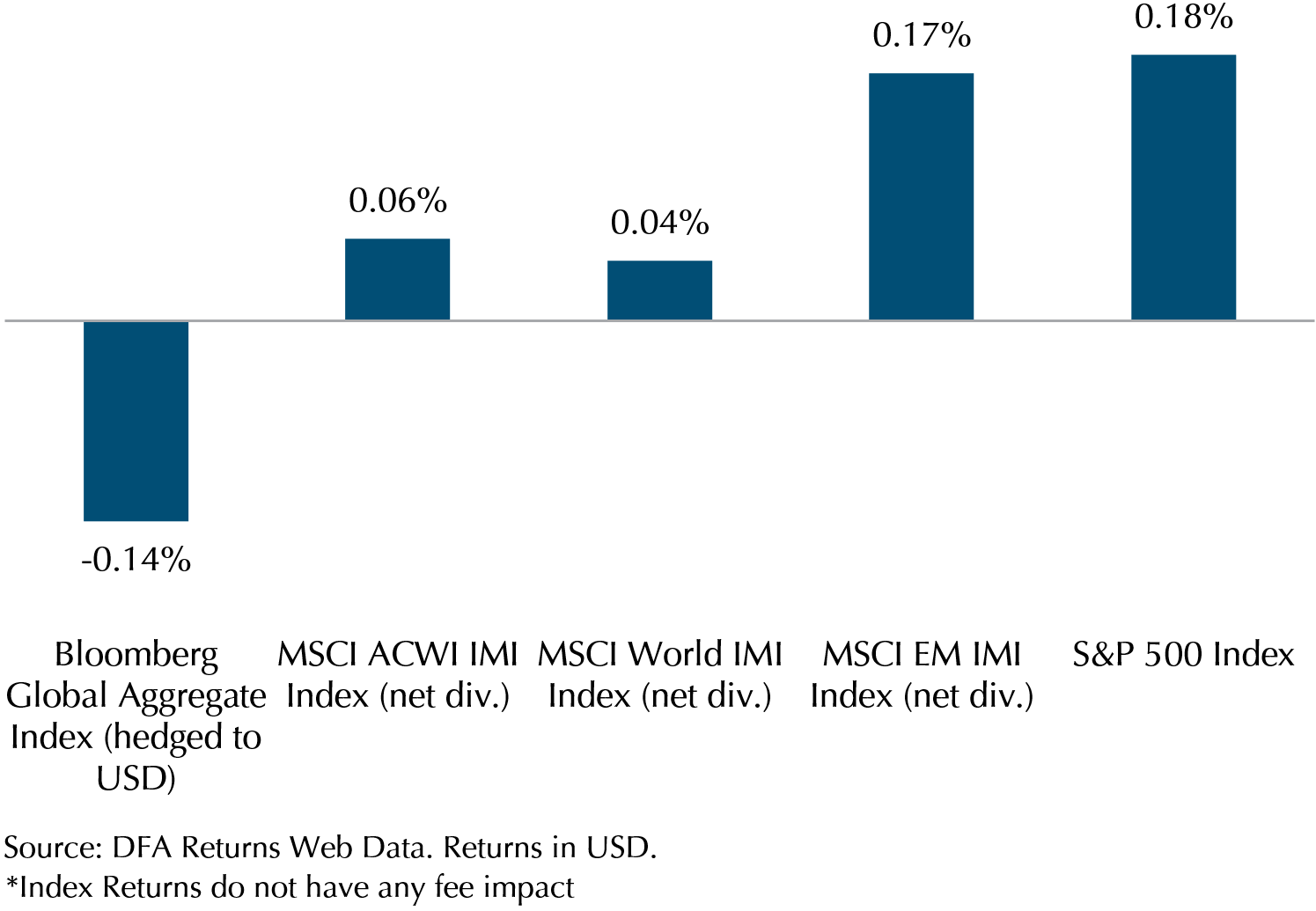

Erratic trading sessions dominated the month of May as major indices fluctuated between gains and losses. The S&P 500 fell for the 7th straight week on 20th May briefly entering a bear market before rebounding sharply. Eventually, stocks delivered a positive return for the month. The S&P 500 fared slightly better than our reference index, the MSCI AC World IMI (0.18% vs 0.04%) because US stocks outperformed their developed market peers. The MSCI Emerging Markets IMI had a similar performance to the S&P 500, up 0.17%.

