Executive Summary

November 2025 was turbulent with a late recovery. Markets entered the month on a dour mood following a “hawkish cut” from the Federal Reserve, and AI-sector specific news added renewed pressure, leading to sizeable declines in the Nasdaq and S&P 500 mid-month. Forced deleveraging in cryptocurrencies spilled over into equities, exacerbating volatility. Relief arrived in the final week as Federal Reserve officials signalled support for a December rate cut, boosting sentiment and erasing losses in major indices. The month underscored the importance of diversification, discipline, and staying invested amidst rapid swings and negative headlines.

November’s Performance

After reaching new highs in October, markets began November 2025 in a dour mood. Market volatility early in the month was largely driven by a “hawkish cut” delivered by the Federal Reserve in October, where Chair Powell made several remarks hinting that the future path of interest rate cuts was less certain than market participants anticipated. This was exacerbated by hawkish remarks from other Federal Reserve officials in the days following, leading expectations for a December rate cut falling sharply to only 20% over the next two weeks. Accordingly, the S&P 500 declined 3% in the first week of November. Over the weekend, the US Government finally passed a vote to end the shutdown, which had been in place since October, providing some much-needed relief for markets that proceeded to rebound strongly over the next three trading days, erasing the month’s losses.

This reprieve was not to last. The next two trading weeks were marked by a series of AI-sector-specific news that resulted in renewed pressure on markets, particularly in the technology sector and other speculative segments.

First, Coreweave, a cloud infrastructure company focusing on providing GPU compute for AI workloads, saw its share price fall sharply after downgrading its 2025 revenue forecast due to operational constraints, while profitability metrics also deteriorated. Additionally, debt issuance by other large cloud infrastructure companies, which have been driving the majority of AI-related capex, accelerated through the month, causing credit spreads for borrowers in the sector to widen swiftly, as fears about the long-term viability of these expensive investments mounted.

Next, early investors in AI chip giant Nvidia, Softbank and Thiel Macro, disclosed divestments of the entirety of their sizeable stakes in the company. The AI storm finally culminated in the third week of November, when Google launched its Gemini 3.0 model that quickly won praise amongst users, particularly for its impressive image creation capabilities. The sour mood of the market meant that this positive news quickly turned into a negative catalyst for competitor and LLM model stalwart OpenAI, with CEO Sam Altman even acknowledging internally that Google’s achievements “presented headwinds” for the company. As investors began to fret about model competition and cast doubt on the long-term viability of the company, shares of companies invested in the OpenAI ecosystem were sold off relentlessly.

Amidst the AI storm, cryptocurrencies also experienced large falls in the same week. This was attributed to forced deleveraging of trader positions, following volatility spikes in October and November that triggered risk limit adjustments in leading exchanges. The deleveraging eventually spilled over to equities, as traders liquidated holdings in other assets to meet margin calls. The result of these events was an intra-month decline of approximately 8% for the Nasdaq, and 4.5% for the S&P500. With only one trading week left in the month. November looked on track to be the first negative-return month since April.

However, this was not to be, as the Federal Reserve (Fed) rode to the rescue of markets. Christopher Waller, an influential member of the Fed Committee, made a statement in a speech where he backed a December rate cut due to his view of macro-economic conditions. This was followed by similar comments from a number of other Fed officials. Finally, rumours emerged that Kevin Hassett, President Trump’s Director of the National Economic Council, had become the favourite to become the next Fed Chair. With the President’s preference for lower interest rates well known, there was little doubt that the presumptive Fed Chair would also be in favour of lower interest rates.

Over the final week of November, probabilities for a rate cut in December rose strongly from a low of 20% to end the month at 80%. This catalyst provided a massive boost for oversold markets, which had likely experienced peak AI fear after several weeks of bubble chatter in financial and mainstream media. The resulting rally erased all losses in the S&P500 and the MSCI World Index, with the Nasdaq ending only slightly lower for the month.

