The first quarter of 2021 ended well for our portfolios as value stocks and small stocks continued to outperform as the economic backdrop improved and major economies continue to re-open as the pandemic hopefully is starting to wane. The re-inflation theme has also been a focus of markets as bond yields continue to rise, impacting the prices of growth stocks and leading to weaker performance in bonds over the month.

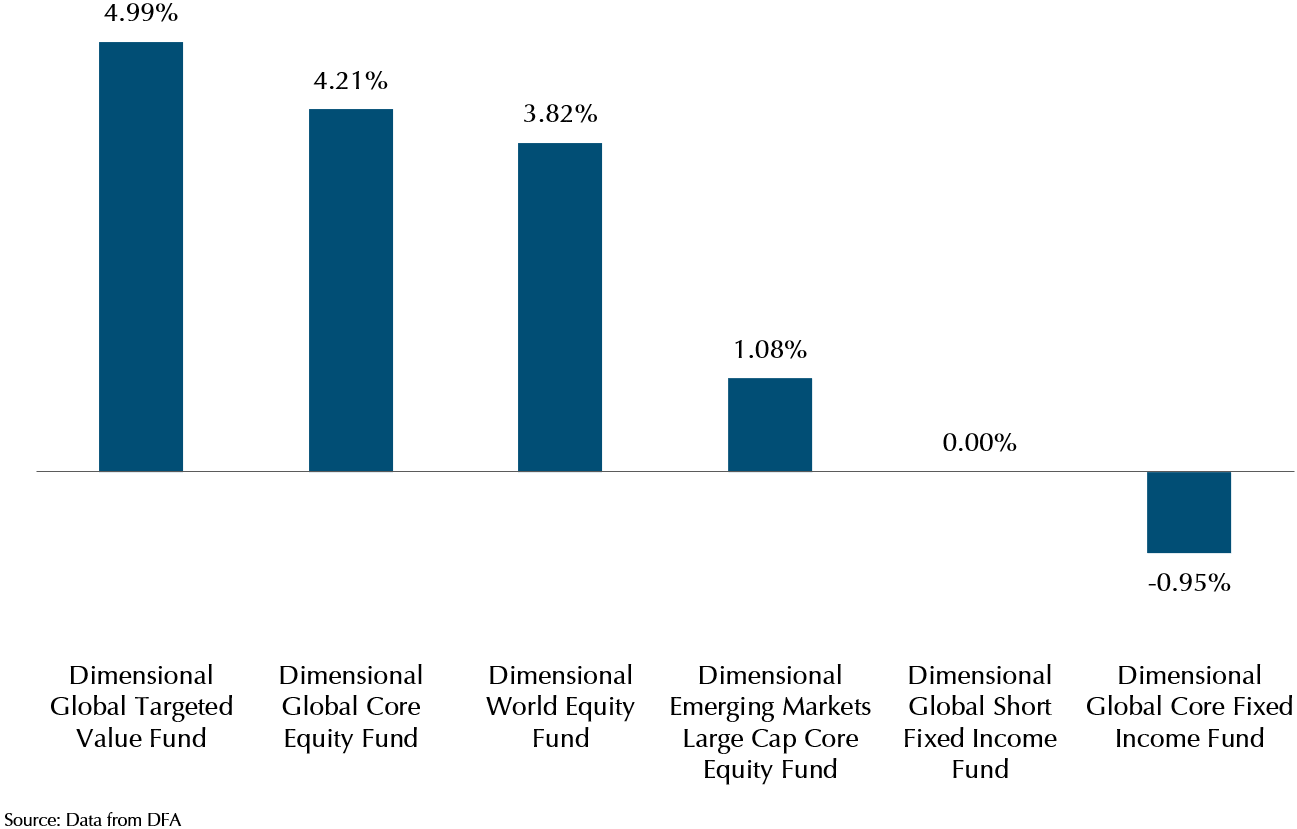

Exhibit 1: 2021 March performance – Dimensional funds (in USD)

As we can see from the data above, Dimensional funds have performed as expected over the month, delivering strong stock returns, with the short-term bond fund preserving capital, while the intermediate bond fund (Core Fixed Income) fell in line with higher long-term yields.

