Stocks and bonds soared in November after lower-than-expected US inflation data in October and the Fed signalling a slowdown in rate hike. Released on November 10th, the US CPI, which measures changes in the prices paid by consumers for a basket of goods and services, showed that headline inflation was at 7.7% versus consensus forecast of 8%. The lower-than-expected inflation rate boosted market confidence that price levels are coming down. Equities ended sharply higher on the same day with S&P 500 up almost 5% while the US 10-year Treasury yield tumbled more than 0.3%, driving bond price higher. In addition, on the last day of November, the Fed Chair, Jerome Powell, commented that rate hikes might slow down as soon as December, triggering another bout of rally for stocks and bonds.

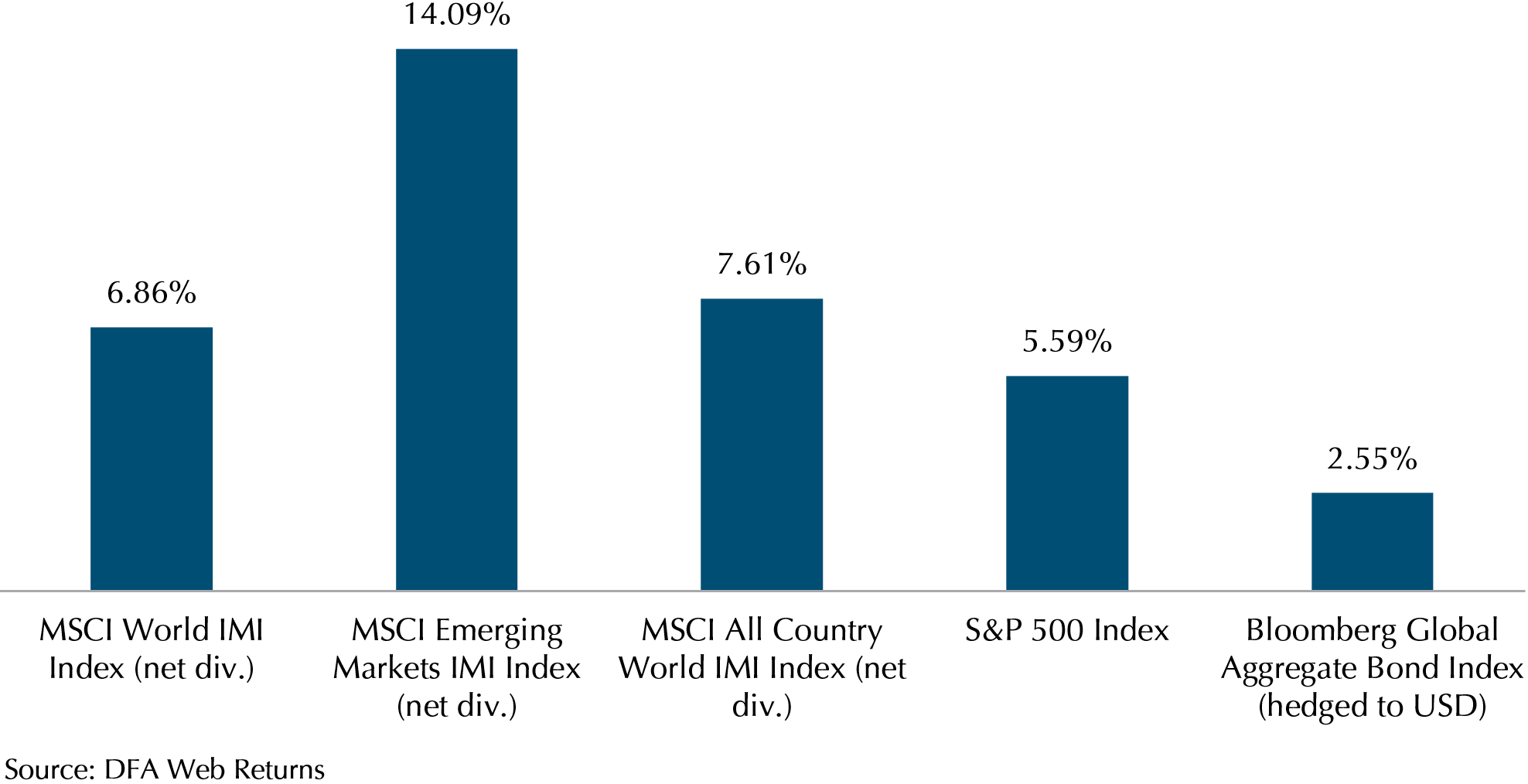

Exhibit 1 shows that the MSCI World IMI, MSCI All Country World IMI and S&P 500 climbed 6.86%, 7.61% and 5.59% respectively, in November. The MSCI Emerging Market IMI had a stellar performance of 14.09% after underperforming against its developed market peers in October. The Bloomberg Global Aggregate Bond Index also climbed 2.55% as yield fell. The US 10-year Treasury, for example, fell 0.37% from 4.07% to 3.70%.

