September was a brutal month for stocks as markets fell to the lowest since March 2020. After 4 rate hikes this year, the Federal Reserve raised an additional 0.75% in September after the Consumer Price Index (CPI), a barometer for measuring inflation, reported that price levels have increased 8.3% year-on-year, beating the market forecasts of 8.1%. Additionally, the US central bank revised its estimated Q4 Fed Funds Rate hike projections in June 2022 from 3.4% to 4.4% in 2022 and 4.4% to 4.6% in 2023.

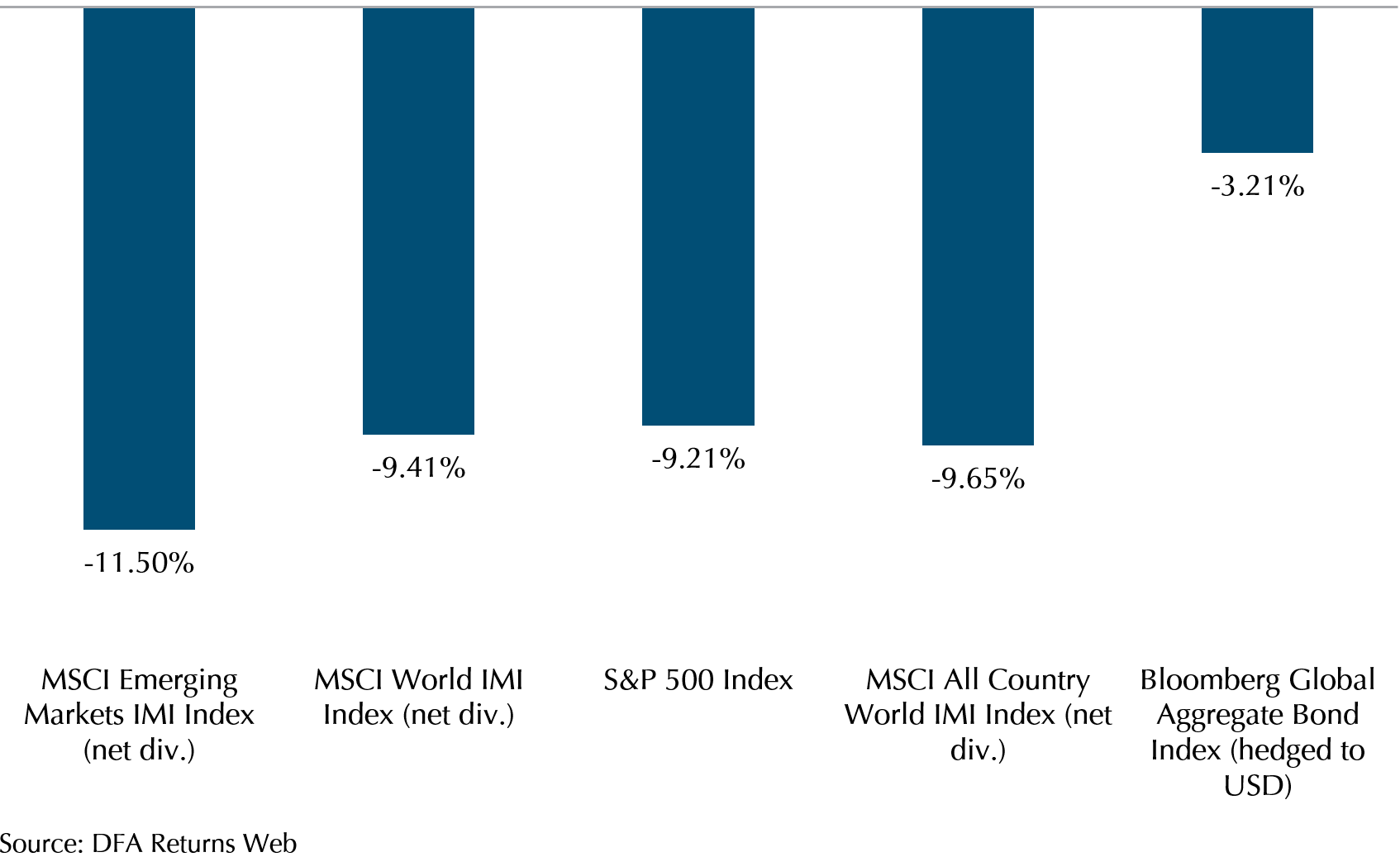

The revision of the terminal Fed Funds Rate and an aggressive hike on 21 September caused the already beaten-down market indexes to fall sharply (refer to Exhibit 1). On average, developed markets fell more than 9% while Emerging Markets did worse off with MSCI Emerging Markets falling 11.5% in September. Chinese companies, which have the highest weightage of 32% in the MSCI EM Index, caused a drag on the Emerging Markets’ performance due to their uncertain outlook caused by economic tensions with the US. Furthermore, a stronger US dollar was putting pressure on the Emerging Market companies.

Once again, inflation, which triggered the Fed to hike rates aggressively, was weighing down on stock markets. It is during times of high volatility that bonds shine due to their ability to dampen equities’ volatility. The Bloomberg Global Aggregate Index, for example, fell 3.21% while equity indexes fell more than 9%.

