we budget mainly the essential spending that would keep the family operational, with minimal allowance for entertainment to maintain the morale of the family.

In challenging times, a spouse could lose their job (in the worst case both). As a business owner, your revenue and profits might be impacted such that you are forced to take a smaller income, fee, or declared dividend income.

In the event of such a scenario, the first thing that would set in is shock and if you have not considered what is your essential spending and the bare minimum you need to keep the morale going, you will be at a loss for what you should do.

By having a baseline and a very conservative budget, you will know what the areas are to stop spending on when something hits.

For example, in your baseline budget, you allow yourself to bring your family and extended family out for a good meal at a good restaurant every weekend. In your very conservative budget, instead of every weekend, you would bring the extended family out once a quarter, and for your family, you would eat out once a month instead.

For both the family and extended family, you will reduce the grade of the eateries chosen to one where the food is value for money.

Cut on the areas that you value less or are lower in priority.

Still spend on the areas that could not be cut or are in higher priority.

Consider critically the grade of the goods and services you will spend on.

This would improve morale and still maintain your mental capacity.

If you already have something like a very conservative budget, consider reducing some of the areas from a standard budget to a point closer to the very conservative one.

The measures provided by the government will help the lower-income family but if you are in the higher income or net wealth spectrum of Singapore, the significant impact will come from optimizing your spending.

2. Have An Emergency Fund. Mr. Heng Swee Kiat said that the deep reserves which Singapore has built up over the years have allowed the government to focus on the appropriate areas to allocate their cashflows instead of worrying about the damage brought about by these events that they cannot control.

As a family, having a liquid pool of money in an emergency fund would allow the family to buffer about three months to a year of a shock to the annual expenses.

3. Consider Carefully When Deciding To Take A Loan. Given the climate, taking on loans may reduce the margin of safety on your finances.

Ideally, the annual debt repayment to your after-tax income should be less than 30%. Should one spouse lose the job, your family should be able to service the debt repayment with one income.

4. Enhance Your Earnings Potential To Retain, Adapt And Grow. For many accumulators or those of you who have not amassed an appropriate net wealth, your family’s income is the most important. It allows you to pay for your current expenses and provides the free cash flow for you to increase debt repayment, build your children’s education fund and your financial independence.

Take advantage of the SkillsFuture credit to find complimentary training to enhance your earnings potential. If you feel strongly about switching to a different industry or domain, consider going for some training to start building side competencies.

Make yourself indispensable at your job by being focused and adding value at work. Take on the things your peers may shun.

Most of all, to do all this and function well, you must be healthy and fit. Ensure that you eat right, de-clutter your mental thoughts and focus on the important areas, and exercise frequently.

5. Invest For The Long Term. History and Experience have taught us that there will always be challenging times. The important thing for all of us is to emerge from tough times like this unscathed, if not stronger.

If you have committed to long-term goals such as your financial independence and children’s education, continue to fund them.

For our client’s portfolios, they are diversified across 7,000 businesses around the world, across 180 high-credit rating bonds. This diversification allows them to reduce the impact of weakness in certain regions in the world and be able to capture the regions where there would be relatively better growth, reducing single-country risks.

There will be a lot of noise along the way that confuses us and increases our anxiety levels. They serve to throw us off our wealth accumulation journey towards our goals so that we cannot amass enough wealth for our financial independence and children’s education.

The government has committed to match every dollar of cash top-up made to CPF Retirement Account (RA) under a new Matched Retirement Savings Scheme.

You can consider taking advantage of this by topping-up your CPF RA account if you are between the ages 55 to 70 and have not hit your CPF BRS.

Summary

The government usually puts out a prudent, conservative budget, targeted to the long-term and short-term needs of Singaporeans.

The underlying theme of this year’s budget is to stabilize the economy, which is suffering from productivity issues, a reversal of globalization, and a virus which is severely reducing commerce activities both locally & overseas.

Packages are now rolled out to alleviate SME’s challenging conditions, to try and retain Singapore workers.

As a family, this is a time to evaluate your resilience.

Be aware of the government incentives and measures so that you can take advantage of them. We have also provided some different ways in which you can shape your personal finances to provide your family with greater resilience. (For our clients, if you wish to review your personal situation, please do not hesitate to contact your Client Adviser).

Experience tells us that all these challenges shall eventually pass. If our finances are in order, it allows us to emerge from these challenging times stronger.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s first Fee-only Wealth Advisory Firm.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.