In September, both the equity and fixed income markets faced a downturn in performance, largely attributed by the escalating U.S. yields. This was caused by an unexpected announcement from the Federal Reserve, outlining a projected 25 basis-point rate hike before year-end. This move was aimed at addressing inflation, as oil prices reached $90 a barrel, catching the market off guard. The surge in yields led to higher borrowing costs, creating a more restrictive financial landscape for businesses. Consequently, concerns over liquidity challenges faced by small and mid-sized banks in the U.S. resurfaced, mirroring the decline observed from March to May in the aftermath of the banking crisis. This put downward pressure on the equity markets, particularly in the U.S.

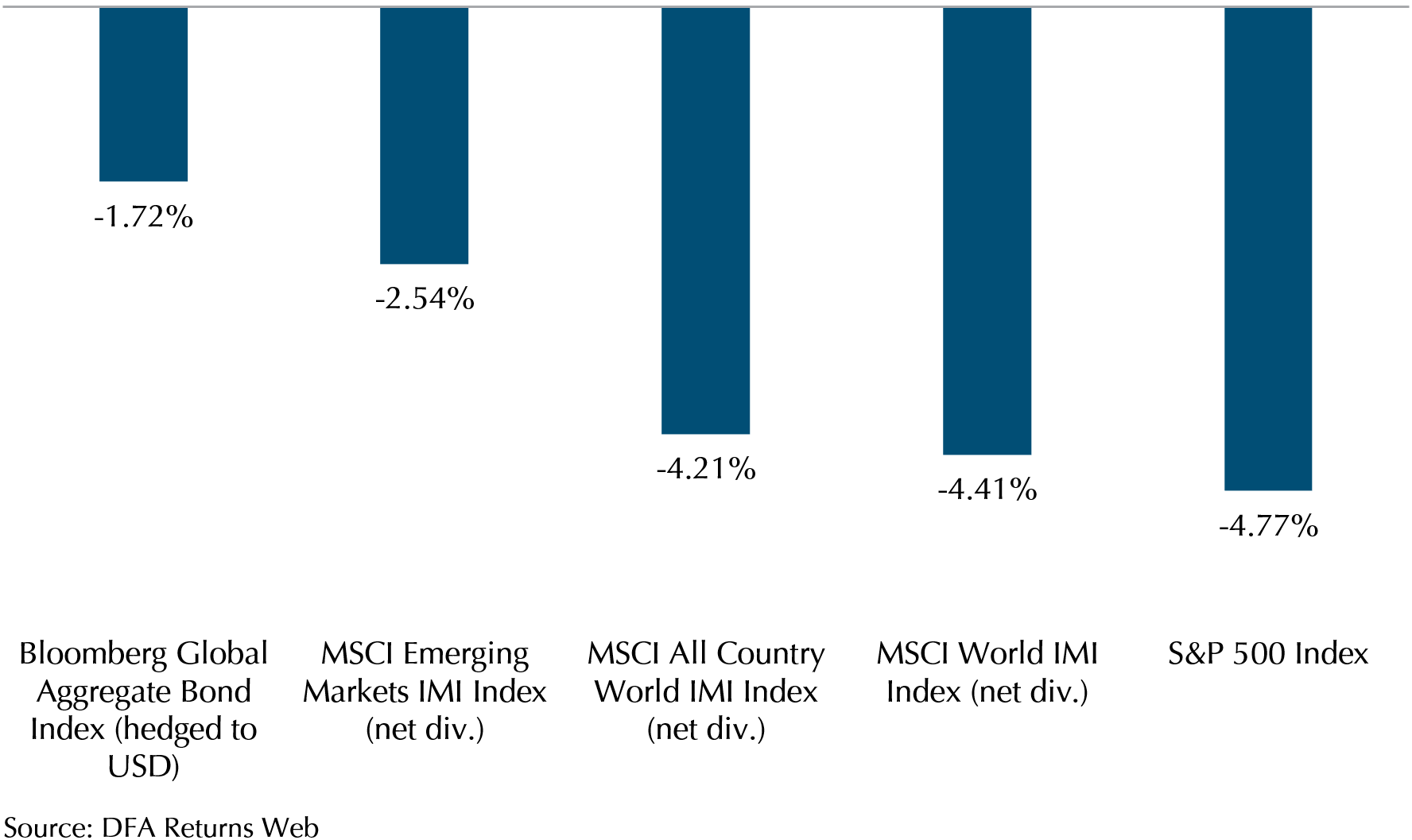

Exhibit 1 illustrates equity market indexes’ performance in September. The S&P 500, representing the largest 500 publicly traded companies in the United States fell 4.77%. The MSCI World IMI, which represents the stock prices of large, mid, and small-sized developed market companies, experienced a decline of 4.41%. Similarly, the MSCI All Country World IMI, encompassing both Developed and Emerging Market stocks of large, mid, and small-sized companies, saw a drop of 4.21%. In comparison, the MSCI Emerging Market IMI, reflecting stocks of large, mid, and small-sized companies from Emerging Markets countries, saw a lesser decline of 2.54%. Emerging Markets outperformed their Developed Markets counterparts due to their lack of exposure to U.S. small and mid-sized banks.

On the fixed income front, the Bloomberg Global Aggregate Index, investing in global investment grade bonds, experienced a decline of 1.72%. Even though bond prices declined, the extent of the drop was significantly smaller in comparison to equities. Therefore, bonds continue to act as a cushion and provide diversification benefits for our portfolios.

Exhibit 1 – Market Indexes September Performance (In USD)

