Equity markets continued their ascent with the S&P 500 setting a record close to 3037.56, up 2.04% for the month. The MSCI World was up 2.54% and the MSCI EM was up 4.22% as both Global and Emerging Market equities rallied hard this month.

US economic data remains robust, coupled with the thawing of trade tensions and a third rate cut by the Fed continue to support the economic expansion. The US treasury yield curve has also reverted to its normal shape after the brief inversion in the summer.

What is key for us is that value has continued to maintain its recovery and outperform growth for the second straight month.

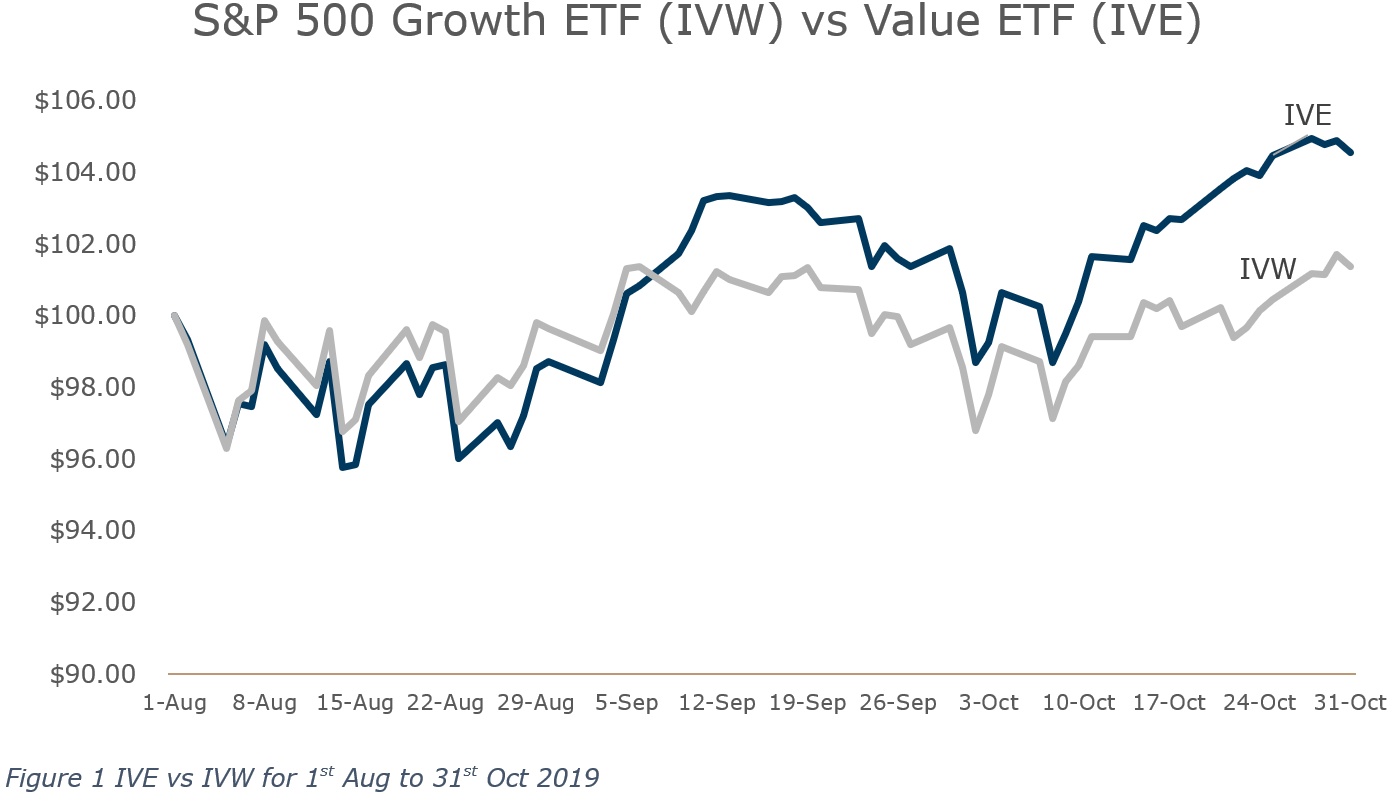

Tracking the S&P 500 value and growth indices via the iShares ETFs IVE and IVW, we can see from the chart below that over the last three months, value has outperformed growth by 3.47%, and this is entirely coming from the past two months outperformance as August was a weak month for value. In October alone, value outperformed growth by 1.1%.

This wouldn’t mean much if our portfolios were not able to capture this outperformance, but we are happy to say that due to the consistent implementation by Dimensional Fund Advisors, our portfolios too have been able to outperform the indices this month, as our tilt to value has allowed us to capture these returns.

The consistency of our implementation is something that we would like to highlight.

Despite the underperformance of value in the recent months, we continue to maintain a consistent tilt to value as we focus on the long-term return premiums, as value has consistently outperformed growth over time.

Instead of adjusting your portfolio in reaction to short term news, we believe that a consistent implementation that does not try to time the market is likely to give the client a more successful investment experience.

As we head into the last two months of the year, we look forward to a successful year for our portfolios as we have managed to get market-like returns in a very cost-effective manner so far, having witnessed US stocks make new highs as well as see the return of the value premium.

We encourage you to take stock of your financial plan if you haven’t and reach out to your adviser if you have any questions or concerns. Thank you for your continued trust and support.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.