Equity markets delivered another stellar month in November as the US market continued to make new highs with the S&P 500 notching up more record closes in the month. Supported by the possibility of an easing of trade tensions between the US and China, growth stocks powered back into the limelight to outperform value stocks for the month.

Thankfully at Providend, we don’t invest one-dimensionally. Aside from value, we have a tilt to small caps in our portfolios that enable them to deliver higher expected returns over time. While value may have underperformed, small-cap stocks had one of the best months of the year, and outperformed their larger counterparts, allowing our portfolios to keep pace with the overall market returns for the month. The Russell Microcap index gained 4.5% in Nov and the small-cap Russell 2000 index gained 4%, beating out the S&P 500 gain of 3.4% for the month. In a similar fashion, the MSCI World Small Cap Index returned 3.24%, beating the 2.79% return of the MSCI World Index.

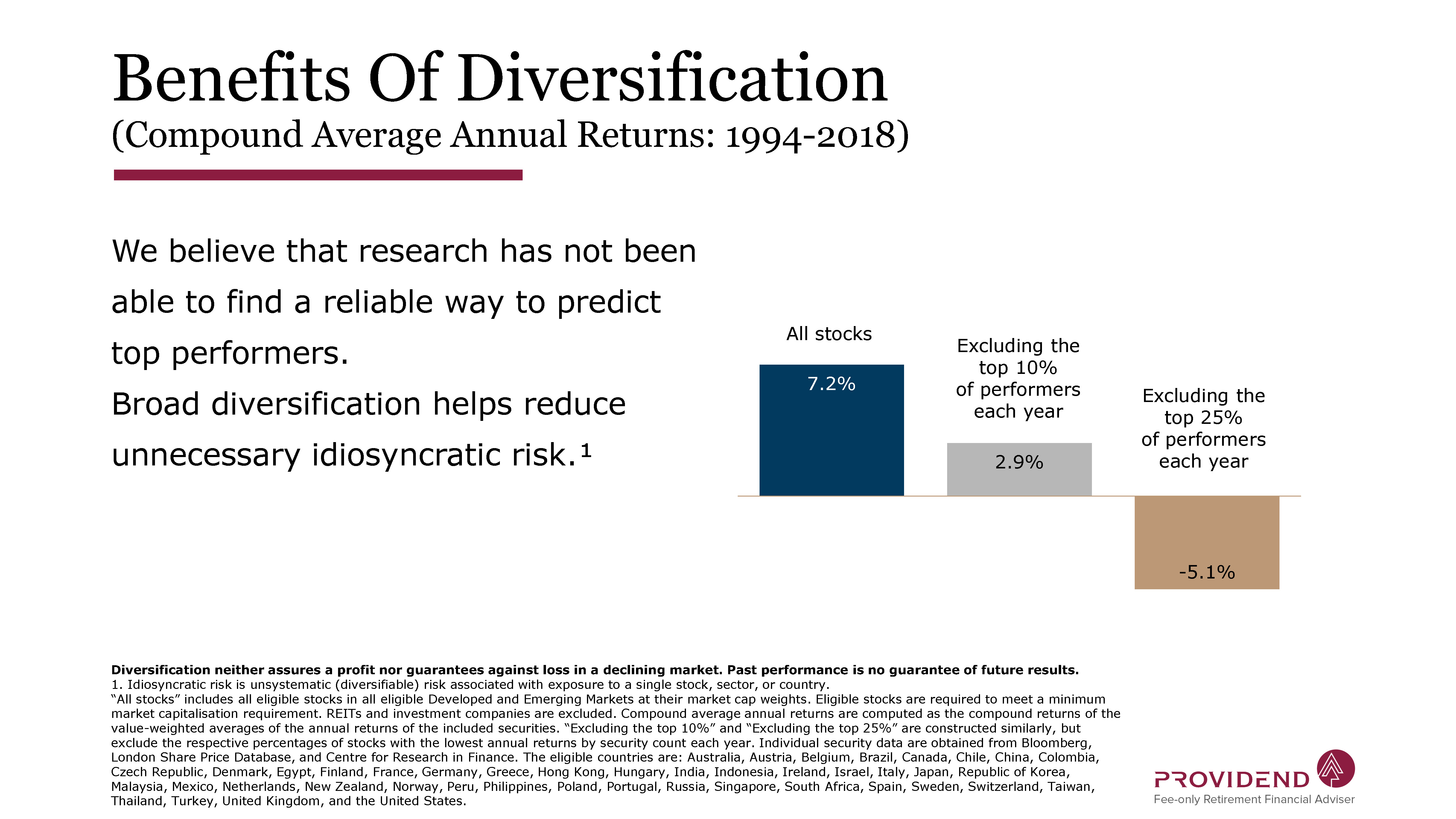

This highlights the effectiveness of portfolio diversification. Apart from being a risk management strategy (when you diversify your portfolio you reduce the risk that any one position will severely impact your returns negatively), it can also serve to improve the expected returns of a portfolio. Diversifying helps you gain exposure to the best-performing stocks in the market. The FAANG stocks have received a lot of attention because they have been delivering most of the market gains in the past few years. Over many periods historically, if you missed holding out on the best-performing stocks, it would impact your returns greatly (see exhibit 1 below).

Exhibit 1

How do you know which stocks will perform best in any period? Unfortunately, the odds of getting it right are very low, and it is hard to consistently pick the best stocks for any period in the market. Thankfully, diversification allows you to increase the probability that your portfolio will own the best-performing stocks of the period, and this is how it can help improve the expected returns of

your portfolio.

This applies to the tilts within your portfolio too. There are various factors or dimensions such as value, size, and profitability that academic research has shown to deliver higher expected returns. While these factors can improve expected returns over the long run, they do not all show up at the same time periods. Diversification in your portfolio to various factors will also increase the probability of exposure to the better performing factor for the time period, improving expected returns.

As we move into the holiday season, we would like to wish all our clients a very Merry Christmas and Happy Holidays. Across all our portfolios, the performance this year is likely to have helped make progress towards your financial goals.

If you wish to check in on your progress or have any questions, please do not hesitate to contact your Client Adviser. Thank you and have a wonderful month ahead.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.