Developed world stocks continued to rise in August, and Emerging Market stocks rebounded after a tumble in July. Bonds fell as yields ticked up after Fed chairman Jerome Powell comments at the annual Jackson Hole symposium.

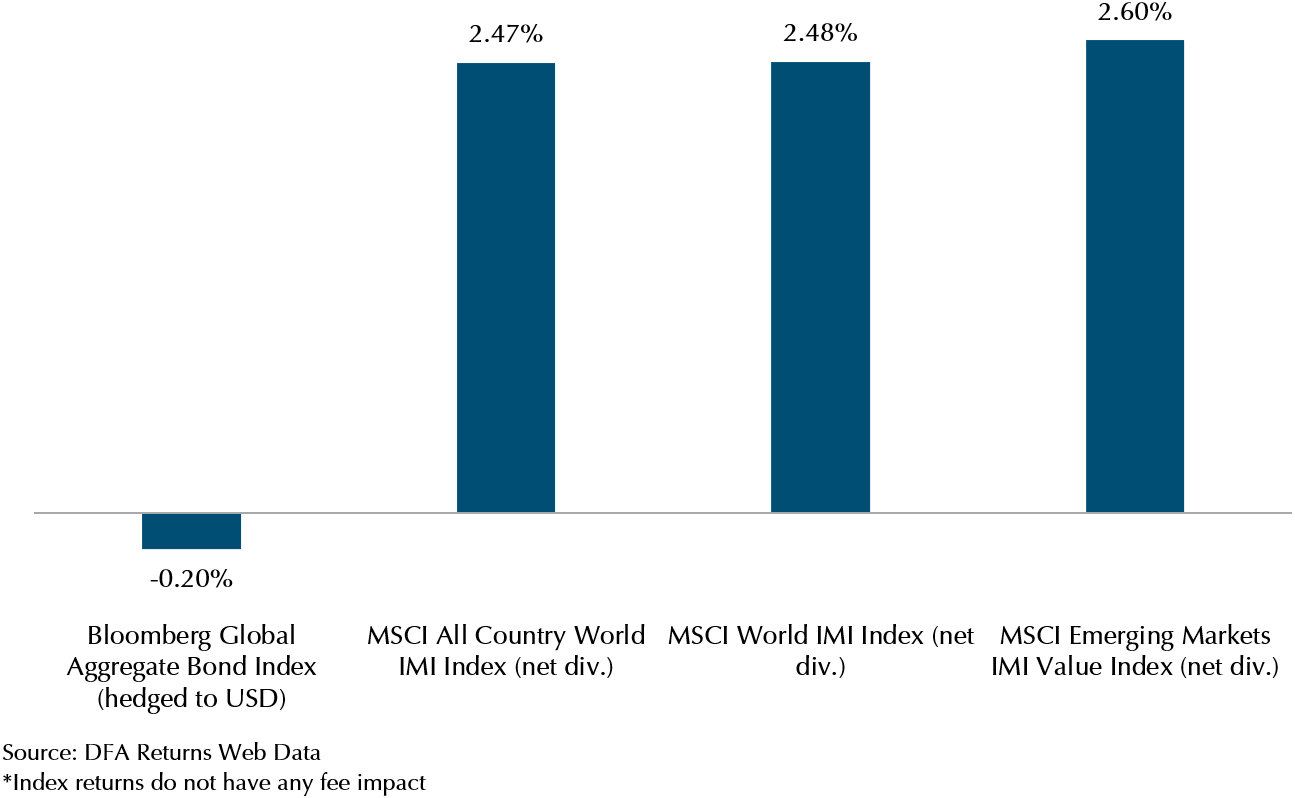

Exhibit 1: Reference index returns August 2021* (USD)

As we can see from the data above, the returns from stocks were strong across both Developed and Emerging Markets. Intermediate bonds fell 0.20% as yields ticked up in the later part of the month as expectations around the tapering of Fed bond purchases were pushed out.

