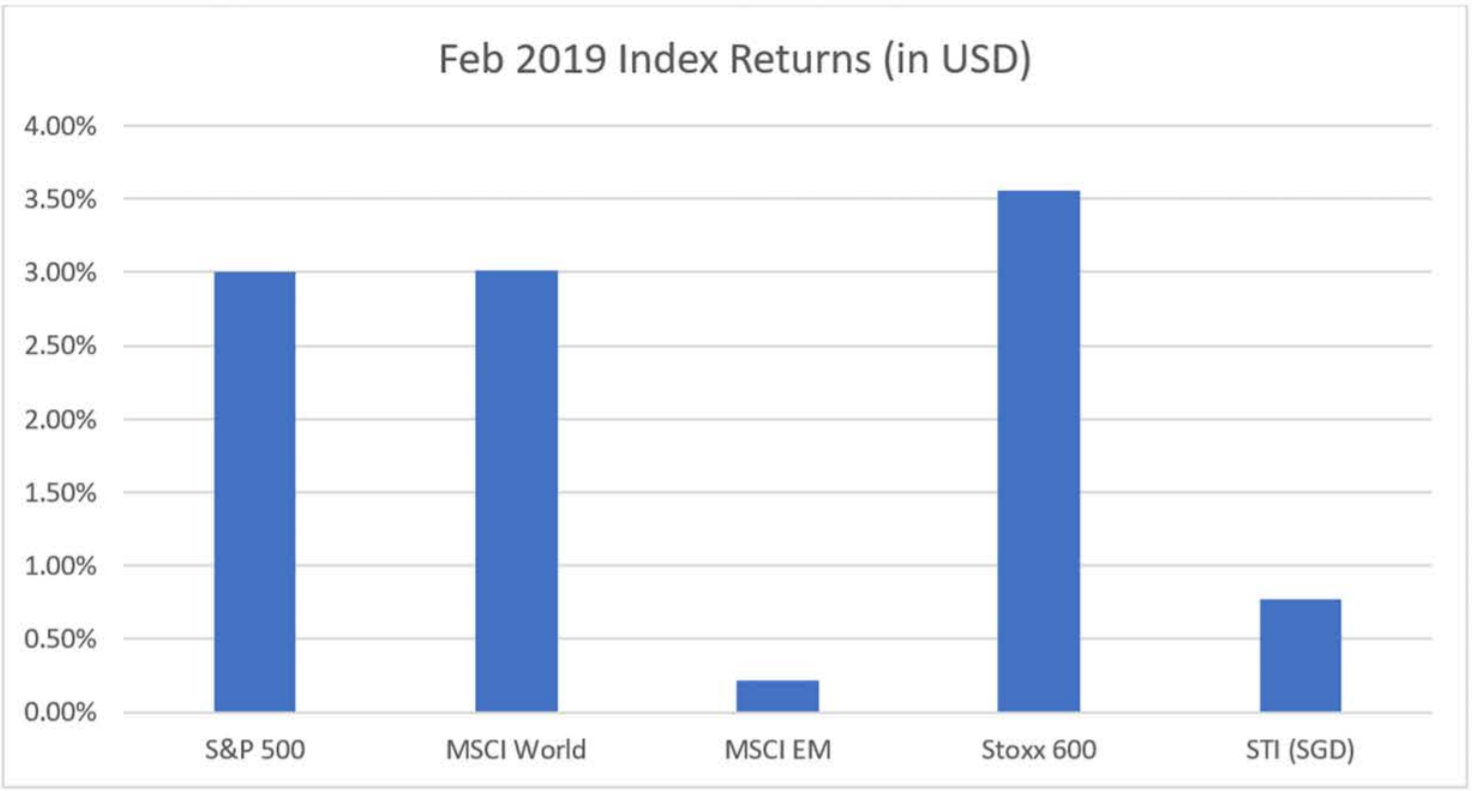

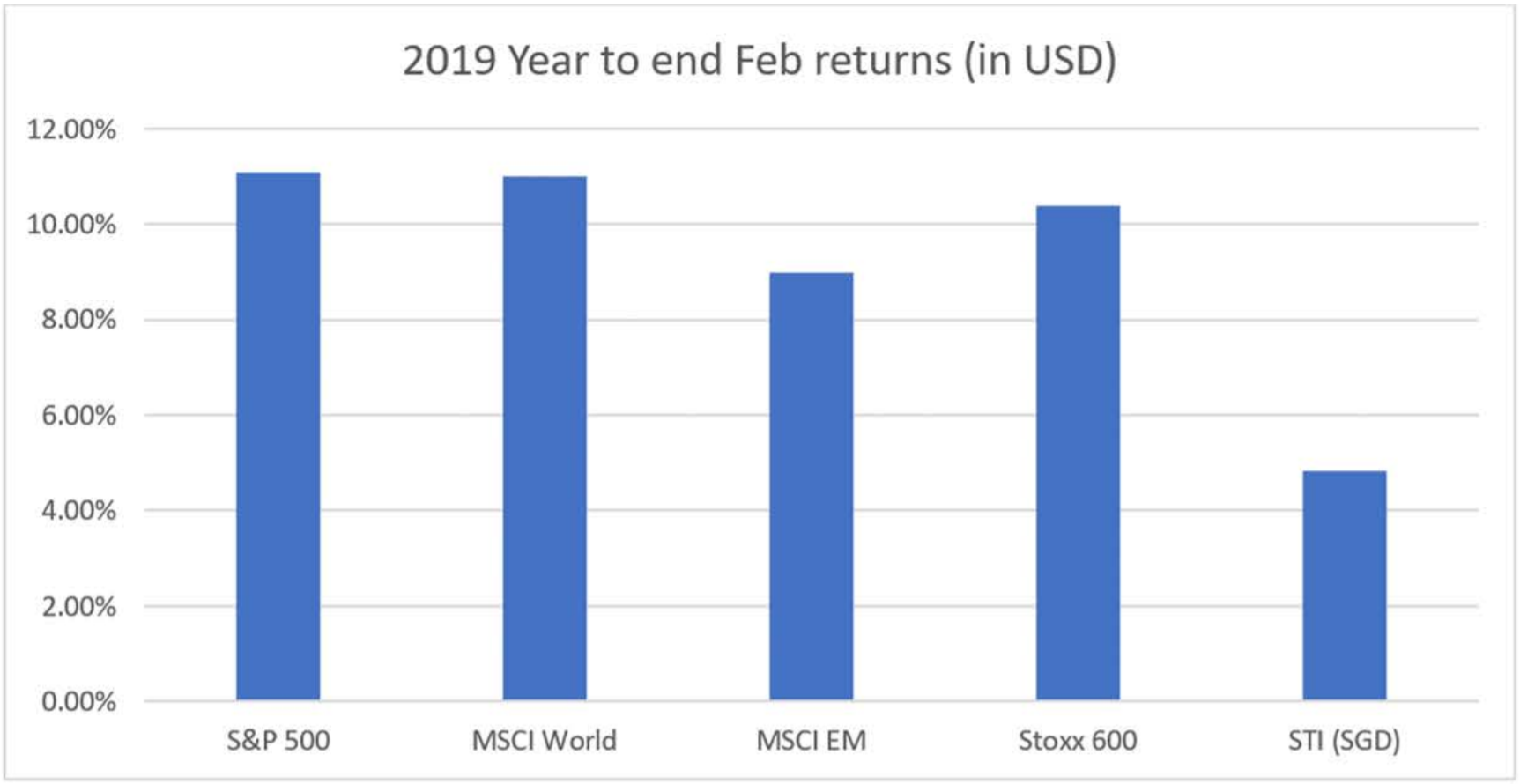

The S&P 500 closed February with its longest losing streak in 2019 of 3 days. It might sound a little gloomy, but this has been the best start for the index since 1991. The chart below shows developed world markets continuing to extend gains into 2019, while the rally in EM has spluttered after a strong start to 2019. The STI overall has been sluggish in Feb, while Europe (Measured by the STOXX 600 Index) has been the surprise package of 2019, extending gains to almost match the S&P 500 and MSCI world so far in 2019 after being largely ignored by investors. (Europe has suffered overall net outflows since Mar 2018)

We quickly look at 2019 performance and note the healthy recovery markets have had since Christmas Eve. In fact, the S&P 500 is just 4-5% off its record high set in 2018. As we have discussed with our clients many times prior, we cannot predict market recoveries, nor can we predict which markets will perform best at any given time. Thus, we constantly encourage our clients to invest in globally diversified portfolios, and also to stay invested to capture the return premiums.

What has been supporting the market rally? It was just 2 months ago that the world was expecting the worst, with economic growth slowing, company earnings falling, and geopolitical tensions rising. Economic growth is slowing. The US reported annualised GDP growth of 2.6% in the 4th Quarter, down from 3.4% and 4.2% recorded in previous quarters. China’s growth has slowed to 6.6% in 2018, the slowest pace in 28 years.

Company earnings have been mixed. Wal Mart reported good news, with same-store sales growth of 4.2% (3.2% expected), and EPS and revenue both growing and beating expectations. This helped to lift some of the gloom around retailers after weaker US consumer sales data was reported for December (falling 1.2% from Nov, a surprise during the Christmas shopping season). Kraft-Heinz wrote down $15 billion of its brand value and cut its dividend by 30% on slower than expected growth, dragging its stock down about 30% on the news.

