We have spent a lot of time and effort reminding our clients to 1) be invested and 2) stay invested over the past year. Sometimes, it is not evident why we encourage clients to do so, especially when markets are falling (like in March). There is a bias towards action, such as getting out and switching to cash. Similarly, when the value stocks have been underperforming, particularly over the 2nd quarter, there is also a bias towards switching into what is working and chasing the historical returns (in this case growth stocks).

The reason why we ask our clients to invest and stay invested is because 1) we don’t know when the returns come, but when it comes it can be very fast and 2) returns are very lumpy, and it’s not a gradual process. Missing some of the best days (or in this case the best month) has a huge impact on your overall return.

Let’s take a look at our returns in November.

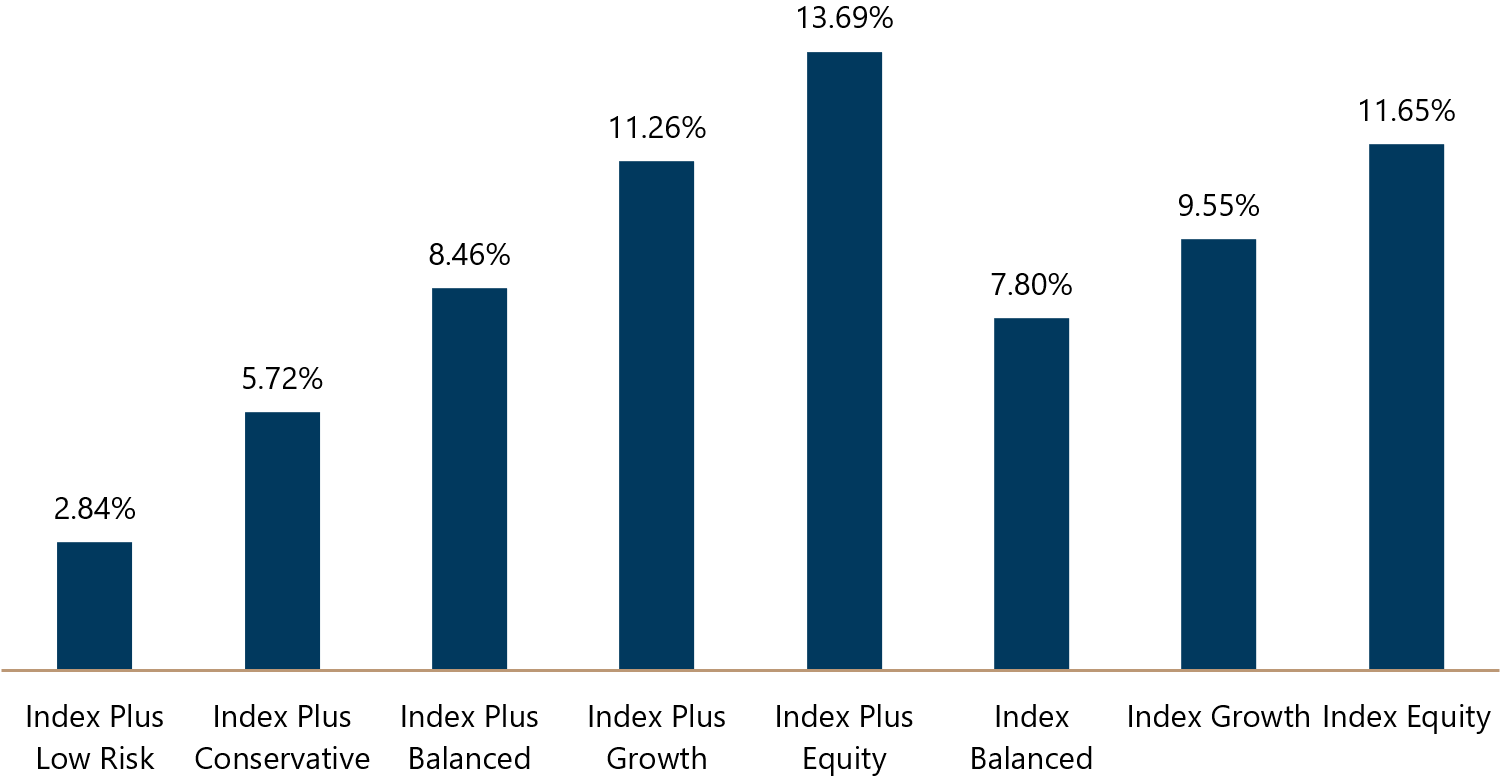

Exhibit 1: Model portfolio returns in USD for Nov 2020

Returns come fast and furious

Our CEO Chris saw these numbers and asked, “Are these the year to date numbers?”. You would not be amiss to be wondering if these numbers are real. These would be fantastic returns for a year, let alone for just one month! It serves to highlight the point we were making earlier. Returns come quickly and are very lumpy. It is likely that the difference between a portfolio making a positive return for 2020 and one that does not is decided by the returns captured in November.

You might also notice that our Index Plus equity portfolio has outperformed the Index Equity portfolio by 2% (13.69% vs 11.65%) in November and wonder why. This is because in November we finally saw a very strong recovery in the Value and Small Company premiums, which have been quite absent for most of the year.

Our Index Plus portfolios have tilts to value and small companies which are expressed via the funds managed by Dimensional Fund Advisers, as their funds are focused on targeting higher expected returns from the Value and Small company premium.