Exhibit 1: Indexes Performance November 2022

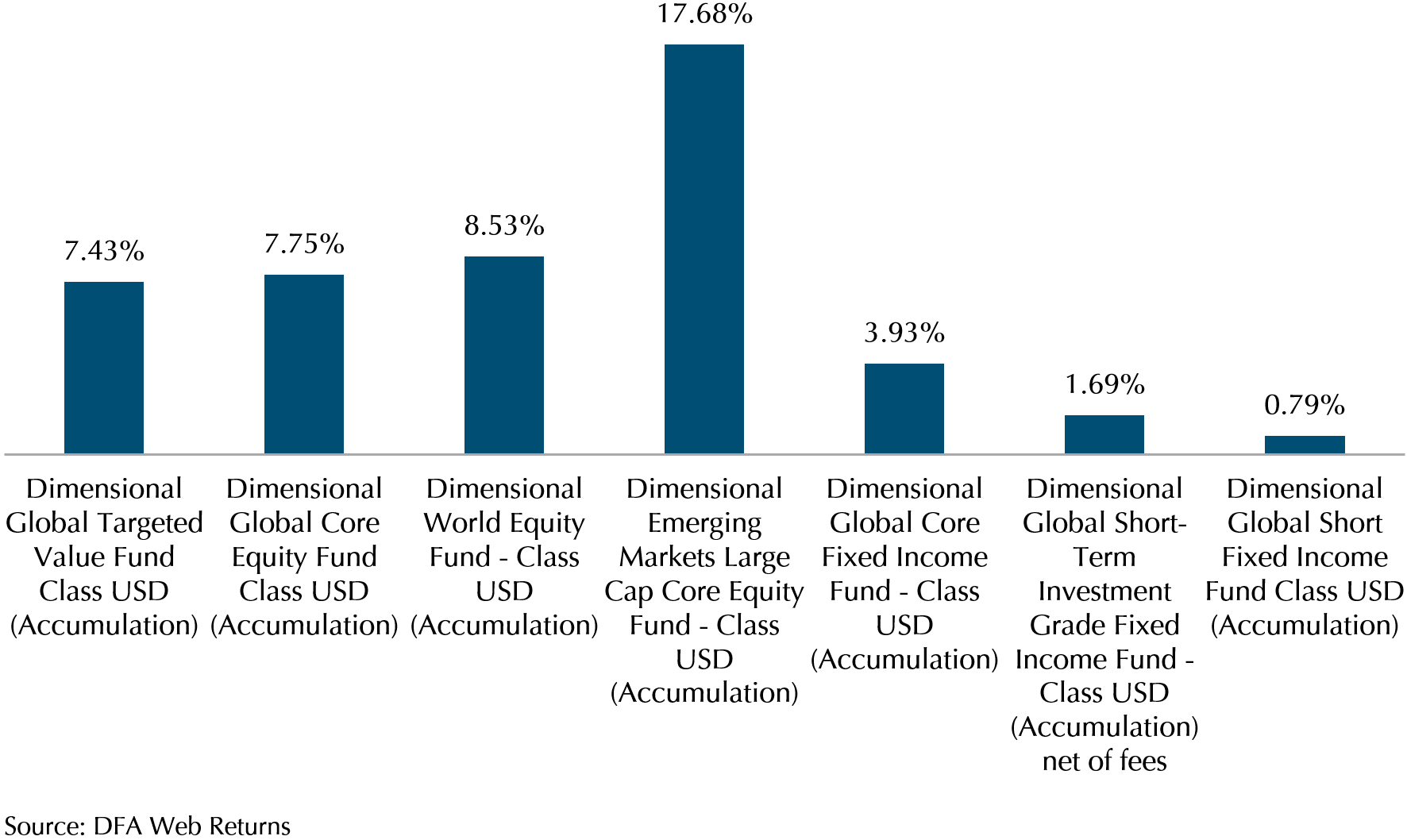

DFA equity funds did very well against the indexes (Exhibit 2). The Global Targeted Value and Global Core Equity funds which consist of mainly developed markets stocks rose 7.43% and 7.75% respectively (vs 6.86% for the MSCI World IMI). The World Equity Fund which has a tilt towards the Emerging Markets stocks rose 8.53% (vs 7.61% for the MSCI All Country World IMI). Finally, the Emerging Markets Large Cap Core Equity Fund notched up a whopping 17.68% in contrast to the MSCI Emerging Markets IMI which rose 14.09%.

