In September this year, a Straits Times report highlighted that while sales of investment-linked policies (ILPs) grew by 72% from 2022 to 2024, complaints against them are also at an all-time high in 2024 – 211 complaints versus 53 in 2023.

Ms Eunice Chua, CEO of the Financial Industry Disputes Resolution Centre (FIDReC), shared that during mediation sessions, it was discovered that most consumers do not really understand what an ILP is, and many of the complaints pertain to market misconduct, which refers to practices such as mis-selling, misrepresentation, inadequate disclosure about the ILP products, or giving inappropriate financial advice.

So why are ILPs so difficult to understand?

In recent years, insurers have launched wealth accumulation-based ILPs, which are known in the industry as 101 ILPs because the insurance coverage is 101% of the value of the investment or total premiums paid, whichever is higher. These policies seem attractive because typically, 100% of the premium is invested, welcome bonuses are given, and after a certain period, policyholders receive annual loyalty bonuses. But this is where it gets complicated.

While different insurers offer ILPs in different forms, the way fees are charged can be broadly structured in two ways:

a. A single account holds all the units of the unit trusts you purchased with your premiums, as well as all the bonus units given. Insurance companies will charge their policy fees on the value of the units in this account. The fees could be higher during the first “X years,” where “X years” are the years you are not allowed to terminate your policy or make partial withdrawals beyond an allowable amount (a.k.a. the lock-in period), and lower fees apply after the lock-in period.

b. Dual accounts, where one account holds all the units purchased, as well as the bonus units given during the first “X years,” and another account holds units purchased and bonus units given after “X years.” Insurers typically charge a higher fee on the first account and a lower fee on the second account.

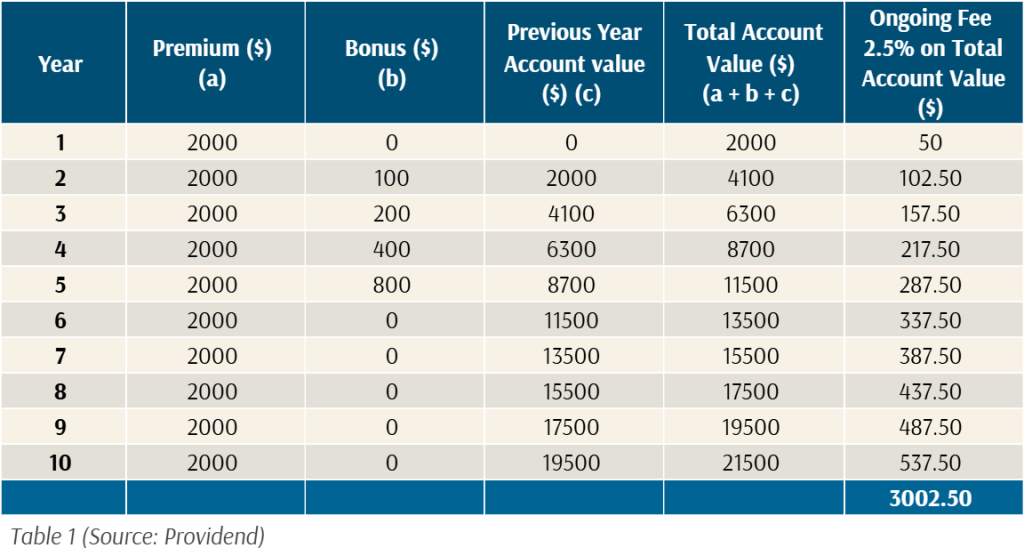

Using the single account structure as an example, let’s say you have bought a 101 ILP with a 10-year lock-in:

- Annual premium of $2000

- Welcome bonus of 75% of the first-year premium spread over five years

- Policy fee of 2.5% p.a. on the total account value during the lock-in period

Assuming there is no growth or loss in your investment after fees, the fees calculated in the first 10 years are as shown in Table 1:

By the end of the 10th year, you would have paid $3002.50, about 150% of your first-year premium in fees! This means that all the welcome bonuses that were given to you are gone. Of course, different insurers have different bonusing schemes, but what you need to know is that there is no free lunch. While the welcome bonus of 75% may sound exciting, the fees eat into it over time, and in this case, all of it.