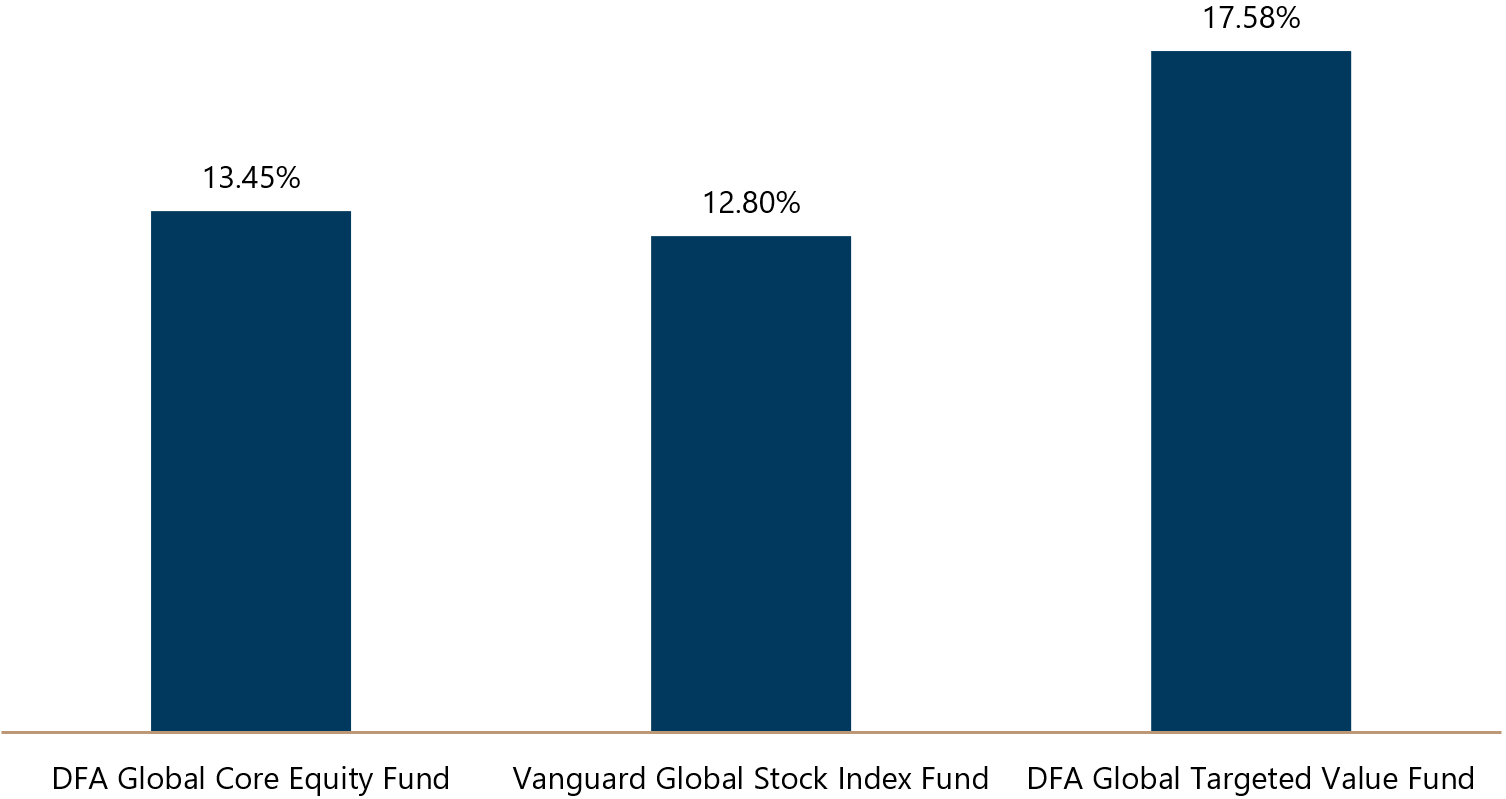

Exhibit 2: DFA funds are delivering what they promise. Returns in USD for Nov 2020

As we can see from the above, the funds are delivering the higher returns expected of them (as compared to the Vanguard Index funds) when Value stocks and Small company stocks do better.

