The market extended its rally into December, building on the optimism seen in November, driven by expectations of more future rate cuts forecasted by the Federal Reserve. This anticipation contributed to a decline in yields, sparking a rally in both the equity and fixed income markets.

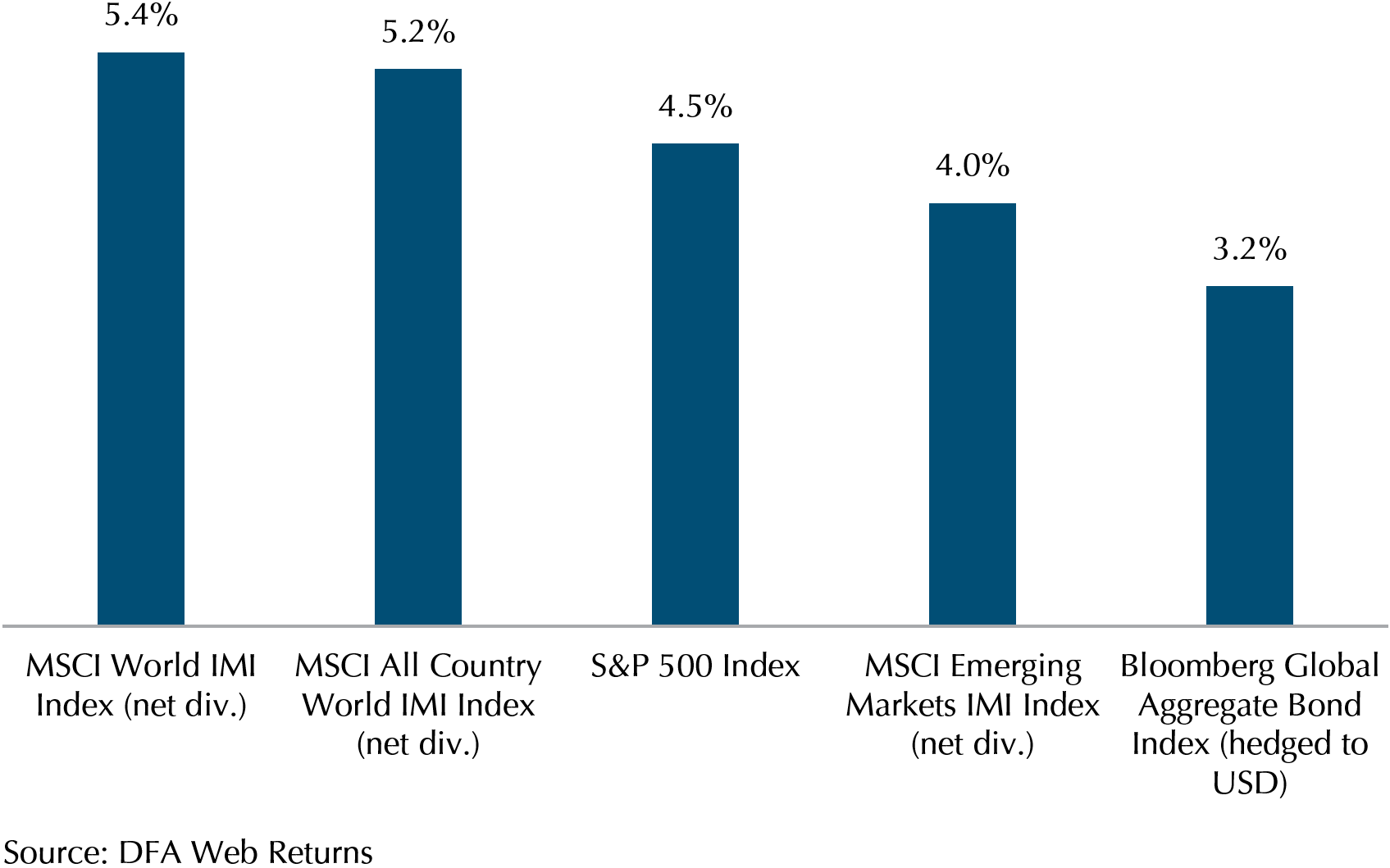

Performance across the market indexes was outstanding. Illustrated in Exhibit 1, the MSCI World IMI, representing the stock prices of large, mid, and small-sized developed market companies, surged by 5.4%. Similarly, the MSCI All Country World IMI, encompassing both developed and emerging market stocks of large, mid, and small-sized companies, climbed by 5.2%. The S&P 500, representing the largest 500 publicly traded companies in the United States, experienced an increase of 4.5%. In emerging markets, the MSCI Emerging Market IMI, reflecting stocks of large, mid, and small-sized companies, witnessed a rise of 4.0%. In the realm of fixed income, falling yields resulted in the Bloomberg Global Aggregate Index climbing by 3.2%, showcasing the inverse relationship between bond prices and yield.

Exhibit 1 – Market Index performance: December 2023 (USD)

