April turned out to be yet another fantastic month to be invested in stocks, as stock market returns continued to be strong. One difference for the performance in the month was that value and smaller company stocks took a back seat to growth and large company stocks for the first time in 6 months or so.

With that out of the way, we remind our clients that even if value stocks do not return as much as growth stocks over a period, it does not mean that value stocks have no return. We would also like to highlight that our portfolios are well diversified, and do not just hold value and small company stocks. They do hold the stocks of large growth companies, and also benefit from the performance of large growth stocks. A look at the data below will show that.

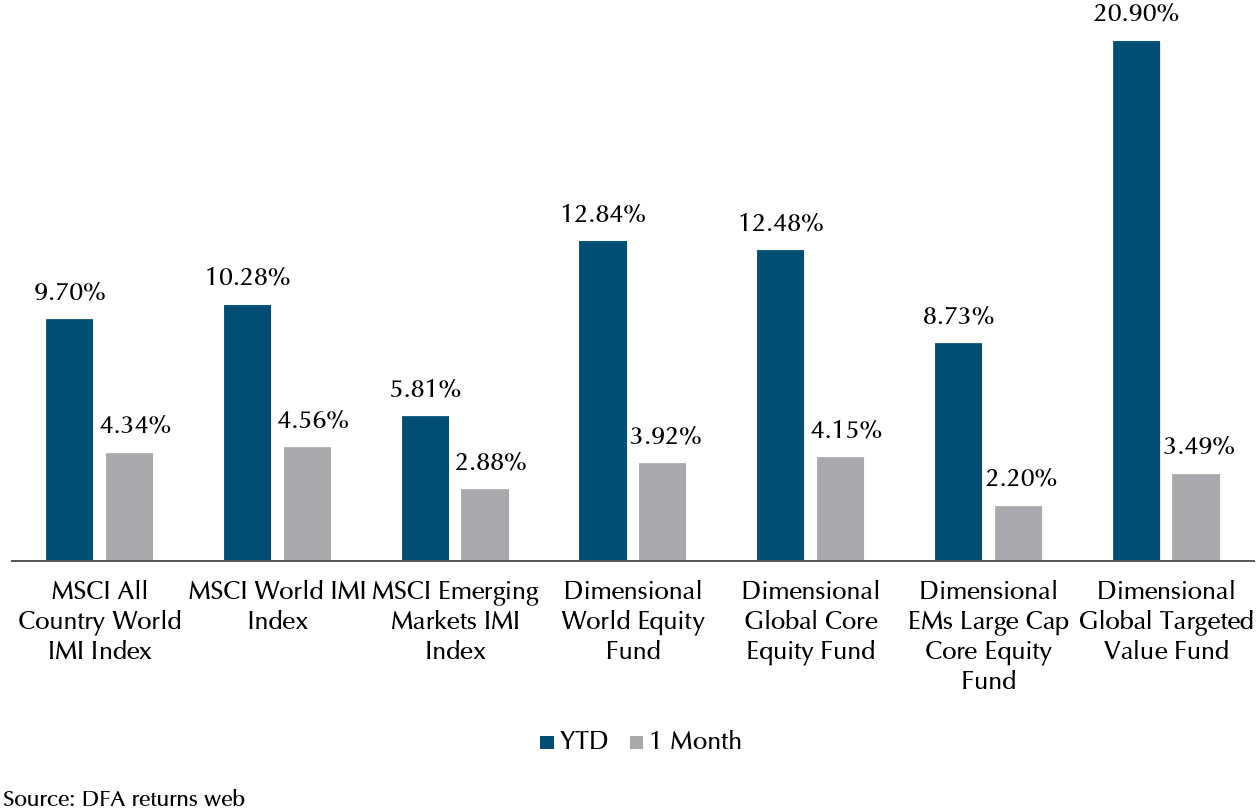

Exhibit 1: YTD and MTD performance of Indexes and DFA Funds (in USD to end Apr 21)

As we can see from the above data, the market indexes, which have more large growth companies, did better than the dimensional funds for the month. Comparing like for like, the MSCI AC World IMI returned 4.3% for the month, while the DFA World Equity Fund returned 3.9%. In contrast, the MSCI AC World IMI returned 9.7% for the year while the DFA World Equity Fund returned 12.84%.

Is the value rally over?

Naturally, this might lead one to ask if the resurgence in value stocks is going to be short lived. We cannot know the future, but what we do know is that the drivers of the recovery for value stocks are still present. As vaccines roll out across the US and UK, their economies are continuing to open up (US 1Q GDP growth was 6.4%). An infusion of fiscal stimulus is also boosting household incomes and likely to boost consumer spending. Coupled with a central bank policy that is likely to allow for some inflation (and higher long-term yields in the process), there is some rationale for expecting the value rally to continue for some time yet.

Our confidence in the value premium comes from the data

Recently, our Senior Advisor Dr Chen Peng wrote an article framing our investment philosophy using 4 pillars (How Providend Helps Affluent Families Have a Good Investment Experience | Providend).

