If you read the news headlines in September, you would not be too amiss for thinking that the stock markets are again in dire shape. News about COVID-19 cases rising in Europe and the US, along with a swoon in tech stocks that led the NASDAQ down 10%, made for gloomy yet sensational headlines.

Investing is not a short-term endeavour

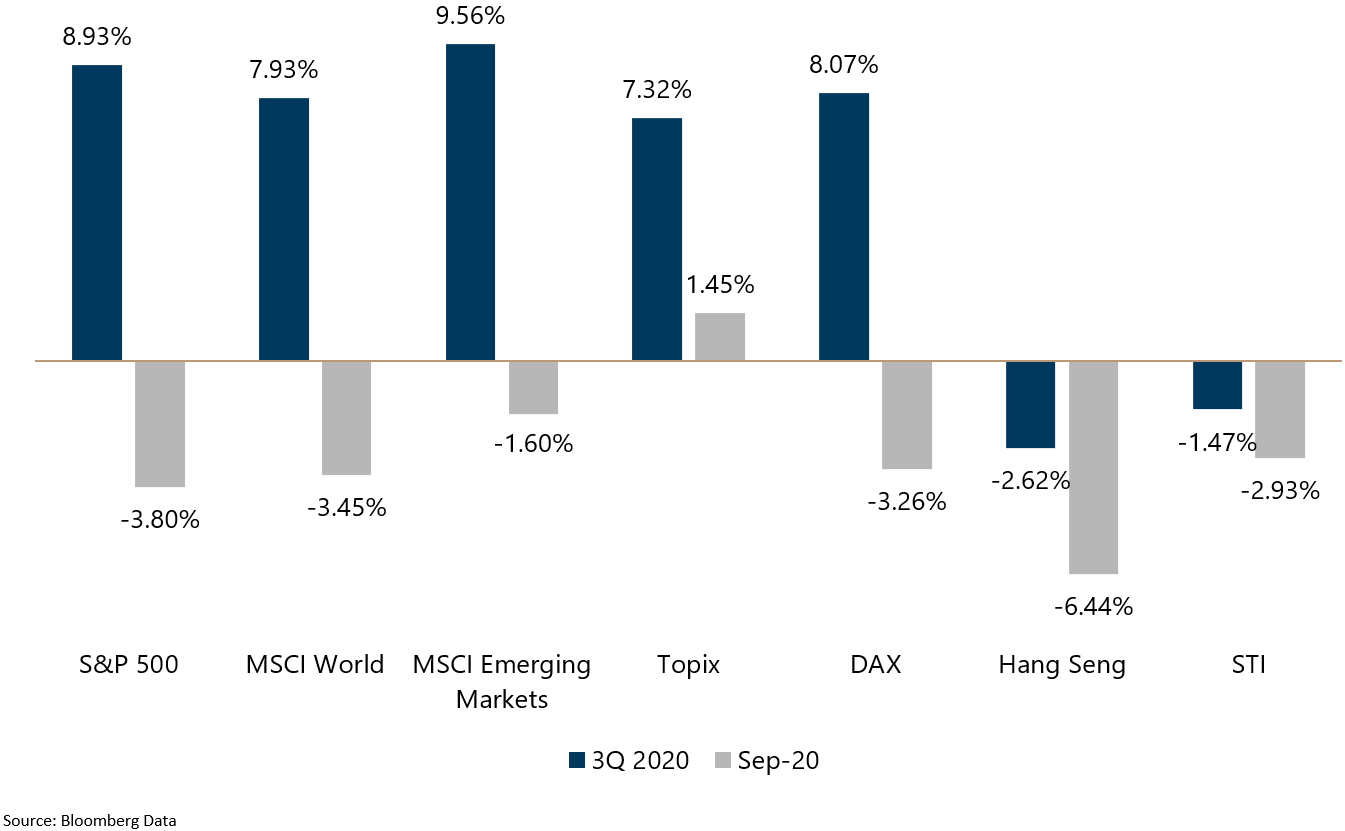

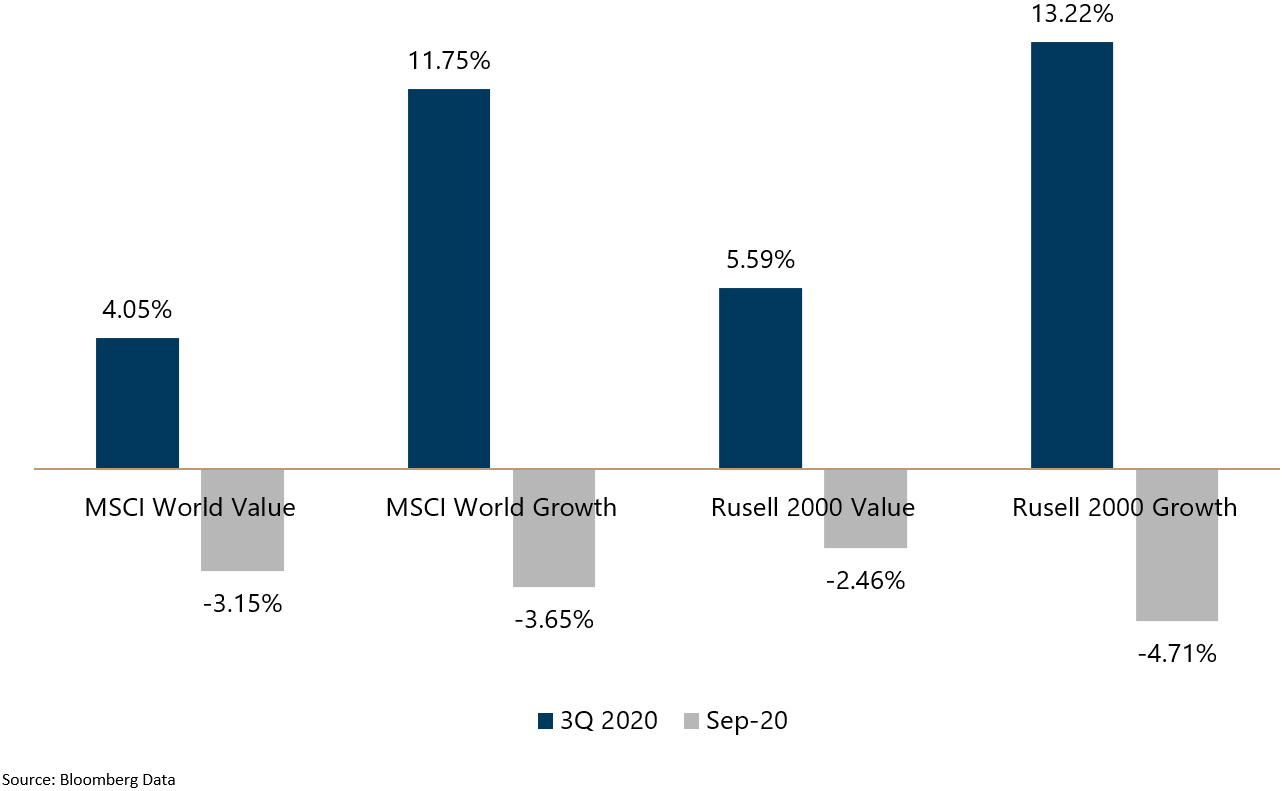

If you had taken a short step back to look at the quarter as a whole, the picture would be remarkably different. Instead of gloomy red ink, you would see gains in the high single digits for most major indices. Even the very much out of favour value factor had a positive quarter (despite the premium’s absence, ie value did not outperform growth).

In the short term, there are many different factors that can affect the price of stocks, many that are unpredictable and out of our control. In the longer term, the largest impact on the price of a stock (or the value of a company rather) is the cashflow generated by the business. Don’t let the short term price fluctuation distract you from the reality that your portfolio is invested in thousands of different companies that are doing their best to generate profits and cashflow every day.

Exhibit 1: Major stock market indices 3Q vs Sep 2020 (USD Returns)

Exhibit 2: Value and Growth 3Q vs Sep 2020 (USD Returns)

Global diversification is a benefit

Over the course of September, one of the questions that always pops up with regularity at our online events and webinars is about the Singapore stock market and its dismal performance. Unfortunately, the data (see Exhibit 1) shows that the STI (Straits Times Index) has again had a difficult quarter, and in US dollar terms fallen 1.47% over the 3rd quarter due to a weak month in September. Contrast that to European stocks (represented by the German DAX index), Japanese stocks (the Topix), broad Emerging markets and of course US stocks, we can see that holding a diversified portfolio helps you benefit from the markets that are performing well at any time period.

