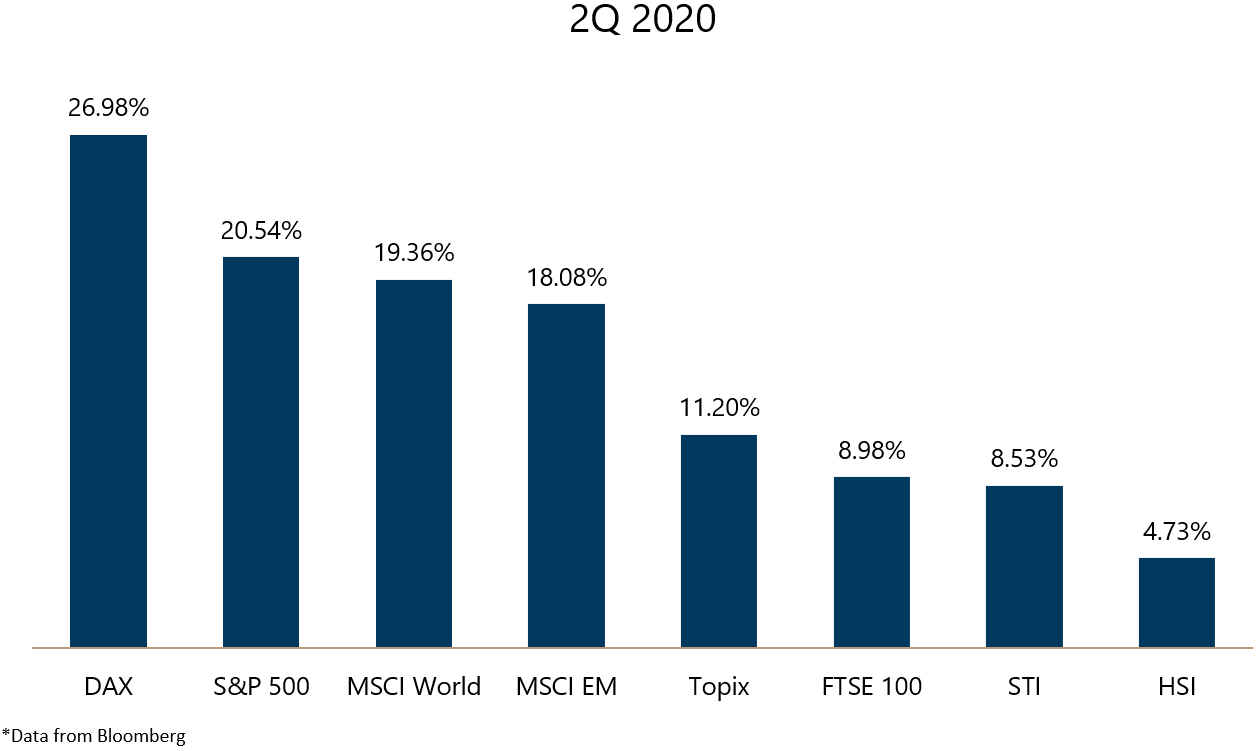

Stock markets lost some momentum going into June, with the S&P 500 up only 1.8% for the month after a blockbuster April and May. Emerging Markets picked up the slack by rising over 7% in June after a slower April and May. Regardless, the second quarter of 2020 has been stellar, and the best performance for the S&P 500 in a second quarter in 20 years.

Stocks rebounded strongly in 2Q 2020 (returns in USD)

Diversification improves returns

It is worth highlighting again the role diversification plays in enhancing returns. Looking at the data above, we can see how the major developed markets performed in comparison to the MSCI World (the global equity benchmark) and MSCI EM (the emerging market benchmark). Stocks in Japan, the UK, HK and Singapore all underperformed the broad MSCI World Index, while stocks in Germany and the US outperformed.

