Prime Minister and Finance Minister Lawrence Wong delivered the Singapore Budget 2026 on 12 February 2026.

Considering a new world order along with rising geopolitical tensions, he emphasised that there are considerable challenges that we will need to face as a nation.

Among them, he mentioned:

- Maintaining Singapore’s global competitiveness through technological transformation and innovation

- The need to develop and safeguard the deployment of AI throughout Singapore

- Continuing to strengthen our workforce in a fast-changing business environment through upskilling and reskilling

- Managing the rising cost of living for Singaporeans

- Supporting our ageing population when it comes to retirement and long-term care

In this piece, we highlight the key changes relevant to our personal finances.

Support for Every Singaporean Household

a. Community Development Council (CDC) Vouchers Scheme

Every Singaporean household will receive $500 in CDC vouchers. Half can be used at participating supermarkets; the other half can be used at participating heartland merchants and hawkers.

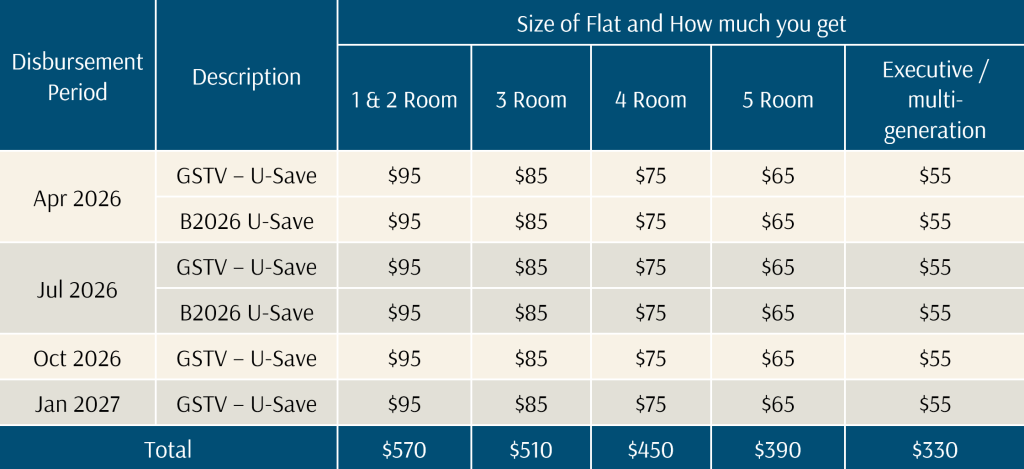

b. 2026 U-Save Rebates

Eligible households will receive a total of up to $570 in U-Save rebates this financial year (equivalent to 1.5 times the regular amount) to help manage rising costs and the carbon tax increase.

Notes:

- If the HDB flat is partially rented out or not rented out, there must be at least one Singaporean owner or occupier in the household to be eligible for U-Save. If the entire HDB flat is rented out, there must be at least one Singaporean tenant.

- Households whose members own more than one property are not eligible for U-Save.

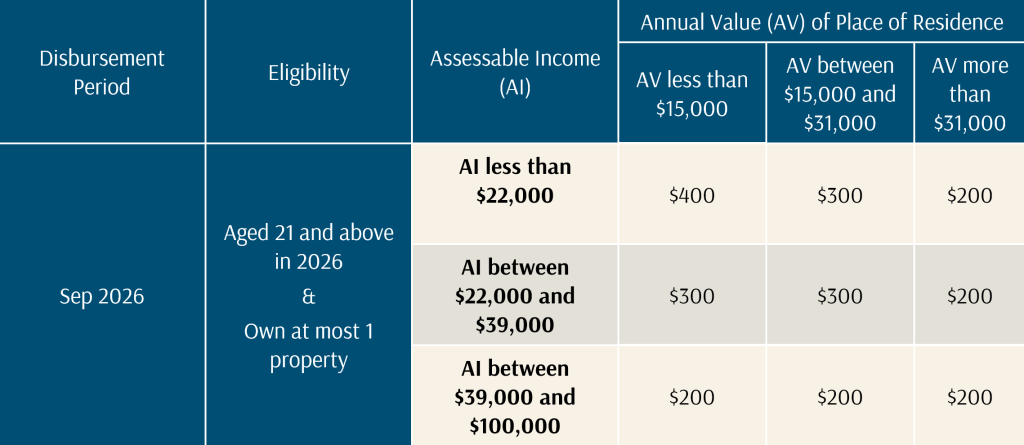

c. Cost of Living Special Payment

Eligible adult Singaporeans will also receive a one-off cash payout of $200 to $400 to help manage daily expenses.

Building Up Seniors’ CPF Savings

a. Creation of a Lifetime Retirement Investment Scheme

Later in the year, CPF will be releasing more details about a Lifetime Retirement Investment Scheme (LRIS) planned for launch in 2028.

The 13-member CPF Advisory Panel (which included Providend CEO Christopher Tan) first proposed the scheme in 2016 as part of a long-term strategy to enhance retirement adequacy.

The new scheme will serve as an alternative to the current CPF Investment Scheme (CPFIS) and help CPF members who are willing to take some risk for potentially higher returns over the long term but may find CPFIS offerings challenging to navigate or prefer not to actively manage their investments.

