Equities Surged by Nearly 10% In November

Following the market declines in October, there was a notable rally in equity and bond markets in November, surpassing the losses incurred the previous month. The market may be pricing in the probability of an earlier interest rate reversal by central banks in developed markets, driven by a lower-than-expected inflation rate.

The most recent US October Consumer Price Index (CPI), reported in November, revealed a year-on-year inflation rate of 3.2%, marking a significant decrease from September’s 3.7%. Similarly, the October inflation rate in Europe declined from 4.3% in September to 2.9%. A significant fall in the inflation rate implies that central banks may not need to maintain interest rates higher for longer to curb spending. Consequently, market expectations shifted towards a possible rate cut by the Fed sometime in 2024, driving yields on longer-term treasuries and corporate debt lower.

One of the contributors to lower inflation is the decrease in energy costs. Despite ongoing unrest in the Middle East, energy prices have fallen, attributed to the increased supply of crude oil by the United States and OPEC+’s failure to adhere to reduced production quotas. Brent crude oil prices declined to $80, and natural gas prices fell by 15% due to weak demand in Europe.

These factors set the stage for a lower inflation rate environment, pushing up asset prices, as we will explore in the following section.

Market Indexes Performance Review

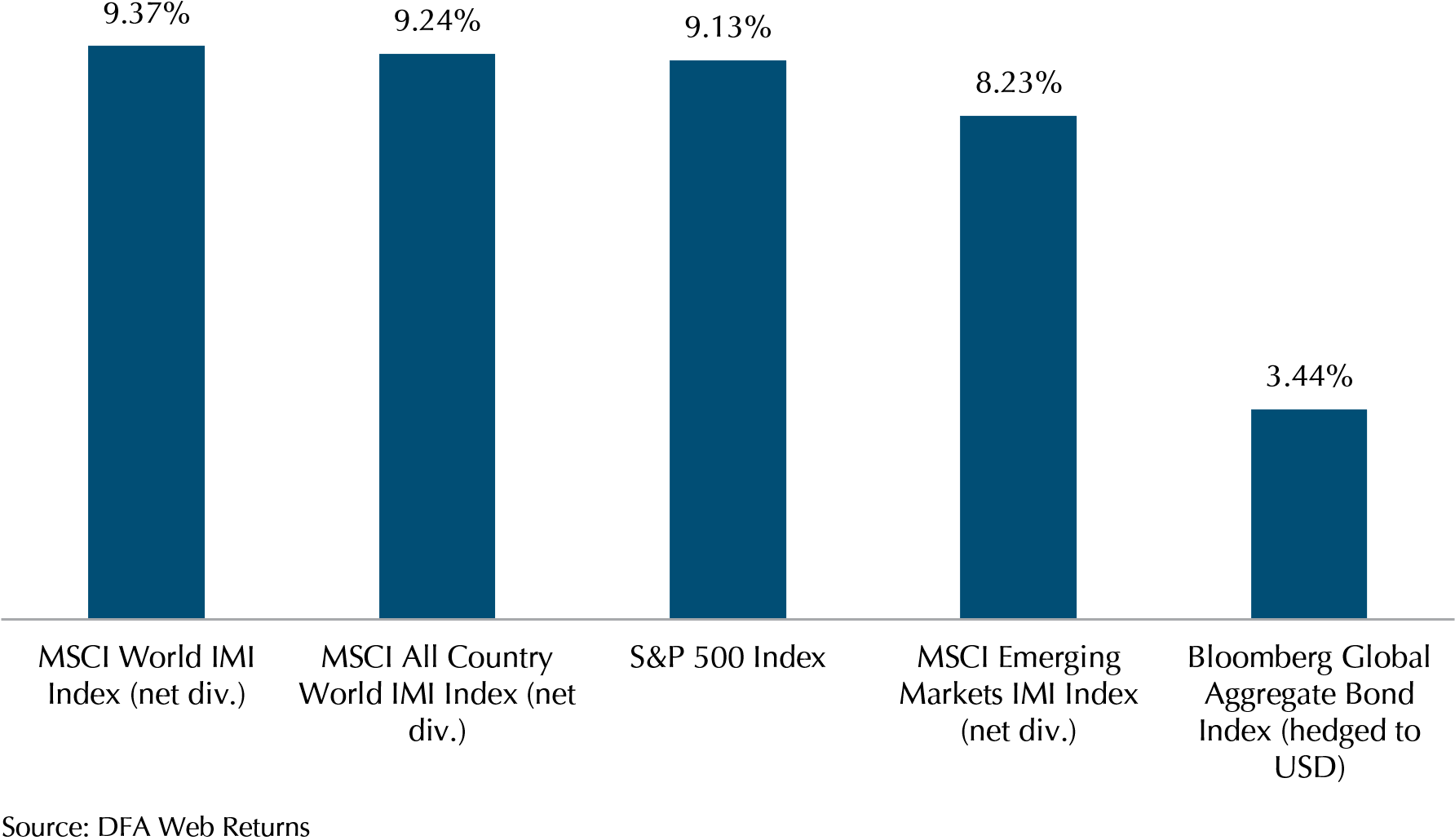

