In the past two decades, we have not used investment-linked policies (ILPs) when constructing investment portfolios for our clients because we do not deem them suitable. However, over the years, ILPs have evolved, and we have been asked numerous times whether we will change our stance towards ILPs.

Protection-based ILPs were first developed in the early ’90s. Similar to whole life plans, for every $1 premium you pay, after deducting distribution costs (commissions) and other fees, a portion goes to the cost of insurance, and the remainder of the premium is invested. Unlike whole life plans, where the cost of insurance is fixed throughout the policy’s lifetime, ILPs charge the cost of insurance based on your age at policy inception, increasing over time as you grow older. For whole life plans, the investment portion is invested in the insurer’s life fund, whereas for ILPs, it is invested into in-house unit trusts or with external fund managers.

The value proposition of ILPs is cost transparency, as policyholders know the cost of insurance and the amount being invested. Additionally, policyholders can decide their investment options. However, due to the increasing cost of insurance with age, there is a risk of policy lapsation if the cost becomes higher than the premium paid, especially if the underlying investment is underperforming. Moreover, there are limited choices of funds, and the burden of obtaining investment returns is now shifted to the policyholder, who decides the funds they want to invest in.

Wealth Accumulation Based ILPs

In recent years, insurers have launched wealth accumulation based ILPs. These ILPs, also known in the industry as 101 ILPs (because the insurance coverage is 101% of the value of your investment or total premiums paid, whichever is higher), have been designed to attract buyers. The regular premium version is usually a limited-pay product, although some allow policyholders to pay throughout the lifetime of the policy. For example, if you buy a 10-year minimum premium payment term 101 ILP, initially, 100% of your premium will be invested. Depending on the product, you may be given a welcome bonus ranging from 5% to 200% of the first-year investment amount. After the 10-year premium payment period, you may receive a yearly loyalty bonus ranging from 0.1% to 2% of your accumulated investment value for the lifetime of the policy, subject to terms and conditions.

In terms of the underlying investments, most funds in these ILPs are actively managed funds that try to beat the markets through forecasting. Some ILPs even tout funds that were previously only available to accredited investors but are now accessible to retail investors through these ILPs. However, there is no free lunch. If you surrender your policy before the minimum premium payment term (or lock-in period) or make partial withdrawals beyond the allowable amount, you will be slapped with a heavy penalty because insurers have already paid commissions upfront to their distributors and given you the bonuses.

With all these exciting new features, are ILPs now suited for executing your investment strategy? Let us first look at the cost of these 101 ILPs compared to other options.

