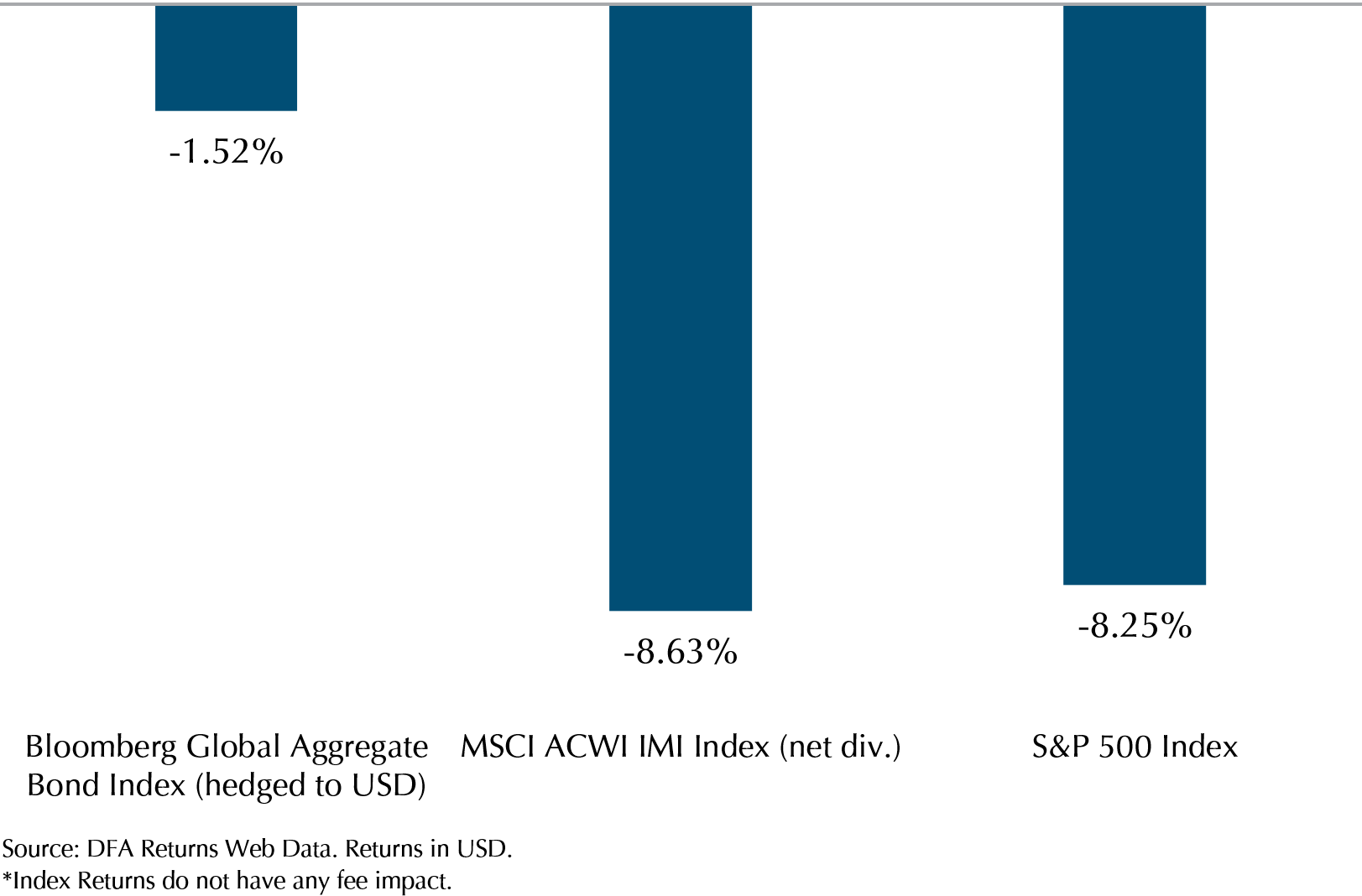

After a month of reprieve in May, selloff in the market resumes in June as the Fed raises rate by 0.75% to curb stubborn inflation. Our reference for stocks, the MSCI All Country World IMI Index and the S&P 500 fell by 8.63% and 8.25% respectively while the Bloomberg Global Aggregate Bond Index fell by 1.52% (See Exhibit 1).