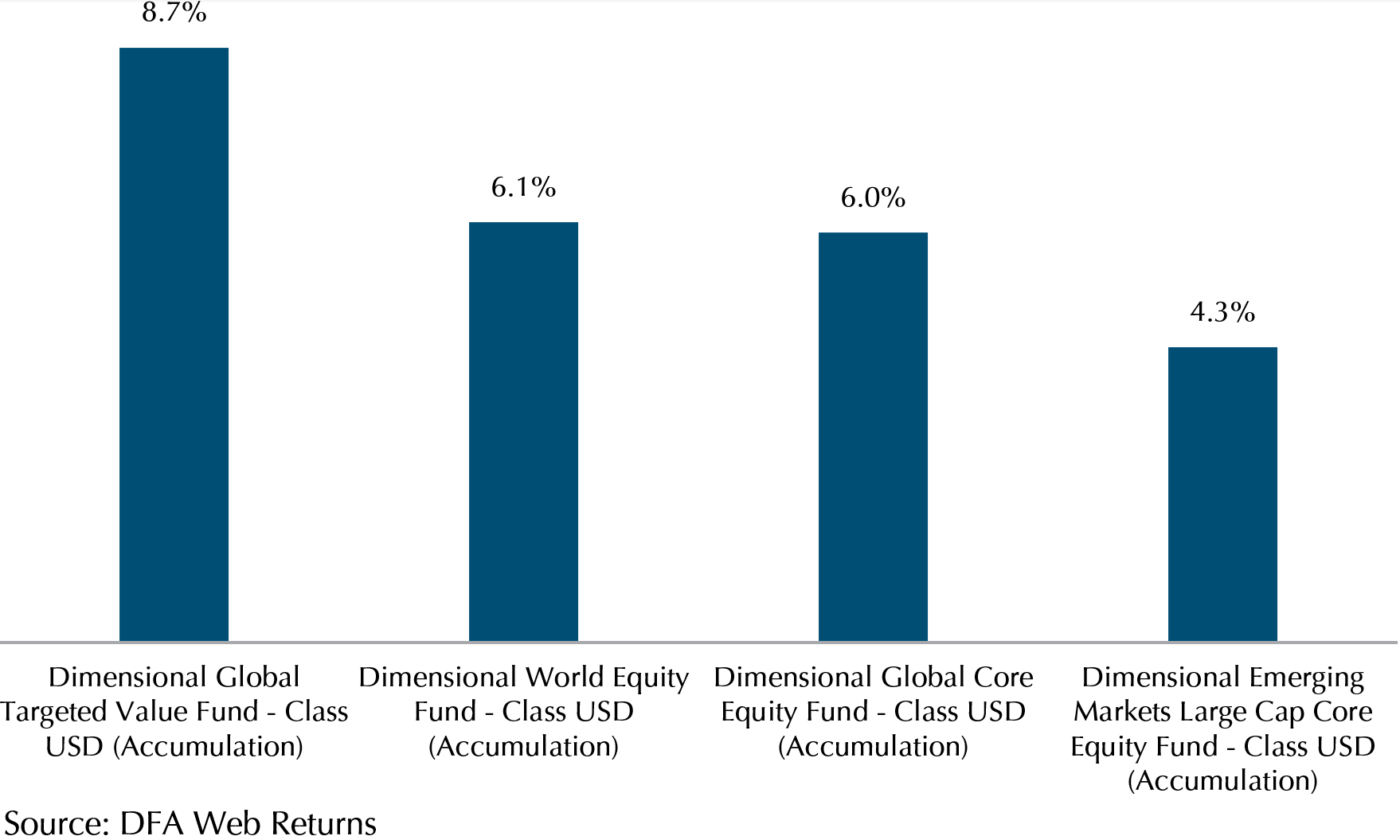

Shifting focus to Dimensional equity funds in December, as depicted in Exhibit 2, small-cap value stocks outperformed large-cap growth. This outperformance was propelled by the robust rebound of US regional banks since the March 2023 crisis. Specifically, the Global Targeted Value exhibited significant gains of 8.7%, surpassing the MSCI World IMI Index by 3.3%, owing to its emphasis on small-cap value stocks. Noteworthy contributions to this outperformance came from small-cap value banks in the fund, including Popular Inc (0.12%, up 11.2%) and Trustmark Corp (0.03%, up 21.7%). The performance of the other Dimensional equity funds was also strong, with the World Equity and Global Core Equity funds up by 6.1% and 6% respectively, while the Emerging Large Cap Core Equity fund increased by 4.3%.

Exhibit 2 – Dimensional Equity Funds Performance: December 2023 (USD)

Reviewing Full Year 2023 Performance

As we head into 2024, let’s take a retrospective look on how we did in 2023.

Despite the challenging first two quarters prompted by the US banking crisis, it turned out to be a robust year for our portfolios. This positive outcome is attributed by a combination of decreasing inflation and strong growth. Developed world inflation, once at 7-7.5%, saw a significant drop to 3-3.5%, coupled with a substantial 30% decrease in energy prices. This positive sentiment prompted forecasts of a future lower interest rate environment, driving yields down and subsequently reducing borrowing costs, which in turn lessened the likelihood of a recession.

