Introducing the Amundi Index Funds

At Providend, we are constantly working to improve our clients’ investment experience by bringing in new funds for our client portfolios. This month, we are pleased to introduce three new funds managed by Amundi. Amundi is a leading European asset manager with over 100 million clients across the retail, institutional, and corporate sectors. It manages over US$2 trillion in Assets Under Management (AUM) and is a subsidiary of the Crédit Agricole group, the second-largest bank in France. We are pleased to announce that we will be using the following three index-tracking funds:

- The Amundi Index MSCI World fund mirrors the MSCI World Index, representing large and mid-cap indexes in developed markets.

- The Amundi Index MSCI Emerging Markets fund mirrors the MSCI Emerging Markets Index, encompassing large and mid-cap companies from 24 emerging markets.

- The Amundi Global Aggregate bond fund tracks the Bloomberg Global Aggregate index, reflecting the global investment grade fixed-rate debt markets from issuers in both developed and emerging markets.

These indexes are commonly used by investment professionals to represent broad market returns, hence we have implemented these funds into a set of passive index portfolios. If you are interested in finding out more, do contact your Client Adviser. We will also be using the funds’ performance this month to reflect the market return as a way to familiarise clients with the new funds.

Market Review for February

Equities surged over 4% in February, propelled by the prevailing optimism surrounding the potential of Artificial Intelligence (AI) to drive profits for big technology companies. This sentiment was substantiated by recent announcements, notably from Nvidia, reporting a remarkable 265% increase in revenue driven primarily by robust sales of AI chips for servers. With a 2.5% allocation in the Amundi Index MSCI World fund, Nvidia’s stock soared 29% in February and 66% year-to-date, consequently lifting the Amundi Index MSCI World fund by 4.2%.

In emerging markets, the Amundi Index MSCI Emerging Markets fund experienced a significant 4.7% increase in February, recovering from a January decline of more than 4%. This resurgence can be attributed to TSMC, experiencing nearly a 10% rise in February after projecting a 20% increase in 2024 revenue, fuelled by soaring demand for AI-related chips. TSMC holds a 7.2% weight in the Amundi Index MSCI Emerging Market fund. Additionally, the Chinese market, comprising 25% of the Amundi Index MSCI Emerging Market fund, rebounded due to new measures by the Chinese government aimed at bolstering equity markets. The CSI 300, reflecting the top 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges, surged by 9.35%.

