Are stock markets not seeing the economic reality?

Stock markets continued to rise in July, led by the major tech companies that turned in strong results for 2Q 2020. Apple, Amazon, Microsoft, Facebook and Google all reported their results, and aside from Google, the other 4 reported strong results that saw their stocks rising to new highs over the month.

- July also saw the US report an almost 10% YoY decline in GDP for the 2nd quarter, as the effects of the pandemic and the economic shutdown across the world started to bite. How do we make sense of a rising stock market and struggling economy? Let’s take a closer look at the data and find out.

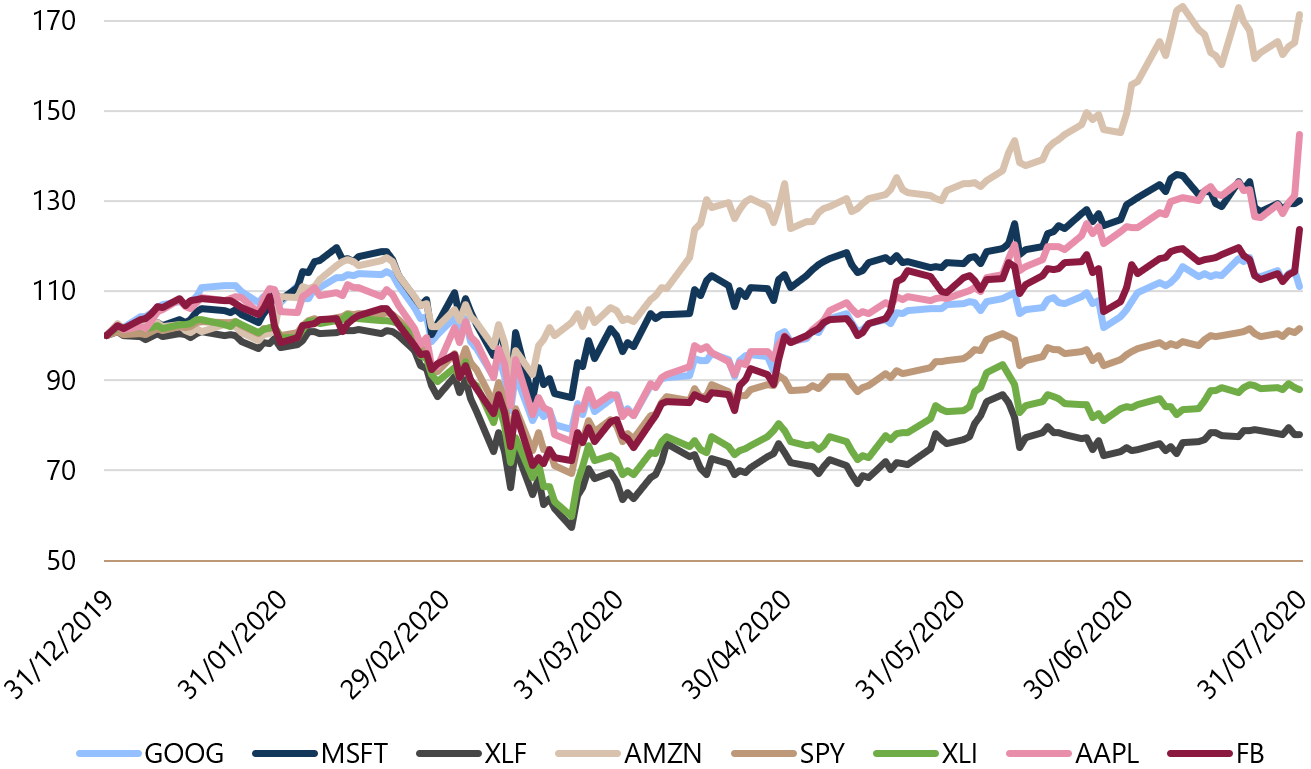

Exhibit 1: YTD performance of major tech stocks vs S&P 500 and Industrial and Financial sectors

From the chart above, we can see that industrials and financials (represented by XLI and XLF respectively) are still below where they started the year, which reflects the economic reality. Manufacturing of heavy machinery and capital goods has slowed because businesses are not investing due to the uncertain environment (and uncertain cash flows they are facing). Banks are setting aside huge sums for bad loans provisions. Wells Fargo set aside US$9.5 billion to cover potential loan losses due to the pandemic in their 2Q results. It’s not surprising then that the XLF ETF that tracks stocks in the financial sector is the worst performer in the chart above. (-21.93% YTD as of 31 July).