Exhibit 1 illustrates the performance of market indexes in November. The MSCI World IMI, which represents the stock prices of large, mid, and small-sized developed market companies, soared by 9.37%, while the MSCI All Country World IMI, encompassing both developed and emerging market stocks of large, mid, and small-sized companies, climbed 9.24%. The S&P 500, representing the largest 500 publicly traded companies in the United States, went up by 9.13%. In the emerging markets, the MSCI Emerging Market IMI, reflecting stocks of large, mid, and small-sized companies, saw a rise of 8.23%. In Fixed Income, the Bloomberg Global Aggregate index climbed 3.44%.

The primary drivers behind the robust performance of developed markets were the technology, consumer cyclical, and financial sectors. In November, Apple witnessed an 11.4% surge, and Expedia Group experienced a substantial 42% increase in share price following a robust revenue report attributed to heightened demand. Additionally, Blackstone, a major global alternative asset manager, recorded a notable 21% rise, reflecting substantial profit growth in its recent report.

In emerging markets, the technology sector played a key role in driving strong performance. For instance, Taiwan Semiconductor Manufacturing Co (TSMC) saw a 13.25% increase, attributed to the high demand for its chips used in AI and the recently released Apple iPhone 15.

Next, we will delve into the Dimensional Funds in your portfolios, exploring how they fared in November.

Exhibit 1 – The Market Indexes November Performance (In USD)

