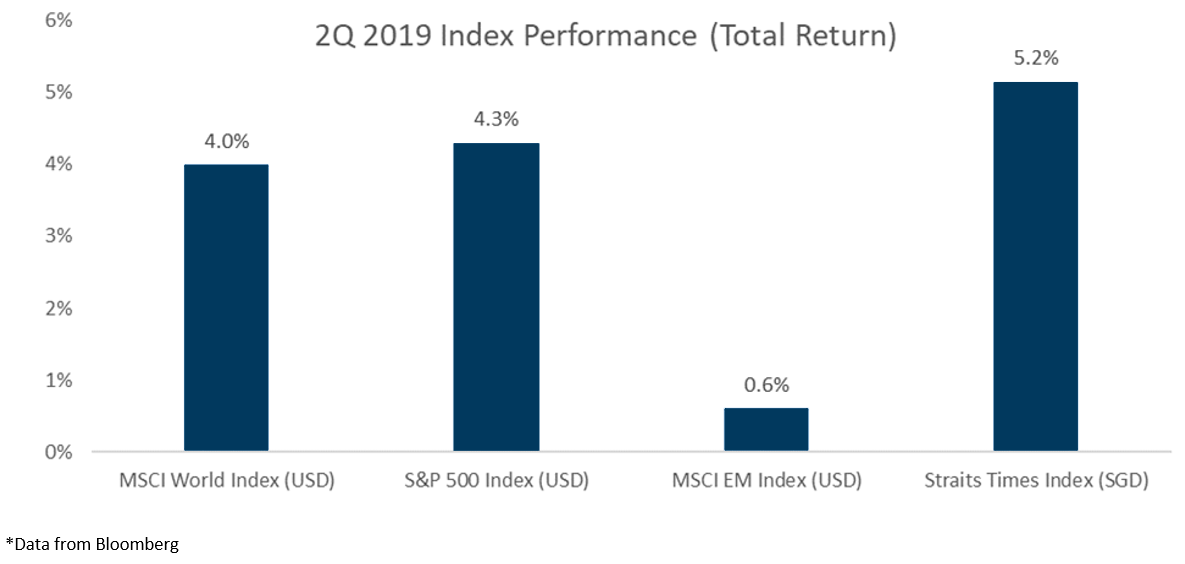

As the first half to 2019 draws to a close, the equity markets are celebrating one of the best first-half performances for a year in a long time. In fact, the S&P 500 has posted its best first-half start to the year in 22 years, according to news headlines. Looking at the second quarter (Apr-Jun) performances more closely, Global Equities had a good quarter, with the MSCI World and S&P 500 up about 4% for the quarter. Emerging Markets had it tougher, up about 0.6% for the quar-ter. The STI Index outperformed with a 5% return over the period as Singapore Equities caught up after a slow first quarter*.

Looking back to just a month ago, it would have been hard to imagine these headlines after equities fell 6% in May. The mood then was not so euphoric, that’s for sure. I am sure you must be wondering what has changed this month for markets to go back up.

First, we have the major central banks turning dovish again. Prior to June, the Fed had largely committed to keep rates steady or even raise them in the future as economic growth seemed on track and its main concern was to prevent the economy from overheating. The ECB had also ended their QE (quantitative easing) program at the end of 2018. In a big reversal in June, the ECB mentioned that further interest rate cuts were possible to boost inflation. Two days later, the Fed lowered its rate outlook for the rest of the year, bringing up the possibility of a rate cut later this year if the economy were to falter.

Next, we also have a resumption of negotiations to end the trade war between the US and China after talks broke down in May. After much uncertainty, a meet-ing between President Trump and President Xi at the G20 has managed to revive the discussions, and this has provided another reason for markets to recover some optimism that the global economy can get back on track.

At Providend, we have been sharing that it is very hard to time the markets and that staying invested in a long-term diversified portfolio is likely to lead to a more successful investment experience. The events of the past quarter alone highlight that it is very difficult to anticipate the market movements, as we have had a strong April (leading to new S&P 500 records), a big drop in May and then a recovery in June that has seen even higher closes for indexes (S&P 500 with an even higher record close).

To highlight how challenging it can be to time the markets accurately, let’s look at the probabilities. For example, for 2Q 2019, you would have wanted to buy at the end of March, sell at the end of April and buy at the end of May. If you have a 70% chance of making the right decision at each step (which is very good!), what is the probability that you make all three right decisions in a row? 0.7×0.7×0.7 = 0.343 or 34.3%. Suddenly the odds don’t look so good anymore.

Instead, if you had invested in a diversified portfolio of just equities, you would have made about 3-4% over the quarter, and if you are a Providend client, you would have had a competent adviser to guide you through the emotional roller coaster that you might have experienced in May.

We encourage our clients to continue to look at the long-term track record of equities and fixed income and focus on their financial goals with our advisers. Thank you for your continued trust and support and do contact your adviser if you have any questions.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.