The major tech stocks though, are all up between 10-70% YTD and have become some of the largest companies in the world despite the pandemic. Yet, this is not surprising as their results have shown that their businesses have been less affected, or in some cases enhanced by the changes the pandemic has caused. Microsoft revenues rose 13% YoY as businesses moved to the cloud more quickly to embrace working from home during the pandemic. Apple reported strong growth in their services and solid iPhone sales, showing that demand for their products and services are not affected by the pandemic. Amazon has been the big winner, as consumers have moved to e-commerce for their groceries and shopping during the pandemic, and demand for their cloud services has grown even more as businesses shift to working from home, pushing the stock up 70% YTD.

Markets are still efficient

Having looked at the data, we can conclude that the markets are still efficient, as the prices are reflecting the economic realities of the various sectors and companies. Tech companies are doing well (and dragging indexes higher) as their businesses are doing well despite and maybe because of the pandemic. Industrials and Financials are not doing well because of the pandemic, and their share prices reflect that too.

What does that mean for our portfolios?

The good news is that having a globally diversified portfolio means that you are going to have a high probability of owning the best performing stocks of any period.

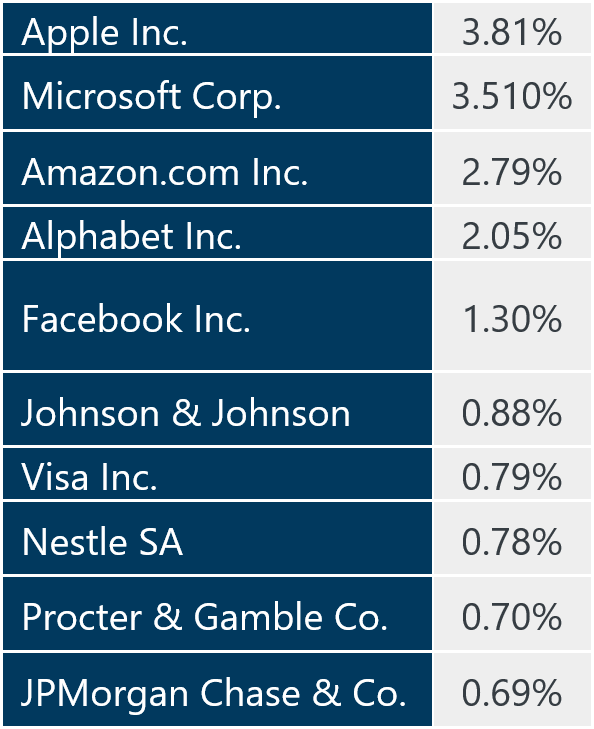

This is the list of the top 10 holdings of the Dimensional Global Core Equity Fund, and the Vanguard Global Stock Index Fund. These 2 funds make up the largest allocation of stocks for our Index Plus and Index portfolios.

Exhibit 2: Top 10 holdings of Dimensional Global Core Equity Fund

Exhibit 3: Top 10 holdings of Vanguard Global Stock Index Fund

As can be seen from exhibits 2 and 3, all five companies mentioned above (Facebook, Microsoft, Apple, Google (Alphabet), and Amazon) are in the top 10 holdings of our largest equity allocation. That means our portfolios have been benefitting from the rise of these stocks during the pandemic. As we have mentioned before, and it’s worth mentioning again, diversification does not just help us reduce risk, but it helps us to capture the returns of the best-performing stocks in any period.

A note on our portfolio rebalancing in July

As you have probably noticed, we are rebalancing our portfolios back to the model weights. A regular rebalancing helps to 1. Ensure that your portfolio is at the model weights so that 2. The return profile of the portfolio is consistent with the intended asset allocation.

We usually try to rebalance our portfolios in May, but due to the market volatility in May, we decided to avoid trading and waited for a period of calm in the markets to begin the process.