November’s Lessons

The frenetic pace and result of November present important lessons for investors. On the surface, it appears that most markets have done nothing for the entire month, yet, beneath the hood, closer observers would have experienced a reasonable level of tumult from the unrelenting pace of negative headlines and rapid swings in both share prices and macro-economic expectations. Understandably, they might have been tempted to make tactical rotation or timing decisions that would have proved sub-optimal or even costly.

Markets are moving ever more swiftly, with rapid advancements in trading technology and AI exponentially increasing the ability of institutional participants to process information and as well as implement strategies. For most private and retail investors who do not have the financial or time resources to keep up with this pace, the costs of a mis-timed or emotional decision are high and rising by the day.

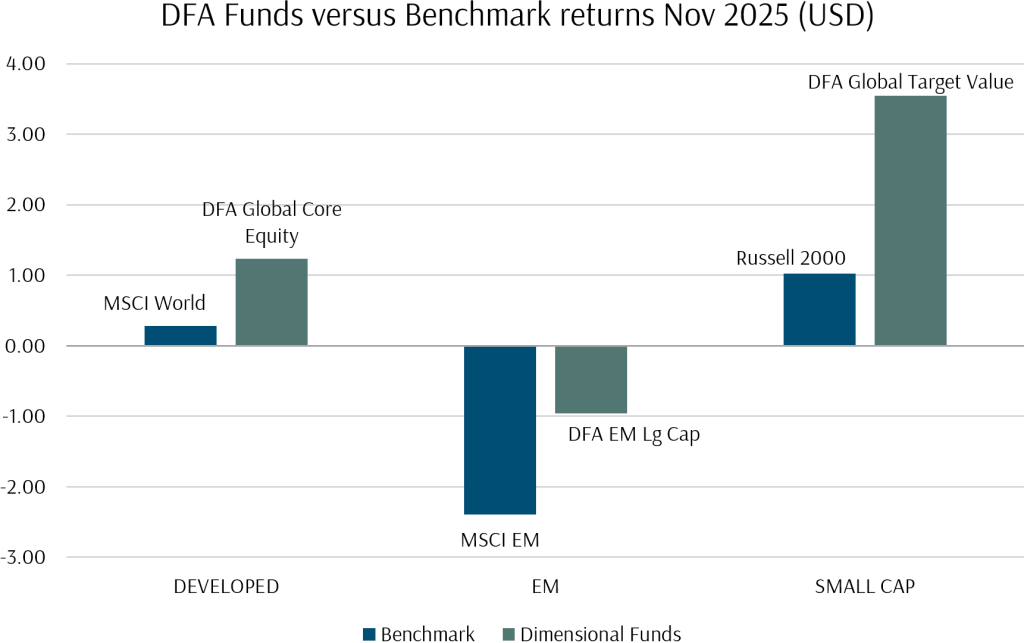

Events over the month also highlight the importance of diversification in portfolios. Broadly diversified markets performed better than concentrated markets, while portfolios tilted in value and/or small cap factors experienced smaller drawdowns and swifter recoveries. This factor outperformance was evident in the returns of Dimensional Funds used in our Providend portfolios.

