(This article follows an earlier one titled I hate my job but don’t know what to do next)

In my previous article, I shared how I arrived at the difficult decision of quitting my job without another. And the steps that I took to identify my subsequent interest.

Some of you may be thinking of pursuing your passion or interests. Others may be looking to slow down by taking a more junior position or changing their career. These options could mean having to take a job that pays less.

As I was preparing to go into a completely different field of work, I tried to calculate the smallest paycheck that I could accept for my new job.

Turns out, my calculations were off.

I learned this after I had joined Providend.

Two articles written by author of Investment Moats and fellow colleague Kyith Ng, Providend’s Senior Solutions Specialist, gave me a lot to think about:

How much money do you need to be financially independent? A deep dive

How much you need to retire at 55 years old (factoring in your CPF LIFE annuity income)

I realised that one of the key mistakes I had made was not accounting for inflation in my calculation. In an article by the New York Times, Mutual funds that consistently beat the market? Not one of 2,132, the evidence suggests that the best way to beat inflation is to hold a low-cost index fund that invests in a basket of world equities and bonds.

While my initial calculations were off, thankfully, I do have sufficient resources to tap on. With some tweaks, I can still make my plan work.

In this article, I will share a way to calculate the smallest paycheck that you could comfortably accept for your next job without compromising on your retirement plans.

What comes next is a ton of numbers. So, grab your coffee and let’s dive right in.

How much do I need to retire?

Suppose that I’m 46 today (2023) and my ideal retirement is 14 years later at 60.

First, let’s calculate my current expenses.

Here’s a possible list:

- food

- transport

- telco (mobile, internet)

- utilities

- entertainment

- property conservancy or maintenance charges

- taxes (property, income)

- children’s education

- insurance

- travel (holidays)

- domestic help/part-time cleaning

- mortgage

- loan (car, renovation)

- allowance/gifting to family members and/or causes

As a single person who does not own a car and has a fully paid HDB, let’s say my current expenses are $3,000/mth or $36,000/yr.

Next, I need to anticipate what my future expenses will be when I’m retired. While this is not the easiest thing to do, it helps to estimate future expenses in today’s dollars. Do note that certain expenses such as income tax, children’s education, and allowances to parents/children will completely disappear at some point during your retirement, so they would reduce your retirement needs.

As I’d like to travel during my retirement, let’s assume that my future monthly expenses are $3,500/mth or $42,000/yr in today’s dollars.

Based on the figure above, I will calculate two retirement pots that would last me from:

- 60 to 64, and

- 65 to 95

60 to 64 years retirement pot

- After adjusting for a long-term inflation rate of 3%, $42,000/yr today will be about $63,529/yr in 2037.

- From 60 to 64 years old, I need $63,529 x 5 = $317,645.

- Technically, we should adjust this sum for inflation over the 5 years. However, given the rather short time horizon of 5 years, it is likely that I would park this sum in a relatively safe instrument that yields a 2 to 3% return. If we assume a 3% inflation rate for this sum and a growth rate that equals that, essentially, both rates would cancel each other out.

- Hence, I’d keep the sum at $317,645.

- If I park $160,432 today into a low-cost, index growth fund (80% equity, 20% bonds) that grows at a long-term return rate of 5% for the next 14 years, I’d have $317,645 at 60.

Before we calculate how much we need between 65-95, let’s do a quick calculation of how much CPF LIFE pay-out we can expect to receive.

CPF LIFE pay-out

I’ve always been a great proponent of CPF, given that it grows at a risk-free, compounded rate of between 2.5% to 6%. There’s nothing quite like it in the market.

As the CPF LIFE pay-out is a guaranteed life-time stream of income from 65, it’s a great way to add stability to your retirement needs.