For this rebalancing, it is likely that you will be selling some fixed-income assets as bonds have gone up since our last rebalancing and buying stocks as stocks have gone down since our last rebalancing.

This is not increasing your risk but instead restoring the intended risk level when you started your portfolio. For example, in a 60/40 balanced portfolio, it is likely your bonds are now around 42% of your allocation and your stocks are 58%, so the rebalancing exercise will sell 2% of bonds and buy 2% of stocks to bring you back to 60/40.

DFA Global Core Fixed Income Fund

We are adding the DFA Global Core Fixed Income Fund to our Index Plus Balanced and Growth portfolios. For the Balanced portfolio, this fund will replace the Global Short-Term Investment-Grade Fixed Income fund. For the Growth portfolio, this fund will be the entire fixed-income allocation.

The Global Core Fixed Income fund is an intermediate duration fund that intends to get a similar or higher return than the Bloomberg Barclays Global Aggregate Index, targeting both the term and credit premiums. As an intermediate duration fund, it will hold bonds with maturities from 5-15 years (term premium) and has the flexibility to hold investment-grade corporate bonds (credit premium).

Regarding the reference index, The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. This is the most widely followed index on Global investment-grade bond returns in the world and is considered the return of the fixed income asset class by most investors. Investing in this gives a broadly diversified exposure to the world’s investment-grade fixed income.