The bond market also struggled to decide on a direction in May. The Bloomberg Global Aggregate Index fell by 0.14%. The major catalyst for this volatility is the uncertainty around how much the Fed will move rates to curb inflation. This volatility will likely continue as further inflation data continues to come in, influencing how the Fed might react in the future.

Exhibit 1 – Stocks and Bonds Index Performance May 2022

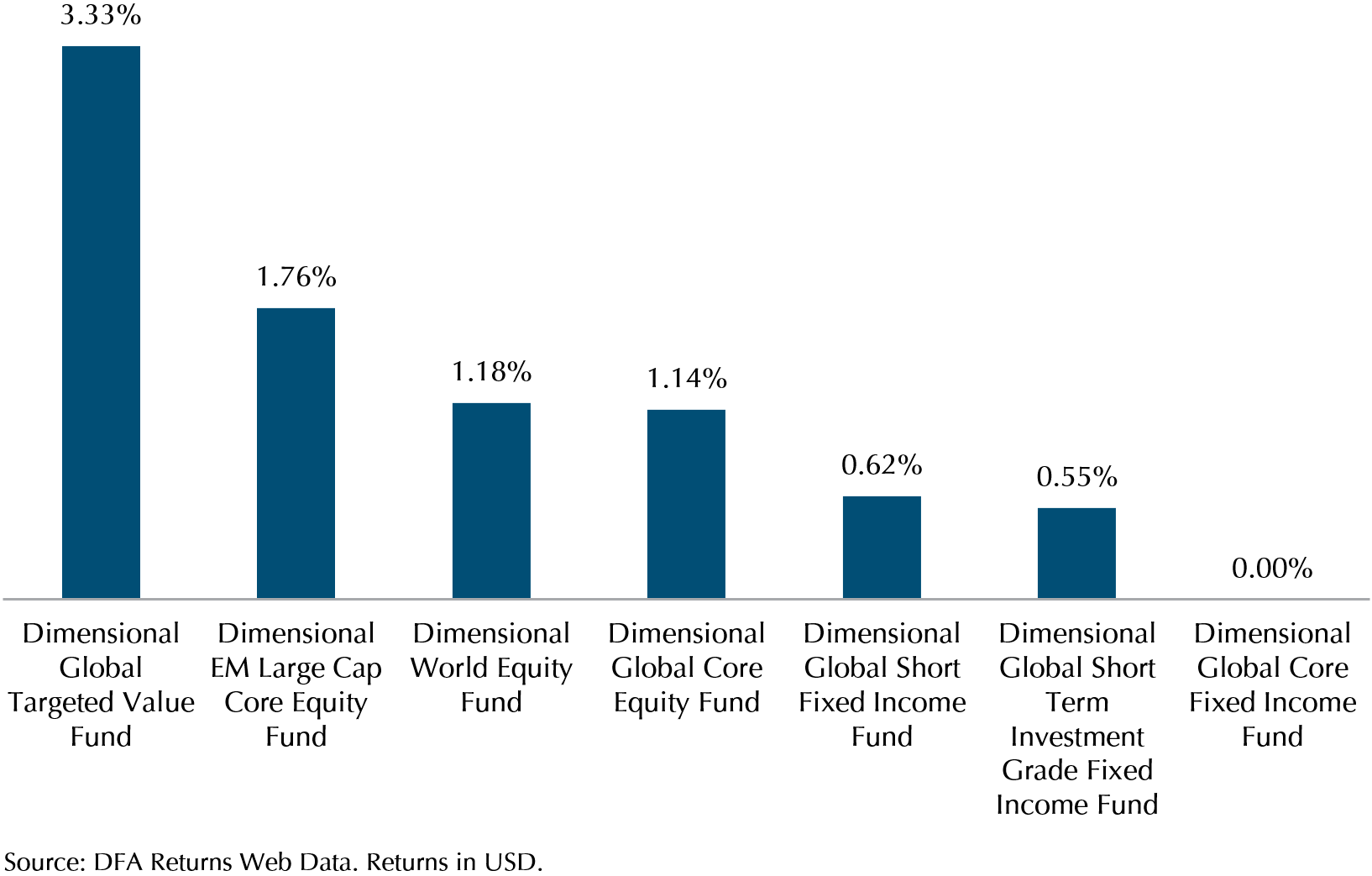

Dimensional Funds outperformed our reference indexes

Dimensional funds generally outperformed our reference indices for the month of May (Exhibit 2). The Global Short Term Fixed Income and the Global Short Term Investment Grade Fixed Income funds rose 0.62% and 0.55% in May respectively while Bloomberg Global Aggregate Index fell by 0.14%. Global Core Fixed Income remains unchanged in May.