Exhibit 1 – Stocks and Bond Index Performance September 2022

Widespread Monetary Policy Tightening

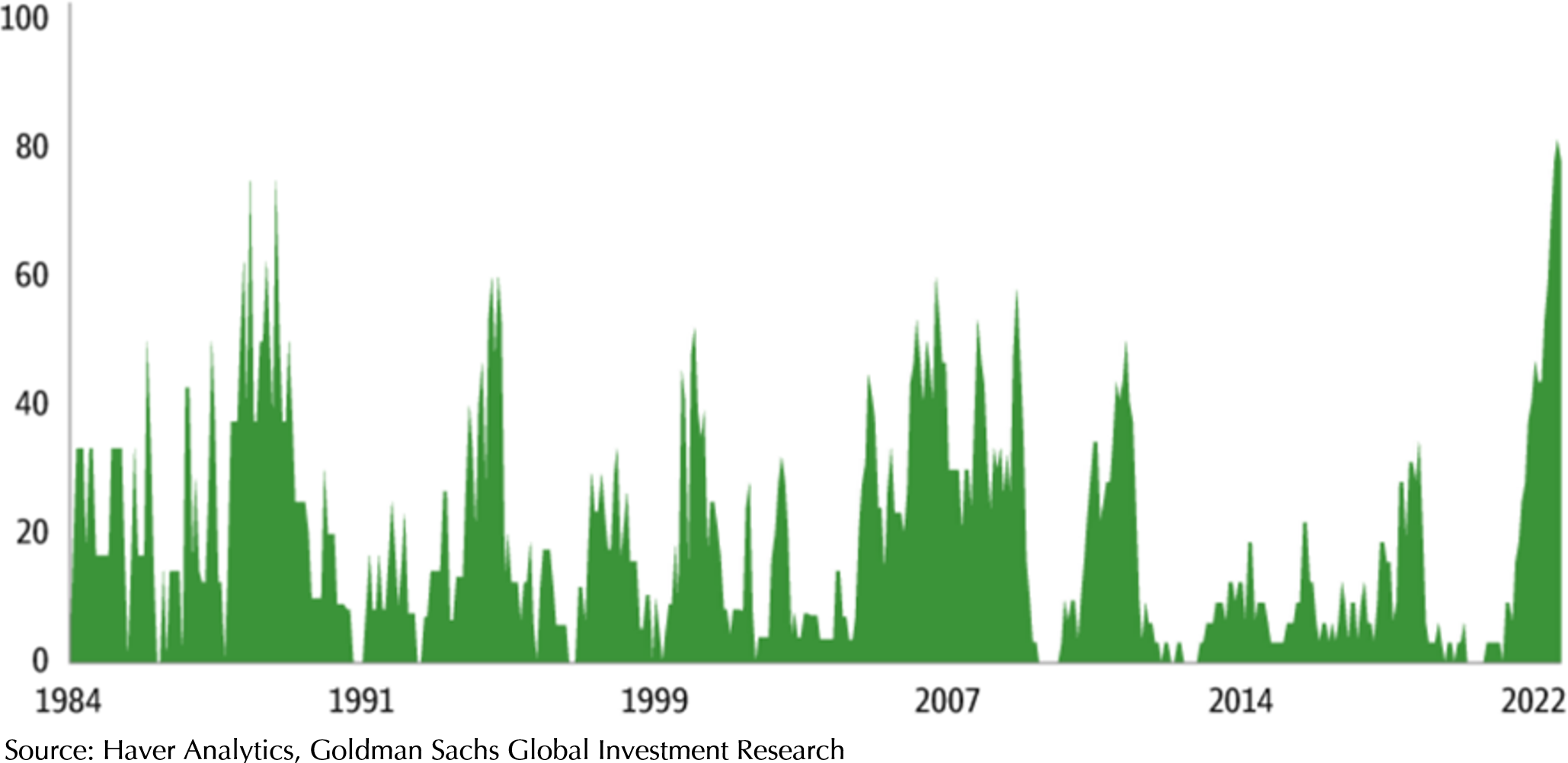

The era of low inflation and easy monetary policy is truly over. We are experiencing a structural change where central banks across the globe are transitioning from an accommodative monetary policy to a restrictive one to slow down demand and curb rising inflation. This is also the first time that 80% of central banks are tightening their monetary policy in sync (Exhibit 2).

Exhibit 2 – Share of Major Global Central Banks Hiking (%)

In Europe, the European Central Bank (ECB) is widely expected to move aggressively this October with some policymakers putting a 0.75% hike on the table. Meanwhile, the Bank of England (BOE) delivered a second consecutive half-point interest rate hike in September to move rate hikes at a quicker pace; this puts interest in BOE at 2.25%. Joining its European peers, Swiss National Bank, the central bank of Switzerland, hiked its rate for the second time this year bringing its interest rate to 0.5% which is officially out of negative territory since 2015.