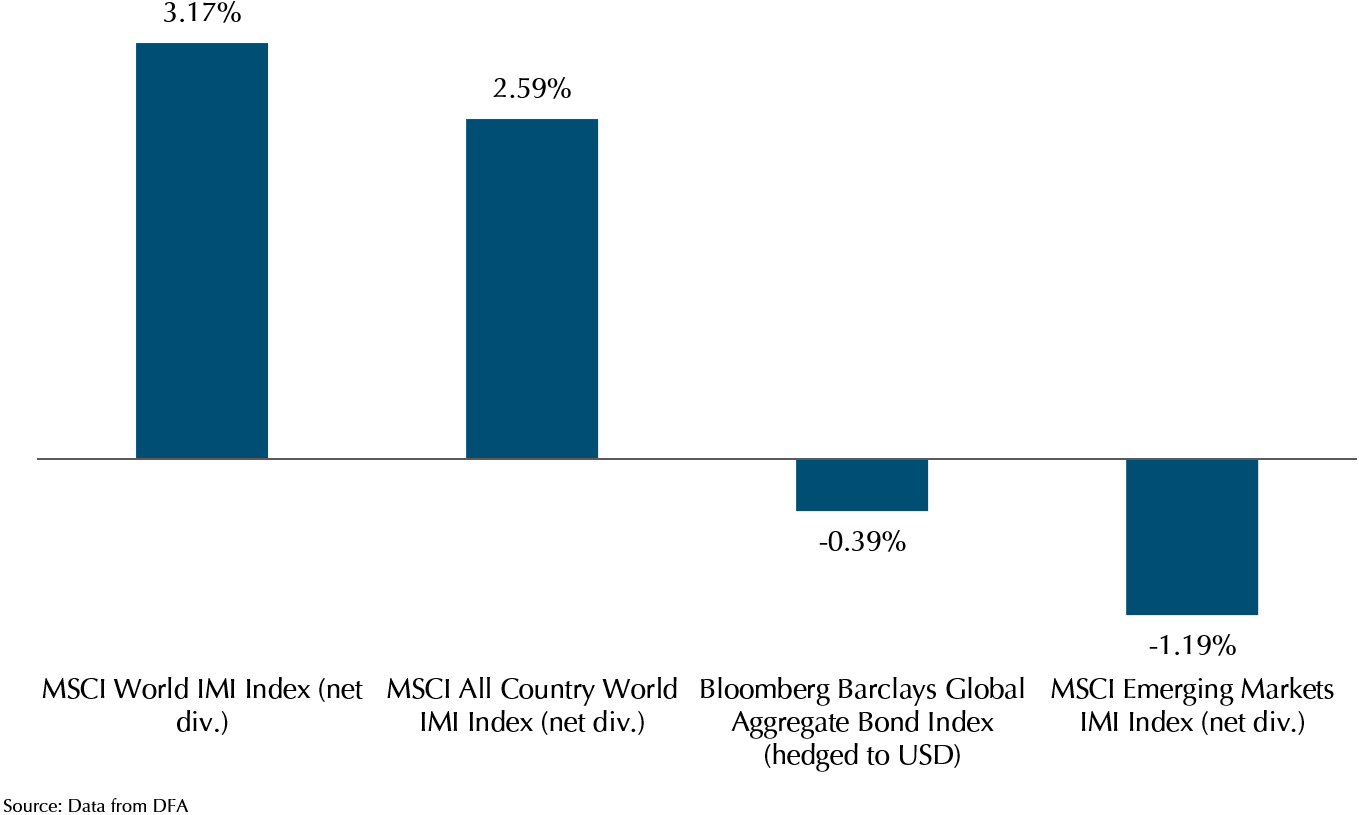

Exhibit 2: 2021 March performance – Global indices (in USD)

Looking at how the broad markets did, in general, stocks did well, and bonds fell. What is worth noting is that due to the tilts to value stocks and small stocks, the Dimensional funds did better than the stock indices, particularly in emerging market stocks. The index fell 1.19% while the Dimensional fund returned 1.08%, an outperformance of 2.27%!

Negative correlation in action

A question that has popped up recently with bond yields rising is whether it is still worth investing in bonds. The short answer is, yes. Bonds continue to constitute a key part of a portfolio for 2 reasons.

1) Negative correlation to stocks. Right now, we have stocks going up, so negative correlation would mean that bonds should be moving in the opposite direction, and they are. The question is one of magnitude. Stocks have a standard deviation of anywhere from 15-20%, while high quality bonds have a standard deviation of less than 3%, so stocks will move up far more than bonds, ensuring that your portfolio will continue to grow in this environment. Where we value the negative correlation, is in periods like last March when stocks fell >30%. Bonds managed to preserve portfolio value by not falling and going up instead. This is important in portfolios for clients that have expressed a preference for lower risk.

2) Higher yields mean higher expected returns. With yields rising, bonds are actually delivering a higher return now, so the market is pricing in the demand for a higher return from bonds. As bonds in the funds we use mature, the managers will recycle the capital into the higher yielding issues, bringing up the expected return of the funds over time.