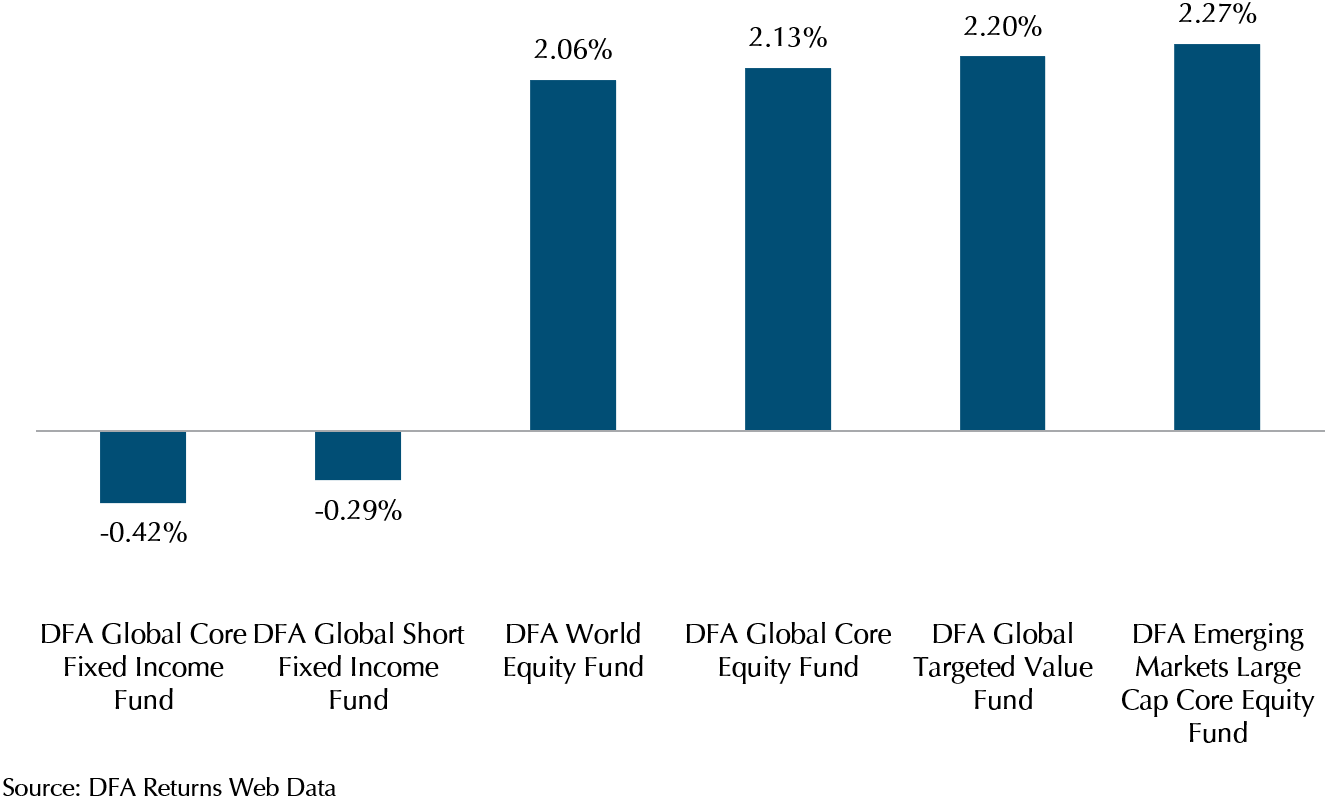

Exhibit 2: DFA fund returns August 2021 (USD)

Dimensional was able to capture the returns from the markets, with the various funds delivering returns close to the reference indexes. Of note, the Global Targeted Value fund had a 2.2% return, outperforming the Global Core Equity fund, highlighting that small company stocks and value stocks had a good month in August. The bond funds followed the general market, falling in August as yields rose. We can see the impact of duration from the difference in performance between the Global Core Fixed Income fund, and the Global Short Fixed Income fund. The Global Core FI fund has a duration of around 7, while the Global Short FI fund has a duration of around 4, a difference of 3. What that means very roughly, is that if yields go up by 1%, the Global Core FI fund will fall by 7% and the Global Short FI fund will fall by 4%. (And vice versa if yields go up).

That’s why for portfolios that require less volatility such as our Balanced portfolio, we allocate to short term bonds to ensure that if there is a spike in yields, we won’t experience large losses in fixed income.