The same applies to loyalty bonuses given after the lock-in period, as ongoing fees will also reduce these bonuses. Then, of course, there is another layer of fees – the annual management fee of the underlying unit trusts that you purchase. Because most ILPs invest into actively managed funds, the fees are high relative to low-cost non-forecasting funds or ETFs. Even for a few ILPs that use index funds, the total expense ratio is still relatively higher than if you buy an index fund or ETF directly without going through ILPs.

So how much are you actually paying?

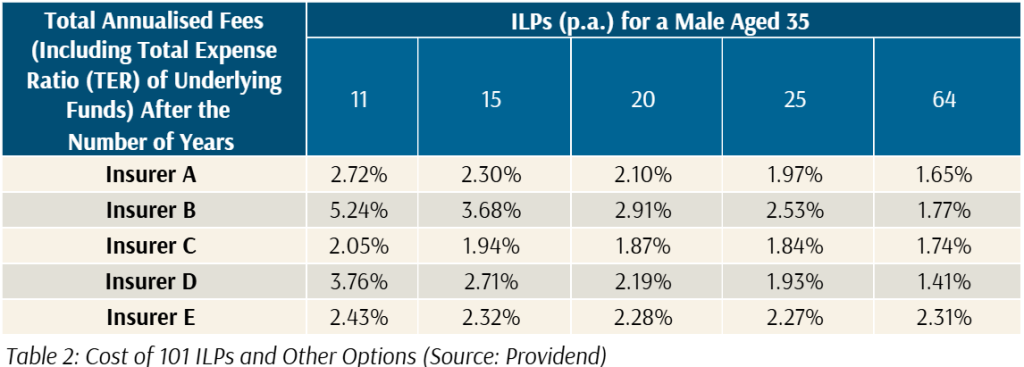

In 2023, my firm conducted in-depth research on 101 ILPs. To determine the cost, we used each insurer’s benefit illustration to calculate the projected net annualised returns of the ILPs. The net annualised returns are net of underlying funds’ total expense ratio, welcome and loyalty bonuses as well as other ILPs fees. By calculating the difference between these numbers and their projected gross return, the team was able to determine the total annualised cost of ILPs from various insurers at the end of different years (see Table 2).

Do you realise now how complicated 101 ILPs can be and why many consumers do not understand the ILPs they have bought, leading to rising complaints?

The reasons why Providend does not use ILPs are:

-

Most ILPs invest in actively managed funds, and there is enough evidence to show that most such funds do not outperform their index, and for those that do, they cannot sustain the performance consistently.

-

As you can see from Table 2, the cost structure of ILPs is not easily understandable and, in our opinion, too high.

-

There are limited choices of funds within the insurers’ ILP universe.

-

The lock-in period is a significant problem. If we do not like the performance of the funds, we cannot change them without incurring a huge loss.

-

We typically prefer instruments that can all be transacted on a single investment platform. ILPs remain with the insurers and not on such platforms, making investment management operationally inefficient when it comes to rebalancing and fund switches.

Personally, I cannot think of a convincing reason why ILPs should be part of an investor’s portfolio. After two decades of writing and talking about ILPs, I am disappointed that their sale is still on the rise. This is probably because the promise of high welcome and loyalty bonuses has distracted investors from understanding ILPs’ real underlying cost and disadvantages.

With so many better options available today to invest directly in financial markets, why pay high fees, have limited fund options, and still be locked into an ILP structure? It makes no sense at all.

The writer, Christopher Tan, is Chief Executive Officer of Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“. He is also a Certified Ikigai Tribe Coach.

The edited version of this article was published in The Business Times on 22 September 2025.

For more related resources, check out:

1. Are Investment-Linked Policies Suited for Executing Your Investment Strategy?

2. Will Providend Finally Include ILPs in Our Clients’ Portfolios?

3. When Does It Make Sense to Buy Investment-Linked Policies (ILPs) Ft. BagHolder Pod

To receive first-hand wealth insights from our team of experts, we invite you to subscribe to our weekly newsletter.

Through deep conversations with our advisers, you will gain clarity on what matters most in life and what needs to be done to live a good life, both financially and non-financially.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.