This supports the case for holding a globally diversified portfolio as compared to one that is concentrated as it allows the portfolio to maintain exposure to the best-performing stocks globally at any time. We also look to diversify into higher expected return emerging market stocks, and that has also done well this quarter, outperforming many of the larger developed world stock markets.

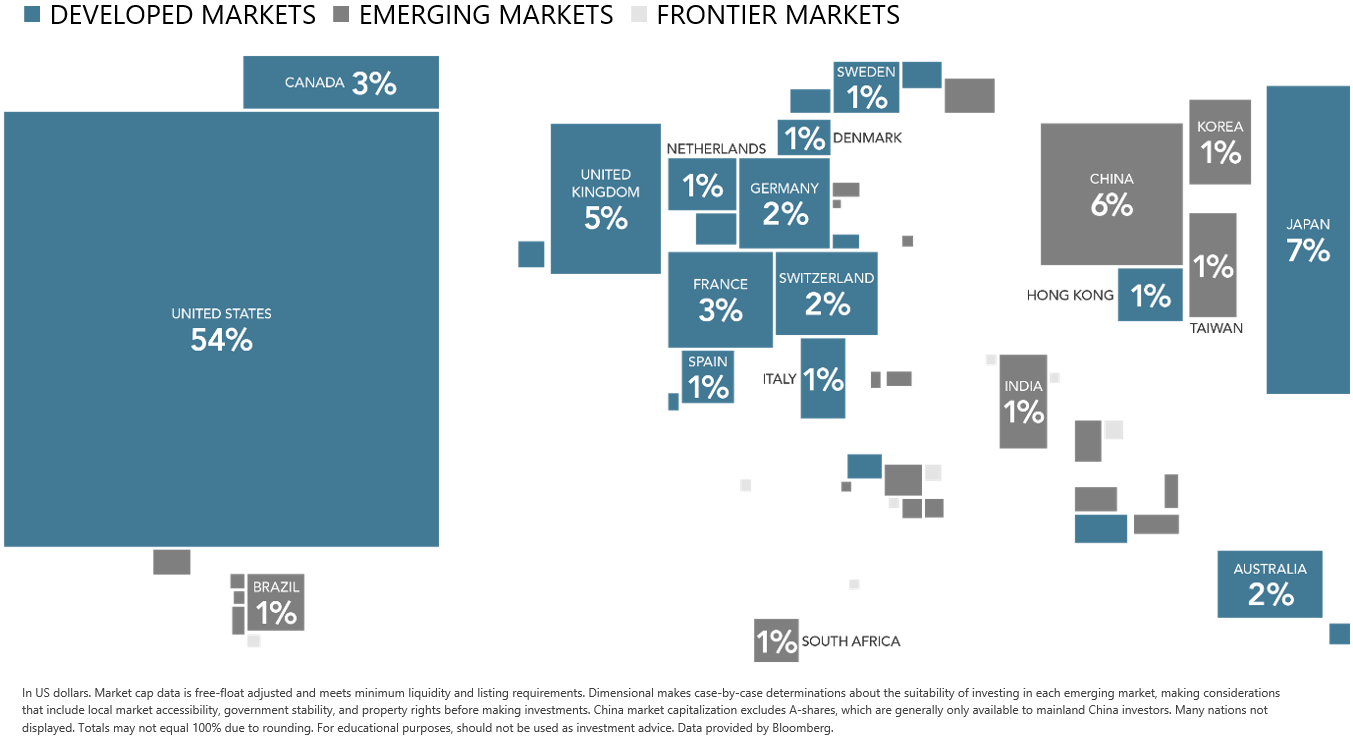

There is a huge global opportunity in stocks to invest in the best companies from all over the world, and this will give our portfolios the chance to capture the returns from the world equity markets.

There is a huge global opportunity in stocks. (Percent of world market capitalisation as of Dec 2019)

What do we make of the rally in 2Q 2020?

Across most of the developed world (and many emerging economies), workers spent a large part of 2Q 2020 working from home due to various social distancing measures governments put in place to combat the COVID-19 pandemic.