Dimensional Funds Performance Review

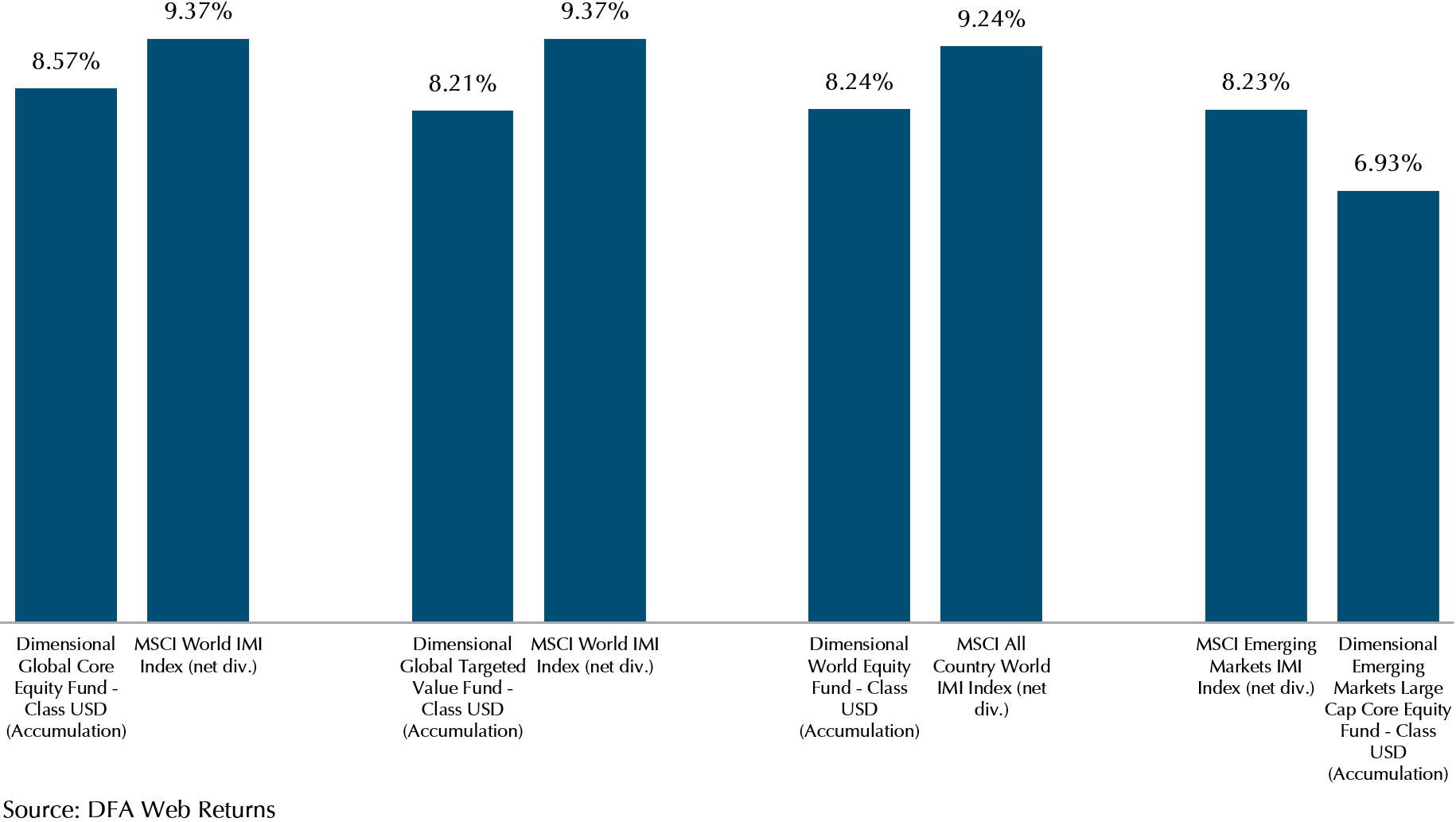

Similar to the market indexes, Dimensional funds also experienced a rally. The Global Core Equity fund, the Dimensional Global Targeted Value fund, the Dimensional World Equity fund, and the Dimensional Emerging Large Cap Core Equity fund saw increases of 8.57%, 8.21%, 8.24%, and 6.93%, respectively. However, these Dimensional funds underperformed their comparable indexes as growth outperformed value stocks in November.

One contributing factor to the funds’ underperformance compared to their comparable indexes was the decreased allocation in the technology sector and increased exposure to the energy sector. The lower price-to-book ratios of energy companies make them more attractive to the value-focused strategies that Dimensional runs.

For instance, the Global Core Equity fund held a 2.9% weight in Microsoft, compared to the 4.6% in the MSCI World Index, and a 1.1% weight in Exxon Mobil, in contrast to the 0.75% in the MSCI World Index. Over the month of November, Microsoft recorded a gain of 9.4%, while Exxon Mobil saw a decline of 4.6%. Therefore, the underweight allocation of a better-performing stock compared to the MSCI World Index contributed to the overall underperformance of the fund compared to its comparable index.

However, as depicted in Exhibit 2, the performance difference is close, within 1% in most cases, and in the case of Emerging Market equities, there is an outperformance of more than 1%. As with any strategy that deviates from an index, there will be periods of outperformance, such as in 2022, and periods of underperformance.

This nuanced view of fund performance highlights the challenges associated with trying to time the market. While certain sectors may experience fluctuations, predicting and capitalising on these shifts can be a complex undertaking. Investors opting for a more consistent approach, focusing on long-term goals rather than short-term market movements, are positioned to have a better investment experience.

Next, we will next explore the risks of attempting to time the market and understand how a steadfast, long-term investment approach can contribute to a better chance of reaching your wealth goals.

Exhibit 2 – Dimensional Equity Funds November Performance vs Comparable Index (In USD)

The Challenge of Timing the Market

The market’s sharp fall in October and subsequent strong rally in November underscore the dynamic and unpredictable nature of financial markets, highlighting the importance of maintaining a long-term investment perspective. Historical evidence has shown that a significant portion of market returns is concentrated in only a few specific days or weeks. Attempting to time these market movements can prove challenging, if not impossible. While one might avoid the market’s worst days, the likelihood of missing out on its best days is also significant.