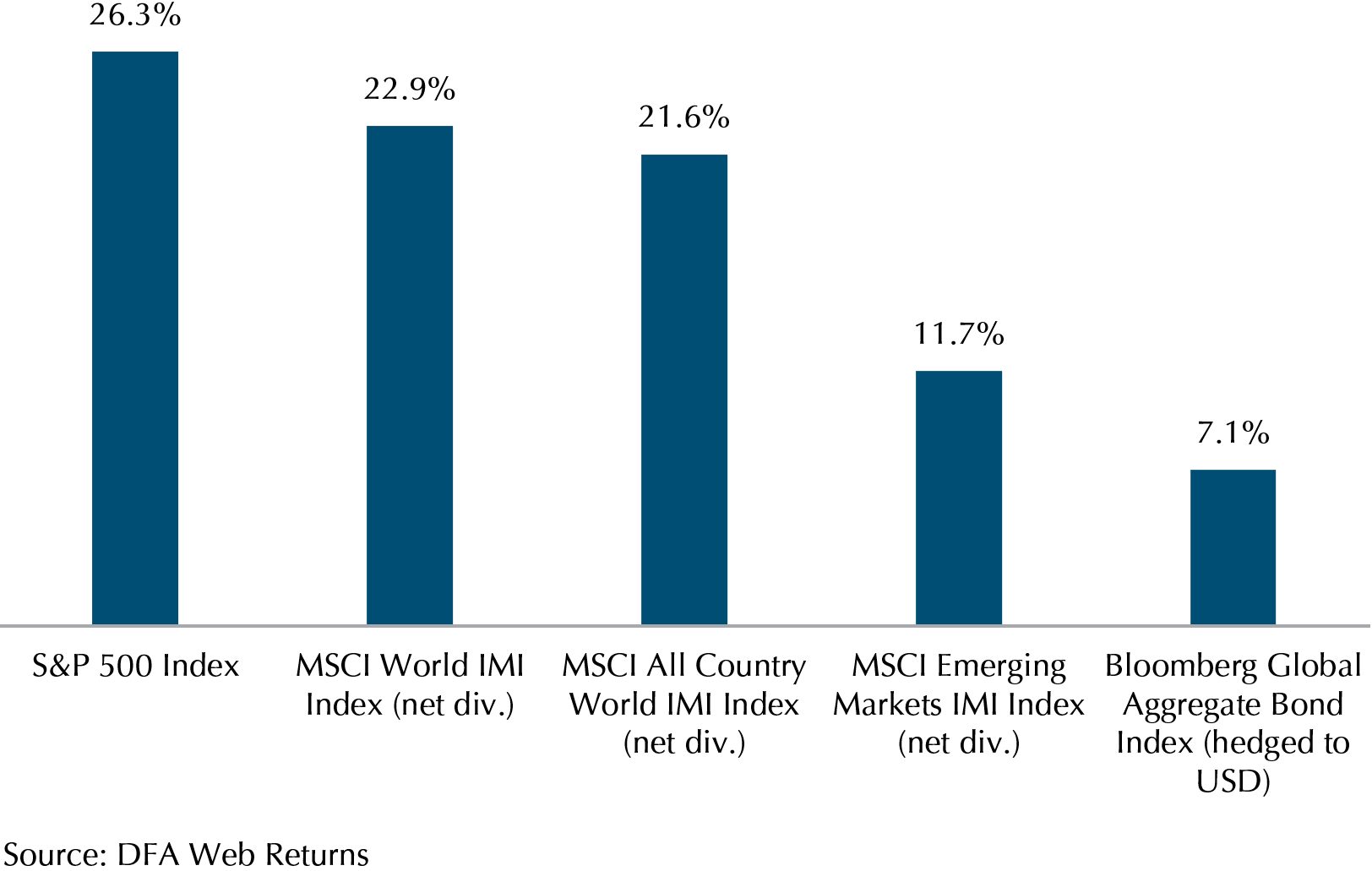

In summary, the 2023 performance was nothing short of stellar. The S&P 500, the MSCI World IMI, and the MSCI All Country World Index all recorded returns exceeding 20%. Even the MSCI Emerging Market Index, though somewhat lower, still delivered an impressive 11.7%. Shifting our focus to fixed income, the Bloomberg Global Aggregate Index also posted a solid return of 7.1%.

Exhibit 3 – Market Index performance: Full Year 2023 (USD)