No premium does not mean no performance

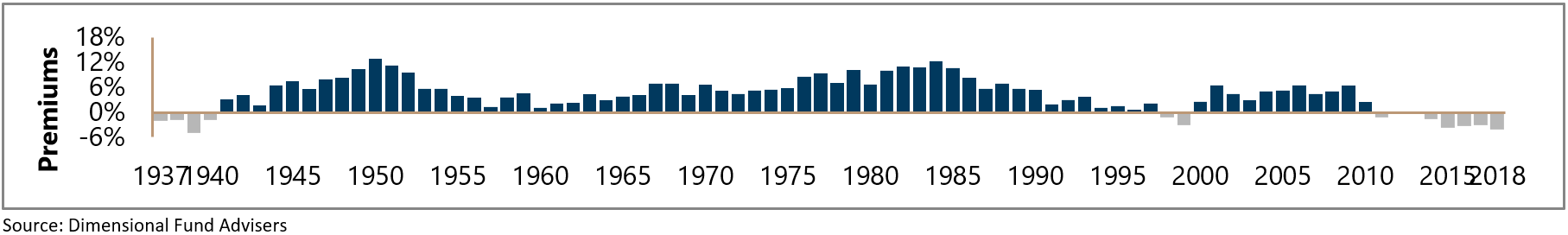

When we talk about the value premium, we refer to the performance of Value over Growth. The excess performance of Value stocks over Growth stocks over time is the Value premium. Exhibit 3 shows that typically, in most years Value stocks go up more than Growth stocks. This premium has not been showing up as strongly since 2010.

Exhibit 3: Performance of Value stocks minus Growth stocks in the US stock market

While the premium might not be there, it does not mean Value stocks are not going up at all.

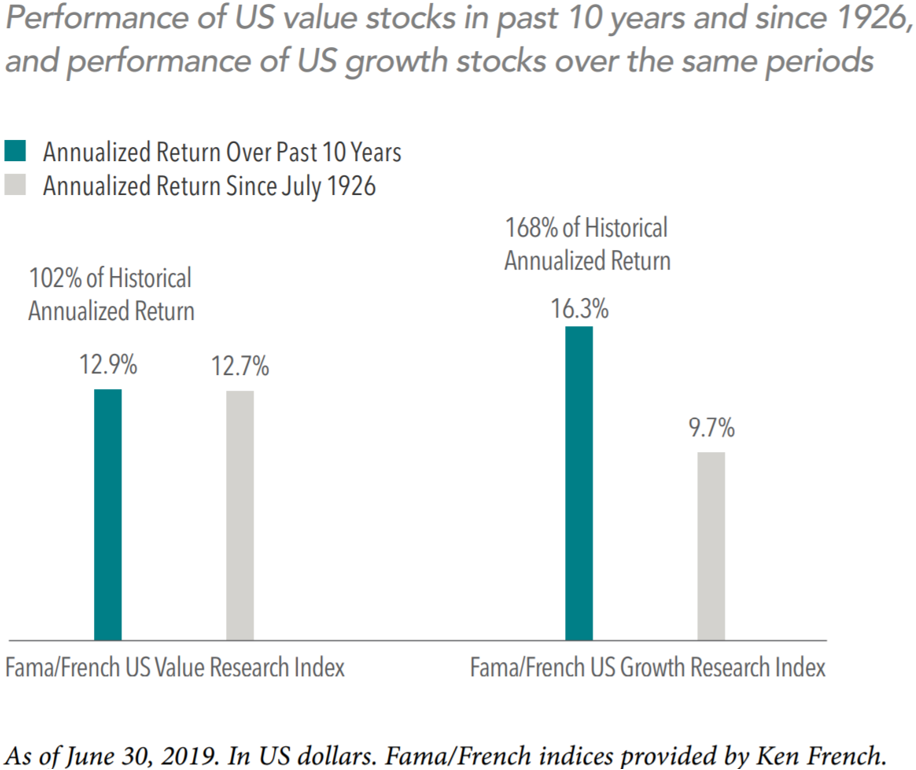

Exhibit 4: US value stocks and growth stocks performance

What Exhibit 4 above shows is, as compared to the past 94 years, the return of Value stocks in the past 10 years (to June 2019) has been very consistent with the historical performance, delivering returns of 12.9% annualised. In fact, Growth stocks have been the outperformer with a return of 16.3% in the past 10 years as compared to a historical annualised return of 9.7%.

The point though, is that even though there has been no premium, investors are still rewarded for holding onto value stocks. Just like the data shows in Exhibit 2 above, there was still a positive return for holding on to Value stocks both globally (MSCI World) and in the US (Russell 1000) over the 3rd quarter. When the premium returns, the potential for higher expected returns will be realised.

Over 10 years, the premium shows up 83% of the time, so we are unfortunately in the other 17% of outcomes in recent years.

Conclusion – your advisers are a steady guide

We are headed into the 4th quarter of 2020. It has been a difficult year. A global pandemic, a deep recession, not just in Singapore but globally, and an upcoming US presidential election. It is not surprising that markets are volatile, as having 1-2 major events in the world would be enough uncertainty, let alone 3! When there is uncertainty, prices will move as markets try to price the uncertainty. In particular, downward moves in prices can be very unnerving, no matter your financial situation at the moment.

Your advisers remain your best resource in such times, as they provide the steady and reassuring guidance about your financial goals, your investment portfolios and your retirement plan. Do reach out to them if you have any questions or concerns, as they are always available to provide a listening ear.

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.