In the stock market, Dimensional’s tilt towards value stocks continued to show its worth. Notably, the Dimensional Global Targeted Value fund rose 3.33% outperforming the MSCI All Country World Index IMI by a large margin (3.33% vs 0.06%). The Global Targeted Value fund has been outperforming well in the higher interest rate environment. Consistent with historical data, this outperformance is an important component of the long-run positive value premium.

Exhibit 2 – DFA Equity Funds Performance May 2022

Why did the major US Indices turn positive this month?

Investors got a reprieve from consecutive weeks of sell-off in the final week of the month in view of more positive economic news. Inflation shows signs of slowing down as the Fed’s favourite inflation measure reported that the core personal consumption price index rose 4.9% in April which is down from the 5.2% pace seen in the previous month. On top of that, the US Commerce Department reported strong retail sales on 17th May which rose 0.9%. The report gave investors a boost of confidence that consumers are doing well, allaying some of the fears of a recession that so far dragged the S&P 500 into a brief bear market.

Inflation concerns are not over – More tightening ahead

While US inflation is showing signs of slowing down in April, it may also be possible that it is just an inflection point. Oil prices have risen more than 8% in May and EU leaders have agreed to ban 90% of Russian crude by end of the year. At 116 USD per barrel, Brent Crude Oil is at its highest in a decade. Higher oil prices will raise the cost of logistics and drive-up prices.

Strained by the Covid-19 lockdown, China’s industrial output slumped in April as the official manufacturing purchasing managers’ index (PMI) reported is 49.6. (Below 50 means contraction in output) Further east, Japan’s industrial output dropped by 1.3% in April compared to the previous month.

Near home, Malaysia is ceasing all exports of chicken as of 1st June to curb supply constraints for domestic demand. Singapore residents are already seeing rising prices in food, transport, and utilities. Singapore’s core inflation accelerated to 3.3 per cent year-on-year in April from a previous 10-year high of 2.9 per cent in March, driven by higher energy and food costs.

Central banks across developed economies are either raising interest rates or poised to raise them to tackle their own inflation challenges. The ECB which has been a laggard in raising rates, changed from a dovish to a more hawkish tone. Notably, President Christine Lagarde surprised the market with a blogpost stating that the central bank could increase rates in July and “be in a position to exit negative interest rates by the end of the third quarter.” In contrast, back in November 2021, the ECB President said that a rate hike was unlikely in 2022.

The issue on how central banks react to inflation and inflation data will continue to play a main role in the direction of the market in the coming months.

Complex trifecta makes market uncertain – Stay diversified and invest in certain cashflows

As the war in Ukraine and Covid restrictions in China persist, supply chains and logistics will continue to be affected which will drive inflation higher. The Fed will continue to look closely at the outcome of these two issues (war and pandemic) as inflation will be the main factor in their decision to tone up or down on their hawkish rhetoric. This complex trifecta between inflation, war and the pandemic means the cost of capital for companies will increase and their performance outlook will be murky.

Furthermore, the weakening of multilateralism and deglobalisation means that countries, big or small, need to be cautious on bilateral relations. Similarly, investors also need to be aware of these new factors that might affect the companies they invest in.