Unpacking Jerome Powell’s speech

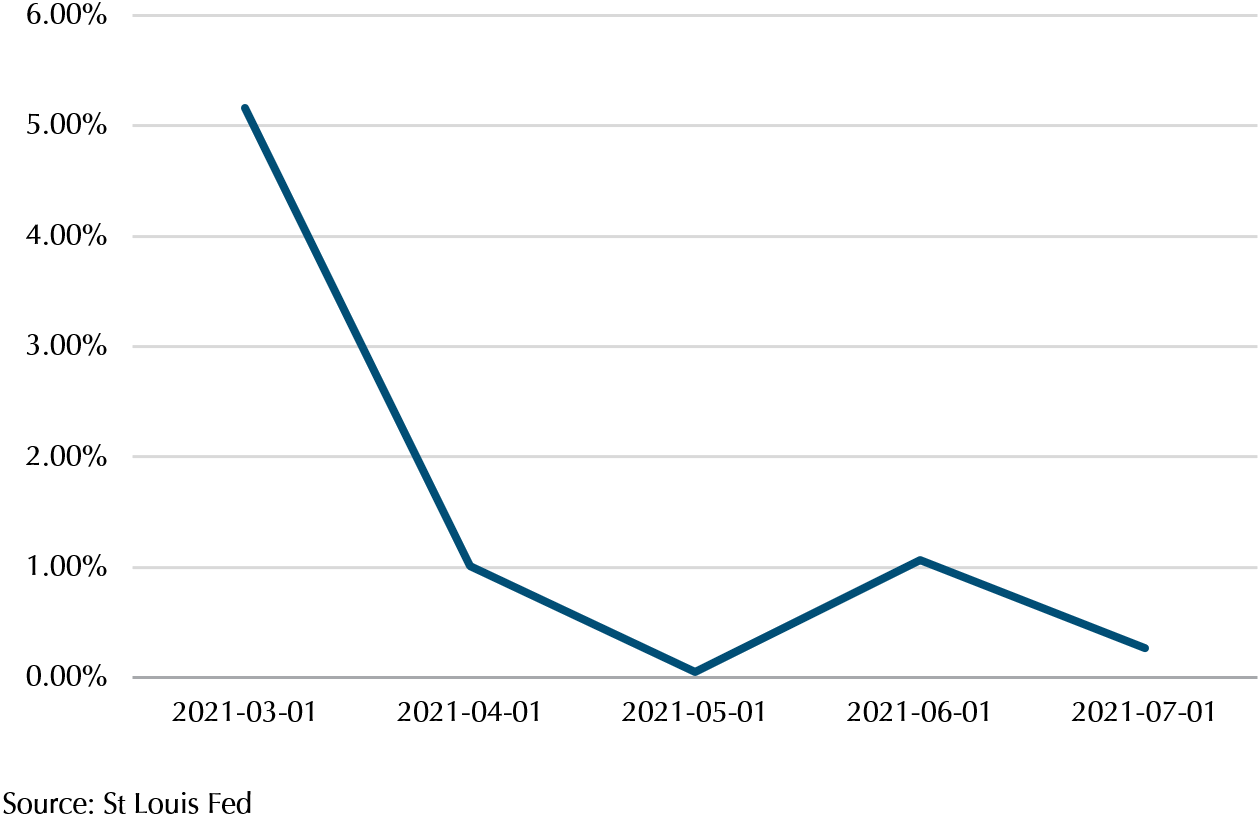

Powell’s speech on the 27th of August was aimed at providing a clear view to the markets on what the Federal Reserve will do next and to align their views that the high inflationary environment is transitory. Released before the speech, July’s PCE deflator data shows that inflation is decelerating (see Exhibit 3), which supports Fed’s narrative that inflation is transitory and their stance to taper at a slower pace on the current 120 billion USD monthly bond purchases.