Diversification works

The last week of March saw the investment world captivated by the implosion of Archegos Capital, a family office that was forced to unwind huge leveraged positions due to margin calls. While the news made for good headlines, the impact was largely limited to a few small company stocks, and losses in a few investment banks that were unable to unwind their positions quickly enough.

What is interesting is that one of the stocks that was part of the forced unwind was ViacomCBS. This shows up as a top holding of the Global Targeted Value Fund and had done well prior to the announcement of a stock sale on the 24th of March.

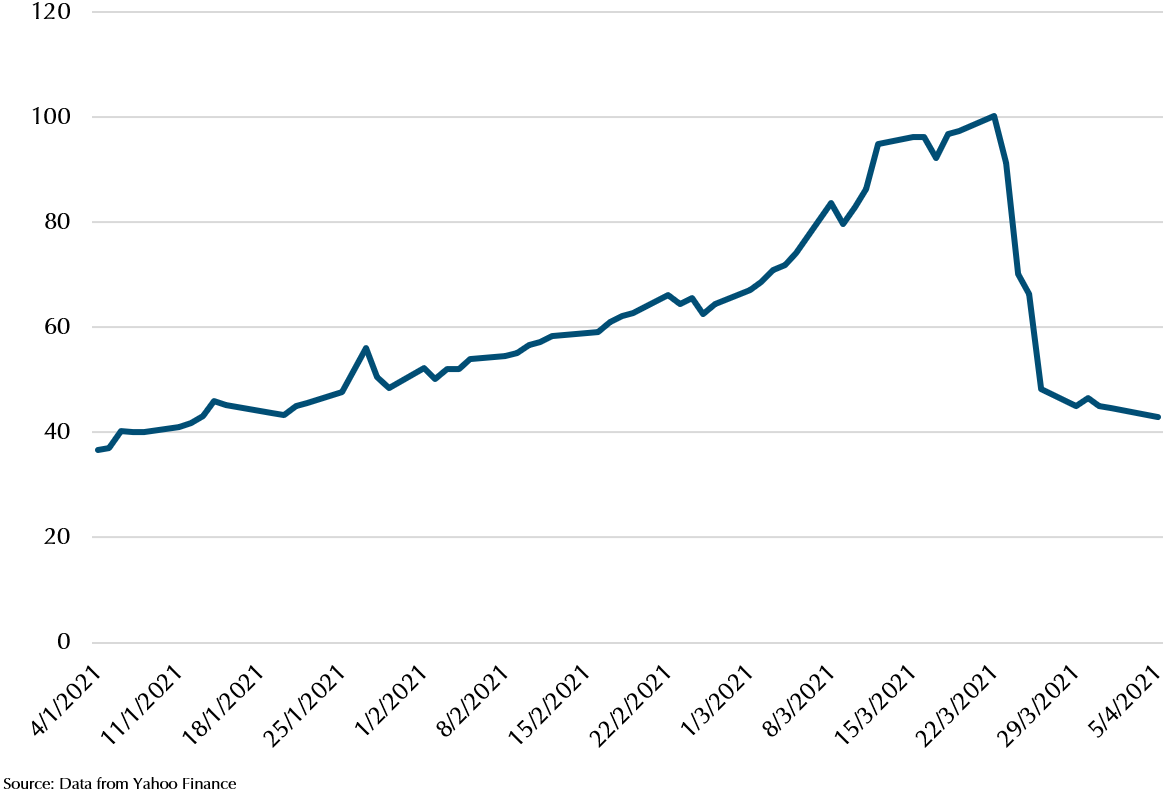

Exhibit 3: Viacom CBS stock price

The announcement of the stock sale triggered a fall in the share price, and that triggered the eventual margin calls and unwinding of the leveraged positions Archegos Capital held on the 25th-26th of March.

Exhibit 4: Global Targeted Value Fund NAV (SGD) during period of leverage unwinding

As we can see, despite this being a large position in the fund, on the 26th when the positions were being unwound, the fund NAV actually went up! This is because the fund is extremely diversified with 4,216 companies in it. The position was far less than 1% of the fund, despite it being a “large” holding. March 25th-26th was a good period for small value stocks overall, so the fund was able to deliver positive performance due to its diversification in reducing the risk of negative performance from any one holding and improving the odds of holding the best performing stocks during any period.

A good time to take stock of your wealth plan

It is just past a year that the pandemic was declared. Portfolios have done well, and with the rollout of vaccinations, and strong economic stimulus in the developed world, there is hope that soon the worst of the pandemic might be behind us. (Although the emergence of new virus strains might delay the recovery). If you have not done so, it might be a good opportunity to have a discussion with your adviser about your current situation and update the plan if required. Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.