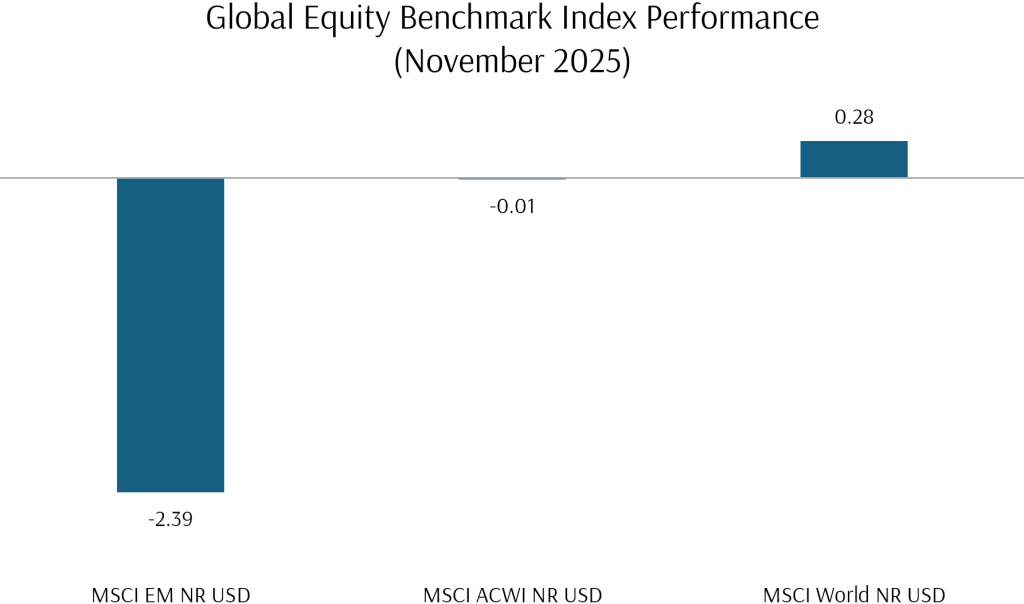

The Dimensional Global Core Equity Fund gained 1.23% in November, outpacing the MSCI World Index return of 0.28%. The MSCI EM index closed November with a -2.39% return – however the Dimensional EM Large Cap Core Equity Fund was down a much more modest -0.96%. Compared to benchmark indices, both Dimensional Funds are more diversified by sector and country, and incorporate tilts towards lower valuation and smaller capitalisation stocks. The Dimensional Global Targeted Value Fund, which incorporates heavier tilts in both factors, returned 3.54% in November, an outstanding result considering the turbulent journey markets experienced throughout the month

For diversified investors, November was a much less tumultuous month than media headlines and market action would have suggested.

Accordingly, adopting a long term, through-the-cycle investment approach, using well-diversified portfolios, remains the best option for investors to reach their financial goals.

