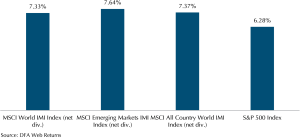

The January effect is a phenomenon where stocks tend to rise at the beginning of the year. The January effect was in full play this year as the stock market rallied following the news of inflation moderating in Europe and the US and news of China reopening. Stock Market indexes experienced their best January since 2019. The MSCI World IMI, Emerging Markets IMI, and All Country World IMI indexes rose above 7% while the S&P 500 rose 6.28% in January (Exhibit 1).

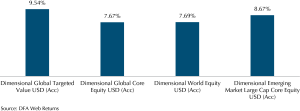

In comparison, Dimensional equity funds did even better when compared against the indexes as value stocks continued their recent period of outperformance (Exhibit 2). The Global Targeted Value and Global Core Equity funds which consist of mainly developed market stocks rose 9.54% and 7.67% respectively (vs 7.33% for the MSCI World IMI). The World Equity Fund which has an allocation to Emerging Market stocks rose 7.69% (vs 7.37% for the MSCI All Country World IMI). Finally, the Emerging Markets Large Cap Core Equity Fund rose 8.67% in contrast to the MSCI Emerging Markets IMI which rose 7.64%.

Exhibit 1: Indexes Performance January 2023

Exhibit 2: DFA Funds Performance January 2023

Capturing the Performance for Clients

What is important to note is that as the market rebounded over the past 4 months and into January this year, our portfolios have captured this performance (as can be seen from the performance of the Dimensional funds and the Index funds) because we have continued to maintain our Strategic Asset Allocation (SAA) and did not make any attempts to be tactical (for example, moving to cash while the markets were volatile last year would constitute as a tactical portfolio change).

While it can be challenging sometimes to not act as markets are moving, our confidence in our asset allocation, along with the extremely diversified portfolios we have constructed allow us to remain patient and wait out the volatile periods to capture the asset class returns over time.

Inflation Moderates but Wages May Remain Sticky

In December 2022, the US inflation rate, as measured by the Consumer Price Index (CPI) fell from 7.1% to 6.5% month on month while the Euro Zone inflation slowed to 9.2% from 10.1% a month earlier. The moderation of inflation in the West suggests that the Federal Reserve and European Central Bank (ECB) may take a less aggressive rate hike stance to counter inflation. Hence, the market had likely reacted positively to cooling inflation due to the increased likelihood of lower borrowing costs which helps boost the economy.

Even though the news of cooling inflation in the new year is welcoming but the path of inflation going forward remains uncertain. Record low unemployment rates (Exhibit 3) in both the US and Euro Area driven by high labour demand and labour supply shortage may continue to fuel competition for workers and drive wage growth even higher. Already, wage growth in the US is at a record high (Exhibit 4). If a tight labour market continues to persist, it may lead to what economists call a “wage-price spiral” where a scarcity of workers leads to higher wages and forces businesses to raise prices on consumers. If this were to happen, the Fed may take an even stronger stance to hike rates as the wage-price spiral tends to be stubborn. In such an environment, the market may continue to recalibrate prices to account for a tougher economy.

Exhibit 3: Euro Area and US Unemployment Rates

Exhibit 4: US Wage Growth Tracker

The Resurgence of China’s Appetite for Commodities

Further east, news of China’s opening after 3 years of lockdown was also welcomed by the market due to hopes that an opened China will reinvigorate the global economy. According to data from Bank of America Global Research, investors poured 12.7 billion USD into emerging debt and equity funds on 18 January after news of China’s reopening. Furthermore, as of 2 February, iShares also recorded net inflows of 8.2 billion USD into their emerging market equity funds year-to-date while having a net outflow of 13.6 billion USD from their developed market equity funds year-to-date. The reasons for the gain in confidence in emerging market stocks were likely due to an expected increase in demand for commodities and a surge in tourism.

Barring any reimposition of stricter lockdowns, China’s opening would likely boost global demand and growth. However, this will be a double-edged sword as well. This is because China is usually the largest importer of commodities and a transition back to pre-Covid times could possibly fan inflation as its appetite for commodities returns.

The uncertain path of inflation in the future is a possible downside scenario as major central banks might be forced to tighten more than what the market is currently expecting, leading to renewed volatility in the prices of stocks and bonds.

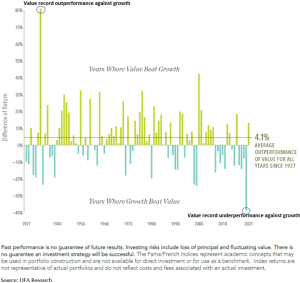

Value Stocks Continue to Do Well into 2023

A couple of years ago, the outperformance of growth stocks was at a record high and there were many articles discussing the death of value investing (Exhibit 5). However, value stocks have done so well in the last year that the Dimensional Global Targeted Value fund has recovered all its losses in 2022 as of the end of January 2023 while the MSCI World IMI Index is still at double-digit losses (Exhibit 6).

Looking at Exhibit 6, we can see that $1 invested in the Dimensional Global Targeted Value Fund on 31 December 2021 would have regained its value by 31 January 2023, but $1 invested the MSCI World IMI Index would be worth only $0.88. As a deep value fund, the Global Targeted Value Fund gives our portfolios a stronger tilt towards the value factor, and it has delivered on its promise in the past couple of years as value stocks have started to regain favour among investors.

Exhibit 5: Yearly Observations of Premiums: Value Minus Growth in US Markets, 1927-2021

Exhibit 6: Growth of Wealth ($100) from 31 December 2021 – 31 January 2023

Conclusion – Expect More Uncertainty Ahead

While the markets had a great January, the outlook is far from certain as investors continue to grapple with inflation and how it impacts central bank decision making. Therefore, it is important to stay prudent with your spending, and invest in a manner that is compatible with achieving your wealth goals.

We encourage you to have a discussion with your advisers should you require any re-calibration of your wealth plans in light of the continued uncertainty around markets and the global economy.

Thank you for your continued trust and support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.