DFA Global Core Fixed Income also outperformed the Bloomberg Global Aggregate Bond at 3.93% (vs 2.55%). In contrast, the Global Short-Term Investment Grade Fixed Income and Global Short Fixed Income rose by a smaller extent at 1.69% and 0.79% respectively due to their shorter duration which is less price sensitive to a change in yield.

Exhibit 2: DFA Funds Performance November 2022

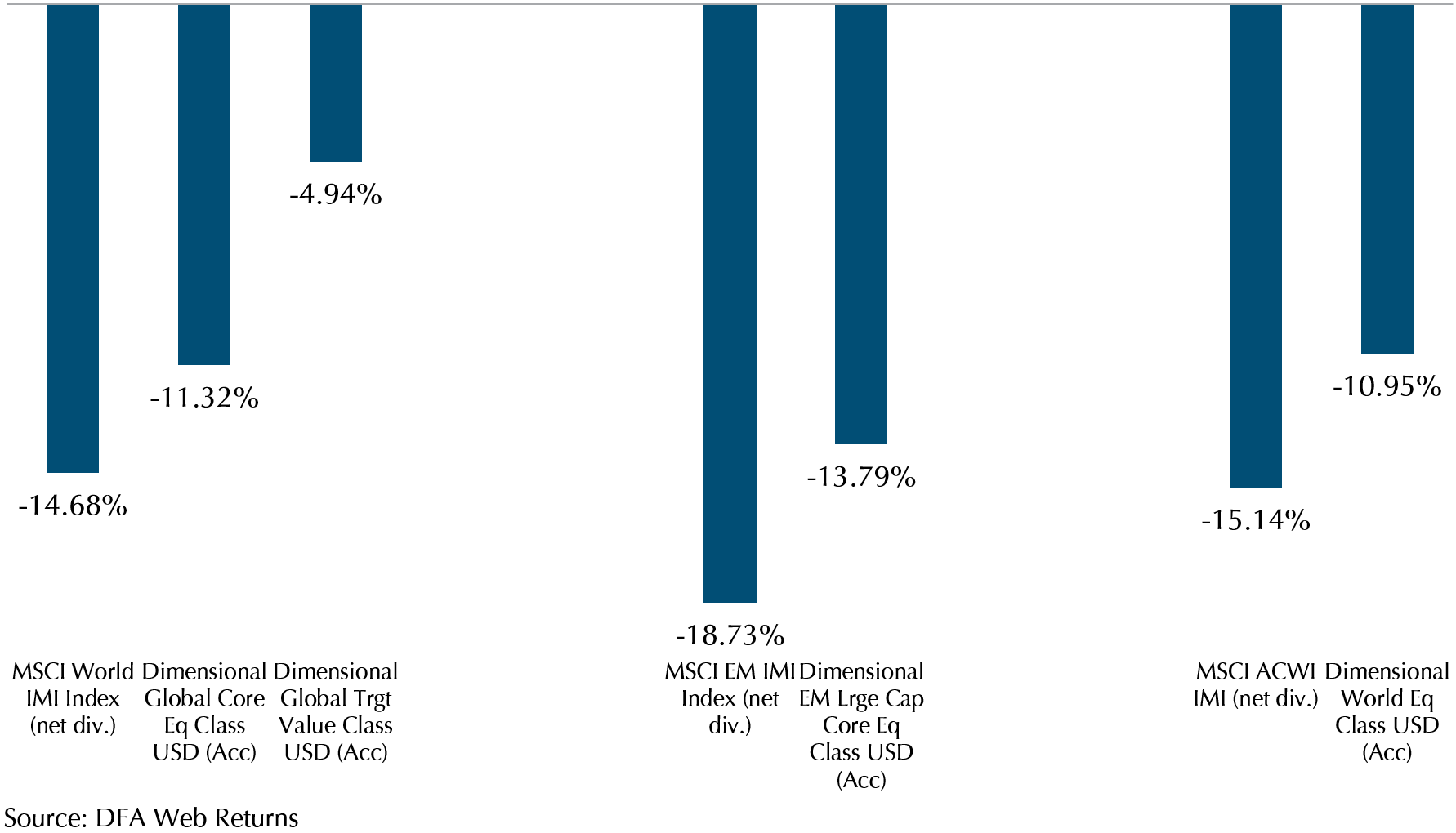

Year-to-date DFA equities have all outperformed the indexes. Looking at Exhibit 3, the MSCI World IMI Index fell 14.68% while the Global Core Equity and the Global Targeted Value fell 11.32% and 4.94% respectively. The EM Large Cap Core Equity outperformed the MSCI EM IMI by almost 5% (-13.79% vs -18.73%). The World Equity Fund outperformed the MSCI ACWI IMI by more than 4% (-10.95% vs -15.14%). Keeping our clients invested and using systematic funds to capture the value premium has allowed our client portfolios to benefit from the rally and outperformance in the past 2 months.