Equity Market Performance

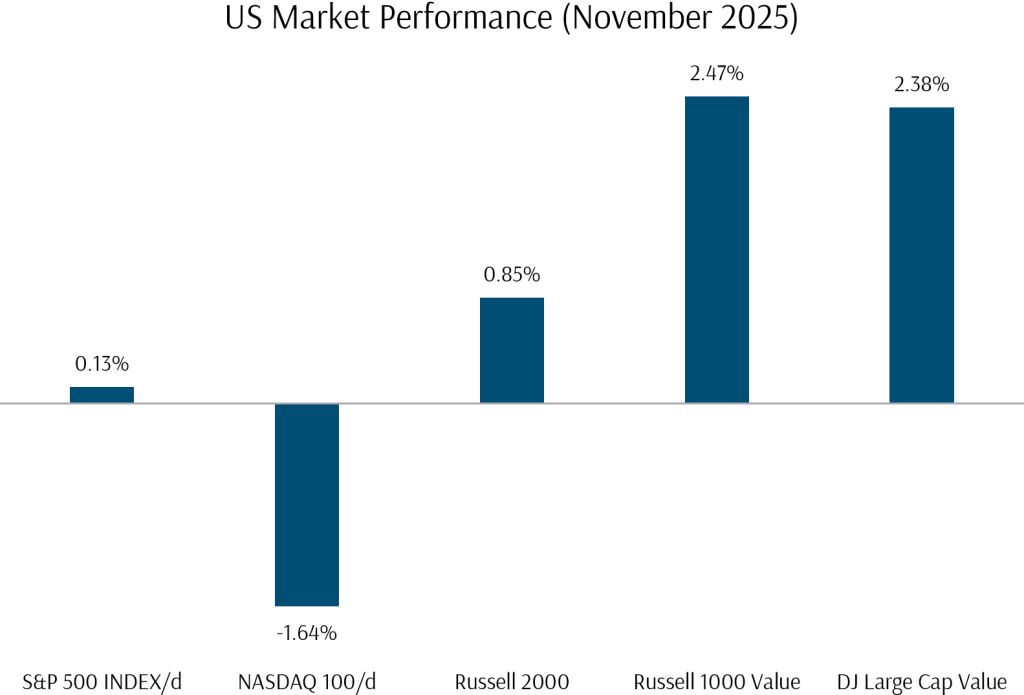

US equity markets were mixed in the month, with the S&P 500 returning 0.25% and the Nasdaq 100 down -1.56%. Technology sector weakness was pronounced, owing to the negative sentiment turn in some AI-related segments and large debt issuances by data centre builders. While the late-month recovery stemmed losses and allowed some tech shares to regain ground, others remained well in the red, as investor fund flows moved aggressively to pick perceived AI winners and losers.

Elsewhere, the Russell 2000 small cap stock index and other small cap indices managed to turn in a positive performance of +0.96%, outperforming broader market indices. Value stocks also performed exceptionally, with the small-cap value index up 2.65% and the large-cap value index returning 2.38%, abetted by the rotation away from growth stocks over the month.

On the macroeconomic front, announcements began to trickle in as the US government shutdown ended. Manufacturing sentiment indices trended lower and remained in contractionary territory, but better-than-expected services growth provided some relief. Consumer sentiment weakened, while private payrolls data continued to show a trend of small job losses. September non-farm payrolls surprised to the upside, along with a small increase in the unemployment rate. Market reaction to delayed data was mixed, evident in the volatile swings of probabilities for a December rate cut.

Exhibit 1: US Stock Market Performance November 2025 (USD)

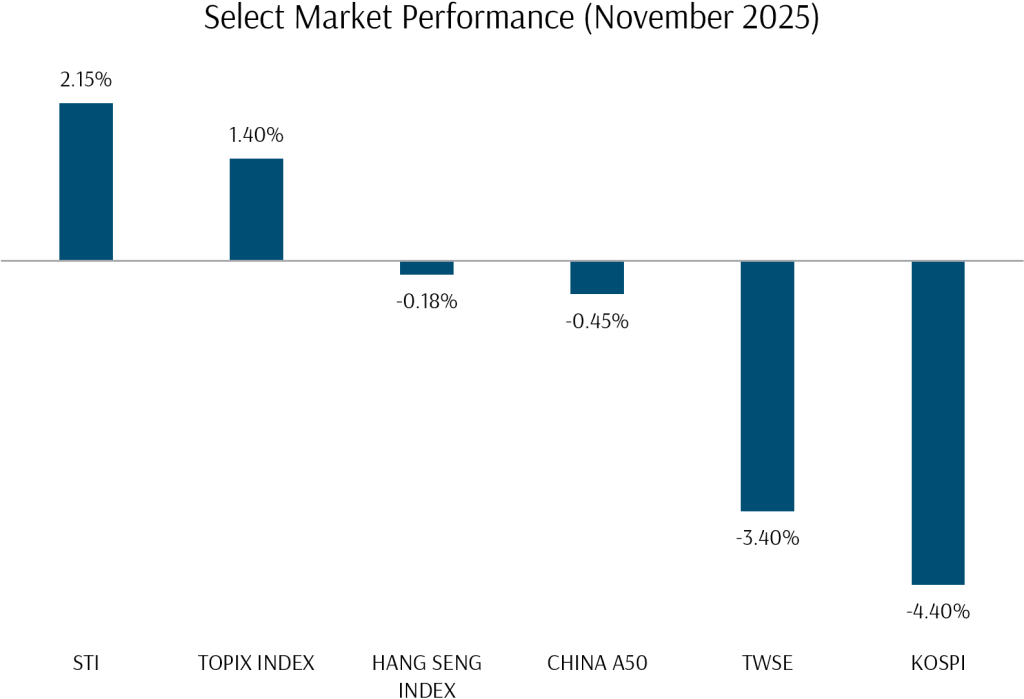

Elsewhere in the world, Asian markets saw pullbacks largely across the board after the shift in AI sentiment triggered a round of profit-taking. Tech-focused markets were the most badly hit, with the Kospi index down 4.4%, followed closely by a 3.4% decline in Taiwan. Greater China and Hong Kong markets were largely flat. Japanese markets managed to finish the month with a 1.42% return on the back of a weak yen, despite the emergence of a contentious political storm involving China-Taiwan relations.