Dimensional Weathers the Storm in September

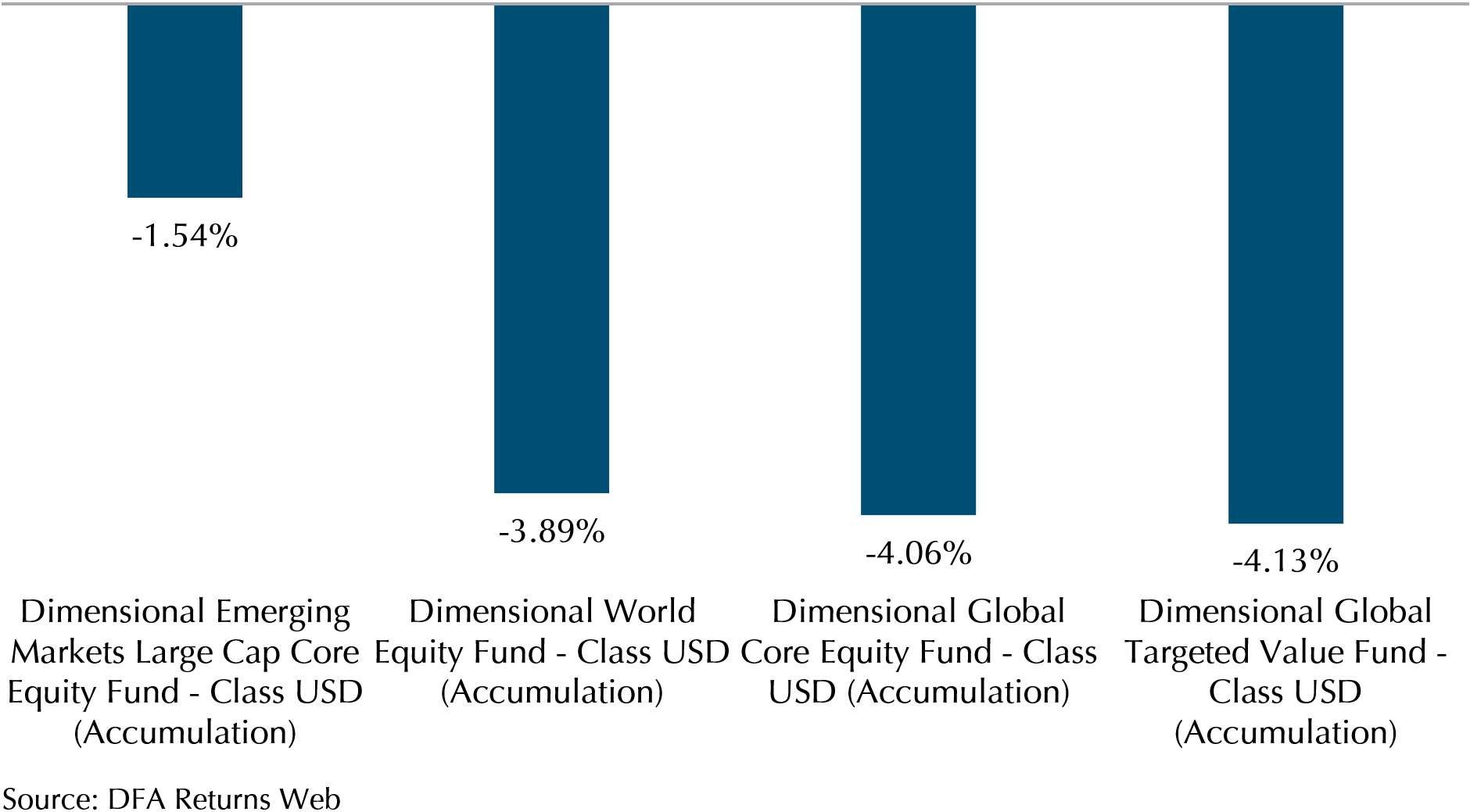

Dimensional’s equity and bond funds delivered strong performance, surpassing the return of the market indexes. This achievement was particularly evident in the case of Dimensional’s equity funds that are tilted to value stocks, as growth stocks did worse than value stocks. The impact of higher yields was notably more pronounced on stocks with anticipated higher future earnings. Exhibit 2 showcases the performance figures, with the Dimensional Global Targeted Value, Dimensional Global Core Equity, Dimensional World Equity, and Dimensional Emerging Markets experiencing declines of 4.13%, 4.06%, 3.89%, and 1.54%, respectively, less than that of the broad market indexes as shown in Exhibit 1.

Exhibit 2 – Dimensional Equity Funds September Performance (In USD)