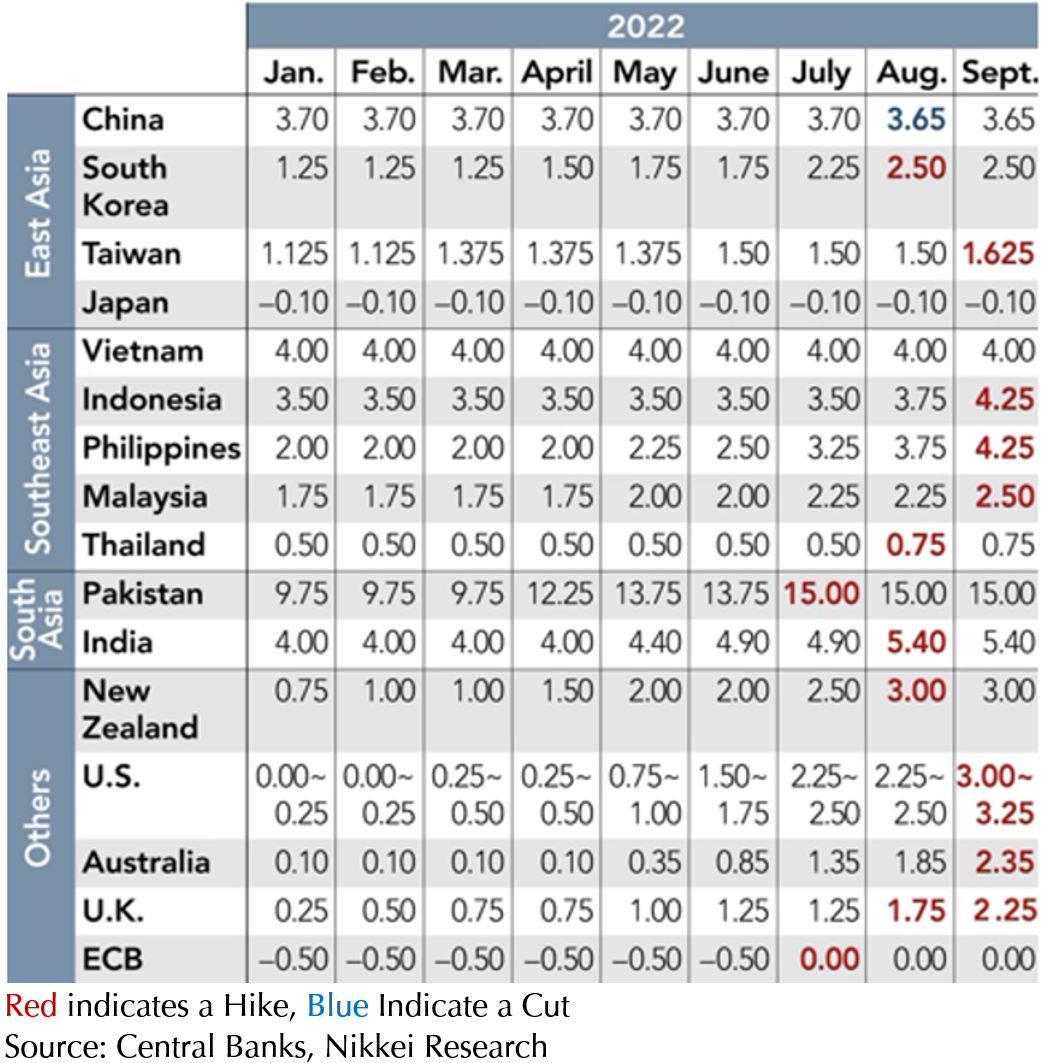

In Asia-Pacific, central banks excluding the Bank of Japan (BoJ) and the People’s Bank of China (PBoC), are also tightening to keep up with their western peers as shown in Exhibit 3 below. Australia, Taiwan, Indonesia, Philippines, and Malaysia tightened their interest rates in September.

Across the world, central banks are fearful of inflation rates going out of control which can have a detrimental effect on their economy.

Exhibit 3 – Selected Central Banks Interest Rates Year to Date

Why Is Curbing Inflation So Important?

It is to ensure that prices remain stable.