Geopolitical tensions remain. The conflict has reignited on the Kashmir border shared by India and Pakistan. The US and North Korea failed to reach a deal on de-nuclearisation in a much anticipated 2nd summit in Vietnam.

Despite this, the markets have recovered mostly due to support from central banks and the prospect of a reduction in trade tensions between the US and China. After weeks of negotiations, the US and China have come closer to a trade deal to avert the prospect of the US raising tariffs on Chinese goods to 25%. The progress in talks has allowed the scheduled tariff increase to be suspended until further notice.

The Fed has also switched to a more accommodative stance. After signalling a pause in rates, the Fed has also discussed ending its balance sheet reduction plan this year. In the years post 2008, the Fed was buying bonds for its QE (Quantitative Easing) programme. This has grown the balance sheet to a peak of $4.4 trillion. AǼter ending QE, the Fed has started to shrink their balance sheet, so far allowing $400 million worth of assets to mature without being replaced. A pause in the runoff will be accommodative for monetary policy, and this has been reflected in the falling 10-year yields, which have hovered around 2.7% since the start of 2019. The European Central Bank (ECB) has also not moved to raise rates, currently at -0.4% despite ending its own QE in Dec 2018.

2019 has so far started well, and while risks are always present (there is no return without risk), we understand that to capture the returns we need to be invested and to keep the focus on the financial goals that we are trying to achieve. Investing in a diversified global portfolio that delivers market returns will help us participate in the returns that allow us to reach our goals.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.