Exhibit 3: US PCE rate of change

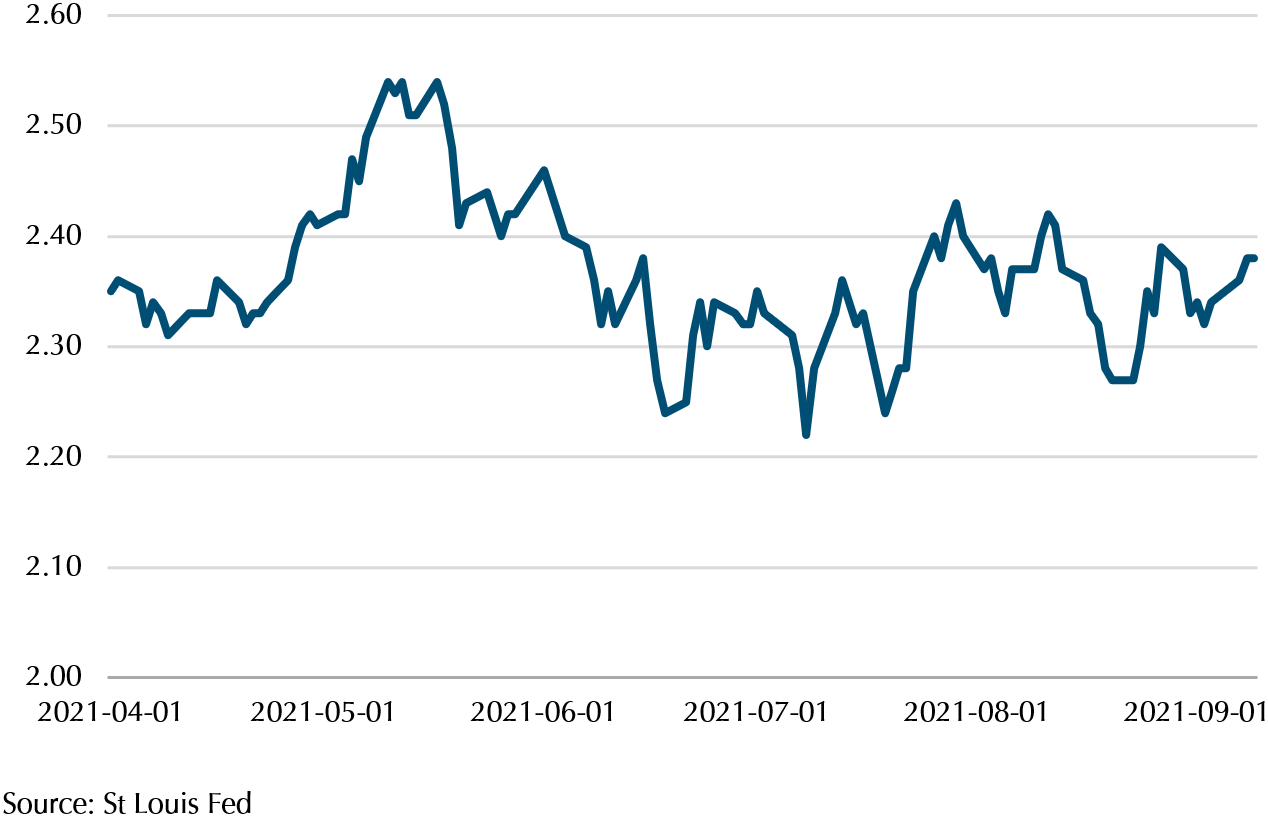

Looking at another piece of data, the 10-year breakeven inflation rate, we can see that it has held fairly constant below 2.4% in the past few months after hitting a peak of 2.54% in May. (See Exhibit 4)

Exhibit 4: US 10-year inflation breakeven

This highlights that the market is not expecting inflation to be going up a lot more from this level (with the current information available). Given the calmer reaction of the bond markets to the speech, it appears that there will not be a repeat of the 2013 taper tantrum (for now!).

In his speech, Powell also highlighted that taking a longer time to respond to economic indicators, like inflation, is more beneficial. We feel that this is sensible as there are some factors which are driving up prices that might prove to be transitory. For example, supply chain disruptions are pushing up prices and keeping them higher, giving a façade that inflation is here to stay. The resurgence of covid in Asia has disrupted supply chains resulting in demand outstripping supply in various markets. In the auto sector, for example, major auto companies have reduced output in cars due to shortage in semiconductors, a crucial part for cars. Toyota announced reduction of global car production by 360,000 this year on 19th August as exacerbated by the covid-19 outbreak in Thailand. News like this will continue to drive up not only primary car market prices but also prices in the secondary market. However, once the supply chain bottlenecks are resolved, we are likely to see prices either moderate or fall.

By taking a longer time to react to inflation data, the Federal Reserve will not make sudden changes to existing policy due to supply chain disruption. This will hopefully allow them to adequately prepare the market for when interest rates rise, which is not likely to be soon, as the Fed Chair also indicated that any tapering of asset purchases will not be linked to interest rate policy which remains at a 0 fed funds rate.

Conclusion

While we do watch the economic data for an idea of where asset prices might be headed, we do know that attempting to predict where markets are headed is usually not a consistent way to capture returns.