Exhibit 3: DFA Equity Funds vs Indexes YTD

Emerging Markets Performance Strongest in 13 Years

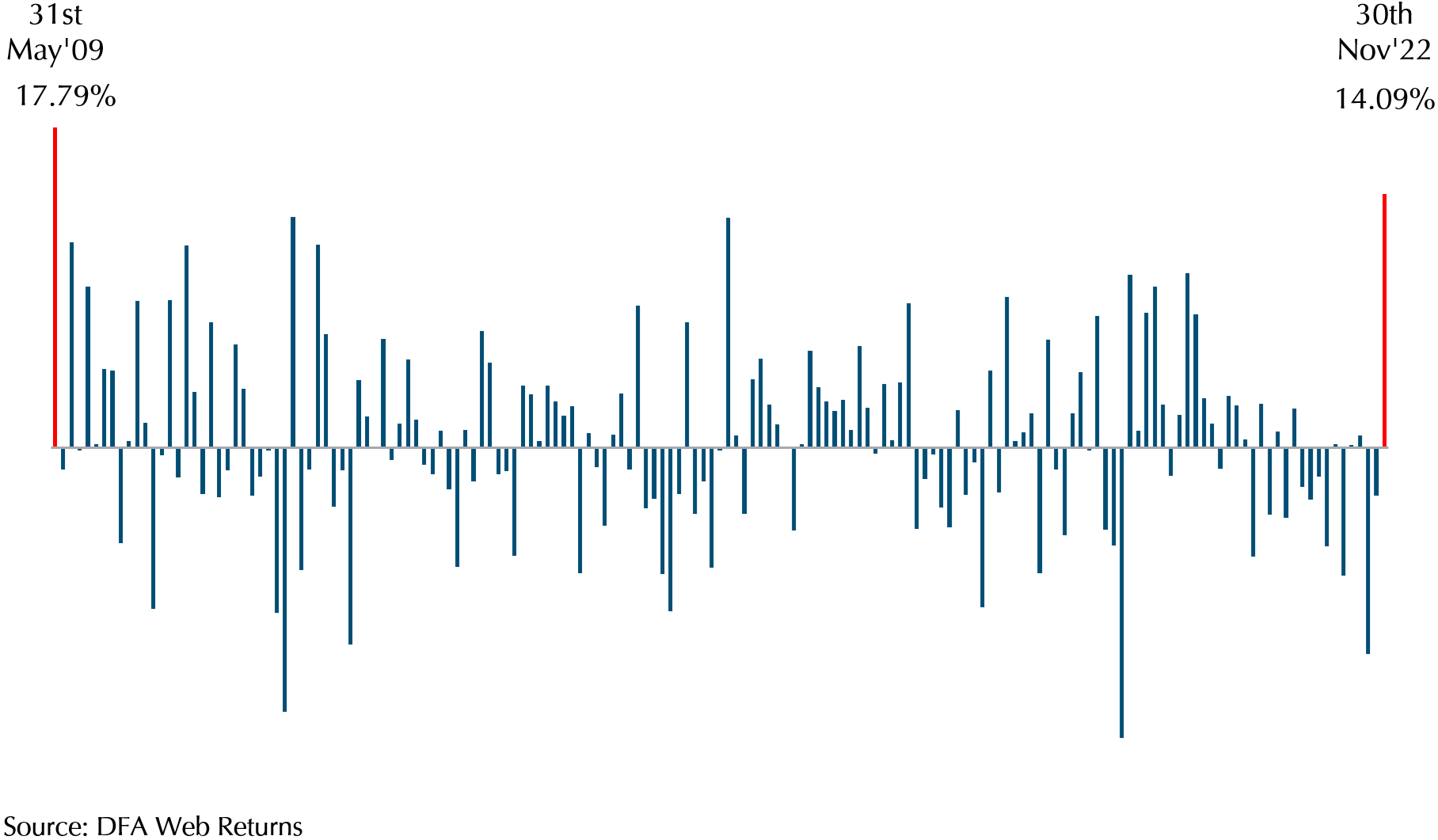

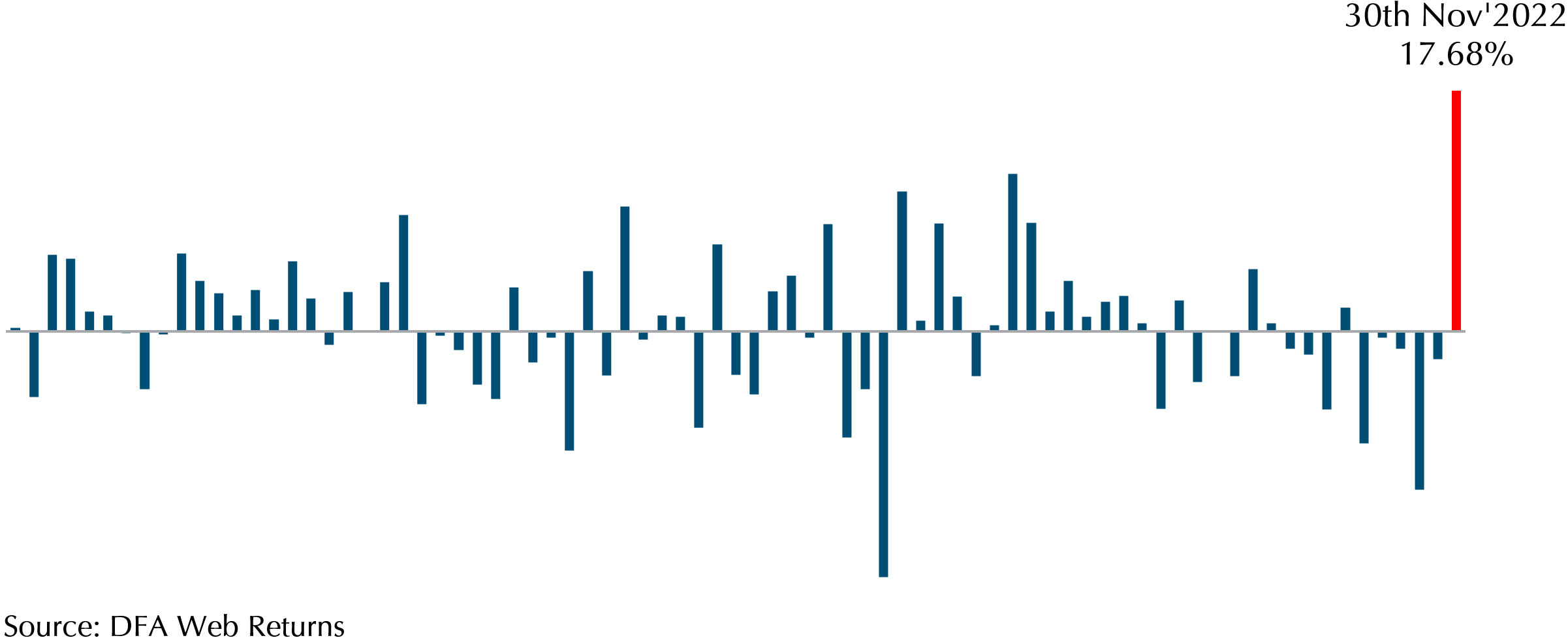

Aside from inflation showing signs of cooling down and the Fed signalling a less hawkish stance, Emerging Markets stocks were buoyed by news of possible easing of China’s Covid restrictions. The MSCI Emerging Markets performance was the strongest since the Global Financial Crisis (Exhibit 4) while the Dimensional Emerging Market Large Cap Core Equity Fund had the best performance since its inception in April 2016 (Exhibit 5).

Prior to November, Emerging Markets equities fell 8 out of the 10 months between Jan 2022 to Oct 2022 with the sharpest fall in September at more than 11%. The unpredictability of the market movements highlights the importance of staying diversified broadly across markets.