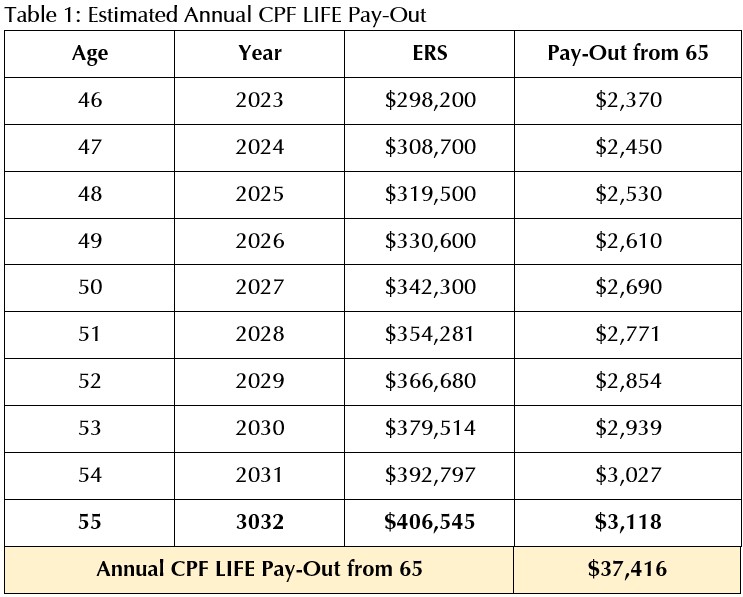

In this Straits Times article dated 18 Feb, 2022, they provided the Enhanced Retirement Sum (ERS) and potential pay-out at 65 for those turning 55 from 2022 to 2027. I extrapolated the numbers till 2030, when I turn 55.

As shown in Table 1 below, this sum to be set aside in my CPF Retirement Account (RA) at 55 would provide me with an estimated CPF LIFE annuity of $3,118/mth (or $37,416/yr) from 65.

If I have been regularly topping up my CPF Special Account (SA) and making voluntary housing refund to my CPF Ordinary Account (OA), I will be able to reach the Enhanced Retirement Sum (ERS) of my cohort, $406,545, 8 years earlier when I’m 47.

Let’s assume that the ERS sum I have saved comprises $180,000 in the OA and $226,554 in the SA. These savings will continue to compound annually at 2.5% and 4% respectively.

At 55, the interest alone that I’d have earned in both accounts would total $122,813*. If I choose not to withdraw the interest and let it grow for another 10 years in CPF, I could yield approx. $173,925* by 65. We’ll come back to this number later.

* The actual figure would be higher as we have not accounted for:

- Those aged 55 and below – An additional 1% interest per annum on the first $60,000 of one’s combined balances (with up to $20,000 from OA).

65 to 95 years retirement pot

- Thanks to inflation, $42,000 in today’s dollars will be about $73,647 in 2042.

- Since I would be receiving CPF LIFE pay-out of $37,416/yr, l would need another $36,231/yr ($73,647 – $37,416).

- To calculate the sum that I need from 65 to 95, I simply divide $36,231 by a safe withdrawal rate of 3.5% and arrive at $1,035,171. The safe withdrawal rate assumes that one withdraws the same amount, adjusted for inflation, every year during one’s retirement. You can read more about the safe withdrawal rates here.

- By investing $409,653 today into a low-cost, index growth fund (80% equity, 20% bonds), I can achieve this retirement sum when I’m 65.

Ideally, to retire at 60, I would need to have $570,085 ($160,432 + $409,653) today and start investing this sum right away.

What if I don’t have so much today?

- Suppose I only have $450,000 today and I still want to give myself a 2-year sabbatical to travel and attend courses.

- During the 2-year sabbatical, let’s assume my expenses are $50,000/yr.

- This leaves me with only $350,000 to invest today.

- From this sum, $160,432 will be invested to grow my first retirement pot.

- The remaining $189,568 goes towards growing my second retirement pot.

- Based on the growth rate of 5%, the $189,568 that I invest today will grow to $479,029 when I’m 65.

- At 65, I will also have the CPF interests from OA and SA totalling $173,925.

- This leaves me with a shortfall of $382,217 ($1,035,171 – $479,029 – $173,925).

My next minimum salary

Stay with me. This is the last stretch of numbers, I promise.

- When I resume work two years later at 48, I’d give myself a year to save and only start investing at 49.