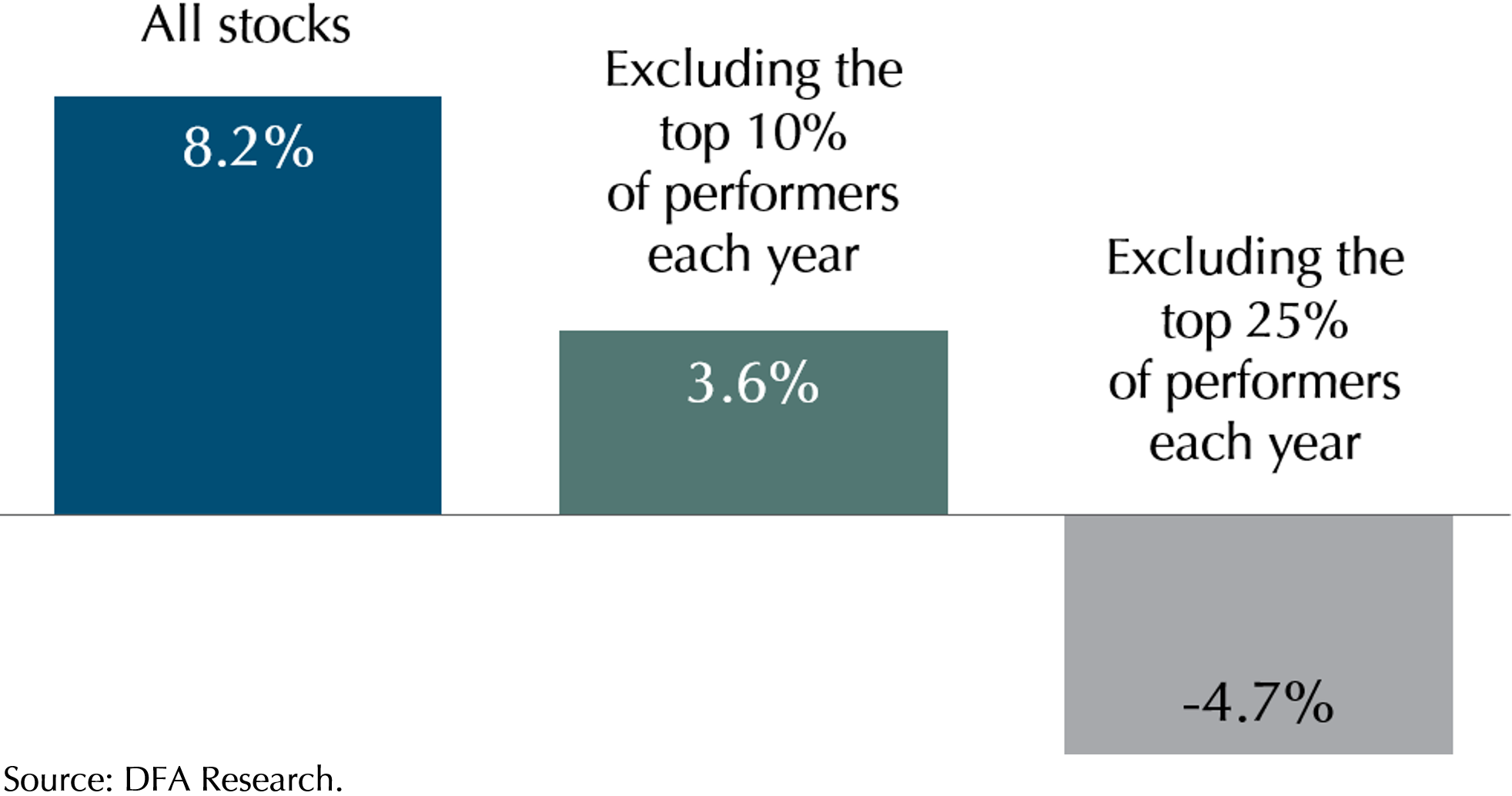

Exhibit 3: Benefits of Diversification – Compound Average Annual Returns 1994-2020

Given the continued uncertainties facing investors geopolitically, and the rising interest rate environment driven by high inflation, investing in value stocks and staying diversified are key to capturing returns and managing risks. Value companies tend to have stable cashflows, which help them to maintain their valuation as interest rates rise, while diversification helps to ensure that despite the uncertainty, our portfolios (which hold over 9,000 stocks) are holding the stocks that will perform the best in any environment (Exhibit 3).