Exhibit 4: MSCI EM IMI Performance May 2009 – Nov 2022

Exhibit 5: DFA EM Large Cap Core Equity Fund Performance April 2016 – Nov 2022

Randomness of Market Returns

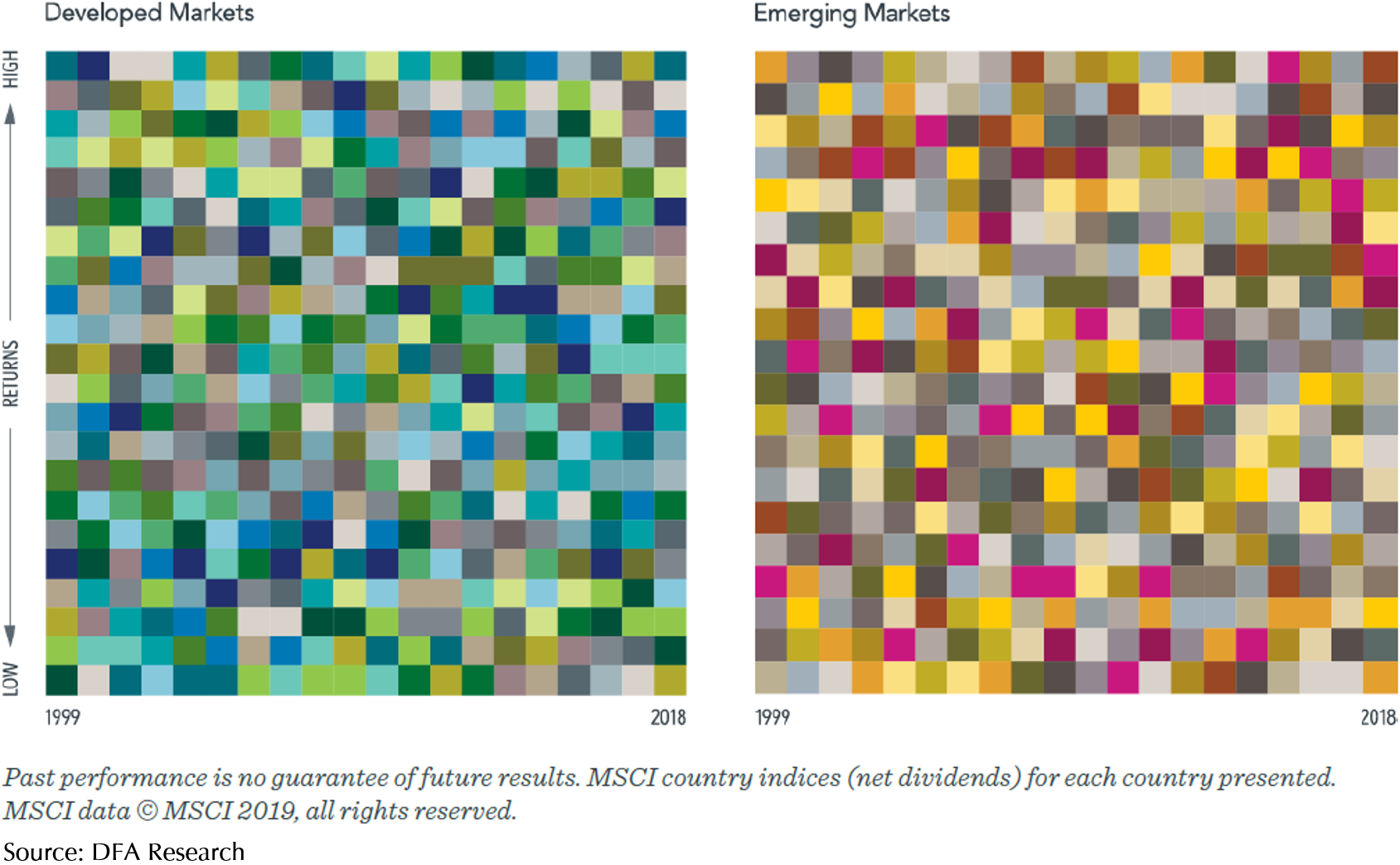

To illustrate the randomness of returns across markets, Dimensional created 2 tables that show 20 years of annual equity returns for developed and emerging markets (Exhibit 6). Each colour represents a different country. Each column is sorted top down, from the highest-performing country to the lowest. The tables show that there are no discernible patterns for investors to follow when investing in markets. This illustration demonstrates the unpredictability of market returns and the only way to capture these equity premiums is through diversification.