Locally, the STI index was a standout, with the STI index up 2.68% despite widespread weakness in global markets, picking up a defensive bid and driven by multiple sectors including banks, utilities, conglomerates and property developers. Investors continued to hunt for yield aggressively as short term SGD rates declined for yet another month. REITS eased over the month, impacted by rising long term government bond rates after a slew of hot economic data emerged in the final week.

Exhibit 2: Select Market Performance October 2025 (Local Currency)

November’s global market performances reflected developed market volatility and profit-taking in Emerging Markets on the back of somewhat soured AI-sentiment impacting Asia’s technology giants which had notched outstanding gains in the prior month.

Exhibit 3: Global Equity Benchmark Index Performance November 2025 (USD)

Fixed Income

Fixed income markets generated positive returns in November. Despite yields enduring yet another see-saw ride triggered by volatile rate-cut expectations, US 10-year bond yields ultimately ended modestly lower. Elsewhere in the world, yield moves were mixed. In the UK, gilt yields fell for the month after the Treasury revealed a prudent budget, while in Australia, a higher-than-expected inflation number effectively put an end to the RBA’s current rate cutting cycle, moving yields and the AUD higher. Yield increments were also noteworthy in Japan. As the only developed country still in an interest rate hike cycle, BOJ officials were hawkish in November, with board members calling for further interest rate hikes to combat inflation running at 2.8% YoY.

Overall, the Bloomberg Global Aggregate Bond Index was up 0.21% for the month, while the Bloomberg Global Aggregate Credit 1–5-year Bond Index was up 0.39%. However, the US Dollar Index fell 0.89% over the month.

How Did Our Portfolio Funds Do in November?

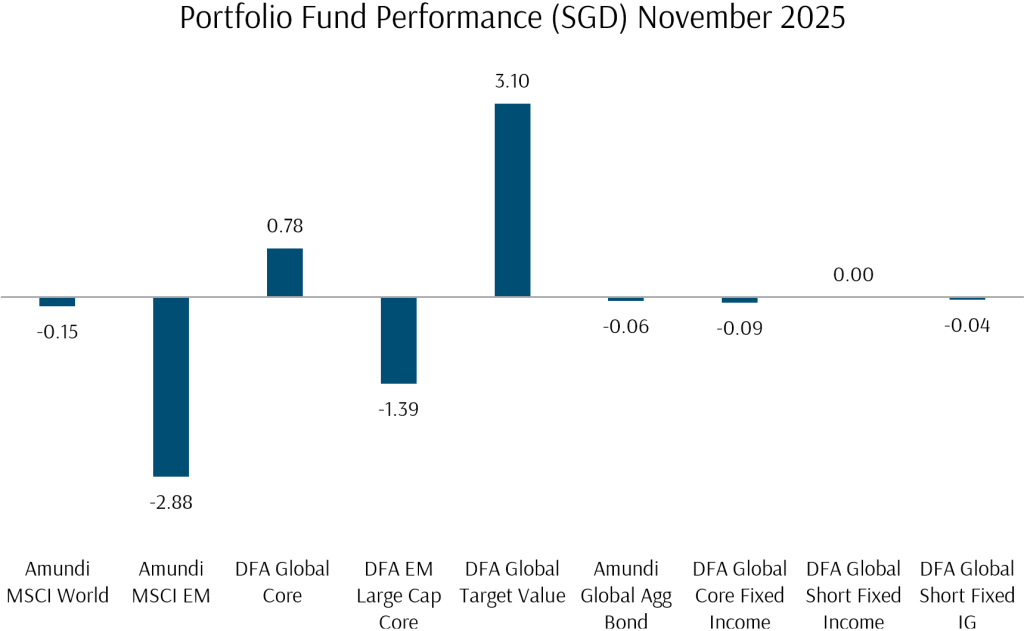

Exhibit 4: Fund Performance November 2025 (SGD)

Portfolio fund performances were mixed amidst the volatility of November. Despite significant weakness in the US dollar over the month, SGD share classes were able to substantially mitigate FX impacts on eventual returns.