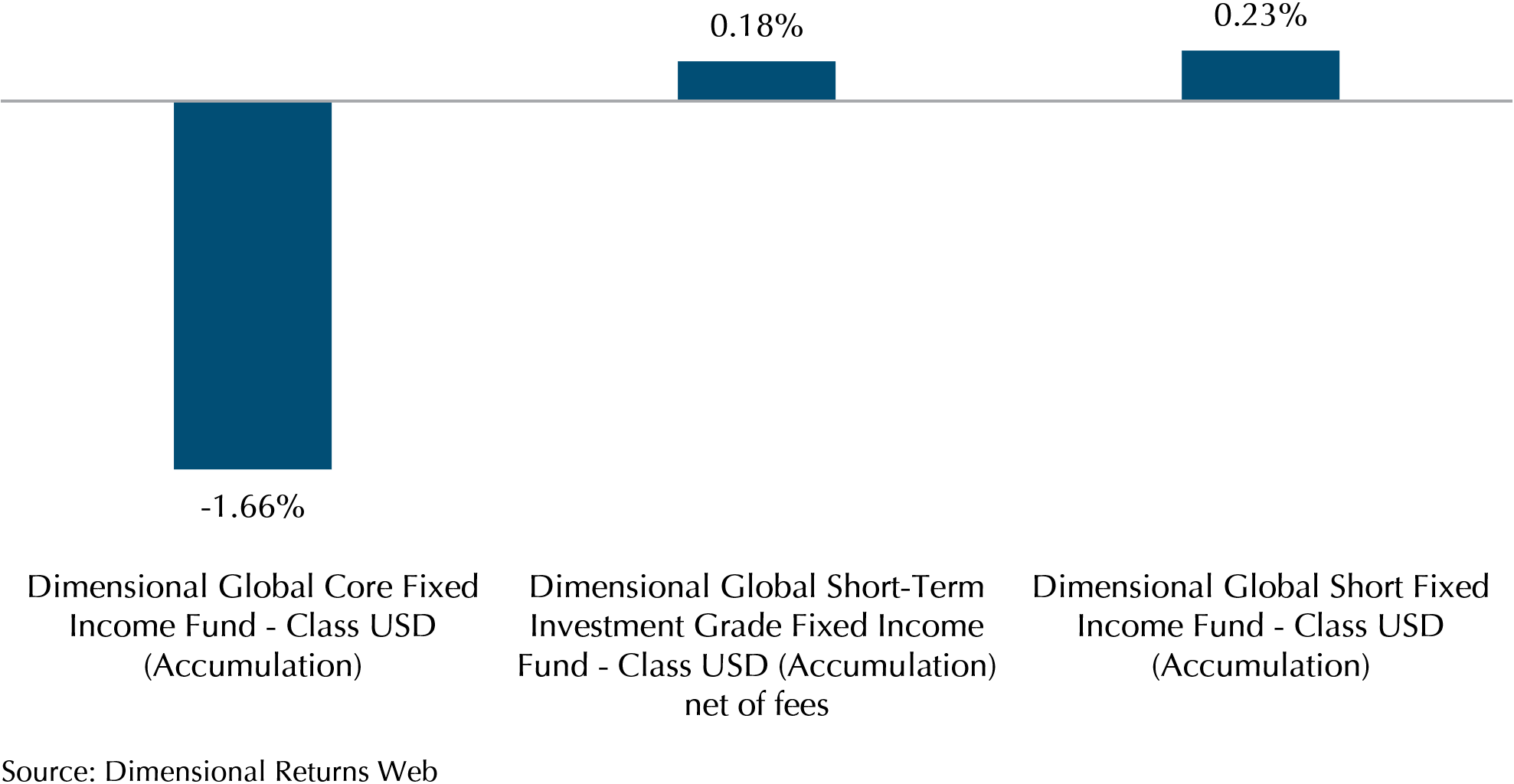

Turning to fixed income, the Dimensional Global Core Fixed Income fell by 1.66% (beating the Bloomberg Global Aggregate) but the Global Short Fixed Income and the Short-Term Investment Grade Fixed Income climbed 0.18% and 0.23% respectively as shown in Exhibit 3. This is because the Global Core Fixed Income fund holds longer duration bonds that are more sensitive to interest rate movements than shorter duration bonds. The inverse relationship between bond yield and price meant that when interest rates climbed, the fall in prices of longer duration bonds would be much greater than that of shorter duration bonds. Hence, Dimensional’s short-duration fixed-income funds were insulated from the negative impact rising yields in the longer-term bonds.

Exhibit 3 – Dimensional Fixed Income Funds September Performance (In USD)