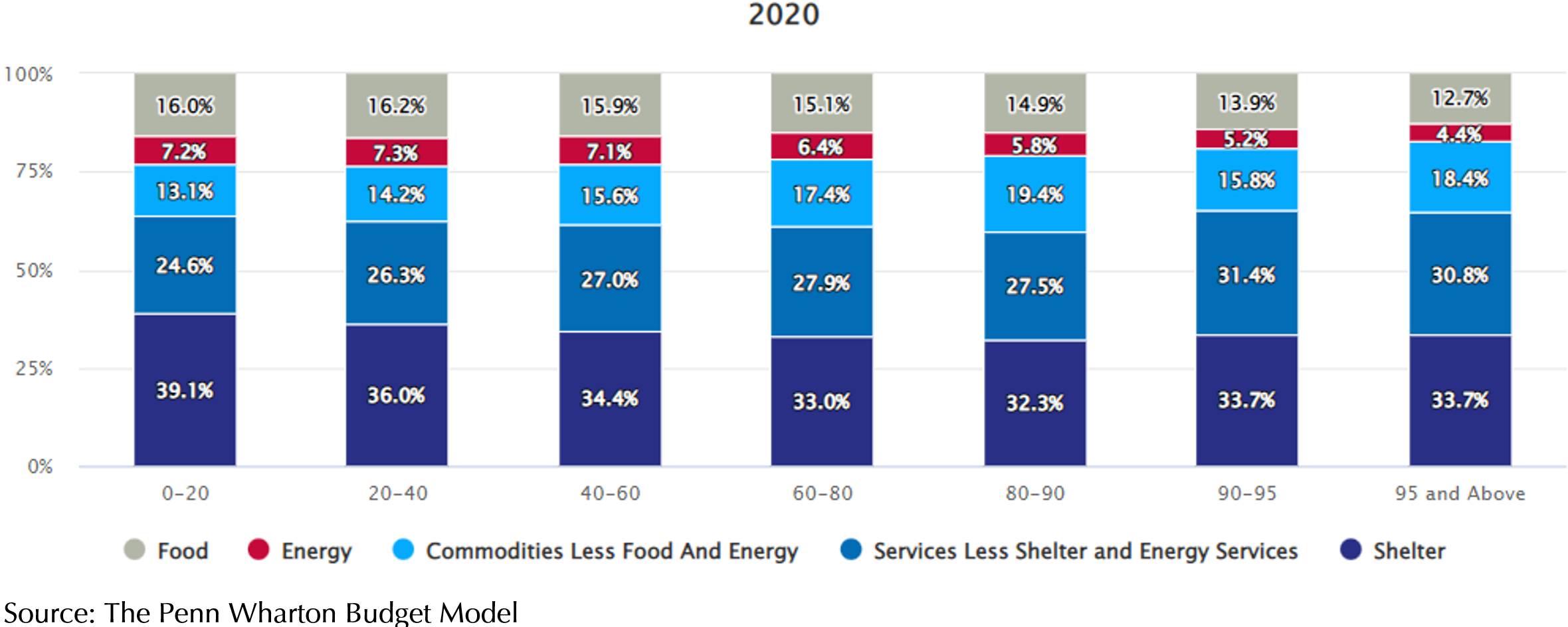

From a social perspective, high inflation has a disproportionately negative impact across different wealth classes which can increase the inequality gap between the rich and the poor. A bigger portion of poor households’ budget is allocated toward items that are most susceptible to inflation like food and gasoline.

Exhibit 4 shows an analysis done by the Penn Wharton Budget Model. It was found that higher-income US households have a lower allocation towards food and energy compared to low- and middle-income households. For example, the top 5% of the US household income spends 12.7% and 4.4% of their total expenditure on food and energy respectively while the bottom 20% of the US household income spends 16% and 7.2% of their total expenditure on food and energy respectively.

Exhibit 4 – US Expenditure Shares on Major Groups of Items by Income Groups 2020

From an investor’s perspective, an unanchored inflationary environment can reduce the value of investment returns as it has a negative impact on consumer spending, business investment and employment rates which puts a brake on economic growth.

Higher inequality can lead to economic instability while stagnant growth causes flat job growth which has a compounding effect on inequality, exacerbating economic instability. Hence, taming inflation is a priority for all central banks even if it means bringing some short-term pain for businesses and households.

Holding a Long-Term View

When the Great Inflation started in the 1960s, the Fed had the opportunity to quell inflation but failed to act. Its inaction led to entrenched inflationary expectations as consumers and companies began to incorporate high inflation into their budget forecasts. Inflationary expectations were so sticky and detrimental to the economy that the Fed chairman at that time, Paul Volcker, had to raise interest rates to 20% in 1981. The key takeaway from the Great Inflation for the Fed is that an aggressive rate hike may be causing short-term pain but is necessary before inflation expectations become entrenched and too difficult to unwind in the long run.

Indeed, the Fed’s current aggressive rate hike pace is showing results. While August inflation in the US is currently 8.3%, market expectations for the average US inflation for the next 5 years had fallen from the peak of 3.59% to 2.14% between 25 March and 30 September (Exhibit 5). This means the market is confident that inflation will not go unanchored.

Exhibit 5 – US 5-Year Breakeven Inflation Rate (Average Expected Inflation for the Next 5 Years)

