Stock markets experienced their worst 1-day drop since the Covid pandemic in June 2020 on the news that inflation in the US rose in August. Against most expectations looking for a fall in oil prices to lead inflation lower, the August Consumer Price Index (CPI) report showed that inflation in other areas was rising, with services, dining out and medical services all rising from July to August.

A 10% fall in gasoline prices and a 5% fall in energy prices were not enough to bring the headline inflation reading lower, reflecting the broad-based nature of the inflation that the US is currently experiencing.

Expectations drive market prices

Stock markets and investors are always forward-looking. Stocks had been going up in the days before 13 September as investors looked at the falling energy prices and started to price in a more moderate inflation reading. If inflation was moderating, the Fed would not be under so much pressure to raise interest rates as quickly.

Instead, with a higher-than-expected inflation number, the markets quickly moved to price in new expectations that the Fed might have to raise interest rates even more than what was previously expected, leading to the sharp fall in stock prices.

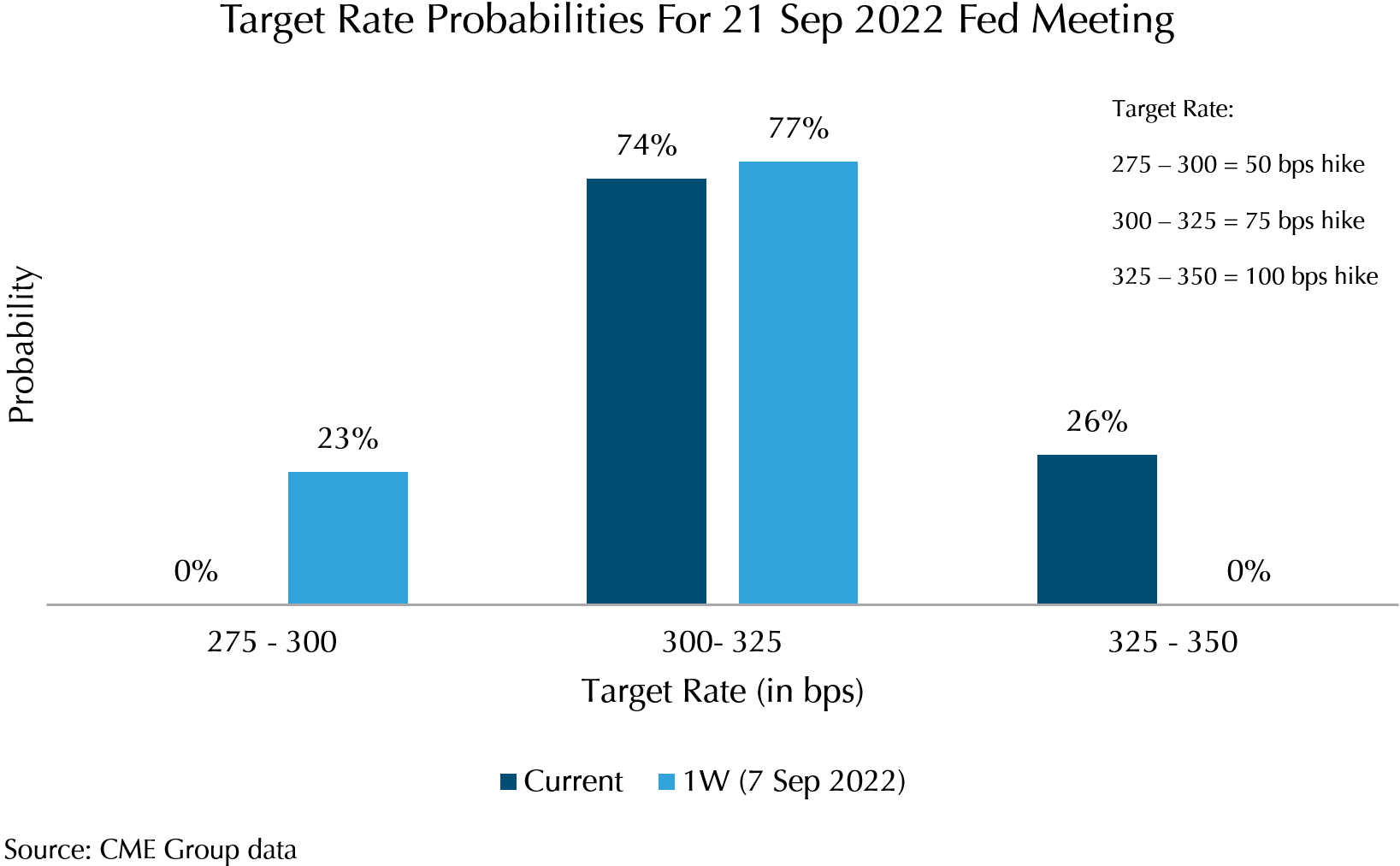

Exhibit 1: Interest rate probabilities for 21 Sep 2022 Fed meeting

Looking at Exhibit 1 above, we can see how the market was viewing the interest rate decision by the Fed prior to the CPI release and after that. The light blue bars show the probability of the interest rate rise on 7 September, while the dark blue bars show the probability after the release of the August CPI.

Before the August CPI was released, the probability of a 0.5% hike was 23%, and the probability of a 0.75% hike was 77%. After the CPI came out, the probability of a 0.5% hike went to 0%, and instead, the market started to think about the possibility of a 1% hike at 26% probability.

The most likely outcome is still a 0.75% increase in the interest rate on 21 September, but now stocks have to price in the possibility that interest rates might go up by 1% instead, leading to sharp falls in stocks, especially the growth stocks that are more sensitive to interest rates.

Expect more volatility ahead

While stocks try to price in all available information, every time new information comes out, we are going to see markets move to incorporate the new information in prices. On 21 September, the Federal Open Market Committee (FOMC) will meet to decide on their next rate decision, which at current expectations is around 0.75%. However, what is unknown is the future trajectory of rate hikes. Will the Fed look to raise rates higher than previously expected? Current guidance from the Fed dot plot is for rates to reach 4% by March 2023, however that was from the meeting in July.

Therefore, we expect that markets will be volatile as we head into the close of September in anticipation of the new information about the Fed rate policy.

Keep Calm and Stay Invested

If as expected, markets are volatile in the end of September and headlines become more exciting (i.e., Attention-grabbing), do remember that you are invested in either systematic funds that hold more value stocks, or in index funds that track the market return. Therefore, your portfolio is either falling less than what the market is doing as value stocks have been outperforming in this period, or it is tracking the market. While short-term volatility may be unnerving, we are invested in solid businesses that are focused on delivering long-term profits for shareholders, and in the long term will likely deliver positive expected returns.

As always, do reach out to your adviser should you have any questions. Thank you.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.