As highlighted earlier, DFA fund performance stood out. Equity funds outperformed benchmark indices, with the Global Targeted Value Fund turning in an outstanding 3.1% return in SGD terms, highlighting the rapid market rotation into value and smaller capitalisation stocks as worries about AI and technology sector mounted.

The Amundi MSCI World Index Fund that tracks the developed world index, was down 0.15% in SGD terms. Emerging market funds gave up some of last month’s stellar gains as investors took profit in the technology sector, with the Amundi MSCI EM fund retracing 2.88%. Greater diversification and factor tilts enabled the DFA EM Large Cap Core Equity Fund to outperform the benchmark index.

For fixed income funds, both index and DFA funds were generally flat to slightly down, as FX movements offset returns in the asset class.

Topic of Interest – 2026 Economic and Market Outlook

With 2025 being another outstanding year for markets and now largely in the rear-view mirror, it is appropriate to look ahead to what 2026 might have in store for investors. To that end, we have closely examined the views of several major research houses, and present common themes and consensus positions in the sections following.

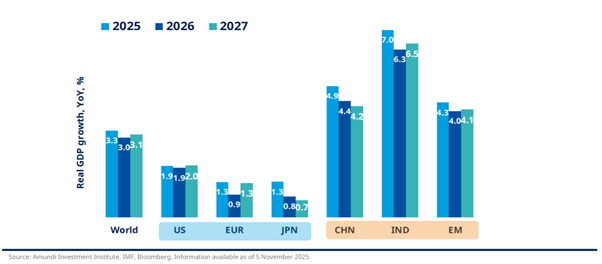

Economic Outlook: Moderate Growth With Divergent Drivers

A broad consensus among major houses is that 2026 will be a year of slower but still solid growth, extending the post-pandemic expansion rather than entering a downturn. Forecasts show global GDP moderating to around 3.0% from 3.3% in 2025. Developed economies are expected to expand by around 1.4% on average, while emerging economies are expected to grow near 4%. Research teams emphasise that 2026 will be a year of extension for the current economic cycle, with a combination of technological investment, easing monetary policy, and fiscal support preventing a hard downturn and keeping global growth resilient.

Exhibit 5: Amundi GDP YoY Growth Expectations 2025 – 2027

The United States

The US economy is broadly expected to avoid recession and achieve a “soft landing”, though growth drivers will be uneven through the year. JPMorgan Asset Management describes the US. as a “2×2 economy”, meaning two distinct speeds across sectors and a year split into two halves. On one hand, the technology and AI-driven sectors are investing heavily, with a major capital expenditure boom in data centres, AI infrastructure, and related equipment providing a vital boost to US growth. On the other hand, more traditional parts of the economy, especially in labour-intensive services, are cooling with job growth decelerating and companies becoming more cautious in hiring.

Analysts concur that consumer activity will support the US in early 2026, aided by fiscal tailwinds, but may then moderate. Due to changes like tax exemptions on tips and overtime, many Americans are set to receive tax rebates in early 2026, creating a temporary surge in consumption in the first half. There are no calls for a US recession in 2026 under base case scenarios.

Emerging Asia and ASEAN

Emerging Asian economies are expected to remain a primary engine of global growth in 2026. Forecasts for China and India, while slightly lower than 2025, still imply robust growth of roughly 4 to 6% next year. Amundi notes that even if China and India moderate from 2025’s strong pace, Asia will continue to outpace other regions. ASEAN economies are seen growing in the 4 to 5% range. Emerging Asia also benefits from the global tech cycle with Asian exporters leveraging into the AI boom with strong semiconductor and electronics demand acting as a tailwind even amid US/China trade tensions.