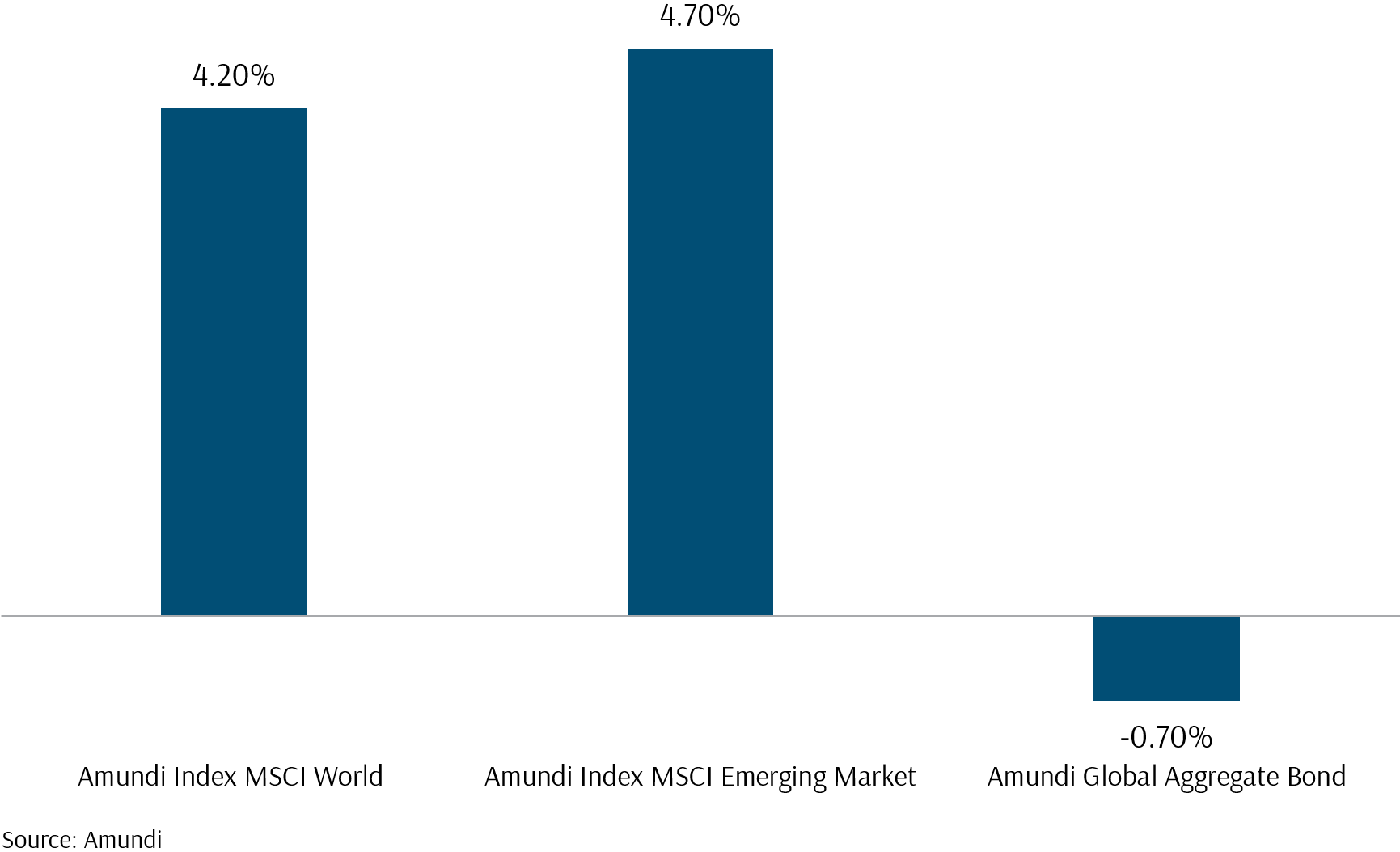

This month’s market review utilises Amundi Index funds as proxies to track index performance. Exhibit 1 illustrates the performance of Amundi USD funds in February. Apart from the previously mentioned equities fund performance, The Amundi Global Aggregate bond fund experienced a 0.7% decrease in February. This decline was linked to increasing yields after the US central bank decided to postpone anticipations of earlier interest rate cuts. Consequently, bond prices fell, with the 10-year US treasury yield rising by 30 basis points.

Aligned with the performance of the Amundi equity fund, the Dimensional Global Core Equity USD fund and the Dimensional Emerging Market Large Cap Core Equity USD fund also excelled, rising by 4.2% and 4.3% in February, respectively. Although the Global Core Equity USD fund underweights big-tech due to its emphasis on value and small-cap stocks, it is currently overweight the industrials sector, which outperformed the broader market. The Industrial Select Sector SPDR Fund, representing the industrial sector of the S&P 500 Index, climbed 7.2% in February. Hence, its performance is similar to the Amundi Index MSCI World fund.

Nevertheless, both Dimensional and Amundi equity funds were primarily driven by AI performance, which surged by more than 4%. Moreover, February witnessed a departure from the recent trend, as equities climbed despite rising yields and falling bond prices, thanks to the optimism over AI-related stocks.

Exhibit 1 – Amundi Index Performance: February 2024 (USD)

Do Not Overlook the Downside

“Why not simply invest in big-tech sectors poised to benefit from the AI wave?” one might ask.