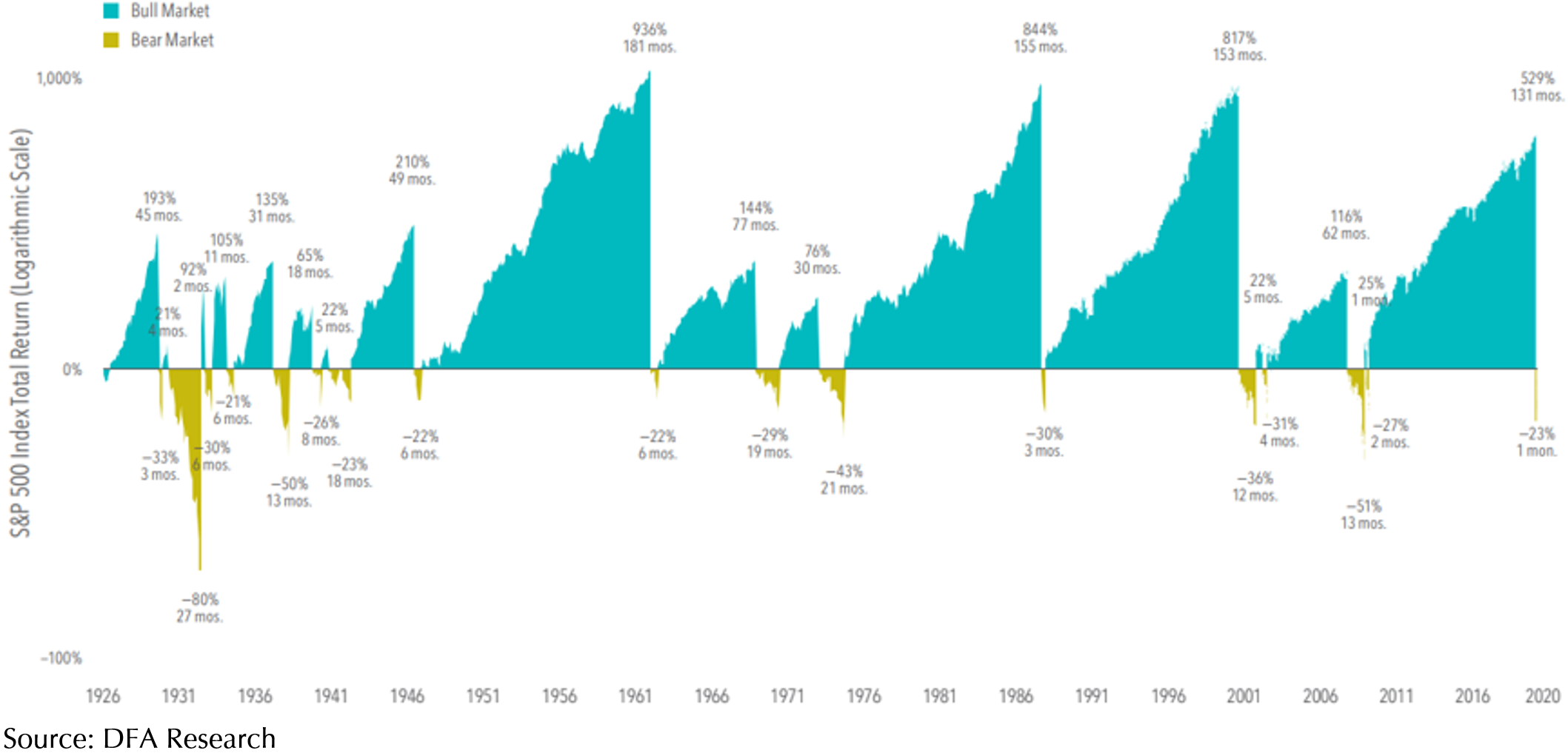

Like the Fed, investors should also hold a long-term view when it comes to putting their money in stocks. While equity is currently taking a hit with S&P 500 down about 25%, history has shown that holding on for the long run will benefit investors. Exhibit 6 shows the S&P 500 Index total returns from January 1926 to March 2020. During this period, S&P 500 experienced 17 bear and bull markets. However, we can see that the bull lasted much longer than the bear and when viewed together, it is clear that equities reward long-term investors. Chances are that the bear market we are currently experiencing will be shorter than the bull market that is to come. Hence, for the best of what the market can offer, stay the course.

Exhibit 6 – S&P 500 Index Total Returns (January 1926 – March 2020)

Conclusion

We understand that investors may feel unnerved during these turbulent times. However, short-term volatility is an inevitable part of investing. That’s why our focus is on the long-term performance of the market. Tuning out from noises or irrelevant information in this digital age can be a very daunting task so please do reach out to your Client Adviser for a chat, where needed.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.