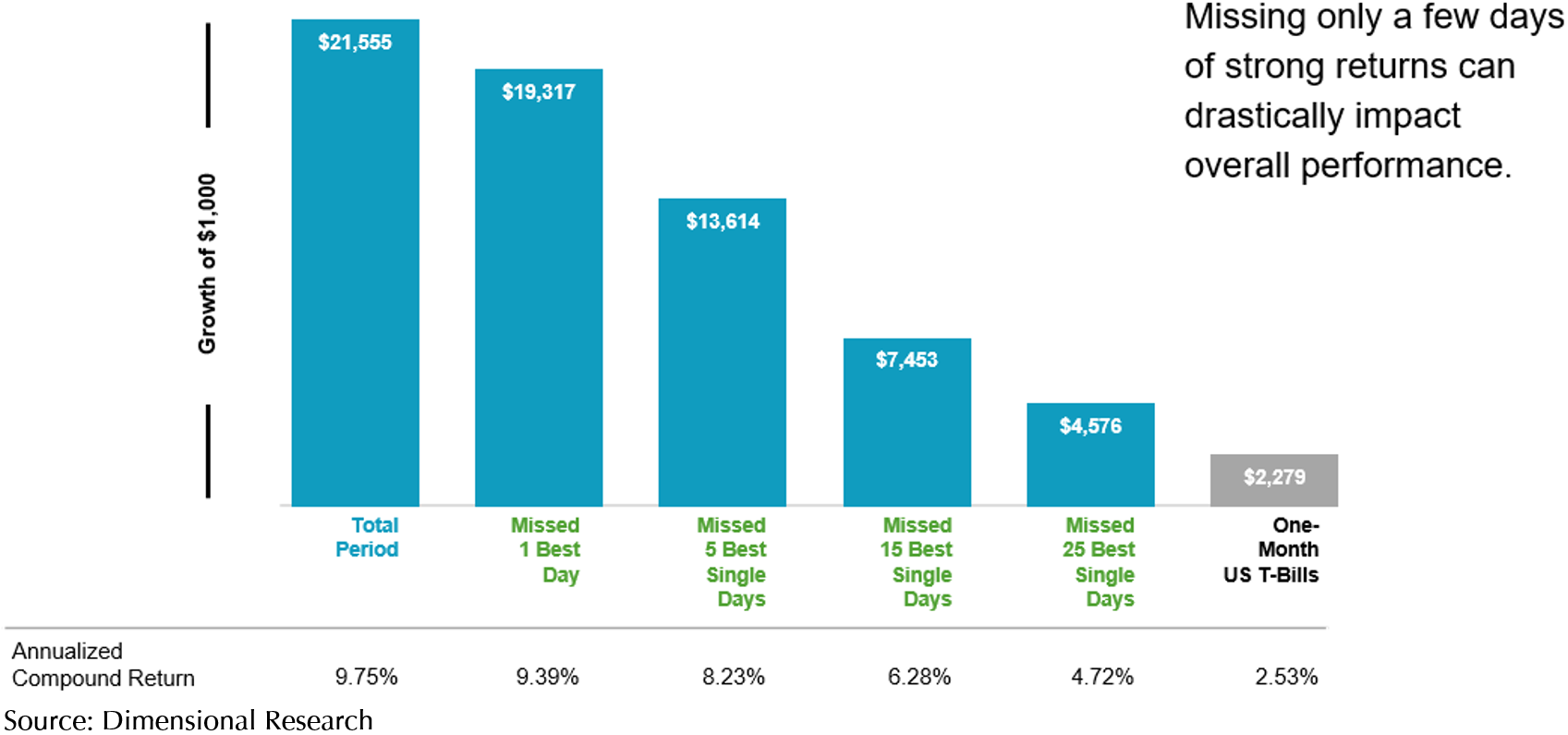

Exhibit 3 illustrates the variations in wealth growth when investing $1,000 in the S&P 500 from 1990 to 2022 under scenarios where the best one, five, 15, and 25 single days are missed. By missing the best day over the period, total wealth fell from $21,555 to $19,317, while missing the 25 best single days resulted in total wealth falling from $21,555 to $4,576.

Exhibit 3 – Performance of the S&P 500 Index, 1990 – 2022 (In USD)