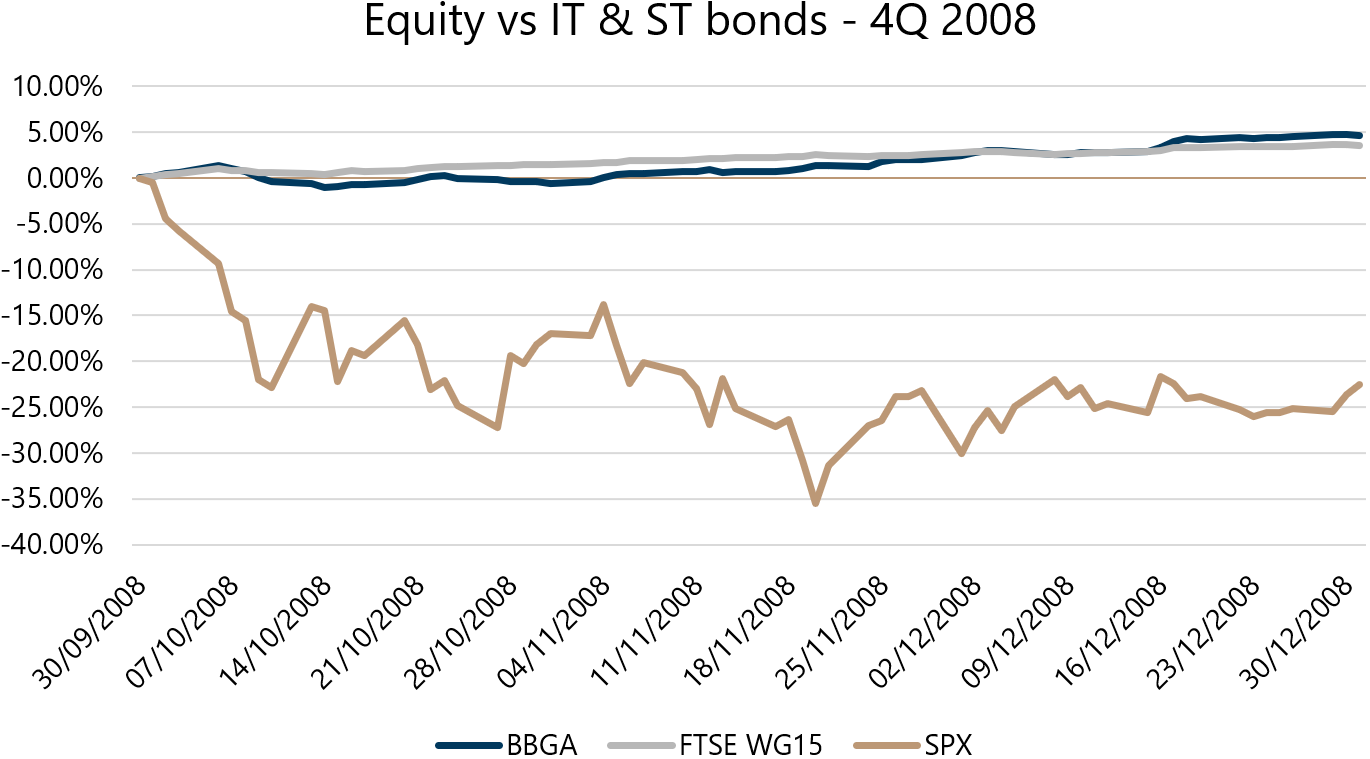

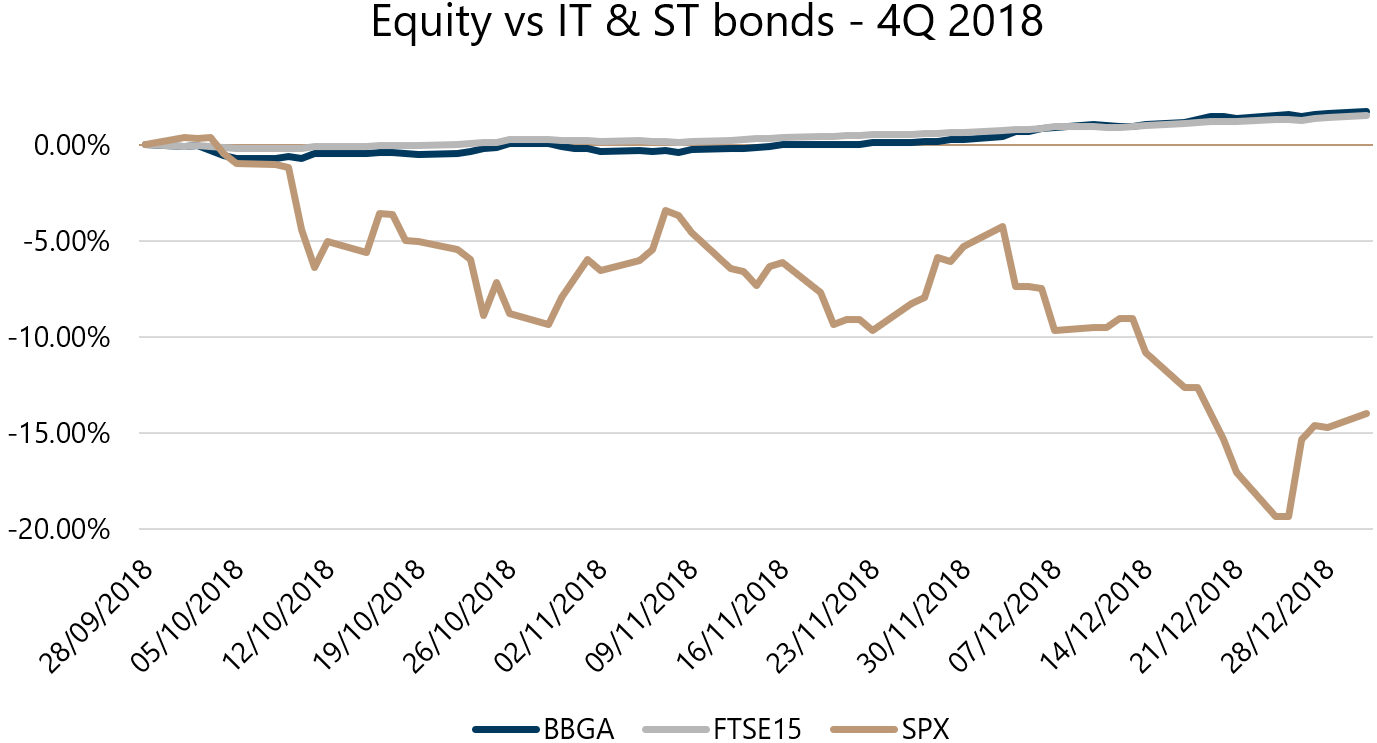

Investing the Global Core Fixed Income fund will improve the expected returns of fixed income, as the longer duration means yields and capital gains from the fixed income have the potential to be higher than the short duration bond funds. Yet this fund does not significantly add to the volatility of the portfolios and still provides a defensive position for the portfolio in times of market stress.