The reason is that concentrating solely on one sector carries a significant downside risk. Reflecting on the dot-com bust of the early 2000s, the surge in Internet-based companies drove the Nasdaq Composite Index to soar over 200% from October 1998 to March 2000. However, it swiftly plummeted by 75% from April 2000 to October 2002, wiping out the initial gains. Many investors were swept up in the hype surrounding Internet stocks, pouring money into them without fully comprehending the risks. When the bubble burst, those heavily invested in the sector had unfortunately suffered substantial losses.

A critical lesson from this period underscores the importance of diversification. Investors who spread their portfolios across various sectors and asset classes were better equipped to weather the downturn compared to those solely focused on technology stocks. Diversification serves to mitigate risk and minimise the impact of losses in any single sector or asset class.

The significance of this lesson was reaffirmed in the recent stock rout of 2022. Prior to November 2021, the Nasdaq Composite had surged since April 2020. However, between November 2021 and December 2022, during a period marked by a sharp rise in yields and borrowing costs, equities, particularly the technology sector, experienced a significant downturn. The technology-heavy Nasdaq Composite plummeted by 33%, while Providend’s 60/40 Reference Index, comprising 60% MSCI All Country World IMI Index and 40% Global Aggregate Bond Index, declined by 12.7%. This decline was notably less severe than the Nasdaq’s, attributed firstly to the 40% allocation to bonds, which cushioned the equity fall to some extent. And secondly, to the MSCI All Country World IMI Index’s more diversified nature across sectors, with only 22% allocated to the information technology sector compared to the Nasdaq Composite’s 57%. Thus, holding a diversified portfolio is a more wise and prudent approach.

This reversal serves as a cautionary tale, emphasising the folly of relying on past performance to predict future outcomes.

How About Just Investing in a Company That Has a Strong Performance Record Like Nvidia?