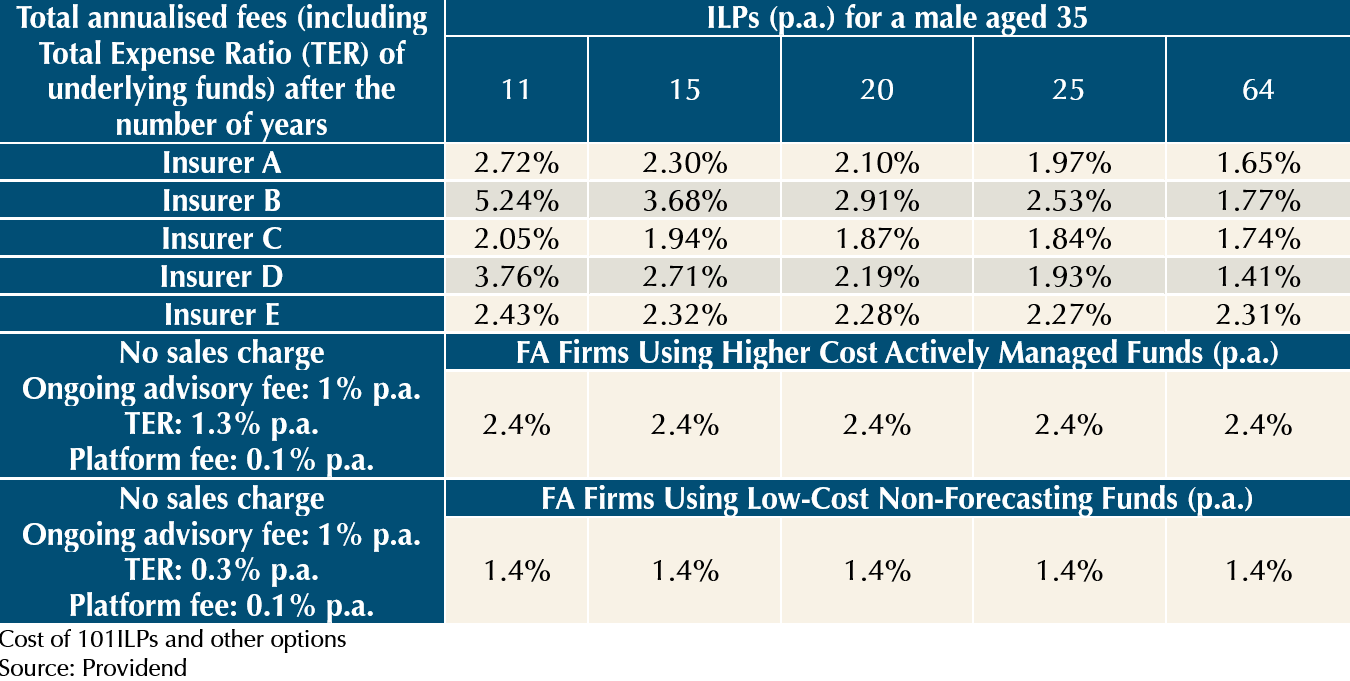

Earlier this year, our Solutions Team at Providend was commissioned with conducting in-depth research on 101 ILPs. To determine the cost, the team used each insurer’s benefit illustration to calculate the projected net annualised returns of the ILPs. The net annualised returns are net of underlying funds’ total expense ratio, welcome and loyalty bonuses as well as other ILPs fees. By calculating the difference between these set of numbers and their projected gross return, the team was able to determine the total annualised cost of the ILPs from various insurers at the end of different years (see the table). We then compared these costs with those of financial advisory firms that use higher-cost actively managed funds and those that use low-cost non-forecasting funds. It is evident that while the cost of ILPs can be lower than that of those using higher-cost actively managed funds, it is still considerably higher than those using low-cost non-forecasting funds.

But beyond cost, whether ILPs are suited will also depend on your investment convictions. At Providend, we assess product suitability based on the four pillars of our investment philosophy.

Pillar 1

We invest in assets that have economic contribution because for an asset class to generate long-term returns, there must be an economic basis or theory behind it. If an investment does not create any economic value, then we should not expect long-term investment returns. This is important to generate more reliable returns that meet our clients’ needs. In this regard, equities and bonds meet this requirement.

Verdict: ILPs are suitable since they invest in these asset classes.

Pillar 2

To ensure the reliability of returns, we validate qualified asset classes with empirical observations across multiple markets and economic cycles. Additionally, to further ensure reliability of returns, we refrain from investing based on market forecasts. Substantial evidence has shown us that funds that invest in equities and bonds by forecasting do not beat the markets most of the time. For those that do, they cannot do it consistently over the long term.

Verdict: ILPs are less suitable as most underlying funds are forecasting-based.

Pillar 3

In terms of implementation, portfolios should be well-diversified and not overly concentrated in any particular investment, and costs should be kept low. Diversification has been proven to be the only effective way to enhance a portfolio’s risk-return trade-offs, and lower costs translate to higher returns.

Verdict: ILPs are less suitable as the total cost is still relatively higher than the ETFs and non-forecasting funds that we use. Higher costs will eat into returns.

Pillar 4

In implementing portfolios for clients, practical considerations include investors’ liquidity needs, investment operations efficiency, and how best to help clients stay invested to capture returns.

Verdict: ILPs are less suitable due to their lack of liquidity, early exit penalties, and limited fund choices. In addition, because of operational inefficiency due to it being transacted on a different platform from other investment instruments, we prefer to use ETFs and non-forecasting funds that can be transacted on the same brokerage platform, ensuring cost-effectiveness and operational efficiency.

Proponents of the 101 ILPs may argue that the lack of liquidity feature can “force” investors to stay invested for the long term and capture returns. However, this comes at a significant expense. What if the underlying fund managers underperform? What if there aren’t suitable funds within the insurers’ range of funds, given the limited choice, to switch to? It may be difficult to get out of the ILPs without incurring huge losses. There are better ways to help investors stay invested through robust cashflow planning and a good risk coaching and turbulence management programme.

So overall, while we have to give credit to the insurance companies for developing better ILPs than before, we still do not find ILPs suitable for us because it is not aligned to our investment philosophy, which is distilled from decades of our collective financial markets experience.

The writer, Christopher Tan, is Chief Executive Officer of Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 20th November 2023.

For more related resources, check out:

1. Why a Robust Estimate of Future Returns Is Important for Investment Planning

2. S2E29: Will Providend Finally Include ILPs in Our Clients’ Portfolios?

3. Are Investment-Linked Policies (ILP) And Unit Trusts A Good Way To Invest?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.