November turned out to be a month of 2 halves, as stocks rose to records in mid-November as optimism over the economic recovery continued, but as news of the new Omicron variant started to emerge at the end of the month, there was a quick and sharp retreat by stocks as investors reacted to the news.

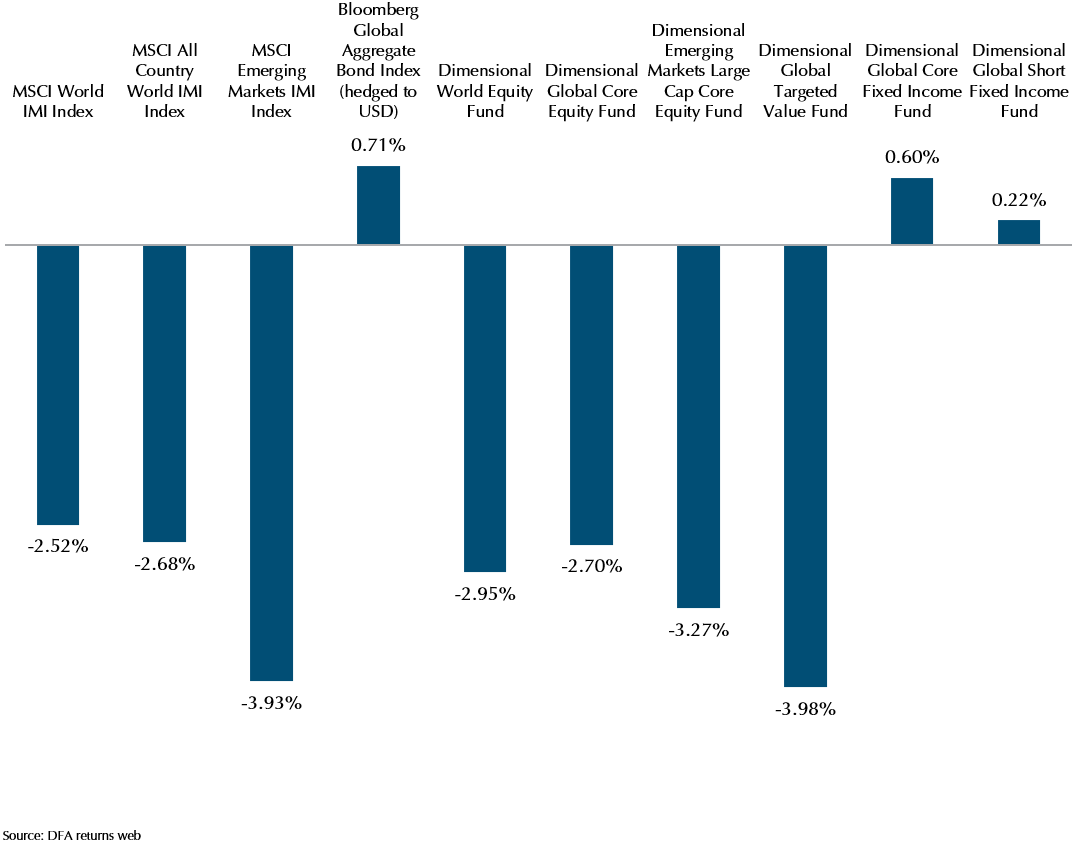

Exhibit 1 – Index and DFA Funds Performance Nov 2021

Bonds stabilise the portfolio in times of genuine market stress

We can see that fixed income returns rose for the month of November despite the continued concerns over the Fed taper, inflation, and rate hikes. This is because, when the markets were attempting to price in the new information on Omicron, the reaction was to sell the risky assets (stocks) and buy the safe ones (bonds). This helped bonds recover from their initial losses over the month to deliver a positive return. While the return might not be very high relative to equity returns, the real impact is to cushion the fall in your portfolio’s value. For example, if you were holding a portfolio with 40% in bonds and 60% in stocks, only 60% of your portfolio value was at risk during the last week of November when stocks fell, while the other 40% was delivering a small positive return.

This happens because historically, bonds have had a negative correlation to stocks. Correlation is the direction of movement of an asset against another asset. In this case, negative correlation means that when stocks go up, typically bonds will fall, but when stocks fall, typically bonds go up. Do note that this is mainly true for high quality sovereign bonds. High yield bonds behave more like equity and are not considered an allocation that will bring stability to a portfolio.

Markets are always pricing in the short-term information

The news of Omicron brought a lot of uncertainty to the market in the last week of November. Travel had only just resumed for many countries with the US lifting travel bans from Europe, Australia allowing limited international travel and Singapore launching many new VTLs. The emergence of a new variant of concern was always a possibility and the stock markets reacted in the most efficient manner to the uncertainty, by selling down the stocks of businesses that are most affected by a resurgence of Covid-19 and possible restrictions on travel and social activities.

What we have seen is markets working very efficiently to price in the new information. As the uncertainty was at its highest towards the end of November, markets fell. As of the time of writing, we have seen that uncertainty reduce, with information that existing vaccines will still work against the variant, along with the possibility that the variant might not have as severe symptoms as Delta (here’s hoping!). With the reduction in uncertainty, and the new information available, we have seen equities recover in December so far.

Beyond Omicron

While we continue to monitor the impact of the pandemic, it is likely any impact from Omicron is going to be short-lived, as a vaccine that targets the variant can be developed as early as March 2022. What bears watching is Fed policy, as the world watches for the signs that rates will start to rise again. Particularly for our portfolios, higher rates are likely to benefit value stocks, that do not have a larger proportion of their expected cashflows in the future.

Inflation, while a challenge for economies, has so far been manageable for businesses as higher costs have been passed on to consumers, and an allocation to equities has so far been a reasonable hedge against the current inflationary pressures.

Watching the markets for you

We are well into the holiday season, with Christmas and New Year fast approaching. While there is still uncertainty in the markets, we are keeping an eye on the situation for our clients, while they enjoy the festive season.

While we might not be adjusting our portfolios constantly, we are always revisiting our investment assumptions and theses, along with constantly monitoring the managers that we implement our portfolios through to make sure that we are getting the performance that we expect from them.

2021 has been a year unlike any other in recent history, with roaring stock markets, rising inflation and many adjustments by businesses and individuals as we progress through the pandemic together. As the year draws to a close, we would like to take this chance to wish you good health, a Merry Christmas and a Happy New Year in 2022! Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.