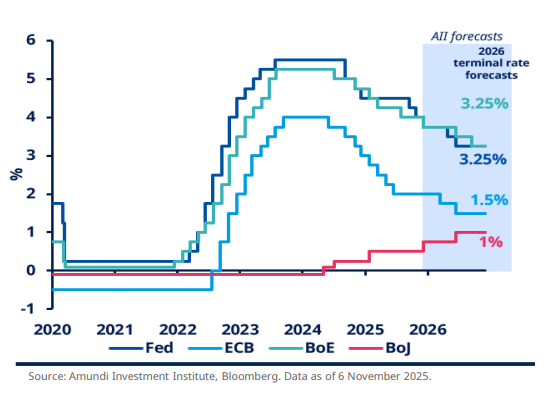

Monetary Policy Easing Cycles on the Horizon

The Federal Reserve is widely expected to maintain its trajectory for at least 3 more rate cuts in 2026. Amundi’s projections put the Fed’s policy rate around 3.25% by 4Q 2026, in line with consensus expectations of around 3.0 to 3.5%. Barring an inflationary shock, the Fed is expected to prioritise ensuring a soft landing.

The European Central Bank’s policy is expected to follow a similar easing trajectory. Eurozone inflation has fallen faster, and growth is weaker, giving the ECB scope to cut rates through 2026. Amundi forecasts the ECB’s deposit rate falling to about 1.5% by mid-2026, from 2.00% in late 2025.

The monetary stance in Emerging Asia and ASEAN in 2026 is expected to be accommodative overall to reinforce growth, but with each country calibrating based on its inflation path. This stance is assisted by a weaker dollar environment, reducing pressure on EM Asia FX, allowing lower rates without sparking capital outflows.

Exhibit 6: Amundi 2026 Central Bank Policy Rate Forecasts

Fiscal Impulse Modestly Supportive

Fiscal support will be varied, with the US implementing short-term tax breaks, Europe focused on targeted spending, and EM focused on maintaining stability. Fiscal policy will be a tailwind for growth early in the year, underpinning certain themes like infrastructure, defence, and AI-related investment. High debt levels and fiscal sustainability will remain an issue in 2026 and beyond, potentially affecting interest rates and market sentiment if deficits are persistent.

Market Return Expectations: Equities Up, Yields Down

Analysts are cautiously optimistic on global equities for 2026. After a strong 2025, the expectation is that stocks can continue to grind higher, though at a more moderate pace. With valuations already at the top end of historical ranges or no longer cheap, the key driver doing the heavy lifting for equities is earnings growth expectations of 7 to 14% for major markets. US analysts appear to be more bullish – according to the average forecast of nine major investment banks surveyed by the Financial Times, the S&P 500 index will rise to more than 7,500 points by the end of 2026, a roughly 10 per cent increase from its current level. Globally, consensus expectations are for non-US markets to outpace US equities in 2026, based on cheaper valuations, competitive earnings growth forecasts and a weaker dollar.

The outlook for bonds in 2026 is significantly better than it has been in recent years, as yields have risen to attractive levels and are poised to potentially fall. With global central banks set to cut rates and inflation moderating, consensus expectations are for bond real returns to be positive in 2026, driven by both carry income and price appreciation as yields gradually decline.

Despite the favourable outlook, analysts remain cautious on longer duration bonds. Allocations in short-to-intermediate duration bonds are preferred, as the sector is poised to benefit from interest rate cuts, whereas heavy issuance supply and fiscal concerns could keep longer term yields from benefiting to the same degree.

Multi and Other Assets

With both stocks and bonds expected to post positive returns, traditional balanced (60/40) portfolios are expected to make further headway in 2026. In the currency space, consensus remains strongly in the camp of a weakening USD, believing that narrow US growth differentials and rate cuts will continue to reduce the dollar’s yield advantage and result in a softer dollar.

This, in turn, is expected to be a tailwind for EM assets and for commodities. Analysts are universally bullish on Gold, with demand driven by strong central bank buying on the back of a new multi-polar geopolitical landscape contributing to ongoing de-dollarisation and reserve diversification.