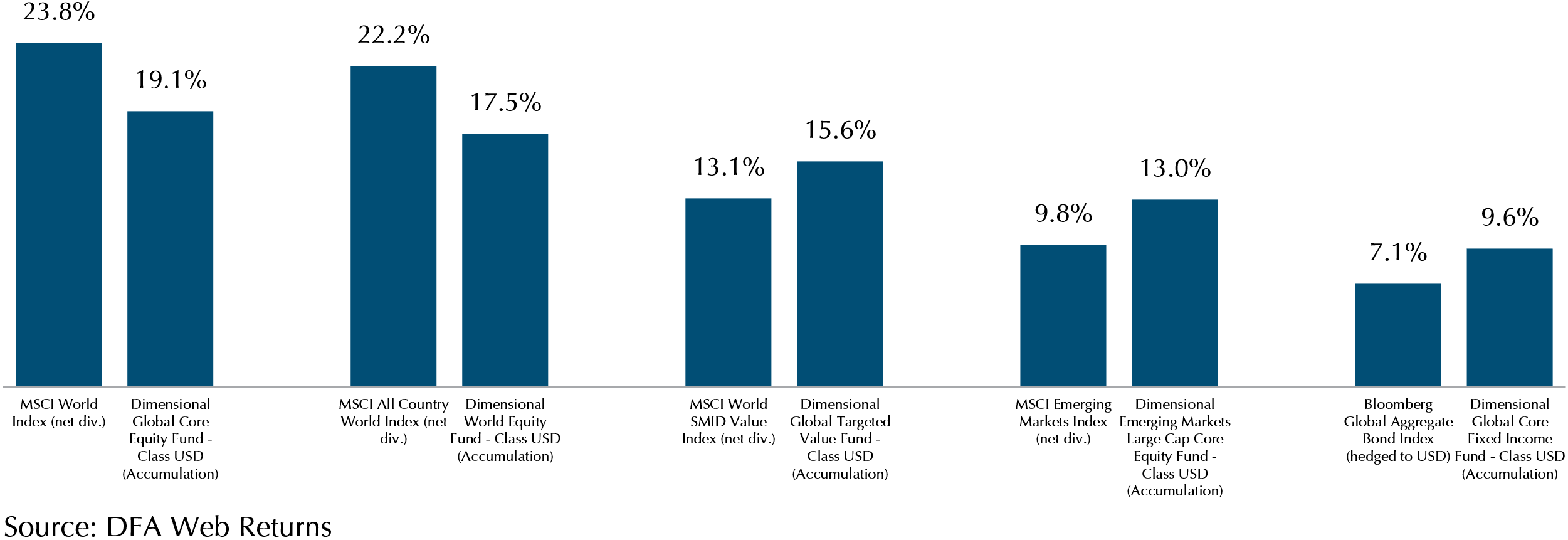

Exhibit 4 – Dimensional Funds vs Market Index Performance: Full Year 2023 (USD)

Next, let’s assess how the Dimensional funds did against the indexes in 2023. Exhibit 4 contrasts the 2023 performance of the Dimensional funds against their reference indexes. In fixed income, the Global Core Fixed Income returned an impressive 9.6%, outpacing the Bloomberg Global Aggregate by 2.5% over the year, as it successfully delivered on capturing higher expected returns by targeting the Term and Credit premiums. On the equity front, the Global Core Equity fund rose 19.1%, as compared to the MSCI World Index’s 23.8% rise. This is largely because as a value focused fund, it is underweight large cap growth and hence underweight the “Magnificent 7” tech stocks that drove a large part of 2023 returns for the indexes. Analysing the contribution of the “Magnificent 7” to the MSCI World Index, 16.8% of the 23.8% returns are attributed to these stocks, with the remaining 7% attributed to other stocks. Holding less of these 7 stocks contributed to a relatively lower performance for the Global Core Equity fund. However, the diversification in the fund still allowed it to deliver a credible return of almost 20% in 2023, following its outperformance vs the MSCI World Index in 2021 and 2022.

From Recession Fears to Market Cheers in 2023

Reflecting on the performance of 2023 underscores the inherent difficulty in trying to predict and time the market. Using analyst forecasts as an example; at the end of 2022, the consensus forecast for the S&P 500 in 2023 anticipated flat performance on average. Instead, the S&P 500 Index surged by 26%. Exhibit 5 illustrates the disparity between Wall Street’s average forecasts for the S&P 500 in 2023 and the actual market performance.

Exhibit 5 – S&P 500 Dec 2022 – Dec 2023 Performance (Wall Street Forecast vs Actual)

Delving into the specifics of Wall Street’s predictions in late 2022, analysts anticipated a recession in 2023, with consensus urging the sale of US stocks, buying Treasuries, and investing in Chinese stocks. The call was that elevated interest rates would lead to recession and negatively impact US stocks, prompting the Fed to reduce interest rates. Analysts expected a robust recovery in the Chinese economy for 2023, driven by a surge in consumer spending after the COVID lockdowns were lifted at the end of 2022.

However, this proved notably wrong as the S&P 500 surged in 2023, driven by robust consumer demand leading to growth and a cooling inflation driven by lower oil prices.

The bond market, expecting a recession from Fed rate hikes, foresaw gains from anticipated rate cuts, but Treasury yields surged instead. Despite the fact that regional US banks had a crisis, the anticipated rate cuts did not materialise. Instead, the Federal Reserve provided a credit lifeline by offering liquidity to eligible depository institutions. This intervention ensured that banks could fulfil their obligations to their depositors, averting an interest rate cut and thwarting the expected bond rally.

While developed markets surged, Chinese stocks encountered difficulties amidst a real estate crisis and deflation, resulting in subdued returns.