Q3 Review

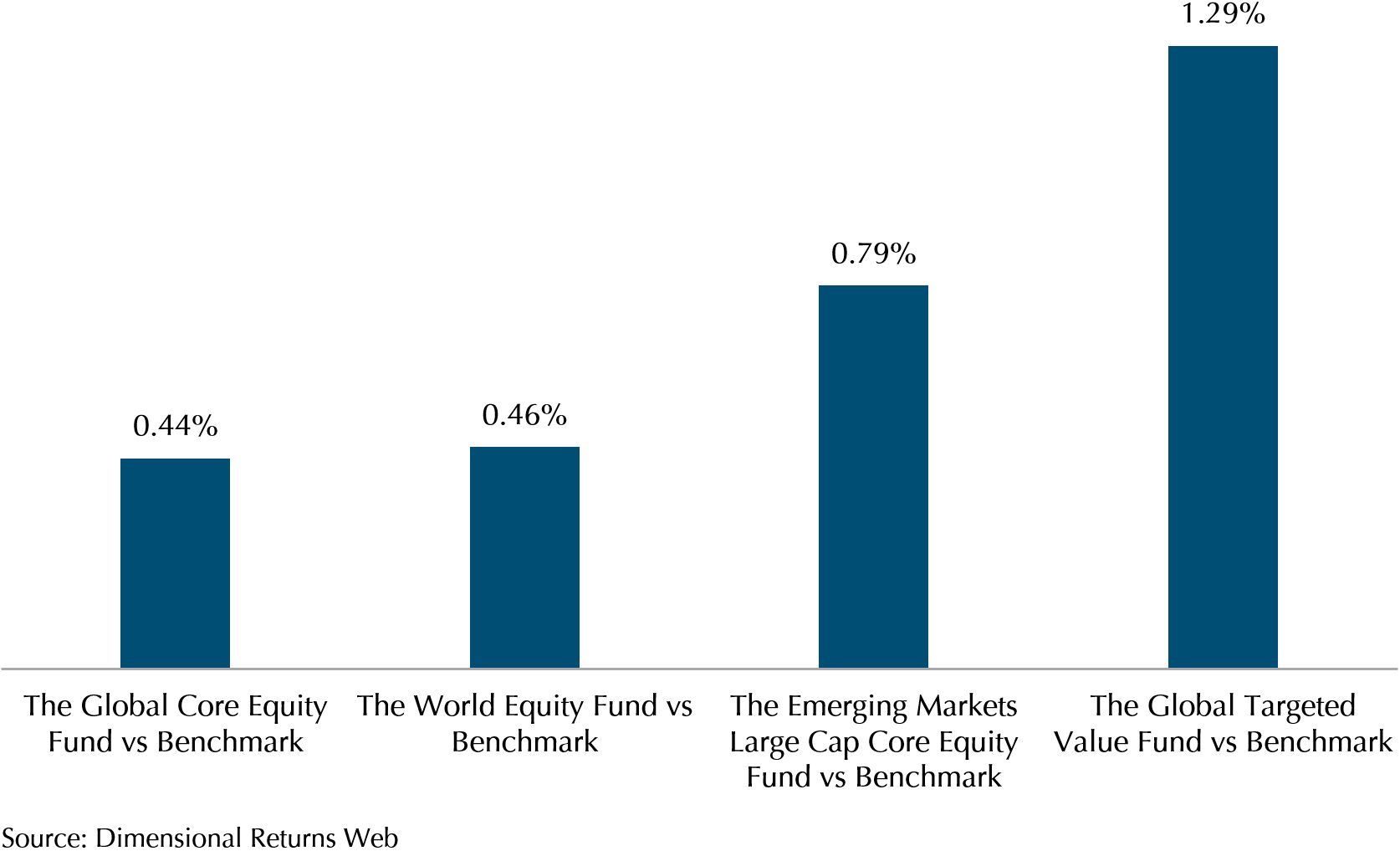

The third quarter proved to be a challenging period for both equities and fixed income. In the equities market, the challenges arose from persistent inflation, resulting in higher borrowing costs in developed economies. Coupled with a deceleration in China’s growth, these factors painted a bleaker outlook for global demand, leading to a downward revision of companies anticipated future earnings, causing a decline in stock prices. Notably, Dimensional’s equity funds demonstrated resilience by surpassing their benchmarks, as demonstrated in Exhibit 4. This performance can be attributed to the notable outperformance of value stocks over growth stocks which was a theme throughout the quarter as yields rose. Another sector that added to the outperformance was Emerging Markets Energy stocks, the Dimensional Emerging Markets Large Cap Core Fund has about 10% allocation to energy, which is almost twice the weight of energy stocks in the comparable MSCI Emerging Markets Index. The MSCI EM Energy Index was up 6.32% over the quarter versus the broad index’s fall of 2.93%, highlighting the disparity in performance.

Exhibit 4 – Q3 Performance for Dimensional Equity Funds vs Benchmark (In USD)