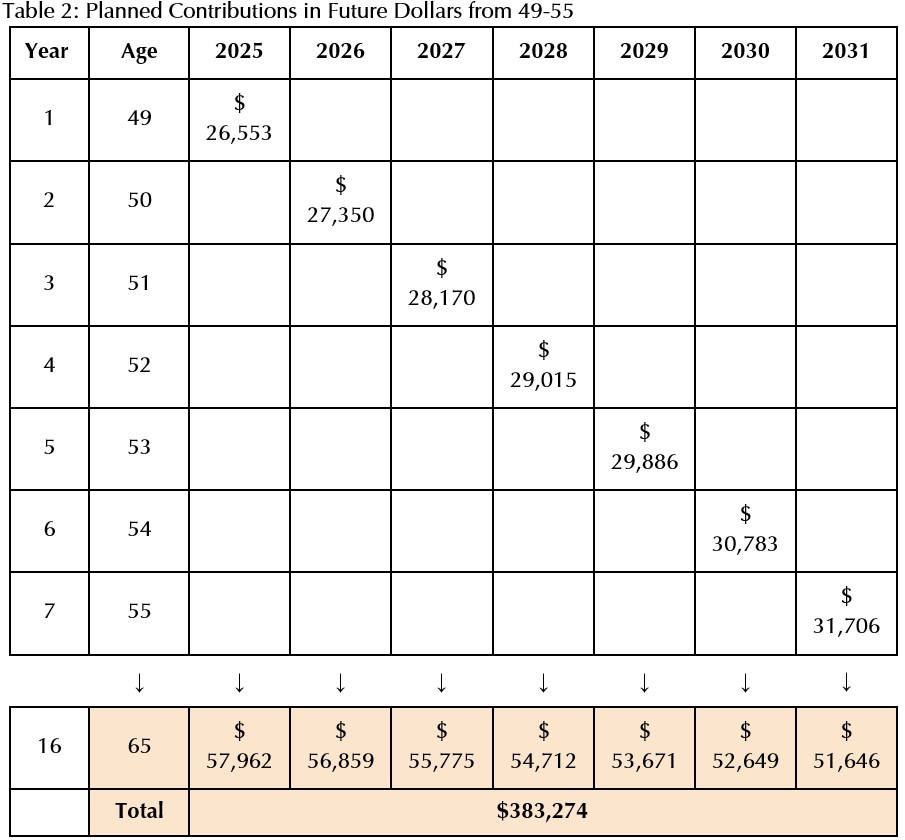

- As shown in Table 2, if I were to invest $24,300/yr (in 2023’s dollars) for the next 7 years into a low-cost, index growth fund (80% equities, 20% bonds) that gives a long-term rate of return of 5%, I can attain $383,274 at 65.

- Although I can easily spread out the savings/investing across more years, I’m taking the prudent approach to save a larger sum in the first 7 years and let the investment compound over the remaining 10 years.

- My new job must cover my annual expenses (assume that it remains at $36,000/yr) as well as my annual investments of $24,300.

- That’s a take-home salary of $60,300/yr or a gross salary of $72,360/yr (in 2023’s dollars).

- By adjusting this figure for inflation, I’m looking at a job that pays a minimum gross salary of approx. $76,767/yr. Ideally, this pay also needs to grow at 3%/yr to keep up with inflation.

- Once I resume work, I will also be contributing to my CPF accounts. If I leave my contributions to grow at CPF’s compounded interest rates, they become an additional resource for me after 55.

A few things to note

As you can see, to arrive at the next minimum salary, you’d have to make many assumptions, especially your expected expenses, retirement age, retirement expenses, growth rate for your investment portfolios and a withdrawal rate.

If you’re a long way from retirement, it’s not so easy to calculate the amount of savings you would have accumulated at 55 or get a definitive number for your CPF LIFE pay-out from 65.

A large part of planning is also a negotiated space, so it helps to be honest with yourself. In terms of expenses, what are some things you can or can’t live without? If your finances are healthy, are you mentally prepared to chase your dream or passion, even if it pays less?

So, the best way to solve this puzzle is to plan with what we know and add a margin of safety. The margin of safety gives you wiggle room to deal with the lemons and black swans that life throws at us.

Here are a few ways to add buffers to your plan:

- Plan for a slightly larger retirement expense

- Delay your retirement age by a few years

- Assume a lower growth rate for your investments

- Assume a lower safe withdrawal rate for your retirement pot

Once your plan is in place, do review it annually to ensure that it is able to accommodate the life changes that you encounter.

If you find the above overwhelming, you don’t have to do this alone. Reach out to a trusted adviser to journey with you.

This is an original article written by Annette Lee, Associate Adviser at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. What Brought Me to Providend

2. Money Advice for My Younger Self

3. Providend’s Money Wisdom Podcast Episode 38: Retirement Planning Beyond the Wealth Aspect

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.