The events of 2023 highlight how challenging it is to make accurate market predictions. Instead, an investor is better off staying invested for the long run, focusing on their wealth goals, and resisting emotional impulses to react to headlines.

Picture liquidating your equity portfolios at the close of 2022 based on the Wall Street predictions dominating headlines. How would that have impacted your returns and impeded progress to your wealth goals?

2024 Outlook – Desirable and Undesirable Outcomes

As we delve into the challenges and opportunities of 2024, the economic landscape presents potential uncertainties for investors. Foremost among these is the spectre of a sharp recession in the U.S. and broader developed economies. The risk lies in central banks maintaining tight monetary policies for an extended period, potentially overlooking signals of weakening growth and tightening financial conditions causing cash-strapped companies to potentially default. The flip side of this scenario could see central banks reversing policies, leading to lower government bond yields and giving companies more breathing space.

China’s real estate sector introduces another layer of complexity, with ongoing concerns about potential spillover contagion impacting the non-bank financial sector and the broader economy. The risk of default with Local Government Financing Vehicles (LGFV) remains a financial vulnerability. However, the Chinese authorities are taking steps to address the LGFV issue, employing debt swaps and relaxing policy restrictions on the property market.

Elections and geopolitical factors are anticipated to dominate headlines in 2024. While conflicts in Ukraine and the Middle East may have limited global economic impact, escalating tensions could drive higher oil prices. The U.S. and China engaging in bilateral dialogue may mitigate the risk of military friction, yet any rise in tensions between these economic giants could prompt investors to seek safe-haven assets, like US treasury bonds.

There are also many important global elections slated for 2024, including India, Indonesia, South Africa, Taiwan, the UK, and the U.S., which consist of 73% of the global market universe or the MSCI All Country World Index. The is a possibility that market volatility may heighten in the lead-up to these major elections.

The complexities arising from economic, political, and market dynamics highlight the inherent challenges and uncertainties. Amidst this challenging landscape, opportunities emerge, notably propelled by advancements in Artificial Intelligence (AI). The year 2023 witnessed a surge in AI optimism, contributing to the dominance of the ‘magnificent 7’ in driving market returns, resulting in a narrow breadth[1] of market performance. However, the benefits of AI adoption is not limited to the tech sector; it has the potential to permeate various industries, creating favourable conditions for sectors such as infrastructure, semiconductors, and software companies. If there is widespread adoption of AI across sectors, it could accelerate technological progress and, consequently, drive market returns upward while expanding the breadth of market performance.

The economic environment in 2024 is poised to be challenging, marked by geopolitics risk and policy uncertainties, but at the same time there is potential for growth propelled by AI. The multifaceted nature of these challenges and opportunities necessitates a diversified portfolio, encompassing stocks and bonds to be resilient against various contingencies.

Conclusion – Staying Invested Might Sound Boring, but It Works

The analysis that forecasts provide are useful for understanding the current investment climate, but they are probably not as effective to use as a tool for formulating an investment strategy. The difference between expectations and reality in 2023 underscores the inherent difficulty in predicting market movements. In fact, this is common to most years since analysts have started trying to forecast the markets.

Despite being seemingly counter-intuitive, taking less action by staying invested in a diversified portfolio worked well in 2023, and has worked well in many previous years where markets have been volatile.

As uncertainties persist in 2024, the emphasis on a balanced and diversified portfolio remains pivotal. The market’s acknowledgment of uncertainties, reflected in the expectation of a premium over risk-free returns, reinforces the wisdom of staying invested rather than attempting to time the market.

As we embark on a new year, it’s essential to appreciate that investment success is often a journey rather than a destination. Providend remains committed to vigilantly monitor market conditions, and keep you informed while reviewing your plans to ensure they align with your evolving circumstances.

We would like to wish you a prosperous and fulfilling year ahead in 2024. Thank you for entrusting us on your wealth journey, and we look forward to another meaningful year with you as we progress together towards your life goals.

– Footnotes –

[1] Narrow Breadth means that only a small number of stocks are driving the movement of the market. In 2023, the magnificent 7 are the ones that drove the market movements upwards.We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.