Using the thinking behind Economic Contribution, this is how we look at value stocks. Value is a relative price concept. It is about paying a cheaper price, for a similar set of cashflows. If the long-term valuation or market price of a company is largely driven by its cashflows, then paying a lower price for the cashflows will give you a higher expected return. Using a very simple example, if you pay $5 for $1 of cashflows a year, your return is 20% a year. If you pay $10 for $1 of cashflows a year, your return is 10%. The lower the price you pay, the more likely you are to have a higher return.

Expecting higher returns from value is also supported by the Empirical Observation in the data.

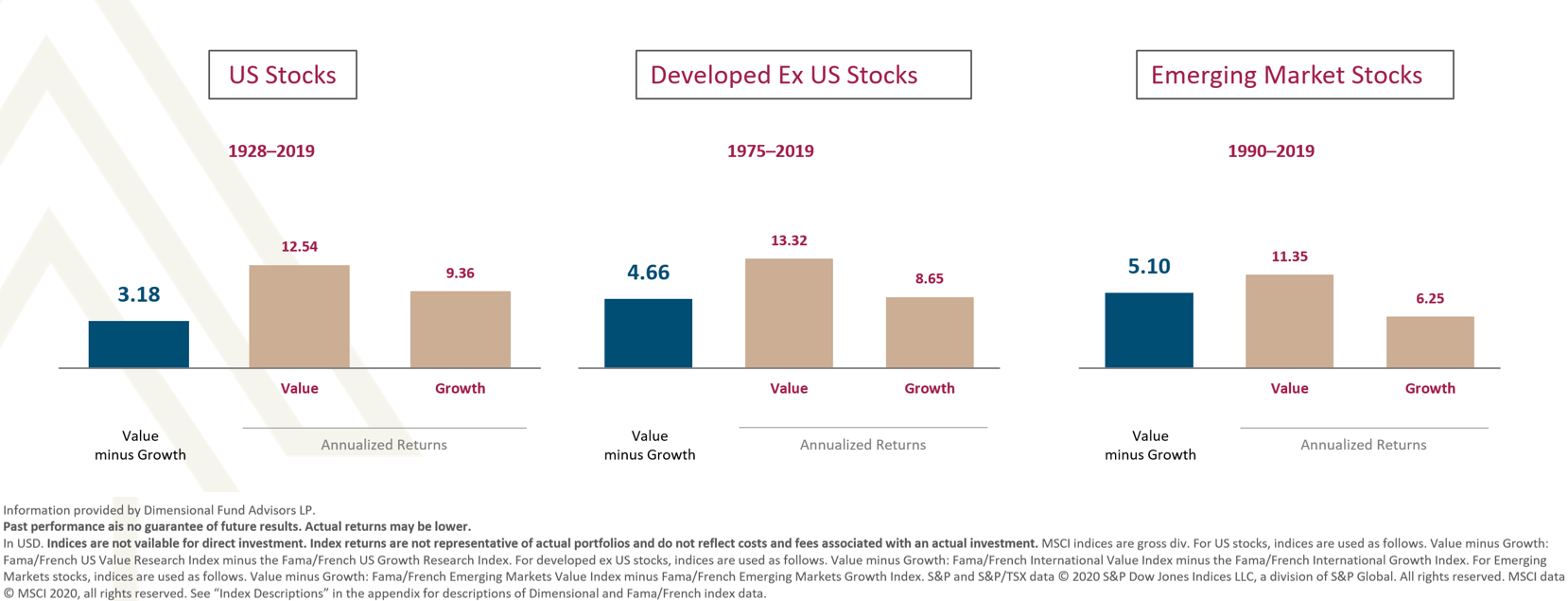

Exhibit 2: Value Premiums for various markets over time

We can see from the data above that investing in value stocks typically generates a return over investing in growth stocks that has been persistent over long periods and across different stock markets.

Diversification helps to hedge our returns

As mentioned earlier, diversification and holding the entire market allows our portfolios to also benefit from the returns of large growth companies. Apple, Microsoft, Amazon and other well known large growth companies are among the top 10 equity holdings of our portfolios.

Even if value stocks underperform (as they did in April), 1) we get a return from value stocks, it is just less than that of growth stocks and 2) our holdings of growth stocks still give us exposure to the higher returns of growth stocks in that period. Returning to the World Equity Fund example, it returned about 0.4% less than the MSCI AC World IMI in April as value stocks did not do so well. For the year to date though, because value stocks have done better overall, it has a 3% higher return than the index.

We feel this is a reasonable trade off to make for higher expected returns over time. Of course, we also have pure Index portfolios available for clients that prefer an entirely passive approach and just the market return.

Covid pandemic still has some way to go

The good news is that Singapore continues to maintain its vaccination pace and is already starting to vaccinate people aged 45 and above. Unfortunately, the virus continues to mutate and as the recent rise in cases locally shows, we are not entirely out of the woods yet.

During this period of tighter restrictions, we encourage our clients to stay vigilant against the virus, and make use of the technological tools available to us to keep in touch with our advisers. We are available on Microsoft Teams, Zoom, WhatsApp, email and phone should you have any questions. Of course if required, we are still available to meet in person. Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.