Make sure your seatbelt is on

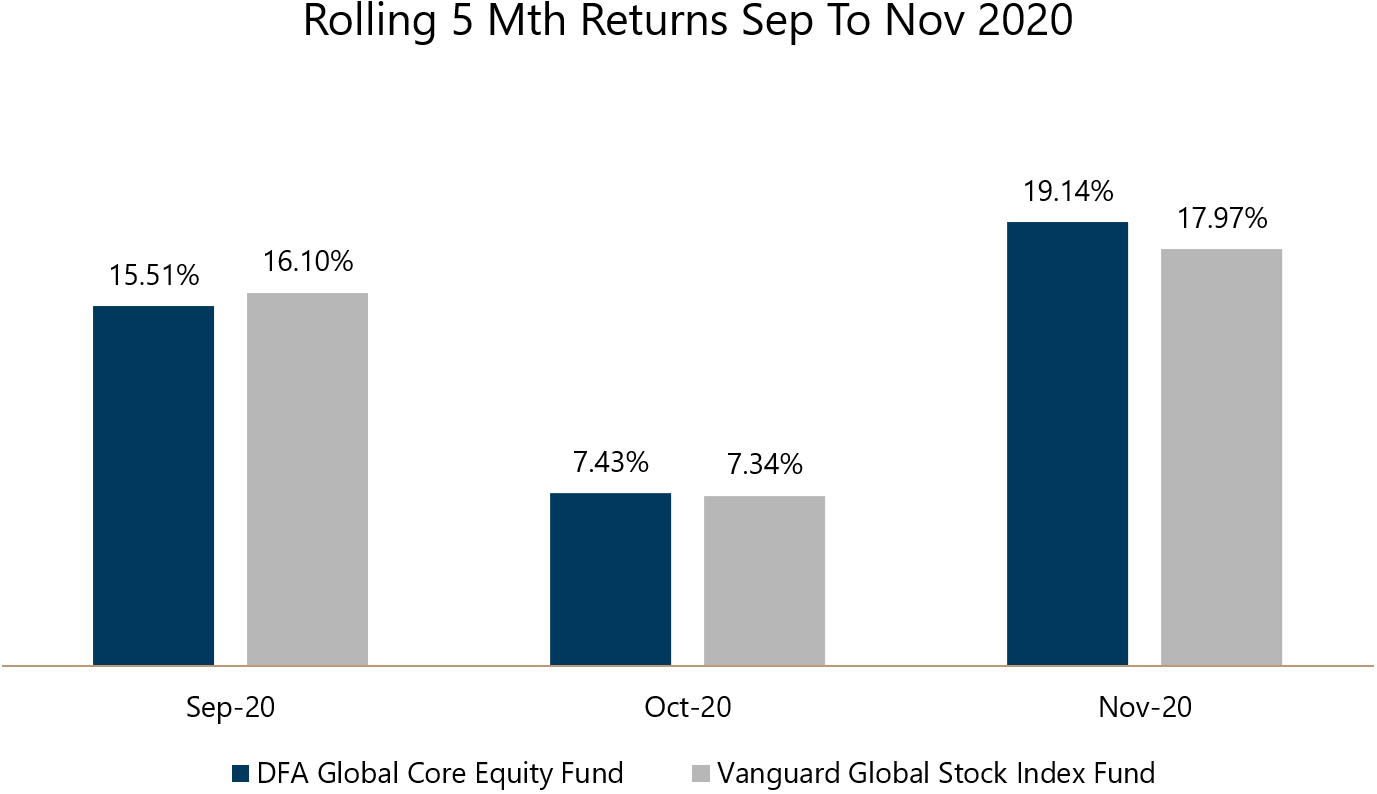

A simple exercise shows how fast things can turn around in investing. Much has been said about the underperformance of Value stocks. In fact, as recently as the end of September, if you have looked at the 5 months prior performance (beginning in May 2020) you would have seen Growth outperform Value (Vanguard fund > DFA fund). In just 2 months, we see Value starting to outperform Growth strongly, and looking at the data, most of the outperformance is due to the month of November.

Exhibit 3: Value and Growth premiums rolling 5 month returns Sep to Nov 2020

The suddenness that returns can appear is why at Providend, we are doing our best to keep you in your seat, with your seatbelt on as the roller coaster of the markets does its thing.

It is all in the data

What gives us the confidence to keep you in your seat despite all the uncertainty as the market roller coaster is moving? Let us use the value premium as an example. Why did we keep our portfolios invested in value stocks even though growth stocks have been outperforming?

We focus on a few principles.

- Does it make economic sense?

Value is a relative metric. If there are 2 companies that do similar businesses, and have similar profits, then if you pay less for one and more for the other, you are likely to have a higher expected return from the one you paid less for. In a simpler example, assume 2 houses that are in the exact