Key Risks

- Persistent or rebounding inflation is mentioned as a possible risk, with analysts worried that inflation might prove stickier than expected or even reaccelerate.

- Central bank policy missteps are also key risks to dovish monetary policy expectations, while fiscal stability could be another pitfall as the Trump administration leans into stimulus ahead of the US mid-term elections.

- Geopolitical risk and the further fragmenting of old-world orders into a new “multi-polar” world remains at the forefront of worries. Whilst markets are currently sitting in the relative comfort of a trade truce, underlying tensions continue to sizzle and may come to a head very abruptly, triggering market volatility reminiscent of April 2025.

- Lastly, heavy market concentration in AI-related companies continues to present a risk, despite the sector having stemmed losses in November. Market demand for evidence of monetization and productivity gains is growing, and the gap between AI winners and losers is expected to be much more bifurcated in 2026. Significant pullbacks in capex spending and return on investment expectations will likely result in market declines.

In Summary

While the central narrative for 2026 is positive under the themes of continued monetary support driven by lower inflation, and fiscal support driven by elections, reshoring and defence, investor diversification and discipline are repeatedly emphasised as the top strategies to mitigate risks. Investors are advised to stay invested as falling yields impact the attractiveness of cash. Earnings growth and income are expected to drive returns. Absent a major shock, the expectation is that 2026 will navigate challenges while the wheels of the economic cycle keep turning.

Looking Forward to December 2025

November 2025 was a month of elevated volatility, driven by longstanding AI market fears and media-driven narratives, unpredictable and seemingly random technical flows in cryptocurrencies, and rate expectations swinging at every parsed word from a Fed official’s statement.

Ultimately, markets ended the month with little ground gained or lost. All events considered, the end-result can be considered a testament to market resilience and rationality. Despite all the noise, the economic, fiscal and monetary backdrop remained positive. Globally, company earnings were also upgraded through the month, an indication of a healthy and growing corporate sector. Segments of the market which have seen risks rise and prospects dim have retraced, while other segments which have benefited from the same forces have advanced.

The key consideration heading into December and 2026 is undoubtedly, valuation. As discussed in an earlier section equity valuation levels are the primary concern of major investment banks and research houses globally. At this stage in the cycle, we still think that it is more instructive to consider elevated valuations as a potential dampener to upside returns, or as an amplifier to potential declines in the event of a growth disappointment, as opposed to a catalyst for negative returns in and of itself.

The first trading week of December has largely been positive, with markets continuing to trek towards all-time highs. As corporate announcements are generally more muted at the end of the calendar year, market movements are likely to be dictated by labour and inflation data to be released over the next few weeks, as well as the upcoming Federal Reserve rate decision.

Seasonally speaking, December has, on average, been a positive month for markets. However, 2025 has been a very strong year for returns so far, notching up high double digit returns in broad indices for the second-year running, on top of some truly outstanding gains in emerging markets.

While earnings and economic risks appear dormant now, we do observe pockets of potential turbulence, particularly regarding developments in Japanese bond yields and the Japanese Yen. With the Bank of Japan now under pressure to raise rates to combat inflation, the prospect of Japan facing a sustained positive real interest rate for the first time in decades has risen. Major adjustments in policy and yields are likely to present challenges to the Yen carry trade, which is a strategy where investors borrow in Japan at very low interest rates and invest the proceeds into higher-yielding foreign assets to capture the interest-rate differential. We last observed a carry trade adjustment in August 2024, when the S&P500 fell nearly 10% in a 3-week period. Although these technical adjustments are generally short-lived in nature, investors should be mentally prepared for such events to occur.

With a comprehensive plan already in place with your Client Adviser, covering near-term spending needs while allocating capital at a level of risk suitable for your longer-term goals, you can have the peace of mind to navigate market volatility and stay invested for the long term, allowing your wealth to compound and fulfil your ikigai. If you have any questions, please do not hesitate to reach out to your Client Adviser.

The writer of this market review, Glenn Tan, is Portfolio Manager at Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm. He is also a CFA Charterholder and a Certified Financial Risk Manager (FRM).

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.