Exhibit 6: Annual Returns Jan 1999 – Dec 2018

Diversify to Capture the Equity Premium

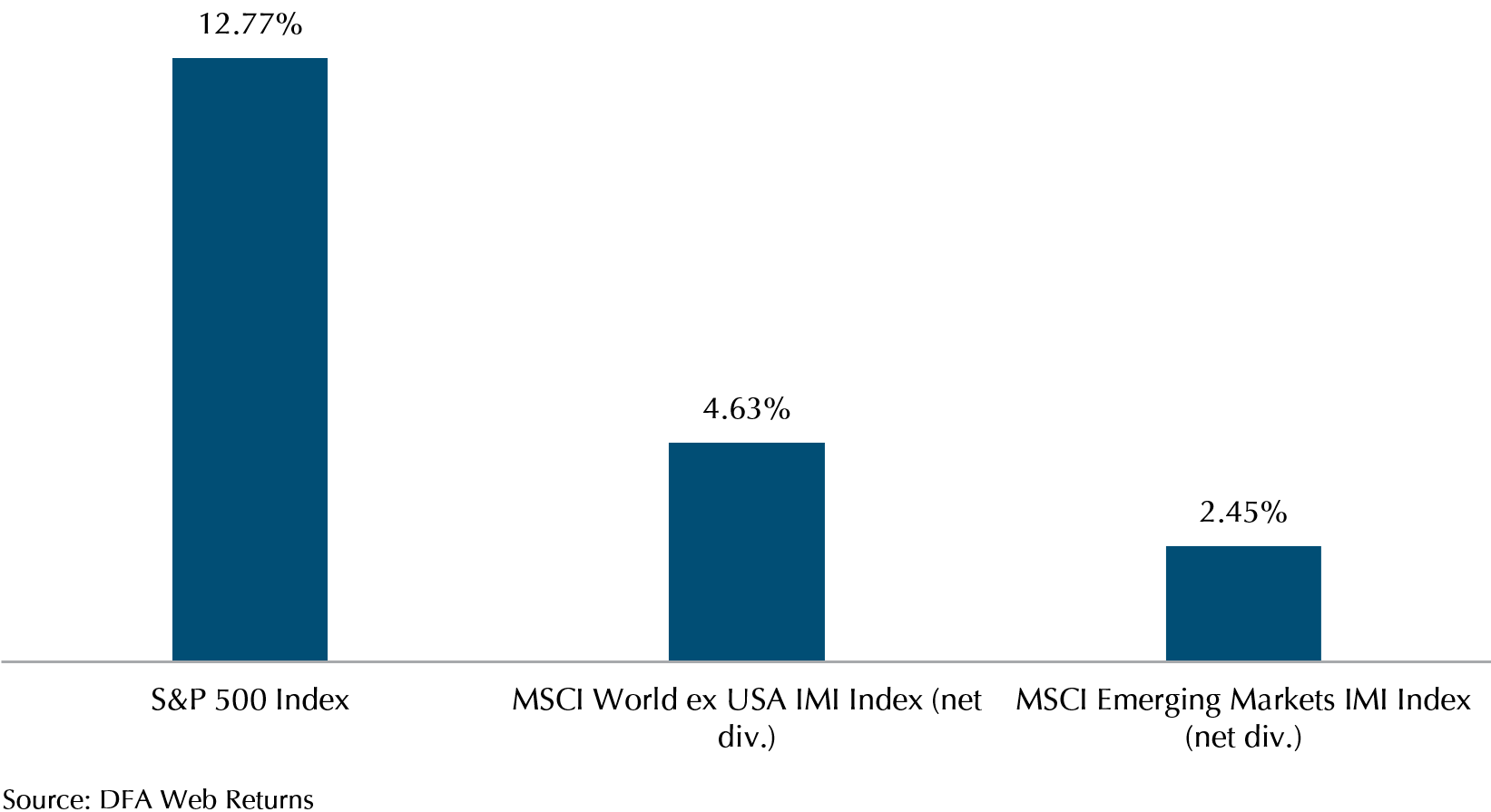

Looking at Exhibit 7, an investor might find little value in investing outside of the US since its annualised returns outperform other markets by a wide margin. S&P 500, which gauges large cap US equities generated 12.77% annualised return while the MSCI World ex USA IMI and MSCI Emerging Markets IMI have a mere annualised return of 4.63% and 2.45% respectively.