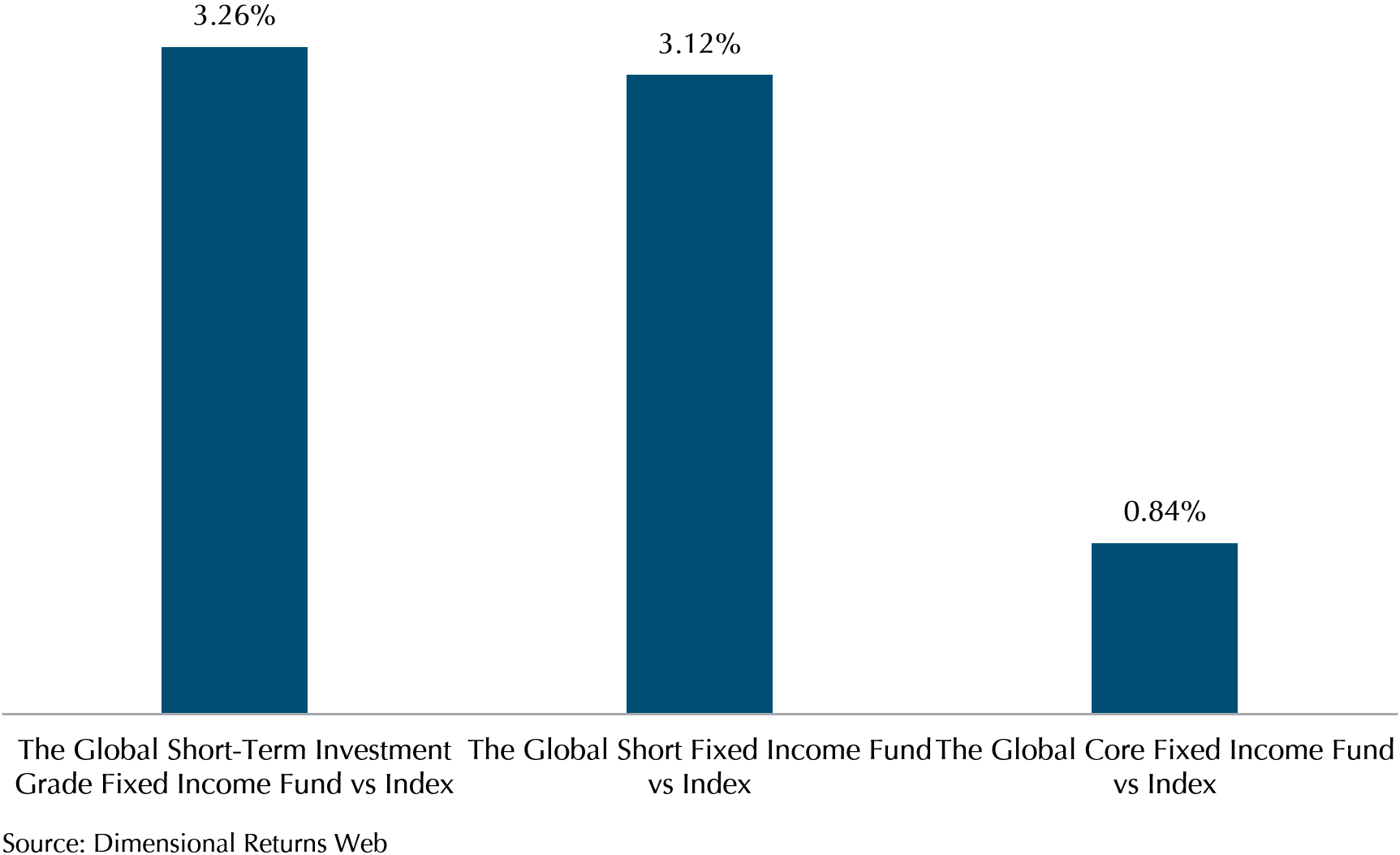

It is worth emphasizing that Dimensional equity funds were not the sole asset class to outperform their respective benchmarks. Within the fixed income sector, the Global Short-Term Investment Grade Fund and the Global Short-Fixed Income Fund delivered positive returns of 1.45% and 1.31% in the third quarter, respectively. Moreover, as illustrated in Exhibit 5, the Global Short-Term Investment Grade, the Global Short-Fixed, and the Global Core Fixed surpassed the Bloomberg Global Aggregate Bond Index, by margins of 3.26%, 3.12%, and 0.84%, respectively.

Exhibit 5 – Q3 Performance for Dimensional Fixed Income Funds vs The Bloomberg Global Aggregate Bond Index hedged to USD (In USD)