This has led to a huge fall in economic output as some jobs (such as manufacturing) and some industries (eg. Travel and hospitality) are incompatible with working from home. The data coming in is dire, with the US losing almost 20 million jobs since February. Eurozone Composite PMI fell to 13.6 in April (recovered to 47.5 in June) signalling massive contraction in services and manufacturing activity across the Eurozone. (A reading below 50 signals contraction. Economic activity in Europe has been in contraction since April).

The question many have been asking is has the stock market run ahead of fundamentals? Is the market somehow ignoring the fact that economic activity almost ground to a halt in the 2nd quarter?

First let us define the intrinsic value of a stock, using the S&P 500 as an example. It can be defined as the present value of future cash flows. The valuation equation is as follows.

![]()

There are two variables in this equation, one is the future cash flows for various time periods (CF), and the other is the discount rate (r). If CF is larger, the price increases. If r gets smaller, the price increases.

Historically, we have price and cash flows (earnings), so we can use this equation to calculate the discount rate that the market might be used to price stocks. Using S&P 500 data as of 31st Dec 2019, we have a price of 3,231 (index price), trailing 12 month earnings of $139.47/share and an average earnings growth of 6% since 1988. If we use this data with the equation above, we get a discount rate of 5.4% for a 20 year model. (ie. Discounting future cash flows 20 years into the future based on 6% earnings growth).

Next, we use this to see what the equation tells us about what the S&P 500 might be worth now. Analysts have expected an earnings decline of 34% for the S&P 500 in 2020. That means earnings will fall from $139.47/share to $92.06/share. Thereafter they are expecting a quick recovery in 2021 to $145.28/share. Using our discount rate of 5.4%, and the future growth rate of 6%, we get an intrinsic value of 2,964 for the S&P 500 using this simple 20 year model.[1]

What does this analysis tell us?

The S&P 500 closed at 3,100.29 at the end of June. This is 4.6% above the calculated intrinsic value of 2,964 from the model. This gives us an idea that even though the economic data right now is bad, the market is already pricing in a 34% decline in earnings for the year! Of course, this is entirely also based on a V-shaped recovery, as the earnings estimates for 2021 show us.

What we can conclude though, is that the market is doing its best to price in the available information to come out with a realistic price for stocks. There are many investors using many different and far more sophisticated models with more data trying to value the companies in the S&P500, and the outcome is the prices we see in the market every day.

It is helpful to understand that models can only work as well as the data used. Right now, there is a lot of uncertainty over the data, as the impact of the pandemic is still unclear. The economic recovery might not be a V shape if the pandemic is not well controlled, and that would change the 2021 earnings estimates, and will result in a different intrinsic value ( lower if estimates come down).

Conclusion – what to make of it all

There are a few takeaways from all this to highlight.

- Stocks are pricing in future cashflows. Indeed, the economic picture is dire right now, but it is also temporary. In the space of a few months, companies have adjusted and found ways to make workplaces safer and found ways to help employees work productively at home. While short term, cashflows might be impacted, longer-term if companies go back to generating profits, there will be a return to holding stocks.

- Diversification is important to reduce risk. While some companies might bounce back, not all companies will be able to weather the storm. Being diversified allows the portfolio to not suffer too much from companies that don’t do well, and benefit from the ones that do well (such as the tech companies that have led the market recovery so far).

- Prices change when the information changes. Markets price in current information, but the future is always uncertain and the information can change. Price changes merely reflect the changing short term information. Long term, the principles of investing remain the same. If a company generates good future cash flows, there will be a positive expected return from holding its stock.

We can see that markets are still working hard to price in all the current economic uncertainty. This will undoubtedly lead to movements in price in the coming weeks (up or down). We cannot consistently predict how the information will change (will we get a vaccine soon? Or will there be a second wave of the pandemic?) but as long as economic activity continues, staying invested long term will allow our portfolios to capture the asset class returns of stock and bonds.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.