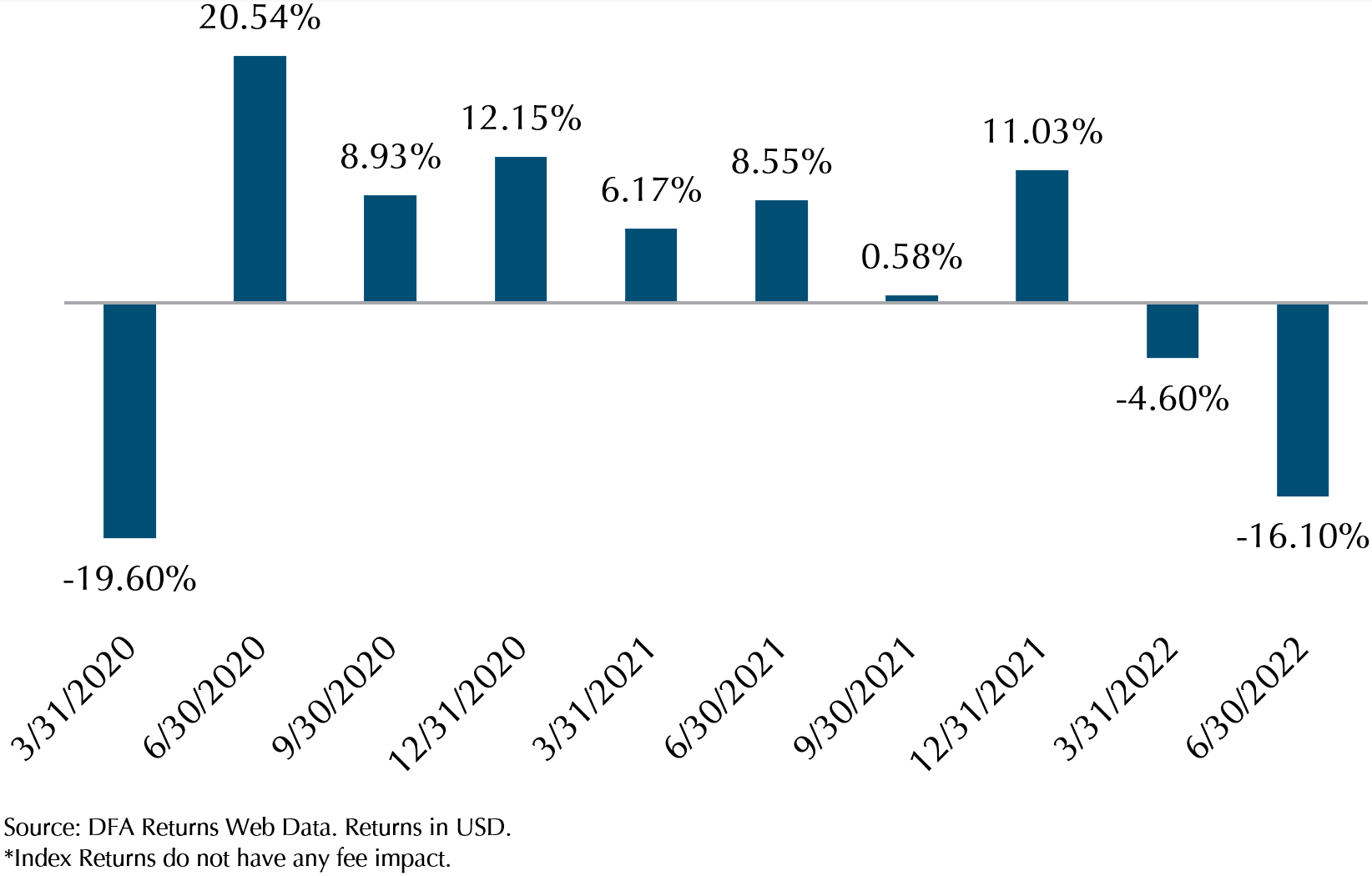

It has been a difficult quarter for both bonds and equities. The S&P 500 fell by 16.1%, its worst quarter since March 2020 when the stock market crashed because of Covid-19 (see Exhibit 2) and the Bloomberg Global Aggregate Bond Index fell by 4.3%, its worst quarter in decades other than the first quarter of 2022 when it fell by 4.9%. In fact, the S&P 500 fell more than 20% from its peak on 13 June, crossing into a bear market, triggering lots of headlines in the financial press and also activating our client management response where our advisers reached out to communicate with clients about the market situation at the time.