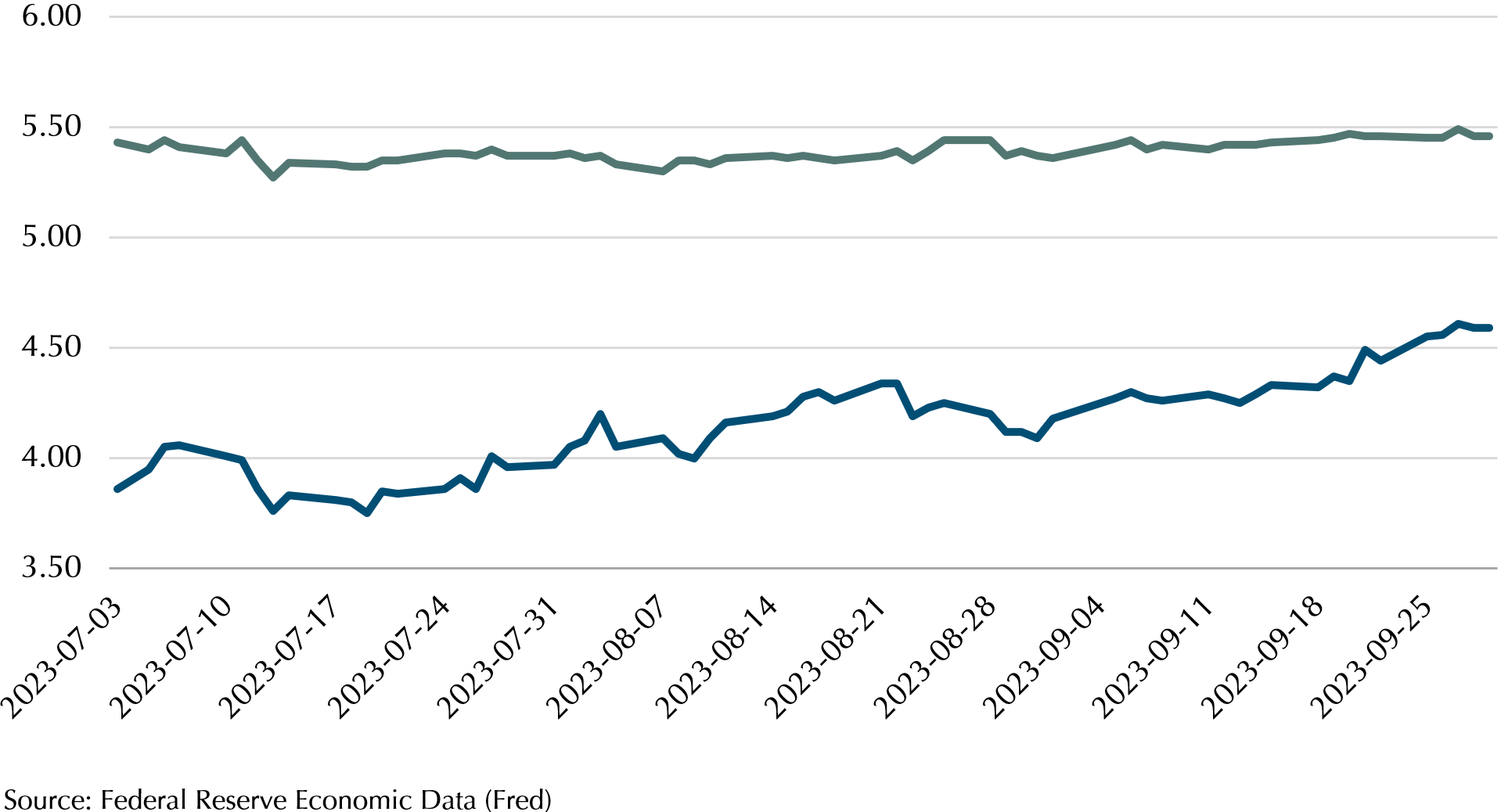

As depicted in Exhibit 6, we observed a rise in longer-term U.S. Treasury yields, such as the 10-year yield, since the commencement of the third quarter. This pattern aligns with the Federal Reserve’s communication of a prolonged period of elevated interest rates to tackle inflation, which has begun to take hold in the market. In contrast, the shorter end of the U.S. Treasury yield curve, represented by the 1-year yield, exhibited minimal movement, as also illustrated in Exhibit 6. Thus, the Global Short Fixed Income Fund and Global Short-Term Investment Grade Fixed Income Fund remained largely unaffected by these fluctuations in the long end of the yield curve.

Exhibit 6 – 10-Year vs. 1-Year U.S. Treasury Yield in Q3

More Bumps in the Road Ahead

While we move into Q4, we would like to advise clients to brace for potential market volatility. Higher long-term yields are quite significant as it can lead to repricing of a lot of asset classes.So as the market works through the various scenarios, we can expect prices of stocks and bonds to move in either direction.

However, amidst this uncertainty, clients are encouraged to maintain open communication with their client advisors. Doing so ensures that their goals remain on track, even in the face of market uncertainty. By leveraging the expertise of their advisors, investors can navigate these uncertain times with confidence and make informed decisions that align with their long-term objectives. This collaborative approach strengthens the investor-advisor partnership, providing a stable anchor amidst the ebb and flow of the stock and bond markets.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.