same location with the exact same design (impossible I know but lets assume), then you would expect that paying less for one of them will give you the better chance of a higher return from capital appreciation. - Is there empirical evidence?

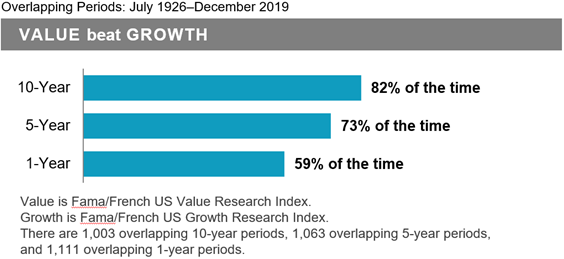

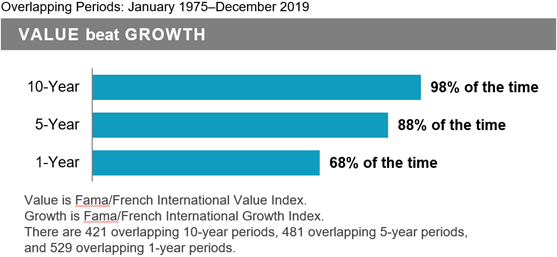

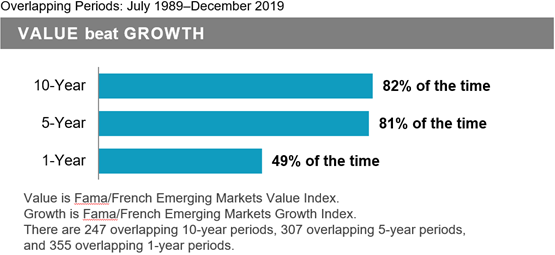

There needs to be data to support the assumption. Thankfully, we have almost a 100 years of data from US stocks and other stock markets that show value stocks outperform growth stocks the majority of the time.

Exhibit 4: Value premium for US, Developed Ex US and Emerging Market stocks

US stocks

Developed Ex US stocks

Emerging Market Stocks

Stay invested to not miss the best days (or month) and achieve your financial goals

We invest to reach our financial goals, be it wealth accumulation, retirement, or to fund our children’s education. The success of the plan requires us to capture the returns from our investment in stocks. Capturing the returns from stocks means that we cannot miss the best days, or month in this case. Thus, we need to stay invested.

Thank you for your continued trust and support. Your advisers are always there to help keep you in your seat on your investment journey. Do reach out if you have any questions. As we head into December, Providend would like to wish you a very Merry Christmas and a Happy Holiday season!

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.