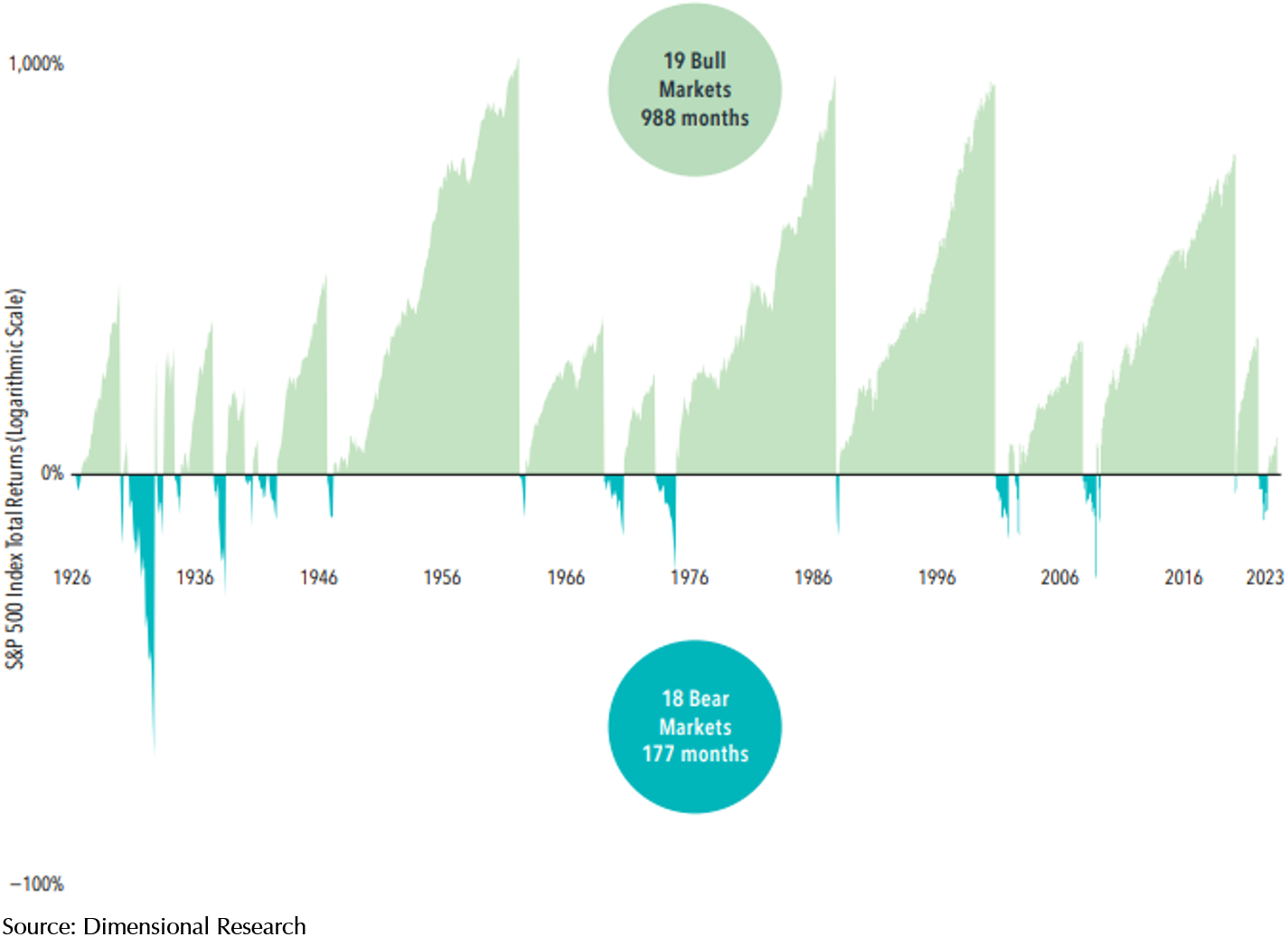

If we continue to look at Exhibit 4, which shows the performance of the S&P 500 Index Total Returns from January 1926 to June 2023, we can see that, while stock returns are volatile, the good times have outshone the bad. When the bull and bear markets are viewed together, it is clear that equities have rewarded disciplined investors.

Exhibit 4 – Performance of the S&P 500 Index Total Returns, Jan 1926 – June 2023 (In USD)

The noticeable disparity in wealth growth depicted in Exhibit 3 and the more robust bull market compared to the bear market illustrated in Exhibit 4 provide a compelling reminder of the risks associated with attempting to time the market. This stark contrast further emphasises the justification to commit to a stable, long-term investment strategy.

Focusing on What You Can Control: The Role of Wealth Planning

Rather than expending energy on trying to predict market movements, it is crucial to prioritise your life goals. Developing a comprehensive wealth plan tailored to your specific needs and risk tolerance is a proactive step toward achieving both short-term and long-term objectives.

In uncertain times, the guidance of a client adviser becomes particularly valuable. Our client advisers offer insights and recommendations tailored to your individual circumstances, serving as partners in your financial journey. They provide guidance on adjusting your plan to evolving market conditions and help you stay on track toward your goals.

It is natural to have questions or concerns about your portfolios, especially during periods of market volatility. Your client adviser plays a crucial role in addressing these concerns. By maintaining an open line of communication, you can gain clarity on your investment approach, discuss any necessary adjustments, and gain reassurance about the resilience of your long-term plan.

We encourage you to reach out to your dedicated client adviser to schedule a conversation. Together, we can review your wealth plan, address any concerns you may have, and ensure that your investments align with your evolving life goals.

Happy Holidays From All at Providend

As 2023 draws to a close, we are glad that our portfolios have recovered strongly in line with markets this year, despite the intra-year volatility. We would like to thank you and express our heartfelt gratitude for your continued support and trust and would like to wish all clients a very Merry Christmas and a Happy New Year filled with warmth and delightful moments.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.