Exhibit 1 – Stocks and Bonds Index Performance June 2022

Exhibit 2 – S&P 500 Quarterly Performance January 2020 – June 2022

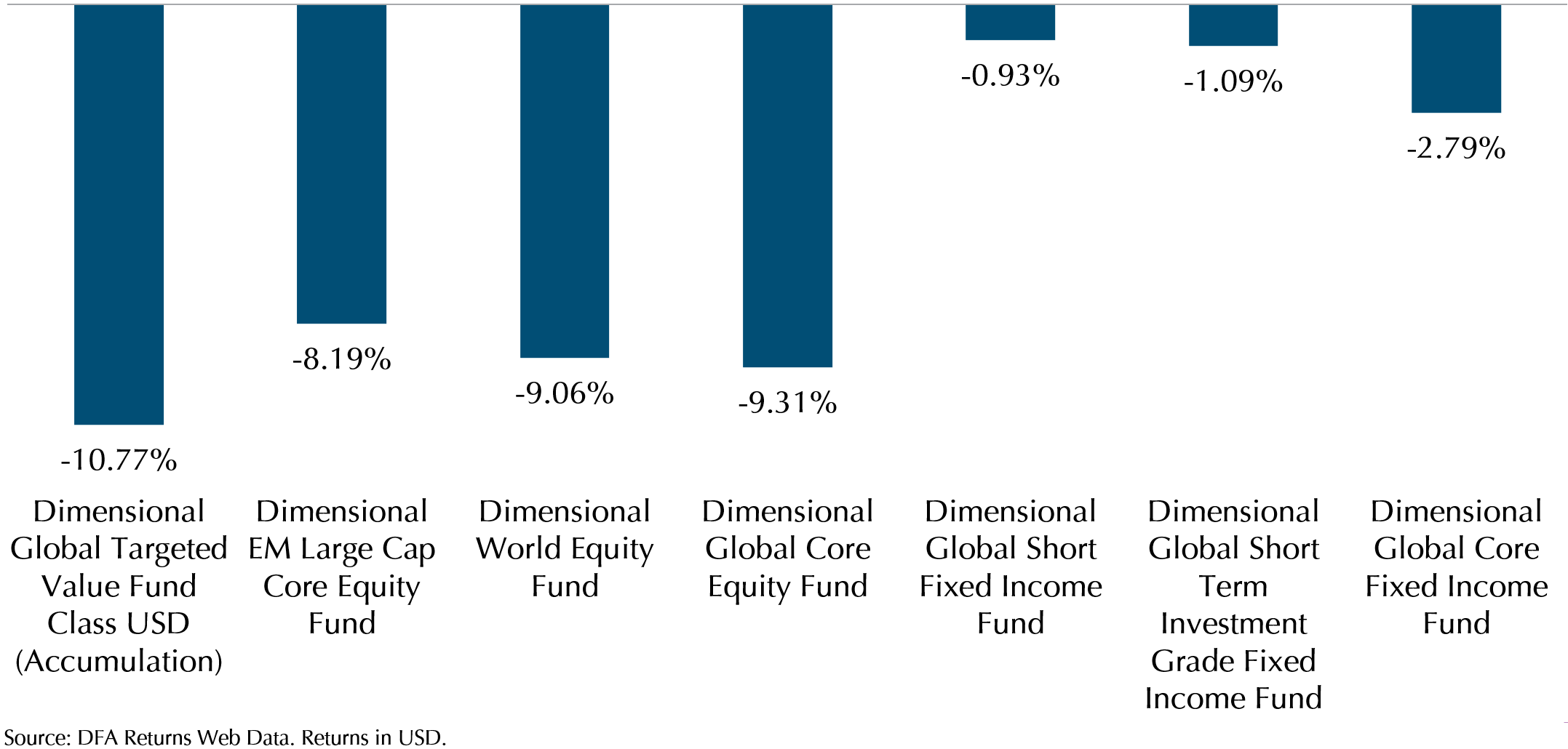

Dimensional Funds’ Performance

Exhibit 3 – DFA Equity Funds Performance June 2022

Exhibit 3 above shows Dimensional’s June performance. Equity funds performed relatively close to their benchmarks. EM Large Cap Core Equity and Global Core Equity returns were -8.19%, and -9.31% respectively compared to MSCI World Index which fell by 8.82%. World Equity fell by 9.06% compared to MSCI All Country World IMI Index which fell by 8.63%.