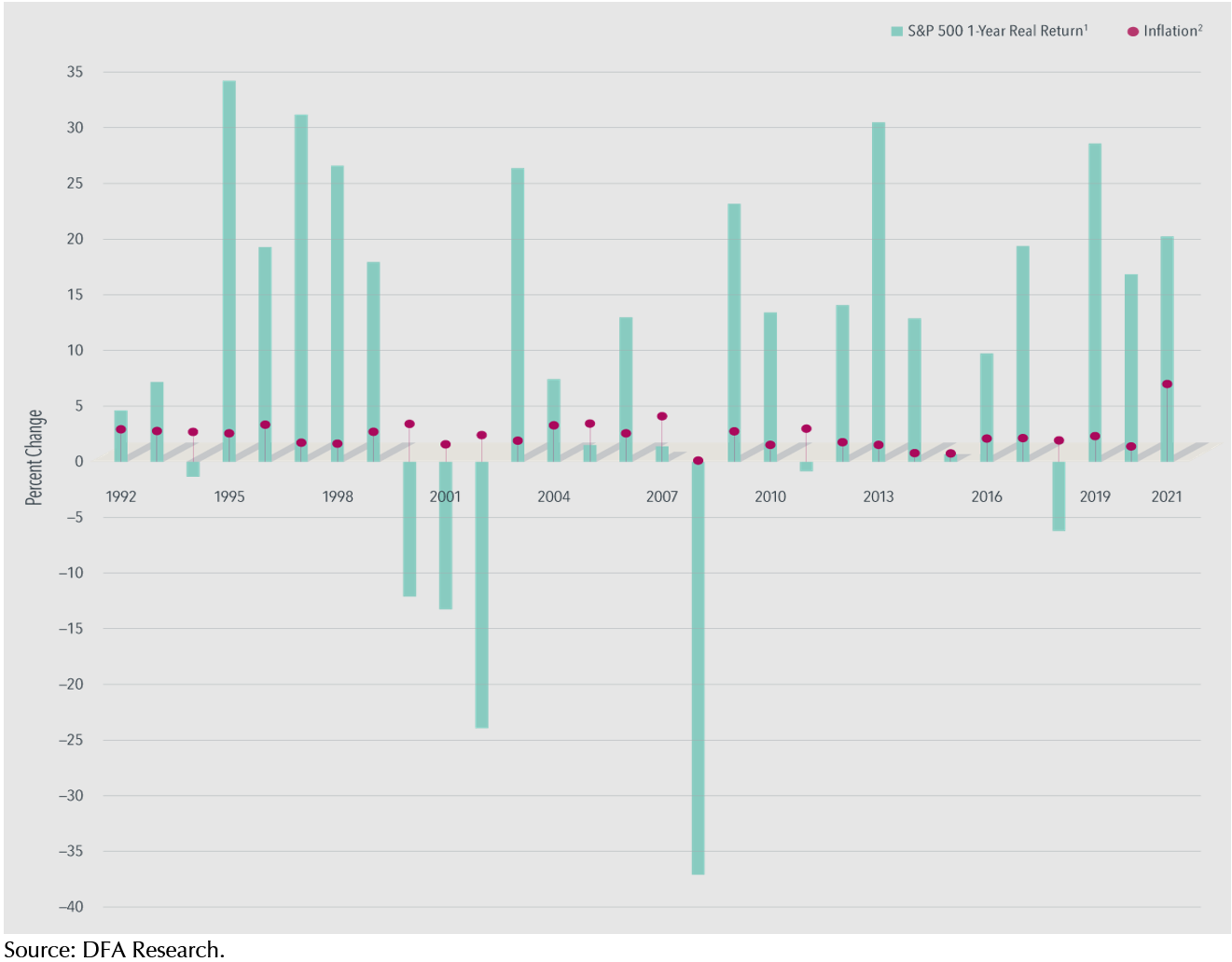

Stay invested for the long term to maintain your purchasing power

Warren Buffett, one of the most successful investors of all time, has often been quoted on the benefits of compounding interest. We would like to highlight the consequences of compounding inflation. While holding cash may seem like a good idea when every asset class is tanking, it is important to remember that inflation can erode your purchasing power tremendously over time. Historical data has shown that market returns beat inflation in the long run, so while falling markets may be scary, it is important to ride through the volatility to capture the long-term returns. Since 1992, the S&P 500 Index has delivered positive real returns (returns adjusted for inflation) in 23 of the past 30 years (see Exhibit 4).

Exhibit 4 – Annual Inflation-Adjusted Returns of S&P 500 Index vs. inflation 1992–2021

We are thankful that markets arrested their decline in May but would like to prepare our clients to expect volatility in the coming months as we get more clarity on the pace of rate hikes by the Fed and the ECB. It is however this uncertainty that generates the return in the market, which we are confident our diversified portfolios can capture. However, it requires experiencing some volatility as the markets work out the short-term uncertainty.

As always, our advisers are here for you and happy to discuss any concerns or questions you may have. Do reach out to your adviser if you require more information or even if you just want to have a chat about the markets. Thank you for your continued trust and support in this difficult period, and we endeavour to support you to the best we can to achieve your wealth goals.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.