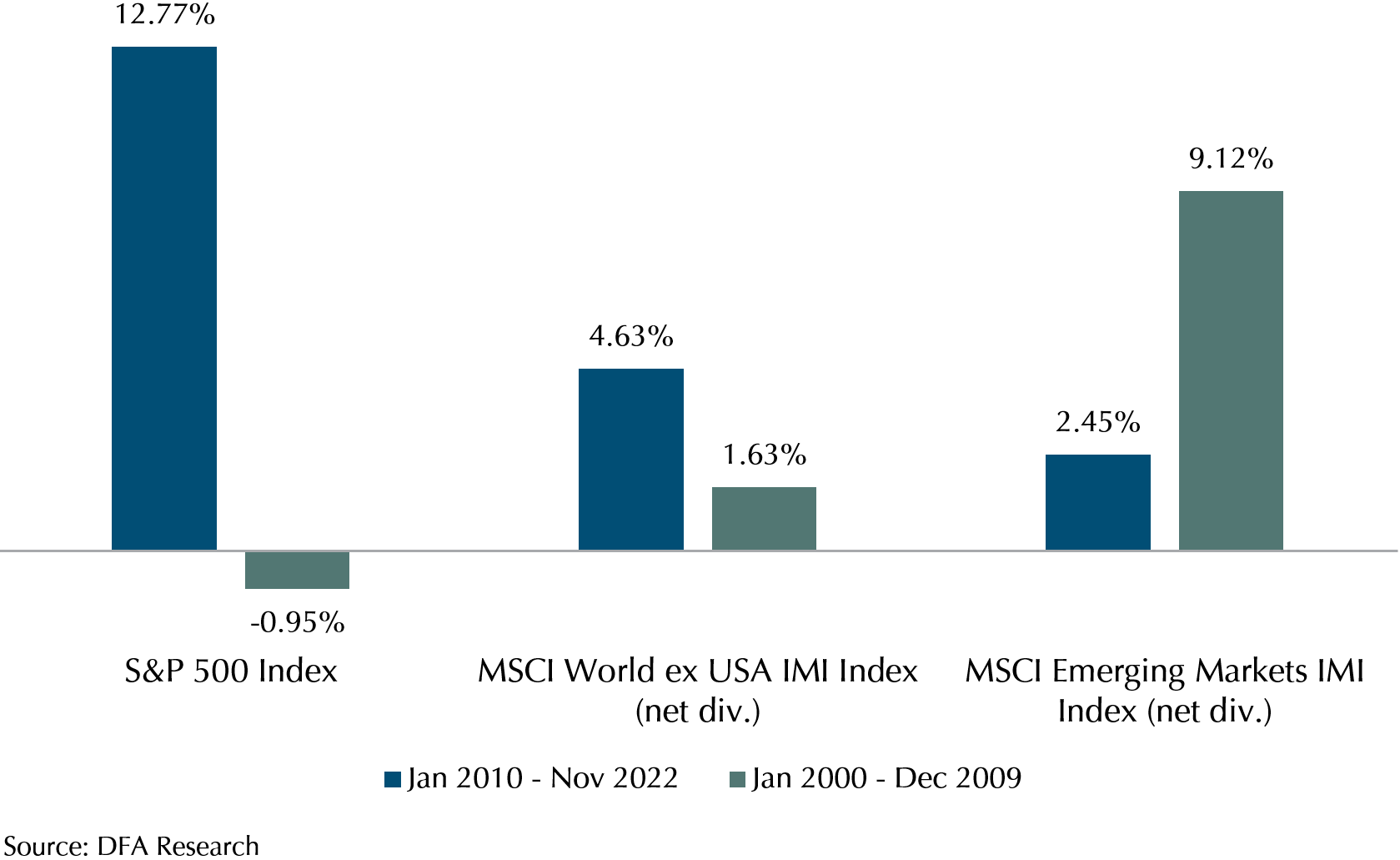

However, if we examine further back another decade, a different story presents itself. Like Exhibit 7, Exhibit 8 compares the US large cap index against markets outside of the US. S&P 500 experienced a “lost decade” with an annualised return of -0.95% from Jan 2000 to Dec 2009. In contrast, the MSCI World ex USA IMI and MSCI Emerging Markets IMI generated an annualised return of 1.63% and 9.12% respectively.

In addition to the evidence of unpredictability in market returns shown in Exhibit 6, Exhibit 8 reinforces why an investor pursuing the equity premium should consider a global allocation. By holding a globally diversified portfolio, investors are positioned to capture returns wherever they occur.

While we are unable to predict where the market will go next, we do know that the market will deliver positive expected returns over time. Hence, staying invested for the long term is paramount.

Exhibit 7: US vs Other Markets Performance Jan 2010 – Nov 2022

Exhibit 8: S&P 500 Performance Jan 2000 – Dec 2009 vs Jan 2010 – Nov 2022

Stay Invested and Disciplined – Avoid Timing the Marke

In periods of high market volatility, investors are often lured by market noises to act and time the market in the near term than to stay invested in the long term. However, casting away rational long-term investing for “buy low, sell high” or other irrational strategies often ends disastrously. Whenever you are in doubt or have a question, our advisers are always here to support you. So please do reach out. We thank you for your continued support.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.