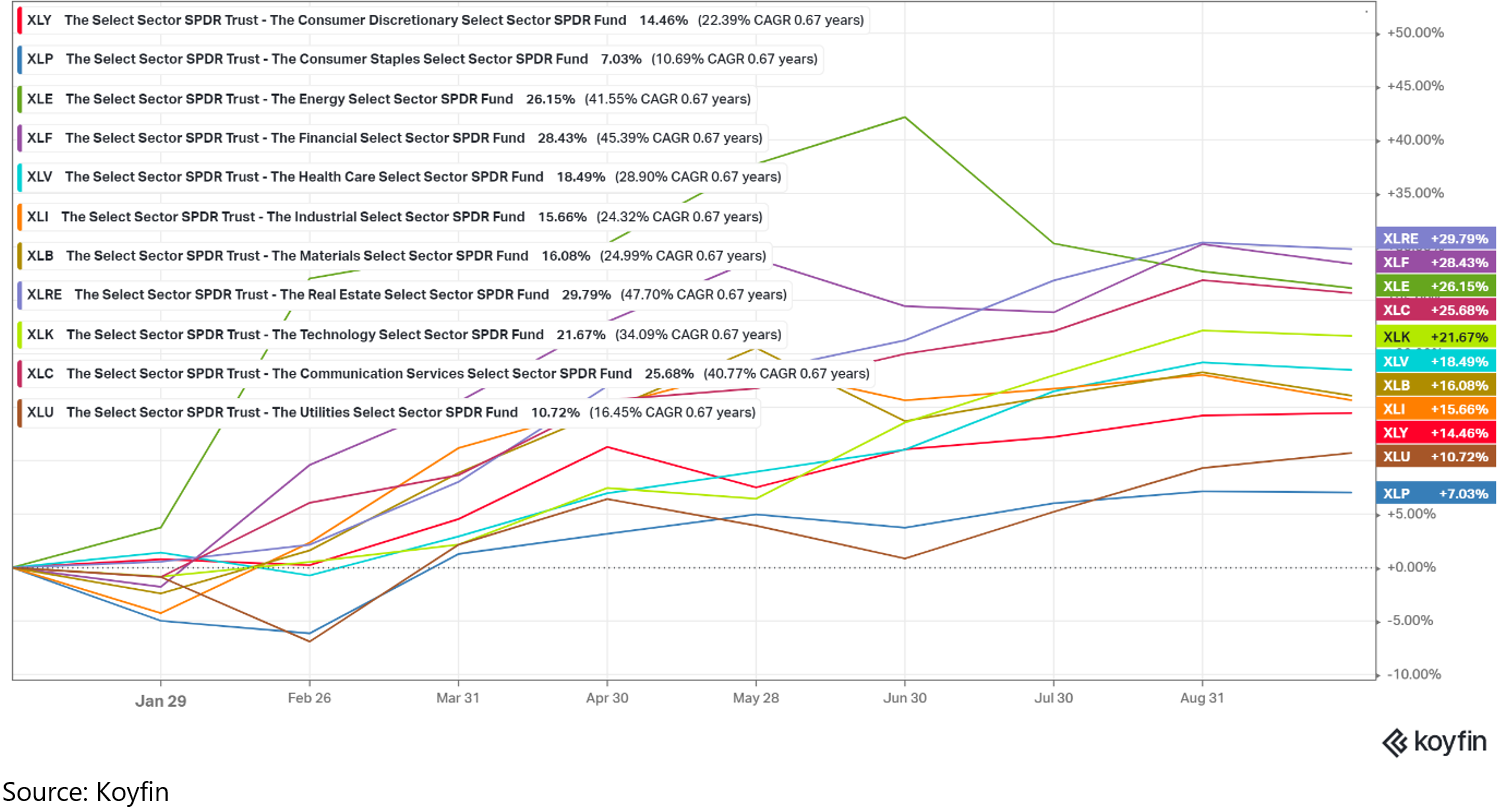

Exhibit 5: Sector performance YTD US stocks

After all if we look at the chart above, we can see that top performers like tech last year, are not doing as well as energy this year, so it is hard to consistently get markets, sectors or stock picks correct.

Therefore, we believe our globally diversified portfolios are sensible to consistently capture the market returns, and deliver on a successful wealth plan for our clients.

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.