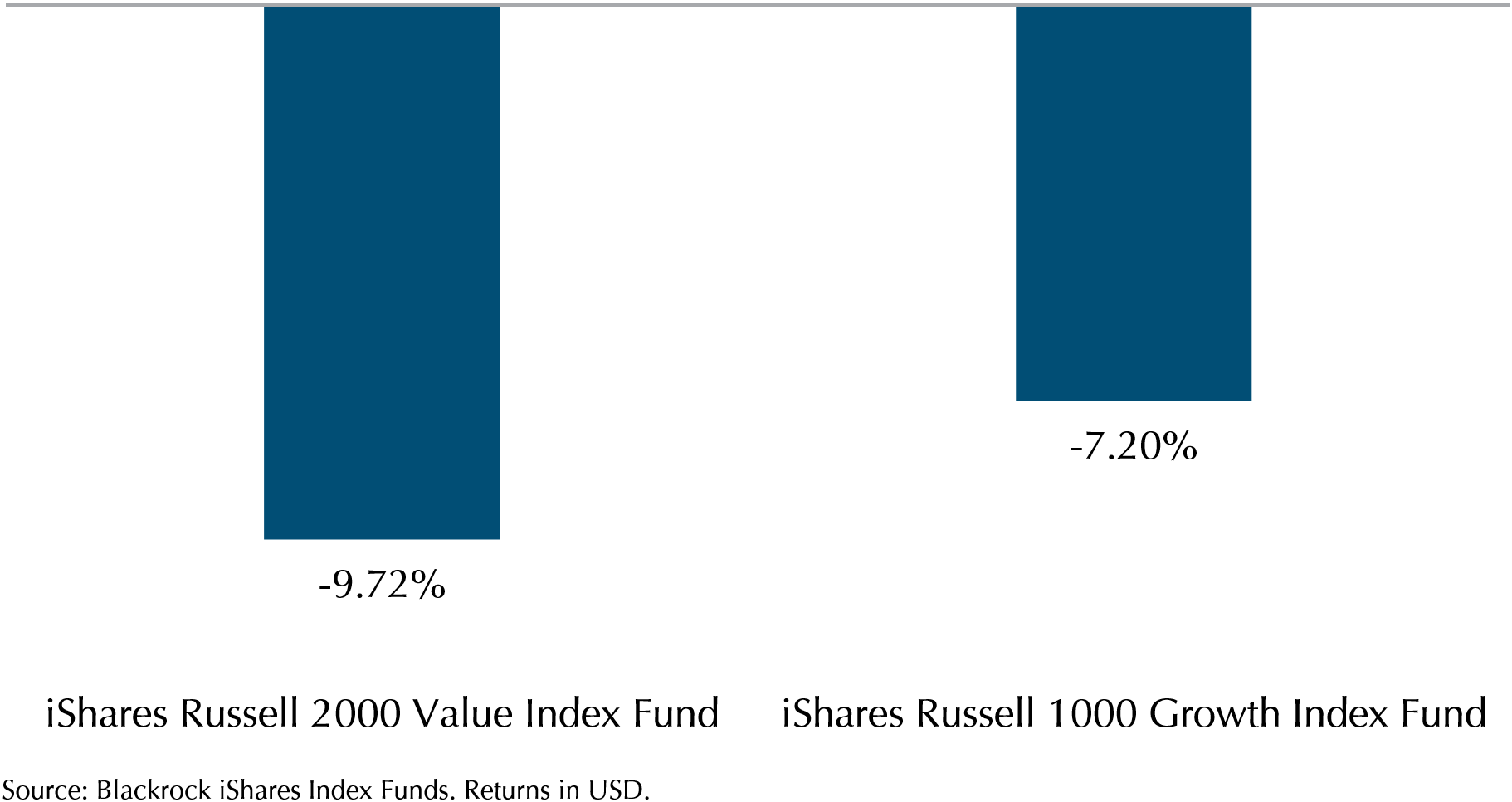

For the first month of the year, Global Targeted Value underperformed against MSCI World Index at -10.77%. The underperformance is most likely attributed to the underperformance of value stocks against growth stocks, and smaller stocks vs larger stocks. We can see this by comparing iShares Russell Value 2000 and Russell Growth 1000 shown below in Exhibit 4. Russell Growth 1000, an ETF that tracks an index composed of large- and mid-capitalisation US equities that exhibit growth characteristics, fell by 7.20% in June while Russell Value 2000, an ETF that seeks to track the investment results of an index composed of small-capitalisation US equities that exhibit value characteristics fell by 9.72%.

Dimensional’s bond funds also fell in June albeit to a much lesser extent cushioning the impact of a sharp fall with portfolios that have bond allocations. Global Short Fixed Income and Global Short Term Investment Grade Fixed Income outperformed the Bloomberg Global Aggregate Bond Index which fell by 0.93% and 1.09% respectively. Global Core Fixed Income fell by 2.79%, underperforming Bloomberg Global Aggregate Bond Index. The fall was caused by a rise in treasury yield. Notably, market priced in a 0.75% rate hike on FOMC 15 June meeting as US 10-year yield reached an 11-year peak of 3.48% on 14 June, a few days after US CPI reported that inflation rose to 8.6% in May from a year ago which is the highest since 1981.