Exhibit 4: Intermediate bonds (BBGA) vs short duration bonds (FTSE) during periods of equity market (SPX) stress.

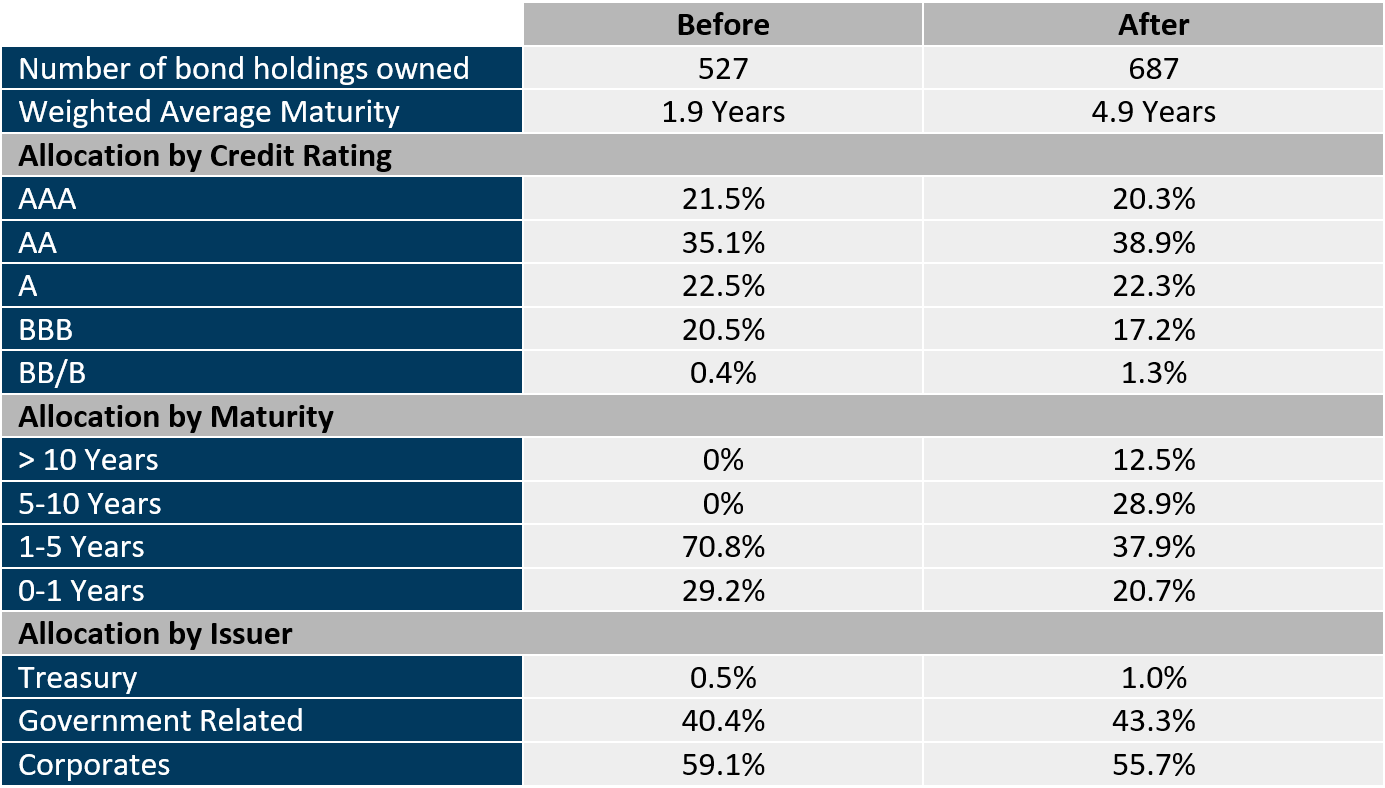

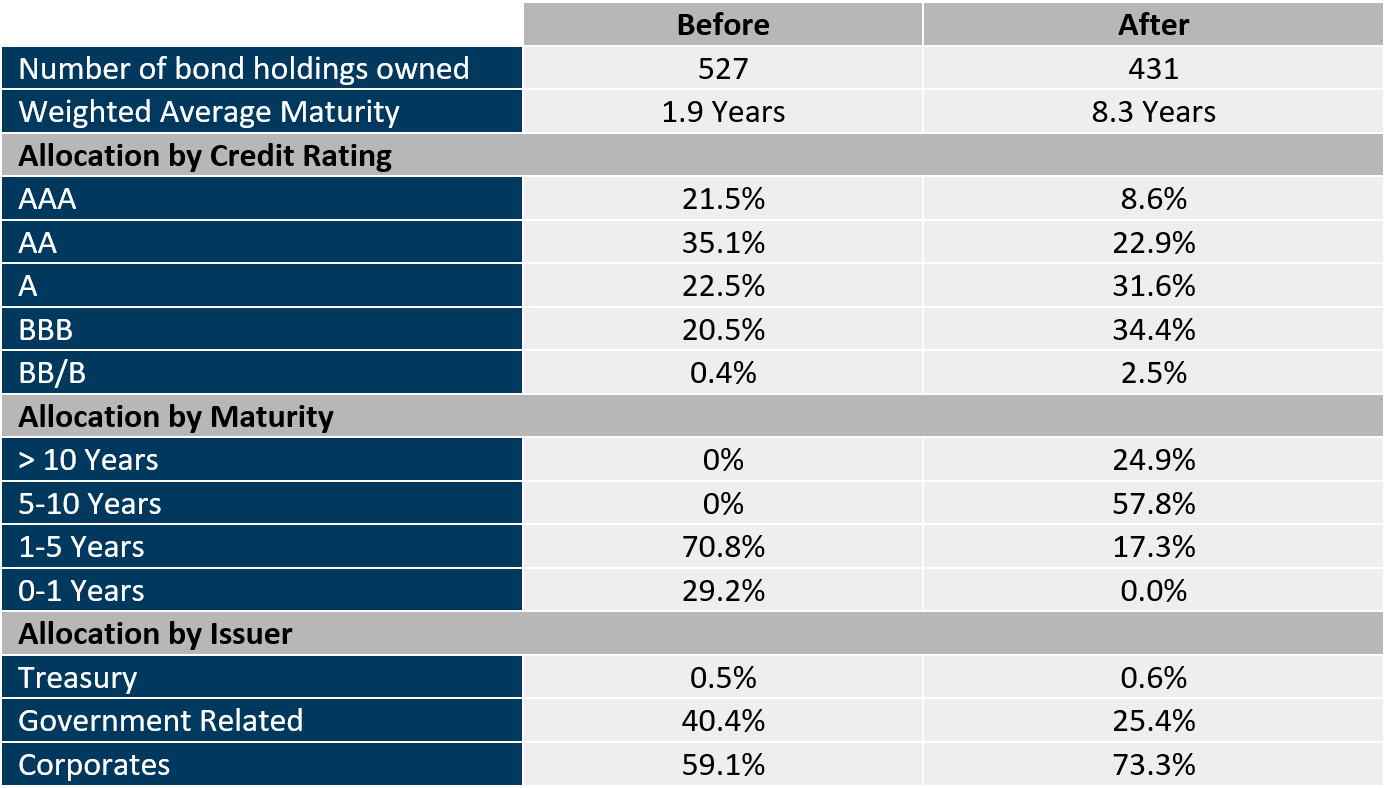

As we can see from the charts above, intermediate bonds are also an effective way to preserve portfolio value in times of stock market stress, with higher expected returns. Below we have a breakdown of the changes to the fixed income allocations of the Index Plus Balanced and Growth portfolios before and after the switch.

Exhibit 5: Index Plus Balanced Portfolio before and after switch

Exhibit 6: Index Plus Growth Portfolio before and after switch

Stay invested and focus on your financial goals

Stock markets are still efficient, with prices reflecting the long term cashflows of companies in different sectors. Our diversification allows us to benefit from the best performers, and our fixed income allocation allows us to reduce portfolio volatility, helping you stay invested.

As always, if you feel your financial situation or goals have changed, please give your adviser a call and set up a meeting to discuss it with them.

Last but not least, here’s wishing all our Singaporean clients a very Happy National Day!

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.