The new scheme will have several key features:

- Automatic age-based rebalancing of investment portfolio mix, with phased liquidation

Investors’ portfolio mix will automatically rebalance along a glidepath from higher-risk assets to lower-risk assets as they age, before being liquidated in phases by the target date.This calibrates the amount of investment risk to which investors are exposed to at different stages of life and mitigates the risk of a market downturn during exit. - Simplified choice

To simplify decision-making for investors, CPF is looking to select two to three reputable product providers to offer a small number of options. - Low fees

All-in fees will be capped to minimise costs and allow investors to retain and benefit from more of their investment returns.

This scheme is a welcome addition to the ways in which one can grow and manage their CPF money, especially because of the proposed emphasis on broad, long term market exposure with low-cost implementation.

While we trust this will be helpful to many, and provide additional options for members, the scheme may not be suitable for CPF members who prioritize capital preservation and are uncomfortable with short-term market fluctuations.

Those who prefer to avoid market uncertainty and value stability above all else may find the existing CPF interest rates more appropriate. In fact, we would generally recommend using only ordinary account (OA) funds rather than any special account (SA) funds for this scheme.

The guaranteed 4% per annum on the SA is a high benchmark for any investment to beat on a risk-adjusted basis; taking on significant equity risk for a potential premium of only 2% to 3% over the SA rate may not be a prudent trade-off for many members.

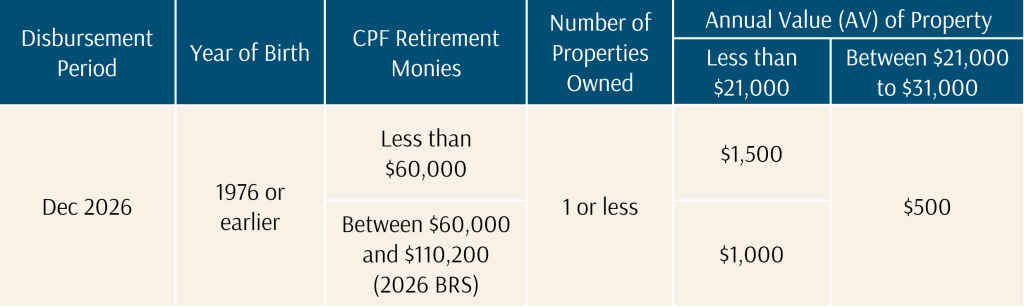

b. Government CPF top-up

To enhance retirement adequacy, Singaporeans aged 50 and above in 2026 will receive a one-off means-tested CPF top-up, provided they are residing in Singapore.

The money will be credited to their CPF Retirement Account or Special Account.

Note on CPF Retirement Monies:

- Before 55: CPF Ordinary Account + Special Account balances

- After 55: CPF Retirement Account + CPF LIFE balances

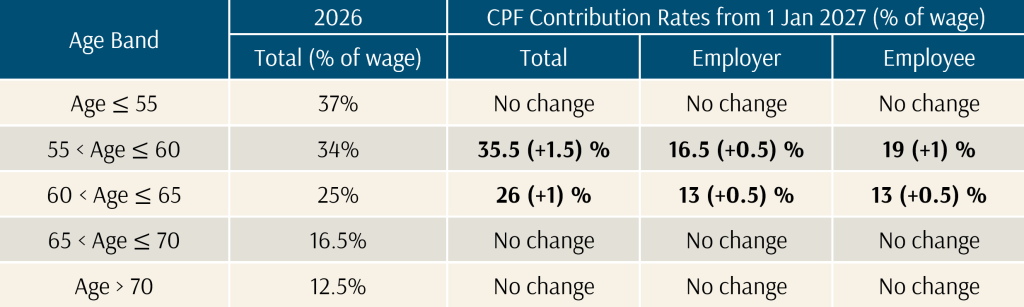

c. 2027 Increase in CPF Contribution Rates for Senior Workers [Recurring]:

For employees earning monthly wages exceeding $750:

Additional Support for Families

a. LifeSG Credits

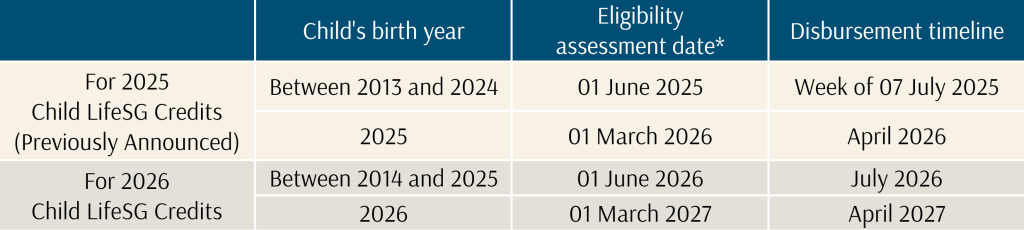

Families with children will receive $500 in LifeSG credits for children for each Singaporean child aged 12 and below this year which can be used to defray household expenses. These will be accessible by via the LifeSG application.