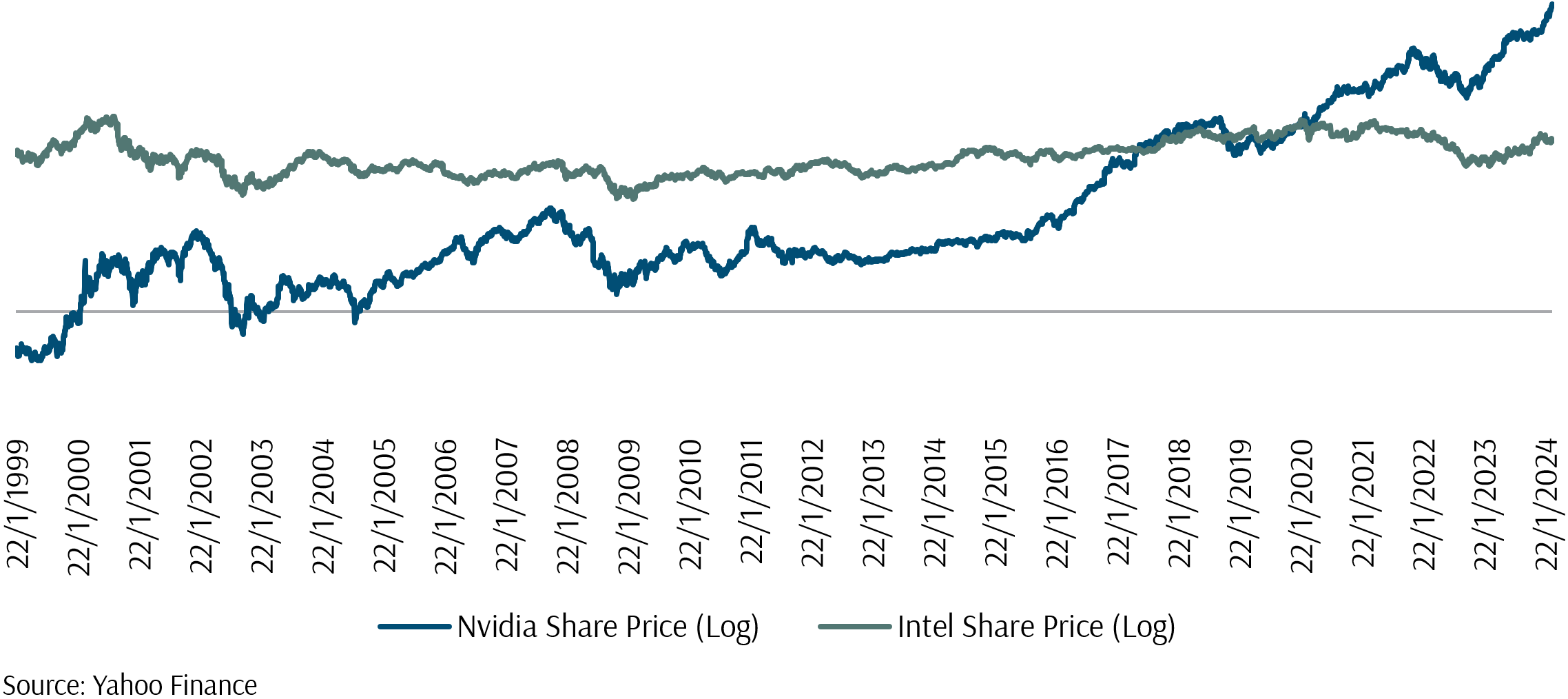

Even if a company has consistently delivered robust stock returns in the past, there is no guarantee of exceptional returns in the future. This reality becomes apparent when examining stocks that have ascended to become the top 10 market cap leaders. It is crucial to recognise that we are only analysing the most resilient survivors. In hindsight, the clarity of vision regarding past events is often 20/20. Consider the choice between investing in Nvidia or Intel 10 or 20 years ago. Back then, Intel boasted a market cap over 10 times larger than Nvidia’s, yet Nvidia only surpassed Intel’s market cap in mid-2020.

Exhibit 2 illustrates the stock market performance of Nvidia versus Intel using logarithmic scales, which compress the price scale for equal percentage changes to be depicted equidistantly on the chart. This allows for a clearer visualisation of percentage changes, enabling investors to focus on relative performance and mitigate the influence of absolute price movements.

Exhibit 2 – Nvidia vs Intel Share Price From 22 Jan 1999 to 7 March 2024 (Log Scales)

Had you invested in Intel for 20 years from 1 March 2004 to 29 February 2024, your annualised returns would have been a mere 1.8%, lower than a conservative estimate of 2% inflation per year. In other words, the purchasing power of your initial investment in March 2004 would have diminished over time. Rushing into investing in a single stock solely based on its historical performance is not advisable.

Choose the Passenger Train Over the Roller Coaster for Life Planning

Riding a roller coaster offers an exhilarating mix of highs and lows—an experience akin to the rapid gains and potential losses of speculative or concentrated investments. While these investments can deliver excitement during market upswings, they also pose risks when conditions shift or sectors falter. Just like the roller coaster, speculative ventures can be thrilling yet unnerving, especially if unforeseen downturns affect your retirement plans.

In contrast, picture yourself aboard a passenger train—a smoother, more predictable journey compared to the roller coaster’s wild fluctuations. Similarly, opting for a diversified portfolio offers stability and reliability over time, albeit without the adrenaline rush of speculative ventures. This approach allows investors to participate in overall market growth while avoiding the volatility of more concentrated investments. When it comes to life planning, the passenger train offers a safer route.

In conclusion, the surge in the stock market, driven by optimism surrounding AI advancements, defies the backdrop of higher yields. While focusing on AI-related sectors can yield substantial gains, diversification remains paramount to mitigate downside risks, as evidenced by historical market fluctuations. It is crucial to heed the lessons of the past and avoid overreliance on any single sector or company’s past performance as a predictor of future success.

As always, if you have any concerns, please do not hesitate to reach out to your Client Adviser. They are here to accompany you on the journey towards retirement, to provide guidance, and to ensure that you stay on track toward your life goals. Thank you very much for your continued trust and support.

To learn more about our purpose-driven approach towards wealth management, please visit this link.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.