Exhibit 4 – iShares Russell Value vs Growth Index Funds’ Performance June 2022

One Covid wave after another in China worsens inflation

Adding to the existing woes of war and supply chain bottleneck, just when China is recovering from its previous pandemic lockdown, a new Covid wave hits the province of Anhui forcing a lockdown in one of the counties north-eastern of Anhui. Already showing slowing economic growth and recovering from lockdowns, being the “factory” of the world, a continued lockdown will impede the recovery of supply chain and therefore inflation across economies.

Higher probability of recession puts downward pressure on Treasury yield

Treasury yield pared its gain in the final week of June as disappointing economic data, raising the probability of recession, drove investors to rush for the safety of risk-free government bonds. US 10-year yield fell from 3.2% to almost 3% in the last week of June.

Consumers’ confidence is tanking as inflation and dampened economic growth, caused by rising interest rates, are hurting their purchasing power. The University of Michigan’s consumer sentiment index released in early June fell to 50.2 from 58.4 which is the lowest since the 1970s. In late June, the Conference Board released its consumer confidence index, which reflects American attitudes toward jobs and the economy, fell to 98.7, down 4.5 points from 103.2 in May.

US Bureau of Economic Analysis reported on Wednesday, 29 June, that US economy contracted in 1st quarter by 1.6% annualised rate amid disappointing consumer spending which came in at 1.8% versus 3.1% prior estimate. The contraction raises the probability of a technical recession which is defined as two consecutive quarters of negative growth in real GDP.

Furthermore, the ISM manufacturing index released on 1 July, an indicator of US economic activity based on a survey of purchasing managers at more than 300 manufacturing firms, fell to 53% in June from 56.1% in May. While an index above 50% means growth but it is at its weakest since June 2020. Notably, new orders have declined 5.9%.

Liquidity dries up as central banks raise interest rates

As rising prices are felt across all economies, central banks all over the world are raising interest rates to curb inflation. Amongst them are the world most important central banks, the Fed, and the European Central Bank (ECB).

The Fed has raised rates by 0.75% on their June 15 FOMC meeting to signal its resolve to curb inflation. Jerome Powell, chair of the Fed, continues to show conviction to tackle inflation commenting during a congressional meeting on 22 June that the Fed “is strongly committed to bringing inflation back down, and we are moving expeditiously to do so”. Market is also pricing in a probability of a 0.75% rate hike by the Fed this month.

Meanwhile, the ECB is preparing for its first rate hike in 11 years this month as June’s headline inflation for Europe reached 8.6%. Christine Lagarde, president of the ECB, hardened her stance on inflation emphasising that the ECB needs to act in a “determined and sustained manner” – departing from her previous comments on raising rates “gradually.” The ECB plans to raise a quarter-percentage-point interest rate rise this month — the first such move in more than a decade — with the possibility of a larger increase in September.

Also facing challenges of rising prices, the Reserve Bank of Australia raises interest rates by 0.5% to quell surging inflation. In Asia, central banks in India, Korea, Philippines, and Malaysia have also hiked interest rates in the face of higher prices.

The tightening signals the end of accommodative monetary policies across economies, especially developed markets.

Singapore bond yields get more attractive

As central banks raise interest rates, governments and institutions are raising their coupon rates to attract lenders. The rising risk-free rate and widening credit spread increase the yields of both government and retail bonds.

Singapore Saving Bonds (SSB) August issue, for example, has hit the highest 10-year average at 3% since its inception in October 2015. The higher yield in safe bonds is becoming more of a boon for savers that have cash on the sidelines. This is an opportunity to get some yield on cash in a low-risk way.

Increasing our communication with clients

We understand that these are difficult times. The twin pressures of inflation and economic slowdown are hurting the returns of our investment portfolios, and also creating a lot of uncertainty around jobs, retirement spending and adequacy.

In light of this, we will be switching the cadence of our market review to twice a month, compared to its current pace of once a month. While we cannot control the direction of markets, we understand it helps to be informed and therefore we will endeavour to provide more timely updates on the market and economic situation going forward.

What we expect as we head into 2H 2022

The continued tug of war between inflation-fighting and economic growth will continue to drive markets, and is likely to add to the volatility. Earnings season will also be upon us, and that will give further clarity into the state of the economy, which all signs are showing is headed for some type of slowdown. It will be a bumpy ride, so do reach out to us if you have any concerns or questions.

Thank you for your continued trust and support, and do stay safe and healthy as Singapore navigates the current Covid-19 wave.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.