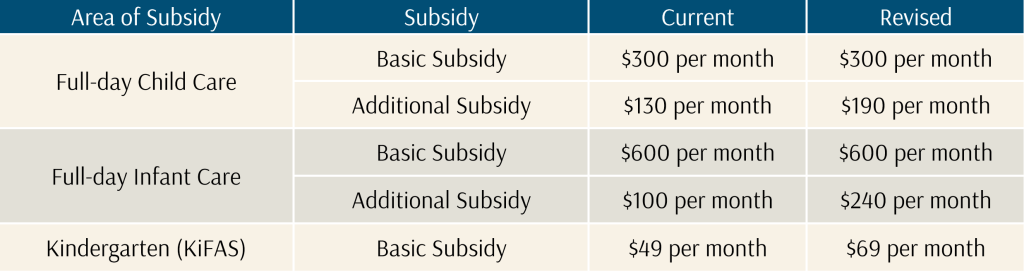

b. Preschool subsidies and Student Care fee assistance

The government has enhanced the subsidies for preschool and student care services to help defray the costs for Singaporeans. They are increasing the means-tested limits so that more Singaporeans can qualify and benefit.

The subsidised schemes that will be enhanced are:

- Infant and Childcare Additional Subsidy Scheme

- Provides basic subsidies for children enrolled in ECDA-licensed infant or childcare centres

- Includes additional subsidies if the main applicant works, subject to a minimum co-payment.

- Kindergarten Fee Assistance Scheme (“KiFAS”)

- Provides subsidies for children enrolled in Anchor Operators or MOE Kindergartens, subject to a minimum co-payment.

- Student Care Fee Assistance (“SCFA”)

- Provides basic subsidies for MSF-registered student care centres.

Singapore Budget 2026 adjusts the means-testing criteria so that Singaporean families with a slightly higher income can qualify for subsidies.

The means-test is based on either:

- Gross Monthly Household Income (HHI): Combined average gross monthly income of both the applicant and spouse.

- Per Capita Income (PCI): Total average gross monthly household income of all family members in the household divided by the number of family members in the household. PCI is used for households with at least 5 family members.

For example, for a family with a combined average gross monthly income of $10,000 will enjoy greater subsidies with this update:

The maximum qualifying household income for Student Care Fee Assistance will be increased from $4,500 per month to $6,500 per month, increasing the number of households that are eligible for student care subsidies.

For more information, please refer to Annex E-4 of Ministry of Finance’s Singapore Budget 2026: Enhancements to Preschool and Student Care Subsidies.

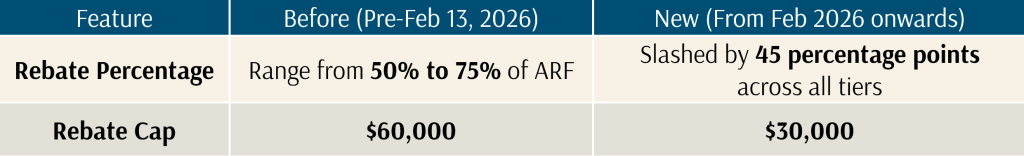

PARF Rebate Reduction

The Preferential Additional Registration Fee (PARF) Rebate given to car owners in Singapore who choose to deregister (scrap or export) their vehicle before the car reaches 10 years of age will be reduced from Feb 2026.

The reduction consists of a percentage cut and a lower cap.

The likely effects of this change are:

- Higher depreciation experience: Due to the lower rebate when you scrap your car, your “total loss” over 10 years is higher, increasing the effective annual cost of owning a new car.

- Luxury cars will be hit hardest: High-end cars with a high ARF (Additional Registration Fee) will see the biggest drop in value. For example, a luxury car that used to get back $60,000 at the 10-year mark will now only get back $30,000 (due to the cap) or even just 5% of its ARF.

- Value of existing registrations may increase: Existing cars registered under the old system (before Feb 2026) might become more attractive because they still carry the higher “old” rebate values, potentially propping up their resale prices.

- Owners are incentivised to keep cars longer: Since the “scrap value” is now so low (only 5% in the final year), there is less financial incentive to deregister a car at the 9th year compared to the 10th.

Conclusion

In conclusion, Budget 2026 aims to increase the resilience of Singaporeans by balancing immediate relief with long term adaptability.

In the short term, the government will still be providing cost of living reliefs such as increasing preschool and childcare subsidies and issuing CDC, U-Save and Special payment vouchers.

In the long term, the government is focusing on supporting families, enhancing upskilling and building retirement adequacy for all Singaporeans, with Child LifeSG credits, topping up CPF for those above 50 and creating new options for CPF investments.

If you would like more information about all the Budget 2026 changes, please visit: Budget 2026 | Singapore Budget

Warmest regards,

Solutions Team

– Reference Links –

- MOF – Singapore Budget Site

- Giving Families More Support and Greater Assurance

- CPF LRIS

- Business Times – Is CPF’s new life-cycle investment scheme for everyone?

- LTA | Revision of Preferential Additional Registration Fee (PARF) Rebate Schedule and Cap

We do not charge a fee at the first consultation meeting. If you would like an honest opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.